- Home

- About Us

- Industry

- Services

- Reading

- Contact Us

Lysine Market: Current Analysis and Forecast (2025-2033)

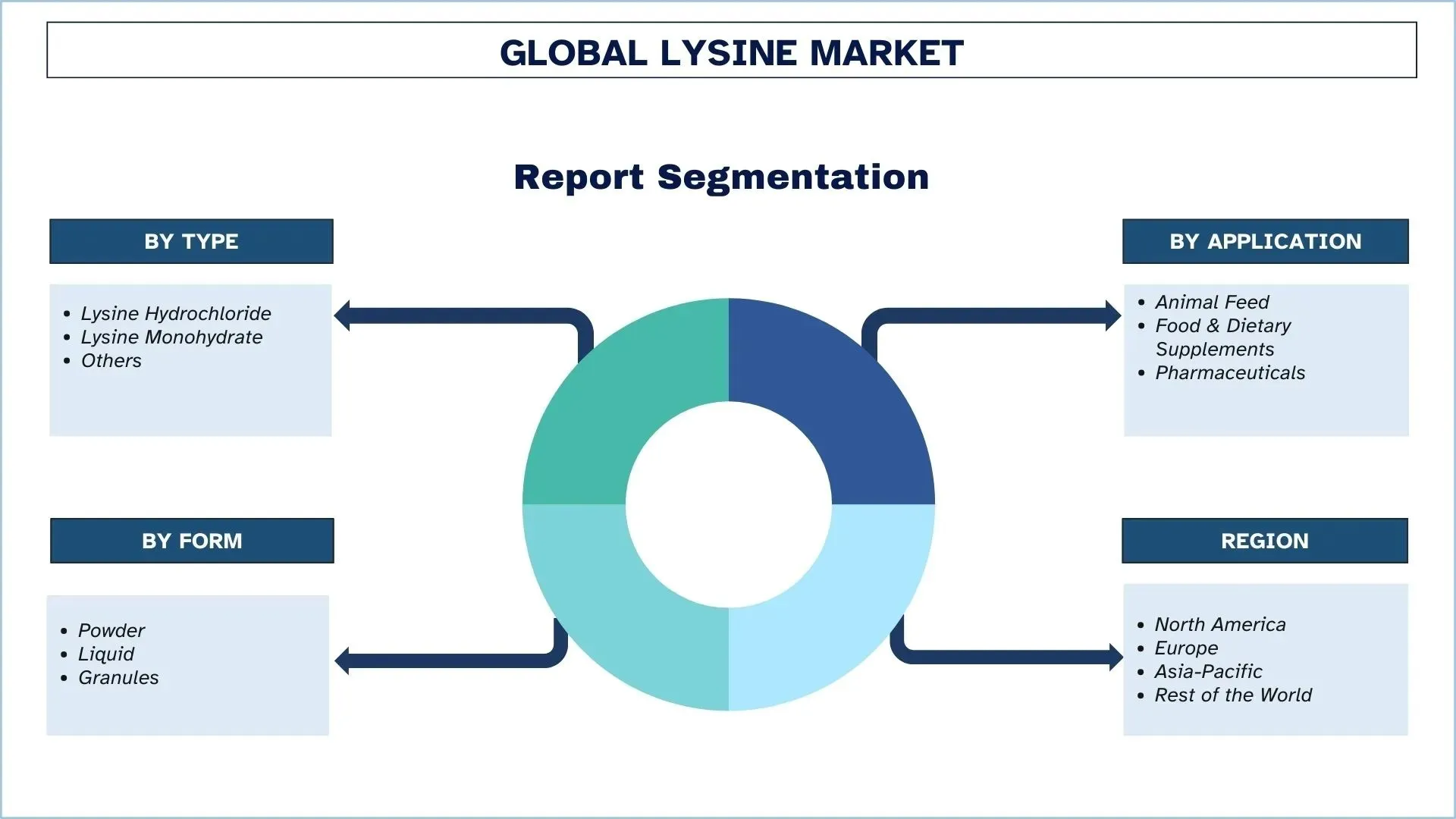

Emphasis on By Type (Lysine Hydrochloride, Lysine Monohydrate, Others); By Application (Animal Feed, Food & Dietary Supplements, Pharmaceuticals); By Form (Powder, Liquid, Granules); and Region/Country

Lysine Market Size & Forecast

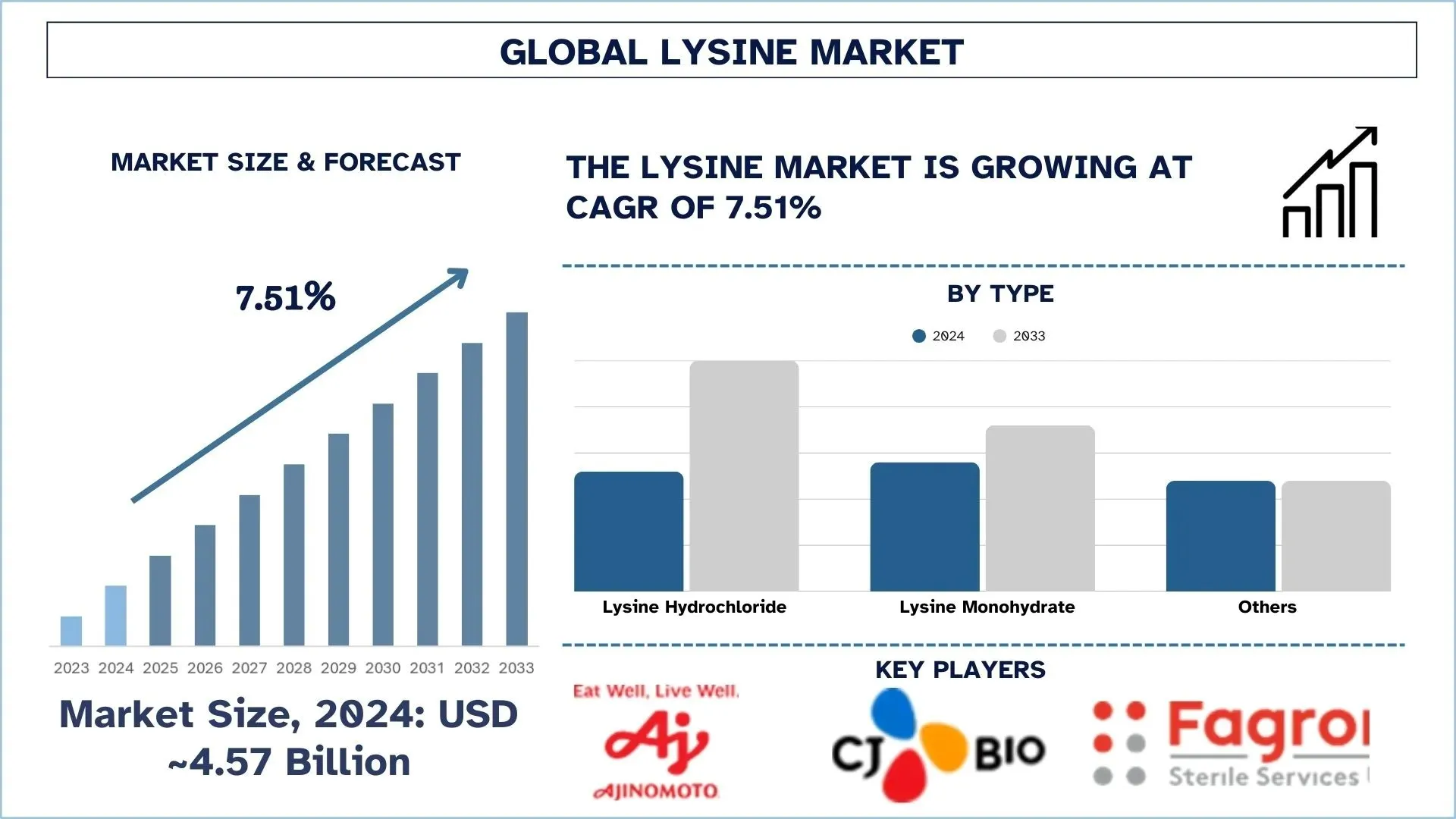

The Lysine Market was valued at USD 4.57 billion in 2024 and is expected to grow to a strong CAGR of 7.51% for the forecast period (2025- 2033F) due to the rising demand for animal protein, the growth of the animal feed industry, and the cost-effectiveness over other protein sources.

Lysine Market Analysis

Lysine is an essential amino acid that is very crucial for protein synthesis, growth, and overall health. It is vital to produce collagen, enzymes, and hormones, and is commonly used in animal feed (especially for poultry and swine) and human nutrition supplements. The global lysine market is witnessing an expeditious growth because of the increasing livestock production, rising demand for high-protein diets, and the growing consumer awareness of the importance of amino acids in nutrition. Key growth factors include the expansion of the animal feed industry, particularly in developing regions where the demand for poultry and pork is surging. Further, the perpetuated growth of plant-based diets and technological advancements in production efficiency are also making lysine more cost-effective, enabling broader market penetration and fueling the market’s expansion globally.

Lysine Market Trends

This section discusses the key market trends influencing the various segments of the lysine market as identified by our research experts.

Shift Toward Plant-Based and Fermentation-Based Production

The paradigm drift of manufacturers toward plant-based and fermentation-based production methods has increased the global lysine demand. Lysine is an important amino acid that is used in animal feed and nutrition and has historically been produced through synthetic methods. Though the escalating environmental concerns, such as the greenhouse gas effect, global warming, are further accentuating the industry to innovate and explore more sustainable options. Plant-based lysine manufacturing is more eco-friendly, and these methods align with the rising consumer preferences for plant-based and ethically sourced ingredients, particularly in animal feed and food products. Furthermore, biotechnology advancements have also boosted the efficiency and cost-effectiveness of fermentation, making it qualitatively better. This modification is also supported by the regulatory pressures for cleaner production processes and the broader movement toward reducing reliance on animal-derived products. As the demand for sustainable and plant-based solutions is escalating, lysine producers are embracing these innovative production methods to meet consumer expectations.

Lysine Industry Segmentation

This section provides an analysis of the key trends in each segment of the global lysine market report, along with forecasts at the global, regional, and country levels for 2025-2033.

The Lysine Hydrochloride product category dominates the Lysine market.

Based on type, the market is segmented into Lysine Hydrochloride, Lysine Monohydrate, and others. The lysine hydrochloride market dominated the market in 2024. The lysine hydrochloride segment is increasing expeditiously in the lysine market due to its high purity, excellent bioavailability, and effectiveness in animal nutrition. It is the most used form of lysine that is used to feed pigs and poultry, thereby helping improve growth rates and efficiency. These are mainly preferred by the poultrymen, feed manufacturers, and farmers because of their convenience of handling, storing, and mixing with other feed components. With the growing global demand for meat, especially in developing regions, the need for efficient additives like lysine hydrochloride increases. Its immense benefits and consistent quality have made it the key choice in modern livestock farming.

The animal feed product dominates the Lysine market.

Based on application, the market is segmented into animal feed, food & dietary supplements, and pharmaceuticals. The animal feed segment is witnessing bolstered growth in the lysine market mainly due to the growing global demand for meat, dairy, and poultry products. With the growing population, livestock farming has become more intensive. To meet this escalating demand, there is a greater need for efficient, high-quality food that promotes faster growth and better animal health. Lysine can't be produced on its own in the animal body, so it is added to feed to improve protein synthesis and growth rates. Further, it may act as a protein substitute, as its use may help to reduce the amount of expensive protein sources like soybean meal, making feed more cost-effective. This makes lysine essential in modern animal nutrition.

North America will hold a dominant share of the Lysine market in 2024

In 2024, North America held a major share of the global lysine market due to innumerable factors. North America has a highly developed and industrialized livestock and poultry farming industry. The United States and Canada have some of the highest per capita meat consumption rates in the world, driving consistent demand for high-quality animal feed. Lysine assists in improving the efficiency of feed, enhancing animal growth, and reducing overall feed costs. This made it an indispensable ingredient in commercial animal nutrition programs. Moreover, North American producers benefit from economies of scale, factor abundance, from advanced feed manufacturing infrastructure, and the presence of several global lysine giants, such as Ajinomoto Heartland and Archer Daniels Midland (ADM), who operate cutting-edge fermentation facilities and supply both local and international markets. The region’s emphasis mainly on environmentally sustainable farming practices has also played a role in augmenting lysine usage. North America’s strategic location, strong logistics, and established trade ties with Asia and Latin America have also contributed to its ability to serve global markets efficiently.

The U.S. held a dominant share of the North American Lysine market in 2024

The United States is the major shareholding country of the global lysine market owing to its large-scale livestock production, strong agricultural infrastructure, and the presence of key lysine manufacturers. It is among the world’s largest producers and consumers of meat, particularly pork, poultry, and beef. It maintains a constant demand for feed-grade lysine, which is used to improve animal growth and feed efficiency. With rising feed costs and growing pressure to increase productivity while reducing environmental impact, American livestock producers increasingly turned to amino acid supplementation, making lysine an essential component in animal diets. Furthermore, the U.S. has a highly organized and mature feed manufacturing sector that makes the integration of lysine into feed formulas widespread and efficient. In 2024, U.S. producers also capitalized on growing export opportunities, particularly in Asia and Latin America, where demand for meat and high-quality animal nutrition is rising.

Lysine Competitive Landscape

The Lysine Market is competitive and fragmented, with several global and international market players. The key players are adopting different growth strategies to enhance their market presence, such as partnerships, agreements, collaborations, new product launches, geographical expansions, and mergers and acquisitions.

Top Lysine Companies

The major players operating in the market are Global Bio-chem Technology Group Company Limited, Ajinomoto Co., Inc., CJ CheilJedang Corp., ADM Animal Nutrition, Inc. (Archer-Daniels-Midland Company), Evonik, Fufeng USA Incorporated, KYOWA HAKKO BIO CO., LTD., Cargill, Incorporated., Meihua Holdings Group Co., Ltd., and Fagron Sterile Services. Companies are investing heavily to gain traction in the Lysine market with the new product launches, mergers and acquisitions, collaborations, etc.

Lysine Market News

On May 25, 2022, Terremoto Biosciences announced that it raised USD 75 million in a Series A financing. The round was co-led by OrbiMed and Third Rock Ventures. Proceeds from the financing will be used to advance Terremoto’s lysine-targeted covalency platform and develop best-in-class therapies against known drug targets, as well as first-in-class medicines against the previously undruggable.

On 8 November 2021, CJ Cheiljedang, the leading Korean food culture company, acquired Batavia Biosciences, a science-based Contract Development and Manufacturing Organization (CDMO) offering personalized services and fully supporting all stages of biopharmaceutical development.

On July 21, 2020, ADM the global leader in animal nutrition, announced the launch of NutriPass L, an encapsulated lysine supplement that is rumen-stable and intestinally available to cows.

Lysine Market Report Coverage

Report Attribute | Details |

Base year | 2024 |

Forecast period | 2025-2033 |

Growth momentum | Accelerate at a CAGR of 7.51% |

Market size 2024 | USD 4.57 billion |

Regional analysis | North America, Europe, APAC, Rest of the World |

Major contributing region | Asia-Pacific is expected to grow at the highest CAGR during the forecasted period. |

Key countries covered | U.S., Mexico, Germany, United Kingdom, Spain, Italy, France, China, Japan, and India |

Companies profiled | Global Bio-chem Technology Group Company Limited, Ajinomoto Co., Inc., CJ CheilJedang Corp., ADM Animal Nutrition, Inc. (Archer-Daniels-Midland Company), Evonik, Fufeng USA Incorporated, KYOWA HAKKO BIO CO., LTD., Cargill, Incorporated., Meihua Holdings Group Co., Ltd., and Fagron Sterile Services. |

Report Scope | Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Demand and Supply Side Analysis; Competitive Landscape; Company Profiling |

Segments Covered | By Type, By Application, By Form, By Region/Country |

Reasons to buy the Lysine Market report:

The study includes market sizing and forecasting analysis validated by authenticated key industry experts.

The report briefly reviews overall industry performance at a glance.

The report covers an in-depth analysis of prominent industry peers, primarily focusing on key business financials, product portfolios, expansion strategies, and recent developments.

Detailed examination of drivers, restraints, key trends, and opportunities prevailing in the industry.

The study comprehensively covers the market across different segments.

Deep dive regional-level analysis of the industry.

Customization Options:

The Global Lysine Market can be customized by requirement or any other market segment. Besides this, UnivDatos understands that you may have your own business needs; hence, feel free to contact us to get a report that completely suits your requirements.

Table of Content

Research Methodology for the Lysine Market Analysis (2023-2033)

We analyzed the historical market, estimated the current market, and forecasted the future market of the global lysine market to assess its application in major regions worldwide. We conducted exhaustive secondary research to gather historical market data and estimate the current market size. To validate these insights, we carefully reviewed numerous findings and assumptions. Additionally, we conducted in-depth primary interviews with industry experts across the lysine value chain. After validating market figures through these interviews, we used top-down and bottom-up approaches to forecast the overall market size. We then employed market breakdown and data triangulation methods to estimate and analyze the market size of industry segments and subsegments:

Market Engineering

We employed the data triangulation technique to finalize the overall market estimation and derive precise statistical numbers for each segment and sub-segment of the global lysine market. We split the data into several segments and sub-segments by analyzing various parameters and trends, including type, application, form, and regions within the global lysine market.

The main objective of the Global Lysine Market Study

The study identifies current and future trends in the global lysine market, providing strategic insights for investors. It highlights regional market attractiveness, enabling industry participants to tap into untapped markets and gain a first-mover advantage. Other quantitative goals of the studies include:

- Market Size Analysis: Assess the current forecast and market size of the global lysine market and its segments in terms of value (USD).

- Lysine Market Segmentation: Segments in the study include areas of type, application, form, and regions.

- Regulatory Framework & Value Chain Analysis: Examine the regulatory framework, value chain, customer behavior, and competitive landscape of the lysine industry.

- Regional Analysis: Conduct a detailed regional analysis for key areas such as Asia Pacific, Europe, North America, and the Rest of the World.

- Company Profiles & Growth Strategies: Company profiles of the lysine market and the growth strategies adopted by the market players to sustain in the fast-growing market.

Frequently Asked Questions FAQs

Q1: What is the Lysine market's current size and growth potential?

The Lysine Market was valued at USD 4.57 billion in 2024 and is expected to grow at a CAGR of 7.51% during the forecast period (2025-2033).

Q2: Which segment has the largest share of the Lysine market by type?

The lysine hydrochloride segment is increasing expeditiously in the lysine market due to its high purity, excellent bioavailability, and effectiveness in animal nutrition. It is the most used form of lysine that is used to feed pigs and poultry, thereby helping improve growth rates and efficiency.

Q3: What are the driving factors for the growth of the Lysine market?

• Rising Demand for Animal Protein: Increasing meat consumption globally (especially in Asia-Pacific and Latin America) is driving the demand for lysine as a key additive for swine and poultry.

• Growth of the Animal Feed Industry: Expansion of the global livestock and aquaculture industries is propelling lysine demand due to its essential role in improving animal growth and feed efficiency.

• Cost-Effectiveness Over Other Protein Sources: Lysine supplementation reduces the need for expensive protein-rich feeds like soybean meal, improving feed conversion ratios and overall profitability.

Q4: What are the emerging technologies and trends in the Lysine market?

• Shift Toward Plant-Based and Fermentation-Based Production: Manufacturers are increasingly using microbial fermentation and non-GMO sources to produce lysine, aligning with sustainable and ethical production practices.

• Product Diversification (Lysine Sulfate & L-Lysine HCl): Companies are offering different lysine variants tailored for specific livestock species, enhancing market segmentation and targeted nutrition.

Q5: What are the key challenges in the Lysine market?

• Volatility in Raw Material Prices (Corn, Glucose): Lysine production is highly dependent on corn and sugar-based inputs; price fluctuations can affect profitability and market stability.

• Stringent Regulatory Approvals: Regulatory hurdles in different countries regarding additive approvals and quality standards can limit market expansion and delay product launches.

Q6: Which region dominates the Lysine Market?

North America is a highly developed and industrialized livestock and poultry farming industry. The United States and Canada have some of the highest per capita meat consumption rates in the world, driving consistent demand for high-quality animal feed. Lysine assists in improving the efficiency of feed, enhancing animal growth, and reducing overall feed costs.

Q7: Who are the key players in the Lysine market?

Some of the Leading companies in Lysine are:

• Global Bio-chem Technology Group Company Limited

• Ajinomoto Co., Inc.

• CJ CheilJedang Corp.

• ADM Animal Nutrition, Inc. (Archer-Daniels-Midland Company)

• Evonik

• Fufeng USA Incorporated

• KYOWA HAKKO BIO CO.,LTD.

• Cargill, Incorporated.

• Meihua Holdings Group Co., Ltd.

• Fagron Sterile Services

Q8: What are the key investment opportunities in the global Lysine industry?

The key investment opportunities in the global lysine industry include expanding production in emerging markets, adopting sustainable fermentation technologies, developing specialty feed formulations, entering the human nutrition segment, and pursuing strategic partnerships or acquisitions.

Q9: How are mergers, acquisitions, and brand collaborations shaping the Lysine landscape?

Mergers, acquisitions, and brand collaborations are reshaping the lysine industry by expanding production capacity, improving supply chain efficiency, and fostering innovation. These strategic moves help companies strengthen their market position and meet growing global demand, especially in sustainable and high-performance feed solutions.

Related Reports

Customers who bought this item also bought