- Home

- About Us

- Industry

- Services

- Reading

- Contact Us

Finance Cloud Market: Current Analysis and Forecast (2024-2032)

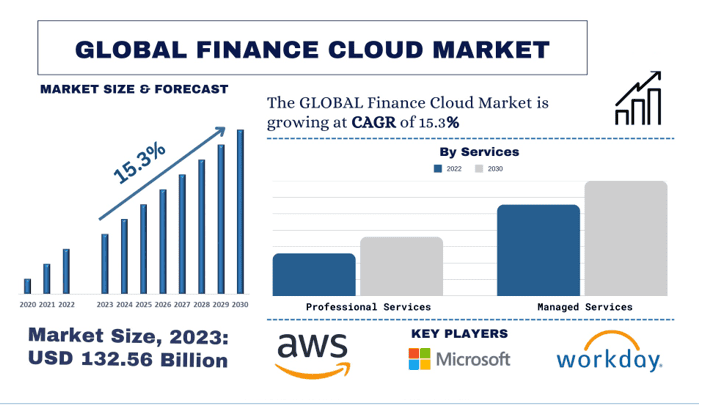

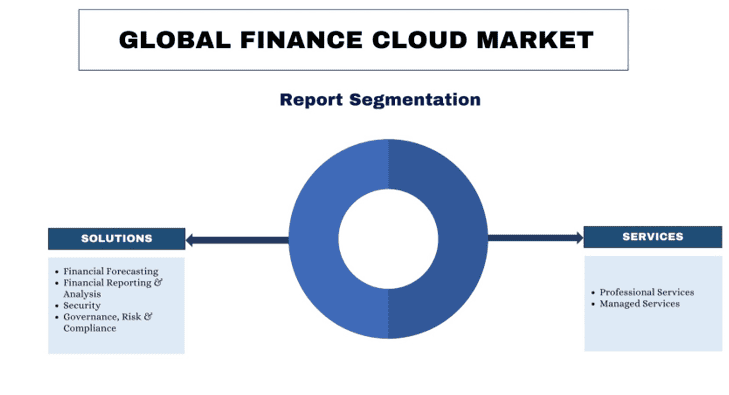

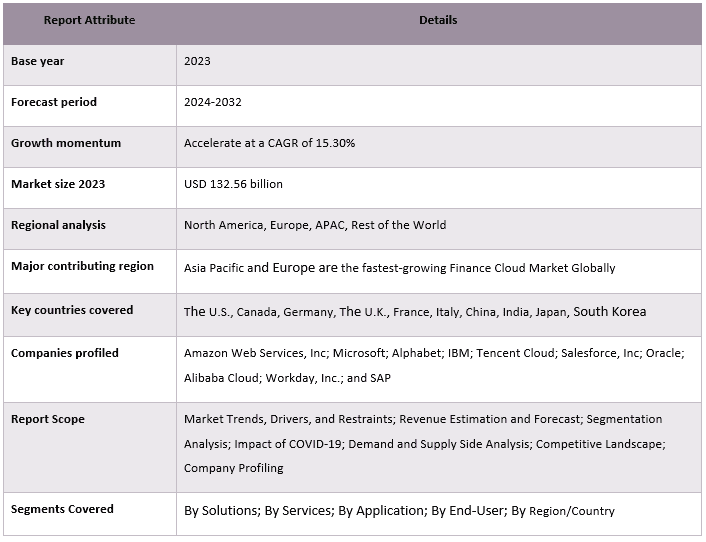

Emphasis on Solution (Financial Forecasting, Financial Reporting, and Analysis, Security, And Governance Risk and Compliance); Services (Professional Services and Managed Services); Application (Revenue Management, Wealth Management, Customer Management, and Account Management); End-Users (Banks, Financial Service Providers, Insurance Companies, Large Enterprises, and Small And Medium Enterprises (SMEs)); and Region/Country

Finance Cloud Market Size & Forecast

The finance cloud market was valued at USD 132.56 Billion and is expected to grow at a strong CAGR of around 15.30% during the forecast period (2024-2032) owing to the growing digitalization of the financial services industry.

Finance Cloud Market Analysis

The finance cloud market refers to the use of cloud computing solutions tailored specifically for the financial services sector. This market involves the adoption of cloud-based technologies by banks, financial institutions, and insurance companies to enhance their operations and services.

The global financial services industry is witnessing an unprecedented surge in the demand for cloud-based solutions and services. As digitalization continues to reshape the financial landscape, an increasing number of institutions are embracing the cloud to streamline operations, enhance scalability, and optimize cost structures. Furthermore, the ever-changing financial landscape demands agility and scalability, which cloud solutions offer in abundance. Traditional on-premises systems often struggle to keep pace with rapidly evolving market conditions, regulatory requirements, and customer expectations. Cloud-based solutions allow financial institutions to scale their resources up or down seamlessly, ensuring they can adapt swiftly to fluctuating demands without incurring significant capital expenditures. Moreover, the cloud computing model presents a compelling value proposition for financial institutions by enabling them to optimize their IT costs. Instead of investing in expensive hardware, software, and maintenance, cloud solutions offer a pay-as-you-go pricing model, allowing institutions to pay only for the resources they consume. This cost-effective approach is particularly attractive for small and medium-sized financial firms, as well as startups, enabling them to access enterprise-grade solutions without the need for substantial upfront investments. Additionally, the financial services industry generates vast amounts of data, and cloud-based solutions provide the infrastructure and tools necessary to harness this data effectively. By leveraging cloud-based analytics platforms, financial institutions can gain valuable insights into customer behavior, market trends, and risk management, enabling them to make data-driven decisions and develop innovative products and services. These advances along with others are creating a favorable environment for the adoption of finance cloud across various markets.

Finance Cloud Market Trends

This section discusses the key market trends that are influencing the various segments of the Finance Cloud Market as identified by our team of research experts.

Security and Governance, Risk & Compliance stands out as a predominant segment in terms of revenue generation for finance cloud worldwide.

Primarily driven by the need to ensure compliance with regulatory framework. Financial institutions are subject to stringent regulations, such as the Basel III framework, the Dodd-Frank Act, and the General Data Protection Regulation (GDPR). Failure to comply with these regulations can result in hefty fines, reputational damage, and legal implications. Furthermore, the financial sector is a prime target for cyber-attacks, including data breaches, phishing scams, and ransomware attacks. These threats can lead to financial losses, disruption of operations, and erosion of customer trust. GRC solutions offer robust security features, such as encryption, access controls, and intrusion detection systems, to protect sensitive financial data and systems. GRC solutions help organizations maintain compliance by automating processes, monitoring controls, and providing real-time reporting capabilities. Additionally, Financial institutions face various risks, including credit risk, market risk, operational risk, and reputational risk. Effective risk management is crucial for maintaining financial stability and making informed business decisions. GRC solutions provide risk assessment tools, risk modeling capabilities, and real-time risk monitoring to identify, analyze, and mitigate potential risks.

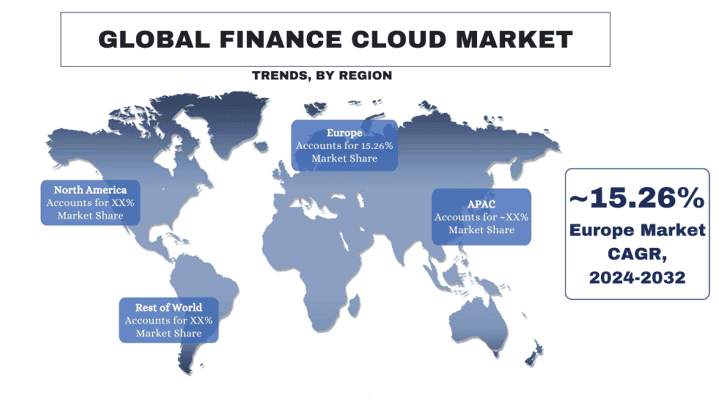

Europe is the fastest-growing Finance Cloud market worldwide.

Within Europe, Germany and France hold a major share of the market. The major factor boosting the market’s growth is Europe’s conducive financial regulatory environment, enabling the industry to thrive at an unprecedented rate.

One of the key factors contributing to this leadership position of Europe in the finance cloud market is its conducive financial regulatory environment helping the industry to thrive at an unprecedented rate, leading to the rapid adoption of cloud services. For instance, the European Union’s Payment Services Directive 2 (PSD2) launched in 2017 in Europe, has played a pivotal role in fostering innovation and competition in the financial sector by enhancing and regulating electronic payment services by allowing third-party access to banking data through open banking APIs. Furthermore, the collaborative ecosystem in Europe amongst fintech, traditional banks, and regulatory bodies has laid down a very favorable environment for the cloud migration of financial services providers in the region. For instance, the partnership between the neo-banking services providers and the traditional banks has enabled these digital-only banks to expand fast and grow their consumer base at a rapid rate. For instance, the partnerships between UK-based neo-bank Revolut and traditional banks like HSBC, signal a shift towards collaboration in the European financial sector. Moreover, the high cultural acceptance of digital innovation in Europe has played a major driving force, in initiating the cloud migration of financial service providers. For instance, the rate at which a German-based neo-bank named N26 has reported its growth numbers regarding its consumer base, of about 7 million consumers across Europe underscores the cultural acceptance of neo-banking in the region. Factors like these have played a major driving force, making Europe one of the dominant regions where the digitalization of the banking industry has flourished the most, further leading to a surge in demand for finance cloud services in the region.

Finance Cloud Industry Overview

The finance cloud market is competitive and fragmented, with the presence of several global and international market players. The key players are adopting different growth strategies to enhance their market presence, such as partnerships, agreements, collaborations, new product launches, geographical expansions, and mergers and acquisitions. Some of the major players operating in the market are Amazon Web Services, Inc; Microsoft; Alphabet; IBM; Tencent Cloud; Salesforce, Inc; Oracle; Alibaba Cloud; Workday, Inc.; and SAP.

Finance Cloud Market News

- In October 2023, SAP Pioneer, a global financial services provider based in Germany, announced an upgrade to its Cloud for Banking platform with the new Anti-Financial Crime feature. This enhancement allows banks to address threats, integrate real-time intelligence, and cut compliance costs by up to 90% quickly and securely.

- In February 2024, Ericsson, and Hewlett-Packard Enterprise (HPE) announced a partnership, at the Mobile World Congress (MWC) 2024 to drive digital transformation in the financial services sector. The collaboration integrates the Ericsson Wallet Platform and HPE GreenLake, providing cloud-based services for improved agility and scalability.

Finance Cloud Market Report Coverage

Reasons to buy this report:

- The study includes market sizing and forecasting analysis validated by authenticated key industry experts.

- The report presents a quick review of overall industry performance at one glance.

- The report covers an in-depth analysis of prominent industry peers with a primary focus on key business financials, product portfolios, expansion strategies, and recent developments.

- Detailed examination of drivers, restraints, key trends, and opportunities prevailing in the industry.

- The study comprehensively covers the market across different segments.

- Deep dive regional level analysis of the industry.

Customization Options:

The global Finance Cloud market can further be customized as per the requirement or any other market segment. Besides this, UMI understands that you may have your own business needs, hence feel free to contact us to get a report that completely suits your requirements.

Table of Content

Research Methodology for the Finance Cloud Market Analysis (2024-2032)

Analyzing the historical market, estimating the current market, and forecasting the future market of the global Finance Cloud market were the three major steps undertaken to create and analyze the adoption of Finance Cloud in major regions globally. Exhaustive secondary research was conducted to collect the historical market numbers and estimate the current market size. Secondly, to validate these insights, numerous findings and assumptions were taken into consideration. Moreover, exhaustive primary interviews were also conducted, with industry experts across the value chain of the global Finance Cloud market. Post assumption and validation of market numbers through primary interviews, we employed a top-down/bottom-up approach to forecasting the complete market size. Thereafter, market breakdown and data triangulation methods were adopted to estimate and analyze the market size of segments and sub-segments of the industry pertains to. Detailed methodology is explained below:

Analysis of Historical Market Size

Step 1: In-Depth Study of Secondary Sources:

A detailed secondary study was conducted to obtain the historical market size of the Finance Cloud market through company internal sources such as annual reports & financial statements, performance presentations, press releases, etc., and external sources including journals, news & articles, government publications, competitor publications, sector reports, third-party database, and other credible publications.

Step 2: Market Segmentation:

After obtaining the historical market size of the Finance Cloud market, we conducted a detailed secondary analysis to gather historical market insights and share for different segments & sub-segments for major regions. Major segments are included in the report as solutions, services, applications, and end-users. Further country-level analyses were conducted to evaluate the overall adoption of testing models in that region.

Step 3: Factor Analysis:

After acquiring the historical market size of different segments and sub-segments, we conducted a detailed factor analysis to estimate the current market size of the Finance Cloud market. Further, we conducted factor analysis using dependent and independent variables such as solutions, services, applications, and end-users of the Finance Cloud market. A thorough analysis was conducted of demand and supply-side scenarios considering top partnerships, mergers and acquisitions, business expansion, and product launches in the Finance Cloud market sector across the globe.

Current Market Size Estimate & Forecast

Current Market Sizing: Based on actionable insights from the above 3 steps, we arrived at the current market size, key players in the global Finance Cloud market, and market shares of the segments. All the required percentage shares split and market breakdowns were determined using the above-mentioned secondary approach and were verified through primary interviews.

Estimation & Forecasting: For market estimation and forecast, weights were assigned to different factors including drivers & trends, restraints, and opportunities available for the stakeholders. After analyzing these factors, relevant forecasting techniques i.e., the top-down/bottom-up approach were applied to arrive at the market forecast for 2030 for different segments and sub-segments across the major markets globally. The research methodology adopted to estimate the market size encompasses:

- The industry’s market size, in terms of revenue (USD) and the adoption rate of the Finance Cloud market across the major markets domestically

- All percentage shares, splits, and breakdowns of market segments and sub-segments

- Key players in the global Finance Cloud market in terms of products offered. Also, the growth strategies adopted by these players to compete in the fast-growing market.

Market Size and Share Validation

Primary Research: In-depth interviews were conducted with the Key Opinion Leaders (KOLs) including Top Level Executives (CXO/VPs, Sales Head, Marketing Head, Operational Head, Regional Head, Country Head, etc.) across major regions. Primary research findings were then summarized, and statistical analysis was performed to prove the stated hypothesis. Inputs from primary research were consolidated with secondary findings, hence turning information into actionable insights.

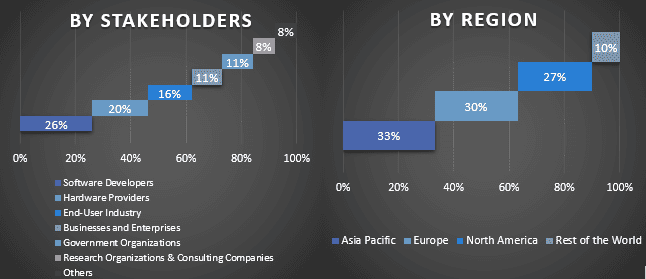

Split of Primary Participants in Different Regions

Market Engineering

The data triangulation technique was employed to complete the overall market estimation and to arrive at precise statistical numbers for each segment and sub-segment of the global Finance Cloud market. data was split into several segments & sub-segments after studying various parameters and trends in the areas of solutions, services, applications, and end-users in the global Finance Cloud market.

The main objective of the Global Finance Cloud Market Study

The current & future market trends of the global Finance Cloud market were pinpointed in the study. Investors can gain strategic insights to base their discretion for investments on the qualitative and quantitative analysis performed in the study. Current and future market trends determined the overall attractiveness of the market at a regional level, providing a platform for the industrial participant to exploit the untapped market to benefit from a first-mover advantage. Other quantitative goals of the studies include:

- Analyze the current and forecast market size of the Finance Cloud market in terms of value (USD). Also, analyze the current and forecast market size of different segments and sub-segments.

- Segments in the study include areas of solutions, services, applications, and end-users.

- Define and analyze the regulatory framework for the Finance Cloud

- Analyze the value chain involved with the presence of various intermediaries, along with analyzing customer and competitor behaviors of the industry

- Analyze the current and forecast market size of the Finance Cloud market for the major region

- Major countries of regions studied in the report include Asia Pacific, Europe, North America, and the Rest of the World

- Company profiles of the Finance Cloud market and the growth strategies adopted by the market players to sustain in the fast-growing market.

- Deep dive regional level analysis of the industry

Frequently Asked Questions FAQs

Q1: What is the current market size and growth potential of the global Finance Cloud market?

Q2: What are the driving factors for the growth of the global Finance Cloud Market?

Q3: Which segment is the fastest growing of the global Finance Cloud market by Solution?

Q4: What are the emerging technologies and trends in the global Finance Cloud market?

Q5: Which region will be the fastest-growing global Finance Cloud market?

Q6: Who are the key players in the global Finance Cloud market?

Related Reports

Customers who bought this item also bought