- Home

- About Us

- Industry

- Services

- Reading

- Contact Us

Japan Car Insurance Market: Current Analysis and Forecast (2025-2033)

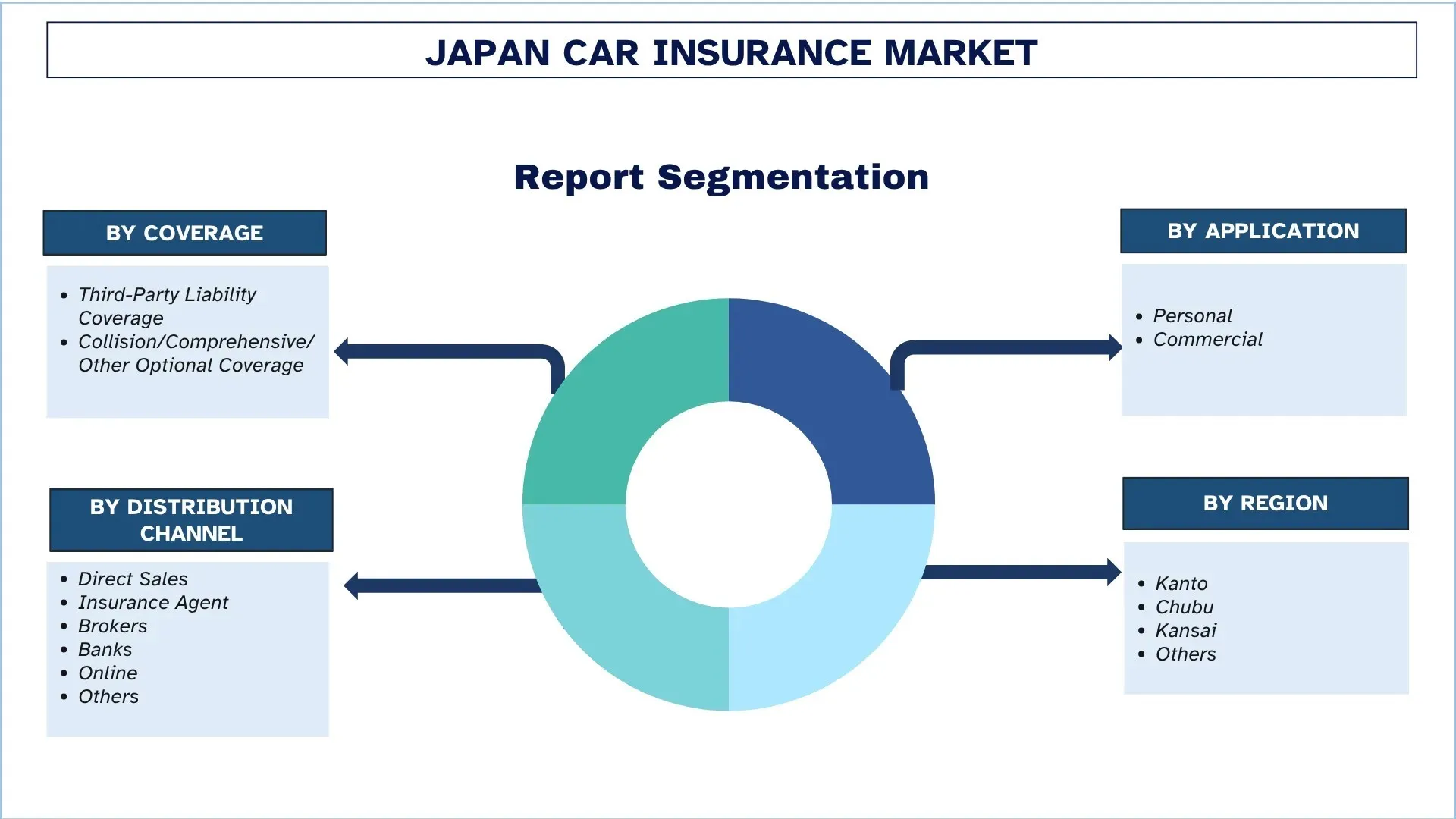

Emphasis By Coverage (Third-Party Liability Coverage and Collision/Comprehensive/Other Optional Coverage), By Application (Personal and Commercial), by Distribution Channel (Direct Sales, Insurance Agents, Brokers, Banks, Online, and Others), By Region (Kanto, Chubu, Kansai, Others)

Japan Car Insurance Market Size & Forecast

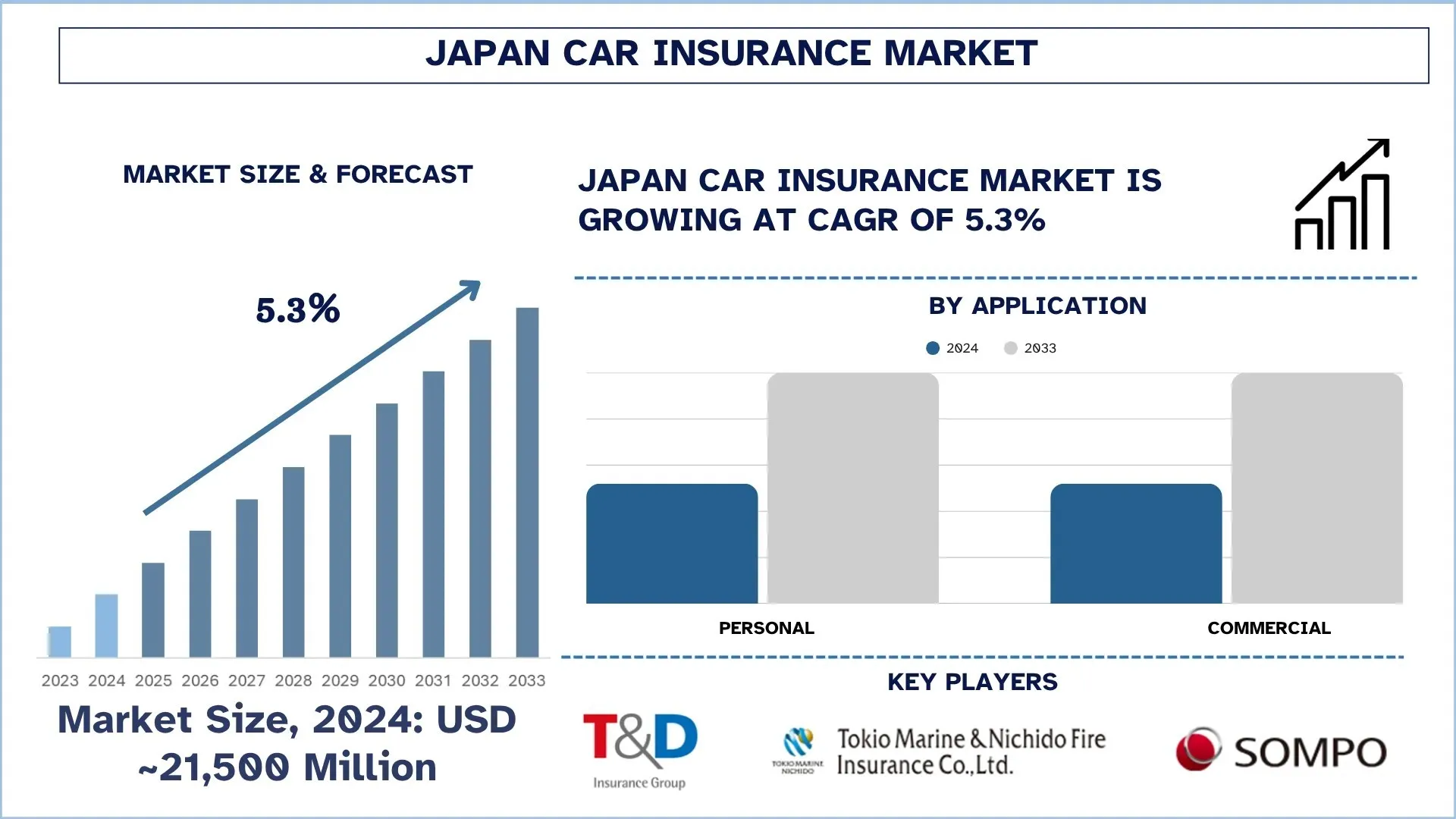

The Japan Car Insurance market was valued at USD 21,500 million in 2024 and is expected to grow to a strong CAGR of around 5.3% during the forecast period (2025-2033F), owing to the rising number of vehicle fleet.

Japan Car Insurance Market Analysis

The Japanese marketplace of car insurance is experiencing a massive transformation due to changing expectations of the consumers, changes in the population, and leaps in technology. As a consequence of an aging population and increasing awareness of safety and cost efficiency, the consumer trend has shifted towards consumers seeking insurance products that are not only reliable but also tailored, transparent, and tech-enabled. The city areas such as Tokyo, Osaka, and Fukuoka are experiencing increased popularity of digital insurance companies, usage-based insurance (UBI), and better customer service platforms. Meanwhile, Japan has its own cultural predispositions, paying particular attention to the safety, trust, and accuracy of its products that determine its development and delivery.

Japan Car Insurance Market Trends

This section discusses the key market trends that are influencing the various segments of the Japan Car Insurance market, as found by our team of research experts.

Integration of AI and Automation:

Automation and integration with artificial intelligence (AI) are changing how the car insurance industry operates in Japan by becoming more efficient and satisfying their customers. Insurers are applying the tool using AI to automate the management of policy underwriting, detection of fraud, and handling of claims. This eliminates human error, reduces the administrative costs, and scales up the delivery of services.

Personalized chatbots and virtual assistants have been utilized to deliver all-day customer service so that policyholders can obtain responses immediately or make a claim or change their policies at any time of the day. Machine learning and image recognition technology can now enable insurers to estimate the damage of a vehicle based on photos that the policyholder submits through smartphone apps, which means faster claims processing.

Japan Car Insurance Industry Segmentation:

This section provides an analysis of the key trends in each segment of the Japan Car Insurance market report, along with forecasts at the country and regional levels for 2025-2033.

The third-party liability Category has shown promising growth in the Car Insurance Market.

Based on coverage, the Japanese car insurance market is bifurcated into third-party liability coverage and collision/comprehensive/other optional coverage. Of these, third-party liability has held the major market share due to being mandatory in Japan for each vehicle. Driving without a third-party liability coverage can attract hefty fines, and the coverage is extensively checked by the authorities to avoid any discrepancies. Furthermore, with the growing vehicle fleet and awareness, and strict policies, people are vying more for collision and other coverage-based insurance, which would be conducive to the market expansion of the segment in the coming years.

Commercial Car Insurance Category Dominates the Japan Car Insurance Market.

Based on the application, the Japanese car insurance sector is bifurcated into personal and commercial. Of these, the commercial category has held a sizeable market share. As the number of commercial cars precedes the number of personal vehicles in the country, the premium on old as well as on the new cars is notably on the higher side as opposed to the personal category. Additionally, the commercial vehicles tend to cover more distance as compared to their counterparts, i.e., personal vehicles, due to which the road accident susceptibility as well as the wear and tear on the vehicles is on the higher side, further enhancing the demand for car insurance for personal cars.

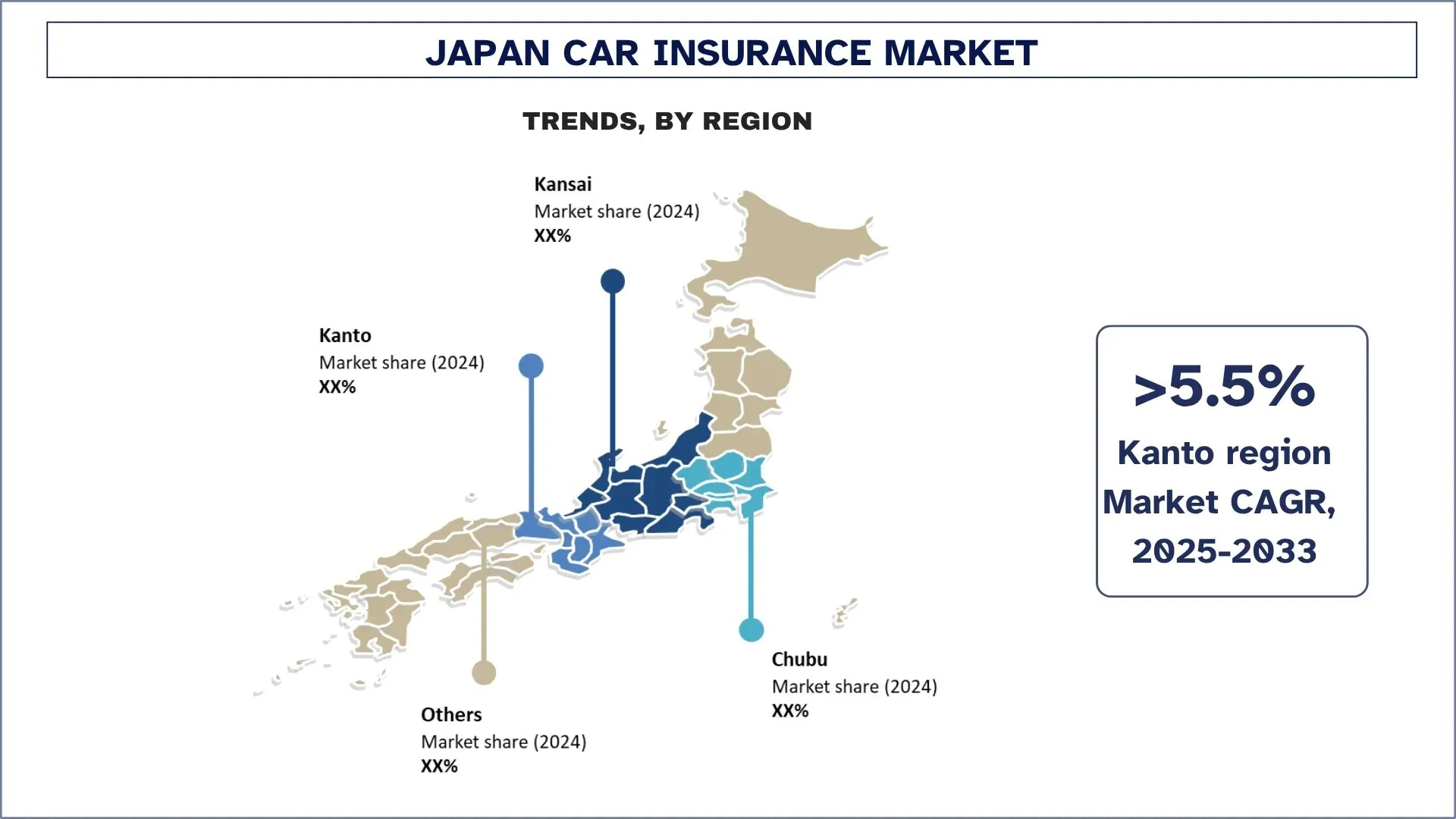

Kanto is expected to grow at a considerable rate during the forecast period.

The Kanto region is one of the most developed car insurance markets in Japan. A high vehicle density in conjunction with tech-savvy consumers is leading to quick adaptation of digital tools by the insurers who are trying to streamline services. Policy administration with the help of an app-based system, and risk assessment being AI-driven, transforming customer expectations and enhancing the real-time experience of driving. It is increasingly being covered by the options that ensure electric and low-emission vehicles, as the region transitions to being sustainable. With lifestyles of customers changing to be convenient and mobile, insurance providers in Kanto are focusing on the flexibility of their plans, speed of claims, and personalized service to help keep them relevant in a highly competitive and transformative environment.

Japan Car Insurance Industry Competitive Landscape:

The Japan Car Insurance market is competitive, with several global and international market players. The key players are adopting different growth strategies to enhance their market presence, such as partnerships, agreements, collaborations, new product launches, geographical expansions, and mergers and acquisitions.

Top Japan Car Insurance Companies

Some of the major players in the market are T&D Holdings, Sony Assurance Inc., Tokio Marine & Nichido Fire Insurance, Rakuten, Sompo Japan Insurance, Mitsui Sumitomo Insurance, Japan Post Co., Ltd., SBI Insurance Group Co., Ltd., Aioi Nissay Dowa Insurance, and Chubb.

Japan Car Insurance Market Report Coverage

Report Attribute | Details |

Base year | 2024 |

Forecast period | 2025-2033 |

Growth momentum | Accelerate at a CAGR of 5.3% |

Market size 2024 | USD 21,500 Million |

Regional analysis | Kanto, Chubu, Kansai, and Others |

Major contributing region | Kanto is expected to dominate the market during the forecast period. |

Companies profiled | T&D Holdings, Sony Assurance Inc., Tokio Marine & Nichido Fire Insurance, Rakuten, Sompo Japan Insurance, Mitsui Sumitomo Insurance, Japan Post Co., Ltd., SBI Insurance Group Co., Ltd., Aioi Nissay Dowa Insurance, and Chubb. |

Report Scope | Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Demand and Supply Side Analysis; Competitive Landscape; Company Profiling |

Segments Covered | By Coverage, By Application, By Distribution Channel, By Region |

Reasons to Buy the Japan Car Insurance Market Report:

The study includes market sizing and forecasting analysis confirmed by authenticated key industry experts.

The report briefly reviews overall industry performance at a glance.

The report covers an in-depth analysis of prominent industry peers, primarily focusing on key business financials, type portfolios, expansion strategies, and recent developments.

Detailed examination of drivers, restraints, key trends, and opportunities prevailing in the industry.

The study comprehensively covers the market across different segments.

Deep dive regional-level analysis of the industry.

Customization Options:

The Japan Car Insurance market can further be customized as per the requirements or any other market segment. Besides this, UnivDatos understands that you may have your own business needs; hence, feel free to contact us to get a report that completely suits your requirements.

Table of Content

Research Methodology for the Japan Car Insurance Market Analysis (2023-2033)

We analyzed the historical market, estimated the current market, and forecasted the future market of the Japan Car Insurance market to assess its application in major regions. We conducted exhaustive secondary research to gather historical market data and estimate the current market size. To validate these insights, we carefully reviewed numerous findings and assumptions. Additionally, we conducted in-depth primary interviews with industry experts across the Car Insurance value chain. After validating market figures through these interviews, we used both top-down and bottom-up approaches to forecast the overall market size. We then employed market breakdown and data triangulation methods to estimate and analyze the market size of industry segments and sub-segments.

Market Engineering

We employed the data triangulation technique to finalize the overall market estimation and derive precise statistical numbers for each segment and sub-segment of the Japan Car Insurance market. We split the data into several segments and sub-segments by analyzing various parameters and trends, By Coverage, By Application, By Distribution Channel, and By regions within the Japan Car Insurance market.

The Main Objective of the Japan Car Insurance Market Study

The study identifies current and future trends in the Japan Car Insurance market, providing strategic insights for investors. It highlights regional market attractiveness, enabling industry participants to tap into untapped markets and gain a first-mover advantage. Other quantitative goals of the studies include:

Market Size Analysis: Assess the current forecast and market size of the Japan Car Insurance market and its segments in terms of value (USD).

Japan Car Insurance Market Segmentation: Segments in the study include areas By Coverage, By Application, By Distribution Channel, and By

Regulatory Framework & Value Chain Analysis: Examine the regulatory framework, value chain, customer behavior, and competitive landscape of the Japan Car Insurance industry.

Regional Analysis: Conduct a detailed regional analysis for key areas such as Kanto, Chubu, Kansai, and Others.

Company Profiles & Growth Strategies: Company profiles of the Japan Car Insurance market and the growth strategies adopted by the market players to sustain the fast-growing market.

Frequently Asked Questions FAQs

Q1: What is the Japan Car Insurance market’s current market size and growth potential?

The Japan Car Insurance market was valued at 21,500 million in 2024 and is expected to grow at a CAGR of 5.3% during the forecast period (2025-2033).

Q2: Which segment has the largest share of the Japan Car Insurance market by coverage?

The third-party liability has held a notable market share, as driving without this coverage can attract hefty fines, and it is extensively checked by authorities to avoid any discrepancies.

Q3: What are the driving factors for the growth of the Japan Car Insurance market?

• Rising Traffic Accidents: With traffic accidents on the rise, there is a growing need for reliable car insurance coverage, prompting consumers to seek better and more responsive policies.

• Aging Population: Japan’s aging demographic has led to an increased demand for coverage tailored to elderly drivers, pushing insurers to develop age-sensitive and safer driving solutions.

Q4: What are the emerging technologies and trends in the Japan Car Insurance market?

• Telematics and Usage-Based Insurance (UBI): Insurers are adopting telematics to track real-time driving behavior, allowing for usage-based premiums that reward safe driving.

• Digital Transformation: Mobile apps, AI-driven risk assessments, and seamless digital claims processing are redefining customer experiences and expectations.

Q5: What are the key challenges in the Japan Car Insurance market?

• Rising Accident Risks: An increase in traffic accidents adds pressure on insurers to manage risk, control claims costs, and ensure financial sustainability.

• Aging Driver Concerns: Ensuring safety and affordability for senior drivers remains a difficult balance as their numbers continue to rise.

Q6: Which region dominates the Japan Car Insurance market?

The Kanto region dominates the Japanese car Insurance market due to the rising demand from major urban centers.

Q7: Who are the key players in the Japan Car Insurance market?

Some of the top Car Insurance companies in Japan include:

• T&D Holdings

• Sony Assurance Inc.

• Tokio Marine & Nichido Fire Insurance

• Rakuten

• Sompo Japan Insurance

• Mitsui Sumitomo Insurance

• Japan Post Co., Ltd.

• SBI Insurance Group Co., Ltd.

• Aioi Nissay Dowa Insurance

• Chubb

Q8: What are the opportunities for companies within the Japan Car Insurance market?

• Usage-Based Insurance (UBI): As telematics and digital tracking systems gain traction, insurers have a major opportunity to expand usage-based insurance offerings. This model allows policyholders to pay premiums based on actual driving behavior, promoting safer habits and creating more personalized coverage.

• Expansion in Rural Areas: With urban insurance markets reaching saturation, rural regions offer untapped growth potential. As infrastructure and vehicle ownership in rural Japan improve, insurers can penetrate these areas with tailored policies and mobile-first services that address specific regional needs.

Q8: How are consumer preferences shaping product development in the Japan Car Insurance market?

Consumer preferences for personalized, tech-enabled, and flexible insurance solutions are driving product development in Japan, pushing insurers to adopt telematics, app-based services, and eco-friendly coverage options.

Related Reports

Customers who bought this item also bought