- Strona główna

- O nas

- Branża

- Usługi

- Czytanie

- Kontakt

Rynek sadzy technicznej: aktualna analiza i prognoza (2021-2027)

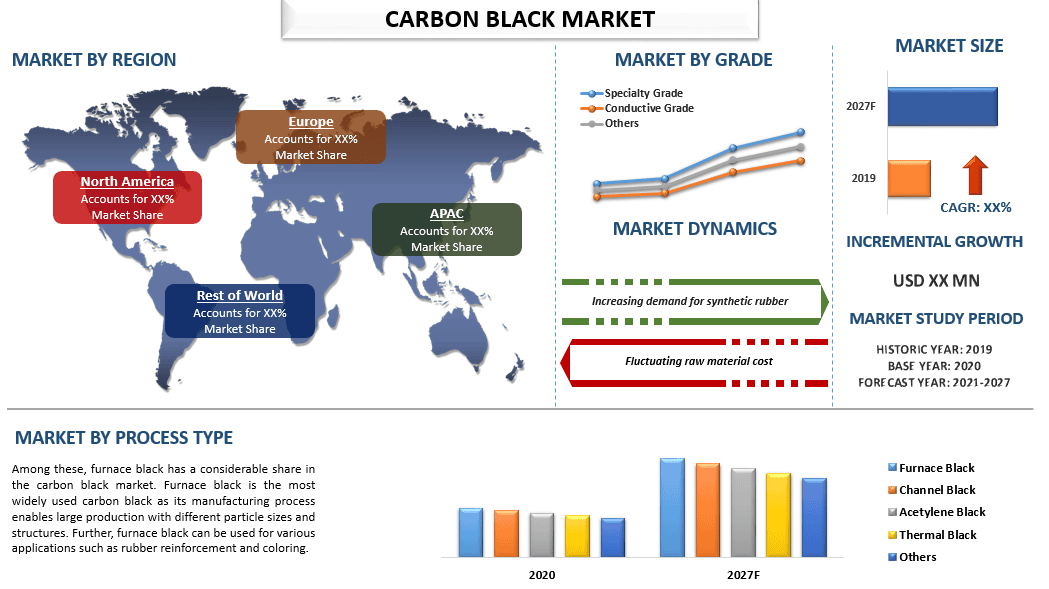

Podział ze względu na rodzaj procesu (sadza piecowa, sadza kanałowa, sadza acetylenowa, sadza termiczna i inne); gatunek (specjalny, przewodzący i inne); zastosowanie (wzmocnienie gumy, farby i powłoki, tworzywa sztuczne, elektrody baterii, farby drukarskie i tonery oraz inne); region i kraj

Oczekuje się, że globalny rynek sadzy wykaże wzrost o około 5% w okresie prognozy. Sadza jest formą parakrystalicznego węgla, która zawiera około 95% czystego węgla i poprawia fizyczne i mechaniczne właściwości materiału, co sprawia, że produkt końcowy jest bardziej efektywny. Ponadto, może absorbować światło UV i przekształcać je w ciepło, dlatego znajduje zastosowanie w izolowaniu przewodów i kabli. Co więcej, jest stosowana w produkcji szerokiej gamy wyrobów gumowych i pigmentów. Służy również jako ekonomiczny środek wzmacniający gumę stosowany w oponach. Ponadto, sadza ma ogromny popyt ze strony przemysłu oponiarskiego oraz budowlanego i produkcyjnego, gdzie jest stosowana do zapewnienia wytrzymałości przemysłowym mieszankom gumowym i innym urządzeniom. Dodatkowo, posiada właściwości fizyczne, takie jak stabilność koloru, odporność na rozpuszczalniki i stabilność termiczna, dzięki czemu jest szeroko stosowana w przemyśle farb i powłok. Ponadto, kilka firm prowadzi innowacje w zakresie wykorzystania sadzy w nowych oponach. Na przykład, w listopadzie 2021 r. Bridgestone Corp. i Michelin Group stworzyły dedykowaną stronę internetową jako platformę komunikacyjną dla swojej wspólnej inicjatywy mającej na celu zwiększenie wykorzystania odzyskanego węgla (rCB) w nowych oponach. Użycie rCB w nowych oponach zmniejszyłoby emisję CO2 z produkcji sadzy o 85% w porównaniu z materiałami pierwotnymi. Ze względu na takie czynniki, popyt na sadzę prawdopodobnie wzrośnie w najbliższej przyszłości.

Wnioski przedstawione w raporcie

„Wśród rodzajów procesów, sadza piecowa ma znaczny udział w rynku sadzy”

Na podstawie rodzaju procesu, rynek jest podzielony na sadzę piecową, sadzę kanałową, sadzę acetylenową, sadzę termiczną i inne. Wśród nich sadza piecowa ma znaczny udział w rynku sadzy. Sadza piecowa jest najczęściej stosowaną sadzą, ponieważ jej proces produkcji umożliwia dużą produkcję z różnymi rozmiarami i strukturami cząstek. Ponadto, sadza piecowa może być stosowana do różnych zastosowań, takich jak wzmacnianie gumy i barwienie.

„Wśród zastosowań, wzmacnianie gumy ma znaczący udział w rynku sadzy”

Na podstawie zastosowania, rynek jest podzielony na wzmacnianie gumy, farby i powłoki, elektrody akumulatorów z tworzyw sztucznych, tusze i tonery oraz inne. Wśród nich wzmacnianie gumy miało znaczący udział w globalnym rynku sadzy. Wzmocnione produkty gumowe łączą matrycę gumową i sadzę jako materiał wzmacniający, dzięki czemu mogą osiągnąć wysoki stosunek wytrzymałości do elastyczności, większą odporność na uszkodzenia mechaniczne, lepszą trakcję i lepszą stabilność w stosunku do dodatkowych obciążeń wywołanych ruchem. Z tego powodu guma wzmacniająca jest szeroko stosowana w przemyśle oponiarskim, ponieważ lepiej spełnia coraz bardziej rygorystyczne specyfikacje opon o wysokich osiągach. Ponadto, w przemyśle motoryzacyjnym, wzmacnianie gumy znajduje zastosowanie w paskach, wężach i uszczelkach. Dlatego wzrost w przemyśle oponiarskim i wymiana komponentów samochodowych to niektóre z kluczowych czynników wpływających na jego znaczącą pozycję na rynku.

„Region Azji i Pacyfiku odpowiadał za znaczny udział w globalnym rynku sadzy”

Dla lepszego zrozumienia adopcji rynkowej sadzy, rynek jest analizowany na podstawie jego obecności na całym świecie w krajach takich jak Ameryka Północna (Stany Zjednoczone, Kanada, Reszta Ameryki Północnej), Europa (Niemcy, Francja, Wielka Brytania, Włochy, Hiszpania, Reszta Europy), Azja i Pacyfik (Chiny, Japonia, Indie, Australia, Reszta Azji i Pacyfiku) i Reszta Świata. Region Azji i Pacyfiku miał znaczący udział w rynku sadzy. Ze względu na duży przemysł produkcji opon i największą bazę produkcji samochodów na całym świecie. Na przykład producenci opon, tacy jak Bridgestone, Yokohama, Kumho, Hankook, Triangle, Apollo i MRF, należą do największych producentów opon na świecie. Ponadto region ten jest największym producentem obuwia na świecie, a kraje takie jak Chiny, Wietnam, Indonezja i Indie mają znaczny udział w rynku. Dlatego region ten posiada dużą liczbę zakładów produkujących kauczuk syntetyczny w celu stworzenia silnego łańcucha dostaw i wykorzystania niższych kosztów produkcji. W rezultacie duże zużycie sadzy przez te zakłady.

Powody, dla których warto kupić ten raport:

- Badanie obejmuje analizę wielkości rynku i prognozowania, zweryfikowaną przez uwierzytelnionych kluczowych ekspertów branżowych

- Raport przedstawia szybki przegląd ogólnej kondycji branży w jednym spojrzeniu

- Raport obejmuje dogłębną analizę wybitnych konkurentów branżowych, z głównym naciskiem na kluczowe dane finansowe przedsiębiorstw, portfolio produktów, strategie ekspansji i najnowsze osiągnięcia

- Szczegółowe badanie czynników napędzających, ograniczeń, kluczowych trendów i możliwości panujących w branży

- Badanie kompleksowo obejmuje rynek w różnych segmentach

- Dogłębna analiza branży na poziomie krajowym

Opcje dostosowywania:

Globalny rynek sadzy można dodatkowo dostosować do wymagań lub dowolnego innego segmentu rynku. Poza tym, UMI rozumie, że możesz mieć własne potrzeby biznesowe, dlatego zachęcamy do kontaktu z nami, aby uzyskać raport, który w pełni odpowiada Twoim wymaganiom.

Spis treści

Metodologia badań do analizy rynku sadzy technicznej (2019-2027)

Analiza historycznego rynku, szacowanie obecnego rynku i prognozowanie przyszłego rynku sadzy technicznej – to trzy główne kroki podejmowane w celu stworzenia i analizy jej adaptacji na całym świecie. Przeprowadzono wyczerpujące badania wtórne, aby zebrać historyczne dane rynkowe i oszacować obecną wielkość rynku. Po drugie, aby zweryfikować te spostrzeżenia, wzięto pod uwagę liczne odkrycia i założenia. Ponadto przeprowadzono również wyczerpujące wywiady pierwotne z ekspertami branżowymi w całym łańcuchu wartości przemysłu sadzy technicznej. Po założeniu i zatwierdzeniu danych rynkowych poprzez wywiady pierwotne, zastosowaliśmy podejście oddolne, aby prognozować całkowitą wielkość rynku. Następnie przyjęto metody podziału rynku i triangulacji danych w celu oszacowania i analizy wielkości rynku segmentów i podsegmentów branży. Szczegółowa metodologia jest wyjaśniona poniżej:

Uzyskaj więcej szczegółów na temat metodologii badań

Analiza historycznej wielkości rynku

Krok 1: Dogłębne badanie źródeł wtórnych:

Przeprowadzono szczegółowe badania wtórne w celu uzyskania historycznej wielkości rynku sadzy technicznej za pośrednictwem wewnętrznych źródeł firmy, takich jak raporty roczne i sprawozdania finansowe, prezentacje wyników, komunikaty prasowe itp., oraz źródeł zewnętrznych, w tym czasopisma, wiadomości i artykuły, publikacje rządowe, publikacje konkurencji, raporty sektorowe, bazy danych stron trzecich i inne wiarygodne publikacje.

Krok 2: Segmentacja rynku:

Po uzyskaniu historycznej wielkości rynku sadzy technicznej przeprowadziliśmy szczegółową analizę wtórną w celu zebrania aktualnych informacji o rynku i udziałów dla różnych segmentów i podsegmentów dla głównych regionów. Główne segmenty zawarte w raporcie obejmują typ procesu, gatunek i zastosowanie. Ponadto przeprowadzono analizy regionalne i krajowe w celu oceny ogólnego stopnia wykorzystania sadzy technicznej na całym świecie.

Krok 3: Analiza czynnikowa:

Po uzyskaniu historycznej wielkości rynku różnych segmentów i podsegmentów przeprowadziliśmy szczegółową analizę czynnikową w celu oszacowania obecnej wielkości rynku sadzy technicznej. Ponadto przeprowadziliśmy analizę czynnikową przy użyciu zmiennych zależnych i niezależnych, takich jak rosnący popyt na opony o wysokich osiągach i produkty lepszej jakości do izolacji. Przeprowadzono dokładną analizę scenariuszy popytu i podaży, biorąc pod uwagę rosnące inwestycje, czołowe partnerstwa, fuzje i przejęcia, ekspansję biznesową i wprowadzanie produktów na rynek w branży sadzy technicznej.

Szacunek i prognoza aktualnej wielkości rynku

Określanie aktualnej wielkości rynku: W oparciu o przydatne informacje z powyższych 3 kroków, doszliśmy do obecnej wielkości rynku, kluczowych graczy na globalnym rynku sadzy technicznej oraz udziałów w rynku każdego segmentu. Wszystkie wymagane udziały procentowe i podziały rynku zostały określone przy użyciu wspomnianego powyżej podejścia wtórnego i zostały zweryfikowane podczas wywiadów pierwotnych.

Szacowanie i prognozowanie: Do szacowania i prognozowania rynku przypisano wagi różnym czynnikom, w tym czynnikom napędzającym i trendom, ograniczeniom i możliwościom dostępnym dla interesariuszy. Po przeanalizowaniu tych czynników zastosowano odpowiednie techniki prognozowania, tj. podejście oddolne, aby dojść do prognozy rynkowej do 2027 r. dla różnych segmentów i podsegmentów w głównych regionach na całym świecie. Metodologia badań przyjęta do oszacowania wielkości rynku obejmuje:

- Wielkość rynku branży pod względem wartości (USD) i stopień wykorzystania sadzy technicznej na głównych rynkach

- Wszystkie udziały procentowe, podziały i rozkłady segmentów i podsegmentów rynku

- Kluczowi gracze na rynku sadzy technicznej. Ponadto strategie rozwoju przyjęte przez tych graczy w celu konkurowania na szybko rozwijającym się rynku

Walidacja wielkości i udziału w rynku

Badania pierwotne: Przeprowadzono dogłębne wywiady z kluczowymi liderami opinii (KOL), w tym kadrą kierowniczą najwyższego szczebla (CXO/wiceprezesi, szef sprzedaży, szef marketingu, szef operacyjny, szef regionalny, szef krajowy itp.) w głównych regionach. Następnie podsumowano wyniki badań pierwotnych i przeprowadzono analizę statystyczną w celu udowodnienia postawionej hipotezy. Dane wejściowe z badań pierwotnych zostały skonsolidowane z wynikami badań wtórnych, przekształcając w ten sposób informacje w przydatne spostrzeżenia.

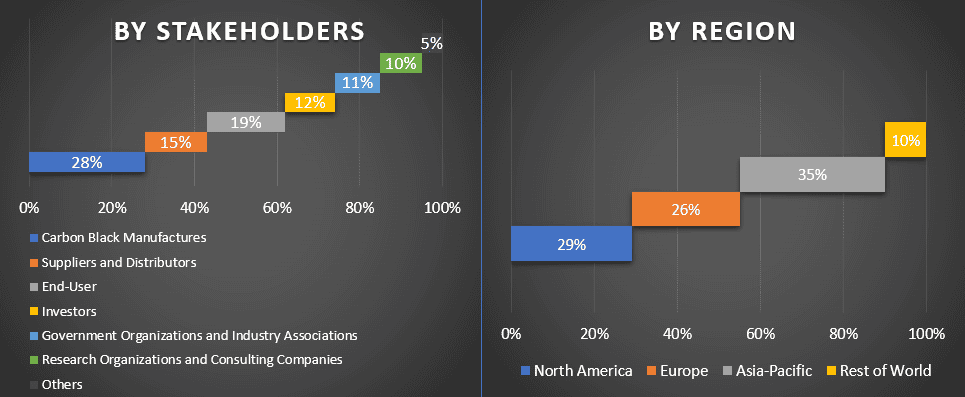

Podział uczestników pierwotnych według interesariuszy i regionów

Inżynieria rynku

Zastosowano technikę triangulacji danych, aby zakończyć ogólne szacowanie rynku i dojść do precyzyjnych danych statystycznych dla każdego segmentu i podsegmentu globalnego rynku sadzy technicznej. Dane zostały podzielone na kilka segmentów i podsegmentów po przestudiowaniu różnych parametrów i trendów w obszarze rodzaju procesu, gatunku i zastosowania.

Główny cel badania rynku sadzy technicznej

W badaniu wskazano aktualne i przyszłe trendy rynkowe globalnej sadzy technicznej. Inwestorzy mogą uzyskać strategiczne informacje, na których mogą oprzeć swoje decyzje dotyczące inwestycji w oparciu o analizę jakościową i ilościową przeprowadzoną w badaniu. Aktualne i przyszłe trendy rynkowe określą ogólną atrakcyjność rynku na poziomie krajowym, zapewniając uczestnikom przemysłu platformę do wykorzystania niewykorzystanego rynku, aby czerpać korzyści jako pierwsi. Inne ilościowe cele badań obejmują:

- Analiza aktualnej i prognozowanej wielkości rynku sadzy technicznej pod względem wartości (USD). Ponadto analiza aktualnej i prognozowanej wielkości rynku różnych segmentów i podsegmentów

- Segmenty w badaniu obejmują obszar rodzaju procesu, gatunku i zastosowania

- Zdefiniowana analiza ram regulacyjnych dla przemysłu sadzy technicznej

- Analiza łańcucha wartości związanego z obecnością różnych pośredników, wraz z analizą zachowań klientów i konkurentów w branży

- Analiza aktualnej i prognozowanej wielkości rynku sadzy technicznej dla głównych krajów

- Główne regiony/kraje analizowane w raporcie obejmują Amerykę Północną (Stany Zjednoczone, Kanada i pozostała część Ameryki Północnej), Europę (Niemcy, Francja, Wielka Brytania, Włochy, Hiszpania i pozostała część Europy), Azję i Pacyfik (Chiny, Japonia, Indie, Australia i pozostała część APAC) oraz resztę świata

- Profile firm graczy na rynku sadzy technicznej i strategie rozwoju przyjęte przez nich w celu utrzymania rosnącego rynku

- Dogłębna analiza branży na poziomie krajowym

Powiązane Raporty

Klienci, którzy kupili ten przedmiot, kupili również