- Home

- About Us

- Industry

- Services

- Reading

- Contact Us

Wi-Fi 7 Market: Current Analysis and Forecast (2025-2033)

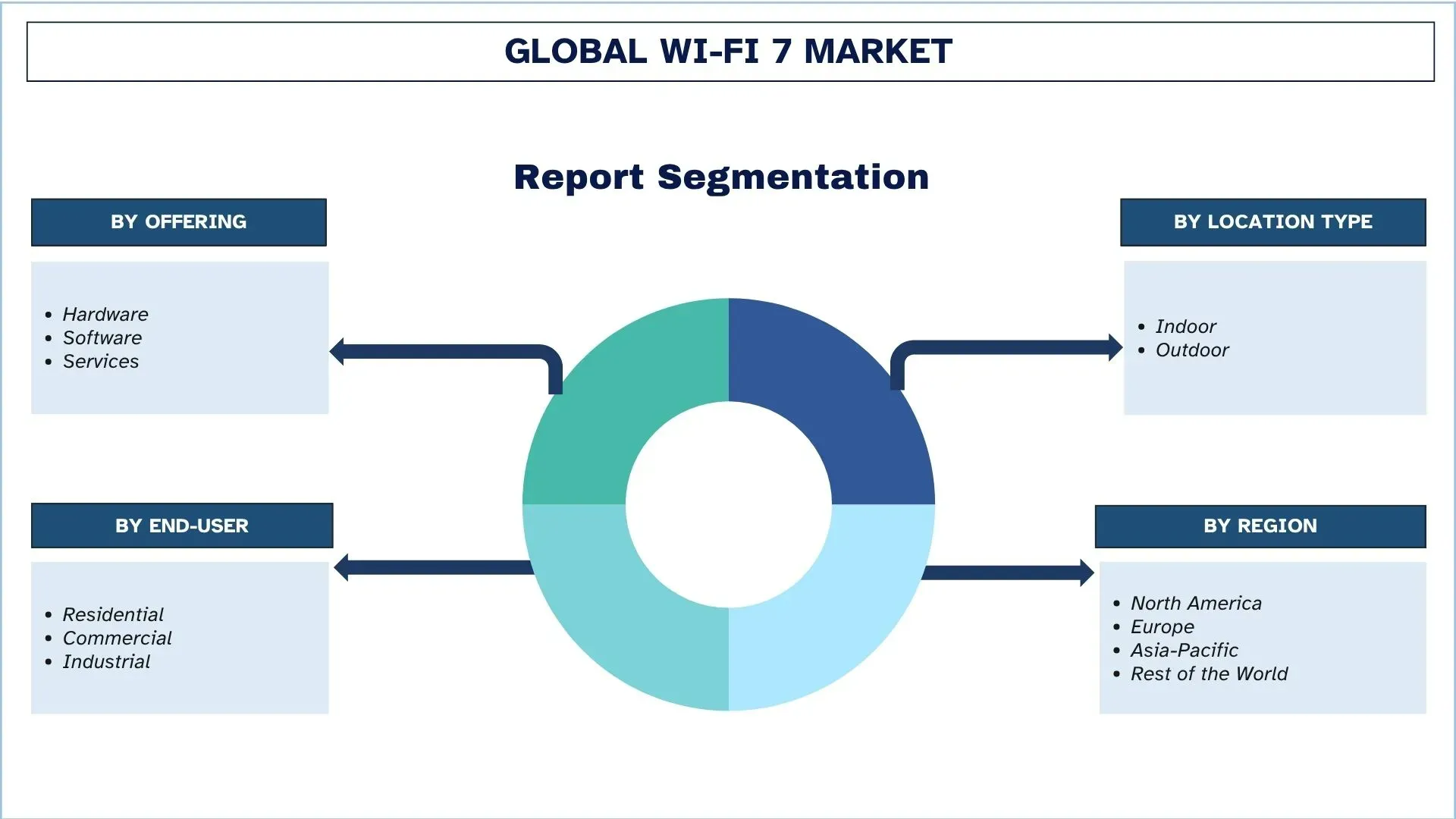

Emphasis on Offering (Hardware, Software, and Services); Location Type (Indoor and Outdoor); End-User (Residential, Commercial, and Industrial); and Region/Country

Global Wi-Fi 7 Market Size & Forecast

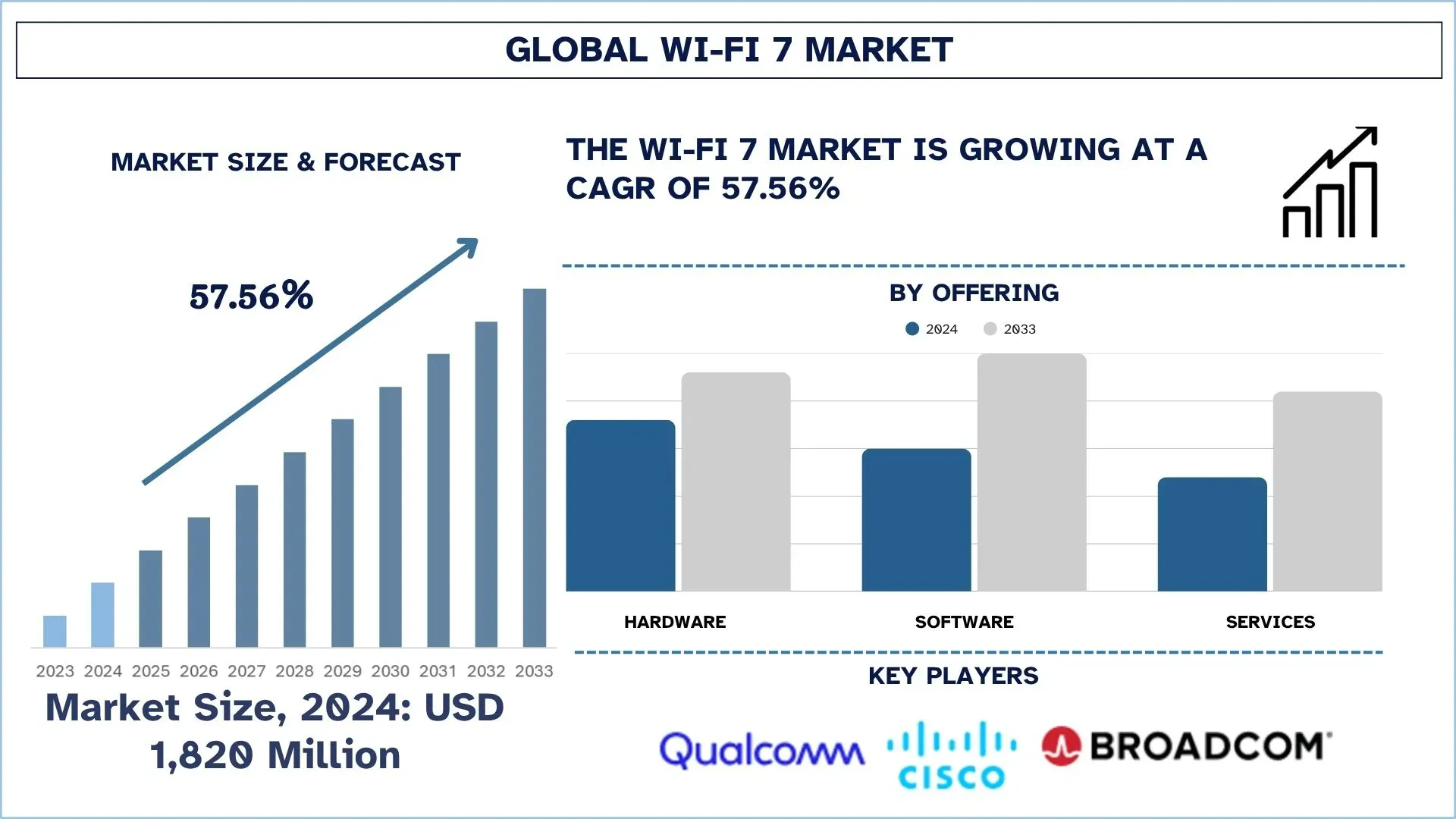

The global Wi-Fi 7 market was valued at USD 1,820 million in 2024 and is expected to grow at a strong CAGR of around 57.56% during the forecast period (2025-2033F), driven by the rising demand for ultra-fast, low-latency connectivity to support data-intensive applications such as 8K streaming, AR/VR, and cloud gaming.

Wi-Fi 7 Market Analysis

Wi-Fi 7 (IEEE 802.11be) is the seventh generation of the 802.11 standard since 1997. It packs all the benefits of Wi-Fi 6/6E and expands several existing standards to a whole new level, such as 320 MHz bandwidth and 4K-QAM, and it introduces some revolutionary features like Multi-Link Operation, Multi-Resource Units (MRU), and puncturing. The Wi-Fi 7 market is driven by the increased popularity of hyper-speed and low-latency connectivity, which accommodates bandwidth-intensive applications such as 8K video streaming, augmented / virtual reality, and cloud gaming. Moreover, chipset development and access to a 6 GHz spectrum are driving broader implementation in residential, commercial, and industrial sectors.

Global Wi-Fi 7 Market Trends

This section discusses the key market trends that are influencing the various segments of the global Wi-Fi 7 market, as found by our team of research experts.

Rising launch of Wi‑Fi 7 routers, laptops, and smartphones: The Latest Trend in the TPE Market

The launch of Wi-Fi 7-enabled routers, laptops, and smartphones is one of the primary emerging trends in the Wi-Fi 7 market, indicating its rapid commercialization and high consumer readiness. The top OEMs, such as Qualcomm, Broadcom, and MediaTek, have already stepped up the development of chipsets to allow brands, like Samsung, Xiaomi, and ASUS, to launch Wi-Fi 7-compatible devices. Due to this, a large-scale adoption is anticipated as compatibility among devices grows and prices become normalized, which will further spur upgrades across residential, enterprise, and industrial markets.

Wi-Fi 7 Industry Segmentation

This section provides an analysis of the key trends in each segment of the global Wi-Fi 7 market report, along with forecasts at the global, regional, and country levels for 2025-2033.

The Hardware Segment Dominates the Global Wi-Fi 7 Market

Based on the offering category, the market is categorized into hardware, software, and services. Among these, the hardware segment occupies the largest market share in the Wi-fi 7 market since there is a high demand for routers, access points, and chipsets that can support next-gen connectivity. This dominance is supported by the early participation of consumers and enterprises, who aim at upgrading their physical infrastructure, and this has resulted in the frequent introduction of new products by leading players. For instance, in November 2024, Cisco launched Wi-Fi 7 access points, which feature the intelligence, security, and assurance of Cisco's advanced networking portfolio. However, the software segment is projected to record the fastest growth in the future, driven by software-advanced network management, Artificial Intelligence-based optimization, and cybersecurity solutions, which are also becoming a necessity to deal with the increasingly complex Wi-Fi 7 environments.

The Residential Segment Dominates the Global Wi-Fi 7 Market.

Based on the end-user category, the market is segmented into residential, commercial, and industrial. Among these, the residential segment currently holds the largest market share, driven by high-speed internet applications in smart home connections, gaming, and streaming. However, the commercial segment is expected to grow the fastest, as business establishments are upgrading their networks to support hybrid work, cloud collaboration, and data-intensive applications in offices, schools, and hospitals.

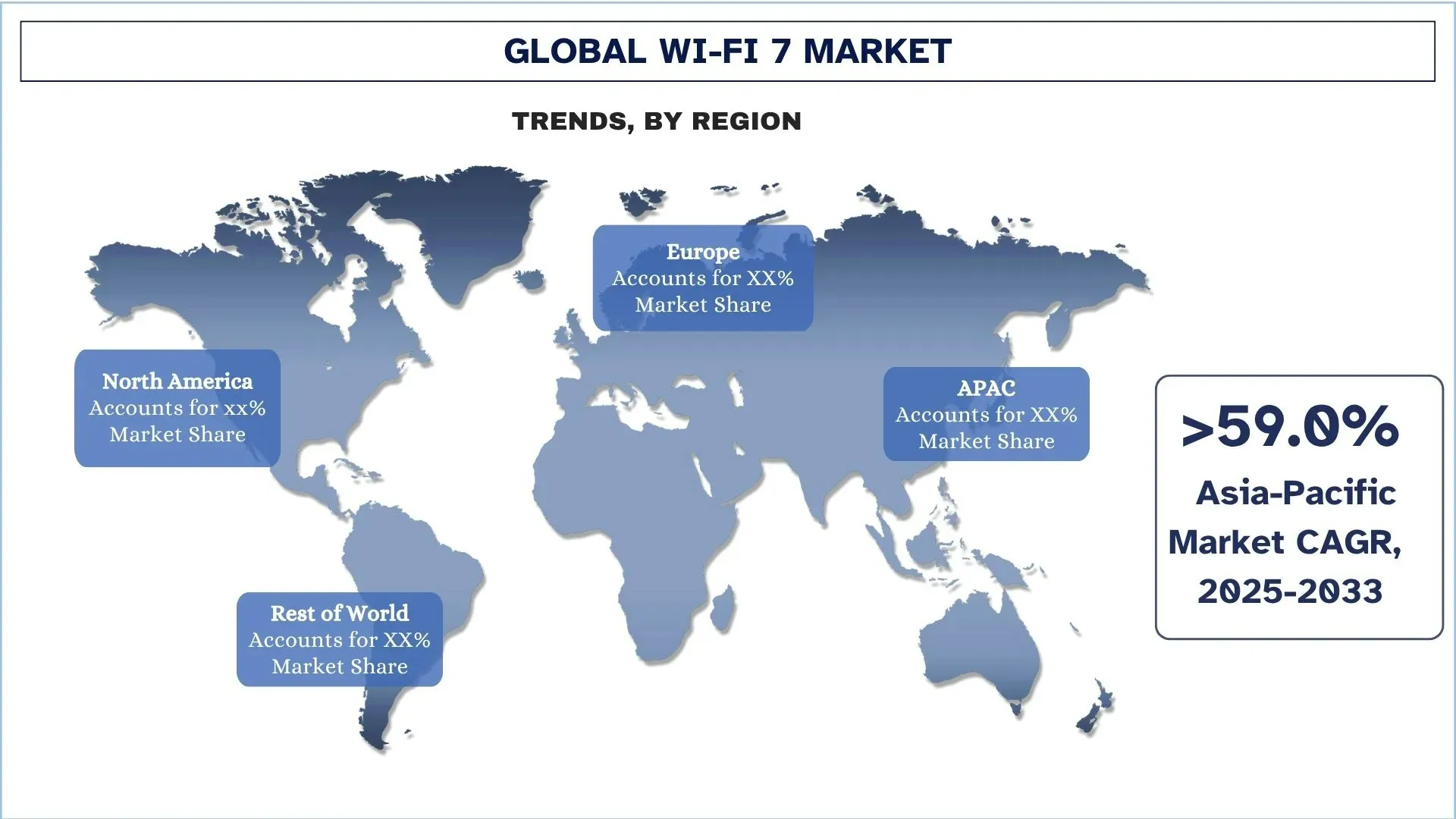

North America holds the largest market share in the global Wi-Fi 7 market

North America holds the largest market share in the global Wi-Fi 7 market due to its early adoption of the latest wireless technologies, sophisticated digital infrastructure, and progressive spectrum regulation by agencies such as the FCC, which enables the appropriate use of the 6 GHz band. Adding to this, the presence of prominent players like Intel, Qualcomm, Cisco, and Broadcom in the United States further brings innovation and commercialization of Wi-Fi 7-enabled equipment faster. There is also a significant need to ensure that consumers get high-speed internet, which accelerates Wi-Fi 7 deployment and revenue generation in the North America region.

The United States held a Dominant share of the North America Wi-Fi 7 Market in 2024

North American Wi-Fi 7 market is dominated by the United States, due to its advanced technological ecosystem, high penetration of next-generation connectivity, and aggressive investments in the development of advanced networking infrastructure. Availability of the 6 GHz spectrum by the FCC in advance gave the U.S. an advantage in supporting the Wi‑Fi 7 readiness. The presence of leading companies such as Intel, Qualcomm, and Cisco, headquartered in the U.S., facilitated the innovation and mass deployments. Moreover, the increased penetration of smart homes and enterprise digitalization, along with the availability of required connectivity, facilitate wi-fi 7 market penetration in the country.

For instance, in February 2024, CommScope, which is a global leader in network connectivity, and Boldyn Networks (Boldyn), which is a leading neutral host provider in the United States and globally, together announced the deployment of Wi-Fi 7 indoor access points in selected areas of “Camping World Stadium” in Orlando, Florida. A 65,000-seat venue, Camping World Stadium is home to world-class events, including sporting games and concerts. Initially deployed in press and VIP areas, the RUCKUS® R770 Wi-Fi® access points are the first Wi-Fi 7 deployment in a major stadium.

Wi-Fi 7 Industry Competitive Landscape

The global Wi-Fi 7 market is competitive, with several global and international market players. The key players are adopting different growth strategies to enhance their market presence, such as partnerships, agreements, collaborations, geographical expansions, and mergers and acquisitions.

Top Wi-Fi 7 Companies

Some of the major players in the market are Intel Corporation, Qualcomm Technologies, Inc., Cisco Systems, Inc., Broadcom, CommScope, VVDN Technologies, Zyxel, ZTE Corporation, ASUSTek Computer Inc., and MediaTek Inc.

Recent Developments in the Wi-Fi 7 Market

In April 2025, Synaptics® Incorporated announced that it has extended its Veros wireless portfolio with its first family of Wi-Fi® 7 systems-on-chips (SoCs) tailored for the Internet of Things (IoT). Comprising the SYN4390 and SYN4384, the scalable offering supports bandwidths of up to 320 MHz, delivering a peak speed of 5.8 Gbps and low latency. The triple-combo SoCs integrate Wi-Fi 7 with Bluetooth® 6.0 and Zigbee/Thread, support Matter, and are designed to minimize system cost and power consumption.

In March 2025, VVDN Technologies, which is a global provider of software, product engineering, and electronics manufacturing services and solutions, announced a collaboration with Qualcomm Technologies, Inc. to introduce its next-generation Wi-Fi 7 access point reference design. Powered by the Qualcomm Dragonwing™ NPro A7 Platform, this AI-driven reference design is built for customizable deployments. This collaboration aims to enhance user experiences with superior performance and intelligence while providing a cost-effective solution for customers seeking the best AI and Wi-Fi experience at an affordable price.

Global Wi-Fi 7 Market Report Coverage

Report Attribute | Details |

Base year | 2024 |

Forecast period | 2025-2033 |

Growth momentum | Accelerate at a CAGR of 57.56% |

Market size 2024 | USD 1,820 million |

Regional analysis | North America, Europe, APAC, Rest of the World |

Major contributing region | The Asia-Pacific region is expected to dominate the market during the forecast period. |

Key countries covered | U.S., Canada, Germany, U.K., Spain, Italy, France, China, Japan, and India. |

Companies profiled | Intel Corporation, Qualcomm Technologies, Inc., Cisco Systems, Inc., Broadcom, CommScope, VVDN Technologies, Zyxel, ZTE Corporation, ASUSTek Computer Inc., and MediaTek Inc. |

Report Scope | Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Demand and Supply Side Analysis; Competitive Landscape; Company Profiling |

Segments Covered | By Offering, By Location Type, By End-User, and By Region/Country |

Reasons to Buy the Wi-Fi 7 Market Report:

The study includes market sizing and forecasting analysis confirmed by authenticated key industry experts.

The report briefly reviews overall industry performance at a glance.

The report covers an in-depth analysis of prominent industry peers, primarily focusing on key business financials, type portfolios, expansion strategies, and recent developments.

Detailed examination of drivers, restraints, key trends, and opportunities prevailing in the industry.

The study comprehensively covers the market across different segments.

Deep dive regional level analysis of the industry.

Customization Options:

The global Wi-Fi 7 market can further be customized as per the requirements or any other market segment. Besides this, UnivDatos understands that you may have your own business needs; hence, feel free to contact us to get a report that completely suits your requirements.

Table of Content

Research Methodology for the Global Wi-Fi 7 Market Analysis (2023-2033)

We analyzed the historical market, estimated the current market, and forecasted the future market of the global Wi-Fi 7 market to assess its application in major regions worldwide. We conducted exhaustive secondary research to gather historical market data and estimate the current market size. To validate these insights, we carefully reviewed numerous findings and assumptions. Additionally, we conducted in-depth primary interviews with industry experts across the Wi-Fi 7 value chain. After validating market figures through these interviews, we used both top-down and bottom-up approaches to forecast the overall market size. We then employed market breakdown and data triangulation methods to estimate and analyze the market size of industry segments and sub-segments.

Market Engineering

We employed the data triangulation technique to finalize the overall market estimation and derive precise statistical numbers for each segment and sub-segment of the global Wi-Fi 7 market. We split the data into several segments and sub-segments by analyzing various parameters and trends, including offering, location type, end-user, and regions within the global Wi-Fi 7 market.

The Main Objective of the Global Wi-Fi 7 Market Study

The study identifies current and future trends in the global Wi-Fi 7 market, providing strategic insights for investors. It highlights regional market attractiveness, enabling industry participants to tap into untapped markets and gain a first-mover advantage. Other quantitative goals of the studies include:

Market Size Analysis: Assess the current and forecast market size of the global Wi-Fi 7 market and its segments in terms of value (USD).

Wi-Fi 7 Market Segmentation: Segments in the study include areas of offering, location type, end-user, and region.

Regulatory Framework & Value Chain Analysis: Examine the regulatory framework, value chain, customer behavior, and competitive landscape of the Wi-Fi 7 industry.

Regional Analysis: Conduct a detailed regional analysis for key areas such as Asia Pacific, Europe, North America, and the Rest of the World.

Company Profiles & Growth Strategies: Company profiles of the Wi-Fi 7 market and the growth strategies adopted by the market players to sustain the fast-growing market.

Frequently Asked Questions FAQs

Q1: What is the global Wi-Fi 7 market’s current market size and growth potential?

As of 2024, the global Wi‑Fi 7 market is valued at USD 1,820 million and is projected to grow at an impressive CAGR of 57.56% from 2025 to 2033. This strong growth is driven by increasing demand for ultra-fast wireless connectivity, smart homes, and next-gen enterprise networking.

Q2: Which segment has the largest share of the global Wi-Fi 7 market by offering?

The hardware segment holds the largest share of the global Wi‑Fi 7 market, driven by the rising demand for routers, chipsets, access points, and consumer electronics integrating Wi‑Fi 7 capabilities.

Q3: What are the driving factors for the growth of the global Wi-Fi 7 market?

Top growth drivers of the Wi‑Fi 7 market include:

• Rising demand for ultra-low latency and high-speed connectivity.

• Explosion of IoT and connected smart devices.

• Widespread adoption of hybrid work models and smart home technologies.

Q4: What are the emerging technologies and trends in the global Wi-Fi 7 market?

Emerging trends in the Wi‑Fi 7 market include:

• Launch of advanced Wi‑Fi 7 routers, laptops, and smartphones.

• Expansion of Wi‑Fi 7 mesh systems for seamless home and enterprise coverage.

• AI-based optimization and integration with 5G networks.

Q5: What are the key challenges in the global Wi-Fi 7 market?

Key challenges in the Wi‑Fi 7 market include:

• High initial infrastructure and device costs.

• Consumer confusion due to fragmented device availability and tech understanding.

• Lack of universal spectrum regulation across regions.

Q6: Which region dominates the global Wi-Fi 7 market?

North America dominates the global Wi‑Fi 7 market due to early adoption of advanced wireless technologies, presence of key players like Intel, Qualcomm, and Cisco, and proactive spectrum allocation by the FCC.

Q7: Who are the key companies in the global Wi-Fi 7 market?

Top players in the Wi-Fi 7 industry include:

• Intel Corporation

• Qualcomm Technologies, Inc.

• Cisco Systems, Inc.

• Broadcom

• CommScope

• VVDN Technologies

• Zyxel

• ZTE Corporation

• ASUSTek Computer Inc.

• MediaTek Inc.

Q8: What are the investment opportunities and competitive advantages in the Wi‑Fi 7 market?

The Wi‑Fi 7 market presents lucrative investment opportunities across hardware manufacturing, chipset innovation, cloud-managed network solutions, and enterprise-grade Wi‑Fi infrastructure. Early entrants can gain a competitive edge by aligning with evolving demands in smart cities, IoT ecosystems, and ultra-low latency applications like AR/VR.

Q9: How should technology providers and OEMs prepare for Wi‑Fi 7 deployment and adoption?

OEMs and network solution providers should focus on R&D in Wi‑Fi 7 chipset integration, backward compatibility, and cloud-managed solutions while aligning with global spectrum regulations. Early product launches, strategic partnerships, and ecosystem development will be crucial for capturing market share.

Related Reports

Customers who bought this item also bought