Растущие доходы и экономический рост развивающихся стран стимулируют рост рынка программного обеспечения для банкоматов от нескольких поставщиков в регионе APAC!

Автор: Himanshu Patni

16 мая 2023 г.

Theрынок программного обеспечения для банкоматов от нескольких поставщиковв Азиатско-Тихоокеанском регионе будет расти со значительным среднегодовым темпом роста (CAGR) в течение прогнозируемого периода. В связи с ростом ВВП на душу населения в странах Азиатско-Тихоокеанского региона, повышением уровня жизни и увеличением располагаемого дохода населения, стимулирующим общее потребление в стране, увеличением банковской деятельности и потребностью в наличных деньгах, поскольку они по-прежнему являются наиболее предпочтительным способом транзакции, особенно в сельской экономике, на которую приходится большая часть в этих регионах. Кроме того, рост неформальной экономики, такой как МСП и микропредприятия, значительно увеличивает использование наличных денег. Кроме того, переход на многовендорное программное обеспечение для банкоматов (MVS) с традиционного OEM-программного обеспечения позволяет банкам осуществлять бесперебойные удаленные обновления безопасности через облако. MVS позволяет банкам предлагать персонализированные, а также новые продукты клиентам в своей сети банкоматов гибким и быстрым способом, тем самым делая банкоматы критически важным компонентом цифровой стратегии банка, что также можно увидеть по инновациям, происходящим в этой области.Например, в августе 2021 года RBP (Программа сельского банковского обслуживания) Finivis Pvt. Ltd запустила самообслуживаемый банкомат Mego, который оснащен устройством микро-банкомата, которое позволяет снимать и вносить наличные. Банкомат Mego также установлен с AEPS-биометрией, где можно проверить свой баланс и перевести деньги напрямую из одного источника в другой. Это инновация в рамках PMJD Yojna и Atma Nirbhar Bharat Yojna, инициативы RBI, которая разрешила Fintechs использовать банкоматы белой марки.

Получите информацию изнутри с примером отчета:-https://univdatos.com/report/multivendor-atm-software-market/get-a-free-sample-form.php?product_id=37456

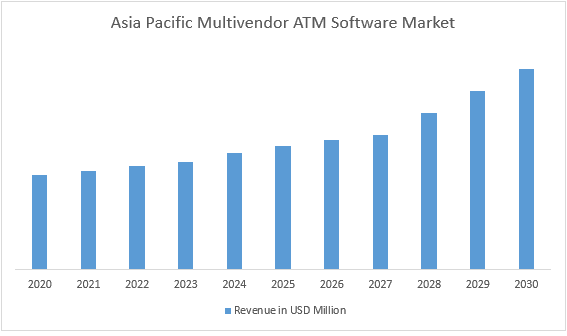

Ожидается, что рынок программного обеспечения для банкоматов от нескольких поставщиков будет расти со значительным среднегодовым темпом роста (CAGR) около 20% в течение прогнозируемого периода.Ожидается, что APAC станет самым быстрорастущим рынком программного обеспечения для банкоматов от нескольких поставщиков, в первую очередь благодаря росту экономической активности, увеличению доходов в сельской местности, где наличные деньги являются наиболее предпочтительным способом транзакций, и быстрому экономическому росту с государственно-частными партнерствами.

РИС. 1 Доход рынка программного обеспечения для банкоматов от нескольких поставщиков APAC (2020-2030 гг.) - млн. долларов США

Для детального анализа Глобального рынка программного обеспечения для банкоматов от нескольких поставщиков просмотрите–https://univdatos.com/report/multivendor-atm-software-market/

«Среди типов компонентов сегмент программного обеспечения занимает доминирующую долю рынка»

Основываясь на типе компонентов, рынок разделен на программное обеспечение и услуги. Из этих двух сегмент программного обеспечения занимает значительную долю рынка. Рынок в основном обусловлен тем, что банки и финансовые учреждения получают большую выгоду от эксплуатации программного и аппаратного обеспечения банкоматов от нескольких поставщиков, что приносит им экономию затрат, поскольку единую интегрированную систему легче поддерживать и масштабировать, чем несколько отдельных приложений.

Основываясь на конечных пользователях, рынок делится на банковские и финансовые учреждения и независимых операторов банкоматов. Из этих двух независимые операторы банкоматов (банкоматы с коричневой и белой маркой) будут расти со значительным среднегодовым темпом роста (CAGR) в течение прогнозируемого периода. Рынок в основном обусловлен тем, что банки переходят от модели capex к модели opex для работы своих банкоматов, где третьи стороны устанавливают и управляют банкоматами банка и получают оплату за каждую транзакцию, освобождая банки от проблем, связанных с выбором площадки, покупкой банкоматов и управлением ими на ежедневной основе, что происходит в модели capex, увеличивая их внимание к росту и основным банковским операциям.

Глобальный рынок программного обеспечения для банкоматов от нескольких поставщиковСегментация

Анализ рынка по типу компонентов

- Программное обеспечение

- Услуги

Анализ рынка по конечному пользователю

- Банковские и финансовые учреждения

- Независимый оператор банкомата

Анализ рынка по типу функций

- Оплата счетов

- Оплата картой

- Диспенсер наличных/чеков

- Принтер для сберкнижек

- Другие

Анализ рынка по регионам

- Северная Америка

- США

- Канада

- Остальная часть Северной Америки

- Европа

- Германия

- Великобритания

- Франция

- Италия

- Испания

- Остальная часть Европы

- APAC

- Китай

- Япония

- Индия

- Южная Корея

- Остальная часть APAC

- Остальной мир

Ведущая компанияПрофили

- СMS

- KAL ATM Software GmbH

- Auriga Spa

- Hyosung Global

- NCR Corporation

- Hexaon Business Mitrasindo

- Diebold Nixdorf

- ZOOM CyberSense

- Clydestone Group

- Printec Group

Заказать звонок