- Home

- About Us

- Industry

- Services

- Reading

- Contact Us

Indian Auto Components Market: Current Analysis and Forecast (2021-2027)

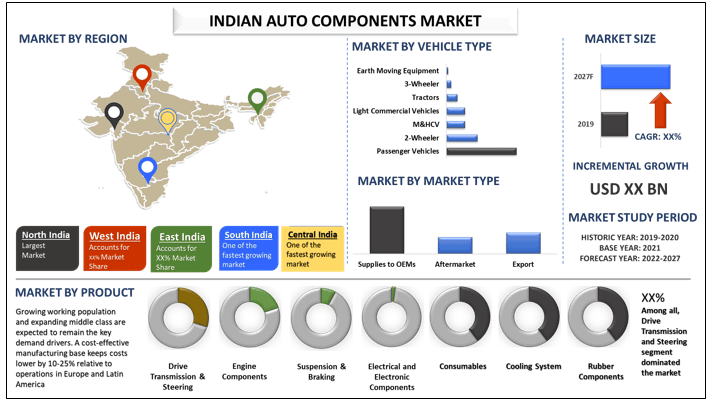

Emphasis on Product (Drive Transmission & Steering, Engine Components, Suspension & Braking, Electrical and Electronic Components, Consumables, Cooling System, Rubber Components); Vehicle Type (Passenger Vehicles, 2-Wheeler, M&HCV, Light Commercial Vehicles, Tractors, 3-Wheeler, Earth Moving Equipment); Market Type (Supplies to OEMs, Aftermarket, Export); and Regions

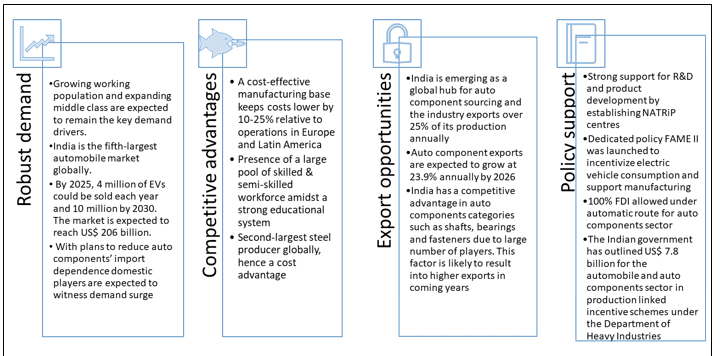

Indian Auto Components Market is anticipated display a CAGR of around 20.3% over the forecast period (2021-2027). The market witnessed a slight decline in 2020, owing to Covid-19 pandemic. Indian automobile industry is one of the largest employers with an ecosystem of more than 50 manufacturer and supporting ancillaries across different vehicle category. FY2020 was a difficult year for the industry due to Covid-19 pandemic, however, the industry is expected to witness regrowth post 2021. Indian auto component sector generated revenue of US$ 39 billion in 2016 and reached US$ 57 billion in 2019. In 2020, the sector witnessed a decline in sales by almost 11.7% to reach US$ 49.3 billion in 2020.Auto component sector includes supplies to domestic OEMs, aftermarket, and export. India’s export of auto components increased at a CAGR of 7.6% between FY2016-2020, in terms of value the market increased from US$ 10.83 billion in FY2016 to US$ 14.5 billion in FY2020.

India’s Advantage in the Auto Component Industry

Owing to the ongoing pandemic and restriction of international trade the export of auto component from India declined by 23.6% to US$ 5.2 billion in H1 2020-21, from USD 7.4 billion in H1 2019-20. Auto components exports is expected to grow at 23.9% annually till 2026. Europe accounted for 31% share of the total auto component exported during FY2021 (April-December), followed by North America (30%) and Asia (29%). In FY2020, export of auto components declined by -4.6% to US$ 14.5 billion, compared to US$ 15.2 billion in FY2019.

Insights Presented in the Report

“Amongst Product, Drive Transmission and Steering segment dominated the market in 2020”

Based on product, the Indian Auto Component Market is segmented into Drive Transmission & Steering, Engine Components, Suspension & Braking, Electrical and Electronic Components, Consumables, Cooling System, Rubber Components. In 2020, Drive Transmission and Steering segment dominated the market accounting for more than 1/5th of the market. Engine Components and Electrical and Electronic Components were the other major revenue generating segment in 2020.

“Amongst Vehicle Type, Passenger Vehicles dominated the market in 2020.”

Based on vehicle type, the Indian Auto Component Market is divided into Passenger Vehicles, 2-Wheeler, Medium and Heavy Commercial Vehicles, Light Commercial Vehicles, Tractors, 3-Wheeler, Earth Moving Equipment. Currently Passenger Vehicles dominated the market with more than 45% share, followed by 2-wheeler and Medium and Heavy Commercial Vehicles.

“Amongst Market Type, Supplies to OEMs Segment is expected to witness significant growth”

Based on market type, the market is bifurcated into Supplies to OEMs, Aftermarket, Export. In 2020, auto component was majorly driven by the increased demand from the automotive OEMs. Aftermarket sales of auto component accounted for more than 20% share in 2020. TVS Group has acquired 90% stake in Universal Components UK Ltd for US$ 19.2 million as part of its expansion plans.

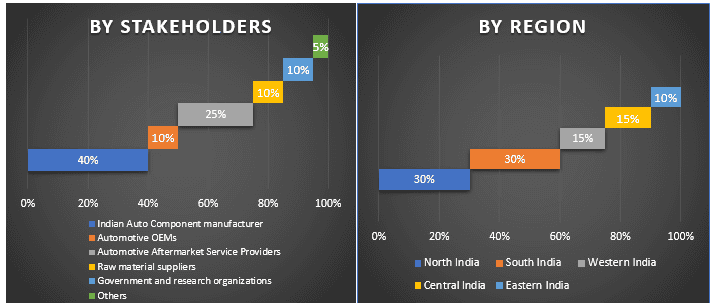

“Northern India represents as the largest market.”

For a better understanding of the demand of auto components in India, the market is analyzed for major Indian regions including India (Northern India, Southern India, Eastern India, Western India, Central India). Northern India is considered as one of the largest markets for vehicles in India, providing major growth opportunity for the auto component manufacturer. Both domestic and export markets are almost similar in terms of potential share by different product types. Engine and Exhaust components along with Body & Structural parts are expected to make up nearly 50% of the potential domestic sales as well as export in 2020. Some of the major players operating in the Indian auto components market includes Minda Industries Ltd., Craftsman Automation and Rolex Rings Ltd., WABCO India Ltd., Endurance Technologies Ltd., Bosch Ltd., Varroc Engineering Ltd., Sundaram Clayton Ltd., Motherson Sumi Systems Limited (MSSL), Bharat Forge, Toyota Kirloskar Motors etc.

Reasons to buy this report:

- The study includes market sizing and forecasting analysis validated by authenticated key industry experts

- The report presents a quick review of overall industry performance at one glance

- The report covers an in-depth analysis of prominent industry peers with a primary focus on key business financials, product portfolio, expansion strategies, and recent developments

- Detailed examination of drivers, restraints, key trends, and opportunities prevailing in the industry

- The study comprehensively covers the market across different segments

- Deep dive regional level analysis of the industry

Customization Options:

The Indian Auto Components Market can further be customized as per the requirement or any other market segment. Besides this, UMI understands that you may have your own business needs, hence feel free to connect with us to get a report that completely suits your requirements.

Table of Content

Analyzing the historical market, estimation of the current market, and forecasting the future of the Indian Auto Components market were the three major steps undertaken to create and analyze the demand and sales of Auto Components across major Indian regions. Exhaustive secondary research was conducted to collect the historical market numbers and estimate the current market size. Secondly, to validate these insights, numerous findings and assumptions were taken into consideration. Moreover, exhaustive primary interviews were conducted, with industry experts across the value chain of the industry. Post assumption and validation of market numbers through primary interviews, we employed a bottom-up approach to forecast the complete market size. Thereafter, market breakdown and data triangulation methods were adopted to estimate and analyze the market size of segments and sub-segments the industry pertains to. Detailed methodology is explained below.

Analysis of Historical Market Size

Step 1: In-Depth Study of Secondary Sources:

Detailed secondary study was conducted to obtain the historical market size of the Indian Auto Components through company internal sources such as annual report & financial statements, performance presentations, press releases, etc., and external sources including journals, news & articles, government publications, competitor publications, sector reports, third-party database, and other credible publications.

Step 2: Market Segmentation:

After obtaining the historical market size of the Indian Auto Components, we conducted a detailed secondary analysis to gather historical market insights and share for different segments & sub-segments for major regions. Major segments included in the report are product, vehicle type, and market type. Further regional level analyses were conducted to evaluate the overall demand of Auto Components in Indian context.

Step 3: Factor Analysis:

After acquiring the historical market size of different segments and sub-segments, we conducted a detailed factor analysis to estimate the current market size. Further, we conducted factor analysis using dependent and independent variables such as growing vehicle ownership in the country, technological advancement in the automotive sector etc. Historical trends and their year-on-year impact on the market size and share was analyzed. Demand and supply side scenario was also thoroughly studied.

Current Market Size Estimate & Forecast

Current Market Sizing: Based on actionable insights from the above 3 steps, we arrived at the current market size, key players in the Market, and market shares of the segments and company. All the required percentage split, and market breakdowns were determined using the above-mentioned secondary approach and were verified through primary interviews.

Estimation & Forecasting: For market estimation and forecast, weights were assigned to different factors including drivers & trends, restraints, and opportunities available for the stakeholders. After analyzing these factors, relevant forecasting techniques i.e., bottom-up approach was applied to arrive at the market forecast to 2027 for different segments and subsegments across the major regions in India. The research methodology adopted to estimate the market size encompasses:

- The industry’s market size, in terms of value (US$) and the demand of Auto Components across the major Indian regions

- All percentage shares, splits, and breakdowns of market segments and sub-segments

- Key players in the Indian Auto Components Market in terms of products offered. Also, the growth strategies adopted by these players to compete in the fast-growing market.

Market Size and Share Validation

Primary Research: In-depth interviews were conducted with the Key Opinion Leaders (KOLs) including Top Level Executives (CXO/VPs, Sales Head, Marketing Head, Operational Head, and Regional Head, Country Head, etc.) across major countries. Primary research findings were then summarized, and statistical analysis was performed to prove the stated hypothesis. Inputs from primary research were consolidated with secondary findings, hence turning information into actionable insights.

Split of Primary Participants in Different Regions

Market Engineering

Data triangulation technique was employed to complete the overall market estimation and to arrive at precise statistical numbers of each segment and sub-segment of the Indian Auto Components market. Data was split into several segments & sub-segments post studying various parameters and trends in the areas of product, vehicle type, and market type for major Indian regions.

The main objective of the Indian Auto Components Market Study

The current & future market trends of the Indian Auto Component Market are pinpointed in the study. Investors can gain strategic insights to base their discretion for investments from the qualitative and quantitative analysis performed in the study. Current and future market trends would determine the overall attractiveness of the market at a regional level, providing a platform for the industrial participant to exploit the untapped market to benefit as a first-mover advantage. Other quantitative goals of the studies include:

- Analyze the current and forecast market size of Indian Auto Component in terms of value (USD). Also, analyze the current and forecast market size of different segments and sub-segments of the industry

- Segments in the study include product, vehicle type, market type, and Regions

- Defined analysis of the regulatory framework for the Indian Auto Components industry

- Analyze the value chain involved with the presence of various intermediaries, along with analyzing customer and competitor behaviors pertaining to the industry

- Analyze the current and forecast market size of the Indian Auto Component across the globe. Major regions analyzed in the report include India (Northern India, Southern India, Eastern India, Western India, Central India)

- Define and analyze the competitive landscape of the Indian Auto Component sector and the growth strategies adopted by the market players to sustain in the fast-growing market

Deep dive regional level analysis of the industry

Related Reports

Customers who bought this item also bought