- Home

- About Us

- Industry

- Services

- Reading

- Contact Us

Artificial Intelligence in Asset Management Market: Current Analysis and Forecast (2025-2033)

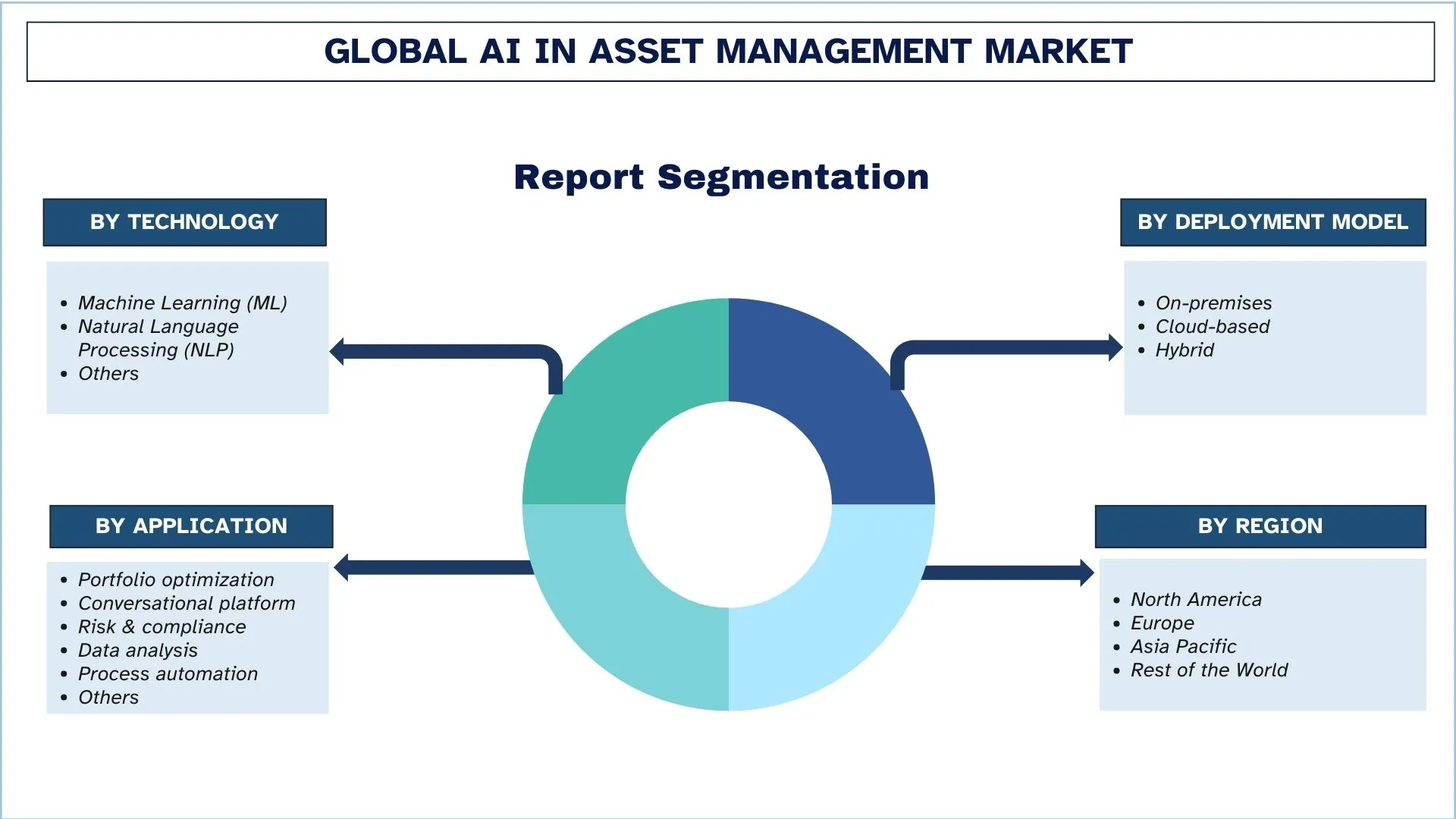

Emphasis on Technology (Machine Learning (ML), Natural Language Processing (NLP), and Others); Deployment Model (On-premises, Cloud-based, and Hybrid); Application (Portfolio optimization, Conversational platform, Risk & compliance, Data analysis, Process automation, and Others); and Region/Country

Global AI in Asset Management Market Size & Forecast

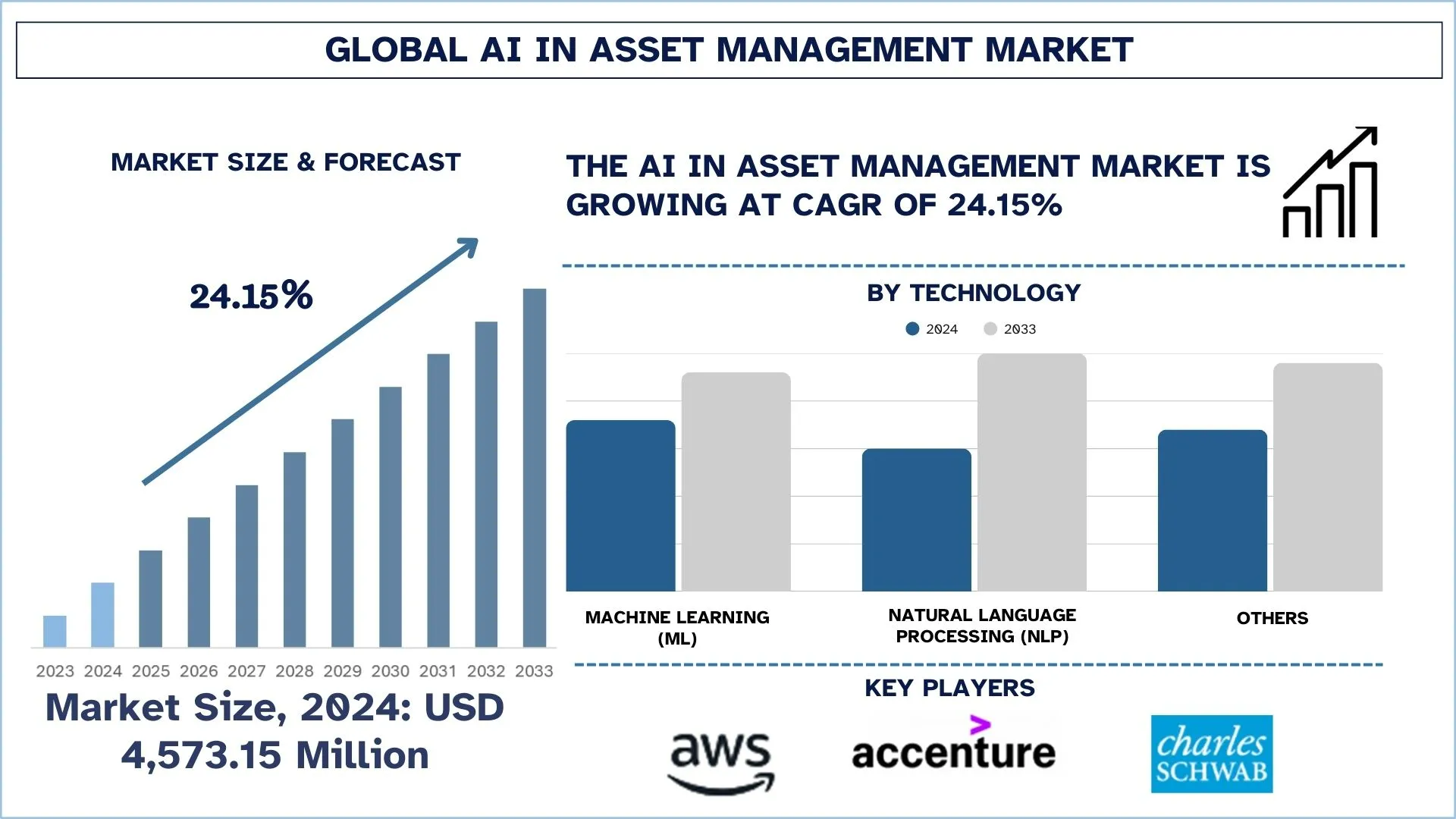

The Global AI in Asset Management Market was valued at USD 4,573.15 million in 2024 and is expected to grow at a strong CAGR of around 24.15% during the forecast period (2025-2033F), driven by the rapid adoption of AI-driven investment and portfolio management solutions.

AI in Asset Management Market Analysis

Artificial Intelligence in Asset Management is the application of emerging technologies like machine learning, natural language processing, and predictive analytics to promote investment in the decision-making process, portfolio management, risk assessment, and operational efficiency.

The market of Artificial Intelligence in Asset Management is expanding because of the evolution of the financial markets and the necessity to make quicker and more exact decisions in investments. Asset managers are embracing AI to effectively process large amounts of financial and other data to enhance the efficiency of portfolio management and risk management. Adoption is also increasing at a rapid pace as the company is pressured to automate to minimize operational expenses, improve compliance, and minimize human error.

Global AI in Asset Management Market Trends

This section discusses the key market trends that are influencing the various segments of the global AI in Asset Management market, as found by our team of research experts.

Increased Collaboration between Asset Managers And Fintech/AI Startups

Enhanced collaboration between asset managers and fintech or AI start-ups will be one of the key trends of the Artificial Intelligence in Asset Management market as conservative companies seek to accelerate the rate of innovation and remain viable in a rapidly evolving financial landscape. Fintech and AI startups allow the asset managers to embrace the best in machine learning, data science, cloud-based environment, and alternative data analytics without necessarily creating them in-house in the long term. The asset management companies can quickly adopt the emerging AI functionalities through partnerships, joint ventures, or acquisitions in their portfolio management, risk modelling, client engagement, and compliance functions. New business models, such as robo-advisory platforms and personalized solutions to investments, are also tested as a result of such partnerships. As the regulatory environment gets more and more complicated and the amount of data grows, collaborations with agile technologies can enable asset managers to get more efficient in their operations, reduce costs, and provide a more responsive and technology-centered approach to investment to clients.

For instance, in November 2025, Franklin Templeton entered into a multi-year strategic partnership with Wand AI to advance the adoption of agentic artificial intelligence across its asset management operations. The collaboration focused on enhancing investment research, portfolio construction, and decision-making capabilities through advanced AI-driven workflows and automation.

AI in Asset Management Industry Segmentation

This section provides an analysis of the key trends in each segment of the global AI in Asset Management market report, along with forecasts at the global, regional, and country levels for 2025-2033.

The Machine Learning Segment Dominates the Global AI in Asset Management Market

Based on the technology category, the market is categorised into Machine Learning (ML), Natural Language Processing (NLP), and Others. Among these, the Machine Learning (ML) segment currently holds the maximum market share since the capacity of analyzing vast historical financial data, identifying patterns, improving core investment process optimization, and automating these processes has established machine learning as the most common technology used by asset managers. However, the Natural Language Processing (NLP) segment is expected to grow fastest in the future, with increasing demand in the processing of unstructured data such as financial news, earnings reports, sentiment analysis, and automated reporting tools that provide more insight into the market.

The Portfolio Optimization Segment Dominates Global AI in Asset Management Market.

Based on the application category, the market is segmented into portfolio optimization, conversational platform, risk & compliance, data analysis, process automation, and others. Among these, the portfolio optimization segment holds the maximum market share due to the intensive use of AI-based tools to maximize investment outcomes, balance the risk-return profile, and efficiently allocate resources across diverse investment portfolios. It has the most popular and commonly used application because of its direct influence on performance and quantifiable returns. However, risk & compliance is expected to grow fastest in the future, as regulators become more controlling and as companies engage more actively in enforcing compliance, identifying outliers, reducing risk exposures, and maintaining solid governance in highly financialized contexts through the implementation of AI.

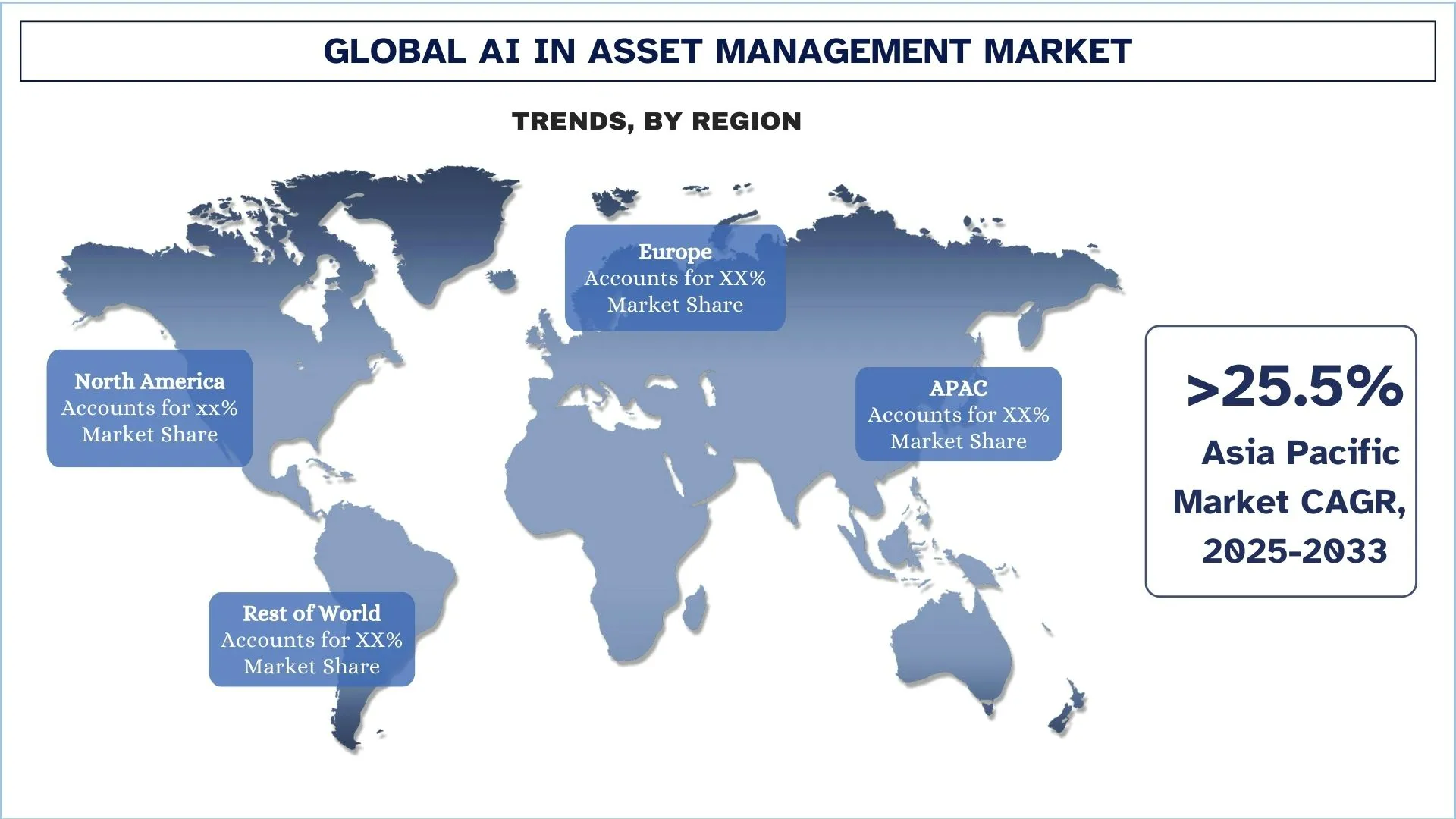

The Asia-Pacific region is expected to grow fastest in the global AI in Asset Management market

The global artificial intelligence (AI) market in Asset Management will grow most rapidly in the Asia-Pacific region, driven by the rapid digitalization of financial services and the increasing use of sophisticated analytics by asset managers. China, India, Japan, and South Korea are among the countries that have been experiencing increased investment in fintech, AI infrastructure, and cloud technologies. Adoption is further being accelerated by expanding capital markets, an increasing number of retail and institutional investors, and the need to use data in making investment strategies. Also, government programs, growing access to big data, and the availability of upcoming AI startups are contributing to the accelerated adoption of AI-based asset management solutions in the region.

China held a Dominant share of the Asia-Pacific AI in Asset Management Market in 2024

China has the largest market share in the Asia-Pacific AI in Asset Management market, because the country has a powerful state policy on the development of artificial intelligence, high rates of digitalization of the financial sphere, and mass use of data-powered investment platforms. The fintech landscape is well-informed, and the asset managers and financial institutions actively use big data, machine learning, and cloud computing in the country. Also, the existence of large technology companies, substantial investment in AI research, and engagement of more retail and institutional investors have accelerated the adoption of AI in asset management. The regulatory efforts that encourage financial innovation have also enhanced the dominance of China.

AI in Asset Management Industry Competitive Landscape

The global AI in Asset Management market is competitive, with several global and international market players. The key players are adopting different growth strategies to enhance their market presence, such as partnerships, agreements, collaborations, geographical expansions, and mergers and acquisitions.

Top AI in Asset Management Market Companies

Some of the major players in the market are Accenture, Amazon Web Services, Charles Schwab & Co, Genpact, IBM, Infosys, Intel Corporation, Microsoft, S&P Global, and Salesforce.

Recent Developments in AI in the Asset Management Market

In December 2025, Nomura Holdings announced a strategic partnership with OpenAI to strengthen its asset management capabilities by integrating generative AI technologies. The collaboration aimed to enhance investment research, data analysis, and client solutions by combining OpenAI’s expertise with Nomura’s proprietary and external datasets.

In July 2025, FNZ entered a five-year strategic partnership with Microsoft to accelerate digital transformation across the wealth management industry, enhancing FNZ’s AI, automation, and cloud capabilities. The collaboration aimed to integrate Microsoft’s advanced AI and cloud technologies into FNZ’s platform to drive innovation, improve operational efficiency, and deliver personalized, intelligent digital wealth solutions to financial institutions and their clients.

Global AI in Asset Management Market Report Coverage

Report Attribute | Details |

Base year | 2024 |

Forecast period | 2025-2033 |

Growth momentum | Accelerate at a CAGR of 24.15% |

Market size 2024 | USD 4,573.15 million |

Regional analysis | North America, Europe, APAC, Rest of the World |

Major contributing region | The North America region is expected to dominate the market during the forecast period. |

Key countries covered | U.S., Canada, Germany, U.K., Spain, Italy, France, China, Japan, and India. |

Companies profiled | Accenture, Amazon Web Services, Charles Schwab & Co, Genpact, IBM, Infosys, Intel Corporation, Microsoft, S&P Global, and Salesforce. |

Report Scope | Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Demand and Supply Side Analysis; Competitive Landscape; Company Profiling |

Segments Covered | By Technology, By Deployment Model, By Application, and By Region/Country |

Reasons to Buy the AI in Asset Management Market Report:

The study includes market sizing and forecasting analysis confirmed by authenticated key industry experts.

The report briefly reviews overall industry performance at a glance.

The report covers an in-depth analysis of prominent industry peers, primarily focusing on key business financials, type portfolios, expansion strategies, and recent developments.

Detailed examination of drivers, restraints, key trends, and opportunities prevailing in the industry.

The study comprehensively covers the market across different segments.

Deep dive regional level analysis of the industry.

Customization Options:

The Global AI in Asset Management Market can further be customized as per the requirements or any other market segment. Besides this, UnivDatos understands that you may have your own business needs; hence, feel free to contact us to get a report that completely suits your requirements.

Table of Content

Research Methodology for Global AI in Asset Management Market Analysis (2023-2033)

We analyzed the historical market, estimated the current market, and forecasted the future market of the global AI in asset management market to assess its application in major regions worldwide. We conducted exhaustive secondary research to gather historical market data and estimate the current market size. To validate these insights, we carefully reviewed numerous findings and assumptions. Additionally, we conducted in-depth primary interviews with industry experts across the AI in asset management value chain. After validating market figures through these interviews, we used both top-down and bottom-up approaches to forecast the overall market size. We then employed market breakdown and data triangulation methods to estimate and analyze the market size of industry segments and sub-segments.

Market Engineering

We employed the data triangulation technique to finalize the overall market estimation and derive precise statistical numbers for each segment and sub-segment of the global AI in asset management market. We split the data into several segments and sub-segments by analyzing various parameters and trends, including technology, deployment model, application, and regions within the global AI in asset management market.

The Main Objective of the Global AI in Asset Management Market Study

The study identifies current and future trends in the global AI in asset management market, providing strategic insights for investors. It highlights regional market attractiveness, enabling industry participants to tap into untapped markets and gain a first-mover advantage. Other quantitative goals of the studies include:

Market Size Analysis: Assess the current and forecast market size of the global AI in asset management market and its segments in terms of value (USD).

AI in Asset Management Market Segmentation: Segments in the study include areas of technology, deployment model, application, and region.

Regulatory Framework & Value Chain Analysis: Examine the regulatory framework, value chain, customer behavior, and competitive landscape of AI in the asset management industry.

Regional Analysis: Conduct a detailed regional analysis for key areas such as Asia Pacific, Europe, North America, and the Rest of the World.

Company Profiles & Growth Strategies: Company profiles of the AI in asset management market and the growth strategies adopted by the market players to sustain the fast-growing market.

Frequently Asked Questions FAQs

Q1: What is the global AI in asset management market’s current market size and growth potential?

The Global AI in Asset Management Market was valued at USD 4,573.15 million in 2024. It is expected to grow at a robust CAGR of 24.15% from 2025 to 2033, driven by the rapid adoption of AI-driven investment and portfolio management solutions.

Q2: Which segment has the largest share of the global AI in asset management market by technology category?

The Machine Learning (ML) segment holds the largest market share, as it is widely used for portfolio optimization, predictive analytics, risk assessment, and automated investment decision-making.

Q3: What are the driving factors for the growth of the global AI in asset management market?

Top growth drivers of the AI in Asset Management market include:

• Growing demand for data-driven investment decision-making

• Increasing adoption of AI for portfolio optimization and risk management.

• Rising volume and complexity of financial and alternative data

Q4: What are the emerging technologies and trends in the global AI in asset management market?

Emerging trends in the AI in Asset Management market include:

• Increasing deployment of machine learning and deep learning models

• Increased collaboration between asset managers and fintech/AI startups

Q5: What are the key challenges in the global AI in asset management market?

Key challenges in the AI in Asset Management market include:

• Data privacy and security concerns related to sensitive financial data.

• High implementation and integration costs of AI solutions

Q6: Which region dominates the global AI in asset management market?

North America dominates the global AI in Asset Management market due to early technology adoption, strong financial infrastructure, and the presence of major asset management and AI solution providers.

Q7: Who are the key competitors in the global AI in asset management market?

Top players in the AI in asset management industry include:

• Accenture

• Amazon Web Services

• Charles Schwab & Co

• Genpact

• IBM

• Infosys

• Intel Corporation

• Microsoft

• S&P Global

• Salesforce

Q8: How are leading asset management firms leveraging AI to gain a competitive advantage?

Leading firms are using AI to enhance portfolio optimization, predictive analytics, risk management, and client personalization, enabling faster and more informed investment decisions while improving operational efficiency.

Q9: What investment opportunities does the AI in Asset Management market offer for investors and stakeholders?

The market offers strong opportunities through AI-driven platforms, fintech collaborations, cloud-based asset management solutions, and firms developing advanced analytics and automation tools amid rapid digital transformation.

Related Reports

Customers who bought this item also bought