- Home

- About Us

- Industry

- Services

- Reading

- Contact Us

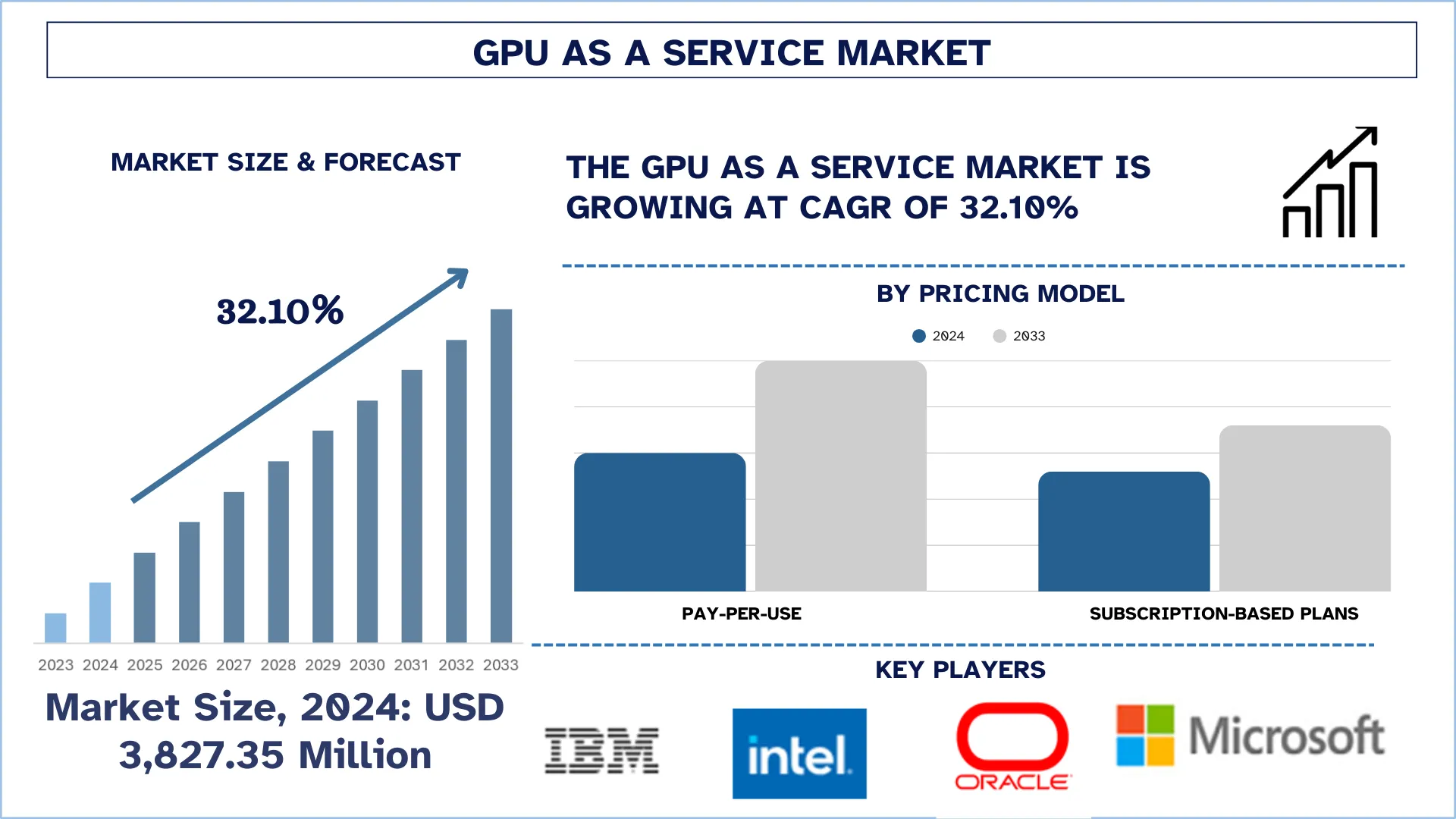

GPU as a Service Market: Current Analysis and Forecast (2025-2033)

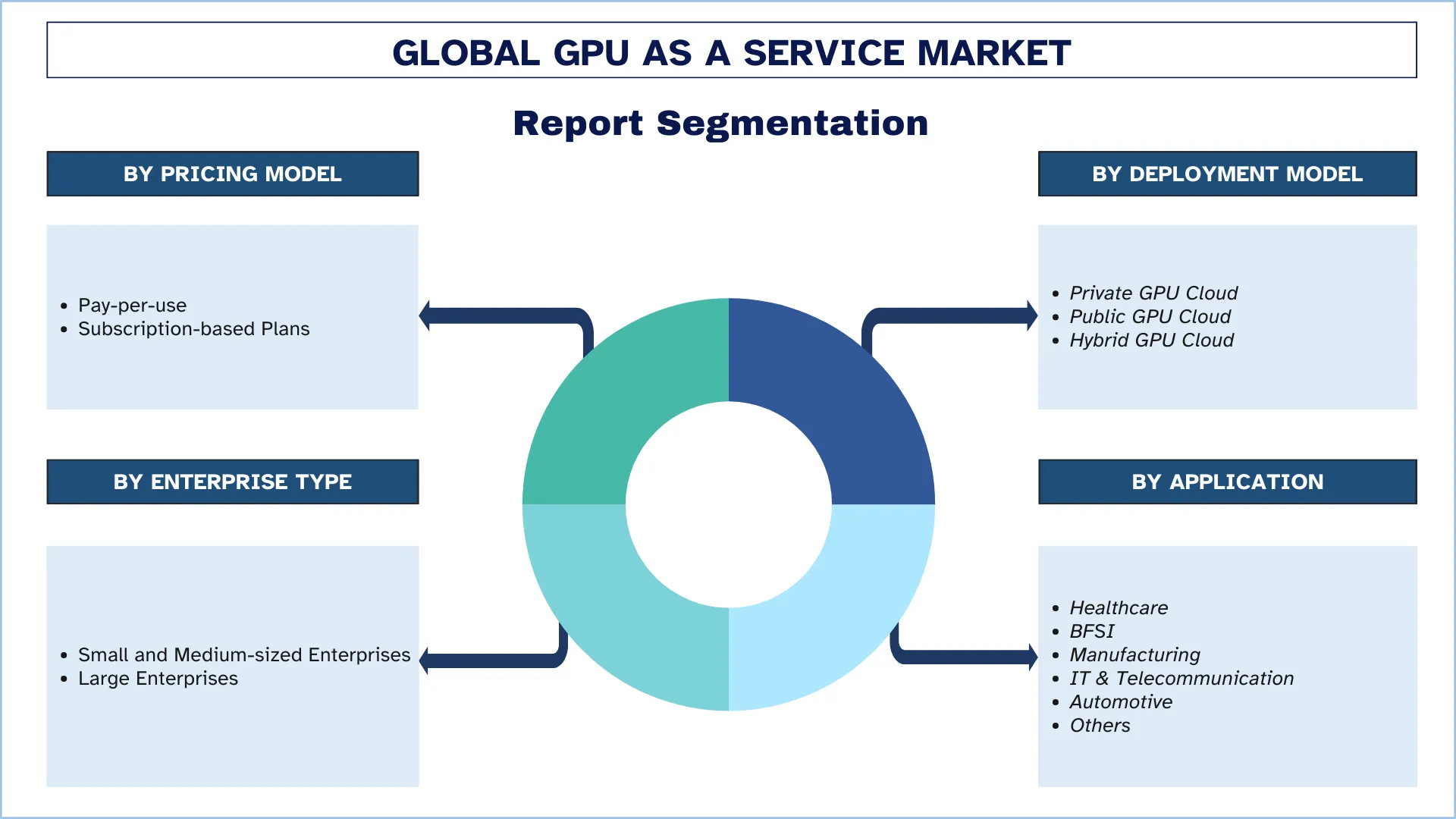

Emphasis on Pricing Model (Pay-per-use, Subscription-based Plans); Deployment Type (Private GPU Cloud, Public GPU Cloud and Hybrid GPU Cloud); Enterprise Type (Small and Medium-sized Enterprises and Large Enterprises); Application (Healthcare, BFSI, Manufacturing, IT & Telecommunication, Automotive and Others) and Region/Country

Global GPU as a Service Market Size & Forecast

The global GPU as a Service Market was valued at USD 3827.35 million in 2024 and is expected to grow to a strong CAGR of around 32.10% during the forecast period (2025- 2033F), owing to the growing demand for AI and machine learning, rising popularity of cloud gaming and content streaming, cost-effective scalability for enterprises.

GPU as a Service Market Analysis

The GPU as a Service (GPUaaS) market is experiencing rapid growth, driven by increasing demand for high-performance computing across industries such as artificial intelligence, machine learning, data analytics, cloud gaming, and media rendering. As companies implement AI and big data technology, they need scalable and economical GPU resources, and hence, cloud-based GPU solutions are more preferred than purchasing costly on-premises hardware. The increase in cloud adoption also speeds this up, allowing businesses to access high-performance GPUs on demand and pay per use. The main drivers are widespread use of deep learning models, real-time rendering needs in gaming and video creation, and expanding use of GPUs among startups and research. Tier-one cloud vendors like NVIDIA, AWS, Google Cloud, and Microsoft Azure are deeply committed to GPUaaS infrastructure to meet the demand. As a result, the market is transforming very quickly with constant innovation focused on more performance, less cost, and more flexibility for a broad range of users and applications.

Global GPU as a Service Market Trends

This section discusses the key market trends that are influencing the various segments of the global GPU as a service market, as found by our team of research experts.

Proliferation of Multi-Cloud and Hybrid Cloud Deployments Drives GPU as a Service Market Growth

The proliferation of multi-cloud and hybrid cloud deployments has emerged as a significant trend driving the growth of the GPU-as-a-Service (GPUaaS) market. The adoption of multi-cloud strategies by organizations is on the rise to prevent vendor lock-in, ensure peak performance, and increase resilience by distributing workloads across several cloud platforms. Concurrently, hybrid cloud configurations that integrate on-premises infrastructure with cloud-based resources are allowing enterprises to keep sensitive data under their control while taking advantage of cloud scalability for compute-centric applications. Such deployment models are also best suited for GPU workloads, as they enable enterprises to access GPU resources dynamically on an as-needed basis, based on workload surges, geospatial proximity, or specific performance needs. Consequently, increasing demand for flexible and interoperable cloud environments is driving the need for GPUaaS offerings that can migrate easily across diverse cloud environments, positioning them at the heart of delivering the scalable, high-performance computing that the contemporary enterprise demands.

GPU as a Service Industry Segmentation

This section provides an analysis of the key trends in each segment of the global GPU as a service market report, along with forecasts at the global, regional, and country levels for 2025-2033.

Pay-Per-Use Segment Dominates the GPU as a Service Market.

Based on the pricing model, the market is segmented into pay-per-use and subscription-based plans. Among these, the pay-per-use segment holds the dominant share because of its cost-benefit factor and operational adaptability. Under this model, companies can harness powerful GPU resources when needed, without having to bear the huge costs involved in buying and maintaining specialized hardware. In addition, increasing adoption of cloud computing and the rising need for real-time computation in applications such as autonomous systems, fraud prevention, and health diagnostics are driving the growth of this segment. As companies increasingly move towards agility and efficiency in IT operations, the pay-per-use model is the most sought-after option for availing GPU services.

Public GPU Cloud Segment Dominates the GPU as a Service Market.

Based on the deployment model, the market is segmented into private GPU cloud, public GPU cloud, and hybrid GPU cloud. Among these, the public GPU cloud segment dominates the GPU as a Service market due to its scalability, cost-effectiveness, and broad accessibility. Public cloud providers provide flexible pricing schemes so that companies pay only for what they consume, which attracts large enterprises and SMEs. The ability to scale computing power as needed, coupled with minimal capital investment, makes public GPU cloud services the preferred choice for organizations across various industries.

North America is expected to grow at a considerable rate during the forecast period.

North America dominates the GPU as a Service market due to the region's strong presence in advanced technological sectors like AI, machine learning, and data analytics. The high take-up of cloud computing and robust infrastructure investments, particularly in sectors such as IT, telecommunication, and healthcare, also added to the dominance of the region. Top-tier U.S. and Canadian technology companies are at the forefront of GPU-based service innovation, thereby making North America unequivocally a market leader. Big data center investments, a robust R&D ecosystem, and the rapid uptake of high-performance computing in the healthcare, finance, and entertainment sectors all work to create this leadership.

The U.S. held a dominant share of the North American GPU as a service market in 2024

The United States dominates the GPU-as-a-Service (GPUaaS) market in North America, largely due to its strong technological ecosystem and the presence of major cloud service providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. These organizations provide cutting-edge and highly scalable GPUaaS offerings, covering numerous industries including artificial intelligence and machine learning, gaming, healthcare, and finance. Besides, the U.S. enjoys a highly advanced infrastructure, a high number of data centers, and a strong base of enterprises and research firms that require high-performance computing facilities. Government initiatives in AI and digital innovation also accelerate the use of GPUaaS, making the U.S. the world leader in the creation and implementation of GPU-based cloud services.

GPU as a Service Industry Competitive Landscape

The global GPU as a service market is competitive, with several global and international market players. The key players are adopting different growth strategies to enhance their market presence, such as partnerships, agreements, collaborations, new product launches, geographical expansions, and mergers and acquisitions.

Top GPU as a Service Companies

Some major players running in the market include IBM, Intel Corporation, Oracle, Microsoft, Amazon.com Inc., NVIDIA Corporation, Samsung Electronics Co., Ltd., Lambda Labs, Google LLC (Alphabet Inc.), and Alibaba Cloud.

Recent Developments in the GPU as a Service Market

In May 2025, Nvidia launched a new cloud service, DGX Cloud Lepton, aimed at giving artificial intelligence developers worldwide broader access to its powerful GPUs through a network of cloud providers. The announcement was made during the Computex technology conference in Taiwan. Nvidia said the platform allows developers to select from a range of cloud vendors to train and deploy AI models, easing dependence on traditional hyperscale cloud service providers such as Amazon Web Services, Microsoft Azure, or Google Cloud.

In May 2025, Cassava Technologies, a global technology leader of African heritage, announced that it has signed a Memorandum of Understanding (MoU) with Sand Technologies, a leading global enterprise AI solutions company and a key player in Africa’s emerging artificial intelligence (AI) ecosystem. The strategic partnership, announced at the Global AI Summit on Africa in Kigali, Rwanda, aims to enhance the delivery of AI solutions and GPU-as-a-service (GPUaas) across the African continent, making AI solutions more accessible to African businesses.

In May 2025, NVIDIA announced NVLink Fusion, new silicon that leverages the NVLink computing fabric to enable integration of third-party CPUs with NVIDIA’s GPUs to make what the company referred to as “semi-custom AI infrastructure.”

In May 2025, Intel launched Arc Pro B60 and B50 graphics processing units for workstations and AI inference, expanding the Arc Pro family with larger memory configurations and expanded software support. During the May 20-23 event in Taipei, Taiwan, Intel marks 40 years of collaboration with local ecosystem partners and expands its GPU lineup, AI accelerator capabilities, and AI assistant availability.

Global GPU as a Service Market Report Coverage

Details | |

Base year | 2024 |

Forecast period | 2025-2033 |

Growth momentum | Accelerate at a CAGR of 32.10% |

Market size 2024 | USD 3,827.35 Million |

Regional analysis | North America, Europe, APAC, Rest of the World |

Major contributing region | Asia-Pacific is expected to dominate the market during the forecast period. |

Key countries covered | U.S., Canada, Germany, U.K., Spain, Italy, France, China, Japan, and India |

Companies profiled | IBM; Intel Corporation; Oracle; Microsoft; Amazon.com Inc.; NVIDIA Corporation; Samsung Electronics Co., Ltd.; Lambda Labs; Google LLC (Alphabet Inc.); Alibaba Cloud. |

Report Scope | Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Demand and Supply Side Analysis; Competitive Landscape; Company Profiling |

Segments Covered | By Pricing Model; By Deployment Model; By Enterprise Type; By Application; By Region/Country |

Reasons to Buy the GPU as a Service Market Report:

The study includes market sizing and forecasting analysis confirmed by authenticated key industry experts.

The report briefly reviews overall industry performance at a glance.

The report covers an in-depth analysis of prominent industry peers, primarily focusing on key business financials, type portfolios, expansion strategies, and recent developments.

Detailed examination of drivers, restraints, key trends, and opportunities prevailing in the industry.

The study comprehensively covers the market across different segments.

Deep dive regional level analysis of the industry.

Customization Options:

The global GPU as a service market can further be customized as per the requirements or any other market segment. Besides this, UnivDatos understands that you may have your own business needs; hence, feel free to contact us to get a report that completely suits your requirements.

Table of Content

Research Methodology for the Global GPU as a Service Market Analysis (2023-2033)

We analyzed the historical market, estimated the current market, and forecasted the future market of the global GPU as a service market to assess its application in major regions worldwide. We conducted exhaustive secondary research to gather historical market data and estimate the current market size. To validate these insights, we carefully reviewed numerous findings and assumptions. Additionally, we conducted in-depth primary interviews with industry experts across the GPU as a service value chain. After validating market figures through these interviews, we used both top-down and bottom-up approaches to forecast the overall market size. We then employed market breakdown and data triangulation methods to estimate and analyze the market size of industry segments and sub-segments.

Market Engineering

We employed the data triangulation technique to finalize the overall market estimation and derive precise statistical numbers for each segment and sub-segment of the global GPU as a service market. We split the data into several segments and sub-segments by analyzing various parameters and trends, including pricing model, deployment model, enterprise type, application, and regions within the global GPU as a service market.

The Main Objective of the Global GPU as a Service Market Study

The study identifies current and future trends in the global GPU as a service market, providing strategic insights for investors. It highlights regional market attractiveness, enabling industry participants to tap into untapped markets and gain a first-mover advantage. Other quantitative goals of the studies include:

Market Size Analysis: Assess the current and forecast market size of the global GPU as a service market and its segments in terms of value (USD).

GPU as a Service Market Segmentation: Segments in the study include areas of pricing model, deployment model, enterprise type, application, and regions.

Regulatory Framework & Value Chain Analysis: Examine the regulatory framework, value chain, customer behavior, and competitive landscape of the GPU as a service industry.

Regional Analysis: Conduct a detailed regional analysis for key areas such as Asia Pacific, Europe, North America, and the Rest of the World.

Company Profiles & Growth Strategies: Company profiles of the GPU as a service market and the growth strategies adopted by the market players to sustain in the fast-growing market.

Frequently Asked Questions FAQs

Q1: What is the global GPU as a service market’s current market size and growth potential?

The GPU as a service market was valued at approximately USD 3,827.35 million in 2024 and is projected to grow at a CAGR of 32.10% from 2025 to 2033, driven by increasing adoption of AI and machine learning applications, the surge in cloud gaming and content streaming, and the demand for cost-efficient and scalable GPU solutions by enterprises.

Q2: Which segment has the largest share of the global GPU as a service market by pricing model?

The pay-per-use pricing model currently holds the largest share of the global GPUaaS market. This model offers flexibility and cost control, making it especially appealing to startups, developers, and enterprises with variable GPU requirements.

Q3: What are the driving factors for the growth of the global GPU as a service market?

Major growth drivers include:

• Rising demand for artificial intelligence (AI) and machine learning (ML) workloads

• Growth in cloud gaming and high-definition content streaming platforms

• The need for scalable and cost-effective computing power in various industries.

Q4: What are the emerging technologies and trends in the global GPU as a service market?

Key trends shaping the GPU as a Service landscape include:

• Integration of AI-powered speech recognition and real-time translation tools

• Growing use of automated transcription technologies

• Migration to cloud-native GPU platforms

• Increased emphasis on compliance with global accessibility and data protection standards.

Q5: What are the key challenges in the global GPU as a service market?

Significant challenges impacting the GPUaaS market include:

• Latency and bandwidth limitations that affect real-time performance

• Data security and privacy concerns, especially in multi-tenant cloud environments

• High infrastructure costs associated with maintaining GPU-intensive platforms.

Q6: Which region dominates the global GPU as a service market?

North America is the dominant region in the global GPUaaS market, fueled by strong technological infrastructure, widespread cloud adoption, and early investment in AI and gaming technologies.

Q7: Who are the key players in the global GPU as a service market?

The key companies shaping the global GPU as a service industry include:

• IBM

• Intel Corporation

• Oracle

• Microsoft

• Amazon.com Inc.

• NVIDIA Corporation

• Samsung Electronics Co., Ltd.

• Lambda Labs

• Google LLC (Alphabet Inc.)

• Alibaba Cloud

Q8: What are the top investment opportunities in the global GPU as a Service (GPUaaS) market?

Key investment opportunities lie in the expansion of cloud-based AI infrastructure, development of GPU-accelerated data centers, partnerships with cloud service providers (CSPs), and vertical integration across industries such as healthcare, automotive, and finance. Demand for edge AI solutions and real-time analytics is also creating new growth areas.

Q9: How can enterprises leverage GPUaaS to drive digital transformation and innovation?

Enterprises can utilize GPUaaS to enhance performance in AI/ML model training, real-time data processing, and high-performance computing (HPC) workloads. It enables faster time-to-market, reduces upfront infrastructure costs, and supports agile scaling for innovation-driven initiatives in sectors like fintech, autonomous vehicles, and digital twins.

Related Reports

Customers who bought this item also bought