- Home

- About Us

- Industry

- Services

- Reading

- Contact Us

Ready-to-Drink (RTD) Coffee & Tea Market: Current Analysis and Forecast (2024-2032)

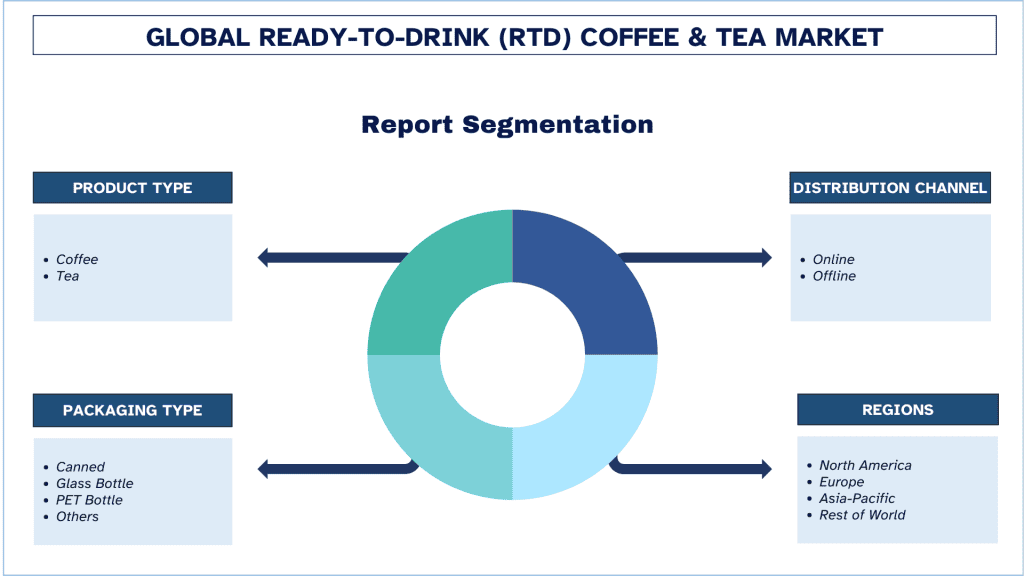

Emphasis on Product Type (Coffee and Tea); Packaging Type (Canned, Glass Bottle, PET Bottle, Others); Distribution Channel (Online and Offline); and Region/Country

Ready-to-Drink (RTD) Coffee & Tea Market Size & Forecast

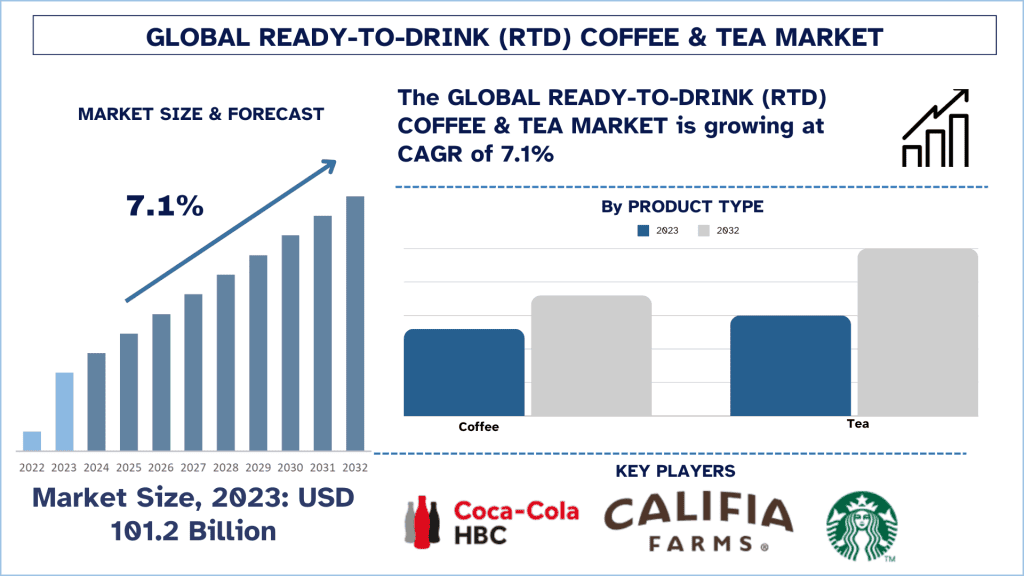

The ready-to-drink (RTD) coffee & tea market was valued at approximately ~USD 101.2 billion in 2023 and is expected to grow at a strong CAGR of around 7.1% during the forecast period (2024-2032) owing to the increasing demand for ready-to-consume beverages globally.

Ready-to-Drink (RTD) Coffee & Tea Market Analysis

The ready-to-drink (RTD) coffee & tea market has seen significant growth, especially in the market as more people are shopping for convenient, grab-and-go beverages. This market has a broad product offering which includes cold brew coffees, iced tea products, and other flavored drinks to suit different demands. Flavor developments, product development, and packaging remain innovative, pulling in new consumers, while new qualitative changes like low-sugar and organic products address current dietary trends. Market growth is supported by expanding distribution outlets and a trend towards premium and artisanal goods.

In September 2023, Keurig Dr Pepper (KDP) invested USD 300m equity in La Colombe Coffee Roasters. The agreement also includes the distribution of La Colombe’s ready-to-drink products.

In October 2022, soft beverage group Britvic acquired Jimmy’s Iced Coffee allowing them to enter the UK ready-to-drink (RTD) coffee market.

Ready-to-Drink (RTD) Coffee & Tea Market Trends

This section discusses the key market trends that are influencing the various segments of the ready-to-drink (RTD) coffee & tea market, as identified by our team of research experts.

The Tea Segment Transforming Industry

The tea segment is growing in the market owing to the high demand for RTD tea especially with less sugar content, natural products, and containing nutrients such as antioxidants. This segment has also been boosted by the popularity of iced and flavored teas which include green, black, and herbal teas. Furthermore, the increasing demand for better quality and flavored RTD tea, new packaging, and attractive marketing both amongst the tea targets has also gained consumer attraction. This growth is also supplemented by a rise in the availability of RTD tea in various retail outlets and the consideration for environmental concerns through leveraging environmentally friendly containers. In conclusion, the tea segment remains one of the most dynamic categories with significant growth potential mainly due to changing consumer palates and a broadening number of choices.

North America is expected to grow at a significant rate in the forecast period.

The North American ready-to-drink (RTD) coffee & tea has been advancing tremendously due to an increase in demand for beverages that are easy to carry. These consumers are already leading busy lives, and as such, they are shifting towards the convenience of RTD coffee and tea to satisfy their need for caffeine quick fixes and a beverage on the go. This is through flavor developments within formulations and increased inclusion of the premium and functional segments that are perceived when people concern themselves with their overall health. The distribution channel has also been effective with RTD beverages being placed in convenience stores, supermarkets, and online shops. Also, consumers’ expectations are met by the brands that address the concepts of sustainability and ethical manufacturing, which are the factors that make the market more attractive. In conclusion, the RTD coffee and tea segment in North America remains on a growth trajectory courtesy of convenience, variety, and more importantly, changes in consumer habits.

In March 2023, Central American multinational beverage company Beliv acquired a 78% stake in High Brew Coffee. High Brew was one of the pioneering cold brew brands in the United States, leading the RTD trend by introducing its drinks to grocery and convenience store shelves during the 2010s.

In June 2022, U.S.-based SYSTM Foods acquired cold brew specialist Chameleon. The month before, they also acquired RBBL, a brand of plant-based RTD “functional beverages,” which included a line of cold brew drinks.

Ready-to-Drink (RTD) Coffee & Tea Industry Overview

The ready-to-drink (RTD) coffee & tea market is competitive, with several global and international market players. The key players are adopting different growth strategies to enhance their market presence, such as partnerships, agreements, collaborations, geographical expansions, and mergers and acquisitions. Some of the major players operating in the market are Danone S.A.; Harney & Sons Fine Teas; Nestlé S.A.; Snapple Beverage Corp.; Starbucks Coffee Company; SUNTORY HOLDINGS LIMITED; Tata Consumer Products Limited; Coca-Cola HBC; Califia Farms, LLC; Unilever.

In August 2024, U.S.-based Black Rifle Coffee Company, a rapidly growing, mission-driven lifestyle brand and premium coffee company, announced to launch of a new line of high-octane, ready-to-drink Black Rifle Energy beverages expected to premier in late Q4 and arrive in early 2025.

In June 2024, Japan-based Ueshima Coffee Company launched two new ready-to-drink (RTD) canned coffees – Iced Latte and Iced Matcha Latte to the UK market for the first time. Both Ueshima’s products are packaged in 100% recyclable cans, further strengthening Ueshima’s existing commitment to sustainable practices.

In May 2024, Nescafé launched its new Nescafé Espresso Concentrate designed to capture the out-of-home cold coffee experience, this premium liquid coffee concentrate brings barista-style personalized iced coffees to consumers’ homes.

In March 2024, U.S.-based Starbucks launched its newest lineup of delicious RTD beverages, with even more café-inspired drinks to meet consumer preferences. NACP is introducing the new non-dairy Starbucks Oatmilk Frappuccino Chilled Coffee Drink, new flavors of Starbucks Cold Brew, and Starbucks Multi-serve Cold Brew.

In December 2023, U.S.-based Chamberlain Coffee launched its new line of Ready To Drink (RTD) Oatmilk Lattes. Following the initial launch of its RTD Lattes in April of this year, the brand has taken fan feedback and created two sweeter, oat milk-based canned lattes in Salted Caramel and Mocha flavors.

Ready-to-Drink (RTD) Coffee & Tea Market Report Coverage

Report Attribute | Details |

Base year | 2023 |

Forecast period | 2024-2032 |

Growth momentum | Accelerate at a CAGR of 7.1% |

Market size 2023 | ~USD 101.2 billion |

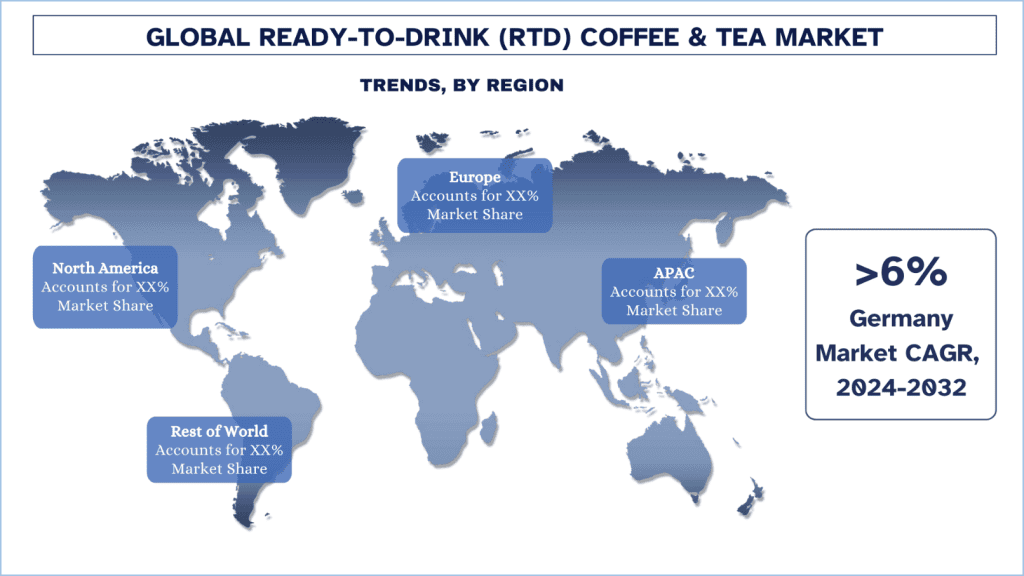

Regional analysis | North America, Europe, APAC, Rest of the World |

Major contributing region | North America is expected to grow at the highest CAGR during the forecasted period |

Key countries covered | U.S., Canada, Germany, United Kingdom, Spain, Italy, France, China, Japan, and India |

Companies profiled | Danone S.A.; Harney & Sons Fine Teas; Nestlé S.A.; Snapple Beverage Corp.; Starbucks Coffee Company; SUNTORY HOLDINGS LIMITED; Tata Consumer Products Limited; Coca-Cola HBC; Califia Farms, LLC; Unilever |

Report Scope | Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Demand and Supply Side Analysis; Competitive Landscape; Company Profiling |

Segments Covered | By Product Type; By Packaging Type; By Distribution Channel; By Region/Country |

Reasons to buy this report:

- The study includes market sizing and forecasting analysis validated by authenticated key industry experts.

- The report presents a quick review of overall industry performance at one glance.

- The report covers an in-depth analysis of prominent industry peers with a primary focus on key business financials, product portfolios, expansion strategies, and recent developments.

- Detailed examination of drivers, restraints, key trends, and opportunities prevailing in the industry.

- The study comprehensively covers the market across different segments.

- Deep dive regional level analysis of the industry.

Customization Options:

The global ready-to-drink (RTD) coffee & tea market can further be customized as per the requirement or any other market segment. Besides this, UMI understands that you may have your own business needs, hence feel free to connect with us to get a report that completely suits your requirements.

Table of Content

Research Methodology for the Ready-to-Drink (RTD) Coffee & Tea Market Analysis (2024-2032)

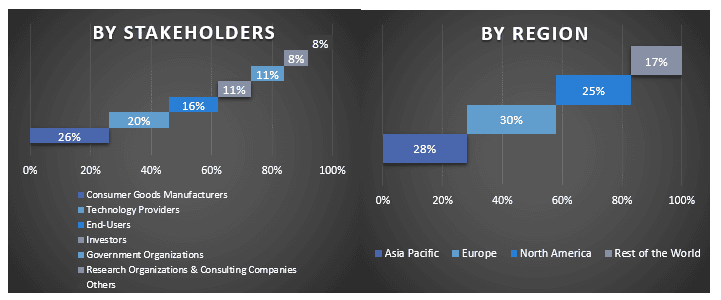

Analyzing the historical market, estimating the current market, and forecasting the future market of the global ready-to-drink (RTD) coffee & tea market were the three major steps undertaken to create and analyze the adoption of ready-to-drink (RTD) coffee & tea in major regions globally. Exhaustive secondary research was conducted to collect the historical market numbers and estimate the current market size. Secondly, to validate these insights, numerous findings and assumptions were taken into consideration. Moreover, exhaustive primary interviews were also conducted, with industry experts across the value chain of the global ready-to-drink (RTD) coffee & tea market. Post assumption and validation of market numbers through primary interviews, we employed a top-down/bottom-up approach to forecasting the complete market size. Thereafter, market breakdown and data triangulation methods were adopted to estimate and analyze the market size of segments and sub-segments of the industry pertains to. Detailed methodology is explained below:

Analysis of Historical Market Size

Step 1: In-Depth Study of Secondary Sources:

A detailed secondary study was conducted to obtain the historical market size of the ready-to-drink (RTD) coffee & tea market through company internal sources such as annual reports & financial statements, performance presentations, press releases, etc., and external sources including journals, news & articles, government publications, competitor publications, sector reports, third-party database, and other credible publications.

Step 2: Market Segmentation:

After obtaining the historical market size of the ready-to-drink (RTD) coffee & tea market, we conducted a detailed secondary analysis to gather historical market insights and share for different segments & sub-segments for major regions. Major segments are included in the report, such as product type, packaging type, distribution channel, and regions. Further country-level analyses were conducted to evaluate the overall adoption of testing models in that region.

Step 3: Factor Analysis:

After acquiring the historical market size of different segments and sub-segments, we conducted a detailed factor analysis to estimate the current market size of the ready-to-drink (RTD) coffee & tea market. Further, we conducted factor analysis using dependent and independent variables such as product type, packaging type, distribution channel, and regions of the ready-to-drink (RTD) coffee & tea market. A thorough analysis was conducted for demand and supply-side scenarios considering top partnerships, mergers and acquisitions, business expansion, and product launches in the ready-to-drink (RTD) coffee & tea market sector across the globe.

Current Market Size Estimate & Forecast

Current Market Sizing: Based on actionable insights from the above 3 steps, we arrived at the current market size, key players in the global ready-to-drink (RTD) coffee & tea market, and market shares of the segments. All the required percentage shares split and market breakdowns were determined using the above-mentioned secondary approach and were verified through primary interviews.

Estimation & Forecasting: For market estimation and forecast, weights were assigned to different factors including drivers & trends, restraints, and opportunities available for the stakeholders. After analyzing these factors, relevant forecasting techniques i.e., the top-down/bottom-up approach were applied to arrive at the market forecast for 2032 for different segments and sub-segments across the major markets globally. The research methodology adopted to estimate the market size encompasses:

- The industry’s market size, in terms of revenue (USD) and the adoption rate of the ready-to-drink (RTD) coffee & tea market across the major markets domestically.

- All percentage shares, splits, and breakdowns of market segments and sub-segments.

- Key players in the global ready-to-drink (RTD) coffee & tea market in terms of products offered. Also, the growth strategies adopted by these players to compete in the fast-growing market.

Market Size and Share Validation

Primary Research: In-depth interviews were conducted with the Key Opinion Leaders (KOLs) including Top Level Executives (CXO/VPs, Sales Head, Marketing Head, Operational Head, Regional Head, Country Head, etc.) across major regions. Primary research findings were then summarized, and statistical analysis was performed to prove the stated hypothesis. Inputs from primary research were consolidated with secondary findings, hence turning information into actionable insights.

Split of Primary Participants in Different Regions

Market Engineering

The data triangulation technique was employed to complete the overall market estimation and to arrive at precise statistical numbers for each segment and sub-segment of the global ready-to-drink (RTD) coffee & tea market. Data was split into several segments and sub-segments after studying various parameters and trends in the areas of the product type, packaging type, distribution channel, and regions in the global ready-to-drink (RTD) coffee & tea market.

The main objective of the Global Ready-to-Drink (RTD) Coffee & Tea Market Study

The current & future market trends of the global ready-to-drink (RTD) coffee & tea market were pinpointed in the study. Investors can gain strategic insights to base their discretion for investments on the qualitative and quantitative analysis performed in the study. Current and future market trends determined the overall attractiveness of the market at a regional level, providing a platform for the industrial participant to exploit the untapped market to benefit from a first-mover advantage. Other quantitative goals of the studies include:

- Analyze the current and forecast market size of the ready-to-drink (RTD) coffee & tea market in terms of value (USD). Also, analyze the current and forecast market size of different segments and sub-segments.

- Segments in the study include areas of the product type, packaging type, distribution channel, and regions.

- Define and analysis of the regulatory framework for the ready-to-drink (RTD) coffee & tea

- Analyze the value chain involved with the presence of various intermediaries, along with analyzing customer and competitor behaviors of the industry.

- Analyze the current and forecast market size of the ready-to-drink (RTD) coffee & tea market for the major region.

- Major countries of regions studied in the report include Asia Pacific, Europe, North America, and the Rest of the World

- Company profiles of the ready-to-drink (RTD) coffee & tea market and the growth strategies adopted by the market players to sustain in the fast-growing market.

- Deep dive regional level analysis of the industry.

Frequently Asked Questions FAQs

Q1: What is the ready-to-drink (RTD) coffee & tea market's current market size and growth potential?

Q2: What are the driving factors for the growth of the ready-to-drink (RTD) coffee & tea market?

Q3: Which segment has the largest share of the ready-to-drink (RTD) coffee & tea market by product type?

Q4: What are the emerging technologies and trends in the ready-to-drink (RTD) coffee & tea market?

Q5: Which region will dominate the ready-to-drink (RTD) coffee & tea market?

Related Reports

Customers who bought this item also bought