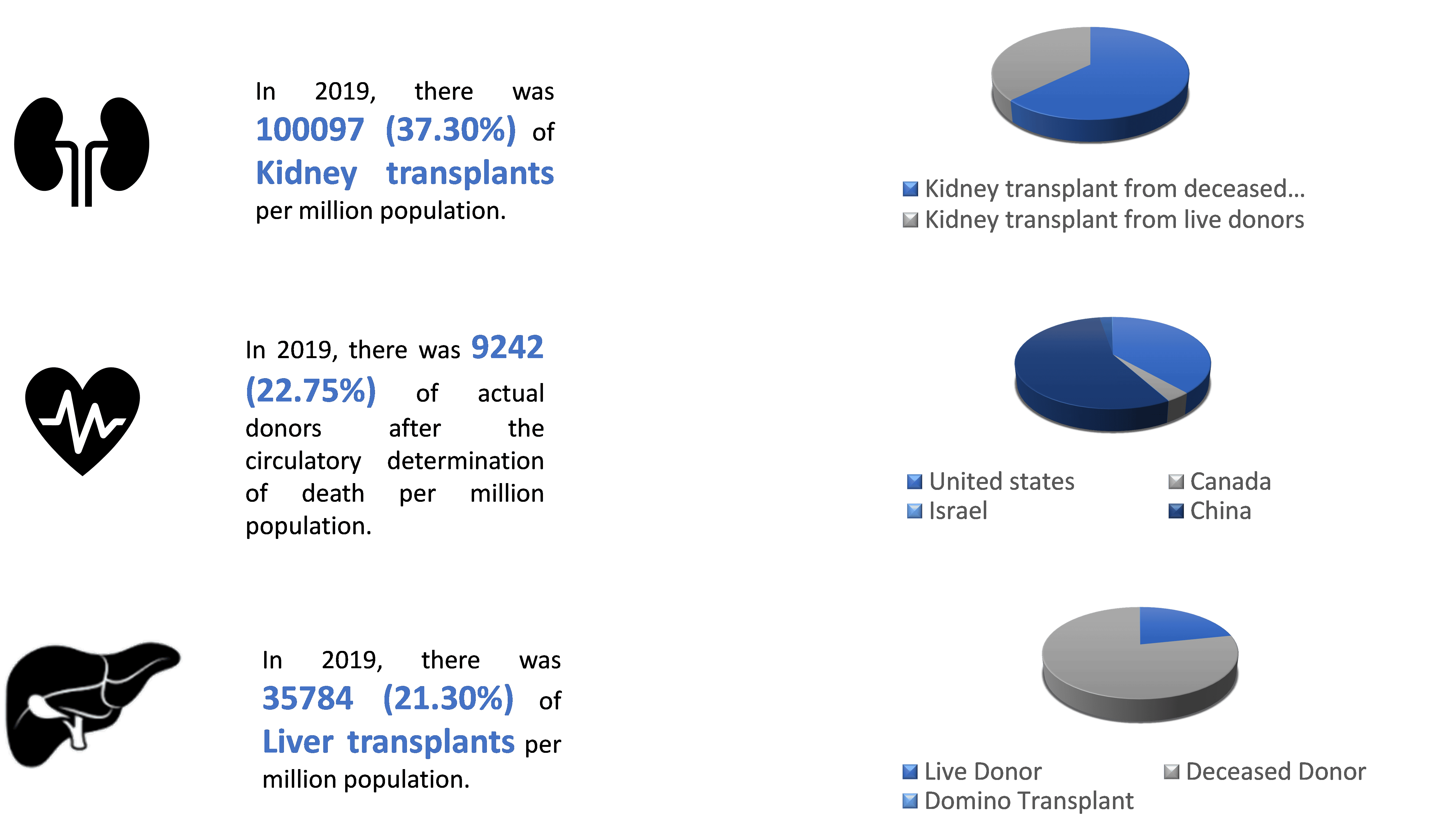

移植诊断是用于确定器官捐赠者和接受者在移植前后是否相容的测试。移植诊断产品的需求预计将主要受到以下因素的推动而增长:公共和私人对目标研究活动资金的增加、器官移植数量的增加以及移植诊断领域的最新技术进展。2019年,世界各国接受器官移植的患者比例有所上升。在这一年里,法国每百万居民中大约有87名器官移植患者。如果血液和氧气一直流经器官直到恢复的那一刻,那么器官捐献可以由已故捐赠者和活体捐赠者进行。器官移植率的提高是由于导致严重器官损伤的疾病增多。这推动了对诊断性移植的需求。

尽管有超过107,453人在等待器官移植,但捐赠者数量一直在稳步上升,其次是已故捐赠者数量。例如,根据全球捐赠和移植观察站 (GODT) 的数据,活体肾脏捐赠者数量从 2018 年到 2019 年增加了 3.3%,而已故捐赠者数量增加了 8.1%。这表明医疗保健行业与移植相关的诊断设施的改进和需求。预计器官捐献者数量的增加对于预测期内移植的增长和主导地位非常有利。

在过去的十年中,这些国家的医疗保健支出与总体经济增长基本保持一致。2010年至2019年,经合组织的医疗保健支出平均每年约占 GDP 的 8.7%。然而,在同一时间跨度内,美国的医疗保健支出从 GDP 的 16.3% 增加到 17.0%。

根据 2019 年的经合组织数据,美国的人均 GDP 最高,占 17%,其次是瑞士和德国,GDP 分别为 12.1% 和 11.7%。医疗保健的改善预计将推动移植诊断市场的增长

2019年全球器官移植(每百万人口)

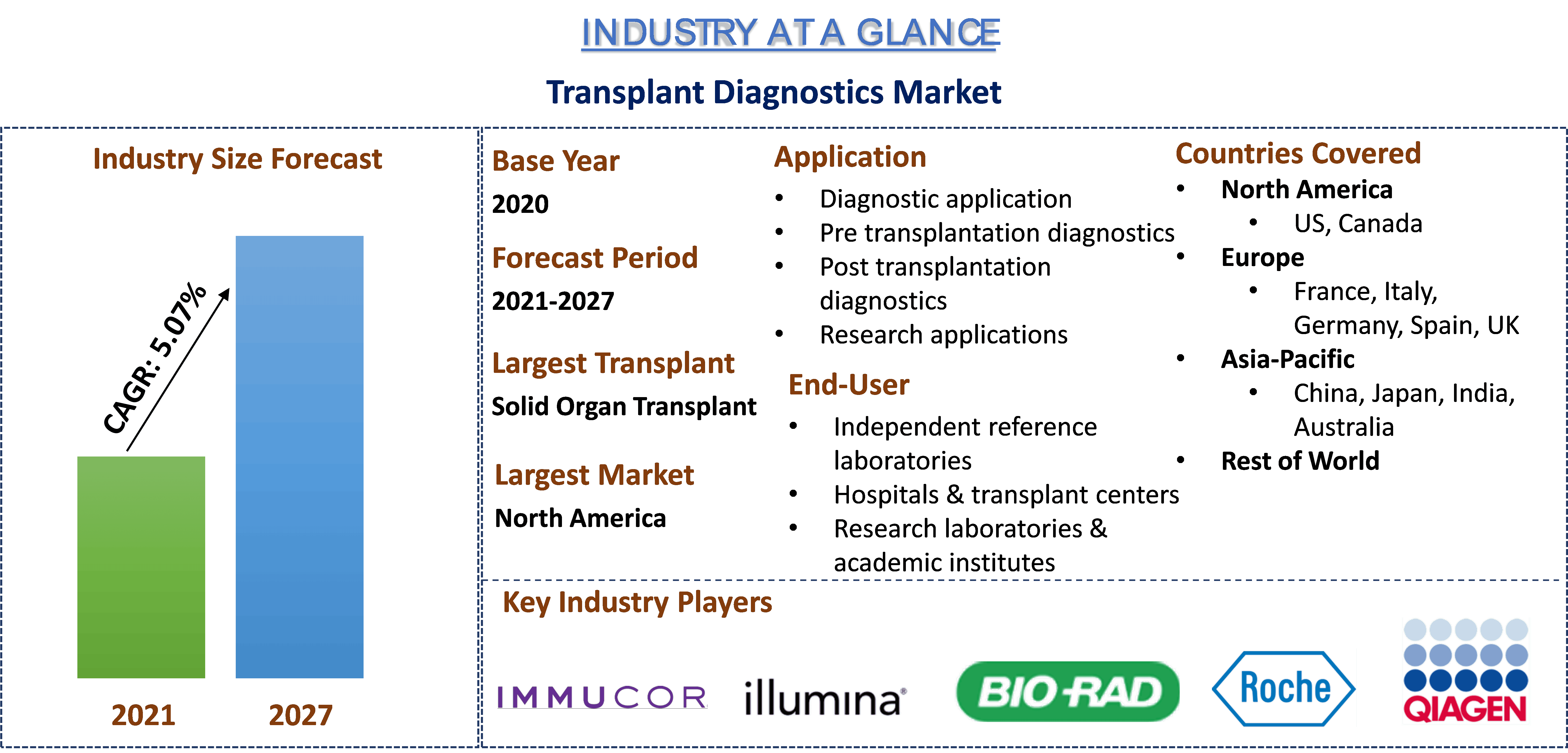

Bio-Rad laboratories, Inc.、Dorel Industries Inc.、F. Hoffman-La Roche Ltd.、QIAGEN N.V.、Thermo Fisher Scientific Inc.、bioMérieux S.A.、Immucor, Inc.、llumina, Inc.、Luminex Corporation、Becton, Dickinson and Company 是全球移植诊断市场的主要参与者。这些公司已经进行了多次并购和合作,以方便客户使用高科技和创新产品。

报告中提出的见解

“在技术中,分子检测技术领域占据主要份额”

基于技术,市场分为分子检测技术和非分子检测技术。此外,对基于 PCR 的分子检测、基于测序的分子检测进行了分子技术研究。分子检测技术领域在 2020 年占据了市场的主导地位,份额为 XX%,并且由于公共和私人对目标研究工作的融资增加以及传染病负担的扩大,预计在预测期内将保持其主导地位。

“在产品和服务中,预计仪器在分析期间将以最高的复合年增长率增长”

此外,根据产品和服务,市场分为试剂和耗材、仪器、软件和服务。2020 年,仪器占最大的市场收入份额,为 XX%,并且由于医疗保健支出的增加,预计在分析期间将保持主导地位。

“在移植类型中,实体器官移植领域占据主要份额”

根据移植类型,市场分为实体器官移植、干细胞移植、软组织移植和骨髓移植。实体器官移植中心在 2020 年占据了市场的主导地位,收入为 XX 亿美元,预计在分析期间将保持其主导地位。此外,预计该细分市场在此期间也将以最高的复合年增长率增长。

“在应用中,诊断应用领域占据主要份额”

根据应用,市场分为诊断应用和研究应用。诊断应用中心在 2020 年占据了市场的主导地位,收入为 XX 亿美元,并且由于其在患者概况分析中的各种应用以及其疗效的临床证据不断增加,预计在分析期间将保持其主导地位。

“在最终用户中,独立参考实验室领域占据主要份额”

根据最终用户类型,市场分为独立参考实验室、医院和移植中心以及研究实验室和学术机构。独立参考实验室在 2020 年占据了市场的主导地位,收入为 XX 亿美元,并且由于制药和生物技术公司外包给独立参考实验室的研发活动数量不断增加,预计在分析期间将保持其主导地位。

“北美是移植诊断市场最大的市场之一”

为了更好地理解移植诊断市场的市场动态,对全球不同地区进行了详细分析,包括北美(美国、加拿大和北美其他地区)、欧洲(德国、法国、意大利、西班牙、英国和欧洲其他地区)、亚太地区(中国、日本、印度和亚太其他地区)和世界其他地区。北美占据了市场的主导地位,并在 2020 年创造了 XX 亿美元的收入,原因是医疗保健基础设施高度发达以及熟练专业人员的可用性等因素。此外,个性化药物、干细胞疗法和软组织移植的高采用率正在推动区域市场增长。尽管美国有 107,453 名个人在等待移植名单中,但与此同时,捐赠者的数量也在以良好的速度增长。

购买本报告的理由:

- 该研究包括经过认证的主要行业专家验证的市场规模和预测分析

- 该报告提供对整体行业绩效的快速回顾

- 该报告涵盖了对杰出的行业同行的深入分析,主要侧重于关键业务财务、产品组合、扩张策略和最新发展

- 详细研究了行业中存在的驱动因素、限制因素、关键趋势和机遇

- 该研究全面涵盖了不同细分市场的市场

- 对行业进行深入的区域层面分析

定制选项:

移植诊断市场可以根据需求或任何其他市场细分进行进一步定制。除此之外,UMI 了解到您可能拥有自己的业务需求,因此请随时与我们联系以获取完全符合您要求的报告。

目录

分析历史市场、评估当前市场以及预测全球移植诊断市场的未来市场是创建和分析全球主要地区不同疾病器官和组织移植应用情况的三个主要步骤。进行了详尽的二级研究,以收集历史市场数据并评估当前市场规模。其次,为了验证这些见解,考虑了大量的发现和假设。此外,还与移植诊断行业价值链上的行业专家进行了详尽的一级访谈。在通过一级访谈对市场数据进行假设和验证后,我们采用了自上而下/自下而上的方法来预测完整的市场规模。此后,采用市场细分和数据三角测量方法来评估和分析行业相关细分市场和子细分市场的市场规模。详细的方法如下所述:

历史市场规模分析

步骤 1:深入研究二级来源:

进行了详细的二级研究,以通过公司内部来源(例如年度报告和财务报表、业绩演示文稿、新闻稿等)以及外部来源(包括期刊、新闻和文章、政府出版物、竞争对手出版物、行业报告、第三方数据库和其他可靠出版物)获取移植诊断的历史市场规模。

步骤 2:市场细分:

在获得移植诊断市场的历史市场规模后,我们进行了详细的二级分析,以收集主要地区不同细分市场的历史市场见解和份额。报告中包含的主要细分市场包括治疗方法、应用和最终用户。此外,还进行了国家层面的分析,以评估每个地区移植诊断的总体应用情况。

步骤 3:因素分析:

在获得不同细分市场和子细分市场的历史市场规模后,我们进行了详细的因素分析,以评估移植诊断的当前市场规模。此外,我们使用依赖变量和独立变量(例如慢性疾病的增加、老年人口的增长)进行了因素分析。我们对需求和供应侧情景进行了全面分析,考虑了全球移植诊断行业中的顶级合作伙伴关系、并购、业务扩张和产品发布。

当前市场规模评估与预测

当前市场规模:基于上述 3 个步骤的可行见解,我们得出了当前的市场规模、移植诊断市场中的主要参与者以及细分市场的市场份额。所有必需的百分比份额划分和市场细分都是使用上述二级方法确定的,并通过一级访谈进行了验证。

评估与预测:对于市场评估和预测,我们为不同的因素分配了权重,包括驱动因素和趋势、限制以及利益相关者可获得的机会。在分析这些因素后,我们应用了相关的预测技术,即自上而下/自下而上的方法,以得出全球主要市场中不同细分市场和子细分市场到 2027 年左右的市场预测。用于评估市场规模的研究方法包括:

- 该行业的市场规模,以价值(美元)衡量,以及移植诊断在国内主要市场的应用率

- 市场细分市场和子细分市场的所有百分比份额、划分和细分

- 移植诊断市场中提供服务的主要参与者。此外,这些参与者为在快速增长的市场中竞争而采取的增长战略

市场规模和份额验证

一级研究:与关键意见领袖 (KOL) 进行了深入访谈,包括主要地区的顶级管理人员(CXO/VP、销售主管、营销主管、运营主管、区域主管、国家主管等)。然后总结了一级研究结果,并进行了统计分析以证明所述假设。一级研究的输入与二级研究结果相结合,从而将信息转化为可行的见解。

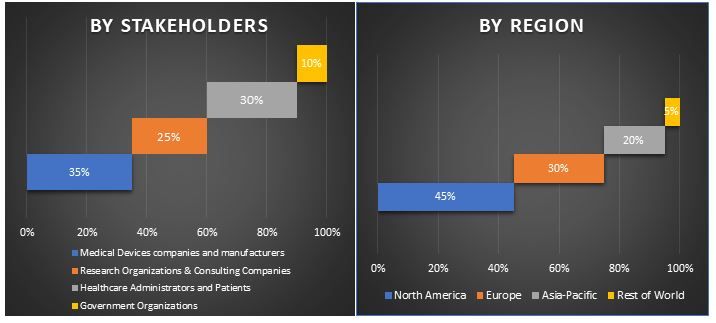

不同地区一级参与者的细分

市场工程

采用数据三角测量技术来完成整体市场评估,并得出移植诊断市场每个细分市场和子细分市场的精确统计数字。在研究了技术、产品与服务、移植类型、应用和移植诊断市场最终用户等领域的各种参数和趋势后,将数据分成几个细分市场和子细分市场。

移植诊断市场研究的主要目标

该研究指出了移植诊断的当前和未来市场趋势。投资者可以从研究中进行的定性和定量分析中获得战略见解,以作为其投资判断的基础。当前和未来的市场趋势决定了区域层面市场的整体吸引力,为行业参与者提供了一个利用未开发市场以获得先行者优势的平台。该研究的其他量化目标包括:

- 分析移植诊断的当前和预测市场规模(按价值(美元)计算)。此外,分析不同细分市场和子细分市场的当前和预测市场规模

- 研究中的细分市场包括技术、产品与服务、移植类型、应用和最终用户领域

- 定义和分析移植诊断行业的监管框架

- 分析涉及各种中介机构的价值链,以及分析行业客户和竞争对手的行为

- 分析主要地区移植诊断市场的当前和预测市场规模

- 报告中研究的主要地区包括北美(美国和加拿大)、欧洲(德国、法国、意大利、西班牙和英国)、亚太地区(中国、日本、印度和澳大利亚)以及世界其他地区

- 移植诊断市场的公司概况以及市场参与者为在快速增长的市场中保持竞争力而采取的增长战略

- 深入的行业区域层面分析

相关 报告

购买此商品的客户也购买了