- Home

- About Us

- Industry

- Services

- Reading

- Contact Us

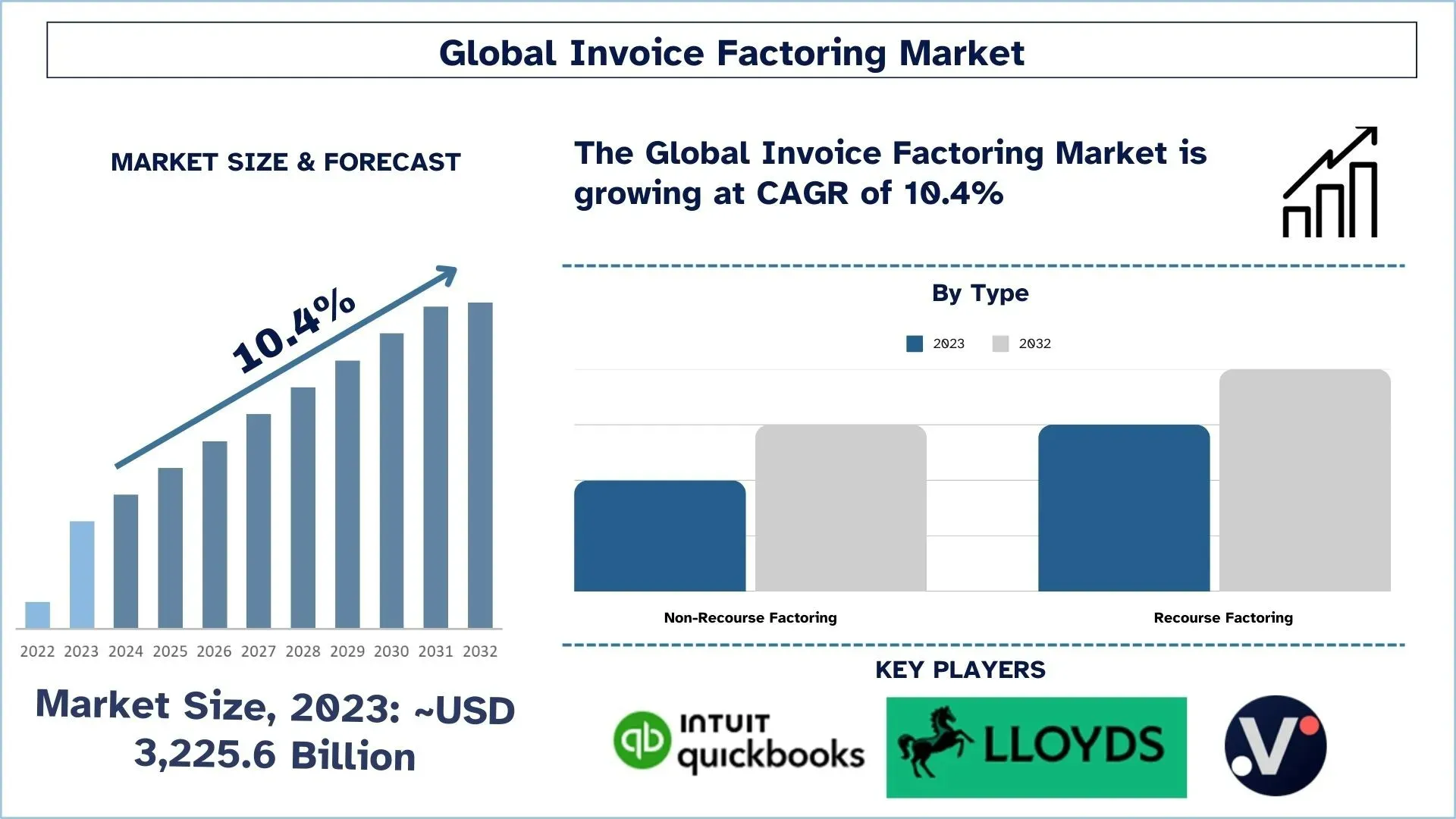

Invoice Factoring Market: Current Analysis and Forecast (2024-2032)

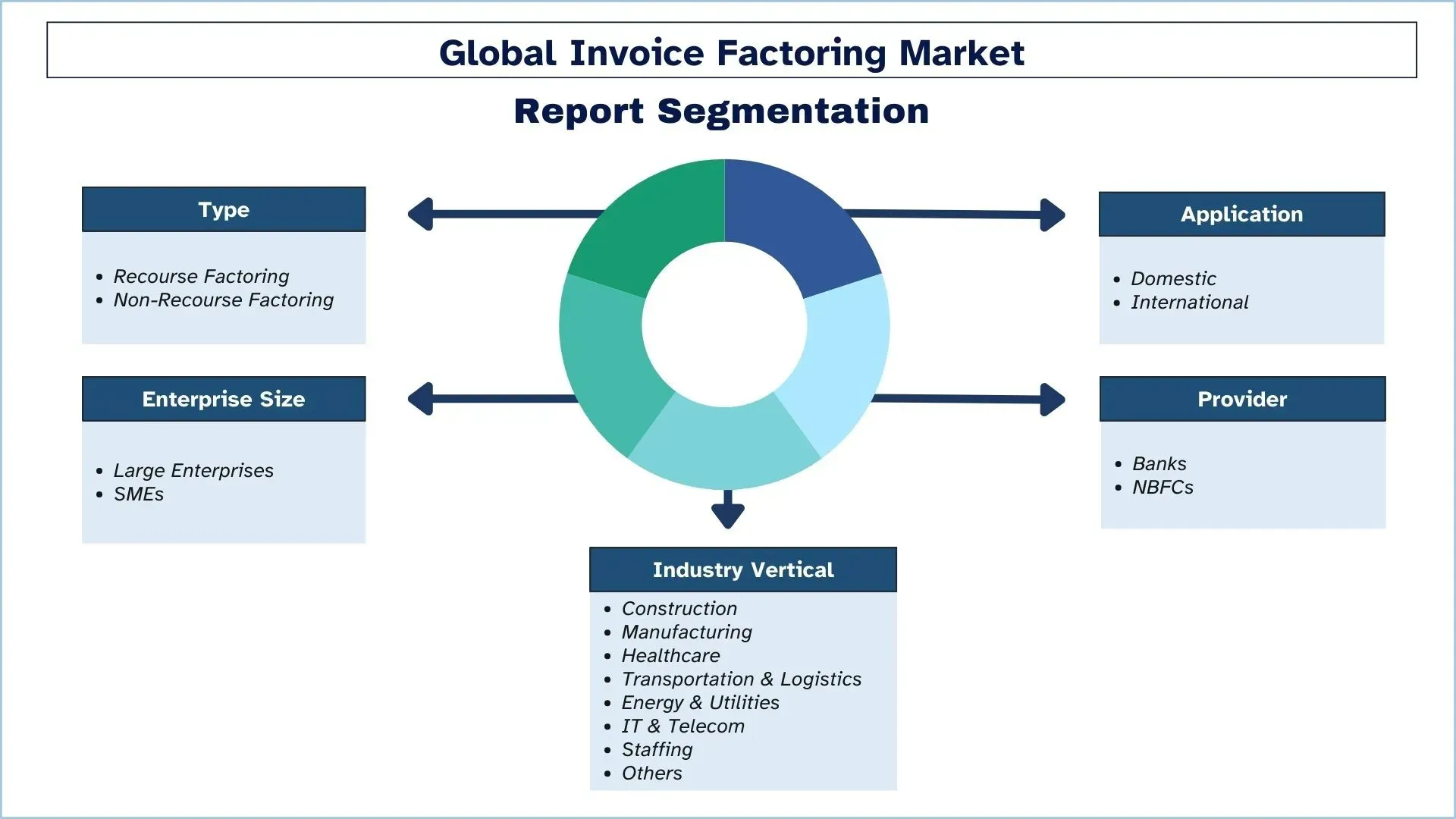

Emphasis on Type (Recourse Factoring and Non-Recourse Factoring); Application (Domestic and International); Enterprise Size (Large Enterprises and SMEs); Provider (Banks and NBFCs); Industry Vertical (Construction; Manufacturing; Healthcare; Transportation & Logistics; Energy & Utilities; IT & Telecom; Staffing; Others); and Region/Country

Global Invoice Factoring Market Size & Forecast

The Global Invoice Factoring Market was valued at USD 3,225.6 Billion in 2023 and is expected to grow at a strong CAGR of around 10.4% during the forecast period (2024-2032) owing to the increased cross-border transactions that require flexible financing solutions, boosting the invoice factoring market.

Invoice Factoring Market Analysis

Businesses secured by the invoice factoring market strengthen cash flow by selling their unpaid invoices to factors who offer reduced payments. SMEs and industries that have extended payment periods use this financial service to preserve their operating cash flow. Market expansion occurs because alternative funding options attract startups together with small businesses that need financing alternatives due to insufficient credit capabilities. Digitalization remains a major growth factor along with automation in factoring services rising global trade and expansion of automated financial technology solutions that increase efficiency and accessibility.

Global Invoice Factoring Market Trends

This section discusses the key market trends that are influencing the various segments of the global invoice factoring market, as found by our team of research experts.

Construction Segment Transforming Industry

The construction category is the largest contributor to the invoice factoring industry. This is mainly due to the businesses operating in construction requiring invoice factoring because they need to manage long payment delays coupled with high working capital demands. Delay payments from contractors and suppliers create a critical need for factoring as a solution that sustains their cash flow operations. Operation of construction projects becomes possible through invoice factoring which helps firms pay expenses for payroll and materials while maintaining operational stability.

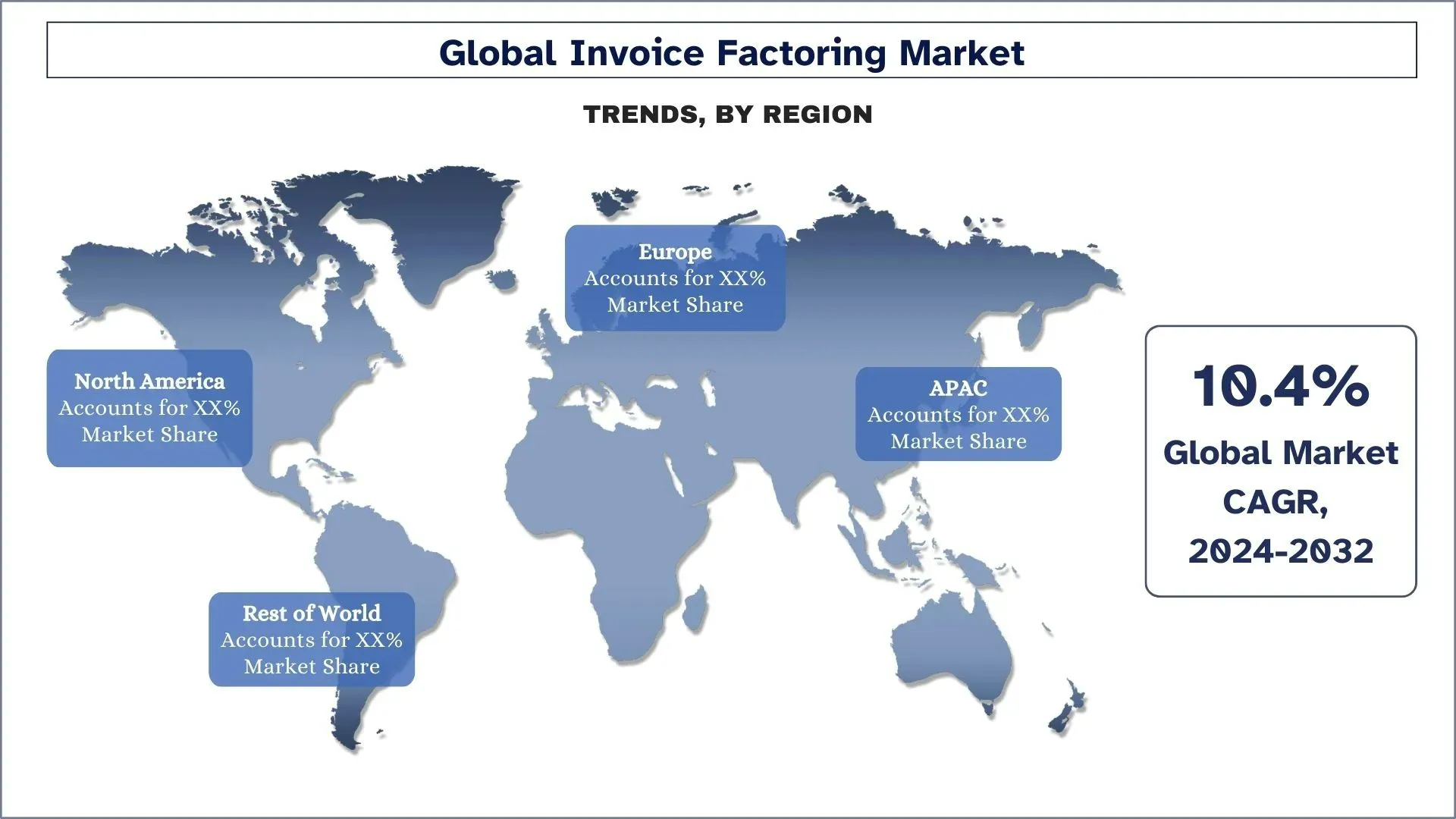

North America is expected to grow at a significant rate during the forecast period.

The North American invoice factoring industry shows stable expansion which results from strong local business operations combined with the growth of small and medium-sized companies and rising customer needs for adaptable funding sources. Businesses gain immediate funds as they sell their accounts receivable through invoice factoring without becoming indebted to third-party factors. The factoring infrastructure in North America benefits the manufacturing, healthcare, and retail businesses with regulatory backing and multiple funding sources through its well-structured system. The factoring market will expand further because of ongoing financial uncertainty because factors are adapting their services to address the changing requirements of businesses.

Global Invoice Factoring Industry Overview

The global invoice factoring market is competitive, with several global and international market players. The key players are adopting different growth strategies to enhance their market presence, such as partnerships, agreements, collaborations, new product launches, geographical expansions, and mergers and acquisitions. Some of the major players in the market are Porter Capital; Adobe; Nav Technologies, Inc.; ICBC; Intuit Inc.; American Express Company; Lloyds Banking Group, Sonovate; eCapital Corp; Velotrade

Global Invoice Factoring Market Report Coverage

Report Attribute | Details |

Base year | 2023 |

Forecast period | 2024-2032 |

Growth momentum | Accelerate at a CAGR of 10.4% |

Market size 2023 | USD 3,225.6 Billion |

Regional analysis | North America, Europe, APAC, Rest of the World |

Major contributing region | North America is expected to dominate the market during the forecasted period. |

Key countries covered | U.S., Canada, Germany, U.K., Spain, Italy, France, China, Japan, and India |

Companies profiled | Porter Capital; Adobe; Nav Technologies, Inc.; ICBC; Intuit Inc.; American Express Company; Lloyds Banking Group, Sonovate; eCapital Corp; Velotrade |

Report Scope | Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Demand and Supply Side Analysis; Competitive Landscape; Company Profiling |

Segments Covered | By Type; By Application; By Enterprise Size; By Provider; By Industry Vertical; By Region/Country |

Reasons to buy this report:

The study includes market sizing and forecasting analysis confirmed by authenticated key industry experts.

The report briefly reviews overall industry performance at one glance.

The report covers an in-depth analysis of prominent industry peers, primarily focusing on key business financials, type portfolios, expansion strategies, and recent developments.

Detailed examination of drivers, restraints, key trends, and opportunities prevailing in the industry.

The study comprehensively covers the market across different segments.

Deep dive regional level analysis of the industry.

Customization Options:

The global invoice factoring market can further be customized as per the requirement or any other market segment. Besides this, UMI understands that you may have your own business needs, hence feel free to contact us to get a report that completely suits your requirements.

Table of Content

Research Methodology for the Global Invoice Factoring Market Analysis (2024-2032)

Analyzing the historical market, estimating the current market, and forecasting the future market of the global Invoice Factoring market were the three major steps undertaken to create and analyze the adoption of global Invoice Factoring in major regions. Exhaustive secondary research was conducted to collect the historical market figures and estimate the current market size. Secondly, to confirm these insights, numerous findings and assumptions were considered. Moreover, exhaustive primary interviews were conducted with industry experts across the value chain of the global Invoice Factoring market. For the assumption and validation of market numbers through primary interviews, we employed a top-down/bottom-up approach to forecasting the complete market size. Thereafter, market breakdown and data triangulation methods were adopted to estimate and analyze the market size of segments and sub-segments of the industry. The detailed method is explained below:

Analysis of Historical Market Size

Step 1: In-Depth Study of Secondary Sources:

A detailed secondary study was conducted to obtain the historical market size of the global Invoice Factoring market through company internal sources such as annual reports & financial statements, performance presentations, press releases, etc., and external sources including journals, news & articles, government publications, competitor reports, third-party databases, and other credible publications.

Step 2: Market Segmentation:

After obtaining the historical market size of the global Invoice Factoring market, we conducted a detailed secondary analysis to gather historical market insights and share for different segments & sub-segments for major regions. Major segments are included in the report, such as type, application, enterprise size, provider, industry vertical, and region. Further country-level analysis was conducted to evaluate the overall adoption of testing models in that region.

Step 3: Factor Analysis:

After acquiring the historical market size of different segments and sub-segments, we conducted a detailed factor analysis to estimate the current market size of the global Invoice Factoring market. Further, we conducted factor analysis using dependent and independent variables such as type, application, enterprise size, provider, industry vertical, and global Invoice Factoring market regions. A thorough analysis of demand and supply-side scenarios was conducted considering top partnerships, mergers and acquisitions, business expansion, and product launches in the global Invoice Factoring market.

Current Market Size Estimate & Forecast

Current Market Sizing: Based on actionable insights from the above 3 steps, we arrived at the current market size, key players in the global Invoice Factoring market, and market shares of the segments. All the required percentage shares split, and market breakdowns were decided using the above-mentioned secondary approach and were verified through primary interviews.

Estimation & Forecasting: For market estimation and forecast, weights were assigned to several factors including drivers & trends, restraints, and opportunities available for the stakeholders. After analyzing these factors, relevant forecasting techniques, i.e., the top-down/bottom-up approach were applied to arrive at the market forecast for 2032 for different segments and sub-segments across the major markets globally. The research method adopted to estimate the market size encompasses:

The industry’s market size, in terms of revenue (USD) and the adoption rate of the global Invoice Factoring market across the major markets domestically

All percentage shares, splits, and breakdowns of market segments and sub-segments

Key players in the global Invoice Factoring market in terms of the types offered. Also, the growth strategies adopted by these players to compete in the fast-growing market.

Market Size and Share Validation

Primary Research: In-depth interviews were conducted with the Key Opinion Leaders (KOLs) including Top Level Executives (CXO/VPs, Sales Head, Marketing Head, Operational Head, Regional Head, Country Head, etc.) across major regions. Primary research findings were then summarized, and statistical analysis was performed to prove the stated hypothesis. Inputs from primary research were combined with secondary findings, hence turning information into actionable insights.

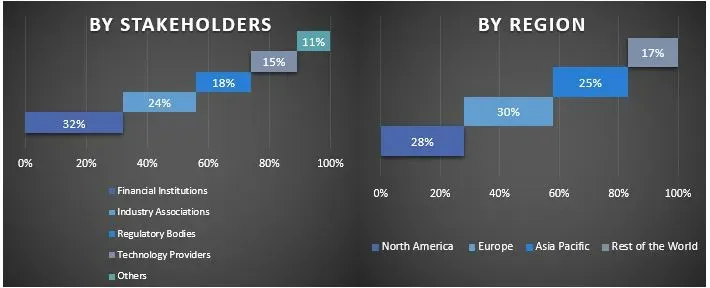

Split of Primary Participants in Different Regions

Market Engineering

The data triangulation technique was employed to complete the overall market estimation and to arrive at precise statistical numbers for each segment and sub-segment of the global Invoice Factoring market. Data was split into several segments and sub-segments after studying various parameters and trends in the global Invoice Factoring market's type, application, enterprise size, provider, industry vertical, and regions.

The Main Objective of the Global Invoice Factoring Market Study

The current & future market trends of the global Invoice Factoring market were pinpointed in the study. Investors can gain strategic insights to base their discretion for investments on the qualitative and quantitative analysis performed in the study. Current and future market trends determined the market's overall attractiveness at a regional level, providing a platform for the industrial participant to exploit the untapped market to receive help from a first-mover advantage. Other quantitative goals of the studies include:

Analyze the current forecast and market size of the global Invoice Factoring market in terms of value (USD). Also, analyze the current forecast and market size of different segments and sub-segments.

Segments in the study include areas of type, application, enterprise size, provider, industry vertical, and regions.

Define and analyze the regulatory framework for the industry.

Analyze the value chain involved with the presence of various intermediaries, along with analyzing customer and competitor behaviors of the industry.

Analyze the current and forecast market size of the global Invoice Factoring market for the major regions.

Major countries of regions studied in the report include Asia Pacific, Europe, North America, and the Rest of the World.

Company profiles of the global Invoice Factoring market and the growth strategies the players adopt to sustain the fast-growing market.

Deep dive regional level analysis of the industry

Frequently Asked Questions FAQs

Q1: What is the global Invoice Factoring market’s current market size and growth potential?

The global invoice factoring market was valued at USD 3,225.6 Billion in 2023 and is expected to grow at a CAGR of 10.4% during the forecast period (2024-2032).

Q2: What are the driving factors for the growth of the global Invoice Factoring market?

Businesses are shifting away from traditional bank loans to alternative financing, including factoring.

Q3: Which segment has the largest global invoice factoring market share by type category?

The recourse factoring category has the largest share of the global invoice factoring market by type segment.

Q4: What are the emerging technologies and trends in the global Invoice Factoring market?

AI-driven risk assessment and fraud detection enhance factoring efficiency.

Q5: Which regions dominate the global Invoice Factoring market?

North America is expected to dominate the market during the forecast period.

Related Reports

Customers who bought this item also bought