- Startseite

- Über uns

- Industrie

- Dienstleistungen

- Lesen

- Kontaktieren Sie uns

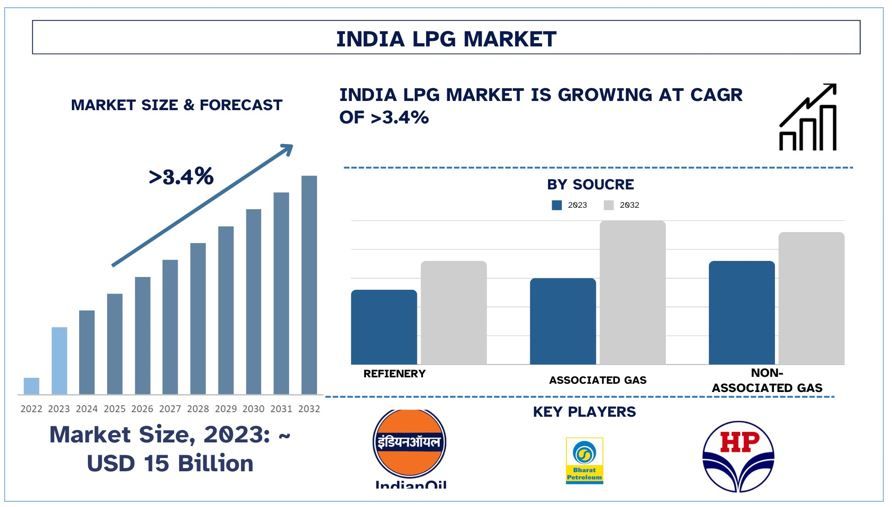

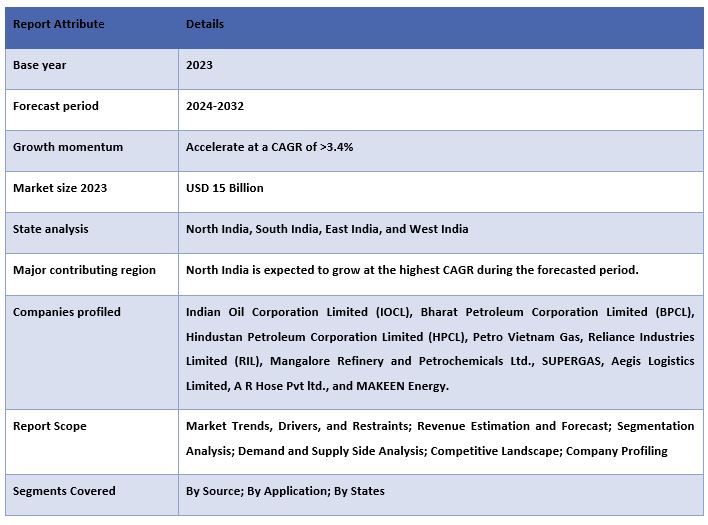

Indien-LPG-Markt: Aktuelle Analyse und Prognose (2024-2032)

Betonung auf Quelle (Raffinerie, Begleitgas, Nicht-Begleitgas); Anwendung (Wohnen/Gewerbe, Chemie, Industrie, Kraftstoff, Raffinerie und Offshore); Bundesstaaten

Indien-LPG-Marktgröße & Prognose

Indien-LPG-Marktgröße & Prognose

Der indische LPG-Markt wurde 2023 auf 15 Milliarden USD geschätzt und wird im Prognosezeitraum (2024-2032) voraussichtlich mit einer starken CAGR von rund 3,4 % wachsen. Die Flüssiggas-(LPG)-Industrie in Indien ist in jüngster Zeit bemerkenswert gewachsen und hat sich weiterentwickelt. Seit jeher haben Inder Biomasse zum Kochen verwendet; die Regierung hat LPG aktiv als weniger umweltschädliche und effiziente Kraftstoffart vermarktet. Um diese Situation zu ändern, zielt die 2016 gestartete Pradhan Mantri Ujjwala Yojana (PMUY) darauf ab, Frauen aus Familien unterhalb der Armutsgrenze LPG-Anschlüsse zu gewähren. Laut der Regierung. In Indien hat das Programm bis 2023 mehr als 90 Millionen Anschlüsse bereitgestellt, was die Nutzung von LPG in ländlichen Gebieten angekurbelt hat.

Indien-LPG-Marktanalyse

Die Regierung hat sich bemüht, die LPG-Infrastruktur, insbesondere die Abfüllanlagen und Rohrleitungsnetze, auszubauen, um eine kontinuierliche Versorgung im ganzen Land zu gewährleisten. Im Jahr 2022 wurde die Inbetriebnahme der Paradip-Hyderabad-Pipeline erfolgreich abgeschlossen, um das Vertriebsnetz zu verbessern und die Transportkosten zu senken. Der indische LPG-Markt verzeichnet auch eine wachsende Tendenz zur Privatisierung. Derzeit unternehmen zahlreiche Unternehmen wie Reliance und BPCL Anstrengungen, ihre LPG-Vertriebsnetze auszubauen, was die Nachfrage nach LPG in Indien weiter beschleunigen wird.

Indien-LPG-Markttrends

Der Wandel hin zu saubereren Kochlösungen: Einer der wichtigsten Trends, die auf dem indischen LPG-Markt beobachtet werden, ist die wachsende Nachfrage nach saubereren Produkten und Lösungen für Kochbewegungen, die durch Maßnahmen der Regierung, das Gesundheitsbewusstsein der Bevölkerung und technologische Entwicklungen verursacht werden. Dieser Trend wird weitgehend durch die zunehmende Tendenz zur Verwendung von LPG als sauberere Brennstoffquelle im Vergleich zu Biomassebrennstoffen wie Brennholz und Kerosin definiert.

Regierungsinitiativen:Mehrere Kampagnen der indischen Regierung zur Förderung der Verwendung von LPG wurden eingeleitet, darunter die Pradhan Mantri Ujjwala Yojana (PMUY). PMUY wurde 2016 ins Leben gerufen und konzentriert sich in erster Linie darauf, BPL-Familien LPG-Anschlüsse anzubieten, wodurch das Wachstum des LPG-Verkaufs in den ländlichen und anderweitig nicht versorgten Märkten gefördert wird. Im Dezember 2022 wurden im Rahmen dieses Programms mehr als acht Crore LPG-Anschlüsse an die Zielgruppen vergeben, wodurch sich das Energieprofil dieser Gebiete veränderte.

Gesundheitliche Vorteile:Dies hat zu einem Wandel hin zur Nutzung von LPG geführt, auch aufgrund des wachsenden Bewusstseins für die Auswirkungen der Nutzung sauberer Energiequellen beim Kochen, insbesondere auf die Gesundheit der Menschen. Herkömmliche Bioenergiequellen setzen Rauch frei, der schlecht für die Lunge und andere Teile des menschlichen Körpers ist. LPG ist sauberer als Holzkohle und Kerosin, was die Fälle von Luftverschmutzung in Innenräumen reduziert und somit die Gesundheit von Frauen und Kindern verbessert.

Nordindien wird voraussichtlich mit einem signifikanten CAGR im Prognosezeitraum wachsen

Nordindien hat aufgrund einer Kombination aus demografischen, wirtschaftlichen und politischen Faktoren einen erheblichen Anteil am indischen LPG-Markt. Zu den wichtigsten Bundesstaaten in diesem Gebiet gehören Uttar Pradesh, Punjab, Haryana und Delhi, die alle eine große Bevölkerung haben; dies macht die private Nutzung von LPG hoch. Die Gesamtnachfrage nach Kochbrennstoff kann auch auf viele Haushalte zurückgeführt werden, die sich in Uttar Pradesh, dem bevölkerungsreichsten Bundesstaat Indiens, befinden.

Mehrere Regierungspolitiken haben eine wichtige Rolle bei der Steigerung der Nutzung von LPG in Nordindien gespielt. Die wichtigste Regelung für Bargeldtransfers in dieser Hinsicht ist die Pradhan Mantri Ujjwala Yojana (PMUY), die wirksam LPG-Anschlüsse für die Frauen von Familien unterhalb der Armutsgrenze (BPL) in dieser Region bereitstellt. Durch die Fokussierung der Regelung auf die ländlichen Regionen, in denen die traditionelle Biomasse-Nutzungstechnik üblich war, wurden Millionen von Haushalten auf LPG umgestellt. Ein erheblicher Anteil von über 90 Millionen Anschlüssen unter PMUY entfiel 2023 auf Nordindien, wodurch der LPG-Verbrauch der Region zunahm.

Indien-LPG-Industrieübersicht

- Der indische LPG-Markt ist wettbewerbsorientiert und fragmentiert, mit der Präsenz mehrerer Marktteilnehmer. Die wichtigsten Akteure verfolgen verschiedene Wachstumsstrategien, um ihre Marktpräsenz zu stärken, wie z. B. Partnerschaften, Vereinbarungen, Kooperationen, Neueinführungen von Produkten, geografische Expansionen sowie Fusionen und Übernahmen. Zu den wichtigsten Akteuren, die auf dem Markt tätig sind, gehören Indian Oil Corporation Limited (IOCL), Bharat Petroleum Corporation Limited (BPCL), Hindustan Petroleum Corporation Limited (HPCL), Petro Vietnam Gas, Reliance Industries Limited (RIL), Mangalore Refinery and Petrochemicals Ltd., SUPER GAS, Aegis Logistics Limited, A R Hose Pvt ltd. und MAKEEN Energy.

Indien-LPG-Markt-Nachrichten

- Im Jahr 2023 weihte die IOCL mehrere neue LPG-Abfüllanlagen und -Terminals ein, um ihr Vertriebsnetz zu erweitern.

- Im Jahr 2023 ging die HPCL eine Partnerschaft mit Forschungsinstitutionen und Technologieunternehmen ein, um die Produktion von Bio-LPG aus erneuerbaren Quellen voranzutreiben.

Indien-LPG-Marktbericht-Abdeckung

Gründe für den Kauf dieses Berichts:

- Die Studie umfasst eine Marktgrößen- und Prognoseanalyse, die von beglaubigten wichtigen Branchenexperten validiert wurde.

- Der Bericht bietet einen schnellen Überblick über die Gesamtleistung der Branche auf einen Blick.

- Der Bericht enthält eine eingehende Analyse prominenter Branchenteilnehmer mit Schwerpunkt auf wichtigen Geschäftszahlen, Produktportfolios, Expansionsstrategien und aktuellen Entwicklungen.

- Detaillierte Untersuchung von Treibern, Einschränkungen, wichtigen Trends und Chancen, die in der Branche vorherrschen.

- Die Studie deckt den Markt umfassend über verschiedene Segmente ab.

- Detaillierte regionale Analyse der Branche.

Anpassungsoptionen:

Der indische LPG-Markt kann weiter an die Anforderungen oder jedes andere Marktsegment angepasst werden. Darüber hinaus versteht UMI, dass Sie möglicherweise eigene Geschäftsanforderungen haben. Kontaktieren Sie uns, um einen Bericht zu erhalten, der Ihren Anforderungen vollständig entspricht.

Inhaltsverzeichnis

Forschungsmethodik für die Analyse des indischen LPG-Marktes (2024-2032)

Die Analyse des historischen Marktes, die Schätzung des aktuellen Marktes und die Prognose des zukünftigen Marktes des indischen LPG-Marktes waren die drei Hauptschritte, die unternommen wurden, um die Einführung von Indien-LPG in wichtigen Bundesstaaten zu erstellen und zu analysieren. Es wurde eine umfassende Sekundärforschung durchgeführt, um die historischen Marktzahlen zu sammeln und die aktuelle Marktgröße zu schätzen. Zweitens wurden zahlreiche Erkenntnisse und Annahmen berücksichtigt, um diese Erkenntnisse zu validieren. Darüber hinaus wurden umfassende Primärinterviews mit Branchenexperten über die gesamte Wertschöpfungskette des indischen LPG-Marktes geführt. Nach der Annahme und Validierung der Marktzahlen durch Primärinterviews wandten wir einen Top-Down-/Bottom-Up-Ansatz an, um die vollständige Marktgröße zu prognostizieren. Danach wurden Markt-Breakdown- und Daten-Triangulationsmethoden angewendet, um die Marktgröße der Segmente und Untersegmente der Branche zu schätzen und zu analysieren. Die detaillierte Methodik wird im Folgenden erläutert:

Analyse der historischen Marktgröße

Schritt 1: Detaillierte Untersuchung von Sekundärquellen:

Es wurde eine detaillierte Sekundärstudie durchgeführt, um die historische Marktgröße des indischen LPG-Marktes durch unternehmensinterne Quellen wie Jahresberichte und Jahresabschlüsse, Leistungspräsentationen, Pressemitteilungen usw. sowie externe Quellen wie Fachzeitschriften, Nachrichten und Artikel, Veröffentlichungen der Regierung, Veröffentlichungen von Wettbewerbern, Branchenberichte, Datenbanken von Drittanbietern und andere glaubwürdige Veröffentlichungen zu erhalten.

Schritt 2: Marktsegmentierung:

Nachdem wir die historische Marktgröße des indischen LPG-Marktes ermittelt hatten, führten wir eine detaillierte Sekundäranalyse durch, um historische Markteinblicke und -anteile für verschiedene Segmente und Untersegmente für wichtige Regionen zu sammeln. Zu den wichtigsten Segmenten, die in dem Bericht enthalten sind, gehören Quelle, Anwendung und Region. Darüber hinaus wurden Analysen auf Länderebene durchgeführt, um die allgemeine Akzeptanz von Testmodellen in dieser Region zu bewerten.

Schritt 3: Faktorenanalyse:

Nachdem wir die historische Marktgröße verschiedener Segmente und Untersegmente ermittelt hatten, führten wir eine detaillierte Faktorenanalyse durch, um die aktuelle Marktgröße des indischen LPG-Marktes zu schätzen. Darüber hinaus führten wir eine Faktorenanalyse mit abhängigen und unabhängigen Variablen wie der Quelle und der Anwendung des indischen LPG-Marktes durch. Es wurde eine gründliche Analyse der Nachfrage- und Angebotsseitenszenarien unter Berücksichtigung der wichtigsten Partnerschaften, Fusionen und Übernahmen, Geschäftserweiterungen und Produkteinführungen im indischen LPG-Marktsektor durchgeführt.

Aktuelle Marktgrößenschätzung & Prognose

Aktuelle Marktgrößenbestimmung:Basierend auf den umsetzbaren Erkenntnissen aus den obigen 3 Schritten kamen wir zur aktuellen Marktgröße, den wichtigsten Akteuren auf dem indischen LPG-Markt und den Marktanteilen der Segmente. Alle erforderlichen prozentualen Anteile, Aufteilungen und Marktgliederungen wurden unter Verwendung des oben genannten sekundären Ansatzes ermittelt und durch Primärinterviews verifiziert.

Schätzung & Prognose:Für die Marktschätzung und -prognose wurden den verschiedenen Faktoren, einschließlich Treibern & Trends, Einschränkungen und Chancen, die den Stakeholdern zur Verfügung stehen, Gewichte zugewiesen. Nach der Analyse dieser Faktoren wurden relevante Prognosetechniken, d. h. der Top-Down-/Bottom-Up-Ansatz, angewendet, um die Marktprognose 2032 für verschiedene Segmente und Untersegmente in den wichtigsten Märkten in Indien zu erstellen. Die Forschungsmethodik zur Schätzung der Marktgröße umfasst:

- Die Marktgröße der Branche, ausgedrückt in Umsatz (USD) und die Akzeptanzrate des indischen LPG-Marktes in den wichtigsten Märkten im Inland

- Alle prozentualen Anteile, Aufteilungen und Gliederungen von Marktsegmenten und Untersegmenten

- Hauptakteure auf dem indischen LPG-Markt in Bezug auf die angebotenen Produkte. Außerdem die Wachstumsstrategien dieser Akteure, um auf dem schnell wachsenden Markt zu konkurrieren.

Validierung von Marktgröße und -anteil

Primärforschung:Tiefgehende Interviews wurden mit den Key Opinion Leaders (KOLs) geführt, darunter Top-Level-Führungskräfte (CXO/VPs, Vertriebsleiter, Marketingleiter, Betriebsleiter, Regionalleiter, Ländermanager usw.) in den wichtigsten Regionen. Die Ergebnisse der Primärforschung wurden dann zusammengefasst und eine statistische Analyse durchgeführt, um die aufgestellte Hypothese zu beweisen. Die Beiträge aus der Primärforschung wurden mit den Sekundärbefunden konsolidiert, wodurch Informationen in umsetzbare Erkenntnisse umgewandelt wurden.

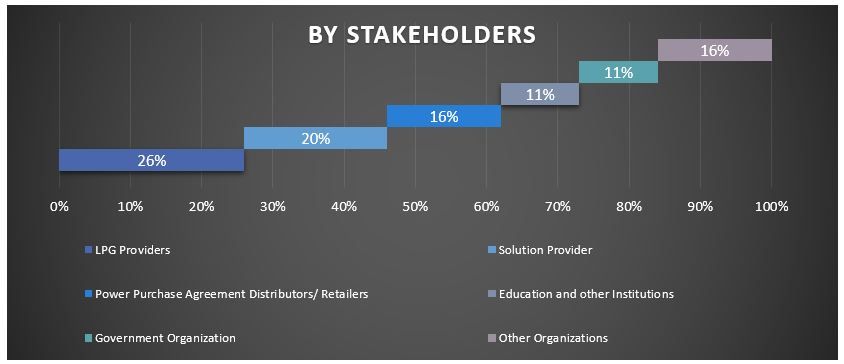

Aufteilung der primären Teilnehmer in verschiedenen Regionen

Markttechnik

Die Datentriangulationstechnik wurde eingesetzt, um die gesamte Marktschätzung abzuschließen und präzise statistische Zahlen für jedes Segment und Untersegment des indischen LPG-Marktes zu ermitteln. Die Daten wurden nach der Untersuchung verschiedener Parameter und Trends in den Bereichen Quelle und Anwendung auf dem indischen LPG-Markt in mehrere Segmente und Untersegmente aufgeteilt.

Das Hauptziel der India LPG Market Study

Die aktuellen und zukünftigen Markttrends des indischen LPG-Marktes wurden in der Studie ermittelt. Investoren können strategische Erkenntnisse gewinnen, um ihre Entscheidungsgrundlage für Investitionen auf der Grundlage der in der Studie durchgeführten qualitativen und quantitativen Analyse zu bilden. Aktuelle und zukünftige Markttrends bestimmten die Gesam привлекательность des Marktes auf staatlicher Ebene und boten den Industrieakteuren eine Plattform, um den unerschlossenen Markt auszunutzen und von einem First-Mover-Vorteil zu profitieren. Weitere quantitative Ziele der Studien umfassen:

- Analysieren Sie die aktuelle und prognostizierte Marktgröße des indischen LPG-Marktes in Bezug auf den Wert (USD). Analysieren Sie außerdem die aktuelle und prognostizierte Marktgröße verschiedener Segmente und Untersegmente.

- Zu den Segmenten der Studie gehören die Bereiche Quelle und Anwendung.

- Definieren und analysieren Sie den regulatorischen Rahmen für das indische LPG

- Analysieren Sie die Wertschöpfungskette mit der Präsenz verschiedener Intermediäre sowie das Verhalten von Kunden und Wettbewerbern in der Branche.

- Analysieren Sie die aktuelle und prognostizierte Marktgröße des indischen LPG-Marktes für die Hauptregion.

- Zu den in dem Bericht untersuchten wichtigsten Bundesstaaten in Indien gehören Nordindien, Südindien, Ostindien und Westindien.

- Unternehmensprofil des indischen LPG-Marktes und die Wachstumsstrategien der Marktteilnehmer, um sich auf dem schnell wachsenden Markt zu behaupten.

- Detaillierte Analyse der Branche auf Staatsebene

Häufig gestellte Fragen FAQs

Q1: Wie ist die aktuelle Marktgröße und das Wachstumspotenzial des indischen LPG-Marktes?

Q2: Was sind die treibenden Faktoren für das Wachstum des indischen LPG-Marktes?

Q3: Welches Segment hat den größten Anteil am indischen LPG-Markt nach Quelle?

Q4: Was sind die neuen Technologien und Trends auf dem indischen LPG-Markt?

Q5: Welcher Bundesstaat wird den indischen LPG-Markt dominieren?

Verwandt Berichte

Kunden, die diesen Artikel gekauft haben, kauften auch