- Home

- About Us

- Industry

- Services

- Reading

- Contact Us

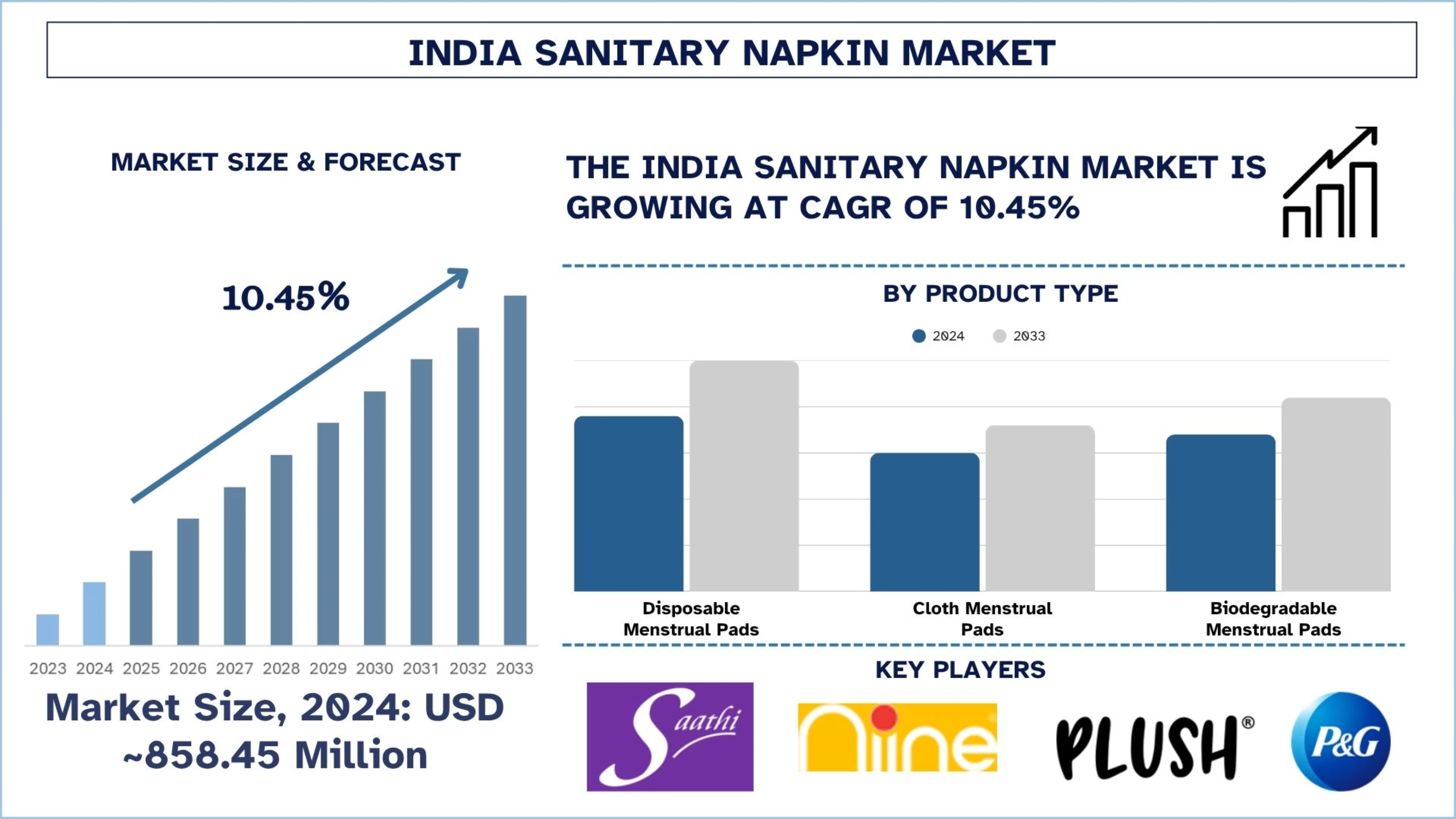

India Sanitary Napkin Market: Current Analysis and Forecast (2025-2033)

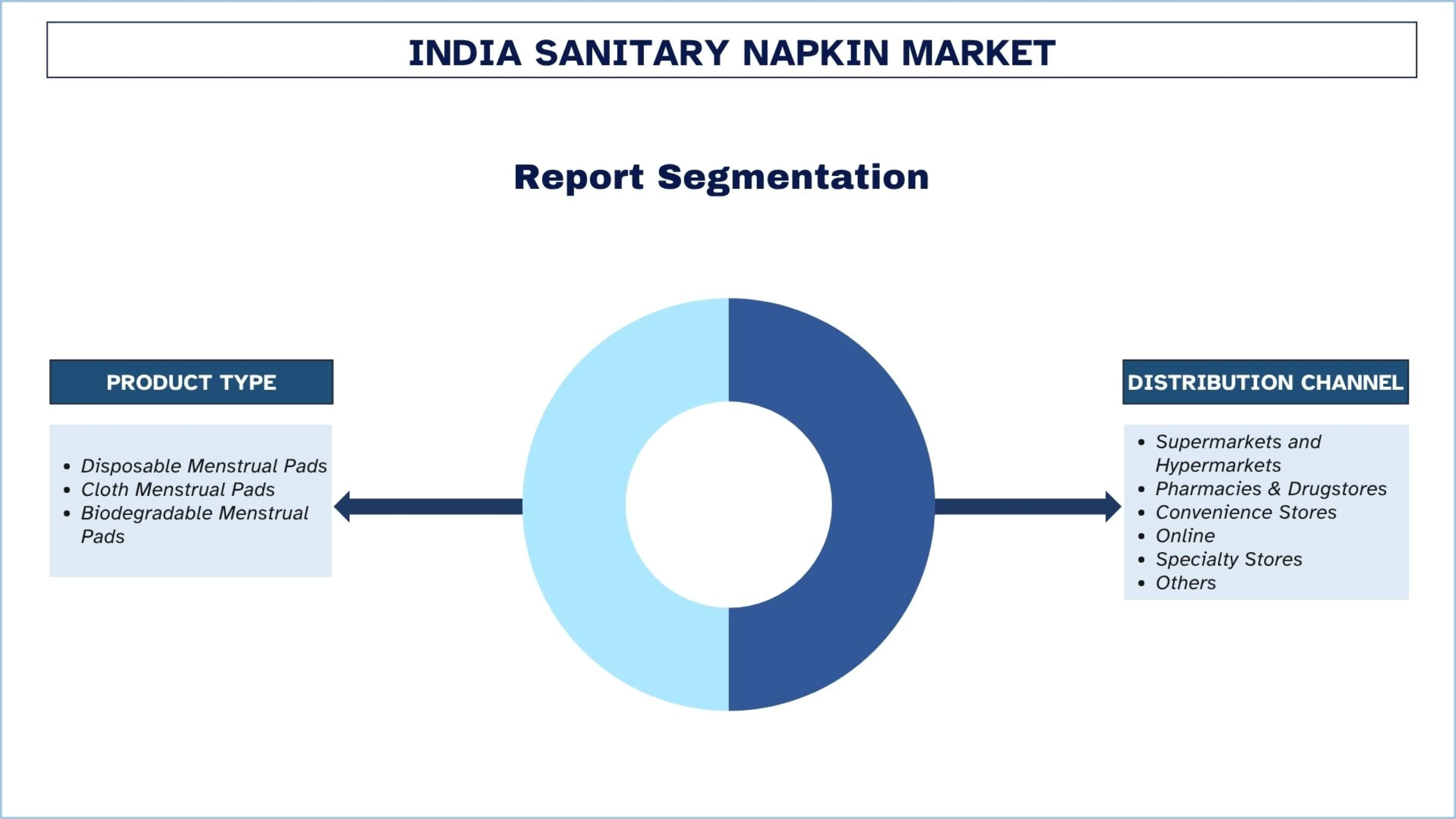

Emphasis on Product Type (Disposable Menstrual Pads, Cloth Menstrual Pads, Biodegradable Menstrual Pads); Distribution Channel (Supermarkets and Hypermarkets, Pharmacies & Drugstores, Convenience Stores, Online, Specialty Stores, Others) and Region/States

India Sanitary Napkin Market Size & Forecast

The India Sanitary Napkin market was valued at USD ~858.45 million in 2024 and is expected to grow to a strong CAGR of around 10.45% during the forecast period (2025-2033F), owing to the rising menstrual health awareness.

Sanitary Napkin Market Analysis

Sanitary napkin can be an alternative term for menstrual pads, these are absorbent items that women wear during menstruation that can be used to absorb menstrual fluids. It usually contains layers of absorbent material like cotton, nonwoven fabric, and waterproof backing to control leakage. Various disposable, reusable, cloth, and biodegradable products are used to satisfy different consumer preferences.

To achieve growth in the sanitary napkin market, companies in India’s sanitary napkin market are adopting eco-friendly innovations, including biodegradable pads, expanding distribution networks in rural areas, and exploiting digital marketing and D2C platforms to achieve growth. Moreover, rising awareness campaigns, school-based health programs, and subscription models will help key players increase engagement and brand loyalty. Although an established brand such as Whisper or Stayfree expands rural outreach and increases product range to meet changing consumer needs, startups like Saathi and Aakar Innovations are producing sustainably.

India Sanitary Napkin Market Trends

This section discusses the key market trends that are influencing the various segments of the India Sanitary Napkin market, as found by our team of research experts.

Rising Product Innovation in Sustainable Hygiene

In India, biodegradable sanitary pads are witnessing an innovative practice as traditional sanitary pads are adding to the growing demand for conscious eco products amongst women. These use materials like banana fiber, bamboo, and corn starch and are a sustainable alternative to plastic-based disposables. This segment is being pioneered by startups like Saathi, Anandi, and Niine that offer compostable solutions. In terms of urban and semi-urban regions, consumers are increasingly preferring health and environmental impact. The trend of this kind is consistent with global sustainability goals and is an emerging trend among socially responsible buyers.

For instance, on May 31, 2023, Niine Sanitary Napkins, a leading provider of premium and affordable hygiene solutions in India, introduced the country's first PLA-based biodegradable sanitary pads. These pads are CIPET-certified, with more than 90% of the pads decomposing within 175 days and the rest within a year. The entire packaging, including the outer cover and disposable bags, is biodegradable.

Sanitary Napkin Industry Segmentation

This section provides an analysis of the key trends in each segment of the India Sanitary Napkin market report, along with forecasts at the regional and state levels for 2025-2033.

The disposable menstrual pads market held the dominant share of the Sanitary Napkin Market in 2024.

Based on the product type, the market is segmented into disposable menstrual pads, cloth menstrual pads, and biodegradable menstrual pads. Among these, the disposable menstrual pads market held the dominant share of the market in 2024. The disposable menstrual pad continues to rule strong because of well-established brand recognition, affordable pricing, and powerful retail distribution networks. The convenience and appeal of being hygienic match consumer preferences, especially for first-time users and the rural population. Following that, government subsidy schemes and school distribution programs also propel volume growth across India. On May 28, 2025, at IIT Bhubaneswar, the event Menstrual Health & Hygiene 2025 Conclave, Project CARE (Campus Action for Reusable Essentials), an initiative to promote the use of reusable menstrual products among school and college-going girls, was launched on the occasion with the distribution of eco-friendly reusable menstrual pads to women from underserved communities. Smt. Parida also unveiled two Sanitary Napkin Vending Machines donated by Canara Bank, symbolizing a step forward in menstrual accessibility on campuses and public institutions.

The online segment is expected to grow with a significant CAGR during the forecast period (2025-2033) of the Sanitary Napkin Market.

Based on the distribution channel, the market is segmented into supermarkets and hypermarkets, pharmacies & drugstores, convenience stores, online, specialty stores, and others. Among these, the online segment is expected to grow with a significant CAGR during the forecast period (2025-2033). An online segment is growing fast as consumers look for more discreet, convenient, and customizable menstrual care solutions. D2C Brands such as Nua and Plush target urban millennials and Gen Z audiences by taking advantage of social media. Moreover, user retention fueled through steady digital adoption is backed up by subscription services and doorstep delivery services.

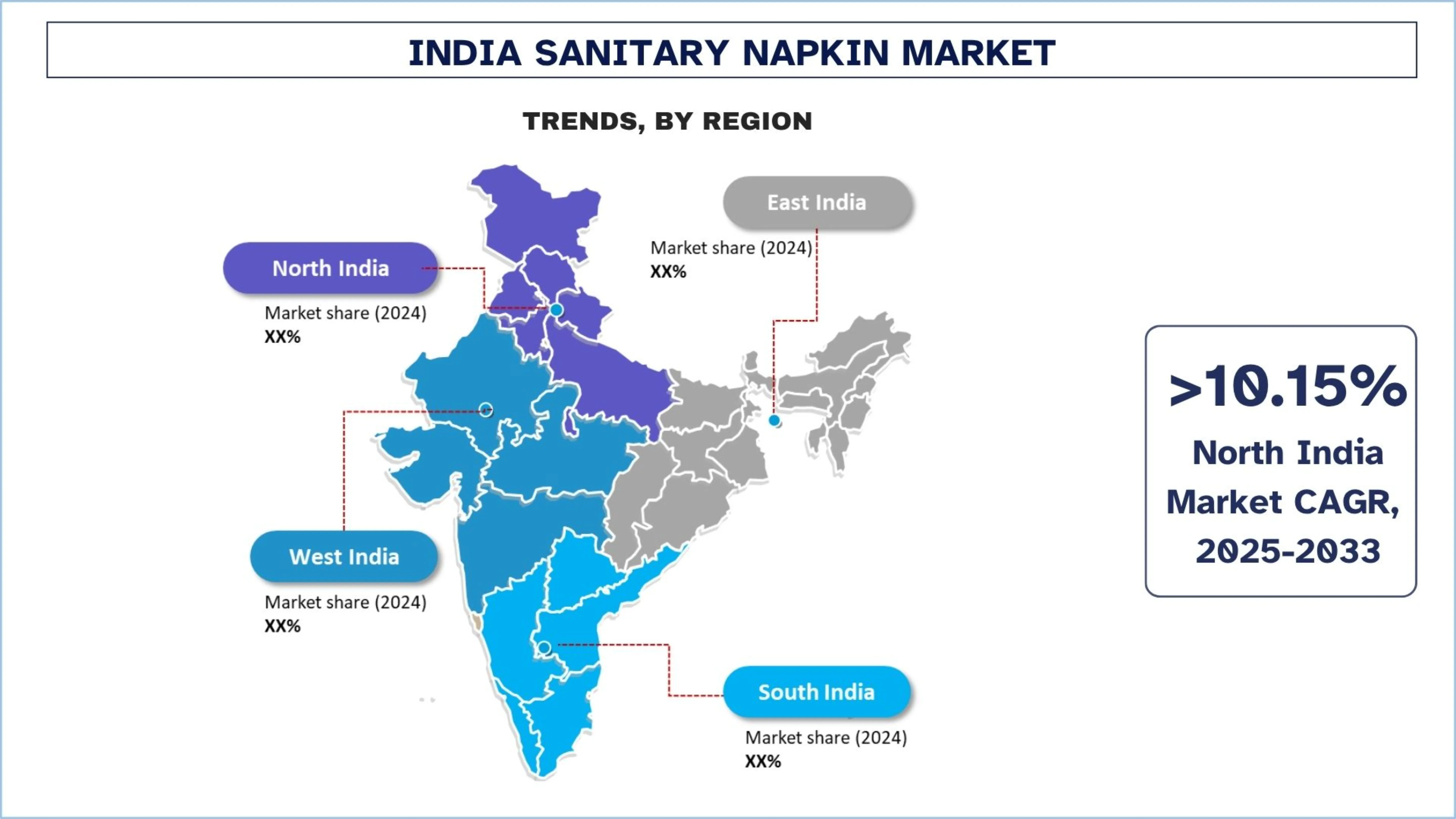

North India leads the Sanitary Napkin Market in 2024.

The sanitary napkin market is dominated by North India, and this dominance can be owed to large population density, urbanization, and active government support to menstrual hygiene programs in the region. In addition, free or subsidized pads are being distributed through schools and Anganwadi centers, in places like Uttar Pradesh, Delhi, and Punjab. Further, the region has a higher penetration of retail with pharmacies, kirana stores, and local medical outlets. Moreover, rural and semi-urban market expansion is a big preoccupation for brand leaders like Whisper and Stayfree, and this region is heavily tapped into to build market presence. Furthermore, the adoption is consistently driven by awareness campaigns, increasing affordability across the low and middle-income groups.

For instance, in September 2024, the state of Uttar Pradesh distributed sanitary pads to girls in government schools, hoping to improve their attendance by assigning INR 300 to each girl in classes 6 to 8. A sum of INR 110.316 lakh (1.103 crore) has been released for 36,772 girls studying in 535 upper primary and composite schools covered under the PM Shri scheme selected in 2024-25.

Sanitary Napkin Industry Competitive Landscape

The India Sanitary Napkin market is competitive, with several global and international market players. The key players are adopting different growth strategies to enhance their market presence, such as partnerships, agreements, collaborations, new product launches, geographical expansions, and mergers and acquisitions.

Top India Sanitary Napkin Companies

Some of the major players in the market are Procter & Gamble (Whisper), Kenvue (Stayfree), Unicharm Corporation (SOFY), Saathi Eco Innovations India Pvt Ltd., M/s Niine Private Limited, Soothe Healthcare, Lagom Labs Private Limited (Nua), Aakar Innovations Pvt Ltd (Anandi), Urban Essentials India Private limited (Plush), Bella Premier Happy Hygiene Care Pvt. Ltd (Bella) (TZMO SA Group).

Recent Developments in the India Sanitary Napkin Market

On May 28, 2025, this Menstrual Hygiene Day, femcare brand Plush has teamed up with quick commerce platform Blinkit for a provocative offline-first campaign that goes beyond product delivery to spark cultural change. Together, they are delivering not just pads, but a wake-up call, redefining how menstruation is perceived and prioritized in Indian homes.

On December 8, 2023, as per the Minister of State for Chemicals and Fertilizers, under Pradhan Mantri Bhartiya Janaushadhi Pariyojana (PMBJP), the Government launched Jan Aushadhi Suvidha Sanitary Napkins at Rs. 1/- per pad for women to ensure easy availability of the menstrual health services at affordable prices. These pads are being sold through more than 10000 Jan Aushadhi kendras, opened across the country. Since inception till 30th November 2023, over 47.87 crore Jan Aushadhi Suvidha Sanitary Pads have been sold at Jan Aushadhi Kendras.

In May 2023, the State Government announced the installation of sanitary napkin vending machines in all schools across Kerala, reaffirming that menstrual hygiene is a fundamental right for girls. This project aims to break taboos, foster health, and empower the girls to soar with confidence!

India Sanitary Napkin Market Report Coverage

Report Attribute | Details |

Base year | 2024 |

Forecast period | 2025-2033 |

Growth momentum | Accelerate at a CAGR of 10.45% |

Market size 2024 | USD ~858.45 million |

Regional analysis | North India, South India, East India, and West India |

Major contributing region | South India is expected to grow at the highest CAGR during the forecasted period. |

Companies profiled | Procter & Gamble (Whisper), Kenvue (Stayfree), Unicharm Corporation (SOFY), Saathi Eco Innovations India Pvt Ltd., M/s Niine Private Limited, Soothe Healthcare, Lagom Labs Private Limited (Nua), Aakar Innovations Pvt Ltd (Anandi), Urban Essentials India Private Limited (Plush), Bella Premier Happy Hygiene Care Pvt. Ltd (Bella) (TZMO SA Group). |

Report Scope | Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Demand and Supply Side Analysis; Competitive Landscape; Company Profiling |

Segments Covered | By Product Type, By Distribution Channel, By Region/Country |

Reasons to Buy the India Sanitary Napkin Market Report:

The study includes market sizing and forecasting analysis confirmed by authenticated key industry experts.

The report briefly reviews overall industry performance at a glance.

The report covers an in-depth analysis of prominent industry peers, primarily focusing on key business financials, type portfolios, expansion strategies, and recent developments.

Detailed examination of drivers, restraints, key trends, and opportunities prevailing in the industry.

The study comprehensively covers the market across different segments.

Deep dive regional level analysis of the industry.

Customization Options:

The India Sanitary Napkin market can further be customized as per the requirements or any other market segment. Besides this, UnivDatos understands that you may have your own business needs; hence, feel free to contact us to get a report that completely suits your requirements.

Table of Content

Research Methodology for the India Sanitary Napkin Market Analysis (2023-2033)

We analyzed the historical market, estimated the current market, and forecasted the future market of the India Sanitary Napkin market to assess its application in major regions in India. We conducted exhaustive secondary research to gather historical market data and estimate the current market size. To validate these insights, we carefully reviewed numerous findings and assumptions. Additionally, we conducted in-depth primary interviews with industry experts across the Sanitary Napkin value chain. After validating market figures through these interviews, we used both top-down and bottom-up approaches to forecast the overall market size. We then employed market breakdown and data triangulation methods to estimate and analyze the market size of industry segments and sub-segments.

Market Engineering

We employed the data triangulation technique to finalize the overall market estimation and derive precise statistical numbers for each segment and sub-segment of the India-Sanitary Napkin market. We split the data into several segments and sub-segments by analyzing various parameters and trends, including Product type, distribution channel, and regions within the India Sanitary Napkin market.

The Main Objective of the India Sanitary Napkin Market Study

The study identifies current and future trends in the India Sanitary Napkin market, providing strategic insights for investors. It highlights regional market attractiveness, enabling industry participants to tap into untapped markets and gain a first-mover advantage. Other quantitative goals of the studies include:

Market Size Analysis: Assess the current market size and forecast the market size of the India Sanitary Napkin market and its segments in terms of value (USD).

Sanitary Napkin Market Segmentation: Segments in the study include areas of product type, distribution channel, and regions.

Regulatory Framework & Value Chain Analysis: Examine the regulatory framework, value chain, customer behavior, and competitive landscape of the Sanitary Napkin industry.

Regional Analysis: Conduct a detailed regional analysis for key areas such as North India, South India, East India, and West India.

Company Profiles & Growth Strategies: Company profiles of the Sanitary Napkin market and the growth strategies adopted by the market players to sustain in the fast-growing market.

Frequently Asked Questions FAQs

Q1: What is the India Sanitary Napkin market’s current market size and growth potential?

The India Sanitary Napkin market was valued at USD ~858.45 million in 2024 and is expected to grow at a CAGR of 10.45% during the forecast period (2025-2033). This robust growth is fueled by rising menstrual health awareness, increasing government support, and expanding retail and e-commerce penetration, especially in rural and semi-urban areas.

Q2: Which segment has the largest share of the India Sanitary Napkin market by product type?

The disposable menstrual pads segment currently holds the largest market share, driven by their affordability, ease of availability, and strong consumer preference for convenience and hygiene. Government-backed initiatives and school-based distributions further reinforce their widespread adoption across India.

Q3: What are the driving factors for the growth of the India Sanitary Napkin market?

Key growth drivers include government subsidy programs, growing female literacy, increased awareness about menstrual hygiene, rising urbanization, and the expansion of both retail and digital sales channels. Corporate CSR and NGO-led distribution programs also play a crucial role in market penetration.

Q4: What are the emerging technologies and trends in the India Sanitary Napkin market?

Notable trends include the rise of biodegradable and reusable pads, direct-to-consumer (D2C) subscription models, and tech-enabled awareness campaigns through social media. Consumers are also showing increased interest in organic materials and eco-friendly packaging solutions.

Q5: What are the key challenges in the India Sanitary Napkin market?

Major challenges include cultural stigma around menstruation, limited affordability among rural populations, inadequate disposal infrastructure, and low awareness of sustainable alternatives. Logistics barriers in remote areas also hinder last-mile distribution.

Q6: Which region dominates the India Sanitary Napkin market?

North India holds the dominant share of the market, supported by a high population base, state-sponsored health programs, and better retail accessibility. States like Uttar Pradesh and Delhi actively support menstrual health initiatives, boosting regional growth.

Q7: Who are the key players in the India Sanitary Napkin market?

Some of the leading companies in the India Sanitary Napkin Industry include:

• Procter & Gamble (Whisper)

• Kenvue (Stayfree)

• Unicharm Corporation (SOFY)

• Saathi Eco Innovations India Pvt Ltd.

• M/s Niine Private Limited

• Soothe Healthcare

• Lagom Labs Private Limited (Nua)

• Aakar Innovations Pvt Ltd (Anandi)

• Urban Essentials India Private Limited (Plush)

• Bella Premier Happy Hygiene Care Pvt. Ltd (Bella) (TZMO SA Group)

Q8: What are the key investment opportunities in the India Sanitary Napkin industry?

High-potential investment areas include rural outreach programs, localized biodegradable pad production, private label expansion, and D2C digital platforms. Investors can also explore partnerships with healthcare NGOs and government programs to scale distribution.

Q9: Which companies are leading the India Sanitary Napkin market, and what strategies are they using?

Key players include Procter & Gamble (Whisper), JNTL Consumer Health (Stayfree), Unicharm (Sofy), and startups like Saathi and Nua. Their strategies focus on rural penetration, product innovation, sustainability, and leveraging e-commerce and influencer marketing to enhance visibility.

Related Reports

Customers who bought this item also bought