Neo Banking Market: Current Analysis and Forecast (2023-2030)

$3999 – $6999

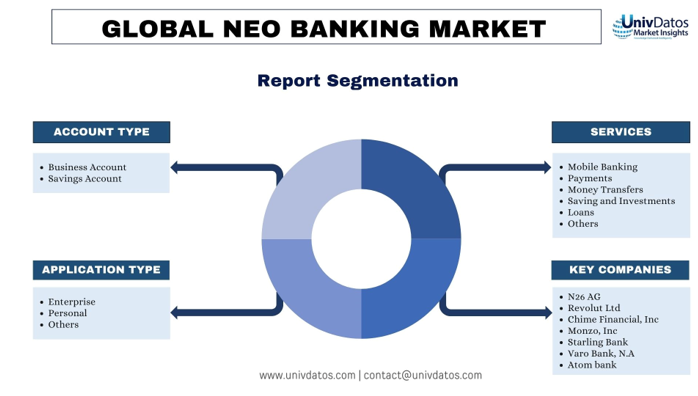

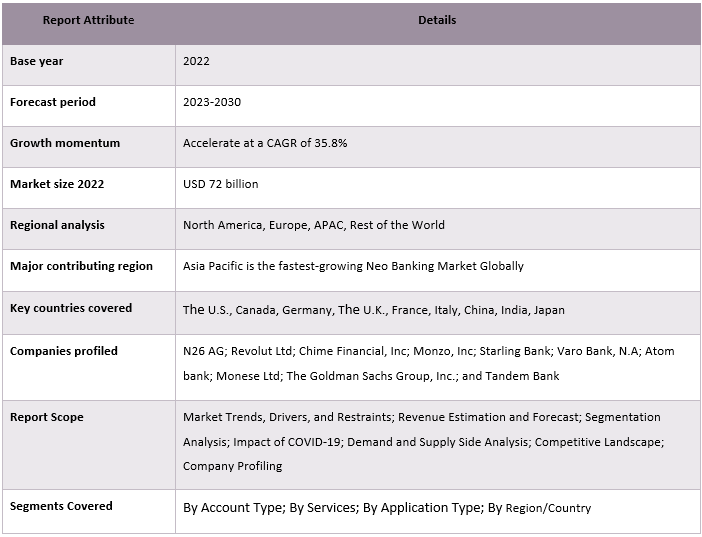

Emphasis on Account Type (Business Accounts and Savings Accounts.); Services (Mobile Banking, Payments, Money Transfer, Savings and Investments, Loans, and Others); Application Type (Enterprise, Personal, and Others); and Region/Country

| Pages: | 145 |

|---|---|

| Table: | 48 |

| Figure: | 98 |

| Report ID: | UMBF212684 |

| Geography: |

Report Description

Neo Banking Market Size & Forecast

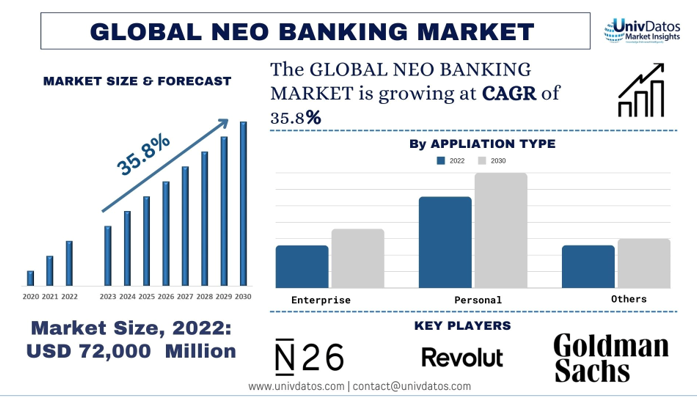

The neo-banking market was valued at USD 72,000 Million and is expected to grow at a strong CAGR of around 35.8% during the forecast period (2023-2030) owing to growing financial digitalization.

Neo Banking Market Analysis

The primary reason for the rapid growth of neo-banks is the convenience they offer. With 24/7 access to services through mobile apps, customers can manage their finances anytime, anywhere. Furthermore, Neo banks often have lower operating costs compared to traditional banks due to their lack of physical branches.

Furthermore, this high growth is also fueled by the conducive government support to this industry as well. Governments in various countries have recognized the potential of fintech innovation and have introduced regulatory sandboxes to foster the growth of neo-banking startups. This supportive regulatory environment has encouraged entrepreneurs and investors to enter this market.

Moreover, in 2021, Stripe, a global payments processing platform, raised USD S600 million in a funding round, valuing the company at USD 95 billion, underscoring investor confidence in fintech companies, and , companies like Chime in the U.S. and Revolut in Europe have gained traction by offering services tailored to millennials and frequent travelers.

Neo Banking Market Trends

This section discusses the key market trends that are influencing the various segments of the Neo Banking Market as identified by our team of research experts.

Mobile Banking Services is Transforming Industry

The application that generates the maximum revenue for neo-banks is mobile banking. With the increasing adoption of smartphones and the growing importance of digital transactions, mobile banking has become an indispensable tool for customers seeking convenience and accessibility in managing their finances. Neo banks have capitalized on this trend by delivering seamless and user-friendly mobile banking experiences that cater to modern-day financial needs. Furthermore, several factors have contributed to the high acceptability of the new mobile banking services among consumers, such as a user-friendly interface. For instance, Neo banks prioritize user experience, offering intuitive interfaces that make it easy for customers to navigate through various banking services. The simplicity and convenience of mobile banking applications enhance customer satisfaction and loyalty. Moreover, the accessibility and the security features that the neo banking provides to their consumers build trust among the consumers, and the level of accessibility, allowing consumers to access their accounts anytime and anywhere is a key driver of consumer retention for the neo banks. For instance, Brazil has become one of the fastest-growing regions for neo-banking, supported by the push towards digitization of the Brazilian economy. As of 2023, a significant portion of the Brazilian population specifically about 43% have a neo-bank account. NuBank, the largest neo bank in Brazil, has experienced remarkable growth with a user base exceeding 48 million, evidently securing the second largest investment of about USD 4.1 billion over time since 2012.

Europe holds the significant portion of Neo Banking in terms of market share

Within Europe, the Germany holds a major share of the market. The major factors boosting the market’s growth in the country are its conducive financial regulatory environment helping the industry to thrive at an unprecedented rate.

According to the European Union’s Payment Services Directive 2 (PSD2) launched in 2017 in Europe, has played a pivotal role in fostering innovation and competition in the financial sector by enhancing and regulating electronic payment services by allowing third-party access to banking data through open banking APIs.

Furthermore, the collaborative ecosystem in Europe amongst fintech, traditional banks, and regulatory bodies has laid down a very favorable environment for the neo-banking industry to thrive in the region. For instance, the partnership between the neo-banking services providers and the traditional banks has enabled these digital-only banks to expand fast and grow their consumer base at a rapid rate.

Neo Banking Industry Overview

The neo-banking market is competitive and fragmented, with the presence of several global and international market players. The key players are adopting different growth strategies to enhance their market presence, such as partnerships, agreements, collaborations, new product launches, geographical expansions, and mergers and acquisitions. Some of the major players operating in the market are N26 AG; Revolut Ltd; Chime Financial, Inc; Monzo, Inc; Starling Bank; Varo Bank, N.A; Atom bank; Monese Ltd; The Goldman Sachs Group, Inc.; and Tandem Bank.

Neo Banking Market News

- In 2023, a German-based neo-bank named N26 reported its growth numbers regarding its consumer base, of about 7 million consumers across Europe underscoring the cultural acceptance of neo-banking in the region.

- In May 2023, Nymbus, a startup that enables banks to transition from their legacy banking infrastructure towards neo banking, with an aim to maximize new customer aquisiton made an announcement of securing an investment of USD 70 million in its series D round.

Neo Banking Market Report Coverage

Reasons to buy this report:

- The study includes market sizing and forecasting analysis validated by authenticated key industry experts.

- The report presents a quick review of overall industry performance at one glance.

- The report covers an in-depth analysis of prominent industry peers with a primary focus on key business financials, product portfolios, expansion strategies, and recent developments.

- Detailed examination of drivers, restraints, key trends, and opportunities prevailing in the industry.

- The study comprehensively covers the market across different segments.

- Deep dive regional level analysis of the industry.

Customization Options:

The global Neo Banking market can further be customized as per the requirement or any other market segment. Besides this, UMI understands that you may have your own business needs, hence feel free to contact us to get a report that completely suits your requirements.

You can also purchase parts of this report. Do you want to check out a section wise

price list?

Frequently Asked Questions (FAQ)

Q1: What is the current market size and growth potential of the global Neo Banking market?

Ans: The global Neo Banking market was valued at USD 72 billion in 2022 and is expected to grow at a CAGR of 35.8% during the forecast period (2023-2030).

Q2: What are the driving factors for the growth of the global Neo Banking Market?

Ans: The major factor contributing to the market's growth is the digitization of financial services as well as the convenience of payments and investments that consumers require today.

Q3: Which segment is the fastest growing of the global Neo Banking market by service type?

Ans: Mobile banking services are the fastest-growing segment of the global neo-banking industry.

Q4: What are the emerging technologies and trends in the global Neo Banking market?

Ans: The growing integration of artificial intelligence and machine learning for creating robust security systems around the financial infrastructure is one of the major trends in the global neo-banking market.

Q5: Which region will be the fastest-growing global Neo Banking market?

Ans: The Asia Pacific region is expected to experience substantial growth in the predicted timeframe.

Q6: Who are the key players in the global Neo Banking market?

Ans: N26 AG; Revolut Ltd; Chime Financial, Inc; Monzo, Inc; Starling Bank; Varo Bank, N.A; Atom bank; Monese Ltd; The Goldman Sachs Group, Inc.; and Tandem Bank

Research Methodology

Research Methodology for the Neo Banking Market Analysis (2023-2030)

Analyzing the historical market, estimating the current market, and forecasting the future market of the global Neo Banking market were the three major steps undertaken to create and analyze the adoption of Neo Banking in major regions globally. Exhaustive secondary research was conducted to collect the historical market numbers and estimate the current market size. Secondly, to validate these insights, numerous findings and assumptions were taken into consideration. Moreover, exhaustive primary interviews were also conducted, with industry experts across the value chain of the global Neo Banking market. Post assumption and validation of market numbers through primary interviews, we employed a top-down/bottom-up approach to forecasting the complete market size. Thereafter, market breakdown and data triangulation methods were adopted to estimate and analyze the market size of segments and sub-segments of the industry pertains to. Detailed methodology is explained below:

Analysis of Historical Market Size

Step 1: In-Depth Study of Secondary Sources:

A detailed secondary study was conducted to obtain the historical market size of the Neo Banking market through company internal sources such as annual reports & financial statements, performance presentations, press releases, etc., and external sources including journals, news & articles, government publications, competitor publications, sector reports, third-party database, and other credible publications.

Step 2: Market Segmentation:

After obtaining the historical market size of the Neo Banking market, we conducted a detailed secondary analysis to gather historical market insights and share for different segments & sub-segments for major regions. Major segments are included in the report as account type, services, and application type. Further country-level analyses were conducted to evaluate the overall adoption of testing models in that region.

Step 3: Factor Analysis:

After acquiring the historical market size of different segments and sub-segments, we conducted a detailed factor analysis to estimate the current market size of the Neo Banking market. Further, we conducted factor analysis using dependent and independent variables such as account type, services, and application type of the Neo Banking market. A thorough analysis was conducted of demand and supply-side scenarios considering top partnerships, mergers and acquisitions, business expansion, and product launches in the Neo Banking market sector across the globe.

Current Market Size Estimate & Forecast

Current Market Sizing: Based on actionable insights from the above 3 steps, we arrived at the current market size, key players in the global Neo Banking market, and market shares of the segments. All the required percentage shares split and market breakdowns were determined using the above-mentioned secondary approach and were verified through primary interviews.

Estimation & Forecasting: For market estimation and forecast, weights were assigned to different factors including drivers & trends, restraints, and opportunities available for the stakeholders. After analyzing these factors, relevant forecasting techniques i.e., the top-down/bottom-up approach were applied to arrive at the market forecast for 2030 for different segments and sub-segments across the major markets globally. The research methodology adopted to estimate the market size encompasses:

- The industry’s market size, in terms of revenue (USD) and the adoption rate of the Neo Banking market across the major markets domestically

- All percentage shares, splits, and breakdowns of market segments and sub-segments

- Key players in the global Neo Banking market in terms of products offered. Also, the growth strategies adopted by these players to compete in the fast-growing market.

Market Size and Share Validation

Primary Research: In-depth interviews were conducted with the Key Opinion Leaders (KOLs) including Top Level Executives (CXO/VPs, Sales Head, Marketing Head, Operational Head, Regional Head, Country Head, etc.) across major regions. Primary research findings were then summarized, and statistical analysis was performed to prove the stated hypothesis. Inputs from primary research were consolidated with secondary findings, hence turning information into actionable insights.

Split of Primary Participants in Different Regions

Market Engineering

The data triangulation technique was employed to complete the overall market estimation and to arrive at precise statistical numbers for each segment and sub-segment of the global Neo Banking market. data was split into several segments & sub-segments after studying various parameters and trends in the areas of purity and application in the global Neo Banking market.

The main objective of the Global Neo Banking Market Study

The current & future market trends of the global Neo Banking market were pinpointed in the study. Investors can gain strategic insights to base their discretion for investments on the qualitative and quantitative analysis performed in the study. Current and future market trends determined the overall attractiveness of the market at a regional level, providing a platform for the industrial participant to exploit the untapped market to benefit from a first-mover advantage. Other quantitative goals of the studies include:

- Analyze the current and forecast market size of the Neo Banking market in terms of value (USD). Also, analyze the current and forecast market size of different segments and sub-segments.

- Segments in the study include areas of account type, services, and application type.

- Define and analyze the regulatory framework for the Neo Banking

- Analyze the value chain involved with the presence of various intermediaries, along with analyzing customer and competitor behaviors of the industry

- Analyze the current and forecast market size of the Neo Banking market for the major region

- Major countries of regions studied in the report include Asia Pacific, Europe, North America, and the Rest of the World

- Company profiles of the Neo Banking market and the growth strategies adopted by the market players to sustain in the fast-growing market.

- Deep dive regional level analysis of the industry

Reviews

There are no reviews yet.