- Home

- About Us

- Industry

- Services

- Reading

- Contact Us

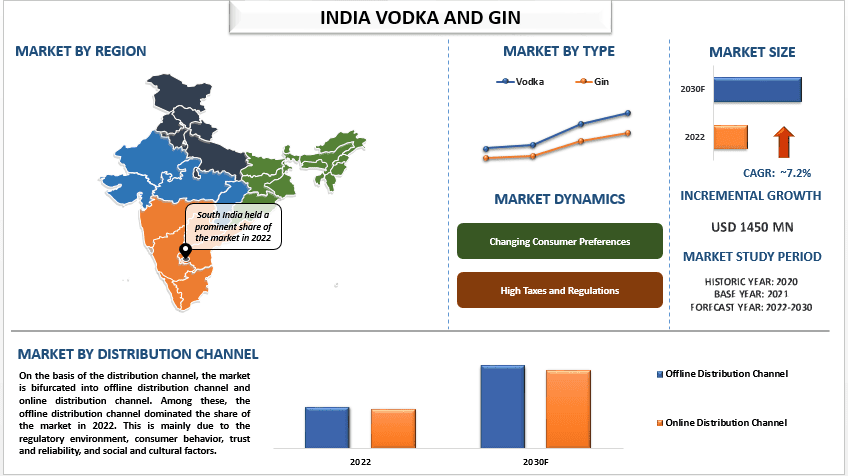

India Vodka and Gin Market: Current Analysis and Forecast (2022-2030)

Emphasis on Type (Vodka and Gin); Distribution Channel (Offline Distribution Channel and Online Distribution Channel); and Region/Country

The India vodka and gin market was valued at USD 1450 million in the year 2022 and is expected to grow at a strong CAGR of around 7.2% during the forecast period owing to Exploring opportunities in untapped regional markets and expanding distribution networks to reach more Tier-II and Tier-III cities can lead to market growth. Moreover, the increasing social acceptance of alcohol consumption in the country has led to a larger consumer base, expanding the market potential. Also, the entry of international vodka & gin brands and the development of domestic craft distilleries have brought about a diverse range of high-quality products, catering to the discerning tastes of consumers. Furthermore, marketing efforts focusing on the mixability and versatility of vodka in various cocktails have been successful in attracting millennials and women consumers. As the hospitality and nightlife sectors continue to flourish, the demand for vodka as a popular choice for mixed drinks is expected to surge, presenting lucrative growth opportunities for both established players and new entrants in the Indian vodka and gin market. For example, according to people’s awareness about the plans, the Delhi government is planning on a new liquor policy that could reduce the legal age floor for alcohol consumption from 25 to 21, allow private- as well as government-run vends, and extend the deadline for serving alcoholic drinks from 1 am to 3 am in the national capital.

Some of the major players operating in the market include Bombay Spirits Company LTD; Diageo plc; Nao Spirits & Beverages Pvt Ltd; Radico khaitan Limited; Bacardi Limited; Beam Suntory, Inc.; Allied Blenders and Distillers Private Limited; United Brewries; Carlsberg Breweries A/S; Anheuser-Busch InBev Several M&As along with partnerships have been undertaken by these players to facilitate customers with hi-tech and innovative products/technologies.

Insights Presented in the Report

“Amongst type, the vodka category dominated the market in 2022”

Based on type, the market is bifurcated into vodka and gin. Amongst these, the vodka category dominated the market in 2022. This is because vodka’s inherent versatility and neutral flavor profile make it an ideal base for an array of cocktails, the surge in cocktail culture and mixology trends has led to a significant increase in the consumption of vodka-based concoctions, further fueling its dominance in the market. Additionally, the growing popularity of socializing in bars, lounges, and restaurants has driven the demand for vodka as the spirit of choice for partygoers and urban dwellers.

“Amongst distribution channel, the wireless smart home technology held the majority share of the market in 2022”

By distribution channel, the market is bifurcated into offline distribution channel and online distribution channel. Among these, online distribution channel will grow at a considerable growth rate in future. Due to the most states in India currently prohibit the online distribution of alcohol, and the government of each state oversees the sale of alcohol. Nevertheless, during the COVID-19 pandemic, some states such as West Bengal, Odisha, and Chhattisgarh have authorized the online sale of alcohol by licensed vendors. In states where online sales are authorized, customers can place orders via licensed retailers’ websites or mobile applications. Age and other necessary details are verified before delivery to the customer’s doorstep. However, it is important to note that the online sale of alcohol is a controversial issue in India that is heavily regulated. There are concerns about responsible consumption and underage drinking, and the laws concerning online distribution of alcohol differ from state to state and are subject to modification.

“East India is expected to grow at a highest CAGR during the forecast period”

East India consists of states such as West Bengal, Chattisgarh, Assam, Arunachal Pradesh, and others. The region is expected to grow at a highest CAGR during the forecast period, along with the rising adult population in the region. Further, the states such as Meghalaya, Sikkim, and Tripura have a significant number of tribal populations that have their regional drinks, and the increasing urbanization of this tribal society is the major attributing factor for the market growth of the alcoholic beverage industry in the east india market. Furthermore, the increasing collaboration of industries in the region also becomes an attributing factor for the market growth of the alcohol industry in the region. These factors will also be contributing to the growth of the vodka and gin market in India. For instance, in February 2022, Devans Modern Breweries, maker of Godfather beer and other malt spirits, expanded its presence to the Northeast. The Jammu-based company, operating in the Indian alcoholic beverage market for about 60 years, added 10,000 KL manufacturing and bottling capacity of beer by tying up with a brewery at Namsai in Arunachal Pradesh.

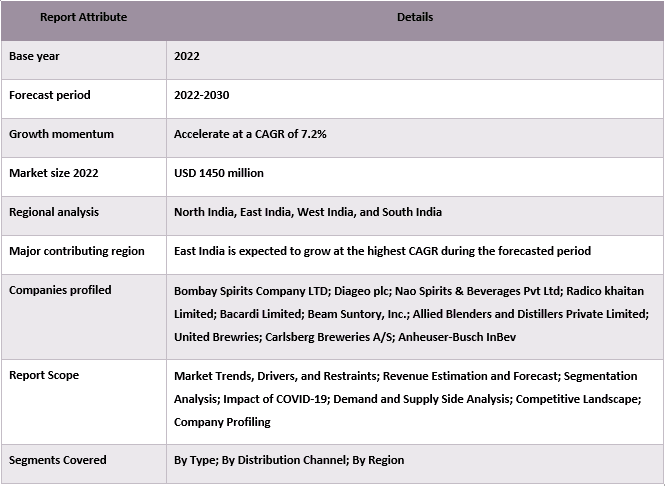

India Vodka and Gin Market Report Coverage

Reasons to buy this report:

- The study includes market sizing and forecasting analysis validated by authenticated key industry experts.

- The report presents a quick review of overall industry performance at one glance.

- The report covers an in-depth analysis of prominent industry peers with a primary focus on key business financials, product portfolios, expansion strategies, and recent developments.

- Detailed examination of drivers, restraints, key trends, and opportunities prevailing in the industry.

- The study comprehensively covers the market across different segments.

- Deep dive regional level analysis of the industry.

Customization Options:

The India vodka and gin market can further be customized as per the requirement or any other market segment. Besides this, UMI understands that you may have your own business needs, hence feel free to contact us to get a report that completely suits your requirements.

Table of Content

Research Methodology for the India Vodka and Gin Market Analysis (2022-2030)

Analyzing the historical market, estimating the current market, and forecasting the future market of the India Vodka and Gin Market were the three major steps undertaken to create and analyze the adoption of vodka and gin in major regions in India. Exhaustive secondary research was conducted to collect the historical market numbers and estimate the current market size. Secondly, to validate these insights, numerous findings and assumptions were taken into consideration. Moreover, exhaustive primary interviews were also conducted, with industry experts across the value chain of the India Vodka and Gin Market. Post assumption and validation of market numbers through primary interviews, we employed a top-down/bottom-up approach to forecasting the complete market size. Thereafter, market breakdown and data triangulation methods were adopted to estimate and analyze the market size of segments and sub-segments of the industry pertains to. Detailed methodology is explained below:

Analysis of Historical Market Size

Step 1: In-Depth Study of Secondary Sources:

Detail secondary study was conducted to obtain the historical market size of the India Vodka and Gin Market through company internal sources such as annual reports & financial statements, performance presentations, press releases, etc., and external sources including journals, news & articles, government publications, competitor publications, sector reports, third-party database, and other credible publications.

Step 2: Market Segmentation:

After obtaining the historical market size of the India Vodka and Gin Market, we conducted a detailed secondary analysis to gather historical market insights and share for different segments & sub-segments for major regions. Major segments are included in the report as type and distribution channel. Further country-level analyses were conducted to evaluate the overall adoption of testing models in that region.

Step 3: Factor Analysis:

After acquiring the historical market size of different segments and sub-segments, we conducted a detailed factor analysis to estimate the current market size of the India Vodka and Gin Market. Further, we conducted factor analysis using dependent and independent variables such as type and distribution channel of the India Vodka and Gin Market. A thorough analysis was conducted for demand and supply-side scenarios considering top partnerships, mergers and acquisitions, business expansion, and product launches in the India Vodka and Gin Market sector across the globe.

Current Market Size Estimate & Forecast

Current Market Sizing: Based on actionable insights from the above 3 steps, we arrived at the current market size, key players in the India Vodka and Gin Market, and market shares of the segments. All the required percentage shares split, and market breakdowns were determined using the above-mentioned secondary approach and were verified through primary interviews.

Estimation & Forecasting: For market estimation and forecast, weights were assigned to different factors including drivers & trends, restraints, and opportunities available for the stakeholders. After analyzing these factors, relevant forecasting techniques i.e., the top-down/bottom-up approach were applied to arrive at the market forecast for 2030 for different segments and sub-segments across the major markets globally. The research methodology adopted to estimate the market size encompasses:

- The industry’s market size, in terms of revenue (USD) and the adoption rate of the India Vodka and Gin Market across the major markets domestically

- All percentage shares, splits, and breakdowns of market segments and sub-segments

- Key players in the India Vodka and Gin Market in terms of products offered. Also, the growth strategies adopted by these players to compete in the fast-growing market

Market Size and Share Validation

Primary Research: In-depth interviews were conducted with the Key Opinion Leaders (KOLs) including Top Level Executives (CXO/VPs, Sales Head, Marketing Head, Operational Head, Regional Head, Country Head, etc.) across major regions. Primary research findings were then summarized, and statistical analysis was performed to prove the stated hypothesis. Inputs from primary research were consolidated with secondary findings, hence turning information into actionable insights.

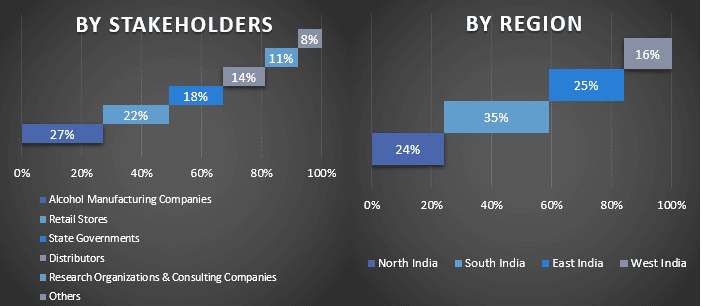

Split of Primary Participants in Different Regions

Market Engineering

The data triangulation technique was employed to complete the overall market estimation and to arrive at precise statistical numbers for each segment and sub-segment of the India vodka and gin market. Data was split into several segments & sub-segments post studying various parameters and trends in the areas of the type and distribution channel in the India Vodka and Gin Market.

The main objective of the India Vodka and Gin Market Study

The current & future market trends of the India Vodka and Gin Market were pinpointed in the study. Investors can gain strategic insights to base their discretion for investments on the qualitative and quantitative analysis performed in the study. Current and future market trends determined the overall attractiveness of the market at a regional level, providing a platform for the industrial participant to exploit the untapped market to benefit from a first-mover advantage. Other quantitative goals of the studies include:

- Analyze the current and forecast market size of the India Vodka and Gin Market in terms of value (USD). Also, analyze the current and forecast market size of different segments and sub-segments

- Segments in the study include areas of the type and distribution channel

- Define and analysis of the regulatory framework for the smart home industry

- Analyze the value chain involved with the presence of various intermediaries, along with analyzing customer and competitor behaviors of the industry

- Analyze the current and forecast market size of the India Vodka and Gin Market for the major regions

- Major countries of regions studied in the report include Asia Pacific, Europe, North America, and the Rest of the World

- Company profiles of the India Vodka and Gin Market and the growth strategies adopted by the market players to sustain in the fast-growing market

- Deep dive regional level analysis of the industry

Related Reports

Customers who bought this item also bought