- Home

- About Us

- Industry

- Services

- Reading

- Contact Us

Saudi Arabia Fuel Station Market: Current Analysis and Forecast (2025-2033)

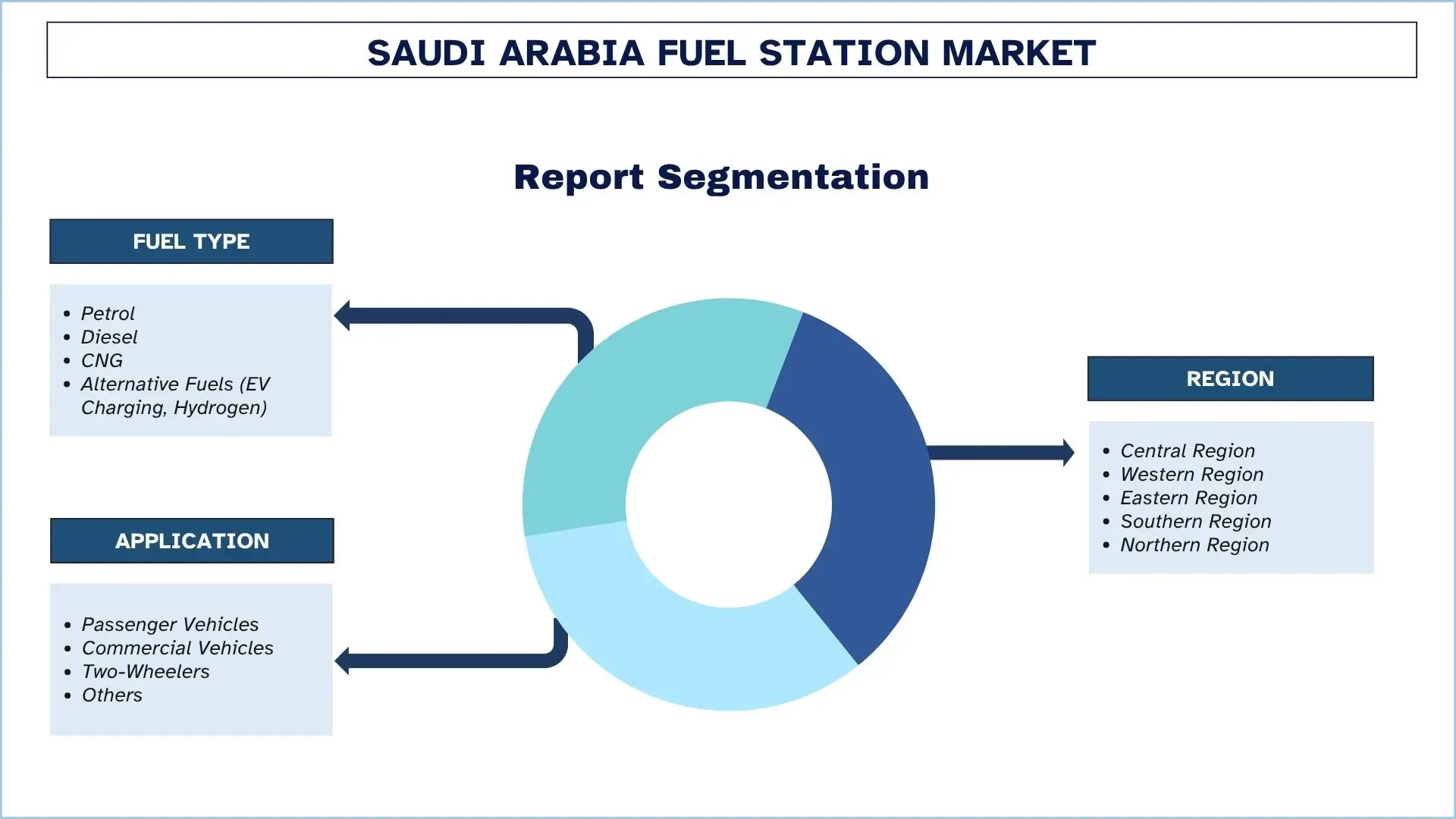

Emphasis on Fuel Type (Petrol, Diesel, CNG, Alternative Fuels (EV Charging, Hydrogen)); Application (Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Others); and Region.

Saudi Arabia Fuel Station Market Size & Forecast

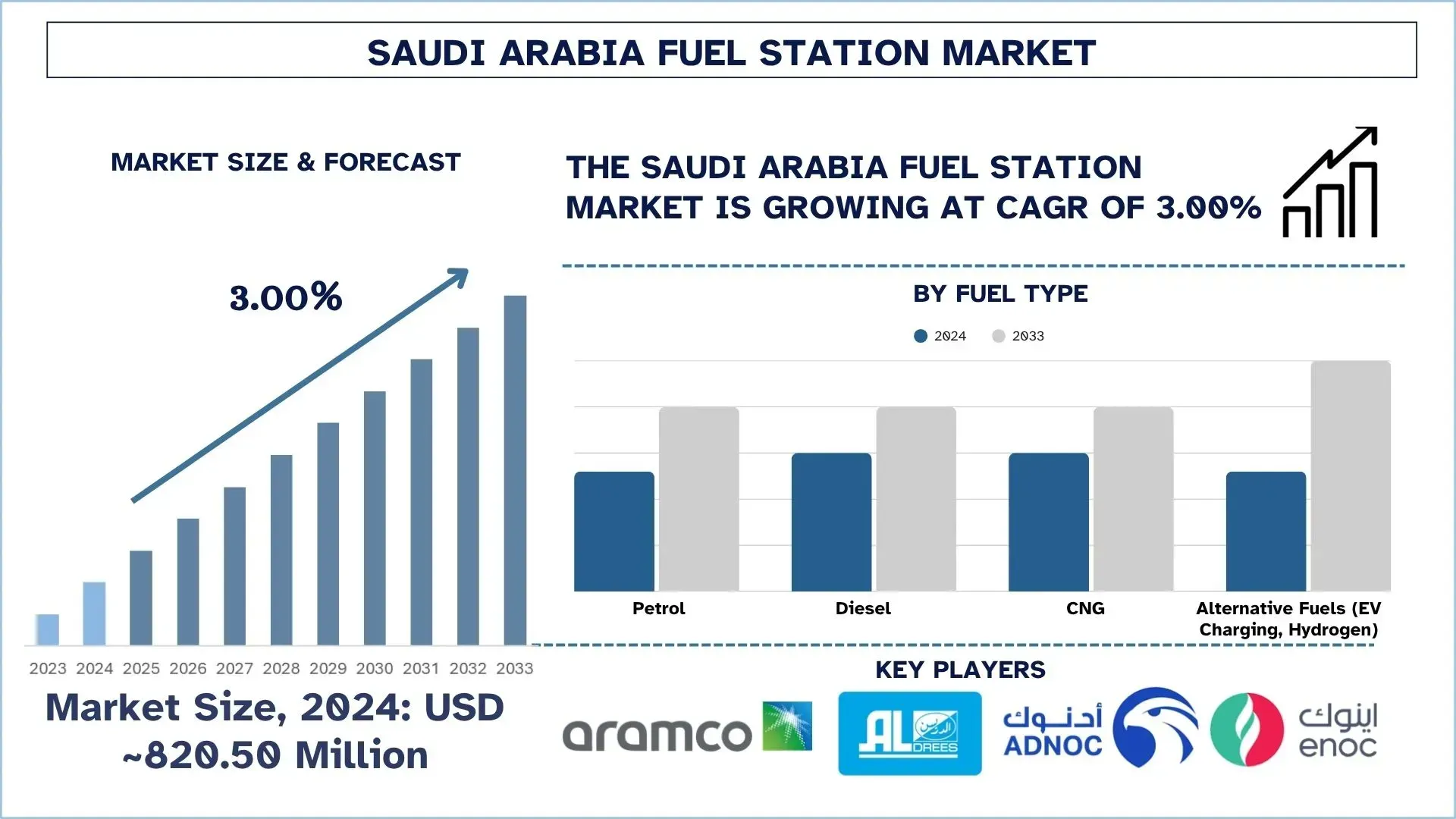

The Saudi Arabia Fuel Station market was valued at USD 820.50 million in 2024 and is expected to grow at a strong CAGR of around 3.00% during the forecast period (2025-2033F), driven by increasing vehicle ownership and rising road transport demand in Saudi Arabia.

Saudi Arabia Fuel Station Market Analysis

A fuel station refers to a sales outlet where communities recharge their cars with gasoline, diesel, CNG, or other forms of energy, such as EV charging. Many gasoline stations traditionally oriented to dispensing fuel have diversified into other activities, such as convenience retailing, food services, and vehicle care.

To drive the fuel station market in Saudi Arabia, companies are expanding their networks, digitalizing, and integrating alternative fuels. Also, major competitors, such as Saudi Aramco, Aldrees, and Petromin, are renovating their stations to include EV charging points, automated payment systems, and improved convenience stores, aiming to increase their customer base. Moreover, the rise of strategic alliances with food brands, the deployment of innovative fueling-related technologies, and investments in renewable energy-supplied stations are driving the market. These projects align with Vision 2030, which focuses on diversification and sustainability in the areas of energy and retail.

For example, on July 16, 2025, EVIQ announced the opening of a new EV charging station in partnership with Petromin, one of the Kingdom’s most trusted fuel, mobility, and e-mobility services providers, marking a significant step forward in the growth of EV infrastructure across Saudi Arabia.

Saudi Arabia Fuel Station Market Trends

This section discusses the key market trends that are influencing the various segments of the Saudi Arabia Fuel Station market, as found by our team of research experts.

Shift Toward Alternative Fuels

The trend of alternative fuel, including EV charging and hydrogen, is significant in the Saudi fuel station market. As Vision 2030 drives toward the use of clean energy, fuel stations are transforming to multi-energy fuel stations, which will fuel electric and hydrogen-powered vehicles. Also, companies are investing in EV charging points and researching hydrogen as a way to meet the demand in the future. Moreover, this shift towards sustainability goals creates a long-term market expansion of the alternative fuel market. For example, on November 15, 2023, Air Products Qudra and Saudi Arabia Railways (SAR) announced the signing of a Memorandum of Understanding (MoU) to collaborate on opportunities to build, own, and operate (BOO) hydrogen fueling stations for trains in the Kingdom of Saudi Arabia.

Saudi Arabia Fuel Station Industry Segmentation

This section provides an analysis of the key trends in each segment of the Saudi Arabia Fuel Station market report, along with forecasts at the regional and provincial levels for 2025-2033.

The alternative fuels (such as EV charging and hydrogen) are expected to grow with the highest CAGR during the forecast period (2025-2033F).

Based on fuel type, the market is segmented into petrol, diesel, CNG, and alternative fuels (EV charging, hydrogen). Among these, alternative fuels (such as EV charging and hydrogen) are expected to grow with the highest CAGR during the forecast period (2025-2033F). The use of alternative fuel, such as EV charging and hydrogen, is such that fuel stations are becoming multi-energy facilities. As Vision 2030 focuses on sustainability and clean energy, charging points and hydrogen refueling systems are being integrated into companies to meet the changing demand. The diversification generates additional income and secures the business against the eventual reduction of gasoline reliance. For instance, on January 17, 2025, Saudi Arabia's ENOWA, in collaboration with Hydrogen Refueling Solutions (HRS), successfully launched the nation's first heavy-duty hydrogen refueling station at Petromin Corporation.

The passenger vehicles segment dominates the market in 2024.

Based on application, the Saudi Arabia fuel station market is segmented into passenger vehicles, commercial vehicles, two-wheelers, and others. Among them, the passenger vehicles segment dominates the market in 2024. The increasing number of passenger cars in Saudi Arabia has sustained the demand for fuel, and this segment forms the backbone of the fuel station market. According to the CEIC Data, Saudi Arabia's motor vehicle sales for passenger cars were reported at 645,723.000 Units in December 2023. The need for easy access to fueling places increases due to rising levels of car ownership, urbanization, and the development of road infrastructure. This is the trend that compels companies to enhance their station networks and integrate value-added services to capture individual vehicle owners.

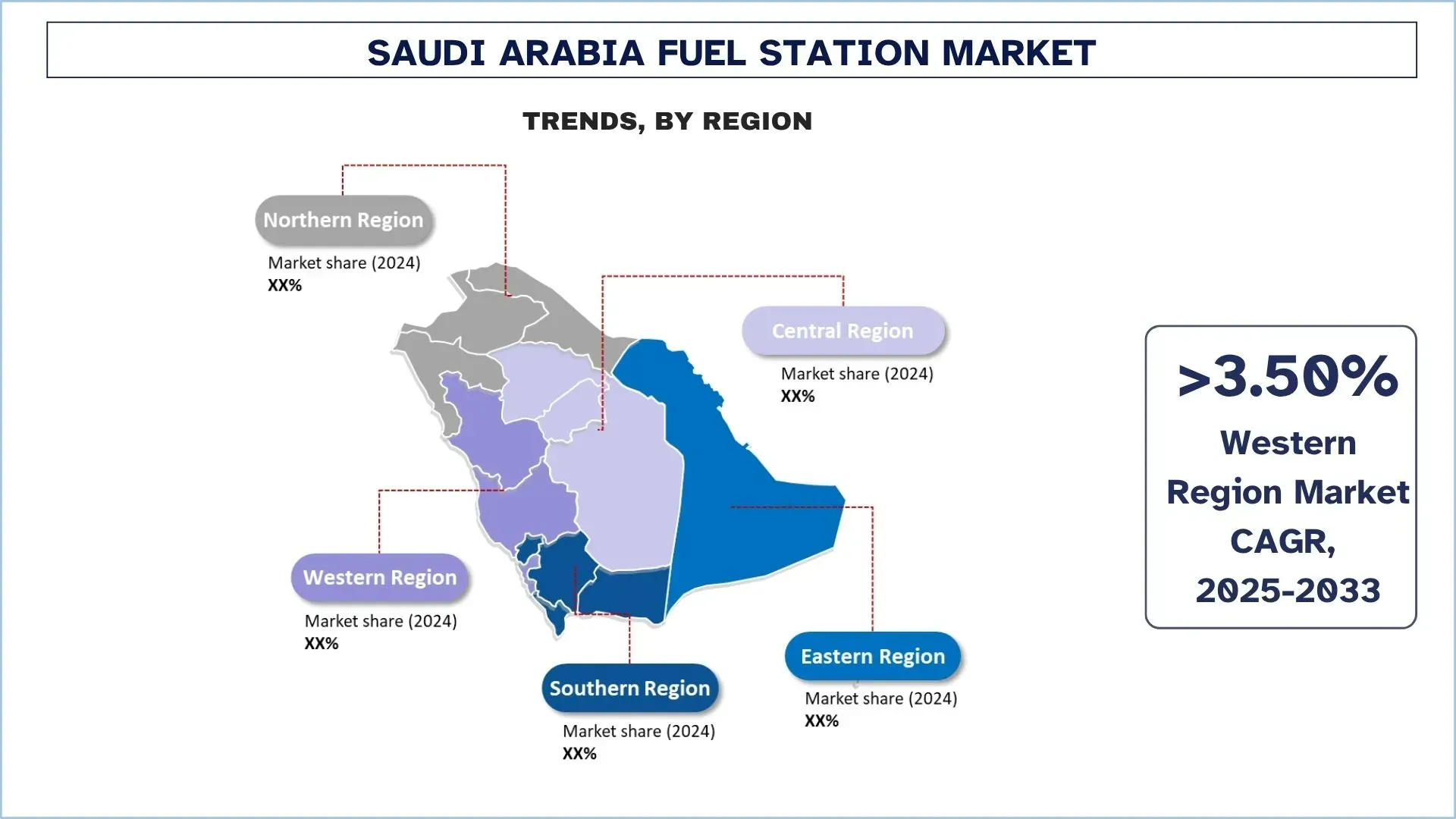

Western Region is expected to grow in the market during the forecast period (2025-2033)

Western Region (comprising Makkah, Madinah, and Jeddah) has a high fuel demand occasioned by tourism and religious pilgrimage. During Hajj and Umrah, traffic peaks with millions of tourists, providing an opportunity for increased fuel sales and service expansion. According to data from the Saudi Arabia Ministry of Tourism, in 2024, the number of Tourists was approximately 86.16 million, including around 0.22 million Hajj tourists and approximately 4.32 million Ziarah Madinah pilgrims. To ensure effective and efficient meeting of the local and tourist demand, companies are enhancing their infrastructure, customer service, and provision of alternative forms of fueling that drive the growth of the market.

On March 23, 2023, Saudi Automotive Services Co. (SASCO) unveiled a 30,000-square-meter station on the Makkah-Taif road. The fuel station includes a convenience store, several branded restaurants, coffee shops, and ATMs. The total investment of the station stands at nearly SAR 12.4 million (~USD 3.31 million), financed through banking facilities from local banks.

Saudi Arabia Fuel Station Industry Competitive Landscape

The Saudi Arabia Fuel Station market is competitive, with several global and international market players. The key players are adopting different growth strategies to enhance their market presence, such as partnerships, agreements, collaborations, new product launches, geographical expansions, and mergers and acquisitions.

Top Saudi Arabia Fuel Station Companies

Some of the major players in the market are Saudi Arabian Oil Company (“Aramco” or “Saudi Aramco”), ALDREES, Abu Dhabi National Oil Company for Distribution PJSC (ADNOC), Emirates National Oil Company, TotalEnergies, NAFT Services Company Limited, Wafi Energy Company LLC (Shell brand) (Asyad Holding Group), Oman Oil Marketing Company SAOG (OOMCO), Petromin Corporation, Tas’helat Marketing Company.

Recent Developments in the Saudi Arabia Fuel Station Market

- On 08 July 2025, Blacklane, the global chauffeur service, and EVIQ, Saudi Arabia’s leading electric vehicle (EV) infrastructure provider, signed a strategic agreement to supercharge the roll-out of electric vehicles across the Kingdom. Under the partnership, the two companies will expand Saudi Arabia’s EV charging network throughout major cities and mobility hubs. Together, they will strategically define priority locations for new charging stations and establish dedicated fleet-charging hubs, including one at Blacklane’s new Gulf regional headquarters in Riyadh.

- On January 21, 2024, Saudi Automotive Services Co. (SASCO) announced that it will inaugurate Saudi Arabia’s largest fuel station in the second quarter of 2024. The station is part of SASCO Al-Jazeera 1 project, located along King Fahd Road, serving as a link between Riyadh and Al-Qassim Province. The Al-Jazeera 1 station covers an area of 280,000 square meters and is situated in the central island along the highway connecting Al-Qassim and Riyadh.

Saudi Arabia Fuel Station Market Report Coverage

Details | |

Base year | 2024 |

Forecast period | 2025-2033 |

Growth momentum | Accelerate at a CAGR of 3.00% |

Market size 2024 | USD 820.50 Million |

Regional analysis | Central Region, Western Region, Eastern Region, Southern Region, Northern Region |

Major contributing region | The Western Region is expected to grow at the highest CAGR during the forecasted period. |

Companies profiled | Saudi Arabian Oil Company (“Aramco” or “Saudi Aramco”), ALDREES, Abu Dhabi National Oil Company for Distribution PJSC (ADNOC, Emirates National Oil Company, TotalEnergies, NAFT Services Company Limited, Wafi Energy Company LLC (Shell brand) (Asyad Holding Group), Oman Oil Marketing Company SAOG (OOMCO), Petromin Corporation, Tas’helat Marketing Company. |

Report Scope | Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Demand and Supply Side Analysis; Competitive Landscape; Company Profiling |

Segments Covered | By Fuel Type, By Application, and By Region |

Reasons to Buy the Saudi Arabia Fuel Station Market Report:

- The study includes market sizing and forecasting analysis confirmed by authenticated key industry experts.

- The report briefly reviews overall industry performance at a glance.

- The report covers an in-depth analysis of prominent industry peers, primarily focusing on key business financials, type portfolios, expansion strategies, and recent developments.

- Detailed examination of drivers, restraints, key trends, and opportunities prevailing in the industry.

- The study comprehensively covers the market across different segments.

Customization Options:

The Saudi Arabia Fuel Station market can further be customized as per requirements or any other market segment. Besides this, UnivDatos understands that you may have your own business needs; hence, feel free to contact us to get a report that completely suits your requirements.

Table of Content

Research Methodology for the Saudi Arabia Fuel Station Market Analysis (2023-2033)

We analyzed the historical market, estimated the current market, and forecasted the future market of the Saudi Arabia Fuel Station market to assess its application. We conducted exhaustive secondary research to gather historical market data and estimate the current market size. To validate these insights, we carefully reviewed numerous findings and assumptions. Additionally, we conducted in-depth primary interviews with industry experts across the Saudi Arabia Fuel Station value chain. After validating market figures through these interviews, we used both top-down and bottom-up approaches to forecast the overall market size. We then employed market breakdown and data triangulation methods to estimate and analyze the market size of industry segments and sub-segments.

Market Engineering

We employed the data triangulation technique to finalize the overall market estimation and derive precise statistical numbers for each segment and sub-segment of the Saudi Arabia Fuel Station market. We split the data into several segments and sub-segments by analyzing various parameters and trends, including fuel type, application, and regions within the Saudi Arabia Fuel Station market.

The Main Objective of the Saudi Arabia Fuel Station Market Study

The study identifies current and future trends in the Saudi Arabia Fuel Station market, providing strategic insights for investors. It highlights market attractiveness, enabling industry participants to tap into untapped markets and gain a first-mover advantage. Other quantitative goals of the studies include:

Market Size Analysis: Assess the current and forecast market size of the Saudi Arabia Fuel Station market and its segments in terms of value (USD).

Saudi Arabia Fuel Station Market Segmentation: Segments in the study include areas of fuel type, application, and region.

Regulatory Framework & Value Chain Analysis: Examine the regulatory framework, value chain, customer behavior, and competitive landscape of the Saudi Arabia Fuel Station industry.

Regional Analysis: Conduct a detailed regional analysis for key areas such as the Central Region, Western Region, Eastern Region, Southern Region, and Northern Region.

Company Profiles & Growth Strategies: Company profiles of the Saudi Arabia Fuel Station market and the growth strategies adopted by the market players to sustain in the fast-growing market.

Frequently Asked Questions FAQs

Q1: What is the Saudi Arabia Fuel Station market’s current market size and growth potential?

The Saudi Arabia Fuel Station market was valued at USD 820.50 million in 2024 and is projected to grow at a CAGR of 3.00% from 2025 to 2033, driven by increasing vehicle ownership, urbanization, and infrastructure development under Vision 2030 initiatives.

Q2: Which segment has the largest share of the Saudi Arabia Fuel Station market by fuel type?

Petrol dominates the market share due to the high number of passenger vehicles and steady demand for conventional fuel, though alternative fuels like EV charging and hydrogen are gaining traction as part of the country’s sustainability goals.

Q3: What are the driving factors for the growth of the Saudi Arabia Fuel Station market?

Key drivers include government investment in transportation infrastructure, growing vehicle ownership, rapid urbanization, and the integration of convenience retail services at fuel stations. Additionally, Vision 2030’s focus on private sector participation is attracting new players to the market.

Q4: What are the emerging technologies and trends in the Saudi Arabia Fuel Station market?

Major trends include the integration of EV charging stations, hydrogen fueling options, smart fuel management systems, and AI-powered automation for pricing and payment. Sustainability initiatives, such as solar-powered fuel stations, and premium customer services like car wash and maintenance, are also rising.

Q5: What are the key challenges in the Saudi Arabia Fuel Station market?

Key challenges include high capital investment for modern stations, regulatory compliance, competition from electric vehicle adoption, and difficulty in acquiring prime urban locations. Additionally, operational costs for advanced technologies and staffing remain a concern for investors.

Q6: Which region dominates the Saudi Arabia Fuel Station market?

The Central Region dominates the market due to the presence of Riyadh, Saudi Arabia’s capital, and its strategic role as a hub for business, transportation, and logistics. High traffic density and infrastructure development make this region the largest contributor to fuel station revenue.

Q7: Who are the key players in the Saudi Arabia Fuel Station market?

Leading companies in the Saudi Arabia Fuel Station market include:

• Saudi Arabian Oil Company (“Aramco” or “Saudi Aramco”)

• ALDREES

• Abu Dhabi National Oil Company for Distribution PJSC (ADNOC)

• Emirates National Oil Company

• TotalEnergies

• NAFT Services Company Limited

• Wafi Energy Company LLC (Shell brand) (Asyad Holding Group)

• Oman Oil Marketing Company SAOG (OOMCO)

• Petromin Corporation

• Tas’helat Marketing Company

Q8: What investment opportunities exist in the Saudi Arabia Fuel Station market?

Investors can explore opportunities in EV charging infrastructure, hydrogen fueling stations, non-fuel retail services (cafes, mini-marts), and digital payment solutions. Partnerships with global energy and retail brands offer strong potential for high ROI as the market transitions toward a sustainable future.

Q9: How is Vision 2030 impacting the Saudi Arabia Fuel Station market?

Vision 2030 is transforming the fuel station landscape by liberalizing the energy retail sector, promoting alternative fuel infrastructure, and encouraging private sector investment. The initiative is driving modernization, creating opportunities for digital transformation, smart stations, and green energy adoption.

Related Reports

Customers who bought this item also bought