- Home

- About Us

- Industry

- Services

- Reading

- Contact Us

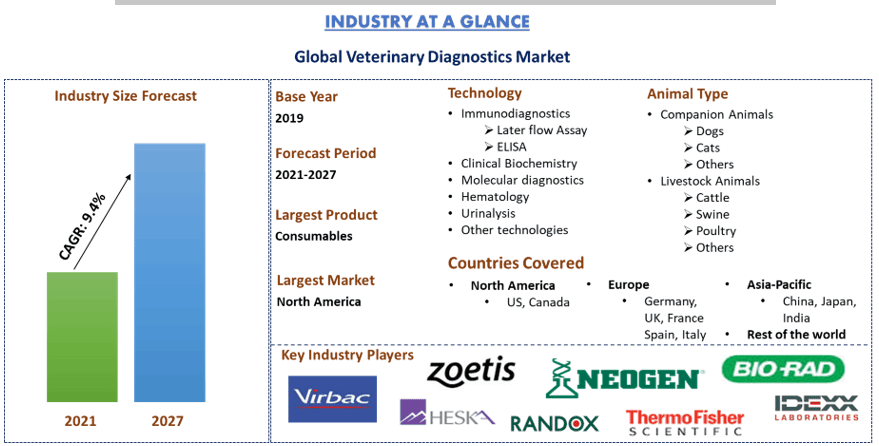

Veterinary Diagnostics Market: Current Analysis and Forecast (2021-2027)

Emphasis on Product (Consumables, Instruments); Technology (Immunodiagnostics [Lateral Flow Assay, ELISA], Clinical Biochemistry, Molecular Diagnostics, Hematology, Urinalysis, Others); Animal Type [Companion Animals (Dogs, Cats, Others) Livestock Animals (Cattle, Swine, Poultry, Others)]; End-User (Veterinary Reference Laboratories, Veterinary Hospitals & Clinics, In-House Testing, Veterinary Research Institutes & Universities) and Region & Country.

Veterinary Diagnostics plays an important role in animal disease diagnosis and its management. The practice of veterinary diagnostics is essential to prevent even a small outbreak of disease among the entire animal community. High-quality diagnostics are important to provide appropriate treatment and to ensure the overall well-being of an animal

The global veterinary diagnostics market is growing exponentially, driven by the increasing number of companion animals all over the world. The most common companion animals adopted as pets are dogs and cats. For instance, As per the “WorldAtlas” statistics of 2021, the global dog population is around 900 million and rising, with the global cat population is about 600 million. Also, approximately 470 Million dogs were kept as pets, and around 370 million pet cats were in the world.

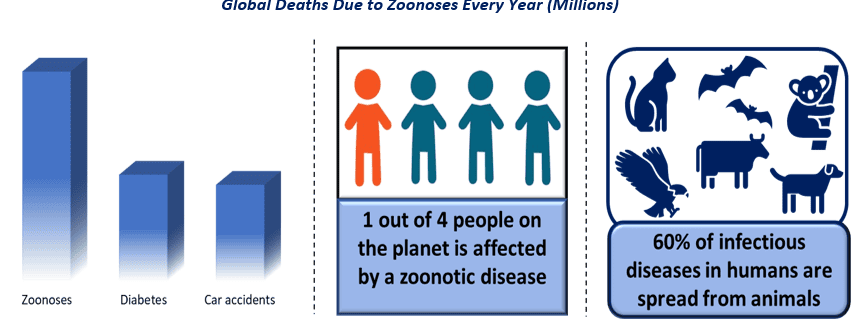

Zoonotic diseases, also known as Zoonoses is an infectious disease that is transmissible from vertebrates to human beings. More than 200 types of zoonoses are known now. Nearly, 75% of all infectious diseases that affect humans are zoonoses. Also, whenever a new communicable disease is diagnosed, 3 out 4 diseases have been originated and transferred. Apart from this, according to the Centers for Disease Control and Prevention, each year 2.5 billion cases of diseases are zoonoses. Also, zoonoses are the cause of nearly 2.7 million deaths worldwide surpassing the number of deaths due to diabetes and car accidents. Given these facts, there is a growing need to prevent such diseases which can be done by regular health checkups and diagnostics of animals. Thereby, increasing the demand for veterinary diagnostics all over the world.

Furthermore, the growth of the veterinary diagnostics market can be attributed to the rising pet population and the expenditure on animal care including veterinary and other services all over the globe. For instance, more than 50$ billion per annum is spent by Americans on their pets. Also, the annual expenditure on veterinary and other pet services in the United Kingdom was approximately USD 4.9 billion in 2017 which raised to USD 6.75 billion in 2019. While, In 2020, this value was decreased to nearly USD 3.9 billion due to the worldwide pandemic. Other factors driving the growth of this market are rising disposable income and increased consumption of animal-derived food products including meat and dairy products. For instance, the annual consumption of fluid cow milk was highest in India (more than 81 million metric tons) followed by European Union (33.4 million metric tons).

Idexx Laboratories, Thermo Fisher Scientific, Zoetis Inc, Virbac, Randox, Qiagen, Neogen, Heska Corporation, Abaxis, Bio-rad Laboratories are some of the prominent players operating in the global veterinary diagnostics market. Several M&As along with partnerships have been undertaken by these players to facilitate customers with hi-tech and innovative products/services.

Insights Presented in the Report

“Amongst Product, consumables segment holds the major share”

Based on the Product, the market is fragmented into Consumables and Instruments. The consumables segment dominated the global veterinary diagnostics market and grabbed XX% market share. This segment will witness a considerable CAGR of XX% during the forecast period (2021-2027F) owing to the introduction of advanced and effective consumables to use with various diagnostics equipment and devices. However, the instrument segment is also anticipated to grow at a considerable CAGR of XX% between 2021-2027F. The growth of this segment is attributable to the technological advancement and innovative launch of various veterinary diagnostics instruments. For example, In August 2020, IDEXX Laboratories, a global leader in veterinary diagnostics and software, announced the expansion of its imaging portfolio to include the ImageVue DR30 Digital Imaging System. This system makes high-quality images and has improved radiation safety accessible to a broader range of veterinarians who may have previously thought advanced low-dose digital radiography was financially out of reach.

“Amongst Technology, immunodiagnostics segment is anticipated to grow at the highest CAGR during the analyzed period”

Based on technology, the market is segmented into immunodiagnostics, clinical biochemistry, molecular diagnostics, hematology, urinalysis, and other technologies. The immunodiagnostics segment held the major market share of XX% in 2020 and is likely to grow continuously over the projected timeframe owing to the increase in animal-borne diseases and the growing need for early and effective diagnosis of these diseases. For instance, nearly 25% of the population all over the world is affected by zoonotic diseases each year. However, the Molecular diagnostics segment is also expected to at the highest CAGR during the forecast period. This can be because of the availability and widespread application of advanced molecular technologies such as nucleic acid diagnosis and polymerase chain reaction (PCR).

“Amongst Animal Type, companion animals segment is anticipated to grow at the highest CAGR during the analyzed period”

The animal type segment of the global veterinary diagnostics market is classified into companion animals and livestock animals. Further, the companion animal includes dogs, cats, and others. The livestock animals include cattle, swine, poultry, and others. The companion animal segment held the major market share in 2020 and is anticipated to dominate throughout the forecast period. The growth of this segment is due to the increasing companion animal population all over the world. For instance, 4.35 million companion animals are present in New Zealand. New Zealand has the second-highest proportion of households with companion animals in the world, second only to the United States (67%).

“Amongst End-Users, veterinary hospitals & clinics segment holds the major share”

Among end-users, the market is divided into veterinary reference laboratories, veterinary hospitals & clinics, in-house testing, veterinary research institutes & universities. The veterinary hospitals & clinics dominated the market and expected to grow at a CAGR of XX% to reach the market valuation at USD XX million by 2027 owing to the presence of advanced technologies and trained personnel in hospitals and clinics. In addition to this, the rapid development of various veterinary hospitals and clinics in developed as well as in some developing nations is further propelling the growth of this market. For instance, In the financial year 2019, more than 12,000 veterinary hospitals and polyclinics were found across India. Along numerous aid centers and dispensaries and about 65,000 veterinary institutions were present across the country that year. However, the veterinary reference laboratories segment is also expected to witness significant growth during the analyzed period.

“North America signifies one of the largest markets of Veterinary Diagnostics Market”

For a better understanding of the market dynamics of the veterinary diagnostics market, a detailed analysis was conducted for different regions across the globe including North America (United States, Canada, and the Rest of North America), Europe (Germany, France, Italy, Spain, United Kingdom and Rest of Europe), Asia-Pacific (China, Japan, India, Australia and Rest of APAC), and Rest of World. North America dominated the market and generated maximum revenue in 2020 owing to Increasing urbanization coupled with the rising consumption of meat and dairy products. For instance, In 2020, the most consumed type of meat in the United States was broiler chicken, at about 96.4 pounds per capita Which is expected to increase to around 101.1 pounds per capita by 2030.

Reasons to buy this report:

- The study includes market sizing and forecasting analysis validated by authenticated key industry experts

- The report presents a quick review of overall industry performance at one glance

- The report covers an in-depth analysis of prominent industry peers with a primary focus on key business financials, product portfolio, expansion strategies, and recent developments

- Detailed examination of drivers, restraints, key trends, and opportunities prevailing in the industry

- The study comprehensively covers the market across different segments

- Deep dive regional level analysis of the industry

Customization Options:

Veterinary Diagnostics Market can further be customized as per the requirement or any other market segment. Besides this, UMI understands that you may have your own business needs, hence feel free to connect with us to get a report that completely suits your requirements.

section class=”price-breakup”>

You can also purchase parts of this report. Do you want to check out a section wise

price list?

Table of Content

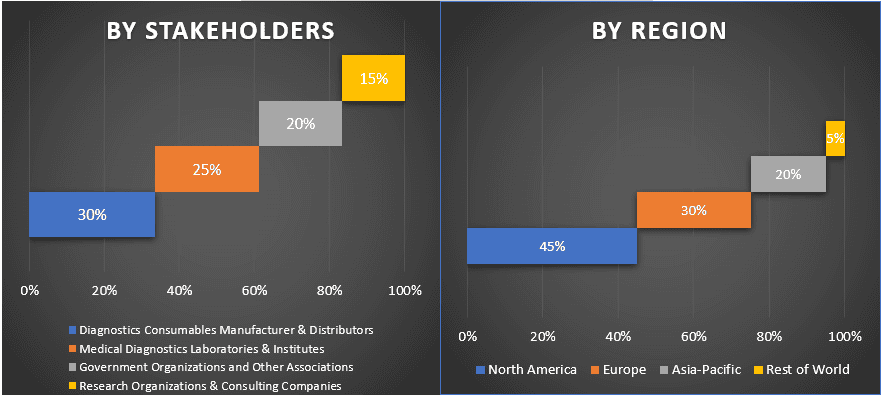

Analyzing the historical market, estimation of the current market, and forecasting the future market of the global veterinary diagnostics market were the three major steps undertaken to create and analyze the adoption of veterinary diagnostics in different segments across major regions globally. Exhaustive secondary research was conducted to collect the historical market numbers and estimate the current market size. Secondly, to validate these insights, numerous findings and assumptions were taken into consideration. Moreover, exhaustive primary interviews were also conducted, with industry experts across the value chain of the veterinary diagnostics sector. Post assumption and validation of market numbers through primary interviews, we employed a top-down/bottom-up approach to forecast the complete market size. Thereafter, market breakdown and data triangulation methods were adopted to estimate and analyze the market size of segments and sub-segments the industry pertains to. Detailed methodology is explained below:

Analysis of Historical Market Size

Step 1: In-Depth Study of Secondary Sources:

Detailed secondary study was conducted to obtain the historical market size of the veterinary diagnostics through company internal sources such as annual report & financial statements, performance presentations, press releases, etc., and external sources including journals, news & articles, government publications, competitor publications, sector reports, third-party database, and other credible publications.

Step 2: Market Segmentation:

After obtaining the historical market size of the veterinary diagnostics market, we conducted a detailed secondary analysis to gather historical market insights and share for different segments for major regions. Major segments included in the report are product, technology, animal type, and end-user. Further country-level analyses were conducted to evaluate the overall adoption of veterinary diagnostics in every region.

Step 3: Factor Analysis:

After acquiring the historical market size of different segments and sub-segments, we conducted a detailed factor analysis to estimate the current market size of veterinary diagnostics. Further, we conducted factor analysis using dependent and independent variables such as increasing pet population and growing expenditure on animal health. A thorough analysis was conducted for demand and supply-side scenarios considering top partnerships, merger and acquisition, business expansion, and product launches in the veterinary diagnostics industry across the globe.

Current Market Size Estimate & Forecast

Current Market Sizing: Based on actionable insights from the above 3 steps, we arrived at the current market size, key players in the veterinary diagnostics market, and market shares of the segments. All the required percentage shares split, and market breakdowns were determined using the above-mentioned secondary approach and were verified through primary interviews.

Estimation & Forecasting: For market estimation and forecast, weights were assigned to different factors including drivers & trends, restraints, and opportunities available for the stakeholders. After analyzing these factors, relevant forecasting techniques i.e., the top-down/bottom-up approach was applied to arrive at the market forecast about 2027 for different segments and subsegments across the major markets globally. The research methodology adopted to estimate the market size encompasses:

- The industry’s market size, in terms of value (USD) and the adoption rate of veterinary diagnostics across the major markets domestically

- All percentage shares, splits, and breakdowns of market segments and sub-segments

- Key players in the veterinary diagnostics market in terms of services offered. Also, the growth strategies adopted by these players to compete in the fast-growing market

Market Size and Share Validation

Primary Research: In-depth interviews were conducted with the Key Opinion Leaders (KOLs) including Top Level Executives (CXO/VPs, Sales Head, Marketing Head, Operational Head, and Regional Head, Country Head, etc.) across major regions. Primary research findings were then summarized, and statistical analysis was performed to prove the stated hypothesis. Inputs from primary research were consolidated with secondary findings, hence turning information into actionable insights.

Split of Primary Participants in Different Regions

Market Engineering

Data triangulation technique was employed to complete the overall market estimation and to arrive at precise statistical numbers of each segment and sub-segment of the veterinary diagnostics market. Data was split into several segments & sub-segments post studying various parameters and trends in the areas of products, technology, animal type, and end-user of the veterinary diagnostics market.

Main Objective of the Veterinary Diagnostics Market Study

The current & future market trends of veterinary diagnostics were pinpointed in the study. Investors can gain strategic insights to base their discretion for investments from the qualitative and quantitative analysis performed in the study. Current and future market trends were determined the overall attractiveness of the market at a regional level, providing a platform for the industrial participant to exploit the untapped market to benefit as a first-mover advantage. Other quantitative goals of the studies include:

- Analyze the current and forecast market size of veterinary diagnostics in terms of value (USD). Also, analyze the current and forecast market size of different segments and sub-segments

- Segments in the study include areas of products, technology, animal type, and end-users

- Analyze the value chain involved with the presence of various intermediaries, along with analyzing customer and competitor behaviors of the industry

- Analyze the current and forecast market size of the veterinary diagnostics market for the major region

- Major regions studied in the report include North America (the United States and Canada), Europe (Germany, France, Italy, Spain, and United Kingdom), Asia-Pacific (China, Japan, India, and Australia), and the Rest of World

- Company profiles of the veterinary diagnostics market and the growth strategies adopted by the market players to sustain in the fast-growing market

- Deep dive regional level analysis of the industry

Related Reports

Customers who bought this item also bought