- Home

- About Us

- Industry

- Services

- Reading

- Contact Us

Southeast Asia Advertising Market: Current Analysis and Forecast (2025-2033)

Emphasis on Type (Traditional Advertising {Television, Print, Radio, Cinema, Out-of-Home (OOH)}, Digital Advertising {Display Ads, Video, Social Media, Search, Digital Out-of-Home (DOOH), Audio, Platform, Others}); Platform (Desktop Web, Mobile Web, Mobile In-App, OTT & Streaming Platforms, Retail Media, Others); Transaction Type (Programmatic, Non-Programmatic); Industry Vertical (BFSI, Retail & E-commerce, Automotive, Healthcare & Pharmaceuticals, Technology and Telecom, FMCG, Travel & Hospitality, Entertainment & Media, Others); and Country.

Southeast Asia Advertising Market Size & Forecast

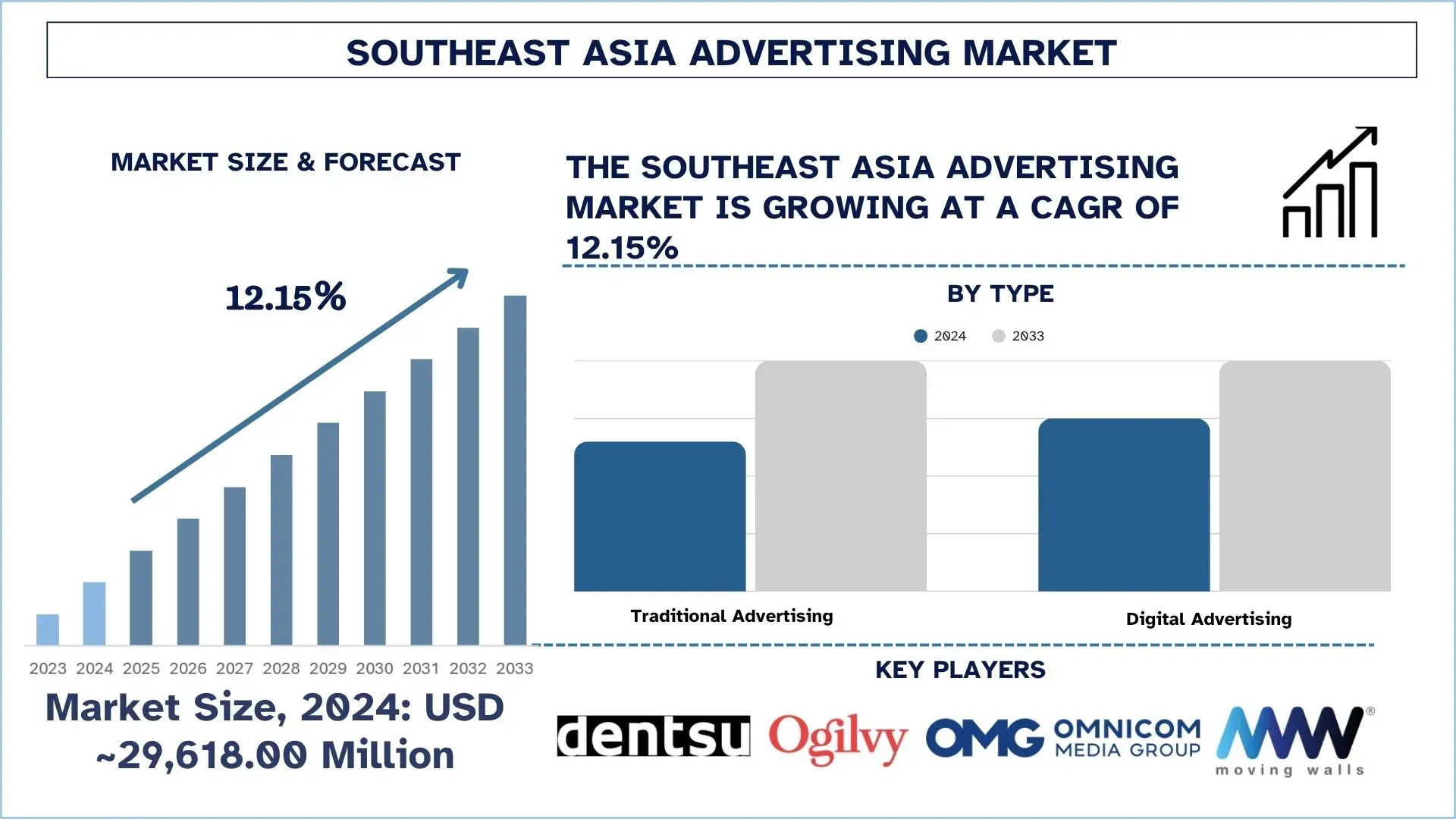

The Southeast Asia Advertising Market was valued at ~USD 29,618.00 million in 2024 and is expected to grow at a strong CAGR of approximately 12.15% during the forecast period (2025-2033F), driven by a surge in internet and smartphone usage, which is fueling digital ad spend across Southeast Asia.

Southeast Asia Advertising Market Analysis

Advertising is a paid communications method that informs, persuades, and reminds potential customers of what a brand has to offer. It employs both online and offline channels to raise awareness and influence buying decisions.

The role of advertising in Southeast Asia is rapidly shifting towards a digital-first approach, automation, and data-driven targeting. To reach mobile consumers, marketers are spending heavily on social media campaigns, influencer partnerships, and programmatic advertising. The transition to video and interactivity, the introduction of AI to optimize advertising, and the emergence of retail media platforms have increased market competition. Moreover, local-language customization, cross-channel advertising, and performance-based advertising purchasing are also being widely adopted to enhance engagement and conversion rates.

For instance, on July 15, 2025, Google announced a suite of new artificial intelligence-powered tools for Search and YouTube aimed at brands and marketers in Southeast Asia.

These developments include applications designed to streamline ad placement, improve campaign optimisation, and aid creative asset production, targeting the increasingly diverse ways consumers interact with digital content.

Southeast Asia Advertising Market Trends

This section discusses the key market trends that are influencing the various segments of the Southeast Asia Advertising market, as found by our team of research experts.

Integration of AI-Powered Ad Personalization

The adoption of AI-driven automated ad customization is making gains in the Southeast Asian region, with advertisers opting to go smarter and efficient with targeting. Additionally, artificial intelligence is utilized to analyze real-time data on consumers, enabling the delivery of customized messages to optimize the performance of creative content and anticipate user intentions. That increases the engagement, increases ROI, and decreases ad fatigue. With the growing competition, it is evident that brands are shifting towards AI-based personalization to increase the relevance of the campaign and provide personalized experiences on mobile, social, and video platforms. On July 18, 2025, Appier, an AI-native SaaS company specializing in advanced AdTech and MarTech solutions, officially launched the AdCreative.ai solution in Thailand. The platform is powered by Generative AI and reduces creative production, improves campaign performance, and scales personalized marketing processes of Thai brands. The opening is a significant move to promote Thai brands as they go through the dynamic marketing environment. Hundreds of marketers and advertisers of leading brands and agencies were present at the event to see how AI is transforming creative workflows and actually delivering business outcomes.

Southeast Asia Advertising Industry Segmentation

This section provides an analysis of the key trends in each segment of the Southeast Asia Advertising market, along with forecasts at the country level for 2025-2033.

The digital advertising market held the dominant share of the Advertising market in 2024.

Based on type, the market is segmented into traditional advertising (television, print, radio, cinema, out-of-home (OOH)), digital advertising (display ads, video, social media, search, digital out-of-home (DOOH), audio, platform, others). Among these, the digital advertising market held the largest share in 2024. This is mainly because it has enabled brands to reach a highly engaged, mobile-first audience. As internet and social media penetration increase, more advertisers are moving their budgets to digital media, where they can measure performance and target in real time. Moreover, the capacity to undertake localized, data-driven campaigns in markets enhances brand presence and Return on investment (ROI), as digital channels drive advertising growth. For example, on October 23, 2025, AdShare Global, an international advertising and digital technology company, officially launched AdWork, a next-generation digital advertising collaboration platform designed to enhance transparency, engagement, and shared value in the global marketing ecosystem. This milestone also marks AdShare Global's expansion into Southeast Asia, with Vietnam chosen as its regional operations hub, a strategic move driven by the country's fast-growing digital economy and highly skilled young workforce.

The programmatic segment is expected to grow at a significant CAGR during the forecast period (2025-2033).

Based on transaction type, the market is segmented into programmatic and non-programmatic. Among these, the programmatic segment is expected to grow at a significant CAGR during the forecast period (2025-2033) through automation and data intelligence. It gives advertisers the opportunity to purchase and optimize media in real time, enhancing efficiency and enabling access to fragmented Southeast Asian markets. Adding to this, the increasing need for transparency, audience accuracy, and measurable results is driving brands to embrace programmatic solutions that simplify ad delivery and optimize ROI across various digital touchpoints. On January 15, 2025, Magnite, the largest independent sell-side advertising company, announced it has strengthened its partnership with Samsung Ads to power programmatic advertising on Samsung TV Plus inventory in Singapore, the Philippines, and Thailand for the first time. Advertisers now have programmatic access to premium video inventory on Samsung’s free ad-supported streaming TV (FAST) service, Samsung TV Plus, which went live across the Southeast Asia region late last year.

Indonesia held a dominant share of the Southeast Asian Advertising market in 2024

The advertising landscape in Indonesia dominates the Southeast Asian region due to its large number of digital consumers and rapid adoption of social media. Additionally, Indonesia's high mobile penetration and growing e-commerce ecosystem have made it a digital ad-spend market. Additionally, brands are becoming increasingly local and influencer-based in their marketing strategies, making Indonesia the growth engine in the region for both digital and traditional advertising investments. On September 12, 2025, ZTE Corporation announced the large-scale commercialization of its comprehensive FAST (Free Ad-Supported TV) solution in July 2025.

Jointly promoted by leading Indonesian fiber optic internet provider MyRepublic Indonesia and digital content platform MetaX, the project leverages an innovative tripartite collaboration model to address a key challenge in emerging markets: balancing high investment with low returns during media service upgrades.

Southeast Asia Advertising Industry Competitive Landscape

The Southeast Asia Advertising market is competitive, with several global and international market players. The key players are adopting different growth strategies to enhance their market presence, such as partnerships, agreements, collaborations, new product launches, geographical expansions, and mergers and acquisitions.

Top Southeast Asia Advertising Companies

Some of the major players in the market are Dentsu International, Ogilvy, Omnicom Media Group, Publicis Commerce, Havas Media Network (Havas), Mediabrands Worldwide, Inc., JCDecaux Group, Clear Channel Outdoor, Moving Walls, and GIGIL Manila.

Recent Developments in the Southeast Asia Advertising Market

On October 29, 2025, Publicis Groupe entered into a definitive agreement to acquire HEPMIL Media Group, a Singapore-based influencer agency. Hepmil serves more than 450 brands with a network of over 3,000 creators and a claimed reach of one billion across Singapore, Thailand, the Philippines, Indonesia, Malaysia, and Vietnam into its operations. The acquisition is subject to customary closing conditions.

On September 23, 2024, Telkom Indonesia launched a telco data-based programmatic advertising solution under the name AdXelerate. AdXelerate aims to provide a solution for advertisers to promote digital advertising that is more targeted, efficient, and based on telco data.

Southeast Asia Advertising Market Report Coverage

Report Attribute | Details |

Base year | 2024 |

Forecast period | 2025-2033 |

Growth momentum | Accelerate at a CAGR of 12.15% |

Market size 2024 | |

Country analysis | Indonesia, Thailand, Philippines, Vietnam, Malaysia, Singapore, Rest of Southeast Asia |

Major contributing Country | Vietnam is expected to grow at the highest CAGR during the forecasted period. |

Companies profiled | Dentsu International, Ogilvy, Omnicom Media Group, Publicis Commerce, Havas Media Network (Havas), Mediabrands Worldwide, Inc., JCDecaux Group, Clear Channel Outdoor, Moving Walls, GIGIL Manila |

Report Scope | Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Demand and Supply Side Analysis; Competitive Landscape; Company Profiling |

Segments Covered | By Type, By Platform, By Transaction Type, By Industry Vertical, By Country |

Reasons to Buy the Southeast Asia Advertising Market Report:

The study includes market sizing and forecasting analysis confirmed by authenticated key industry experts.

The report briefly reviews overall industry performance at a glance.

The report covers an in-depth analysis of prominent industry peers, primarily focusing on key business financials, product portfolios, expansion strategies, and recent developments.

Detailed examination of drivers, restraints, key trends, and opportunities prevailing in the industry.

The study comprehensively covers the market across different segments.

Customization Options:

The Southeast Asia Advertising Market can further be customized as per requirements or any other market segment. Besides this, UnivDatos understands that you may have your own business needs; hence, feel free to contact us to get a report that completely suits your requirements.

Table of Content

Research Methodology for the Southeast Asia Advertising Market Analysis (2023-2033)

We analyzed the historical market, estimated the current market, and forecasted the future market of the Southeast Asian Advertising market to assess its application in major countries. We conducted exhaustive secondary research to gather historical market data and estimate the current market size. To validate these insights, we carefully reviewed numerous findings and assumptions. Additionally, we conducted in-depth primary interviews with industry experts across the Southeast Asian Advertising value chain. After validating market figures through these interviews, we used both top-down and bottom-up approaches to forecast the overall market size. We then employed market breakdown and data triangulation methods to estimate and analyze the market size of industry segments and sub-segments.

Market Engineering

We employed the data triangulation technique to finalize the overall market estimation and derive precise statistical numbers for each segment and sub-segment of the Southeast Asia Advertising market. We split the data into several segments and sub-segments by analyzing various parameters and trends, including type, platform, transaction type, industry vertical, and country within the Southeast Asian Advertising market.

The Main Objective of the Southeast Asia Advertising Market Study

The study identifies current and future trends in the Southeast Asia Advertising market, providing strategic insights for investors. It highlights market attractiveness, enabling industry participants to tap into untapped markets and gain a first-mover advantage. Other quantitative goals of the studies include:

Market Size Analysis: Assess the current and forecast market size of the Southeast Asia Advertising market and its segments in terms of value (USD).

Southeast Asia Advertising Market Segmentation: Segments in the study include areas of type, platform, transaction type, industry vertical, and country.

Regulatory Framework & Value Chain Analysis: Examine the regulatory framework, value chain, customer behavior, and competitive landscape of the Southeast Asia Advertising industry.

Country Analysis: Conduct a detailed country analysis for key areas such as Indonesia, Thailand, the Philippines, Vietnam, Malaysia, Singapore, and the Rest of Southeast Asia.

Company Profiles & Growth Strategies: Company profiles of the Southeast Asia Advertising market and the growth strategies adopted by the market players to sustain in the fast-growing market.

Frequently Asked Questions FAQs

Q1: What is the Southeast Asia Advertising market’s current market size and growth potential?

The Southeast Asia Advertising market was valued at ~USD 29,618.00 million in 2024 and is projected to expand at a CAGR of 12.15% from 2025 to 2033. This growth is driven by the rapid digitalization, increasing mobile and internet penetration, and rising ad investments from e-commerce, BFSI, and technology sectors across the region.

Q2: Which segment has the largest share of the Southeast Asia Advertising market by type?

Digital Advertising holds the largest share of the Southeast Asia Advertising Market, fueled by strong demand for social media, video, and mobile ads. Businesses are prioritizing digital channels due to measurable ROI, audience targeting capabilities, and the region’s growing online consumer base.

Q3: What are the driving factors for the growth of the Southeast Asia Advertising market?

The market growth is primarily driven by:

• Rising smartphone and internet penetration across emerging economies.

• Expansion of e-commerce and digital payment ecosystems.

• Adoption of AI and programmatic advertising for data-driven targeting.

• Growth in influencer and social media marketing.

• Government-led digital transformation initiatives in ASEAN countries.

Q4: What are the emerging technologies and trends in the Southeast Asia Advertising market?

Key trends include the integration of AI-powered ad personalization, the growth of digital out-of-home (DOOH) platforms, and the rise of short-form video content across TikTok and YouTube. Advertisers are also adopting retail media networks, programmatic buying, and privacy-first strategies to optimize reach and consumer trust.

Q5: What are the key challenges in the Southeast Asia Advertising market?

The market faces challenges such as fragmented media landscapes, rising ad fraud, and inconsistent measurement standards across countries. Additionally, data privacy regulations and increasing competition for consumer attention make it difficult for brands to maintain visibility and engagement.

Q6: Which country dominates the Southeast Asia Advertising market?

Indonesia holds the dominant share in the Southeast Asia Advertising Market due to its massive digital audience, mobile-first economy, and strong social media engagement. Meanwhile, Vietnam is experiencing the fastest growth, driven by expanding e-commerce, digital startups, and a young, tech-savvy population.

Q7: Who are the key players in the Southeast Asia Advertising market?

Leading companies in the Southeast Asia Advertising market include:

• Dentsu International

• Ogilvy

• Omnicom Media Group

• Publicis Commerce

• Havas Media Network (Havas)

• Mediabrands Worldwide, Inc.

• JCDecaux Group

• Clear Channel Outdoor

• Moving Walls

• GIGIL Manila

Q8: How are businesses in Southeast Asia leveraging technology to enhance advertising effectiveness?

Businesses are integrating AI, automation, and data analytics to improve targeting precision and campaign optimization. Programmatic platforms enable real-time bidding, while AI tools personalize ad experiences based on user behavior. This technology-driven shift is helping companies improve ROI and enhance brand engagement across multiple digital channels.

Q9: What is the future outlook for the Southeast Asia Advertising Market?

The future of advertising in Southeast Asia lies in personalized, cross-channel, and AI-driven campaigns. With the continued rise of mobile advertising, digital video, and retail media networks, brands will focus on contextual relevance, automation, and privacy compliance. The region’s dynamic consumer base and growing digital infrastructure position it for sustained double-digit growth through 2033.

Related Reports

Customers who bought this item also bought