- Home

- About Us

- Industry

- Services

- Reading

- Contact Us

Brazil Intellectual Property Software Market: Current Analysis and Forecast (2025-2033)

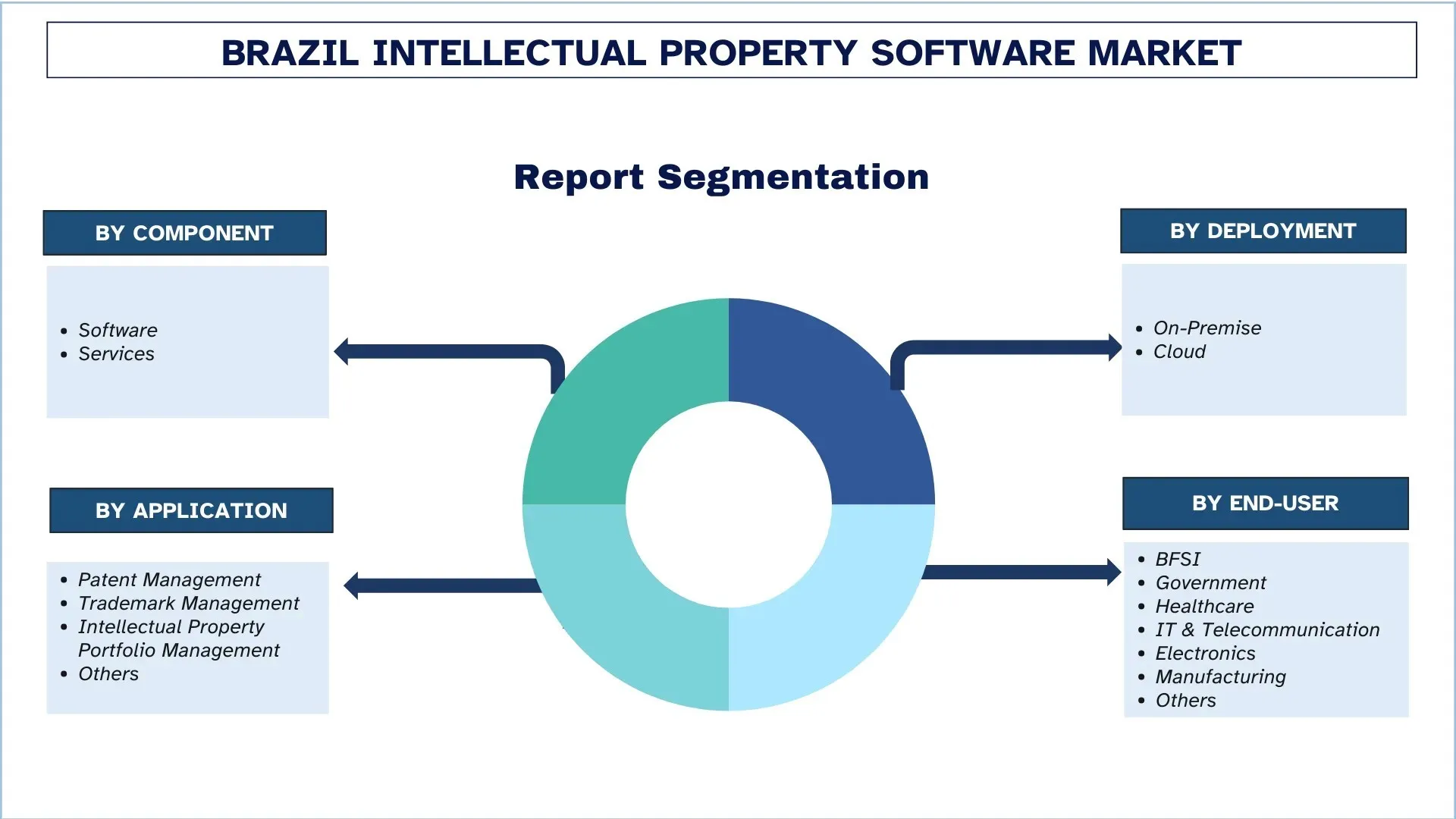

Emphasis By Component (Software and Services), By Deployment (On-Premise and Cloud), By Application (Patent management, Trademark management, Intellectual Property Portfolio Management, and Others), By End-User (BFSI, Government, Healthcare, IT & Telecommunication, Electronics, Manufacturing, and Others), By Region (North Brazil, Northeast Brazil, Central-West Brazil, Southeast Brazil, and South Brazil)

Brazil Intellectual Property Software Market Size & Forecast

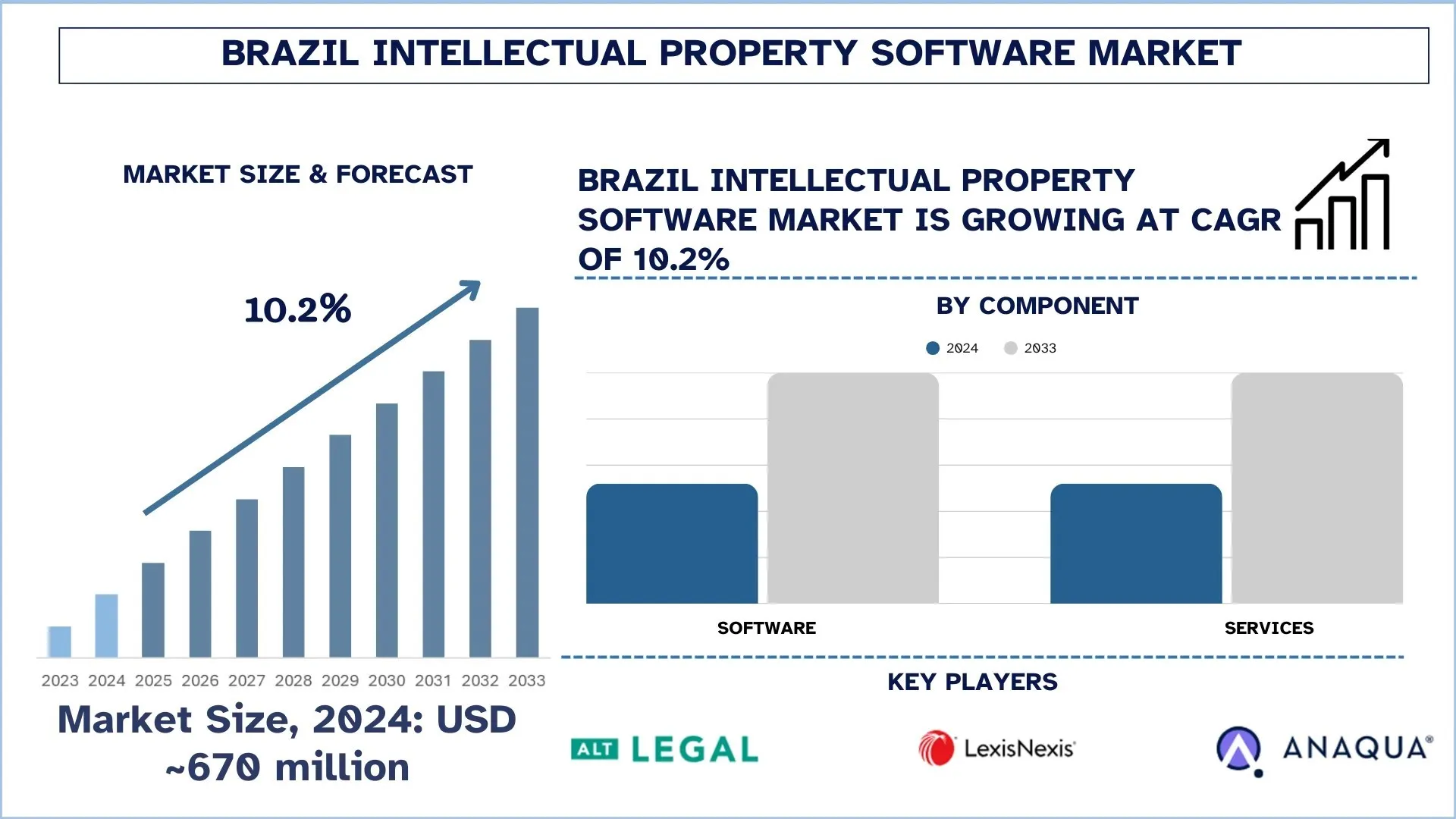

The Brazilian Intellectual Property Software Market was valued at USD 670 million in 2024 and is expected to grow at a strong CAGR of around 10.2% during the forecast period (2025-2033F), owing to Rising patent and trademark filings and Brazil as a Regional Innovation Leader.

Brazil Intellectual Property Software Market Analysis

Intellectual Property (IP) Software market in Brazil is a quickly developing market due to local, as well as international phenomena. The overall improvement of digital infrastructure, the rise of technological investments in Brazil, and the increasing demand for software solutions are fueling the market to a considerable extent. With a variety of industries, including agriculture, technology, and others, Brazil is becoming ever more interested in IP software in patent management, copyright, and trademark regulations. The market has huge potential as the economy is modernizing, as are the intellectual property systems. The demand for IP solutions is being driven by the increase in the number of tech start-ups and innovation ecosystems (particularly in urban areas). Additionally, the growing interest in securing domestic inventions and innovations, as well as the increasing involvement in IP cooperation in the international sphere, positions Brazil as a key player to challenge IP software on an international scale.

Brazil Intellectual Property Software Market Trends

This section discusses the key market trends that are influencing the various segments of the Brazil Intellectual Property Software market, as found by our team of research experts.

Strengthened Enforcement & Anti‑Counterfeiting Framework:

The commitment to a stronger enforcement and anti-counterfeiting framework amounts to the increased influence of the effective intellectual property (IP) software market in Brazil. Brazil has focused in recent years on efforts to fight piracy, unlicensed use of software, and duplication of digital products, keeping pace with the best practices in the world. The increase in stringent standards of compliance accepted by the government, along with the growing cooperation between regulatory bodies and stakeholders in the private sector, is strengthening the integrity of the market.

The implications of the trend for software providers are increased legal protections, a better return on any innovation, and increased reassurance on any commercial expansion. Moreover, the judicial and enforcement bodies of Brazil are fast-tracking the settlement of cases and using high-tech-based surveillance provisions to identify and prevent violations better. Such developments not only protect the software developers but also stimulate foreign investments because they illustrate the fact that Brazil is increasingly committed to the role of IP and its rights. This has resulted in a clearer, secure, and innovative-friendly marketplace.

Brazil Intellectual Property Software Industry Segmentation:

This section provides an analysis of the key trends in each segment of the Brazil Intellectual Property Software market report, along with forecasts at the country and regional levels for 2025-2033.

Software Category has shown promising growth in the Intellectual Property Software Market.

Based on the component, the Brazilian Intellectual Property Software Market has been bifurcated into software and services. Of these, the software segment has held the majority market share. The key factors that contribute to this kind of dominance are the rising use of automation tools and the application of artificial intelligence solutions to the process of managing patents, trademarks, and copyrights. The use of software solutions enables businesses to manage their IP portfolios effectively, monitor them in real-time, and increase protection against infringement. Besides, the rising interest in technological startups and innovative sectors in Brazil has led to a demand for software that can simplify IP management procedures, thus spurring the growth of the segment. The growth of digital transformation and the need for secure and cost-efficient IP solutions also contribute to the growth of this market segment.

On-Premise Category Dominates the Brazilian Intellectual Property Software Market.

On-Premise and Cloud form the two segments of the Brazil intellectual property software market on the basis of Deployment. On-premise solutions are still attractive due to increased control, improved data protection, and deep customization in infrastructure among big enterprises. On the other hand, cloud deployment is gaining traction at a fast pace due to flexibility, affordability, expandability, and the capacity to sustain remote functionalities. The segment, particularly small and medium enterprises, is shifting towards cloud-based platforms to streamline operations, ease IT load, and enhance collaboration, and the future is bright as far as the cloud is concerned.

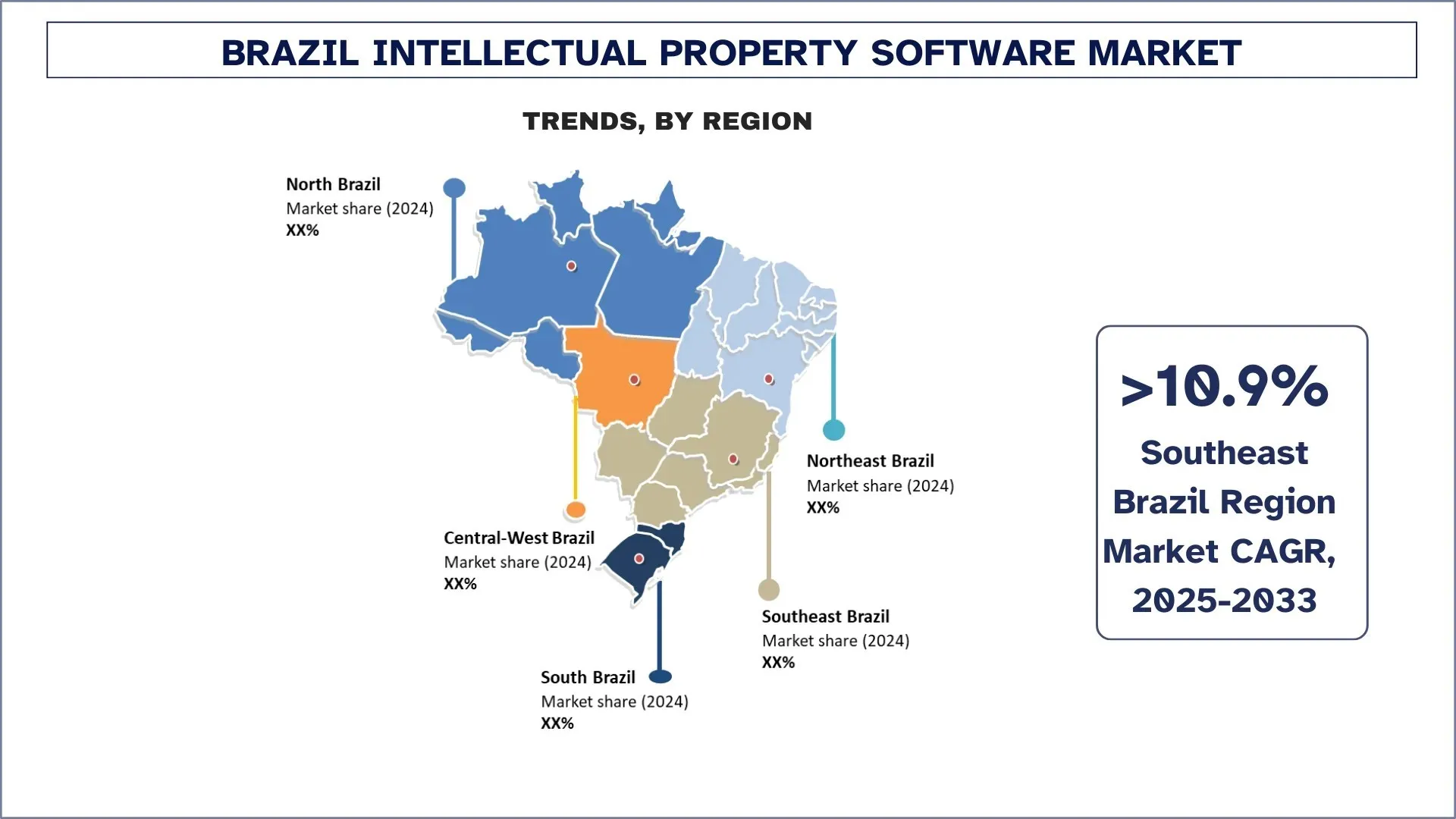

Southeast Brazil is expected to grow at a considerable rate during the forecast period.

The Southeast Brazil IP software market is a highly competitive part of the country with great dynamic growth and localization. It is propelled by the region's economic power, with key industries including technology, healthcare, and manufacturing. Also, the economic center of Brazil, São Paulo, is a central point in the market, and the market is host to numerous tech startups and established businesses that use the best IP software designed and updated to manage patents, trademarks, and copyrights, as well as copyright protection. Businesses are also seeking to automate the IP management process, thereby deploying AI-enabled IP management systems to enhance business efficiency and provide better IP protection. Additionally, the region's emphasis on innovation and digitalization is likely to further drive growth, qualifying Southeast Brazil to be a national leader in IP software development.

Brazil Intellectual Property Software Industry Competitive Landscape:

The Brazil Intellectual Property Software market is competitive, with several global and international market players. The key players are adopting different growth strategies to enhance their market presence, such as partnerships, agreements, collaborations, new product launches, geographical expansions, and mergers and acquisitions.

Top Brazil Intellectual Property Software Companies

Some of the major players in the market are Alt Legal, Inc., Minesoft, LexisNexis, Clarivate, Anaqua, Inc., Questel, and Dennemeyer.

Brazil Intellectual Property Software Market Report Coverage

Report Attribute | Details |

Base year | 2024 |

Forecast period | 2025-2033 |

Growth momentum | Accelerate at a CAGR of 10.2% |

Market size 2024 | USD 670 Million |

Regional analysis | North Brazil, Northeast Brazil, Central-West Brazil, Southeast Brazil, and South Brazil |

Major contributing region | Southeast Brazil is expected to dominate the market during the forecast period. |

Companies profiled | Alt Legal, Inc., Minesoft, LexisNexis, Clarivate, Anaqua, Inc., Questel, and Dennemeyer |

Report Scope | Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Demand and Supply Side Analysis; Competitive Landscape; Company Profiling |

Segments Covered | By Component, By Deployment, By Application, By End-User, By Region |

Reasons to Buy the Brazil Intellectual Property Software Market Report:

The study includes market sizing and forecasting analysis confirmed by authenticated key industry experts.

The report briefly reviews overall industry performance at a glance.

The report covers an in-depth analysis of prominent industry peers, primarily focusing on key business financials, type portfolios, expansion strategies, and recent developments.

Detailed examination of drivers, restraints, key trends, and opportunities prevailing in the industry.

The study comprehensively covers the market across different segments.

Deep dive regional-level analysis of the industry.

Customization Options:

The Brazil Intellectual Property Software Market can further be customized as per the requirements or any other market segment. Besides this, UnivDatos understands that you may have your own business needs; hence, feel free to contact us to get a report that completely suits your requirements.

Table of Content

Research Methodology for the Brazil Intellectual Property Software Market Analysis (2023-2033)

We analyzed the historical market, estimated the current market, and forecasted the future market of the Brazil Intellectual Property Software market to assess its application in major regions. We conducted exhaustive secondary research to gather historical market data and estimate the current market size. To validate these insights, we carefully reviewed numerous findings and assumptions. Additionally, we conducted in-depth primary interviews with industry experts across the Intellectual Property Software value chain. After validating market figures through these interviews, we used both top-down and bottom-up approaches to forecast the overall market size. We then employed market breakdown and data triangulation methods to estimate and analyze the market size of industry segments and sub-segments.

Market Engineering

We employed the data triangulation technique to finalize the overall market estimation and derive precise statistical numbers for each segment and sub-segment of the Brazil Intellectual Property Software market. We split the data into several segments and sub-segments by analyzing various parameters and trends, By Component, By Deployment, By Application, By End-User, and by regions within the Brazil Intellectual Property Software market.

The Main Objective of the Brazil Intellectual Property Software Market Study

The study identifies current and future trends in the Brazil Intellectual Property Software market, providing strategic insights for investors. It highlights regional market attractiveness, enabling industry participants to tap into untapped markets and gain a first-mover advantage. Other quantitative goals of the studies include:

Market Size Analysis: Assess the current forecast and market size of the Brazil Intellectual Property Software market and its segments in terms of value (USD).

Brazil Intellectual Property Software Market Segmentation: Segments in the study include areas By Component, By Deployment, By Application, By End-User, and By

Regulatory Framework & Value Chain Analysis: Examine the regulatory framework, value chain, customer behavior, and competitive landscape of the Brazil Intellectual Property Software industry.

Regional Analysis: Conduct a detailed regional analysis for key areas such as North Brazil, Northeast Brazil, Central-West Brazil, Southeast Brazil, and South Brazil.

Company Profiles & Growth Strategies: Company profiles of the Brazil Intellectual Property Software market and the growth strategies adopted by the market players to sustain the fast-growing market.

Frequently Asked Questions FAQs

Q1: What is the Brazil Intellectual Property Software market’s current market size and growth potential?

The Brazil Intellectual Property Software market was valued at 670 million in 2024 and is expected to grow at a CAGR of 10.2% during the forecast period (2025-2033).

Q2: Which segment has the largest share of the Brazil Intellectual Property Software market by Component?

The rising use of automation tools and the application of artificial intelligence solutions to the process of managing patents, trademarks, and copyrights have assisted the software category.

Q3: What are the driving factors for the growth of the Brazil Intellectual Property Software market?

• Rising Patent and Trademark Filings: A surge in IP applications is driving demand for efficient software to manage and protect assets.

• Brazil as Regional Innovation Leader: The country’s growing role as a hub for R&D and technology fosters stronger IP protection needs.

Q4: What are the emerging technologies and trends in the Brazil Intellectual Property Software market?

• Strengthened Enforcement & Anti-Counterfeiting Framework: Advanced monitoring and enforcement tools are being adopted to curb IP infringements.

• Growing Focus on IP Finance & Innovation Capitalization: Companies are increasingly leveraging IP as a financial asset, boosting demand for advanced management solutions.

Q5: What are the key challenges in the Brazil Intellectual Property Software market?

• Complex Regulatory Landscape: Diverse legal requirements create compliance burdens and slow market adoption.

• Affordability and Awareness among SMEs: Many smaller businesses face barriers in adopting IP software due to cost and lack of knowledge.

Q6: Which region dominates the Brazil Intellectual Property Software market?

The Southeast Brazil region dominates the Brazilian Intellectual Property Software market due to the rising demand from major urban centers.

Q7: Who are the key players in the Brazil Intellectual Property Software market?

Some of the top Intellectual Property Software companies in Brazil include:

• Alt Legal, Inc.

• Minesoft

• LexisNexis

• Clarivate

• Anaqua, Inc.

• Questel

• Dennemeyer

• Others

Q8: What are the opportunities for companies within the Brazil Intellectual Property Software market?

• Growing Creative Economy ("Orange Economy"): The rise of Brazil’s creative industries is boosting demand for robust IP protection and software solutions.

• Expansion through Internationalization: Increasing cross-border collaborations and global market entry create opportunities for IP software adoption to manage and protect international assets.

Q9: How are consumer preferences shaping product development in the Brazil Intellectual Property Software market?

Consumer preferences in Brazil’s Intellectual Property Software market emphasize affordability, user-friendly design, automation, and compliance support, pushing developers to create accessible, efficient, and scalable solutions tailored to SMEs and innovation-driven enterprises.

Related Reports

Customers who bought this item also bought