中東先買後付市場:現況分析與預測 (2024-2032)

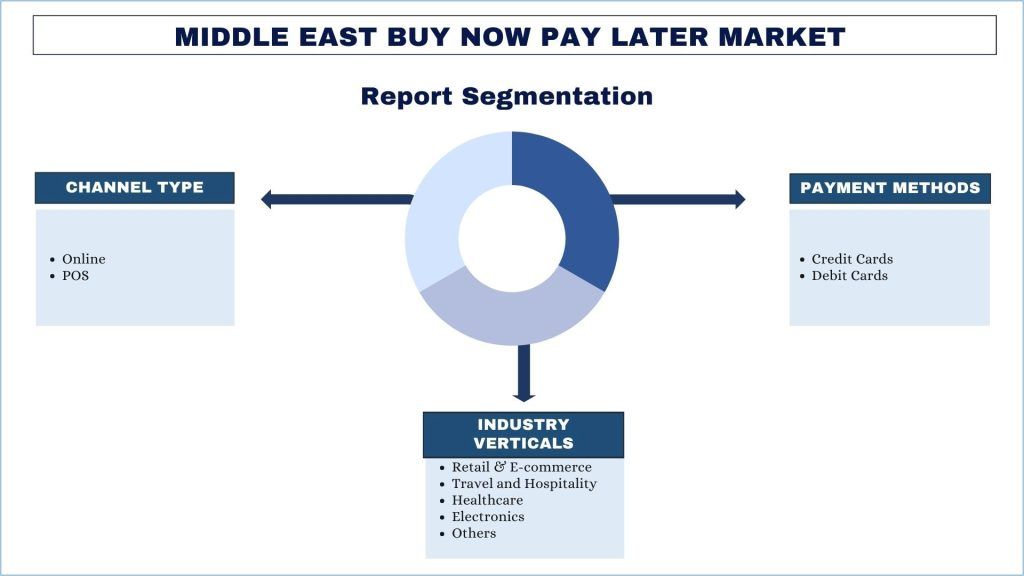

著重於通路類型(線上與POS)、付款方式(信用卡與簽帳金融卡)、產業垂直領域(零售與電子商務、旅遊與餐飲、醫療保健、電子產品及其他);區域/國家。

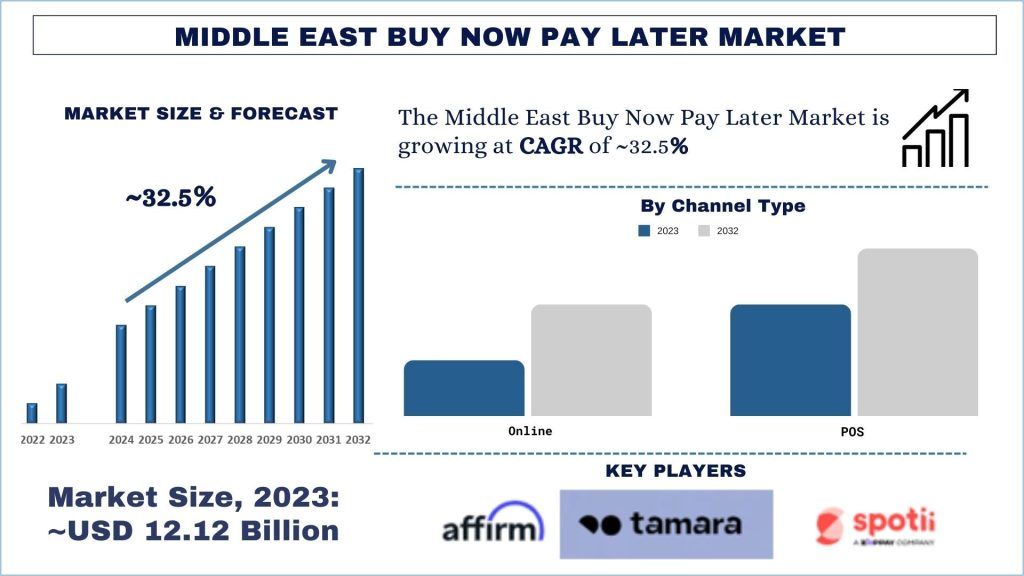

中東先買後付市場規模與預測

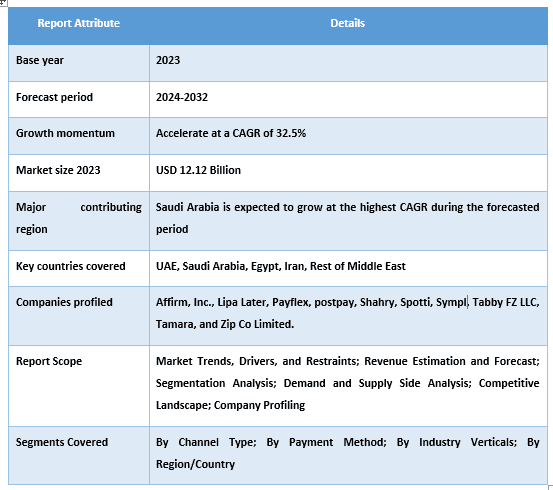

2023年中東先買後付市場的價值為121.2億美元,預計在預測期間(2024-2032年)將以約32.5%的穩健複合年增長率增長。

中東先買後付市場分析

先買後付 (BNPL) 是一種金融服務,允許消費者進行購買並延遲付款,通常分期付款,如果在指定期限內支付,則不產生利息費用。由於政府支持力道加大,中東先買後付市場預計在預測期間將以 32.5% 的大幅複合年增長率增長。例如,在沙烏地阿拉伯,政府已推出政策以促進數位支付和金融普及。這些措施包括促進 BNPL 服務的監管改革,以及鼓勵金融科技公司擴大在該國的業務。此外,阿聯酋已啟動阿聯酋 2021 年願景和杜拜未來議程等戰略舉措,將數位轉型和金融服務創新列為優先事項。這種政府的支持為 BNPL 供應商蓬勃發展創造了有利的環境,吸引投資並加速區域市場增長。由於這些支持性措施,BNPL 服務有望更深入地滲透到中東經濟的各個領域,為消費者提供更大的支付靈活性,並提高零售、電子商務及其他領域的採用率。

中東先買後付市場區隔

根據通路類型,中東先買後付市場分為線上和 POS。由於該地區電子商務活動的快速增長,線上部門在 2023 年佔據了主要的市場份額。BNPL 服務在線上交易中提供的便利性和靈活性吸引了廣泛的消費者群體,加速了 Souq.com 和 Noon 等平台上的採用。

按付款方式,中東的先買後付市場分為信用卡和金融卡。由於消費者普遍傾向於直接從他們的銀行帳戶中提取資金,而不是累積信用卡債務,因此金融卡部門在 2023 年佔據了主要的市場份額。這符合該地區的銀行業務慣例和對財務管理的文化態度。

按產業垂直劃分,中東先買後付市場分為零售和電子商務、旅遊和酒店、醫療保健、電子產品和其他。在疫情過後線上購物激增的推動下,零售和電子商務部門在 2023 年領先市場。Majid Al Futtaim 和 Emaar Malls 等零售巨頭已整合 BNPL 選項,以加強客戶參與並提高銷售量。

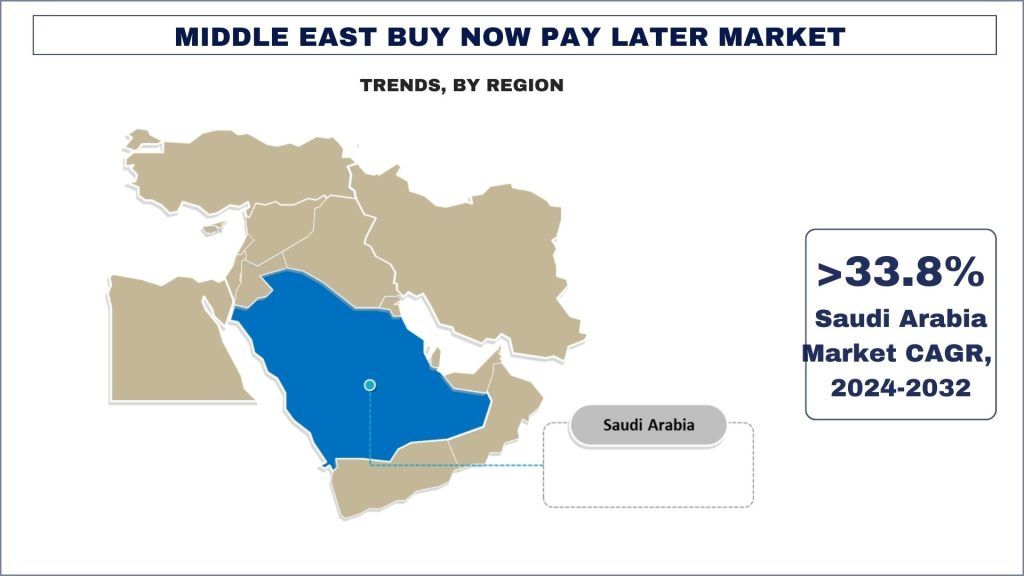

2023年沙烏地阿拉伯佔據了市場的主要份額

2023年沙烏地阿拉伯佔據了市場的主要份額。該國的經濟實力和不斷增加的可支配收入推動了消費者通過 BNPL 服務進行消費。例如,Tamara 和 Tamweel 等當地金融科技公司與主要零售商合作,提供靈活的付款方式,吸引了越來越多的年輕消費者渴望採用數位金融解決方案。這一趨勢突顯了沙烏地阿拉伯在塑造該地區 BNPL 格局方面的領導地位。

中東先買後付產業概況

中東先買後付市場競爭激烈且分散,存在多家區域和國際市場參與者。主要參與者正在採取不同的增長策略來增強其市場影響力,例如合作夥伴關係、協議、合作、新產品發布、地域擴張以及併購。市場上的一些主要參與者包括 Affirm, Inc.、Lipa Later、Payflex、postpay、Shahry、Spotti、Sympl、Tabby FZ LLC、Tamara 和 Zip Co Limited。

中東先買後付市場新聞

2022 年 1 月,肯亞 BNPL 新創公司 Lipa Later 籌集了 1200 萬美元的 A 輪前融資,以擴大其在非洲的業務。這筆資金將支持該公司擴大其先買後付服務,覆蓋現有用戶,並加強其在肯亞、烏干達和盧安達等當前市場的影響力。此外,Lipa Later 計劃進軍奈及利亞、南非、迦納和坦尚尼亞等新市場。

2022 年 2 月,總部位於阿聯酋的金融科技公司 Postpay 與杜拜商業銀行 (CBD) 達成債務融資協議,以使其金融產品範圍多樣化。此次合作體現了金融科技公司與傳統銀行之間日益增長的合作趨勢,利用他們結合的專業知識來加強市場上可用的金融服務範圍。

中東先買後付市場報告涵蓋範圍

購買本報告的理由:

- 該研究包括經過驗證的權威產業專家驗證的市場規模和預測分析。

- 該報告以一目瞭然的方式快速回顧整體產業績效。

- 該報告深入分析了傑出的產業同業,主要側重於關鍵業務財務、產品組合、擴張策略和近期發展。

- 詳細檢視產業中現有的驅動因素、限制、主要趨勢和機會。

- 該研究全面涵蓋了不同區隔市場的市場。

- 深入分析該產業的區域層面。

客製化選項:

中東先買後付市場可以根據需求或任何其他市場區隔進一步客製化。除此之外,UMI 了解您可能有自己的業務需求,因此請隨時與我們聯繫以取得一份完全符合您需求的報告。

目錄

中東先買後付市場分析 (2024-2032) 的研究方法

分析歷史市場、估計當前市場和預測中東先買後付市場的未來市場,是創建和分析主要國家採用中東先買後付的三個主要步驟。 進行了詳盡的二級研究,以收集歷史市場數據並估算當前市場規模。 其次,為了驗證這些見解,我們考慮了大量的發現和假設。 此外,我們還與中東先買後付市場價值鏈中的行業專家進行了詳盡的初步訪談。 在透過初步訪談假設和驗證市場數據後,我們採用了自上而下/自下而上的方法來預測完整的市場規模。 隨後,採用市場細分和數據三角測量方法來估計和分析行業相關的細分市場和子細分市場的市場規模。 詳細方法如下所述:

歷史市場規模分析

步驟 1:深入研究二級來源:

進行了詳細的二級研究,以透過公司內部來源(例如年度報告和財務報表、績效簡報、新聞稿等)以及外部來源(包括期刊、新聞和文章、政府出版物、競爭對手出版物、行業報告、第三方資料庫和其他可靠出版物)來獲得中東先買後付市場的歷史市場規模。

步驟 2:市場細分:

在獲得中東先買後付市場的歷史市場規模後,我們進行了詳細的二級分析,以收集主要地區不同細分市場和子細分市場的歷史市場洞察和份額。 報告中包含的主要細分市場包括管道類型、付款方式和行業垂直領域。 此外,還進行了國家層級的分析,以評估整體採用情況。

步驟 3:因素分析:

在獲得不同細分市場和子細分市場的歷史市場規模後,我們進行了詳細的因素分析,以估計中東先買後付市場的當前市場規模。 此外,我們使用中東先買後付市場的管道類型、付款方式和行業垂直領域等相關和獨立變數進行了因素分析。 考慮到中東先買後付市場的頂級合作夥伴關係、併購、業務擴張和產品發布,對需求和供應方面的場景進行了徹底的分析。

當前市場規模估計與預測

當前市場規模:根據以上 3 個步驟的可行見解,我們得出了中東先買後付市場的當前市場規模、主要參與者以及各細分市場的市場份額。 所有要求的百分比份額分割和市場細分均使用上述二級方法確定,並透過初步訪談進行驗證。

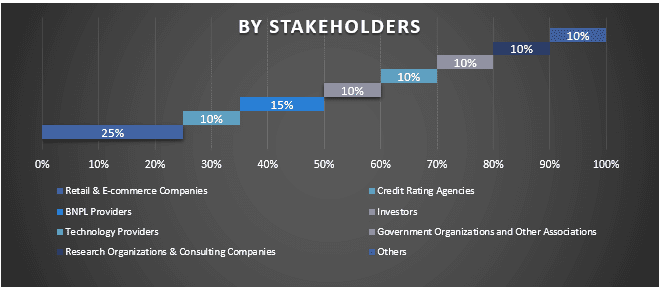

估計與預測:對於市場估計和預測,我們為不同的因素分配了權重,包括利害關係人的驅動因素和趨勢、限制和機會。 在分析了這些因素後,我們應用了相關的預測技術,即自上而下/自下而上的方法,以得出 2032 年主要市場中不同細分市場和子細分市場的市場預測。 用於估計市場規模的研究方法包括:

- 該行業的市場規模,以收入 (美元) 和主要國內市場中東先買後付市場的採用率衡量

- 市場細分市場和子細分市場的所有百分比份額、分割和細分

- 中東先買後付市場中的主要參與者,以提供的產品衡量。 此外,這些參與者為在快速成長的市場中競爭而採取的成長策略

市場規模和份額驗證

初步研究:與主要地區的關鍵意見領袖 (KOL)(包括高階主管(CXO/VP、銷售主管、行銷主管、營運主管、區域主管、國家主管等))進行了深入訪談。 然後總結初步研究結果,並進行統計分析以證明既定假設。 初步研究的輸入與二級研究結果合併,從而將資訊轉化為可行的見解。

主要參與者分割

市場工程

採用資料三角測量技術來完成整體市場估計,並得出中東先買後付市場每個細分市場和子細分市場的精確統計數字。 在研究了中東先買後付市場的管道類型、付款方式和行業垂直領域的各種參數和趨勢後,資料被分成幾個細分市場和子細分市場。

中東先買後付市場研究的主要目標

研究中指出了中東先買後付市場的當前和未來市場趨勢。 投資者可以獲得策略性見解,以將其投資決策建立在研究中進行的定性和定量分析的基礎上。 當前和未來的市場趨勢決定了國家層級市場的整體吸引力,為產業參與者提供了一個利用未開發市場以從先發優勢中受益的平台。 該研究的其他定量目標包括:

- 分析中東先買後付市場的當前和預測市場規模(以價值(美元)衡量)。 此外,分析不同細分市場和子細分市場的當前和預測市場規模。

- 研究中的細分市場包括管道類型、付款方式和行業垂直領域。

- 定義和分析中東先買後付的監管框架

- 分析與各種中介機構相關的價值鏈,以及分析該行業的客戶和競爭對手的行為。

- 分析主要國家中東先買後付市場的當前和預測市場規模。

- 中東先買後付市場的公司簡介以及市場參與者為在快速成長的市場中維持而採取的成長策略

- 深入分析該行業的國家層級

常見問題 常見問題

Q1:中東先買後付市場目前的市場規模和成長潛力為何?

Q2:中東先買後付市場增長的驅動因素是什麼?

Q4:中東先買後付市場的新興技術和趨勢是什麼?

Q5:哪個國家將主導中東地區的「先買後付」市場?

相關 報告

購買此商品的客戶也購買了