- Home

- About Us

- Industry

- Services

- Reading

- Contact Us

India Aluminum Beverage Can Market: Current Analysis and Forecast (2024-2032)

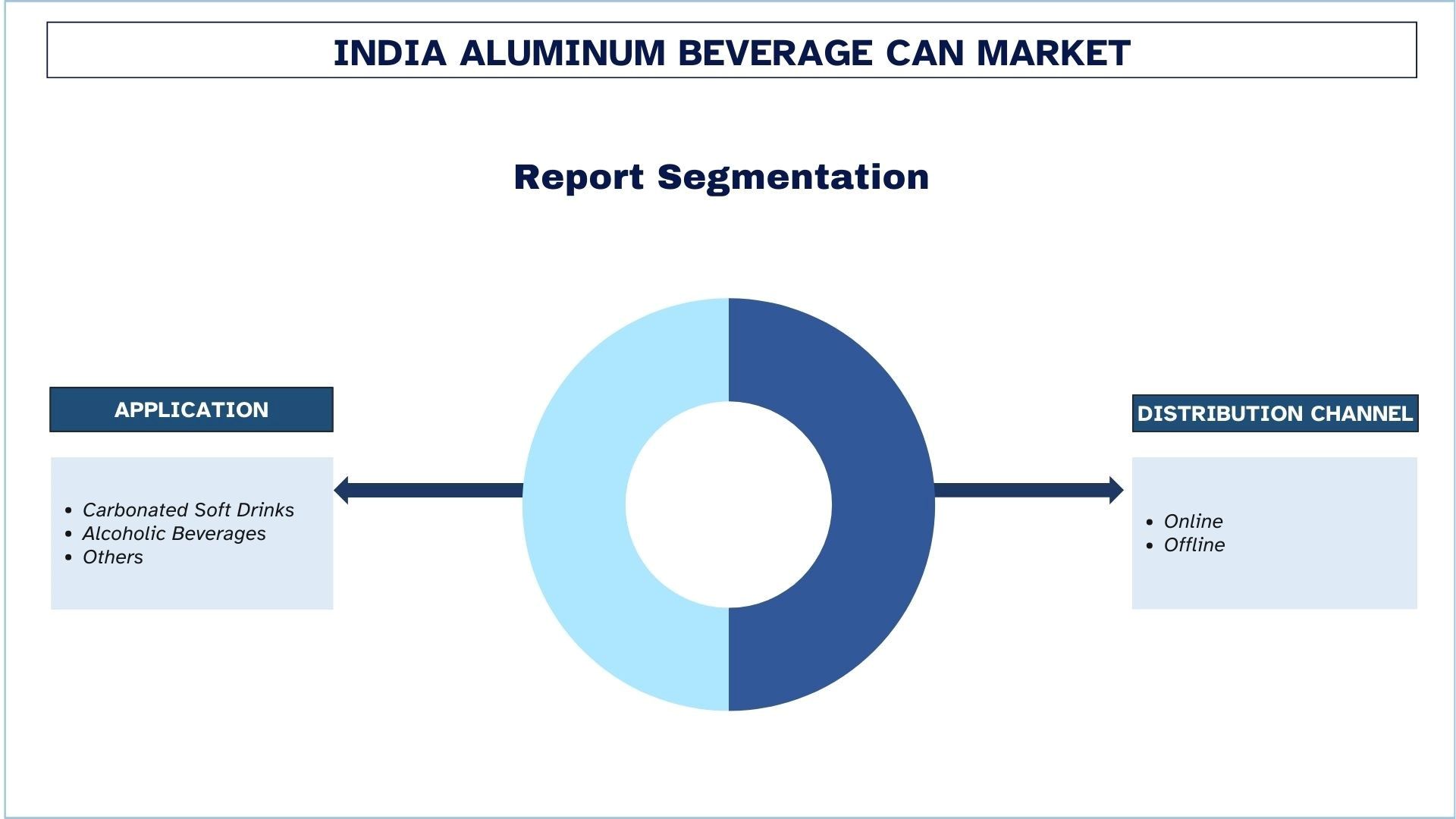

Emphasis on Application (Carbonated Soft Drinks, Alcoholic Beverages, and Others); Distribution Channel (Online and Offline); Region

India Aluminum Beverage Cans Market Size & Forecast

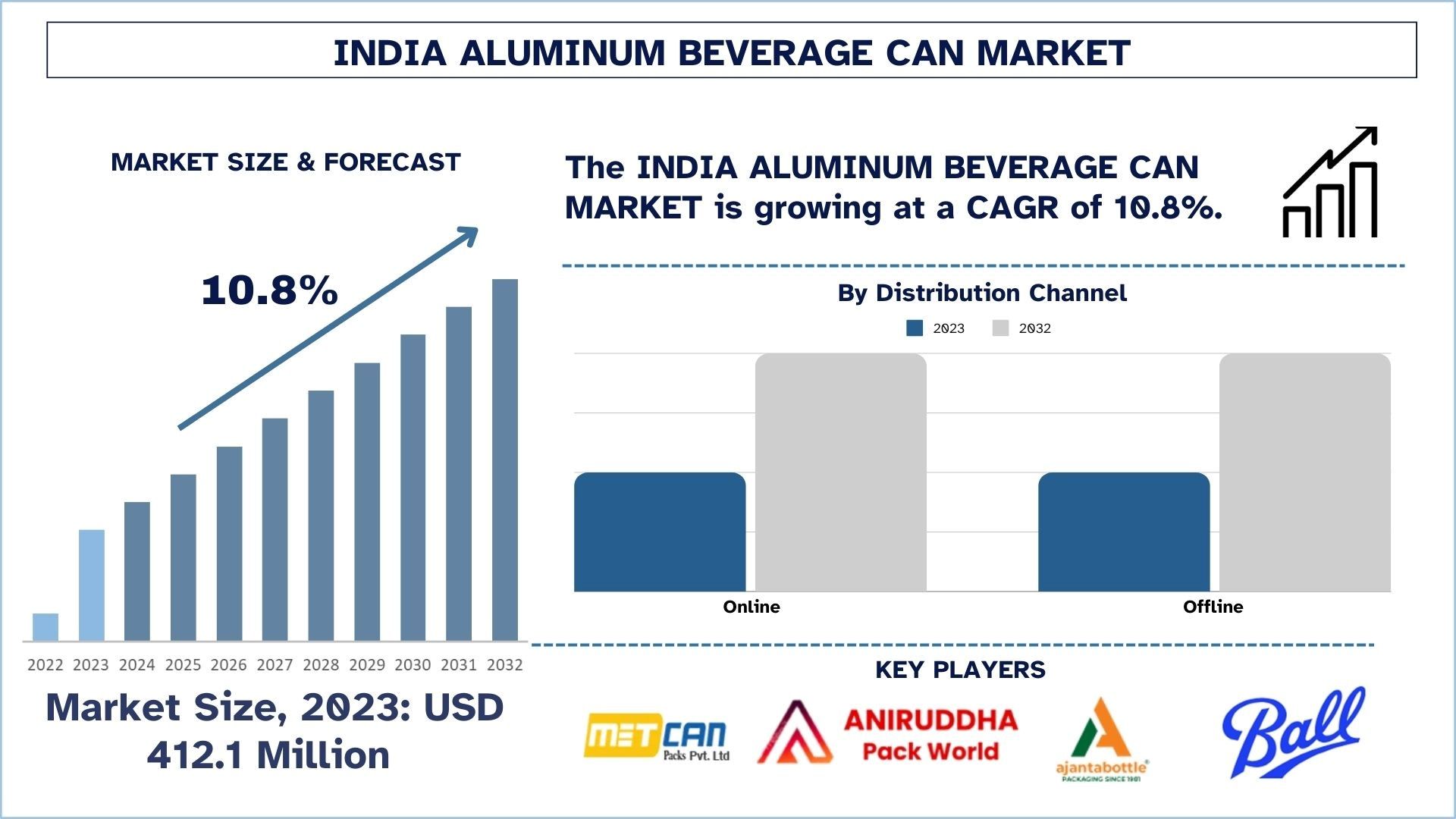

The India Aluminum Beverage Cans market was valued at USD 412.1 million in 2023 and is expected to grow at a strong CAGR of around 10.8% during the forecast period (2024-2032) owing to the increasing consumption of beverages in the nation.

India Aluminum Beverage Cans Market Analysis

The market for aluminum beverage cans in India has shown good growth due to increasing consumer consciousness and convenience driven by the growth in the population of the country. Aluminum cans are lightweight and portable, and as the beverage industry grows especially in segments such as carbonated drinks, energy drinks, and packaged water aluminum cans have been adopted as the primary packaging medium. These aspects show that the market has observed an increment in investments from the key stakeholders in the network, as well as a focus on improving local production and unique value propositions that would capture consumers’ attention.

Recent Developments in the Market

In January 2024, Ball Corporation and Del Monte Foods joined hands to pledge their commitment to sustainability aligned to the Government of India’s ambitious target of achieving net-zero emission by 2070 and reducing the carbon intensity of the economy by 45% by 2030, With support from Ball, Del Monte Foods recently transitioned from using traditional three-piece tin cans for its beverage products to adopting infinitely recyclable two-piece aluminium beverage cans.

In August 2024, AkzoNobel introduces Accelshield 300, a high-performance internal coating for aluminum cans, enhancing safety and regulatory compliance. Beverage can manufacturers are poised to benefit from AkzoNobel's innovative approach with the launch of Accelshield 300, a new high-performance internal coating technology. This cutting-edge solution is free from all bisphenols, styrene, PFAS, and formaldehyde, addressing growing industry demands for safer and more sustainable materials.

In April 2024, the Coca-Cola Company’s Glacéau smartwater brand, which has consistently delivered ahead-of-the-curve innovations since debuting its signature offering nearly three decades ago, is rolling out 12-oz. aluminum cans sporting a fresh, sophisticated look and offering a functional, elevated consumption experience for all occasions.

India Aluminum Beverage Cans Market Trends

This section discusses the key market trends that are influencing the various segments of the Indian aluminum beverage cans market, as identified by our team of research experts.

The Alcoholic Drink Segment Transforming Industry

The alcoholic drink segment is another key trend in the aluminum beverage can market in India because of its increasing demand for a change in drink preference and the increasing craft drink industry. Younger consumers are turning their attention to portable and convenient packaging formats and cans are proving popular for beers, ciders, and ready-to-drink cocktails. This is further evidenced by the growth in the craft beer segment, which focuses on exclusive and distinct flavours, and a large emphasis on local brewing, while can also act as a useful tool for building a brand image. Furthermore, the shift to sustainability is placing pressure on both producers and consumers to adopt aluminum packaging because it can be recycled and has a lower ecological footprint than many other materials. Despite the continual growth in the distribution channels and accessibility in retail shops and e-commerce platforms, the segment of alcoholic drinks in aluminum cans can significantly improve its scope contributing greatly to the general tipping point of the beverage can market in India.

West India is Expected to Grow with Significant CAGR During Forecast Period

The aluminum beverage can market in West India is growing rapidly due to factors like urbanization, general growth in disposable income, and evolving trends among consumers. Amid the arrival of fast-growing beverage markets like Maharashtra and Gujarat along with large conventional and modern commercial centers, more food and beverage sectors are demanding convenient packaging products including aluminum cans. The increased consumption of soft and sparkling beverages, energy, and ready-to-drink products, especially for the younger generation is also accelerating this trend. Also, changes in consciousness regarding sustainability and recycling have become important for consumers and manufacturers, because they are encouraged to use environmentally friendly packaging. Major market players are increasingly investing in local production capabilities and spot-on advertising techniques that augur well for West India to emerge as a major market to boost the aluminum beverage can market industry growth trajectory in the region.

India Aluminum Beverage Cans Industry Overview

The India Aluminum Beverage Cans market is competitive and fragmented, with the presence of several country market players. The key players are adopting different growth strategies to enhance their market presence, such as partnerships, agreements, collaborations, new product launches, geographical expansions, and mergers and acquisitions. Some of the major players operating in the market include Hindustan Tin Works Ltd; Akshar Products; CANPACK; Ajanta Bottle; METCAN Packs Pvt Ltd; Bikaner Polymers Pvt Ltd.; Aniruddha Pack World; Casablanca Industries Pvt Ltd; SHIBA CONTAINERS PVT. LTD.; Ball Corporation.

India Aluminum Beverage Cans Market News

In February 2022, Ball Beverage Packaging India welcomed the move by FSSAI (Food Safety and Standards Authority of India) to pave the way for packaging drinking water in non-transparent packaging solutions like aluminium beverage cans.

In February 2021, Responsible Whatr, a home-grown brand launched spring water in aluminum beverage cans made by Ball Corporation, the world’s leading producer of aluminum packaging. The canned water is sourced directly from the Himalayas and offers naturally balanced essential minerals with a pH of 7.4. When packaged in aluminum cans, this pure water does not alter the freshness when exposed to light or heat.

India Aluminum Beverage Cans Market Report Coverage

Report Attribute | Details |

Base year | 2023 |

Forecast period | 2024-2032 |

Growth momentum | Accelerate at a CAGR of 10.8% |

Market size 2023 | USD 412.1 Million |

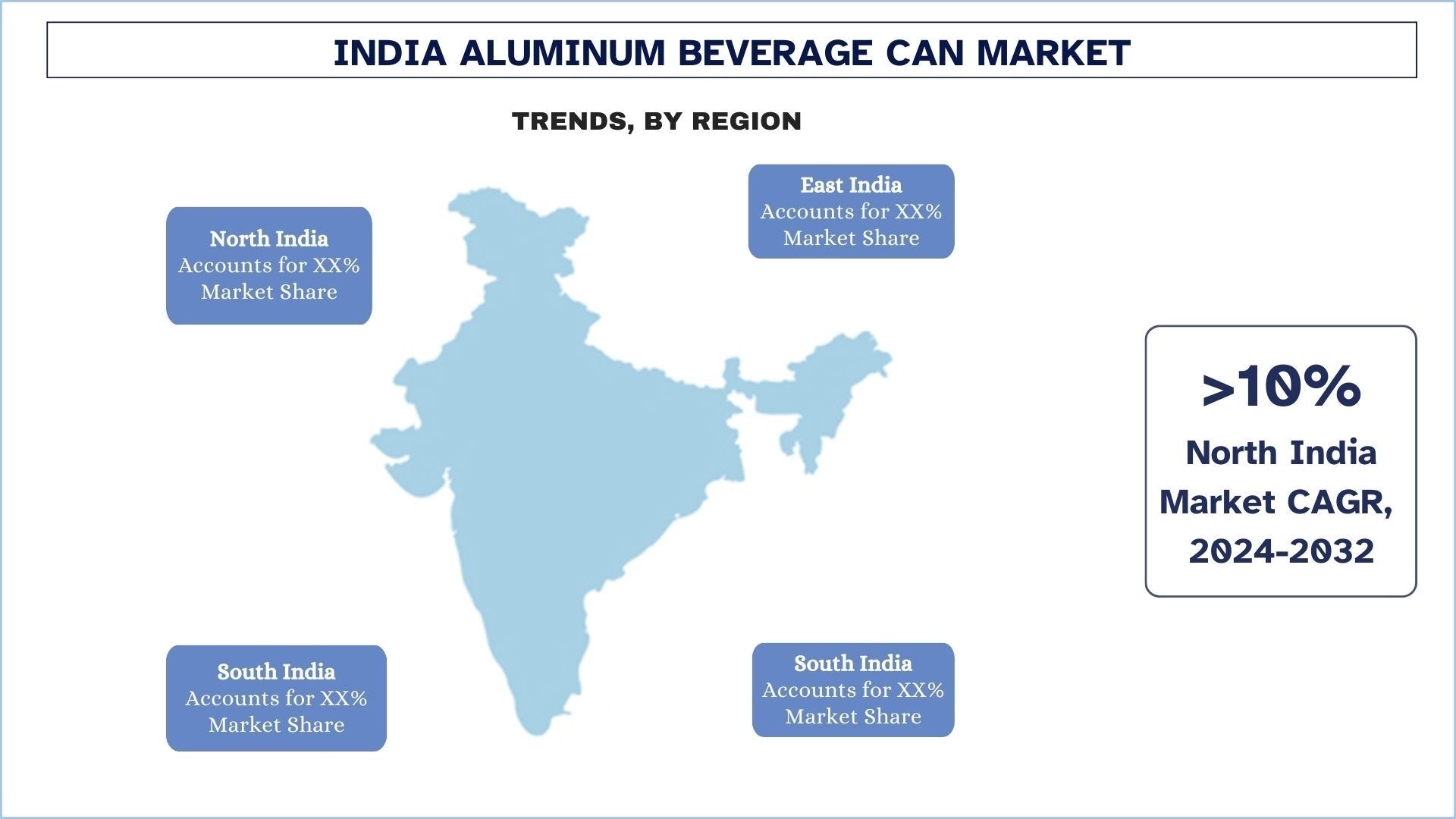

Regional analysis | North India, South India, East India, and West India |

Major contributing region | North India is expected to grow at the highest CAGR during the forecasted period. |

Companies profiled | Hindustan Tin Works Ltd; Akshar Products; CANPACK; Ajanta Bottle; METCAN Packs Pvt Ltd; Bikaner Polymers Pvt Ltd.; Aniruddha Pack World; Casablanca Industries Pvt Ltd; SHIBA CONTAINERS PVT. LTD.; Ball Corporation |

Report Scope | Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Demand and Supply Side Analysis; Competitive Landscape; Company Profiling |

Segments Covered | By Application; By Distribution Channel; By Region |

Reasons to buy this report:

The study includes market sizing and forecasting analysis validated by authenticated key industry experts.

The report presents a quick review of overall industry performance at one glance.

The report covers an in-depth analysis of prominent industry peers with a primary focus on key business financials, product portfolios, expansion strategies, and recent developments.

Detailed examination of drivers, restraints, key trends, and opportunities prevailing in the industry.

The study comprehensively covers the market across different segments.

Deep dive regional level analysis of the industry.

Customization Options:

The India aluminum beverage cans market can further be customized as per the requirement or any other market segment. Besides this, UMI understands that you may have your own business needs, hence feel free to connect with us to get a report that completely suits your requirements.

Table of Content

Research Methodology for the India Aluminum Beverage Cans Market Analysis (2024-2032)

Analyzing the historical market, estimating the current market, and forecasting the future market of the India aluminum beverage cans market were the three major steps undertaken to create and analyze the adoption of India aluminum beverage cans in major states. Exhaustive secondary research was conducted to collect the historical market numbers and estimate the current market size. Secondly, to validate these insights, numerous findings and assumptions were taken into consideration. Moreover, exhaustive primary interviews were also conducted, with industry experts across the value chain of the India aluminum beverage cans market. Post assumption and validation of market numbers through primary interviews, we employed a top-down/bottom-up approach to forecasting the complete market size. Thereafter, market breakdown and data triangulation methods were adopted to estimate and analyze the market size of segments and sub-segments of the industry pertaining to detailed methodology is explained below:

Analysis of Historical Market Size

Step 1: In-Depth Study of Secondary Sources:

A detailed secondary study was conducted to obtain the historical market size of the India aluminum beverage cans market through company internal sources such as annual reports & financial statements, performance presentations, press releases, etc., and external sources including journals, news & articles, government publications, competitor publications, sector reports, third-party database, and other credible publications.

Step 2: Market Segmentation:

After obtaining the historical market size of the India aluminum beverage cans market, we conducted a detailed secondary analysis to gather historical market insights and share for different segments & sub-segments for major regions. Major segments are included in the report as application, distribution channel, and regions. Further country-level analyses were conducted to evaluate the overall adoption of testing models in that region.

Step 3: Factor Analysis:

After acquiring the historical market size of different segments and sub-segments, we conducted a detailed factor analysis to estimate the current market size of the India aluminum beverage cans market. Further, we conducted factor analysis using dependent and independent variables such as the application, distribution channel, and regions of the India Aluminum Beverage Cans market. A thorough analysis was conducted of demand and supply-side scenarios considering top partnerships, mergers and acquisitions, business expansion, and product launches in India aluminum beverage cans market sector across the country

Current Market Size Estimate & Forecast

Current Market Sizing: Based on actionable insights from the above 3 steps, we arrived at the current market size, key players in the India Aluminum Beverage Cans market, and market shares of the segments. All the required percentage shares split, and market breakdowns were determined using the above-mentioned secondary approach and were verified through primary interviews.

Estimation & Forecasting: For market estimation and forecast, weights were assigned to varied factors including drivers & trends, restraints, and opportunities available for the stakeholders. After analyzing these factors, relevant forecasting techniques i.e., the top-down/bottom-up approach were applied to arrive at the market forecast 2032 for different segments and sub-segments across the major markets in India. The research methodology adopted to estimate the market size encompasses:

The industry’s market size, in terms of revenue (USD) and the adoption rate of the India Aluminum Beverage Cans market across the major markets domestically

All percentage shares, splits, and breakdowns of market segments and sub-segments

Key players in the India Aluminum Beverage Cans market regarding products offered. Also, the growth strategies adopted by these players to compete in the fast-growing market.

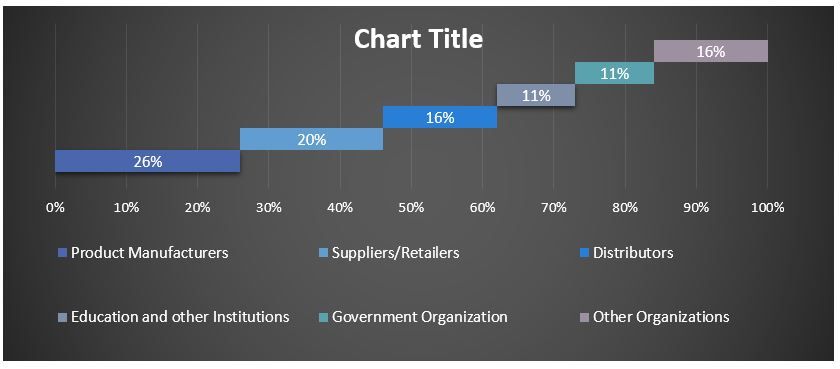

Market Size and Share Validation

Primary Research: In-depth interviews were conducted with the Key Opinion Leaders (KOLs) including Top Level Executives (CXO/VPs, Sales Head, Marketing Head, Operational Head, Regional Head, Country Head, etc.) across major regions. Primary research findings were then summarized, and statistical analysis was performed to prove the stated hypothesis. Inputs from primary research were consolidated with secondary findings, hence turning information into actionable insights.

Split of Primary Participants in Different Regions

Market Engineering

The data triangulation technique was employed to complete the overall market estimation and to arrive at precise statistical numbers for each segment and sub-segment of the India aluminum beverage cans market. Data was split into several segments & sub-segments post studying various parameters and trends in the areas of the application, distribution channel, and regions in the India aluminum beverage cans market.

The main objective of the India Aluminum Beverage Cans Market Study

The current & future market trends of the India Aluminum Beverage Cans market were pinpointed in the study. Investors can gain strategic insights to base their discretion for investments on the qualitative and quantitative analysis performed in the study. Current and future market trends determined the overall attractiveness of the market at a state level, providing a platform for the industrial participant to exploit the untapped market to benefit from a first-mover advantage. Other quantitative goals of the studies include:

Analyze the current and forecast market size of the India aluminum beverage cans market in terms of value (USD). Also, analyze the current and forecast market size of different segments and sub-segments.

Segments in the study include areas of application, distribution channel, and regions.

Define and analyze the regulatory framework for the India aluminum beverage cans

Analyze the value chain involved with the presence of various intermediaries, along with analyzing customer and competitor behaviors of the industry.

Analyze the current and forecast market size of the India aluminum beverage cans market for the major region.

Major Regions in India studied in the report include North India, South India, East India, and West India.

Company profile of the India aluminum beverage cans market and the growth strategies adopted by the market players to sustain in the fast-growing market.

Deep dive state-level analysis of the industry

Frequently Asked Questions FAQs

Q1: What is the current market size and growth potential of the Indian Aluminum Beverage Can market?

The India Aluminum Beverage Cans market was valued at USD 412.1 million in 2023 and is expected to grow at a CAGR of ~10.8% during the forecast period (2024-2032).

Q2: What are the driving factors for the growth of the India Aluminum Beverage Cans market?

The rising beverage consumption growing sustainability focus, and demand for convenience factors are driving the India aluminum beverage can market.

Q3: Which segment has the largest share of the India Aluminum Beverage Cans market by application?

The carbonated soft drinks segment has the largest share of the India Aluminum Beverage Cans market by application.

Q4: What are the emerging technologies and trends in the India Aluminum Beverage Cans market?

Prominent players are inclined towards the development of advanced aluminum beverage cans solutions.

Q5: Which region will dominate the India Aluminum Beverage Cans market?

North India is expected to dominate the market during the forecast period.

Related Reports

Customers who bought this item also bought