印度电动汽车市场规模与预测

2024年,印度电动汽车市场估值为 48 亿美元,预计在预测期内(2025-2033 年)将以约 40.34% 的强劲复合年增长率增长,这归因于城市化进程加快、可负担性提高、可支配收入增加以及向电动出行的转变。

印度电动汽车市场分析

在政府举措和油价上涨的推动下,印度电动汽车行业正在加速发展。然而,从内燃机汽车 (ICE) 大规模转向电动汽车需要扩大基础设施,包括充电站和能够提供更长续航里程的车辆(单次充电的公里数)。此外,印度政府为支持国内电动汽车的制造和普及而采取的多项举措应有助于实现印度品牌资产基金会 (IBEF) 提出的到 2030 年 100% 普及电动汽车的目标。这些举措包括电池更换政策。2022 年 4 月 22 日,印度国家转型委员会 (NITI Aayog) 发布了一项电池更换政策草案,有效期至 2025 年 3 月 31 日。该政策将从实施之日起实施一到两年,并将覆盖所有人口超过 400 万的大城市。第二阶段将从该政策的启动之日起运行两到三年,并将覆盖所有联邦属地 (UT) 和人口超过 50 万的主要城市。

印度电动汽车市场趋势

本节讨论了我们的研究专家团队确定的、影响印度电动汽车市场各个细分市场的关键市场趋势。

日益关注国内电动汽车制造和本地化供应链

印度电动汽车市场的主要趋势是在本地供应链网络的支持下,国内制造业部门不断发展壮大。印度和全球电动汽车公司通过政府激励计划(包括生产关联激励 (PLI) 计划和 FAME II)以及进口关税优势,建立装配厂、电池生产厂和零部件制造部门。在印度国内进行的制造和供应链活动降低了电动汽车的进口依赖性和生产成本,从而降低了主流市场的价格。通过支持创新和就业机会,印度正成为发展成为电动汽车制造中心的先锋。

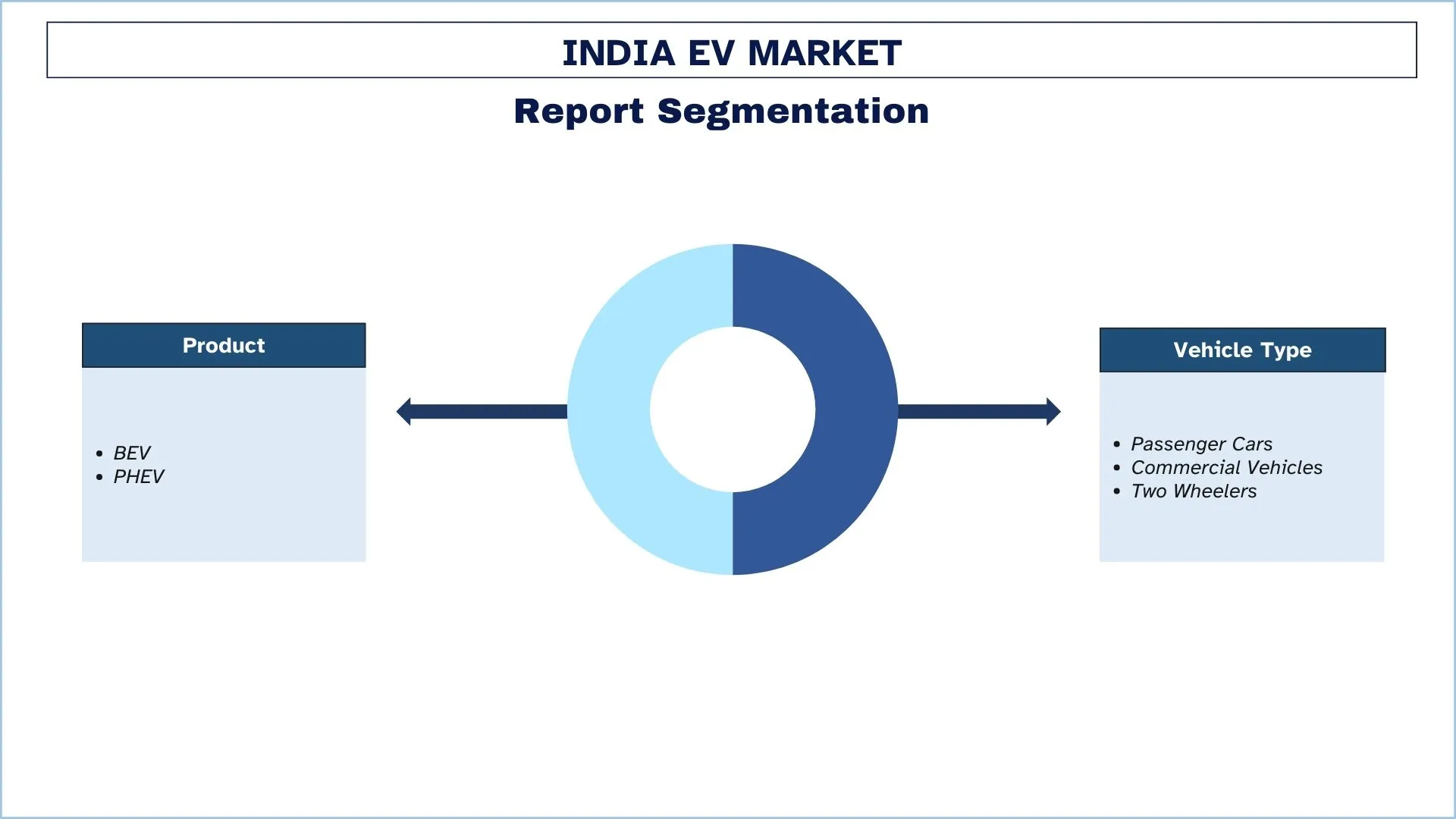

印度电动汽车行业细分

本节分析了印度电动汽车市场报告每个细分市场的关键趋势,并提供了 2025-2033 年区域层面的预测。

BEV 市场占据印度电动汽车市场的最大份额。

根据产品,市场分为 BEV 和 PHEV。2024 年,BEV 细分市场占据了印度电动汽车市场的主导份额。该细分市场占据主导市场份额的原因可归因于消费者越来越偏爱电动汽车而不是内燃机 (ICE) 汽车以及车辆二氧化碳排放法规。BEV 有潜力大幅降低车辆排放以及长期拥有成本。预计在预测期内,电池技术的改进和锂离子电池价格的下降也将推动对 BEV 的需求。

商用电动汽车市场占据印度电动汽车市场的最大份额。

根据车辆类型,市场分为乘用车、商用车和两轮车。商用车辆包括电动巴士、三轮车和电动汽车,该细分市场在 2024 年占据了相当大的市场份额。该细分市场的扩张归功于该国正在进行的电动轻型商用车和电动巴士的部署。由于政府正在积极制定增加道路上电动汽车数量的计划,以最大限度地减少该国主要城市的车辆污染,电动巴士已经越来越受欢迎。由于塔塔汽车、马恒达有限公司和 Olectra Greentech Limited 等公司的存在,电动轻型商用车和电动巴士已经在该国市场上销售。

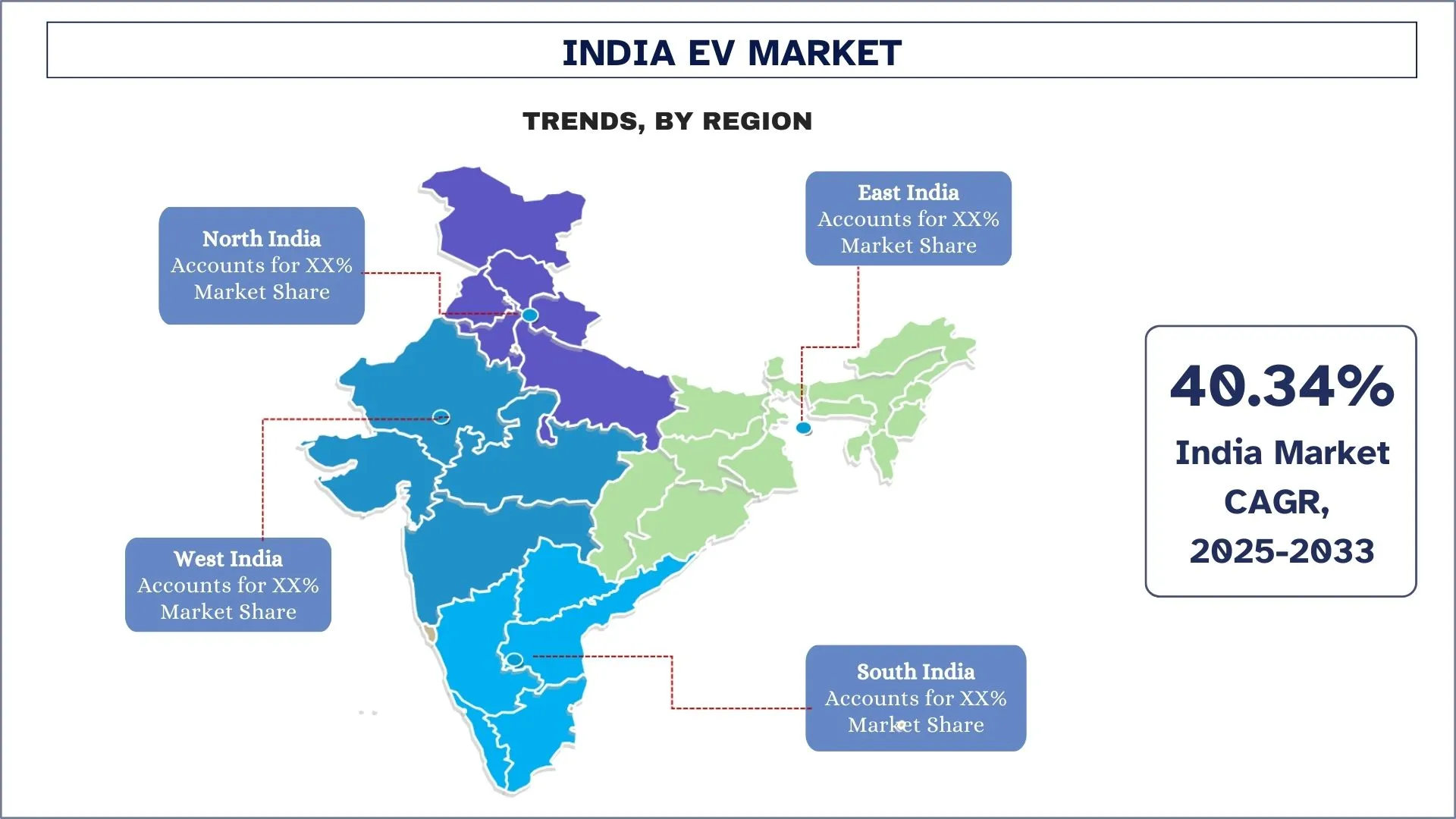

印度北部引领市场

印度北部电动汽车市场的增长得益于政府激励措施和政策,这些措施使电动汽车更经济实惠,城市污染日益严重,推动了对更清洁交通工具的需求,以及燃油价格上涨,凸显了电动汽车的成本效益。此外,充电网络和电池更换站等基础设施的完善,加上可支配收入的增加,进一步支持了市场的扩张。这些因素共同促进了印度北部电动汽车的普及,反映了向更可持续和更经济高效的交通解决方案的转变。

印度电动汽车行业概览

印度电动汽车市场竞争激烈且分散,存在多家国内市场参与者。主要参与者正在采取不同的增长战略来提高其市场占有率,例如合作伙伴关系、协议、合作、新产品发布、地域扩张以及并购。

印度顶级电动汽车公司

在该市场运营的主要参与者包括奥迪汽车股份公司(大众汽车集团)、宝马汽车公司、现代汽车公司、捷豹路虎汽车公司(塔塔汽车有限公司)、马恒达有限公司、梅赛德斯-奔驰集团股份公司、名爵汽车英国有限公司(上海汽车集团股份有限公司)、Olectra Greentech Limited (MEIL)、塔塔汽车有限公司和丰田汽车公司。

印度电动汽车市场近期发展

- 例如,2024 年,电动滑板车制造商 Ather Energy 推出了一款名为 Rizta 的全新系列滑板车,专注于家庭市场。

- 例如,本田全球公司已确认计划明年在印度推出一款相当于 110-125 cc 通勤车的电动摩托车。该公告是本田汽车公司新摩托车电气化战略的一部分,该战略将使制造商到 2030 年投资 34 亿美元用于新产品和开发。这家两轮车巨头还将 2030 年的全球销售目标从 350 万辆修正为 400 万辆电动摩托车。

印度电动汽车市场报告覆盖范围

报告属性 | 详情 |

基准年 | 2024 |

预测期 | 2025-2033 |

增长势头 | 以 40.34% 的复合年增长率加速增长 |

2024 年市场规模 | 48 亿美元 |

区域分析 | 印度北部、印度南部、印度东部和印度西部 |

主要贡献区域 | 预计印度北部将主导市场。 |

公司简介 | 奥迪汽车股份公司(大众汽车集团)、宝马汽车公司、现代汽车公司、捷豹路虎汽车公司(塔塔汽车有限公司)、马恒达有限公司、梅赛德斯-奔驰集团股份公司、名爵汽车英国有限公司(上海汽车集团股份有限公司)、Olectra Greentech Limited (MEIL)、塔塔汽车有限公司和丰田汽车公司 |

报告范围 | 市场趋势、驱动因素和限制因素;收入估算和预测;细分分析;需求和供应侧分析;竞争格局;公司简介 |

按产品、按车辆类型、按地区 |

购买印度电动汽车市场报告的理由:

- 该研究包括由经过验证的关键行业专家验证的市场规模和预测分析。

- 该报告一目了然地快速回顾了整体行业表现。

- 该报告涵盖了对杰出行业同行的深入分析,主要侧重于关键业务财务、产品组合、扩张战略和近期发展。

- 详细考察了行业中存在的驱动因素、制约因素、关键趋势和机遇。

- 该研究全面涵盖了不同细分市场的市场。

- 深入的行业区域层面分析。

定制选项:

印度电动汽车市场可以根据任何其他细分市场的要求进一步定制。除此之外,UnivDatos 明白您可能拥有自己的业务需求;因此,请随时与我们联系以获取完全满足您需求的报告。

目录

印度电动汽车市场分析 (2025-2033) 的研究方法

我们分析了印度电动汽车市场的历史市场、估计了当前市场,并预测了未来市场,以评估其在全球主要区域的应用。我们进行了详尽的二级研究,以收集历史市场数据并估计当前市场规模。为了验证这些见解,我们仔细审查了大量发现和假设。此外,我们还与印度电动汽车价值链中的行业专家进行了深入的一级访谈。通过这些访谈验证市场数据后,我们使用自上而下和自下而上的方法来预测整体市场规模。然后,我们采用市场细分和数据三角测量方法来估计和分析行业细分和子细分市场的规模。

市场工程

我们采用数据三角测量技术来最终确定整体市场估算,并为印度电动汽车市场的每个细分和子细分市场得出精确的统计数字。我们通过分析各种参数和趋势,包括产品、车辆类型以及印度电动汽车市场内的区域,将数据分成几个细分和子细分。

印度电动汽车市场研究的主要目标。

该研究确定了印度电动汽车市场的当前和未来趋势,为投资者提供战略见解。它突出了区域市场的吸引力,使行业参与者能够进入未开发的市场并获得先发优势。该研究的其他量化目标包括:

- 市场规模分析:评估印度电动汽车市场及其细分市场的当前和预测市场规模(按价值(美元)计)。

- 印度电动汽车市场细分:该研究按产品、车辆类型和地区对市场进行细分。

- 监管框架和价值链分析: 检查印度电动汽车行业的监管框架、价值链、客户行为和竞争格局。

- 区域分析:对亚太地区、欧洲、北美和世界其他地区等关键区域进行详细的区域分析。

公司简介和增长策略:印度电动汽车市场的公司简介以及市场领导者为维持快速增长的市场而采取的增长策略。

常见问题 常见问题

Q1: 印度电动汽车市场目前的市场规模和增长潜力是什么?

2024年印度电动汽车市场估值为480万美元,预计从2024年到2032年将以40.34%的复合年增长率增长。

Q2:印度电动汽车市场增长的驱动因素是什么?

通过激励措施、补贴(如FAME II)和推动清洁出行的监管,政府的大力支持正在推动电动汽车的快速扩张。

Q3:按产品划分,哪个细分市场在印度电动汽车市场中占有最大的份额?

按产品细分,BEV市场在印度电动汽车市场中占据最大的市场份额。

Q4:印度电动汽车市场的趋势是什么?

私人和公共部门加大对电动汽车充电基础设施的投资正在加速电动汽车用户的接受度和信心。

Q5:哪个地区将主导印度电动汽车市场?

预计印度北部将在印度电动汽车市场占据主导地位。

Q6:印度电动汽车市场面临的最大挑战是什么?

电池制造能力有限以及对进口原材料的依赖阻碍了成本效益和供应链弹性。

Q7:印度电动汽车市场的关键参与者有哪些?

引领印度电动汽车行业创新的领先公司包括:

• 奥迪股份公司(大众集团)

• 宝马集团

• 现代汽车公司

• 捷豹路虎汽车公司(塔塔汽车有限公司)

• 马恒达有限公司

• 梅赛德斯-奔驰集团股份公司

• MG MOTOR UK Limited(上海汽车集团股份有限公司)

• Olectra Greentech Limited (MEIL)

• 塔塔汽车有限公司

• 丰田汽车公司

Q8:印度电动汽车市场为原始设备制造商和技术供应商提供的关键投资机会有哪些?

主要的投资机会在于国内电动汽车制造、电池生产(在PLI计划下)、电动汽车充电基础设施以及车队和能源管理的软件平台。与政府倡议和本地伙伴关系的合作可以提供战略性的市场准入优势。

Q9:政府政策如何塑造印度电动汽车生态系统的未来?

像FAME II这样的政府政策、各州特定的电动汽车补贴和税收激励措施对于推动电动汽车的普及至关重要。将重点放在电池生产本地化、降低电动汽车的商品及服务税以及在城市中设立纯电动汽车区域,正在为长期增长构建一个支持性的生态系统。

相关 报告

购买此商品的客户也购买了