- Home

- About Us

- Industry

- Services

- Reading

- Contact Us

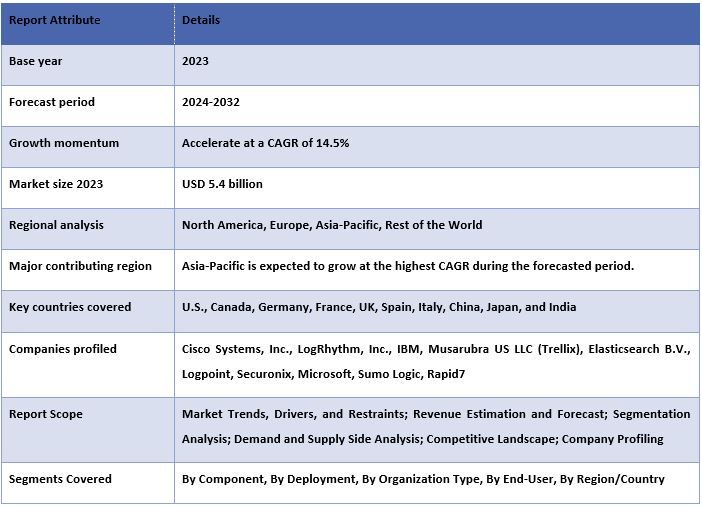

Security Information and Event Management Market: Current Analysis and Forecast (2024-2032)

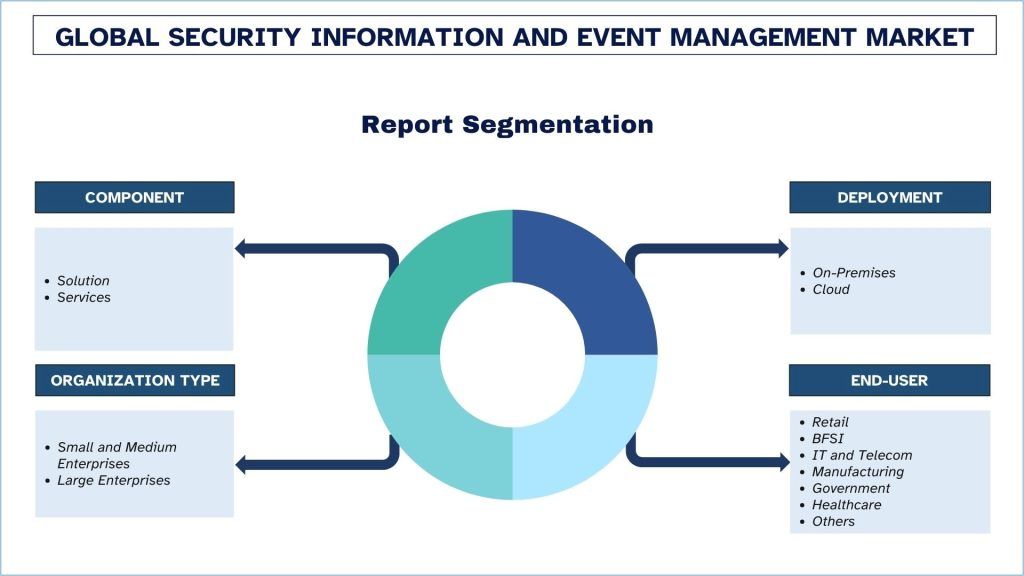

Emphasis on Component (Solution, Services); Deployment (On-Premise, Cloud); Organization Type (Small and Medium Enterprises, Large Enterprises); End-user (Retail, BFSI, IT and Telecom, Manufacturing, Government, Healthcare, and Others); and Region/Country

Security Information and Event Management Market Size & Forecast

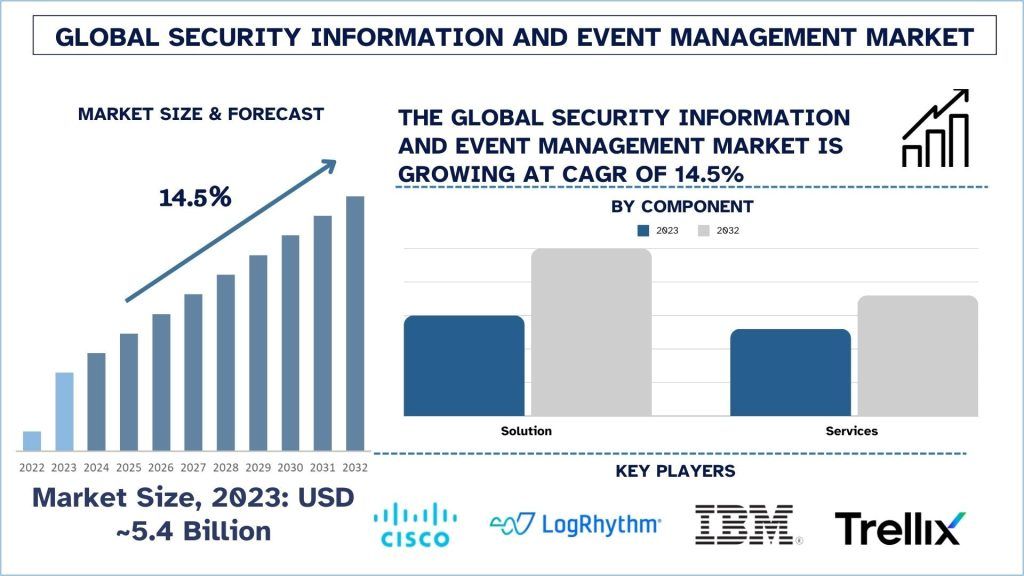

The Security Information and Event Management Market was valued at approximately USD 5.4 billion in 2023 and is expected to grow at a substantial CAGR of around 14.5% during the forecast period (2024-2032) owing to the increasing cybersecurity threats.

Security Information and Event Management Market Analysis

The Security Information and Event Management (SIEM) market refers to the segment of the market that deals with products for real-time collection, analysis, and management of security-related events and incidents in an organization’s IT system. SIEM systems are used to collect and analyze log and event data from multiple sources to detect security threats and then respond to and mitigate them. The market is full of various products and services whose main purpose is to assist in threat detection, compliance, and other aspects related to cybersecurity. This helped in increasing the level of integration with Security Orchestration, Automation, and Response (SOAR) in handling incident management.

Moreover, organizations are increasingly aiming to incorporate application layers like artificial intelligence and machine learning layers into their SIEM systems to improve threat detection and prevention. For instance, on May 6, 2024, Elastic, the Search AI Company, announced Search AI which replaced the traditional SIEM with an AI-driven security analytics solution for the modern SOC. Powered by the Search AI platform, Elastic Security is replacing largely manual processes for configuration, investigation, and response by combining search and retrieval augmented generation (RAG) to provide hyper-relevant results that matter. The newest feature, Attack Discovery, triages 100s of alerts down to the few attacks that matter with a single button click, and returns results in an intuitive interface, allowing security operations teams to quickly understand the most impactful attacks, take immediate follow-up actions, and more. They are also moving to cloud-based SIEM solutions for their better scalability and flexibility, more engaged with Managed Security Service Providers (MSSP) for their specialized skills and affordable solutions. Moreover, there is a focus on the automation of reporting, especially in areas of compliance and in handling incidents; this goes alongside meeting the increasing amount of intricate security data.

Security Information and Event Management Market Trends

This section discusses the key market trends influencing the various segments of the security information and event management market as identified by our research experts.

IT and Telecom Transform Security Information and Event Management Industry

IT and Telecom held a significant market share in 2023. The sectors of IT and telecom are the biggest growth contributors to the SIEM market because of their far-reaching networks, as well as their obligations to deal with a variety of records. They create big amounts of security data that must be constantly observed and analyzed to prevent cyber threats and fulfill regulations. For instance, on April 8, 2021, LogPoint, the global cybersecurity innovator, announced a more efficient architecture for their SIEM with UEBA machine learning, of particular benefit for education, healthcare, and local government.

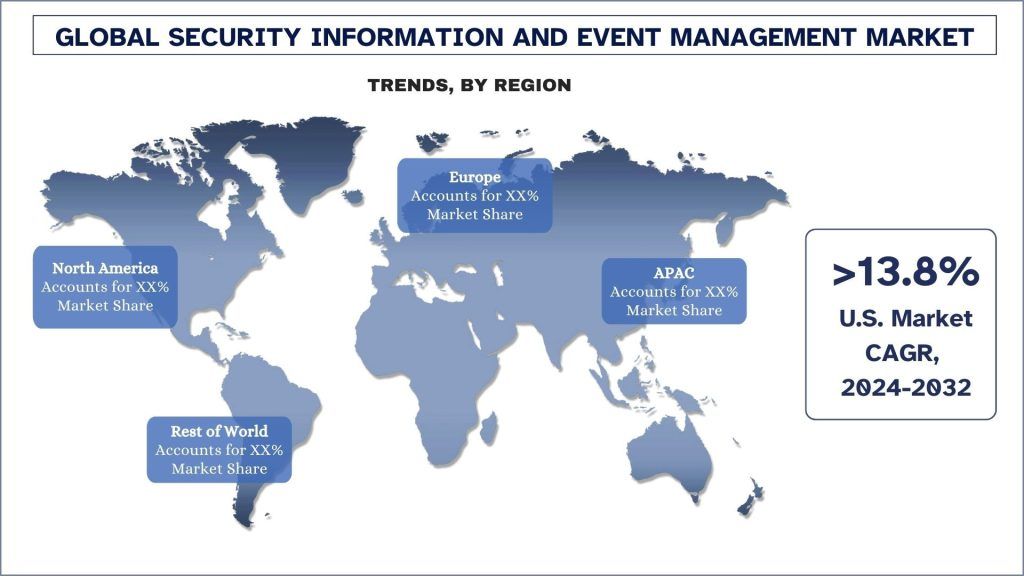

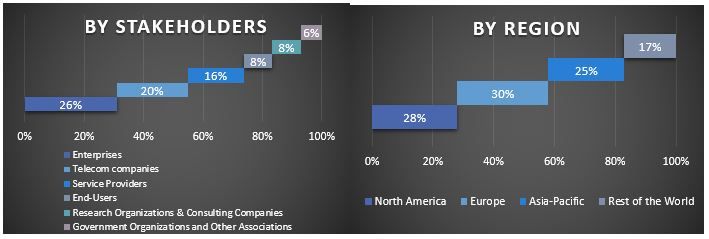

North America leads the market in 2023.

North America region has the largest share in the Security Information and Event Management market because of the technological advancement and systematic approach towards security in countries like the US and Canada. It has a high density of big industries and industries with high-security needs for large volumes of information. Additional compliance standards and raising concerns about cyber threats due to massive data breaches also keep driving the growth of SIEM solutions. Furthermore, North American companies are essentially the most technologically progressive and they are constantly implementing more progressive SIEM innovations as threats emerge. For instance, on Nov. 7, 2023, IBM announced a major evolution of its flagship IBM QRadar SIEM product: redesigned on a new cloud-native architecture, built specifically for hybrid cloud scale, speed, and flexibility. IBM also unveiled plans for delivering generative AI capabilities within its threat detection and response portfolio – leveraging Watsonx, the company’s enterprise-ready data and AI platform. There is also a significant representation of major SIEM vendors as well as a competitive market environment that also makes these solutions quickly develop and widely used in the region.

Security Information and Event Management Industry Overview

The Security Information and Event Management market is competitive, with several global and international players. The key players are adopting different growth strategies to enhance their market presence, such as partnerships, agreements, collaborations, new product launches, geographical expansions, and mergers and acquisitions. Some of the major players operating in the market are Cisco Systems, Inc., LogRhythm, Inc., IBM, Musarubra US LLC (Trellix), Elasticsearch B.V., Logpoint, Securonix, Microsoft, Sumo Logic, Rapid7.

Security Information and Event Management Market News

On March 18, 2024, Cisco announced it completed the acquisition of Splunk, setting the foundation for delivering unparalleled visibility and insights across an organization’s entire digital footprint.

On April 8, 2021, LogPoint, the global cybersecurity innovator, announced a more efficient architecture for their SIEM with UEBA machine learning, of particular benefit for education, healthcare, and local government.

On April 1, 2024, LogRhythm introduced advanced capabilities for the cloud-native SIEM Platform, LogRhythm Axon. The latest innovations to LogRhythm Axon facilitate a seamless dashboard and search import/export to community repositories, bridging the communication gap.

On January 19, 2022, LogPoint announced the release of LogPoint 7, combining the analytical capabilities of SIEM with the powerful response tools in SOAR. With SOAR included at no additional cost and packed with out-of-box use cases, playbooks, and ready-to-use integrations, LogPoint 7 makes cybersecurity automation available for organizations of all sizes.

In March 2021, SIRP (www.sirp.io), a leading No-code Risk-based Security Orchestration, Automation, and Response (SOAR) platform provider, announced the launch of its SOAR-as-a-Service offering. The cloud-based model provides a fast, flexible solution for enterprises and MSSPs who can access its single, centralized interface to gain valuable intelligence and context on threats, reducing incident response times from hours to minutes.

Security Information and Event Management Market Report Coverage

Reasons to buy this report:

- The study includes market sizing and forecasting analysis validated by authenticated key industry experts.

- The report presents a quick review of overall industry performance at one glance.

- The report covers an in-depth analysis of prominent industry peers with a primary focus on key business financials, product portfolios, expansion strategies, and recent developments.

- Detailed examination of drivers, restraints, key trends, and opportunities prevailing in the industry.

- The study comprehensively covers the market across different segments.

- Deep dive regional level analysis of the industry.

Customization Options:

The global Security Information and Event Management market can be customized further as per the requirement or any other market segment. Besides this, UMI understands that you may have your own business needs, hence feel free to connect with us to get a report that completely suits your requirements.

Table of Content

Research Methodology for the Security Information and Event Management Market Analysis (2024-2032)

Analyzing the historical market, estimating the current market, and forecasting the future market of the global security information and event management market were the three major steps undertaken to create and analyze the adoption of security information and event management in major regions globally. Exhaustive secondary research was conducted to collect the historical market numbers and estimate the current market size. Secondly, to validate these insights, numerous findings and assumptions were taken into consideration. Moreover, exhaustive primary interviews were also conducted, with industry experts across the value chain of the global security information and event management market. Post assumption and validation of market numbers through primary interviews, we employed a top-down/bottom-up approach to forecasting the complete market size. Thereafter, market breakdown and data triangulation methods were adopted to estimate and analyze the market size of segments and sub-segments of the industry. Detailed methodology is explained below:

Analysis of Historical Market Size

Step 1: In-Depth Study of Secondary Sources:

A detailed secondary study was conducted to obtain the historical market size of the Security Information and Event Management market through company internal sources such as annual reports & financial statements, performance presentations, press releases, etc., and external sources including journals, news & articles, government publications, competitor publications, sector reports, third-party database, and other credible publications.

Step 2: Market Segmentation:

After obtaining the historical market size of the security information and event management market, we conducted a detailed secondary analysis to gather historical market insights and share for different segments & sub-segments for major regions. Major segments are included in the report as component, deployment, organization type, end-user, and regions. Further country-level analyses were conducted to evaluate the overall adoption of testing models in that region.

Step 3: Factor Analysis:

After acquiring the historical market size of different segments and sub-segments, we conducted a detailed factor analysis to estimate the current market size of the security information and event management market. Further, we conducted factor analysis using dependent and independent variables such as component, deployment, organization type, end-user, and regions of the security information and event management market. A thorough analysis was conducted for demand and supply-side scenarios considering top partnerships, mergers and acquisitions, business expansion, and product launches in the Security Information and Event Management market sector across the globe.

Current Market Size Estimate & Forecast

Current Market Sizing: Based on actionable insights from the above 3 steps, we arrived at the current market size, key players in the global Security Information and Event Management market, and market shares of the segments. All the required percentage shares split, and market breakdowns were determined using the above-mentioned secondary approach and were verified through primary interviews.

Estimation & Forecasting: For market estimation and forecast, weights were assigned to different factors including drivers & trends, restraints, and opportunities available for the stakeholders. After analyzing these factors, relevant forecasting techniques i.e., the top-down/bottom-up approach were applied to arrive at the market forecast for 2032 for different segments and sub-segments across the major markets globally. The research methodology adopted to estimate the market size encompasses:

- The industry’s market size, in terms of revenue (USD) and the adoption rate of the security information and event management market across the major markets domestically

- All percentage shares, splits, and breakdowns of market segments and sub-segments

- Key players in the global Security Information and Event Management market in terms of products offered. Also, the growth strategies adopted by these players to compete in the fast-growing market

Market Size and Share Validation

Primary Research: In-depth interviews were conducted with the Key Opinion Leaders (KOLs) including Top Level Executives (CXO/VPs, Sales Head, Marketing Head, Operational Head, Regional Head, Country Head, etc.) across major regions. Primary research findings were then summarized, and statistical analysis was performed to prove the stated hypothesis. Inputs from primary research were consolidated with secondary findings, hence turning information into actionable insights.

Split of Primary Participants in Different Regions

Market Engineering

The data triangulation technique was employed to complete the overall market estimation and to arrive at precise statistical numbers for each segment and sub-segment of the global security information and event management market. Data was split into several segments and sub-segments after studying various parameters and trends in the component, deployment, organization type, end-user, and regions of the global Security Information and Event Management market.

The main objective of the Global Security Information and Event Management Market Study

The current & future market trends of the global security information and event management market were pinpointed in the study. Investors can gain strategic insights to base their discretion for investments on the qualitative and quantitative analysis performed in the study. Current and future market trends determined the overall attractiveness of the market at a regional level, providing a platform for the industrial participant to exploit the untapped market to benefit from a first-mover advantage. Other quantitative goals of the studies include:

- Analyze the current and forecast market size of the Security Information and Event Management market in terms of value (USD). Also, analyze the current and forecast market size of different segments and sub-segments.

- Segments in the study include areas of the component, deployment, organization type, end-user, and regions.

- Define and analyze the regulatory framework for the security information and event management

- Analyze the value chain involved with the presence of various intermediaries, along with analyzing customer and competitor behaviors of the industry.

- Analyze the current and forecast market size of the security information and event management market for the major region.

- Major countries of regions studied in the report include Asia Pacific, Europe, North America, and the Rest of the World

- Company profiles of the street cleaning machine market and the growth strategies adopted by the market players to sustain the fast-growing market.

- Deep dive regional level analysis of the industry

Frequently Asked Questions FAQs

Q1: What is the security information and event management market's current size and growth potential?

Q2: What are the driving factors for the growth of the security information and event management market?

Q3: Which segment has the largest share of the security information and event management market by component?

Q4: What are the major trends in the security information and event management market?

Q5: Which region will dominate the security information and event management market?

Related Reports

Customers who bought this item also bought