- Home

- About Us

- Industry

- Services

- Reading

- Contact Us

Certificate Authority Market: Current Analysis and Forecast (2025-2033)

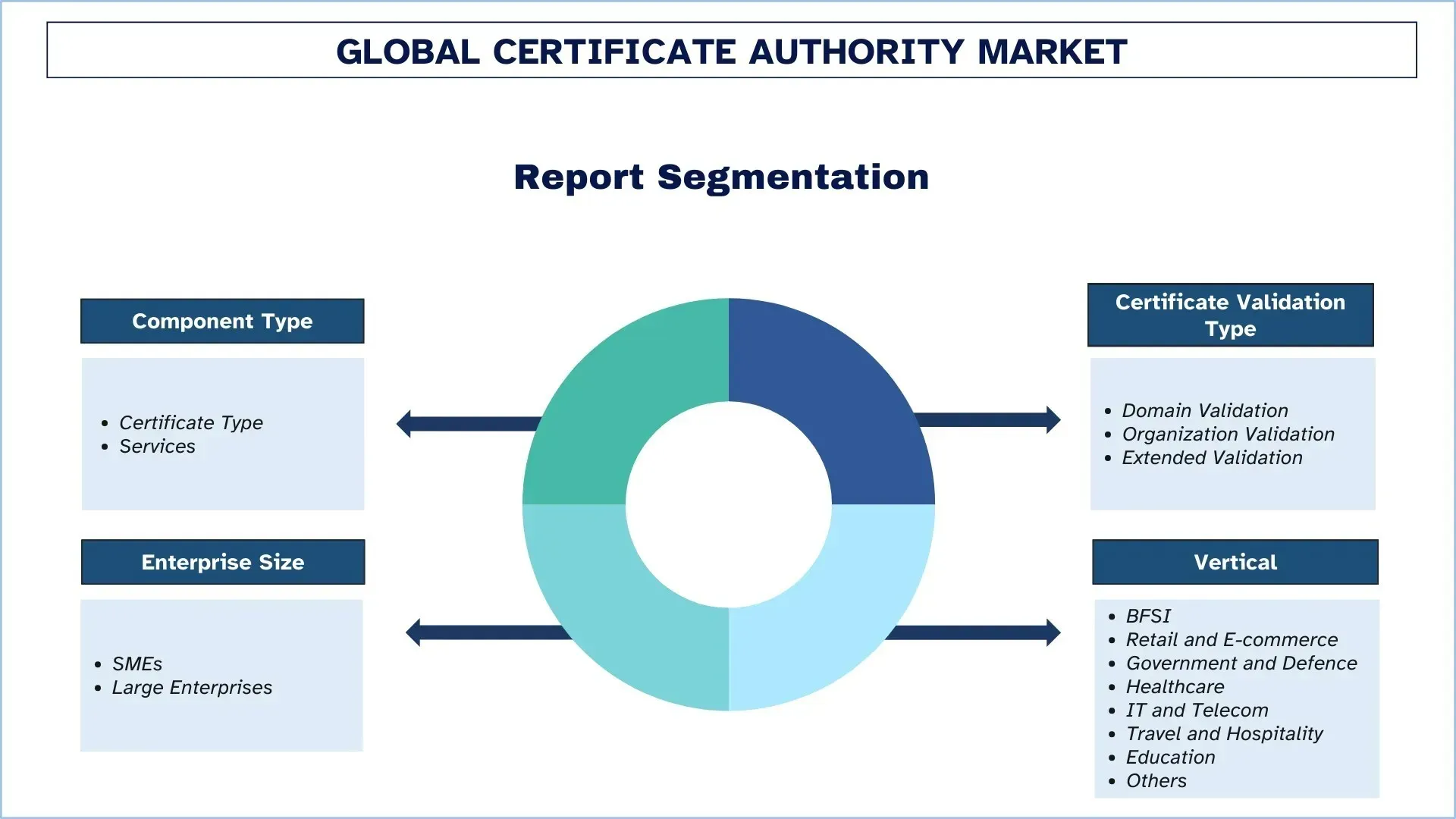

Emphasis on Component (Certificate Type, SSL Certificates, Code Signing Certificates, Secure Email Certificates, Authentication Certificates, Services); Certificate Validation Type (Domain Validation, Organization Validation, and Extended Validation); Enterprise Size (SMEs and Large Enterprises); Vertical (BFSI, Retail and E-commerce, Government and Defence, Healthcare, IT and Telecom, Travel and Hospitality, Education, and Others); and Region/Country

Global Certificate Authority Market Size & Forecast

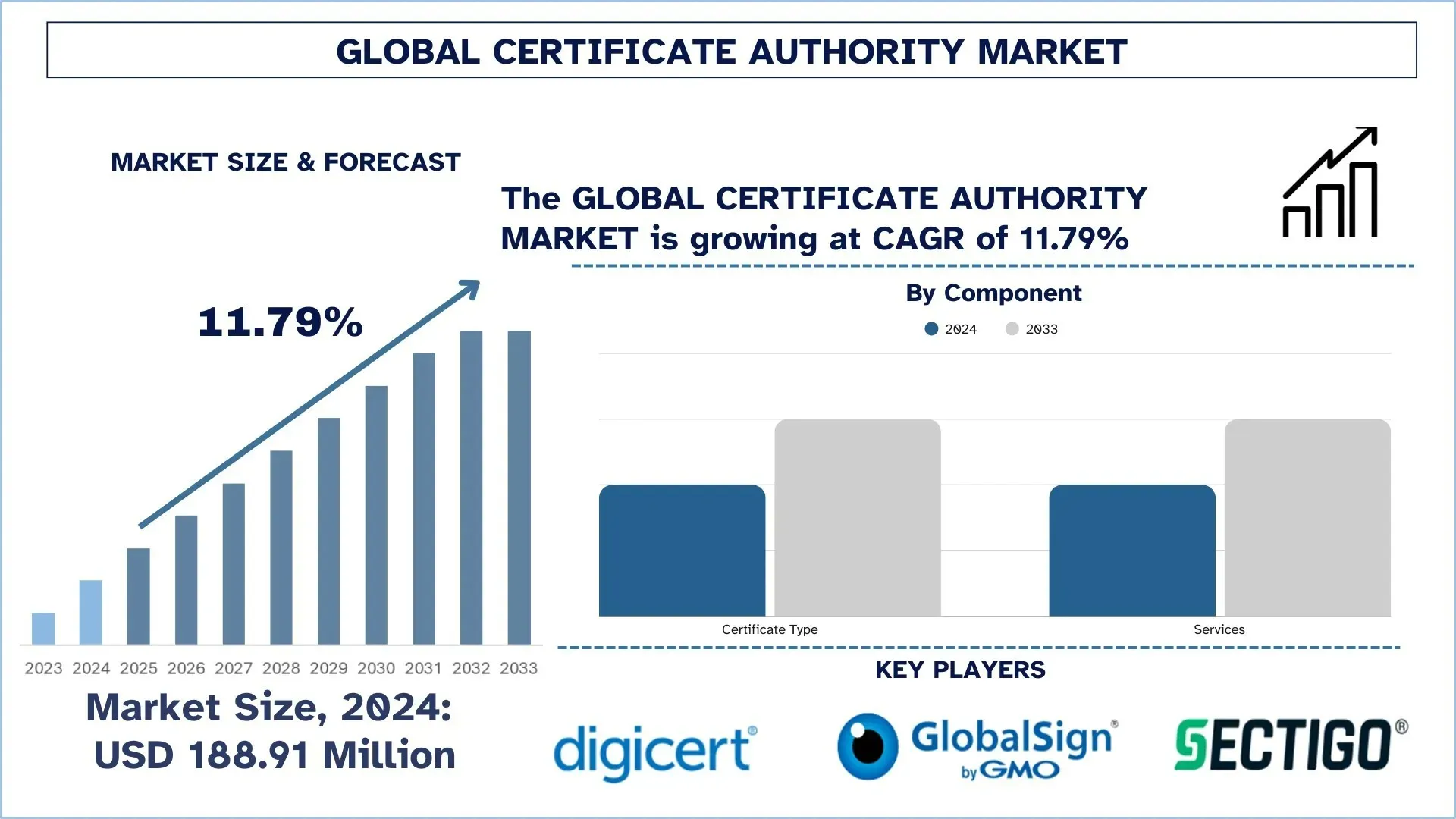

The Global Certificate Authority Market was valued at USD 188.91 Million in 2024 and is expected to grow at a robust CAGR of around 11.79% during the forecast period (2025-2033F), owing to rising cybersecurity threats, growing regulatory compliance requirements, and rapid digital transformation.

Certificate Authority Market Analysis

Digital certificates have become the backbone of modern internet security, while the role of Certificate Authorities (CAs) is vital to enabling any trust, authenticity, and privacy within the digital ecosystem. They are necessary in protecting clients from harmful encryption, all communications and the identities of the communicating parties, data integrity, and implementing e-commerce, banking, and enterprise operations. However, there is a great acceleration in the demand for CA and SSL/TLS certificates due to the rapid change in the last year of digital transformation, the increasing threats of cyberattacks, and the increased need for secure online transactions. Data breaches, compliance requirements from different organizations, such as the GDPR, HIPAA, or PCI DSS, as well as the rise of IoT and cloud platforms, are significantly increasing market demand. Across all industries, organizations have redefined digital certificates from mere technical formalities into key parts of their cybersecurity infrastructures. Besides, rising awareness of small- and medium-sized businesses (SMBs) coupled with free and automated certificate solution availability, such as ones provided by Let’s Encrypt, is also expanding market reach. Additionally, Technological advancement is reshaping the Certificate Authority landscape. The growing adoption of automated certificate lifecycle management, quantum-resistant cryptography, and integration with DevOps pipelines has driven digitally mature organizations. Moreover, remote work and zero-trust security models have placed even more emphasis on authentication and secure endpoints.

Global Certificate Authority Market Trends

This section discusses the key market trends that are influencing the various segments of the global certificate authority market, as found by our team of research experts.

Automated Certificate Management (ACM) to Reduce Risk and Complexity

Today's enterprises are administering thousands of certificates across their hybrid settings-from internal services to external APIs. Manual tracking leads to expired or misconfigured certificates, which ultimately cause outages or vulnerabilities (the Equifax breach was attributed, in part, to an expired certificate). Thus, automated certificate lifecycle management tools are a trend. Companies such as Venafi and Keyfactor, and AppViewX now provide advanced ACM solutions to automate the issuance, renewal, and revocation processes with methodologies that integrate DevOps pipelines plus CI/CD workflows, and IT service management (ITSM) tools such as ServiceNow. More such solutions include Google Cloud's Certificate Manager, meant to automatically provision TLS certificates for Kubernetes and improve uptime and reduce attack surface. This trend is fundamentally significant in DevSecOps, with agility and trust being at the heart of its operation.

Certificate Authority Industry Segmentation

This section provides an analysis of the key trends in each segment of the global certificate authority market report, along with forecasts at the global, regional, and country levels for 2025-2033.

The Certificate Type Segment Dominates the Certificate Authority Market

Based on component, the certificate authority market is bifurcated into Certificate Type and Services. In 2024, the Certificate Type segment dominated the market and is expected to maintain its leading position throughout the forecast period. Among the various certificate types such as SSL Certificates, Code Signing Certificates, Secure Email Certificates, and Authentication Certificates. SSL certificates accounted for the largest share of the certificate types. Domain Validation (DV) and Organization Validation (OV) certificate validation types are the most issued and widely accepted validation types in SSL certificates due to their fast issuance, affordability, and ability to meet basic to mid-level assurance needs. They have thereby become necessities integrated into cloud platforms, remote-work setups, and enterprise IT systems. Digital transformation, coupled with near-punitive compliance regulations such as GDPR and HIPAA, has further opened the doors to adoption. Simultaneously, automation tools, CI/CD pipeline integrations, and certificate lifecycle management advancements abound from vendors like DigiCert, Sectigo, and Let's Encrypt, hence transforming the management of digital trust at scale for organizations. Companies in the market are coming up with advanced innovations, automation tools, and CI/CD pipeline integrations from vendors like DigiCert, Sectigo, and Let's Encrypt. In January 2023, DigiCert launched its new generation product called DigiCert Trust Lifecycle Manager, an integration of certificate lifecycle automation with advanced analytics and policy governance for enterprises seeking frictionless, scalable certificate management.

The Domain Validation Market Dominates the Certificate Authority Market.

Based on certificate validation type, the certificate authority market is segmented into Domain Validation, Organization Validation, and Extended Validation. The domain validation market held the largest market share in 2024. The rising trend in affordable and rapid issuance of SSL certificates, along with automated issuance and simpler validation processes, has served to entrench the lead of this segment. During the past 5 years or so, the bigger certificate authorities-like Let's Encrypt (USA), Sectigo (USA), GoDaddy (USA), etc.-have changed the game by offering free or low-priced DV certificates in very large volumes. This has enabled startups, SMEs, and individual owners of websites to secure their websites quickly and economically. To help with this process more than ever, DTC CA brands have incorporated API's, self-service certificate management platforms, and partnerships with web hosting providers to help improve their service while minimizing overhead. With the growing understanding of cybersecurity threats and the need for encrypting communications, this has dramatically bolstered the demand for DV certificates in developing digital economies like India, Brazil, and Southeast Asia. The SSL certificate market in India witnessed rapid growth in the year 2024, with DV certificates making up over 70% of newly issued certificates due to increased website registration and digital transformation of various sectors. For instance, in March 2025, Cloudflare, Inc., the leading connectivity cloud company, announced that it is expanding end-to-end support for post-quantum cryptography to its Zero Trust Network Access solution. Organizations can securely route communications from web browsers to corporate web applications to gain immediate, end-to-end quantum-safe connectivity. By mid-2025, Cloudflare is going to add support for post-quantum cryptography to all its IP protocols, thereby significantly extending compatibility across most corporate applications and devices.

North America Dominated the Global Certificate Authority Market

The North America certificate authority market dominated the global industry in 2024 and is projected to maintain its leading position throughout the forecast period. The increase in certificate deployment and innovation in PKI services in a mature cybersecurity ecosystem, a high degree of internet penetration, and a regulatory environment that requires strong data protection make the region the leader in both. The United States is home to major CA players as DigiCert, Sectigo, and Let’s Encrypt, all of which have led in automating SSL issuance, pushing zero-trust security models, and spearheading a significant drive toward ubiquitous encryption. Many government-backed standards, such as FedRAMP and NIST, in addition to frameworks like CMMC in defense and HIPAA in healthcare, further mandate robust encryption protocols, such that CA services become necessary across sectors. The progressive shift toward digital transformation in North America, especially in the financial services, e-commerce, healthcare, and education sectors, has further broadened the horizons for deploying digital certificates beyond traditional website security to APIs, cloud workloads, IoT devices, and mobile applications. Additionally, the burgeoning adoption of public key infrastructure among small businesses and startups and the increased investment in cybersecurity, in tandem with the emergence of tech startups and cloud-native enterprises, will continue to attract innovations and capital into the CA space. For instance, in 2025, Sectigo, a global tech firm that specializes in digital certificate management solutions, announced its new platform that will help organizations move to "quantum-resistant cryptography," as per a news release. Quantum-proof cryptography, also called post-quantum cryptography (PQC), protects cryptographic methods from being compromised by future quantum computers, according to a post on the California Institute of Technology's site.

U.S. held a dominant Share of the North America Certificate Authority Market in 2024

The Certificate Authority in the USA is far ahead of the rest of the world due to the intersection of advances in cybersecurity, increased regulatory compliance, and the rapidly changing environment of the cloud-native enterprise. As the projection of digital trust in the American economy, certificate authorities have carved out niches in government, finance, health care, and tech. The U.S. landscape has equally been shut off by deep-rooted concerns over data privacy, zero-trust security architecture, plus accelerated enterprise-wide digitization, which all contribute to pushing the rate of adoption for certificates significantly ahead of the world norm. Furthermore, the adoption chain in which certificates are deployed the more likely, particularly true for mid-large organizations, often at the directive of CIOs and CISOs, who have recognized that their workdays are being made easier by using automated PKI in DevOps pipelines and regulatory audits. With cyberattacks and ransomware cases escalating in range across U.S. businesses and institutions, a trusted verified digital identity has become a strategic priority in the nation. The dominance of the native certificate management by the U.S.-based cloud providers (AWS, Microsoft Azure, Google Cloud) is further incentivizing the native integrations of certificate management, embedding CA services deep into cloud & hybrid environments.

Certificate Authority Competitive Landscape

The global Certificate Authority market is competitive, with several global and international market players. The key players are adopting different growth strategies to enhance their market presence, such as partnerships, agreements, collaborations, new product launches, geographical expansions, and mergers and acquisitions.

Top Certificate Authority Companies

Some of the major players in the market are DigiCert, Inc., GlobalSign, Sectigo Limited, GoDaddy Operating Company, LLC., Entrust Corporation, IdenTrust, Inc., Asseco Data Systems S.A., Network Solutions, LLC., ACTALIS S.p.A., and Let's Encrypt (Internet Security Research Group).

Recent Developments in the Certificate Authority Market

In October 2023, GMO GlobalSign, Inc. specializes in identity security, digital signing, and IoT solutions, announced a strategic alliance with airSlate for promoting productivity and automated solutions through a wider adoption of advanced electronic signatures in Europe and Latin America.

In May 2023, a partnership between DigiCert and a new digital trust platform on Oracle Cloud Infrastructure (OCI) was announced regarding DigiCert ONE. According to this partnership, it is expected to bring customers the joint benefits of both the speedy time-to-value it offers and the high-performance and security-centric architecture of OCI that caters to single and multi-cloud deployments. Under this agreement, both companies will work closely together in further integrating DigiCert ONE within the OCI ecosystem for joint customers to run their digital trust initiatives under one architecture.

In April 2023, Entrust Corporation made major improvements to its Identity and Access Management (IAM) solution by adding new passwordless features for FIDO2 passkeys and Smart Keys-based certificate authentication. The enhancements aim to improve security mechanisms while providing users with effortless and convenient methods of authentication.

In April 2025, according to the news published by the Cryptographic Security Platform, a novel creation of Entrust will be unveiled at the RSA Conference 2025, representing the first solution in the industry to unify the management of cryptographic assets. With this offering, PKI and HSM are integrated for comprehensive management, compliance, and automation of keys, secrets, and certificates within multiple environments: on-premises, cloud, and hybrid. The demand for this platform arises from the growing challenges against AI-powered cyber threats and the forthcoming transition to post-quantum cryptography, thus enabling visibility, risk management, and scaling within the enterprise.

Global Certificate Authority Market Report Coverage

Report Attribute | Details |

Base year | 2024 |

Forecast period | 2025-2033 |

Growth momentum | Accelerate at a CAGR of 11.79% |

Market size 2024 | USD 188.91 Million |

Regional analysis | North America, Europe, APAC, Rest of the World |

Major contributing region | North America is expected to dominate the market during the forecast period. |

Key countries covered | U.S., Canada, Germany, U.K., Spain, Italy, France, China, Japan, and India |

Companies profiled | DigiCert, Inc., GlobalSign, Sectigo Limited, GoDaddy Operating Company, LLC., Entrust Corporation, IdenTrust, Inc., Asseco Data Systems S.A., Network Solutions, LLC., ACTALIS S.p.A., and Let's Encrypt (Internet Security Research Group) |

Report Scope | Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Demand and Supply Side Analysis; Competitive Landscape; Company Profiling |

Segments Covered | By Component; By Certificate Validation Type; By Enterprise Size; By Vertical; and By Region/Country |

Reasons to Buy the Certificate Authority Market Report:

The study includes market sizing and forecasting analysis confirmed by authenticated key industry experts.

The report briefly reviews overall industry performance at a glance.

The report covers an in-depth analysis of prominent industry peers, primarily focusing on key business financials, type portfolios, expansion strategies, and recent developments.

Detailed examination of drivers, restraints, key trends, and opportunities prevailing in the industry.

The study comprehensively covers the market across different segments.

Deep dive regional level analysis of the industry.

Customization Options:

The global certificate authority market can further be customized as per the requirements or any other market segment. Besides this, UnivDatos understands that you may have your own business needs; hence, feel free to contact us to get a report that completely suits your requirements.

Table of Content

Research Methodology for the Global Certificate Authority Market Analysis (2023-2033)

We analyzed the historical market, estimated the current market, and forecasted the future market of the global certificate authority market to assess its application in major regions worldwide. We conducted exhaustive secondary research to gather historical market data and estimate the current market size. To validate these insights, we carefully reviewed numerous findings and assumptions. Additionally, we conducted in-depth primary interviews with industry experts across the certificate authority value chain. After validating market figures through these interviews, we used both top-down and bottom-up approaches to forecast the overall market size. We then employed market breakdown and data triangulation methods to estimate and analyze the market size of industry segments and sub-segments.

Market Engineering

We employed the data triangulation technique to finalize the overall market estimation and derive precise statistical numbers for each segment and sub-segment of the global certificate authority market. We split the data into several segments and sub-segments by analyzing various parameters and trends, including component type, certificate validation type, enterprise size, vertical, and regions within the global certificate authority market.

The Main Objective of the Global Certificate Authority Market Study

The study identifies current and future trends in the global certificate authority market, providing strategic insights for investors. It highlights regional market attractiveness, enabling industry participants to tap into untapped markets and gain a first-mover advantage. Other quantitative goals of the studies include:

Market Size Analysis: Assess the current market size and forecast the market size of the global certificate authority market and its segments in terms of value (USD).

Certificate Authority Market Segmentation: Segments in the study include areas of component type, certificate validation type, enterprise size, vertical, and regions.

Regulatory Framework & Value Chain Analysis: Examine the regulatory framework, value chain, customer behavior, and competitive landscape of the certificate authority industry.

Regional Analysis: Conduct a detailed regional analysis for key areas such as Asia Pacific, Europe, North America, and the Rest of the World.

Company Profiles & Growth Strategies: Company profiles of the certificate authority market and the growth strategies adopted by the market players to sustain the fast-growing market.

Frequently Asked Questions FAQs

Q1: What is the global certificate authority market current market size and its growth potential?

The global certificate authority market was valued at USD 188.91 million in 2024 and is expected to grow at a CAGR of 11.79% during the forecast period (2025-2033).

Q2: Which segment has the largest share of the global certificate authority market by component?

The certificate authority market is bifurcated into Certificate Type and Services. In 2024, the Certificate Type segment dominated the market and is expected to maintain its leading position throughout the forecast period. Among the various certificate types such as SSL Certificates, Code Signing Certificates, Secure Email Certificates, and Authentication Certificates. SSL certificates accounted for the largest share of the certificate types. Domain Validation (DV) and Organization Validation (OV) certificate validation types are the most issued and widely accepted validation types in SSL certificates due to their fast issuance, affordability, and ability to meet basic to mid-level assurance needs.

Q3: What are the driving factors for the growth of the global certificate authority market?

• Rising Cybersecurity Threats: Increasing incidents of data breaches, phishing, and man-in-the-middle attacks are compelling organizations to adopt digital certificates for secure communication and authentication.

• Regulatory Compliance Requirements: Stringent regulations like GDPR (EU), HIPAA (US), PCI-DSS (global), and PSD2 (EU) mandate the use of SSL/TLS certificates and secure identity verification, fueling market demand.

• Rapid Digital Transformation: The growth of online services, e-commerce, cloud computing, and IoT is increasing the need for trusted digital identities and encrypted channels.

Q4: What are the emerging technologies and trends in the global certificate authority market?

• Automated Certificate Management (ACM): Growing use of AI/ML for certificate issuance and renewal is one of the latest trends in the certificate authority market.

• Post-Quantum Cryptography (PQC): CAs preparing quantum-resistant encryption standards.

• Integration of CA with Zero Trust Architecture: CAs are becoming foundational in identity-centric security models.

Q5: What are the key challenges in the global certificate authority market?

• Certificate Mis-issuance and Trust Issues: Incidents involving misissued certificates can damage the credibility of CAs.

• Complexity in Certificate Management: Enterprises struggle with lifecycle management, renewal, and revocation of a growing number of certificates.

• Competition from Free Certificate Providers: Let’s Encrypt and other free CAs pressure revenue models.

Q6: Which region dominates the global certificate authority market?

The North America certificate authority market dominated the global industry in 2024 and is projected to maintain its leading position throughout the forecast period. The increase in certificate deployment and innovation in PKI services in a mature cybersecurity ecosystem, a high degree of internet penetration, and a regulatory environment that requires strong data protection make the region the leader in both. The United States is home to major CA players as DigiCert, Sectigo, and Let’s Encrypt, all of which have led in automating SSL issuance, pushing zero-trust security models, and spearheading a significant drive toward ubiquitous encryption. Many government-backed standards, such as FedRAMP and NIST, in addition to frameworks like CMMC in defense and HIPAA in healthcare, further mandate robust encryption protocols, such that CA services become necessary across sectors. The progressive shift toward digital transformation in North America, especially in the financial services, e-commerce, healthcare, and education sectors, has further broadened the horizons for deploying digital certificates beyond traditional website security to APIs, cloud workloads, IoT devices, and mobile applications.

Q7: Who are the key players in the global certificate authority market?

Some of the leading companies in certificate authority includes:

• DigiCert, Inc.

• GlobalSign

• Sectigo Limited

• GoDaddy Operating Company, LLC.

• Entrust Corporation

• IdenTrust, Inc.

• Asseco Data Systems S.A.

• Network Solutions, LLC.

• ACTALIS S.p.A.

• Lets Encrypt (Internet Security Research Group)

Q8: How do mergers and acquisitions impact market consolidation and investor value in the Certificate Authority industry?

• Strategic Acquisitions Enhance Market Share: Sectigo's acquisition of Entrust's public certificate business doubled its enterprise client base, showcasing how strategic acquisitions can rapidly expand market presence.

• Addressing Compliance and Trust Issues: Entrust faced recognition issues with major browsers like Google Chrome and Mozilla Firefox due to compliance failures. Sectigo's acquisition aims to facilitate a smooth transition for Entrust's clients, mitigating potential trust deficits.

• Investor Value Through Risk Mitigation: By acquiring businesses facing compliance challenges, companies like Sectigo can turn potential liabilities into assets, enhancing investor confidence and long-term value.

Q9: What is the significance of service diversification in enhancing profitability and investor returns in the Certificate Authority market?

• Shift to Recurring Revenue Models: The CA market is transitioning from one-time certificate sales to subscription-based models, offering services like managed PKI and automated certificate lifecycle management, leading to predictable and recurring revenue streams.

• Catering to Diverse Enterprise Needs: By offering a range of services tailored to different enterprise sizes and sectors, CAs can tap into broader markets, enhancing profitability.

• Investor Appeal Through Stability: Diversified service offerings reduce dependency on a single revenue source, providing financial stability and making the company more attractive to investors seeking consistent returns.

Related Reports

Customers who bought this item also bought