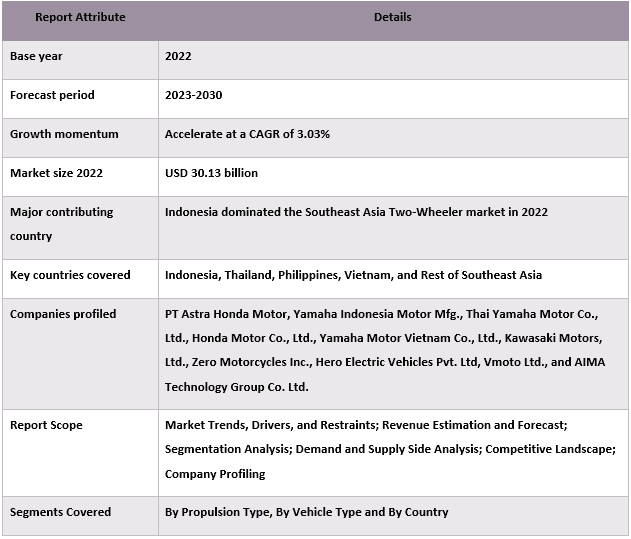

東南亞二輪車市場:現況分析與預測 (2023-2030)

著重於推進類型(內燃機車輛 {50 cc以下、100-250 cc以及250 cc以上} 和電動車輛);車輛類型(機車和速克達)和地區/國家

東南亞二輪車市場規模與預測

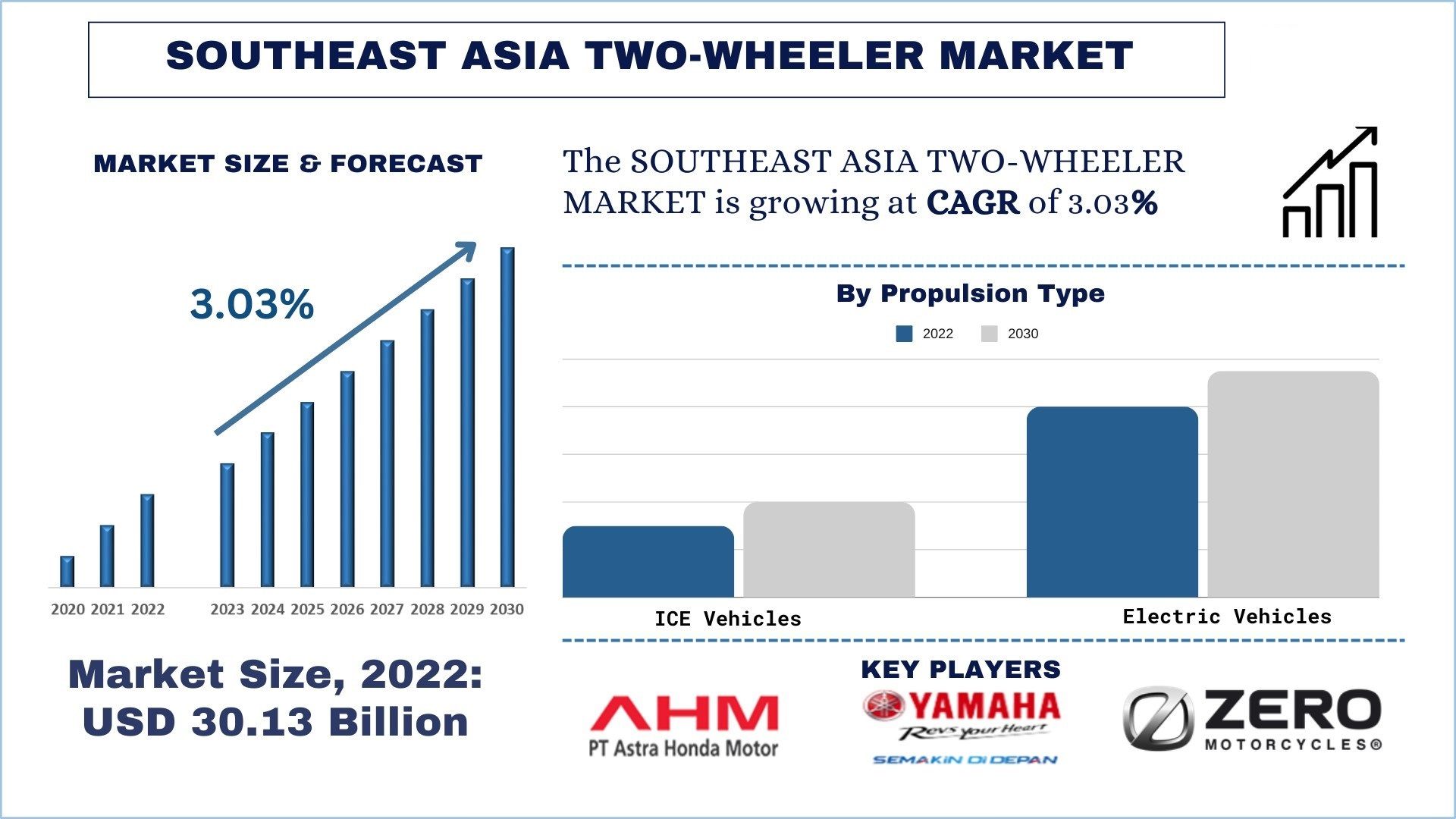

東南亞二輪車市場估值為 301.2 億美元,預計在預測期內(2023-2030 年)將以約 3.03% 的強勁複合年增長率增長,這歸因於全球航空運輸量的增加和安全問題。

東南亞二輪車市場分析

東南亞許多城市的公共運輸基礎設施目前正處於發展過程中,導致覆蓋範圍存在差距,並且與特定區域的連接有限。二輪車作為「最後一哩」的交通方式發揮著關鍵作用,彌合了公共運輸樞紐與最終目的地之間的距離。在泰國和菲律賓等國家,摩托計程車(被稱為「habal-habal」或「motorcycle taxis」)是短途旅行的熱門選擇,尤其是在傳統計程車或共享乘車服務可能不易取得的地點。這種對二輪車在「最後一哩」連接上的依賴促進了該地區對摩托車和速克達的需求。此外,食品外送服務和電子商務平台的興起進一步推動了東南亞對二輪車的需求。外送員依靠摩托車和速克達快速有效地完成訂單,從而促進了市場的整體增長。

主要參與者

市場上的一些主要參與者包括 PT Astra Honda Motor、Yamaha Indonesia Motor Mfg.、Thai Yamaha Motor Co., Ltd.、Honda Motor Co., Ltd.、Yamaha Motor Vietnam Co., Ltd.、Kawasaki Motors, Ltd.、Zero Motorcycles Inc.、Hero Electric Vehicles Pvt. Ltd、Vmoto Ltd. 和 AIMA Technology Group Co. Ltd.。這些參與者已進行了幾次併購以及合作夥伴關係,以向客戶提供高科技和創新產品/技術。

東南亞二輪車市場趨勢

有利的政府政策和激勵措施

印尼、泰國、越南和馬來西亞等國的政府已實施一系列激勵措施和法規,以促進電動二輪車的採用。這些措施包括減稅、補貼以及免除註冊費和道路稅。例如,泰國政府為購買電動摩托車提供高達 18,000 泰銖(約 500 美元)的補貼。同樣,印尼已設定到 2035 年每年生產 250 萬輛電動摩托車的目標。此外,由於人們越來越認識到傳統汽油動力汽車造成的生態後果,東南亞的消費者也越來越關注自己的碳足跡。電動二輪車提供了一種永續的選擇,因為它們不產生直接排放,並且與汽油車相比,營運成本也大大降低。這種日益增強的環保意識,尤其是在年輕族群中,正在推動對電動二輪車的需求。

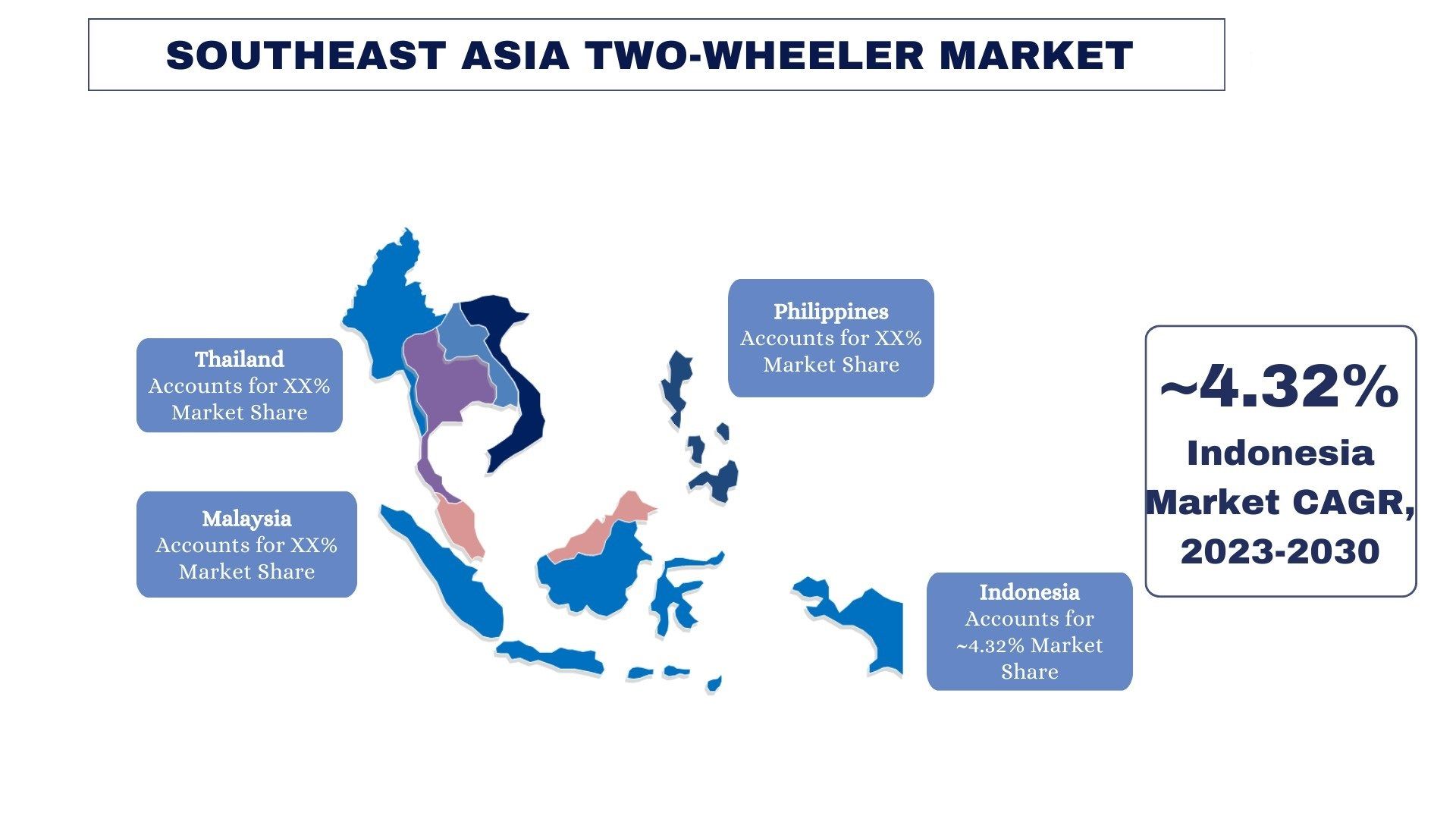

印尼主導東南亞二輪車市場

由於龐大的消費群體,印尼市場主導了二輪車市場,預計將繼續保持這種態勢。由於印尼是世界上人口第四多的國家,擁有 2.79 億人口。此外,由於對經濟運輸方式的需求不斷增長,以及道路基礎設施的改善,過去幾年對二輪車的需求有所增加。例如,根據「印尼摩托車工業協會 (AISI)」發布的報告,2021 年 3 月的總銷量為 521,424 輛,到 2024 年 1 月增加到 592,658 輛。此外,印尼政府收緊了貨幣政策,使得摩托車購買的融資更加困難。此外,Gojek、Tokopedia 和 Bluebird 等行動服務提供商在印尼迅速發展,這在過去十年中並行加速了對摩托車和乘用車的需求。

東南亞二輪車市場報告涵蓋範圍

購買本報告的理由:

- 該研究包括經過認證的關鍵行業專家驗證的市場規模和預測分析。

- 該報告快速回顧了整體行業績效。

- 該報告深入分析了主要的行業同行,主要關注關鍵業務財務、產品組合、擴張策略和最新發展。

- 詳細審查了行業中普遍存在的驅動因素、限制因素、主要趨勢和機會。

- 該研究全面涵蓋了不同細分市場的市場。

- 深入分析了該行業的區域層面。

客製化選項:

東南亞二輪車市場可以根據需求或任何其他細分市場進一步客製化。除此之外,UMI 了解您可能有自己的業務需求,因此請隨時與我們聯繫以獲取完全符合您需求的報告。

目錄

東南亞二輪車市場分析(2023-2030)的研究方法

分析歷史市場、估算當前市場以及預測東南亞二輪車市場的未來市場是創建和分析東南亞主要地區二輪車採用情況的三個主要步驟。進行了詳盡的二級研究,以收集歷史市場數據並估算當前市場規模。其次,為了驗證這些見解,考慮了許多發現和假設。此外,還與東南亞二輪車價值鏈中的行業專家進行了詳盡的初步訪談。在通過初步訪談對市場數據進行假設和驗證後,我們採用了自上而下/自下而上的方法來預測完整的市場規模。此後,採用市場細分和數據三角測量方法來估算和分析行業相關的細分市場和子細分市場的市場規模。詳細方法如下所述:

歷史市場規模分析

步驟 1:深入研究二級來源:

進行了詳細的二級研究,通過公司內部來源(例如年度報告和財務報表、業績演示、新聞稿等)以及外部來源(包括期刊、新聞和文章、政府出版物、競爭對手出版物、行業報告、第三方數據庫和其他可靠的出版物)來獲取東南亞二輪車市場的歷史市場規模。

步驟 2:市場細分:

在獲得東南亞二輪車市場的歷史市場規模後,我們進行了詳細的二級分析,以收集主要地區不同細分市場和子細分市場的歷史市場見解和份額。報告中包含的主要細分市場包括推進類型、車輛類型。此外,還進行了國家/地區層面的分析,以評估該地區測試模型的總體採用情況。

步驟 3:因素分析:

在獲得不同細分市場和子細分市場的歷史市場規模後,我們進行了詳細的因素分析,以估算東南亞二輪車市場的當前市場規模。此外,我們使用推進類型和東南亞二輪車的車輛類型等自變量和因變量進行了因素分析。我們對需求和供應方情景進行了徹底分析,考慮了全球東南亞二輪車市場領域的頂級合作夥伴關係、併購、業務擴張和產品發布。

當前市場規模估算與預測

當前市場規模:基於上述 3 個步驟的可行見解,我們得出了東南亞二輪車市場的當前市場規模、主要參與者以及細分市場的市場份額。所有需要的百分比份額拆分和市場細分均使用上述二級方法確定,並通過初步訪談進行驗證。

估算與預測:對於市場估算和預測,權重被分配給包括驅動因素和趨勢、限制以及利益相關者可用的機會在內的各種因素。在分析了這些因素之後,應用了相關的預測技術,即自上而下/自下而上的方法,以得出 2030 年主要市場不同細分市場和子細分市場的市場預測。用於估算市場規模的研究方法包括:

- 該行業的市場規模,以收入(美元)和東南亞主要市場的二輪車市場的採用率衡量。

- 市場細分和子細分的所有百分比份額、拆分和細分。

- 東南亞二輪車領域的主要參與者(就提供的產品而言)。此外,這些參與者為在快速增長的市場中競爭而採取的增長策略。

市場規模和份額驗證

初步研究:與主要意見領袖 (KOL) 進行了深入訪談,包括主要地區的高層管理人員(CXO/VP、銷售主管、營銷主管、運營主管、區域主管、國家/地區主管等)。然後對初步研究結果進行總結,並進行統計分析以證明所述假設。初步研究的輸入與二級研究結果合併,從而將信息轉化為可操作的見解。

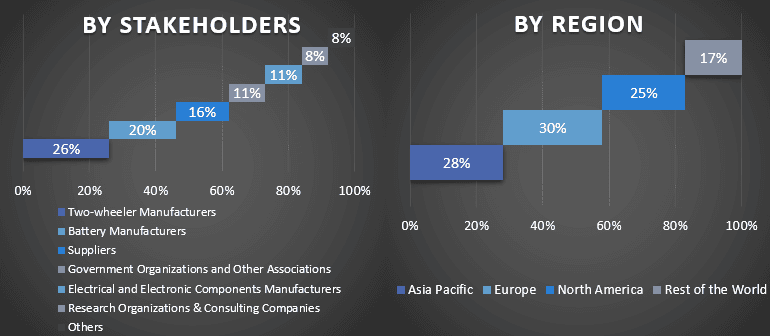

不同地區的初步參與者分配

市場工程

採用數據三角測量技術來完成整體市場估算,並得出東南亞二輪車市場各個細分市場和子細分市場的精確統計數字,在研究了東南亞二輪車領域的推進類型和車輛類型的各種參數和趨勢後,數據被分為幾個細分市場和子細分市場。

東南亞二輪車市場研究的主要目標

該研究精確指出了東南亞二輪車市場的當前和未來市場趨勢。投資者可以獲得戰略見解,以基於研究中進行的定性和定量分析來判斷其投資。當前和未來的市場趨勢決定了區域層面市場的總體吸引力,為行業參與者提供了一個利用未開發市場以從先發優勢中受益的平台。研究的其他定量目標包括:

- 分析東南亞二輪車市場以價值(美元)衡量的當前和預測市場規模。此外,分析不同細分市場和子細分市場的當前和預測市場規模。

- 研究中的細分市場包括推進類型和車輛類型領域。

- 定義和分析東南亞二輪車的監管框架

- 分析涉及各種中介機構的價值鏈,同時分析該行業的客戶和競爭對手行為。

- 分析主要地區東南亞二輪車市場的當前和預測市場規模。

- 報告中研究的地區主要國家包括印度尼西亞、泰國、菲律賓、越南和東南亞其他地區。

- 東南亞二輪車市場的公司概況以及市場參與者為在快速增長的市場中維持發展而採取的增長策略。

- 深入分析行業的區域層面

常見問題 常見問題

Q1:目前東南亞二輪車市場的市場規模及成長潛力為何?

Q2:推動東南亞兩輪車市場增長的主要因素是什麼?

Q3: 東南亞二輪車市場中,哪個區隔在推進類型方面佔據最大的份額?

Q4:東南亞兩輪車市場的新興技術與趨勢為何?

Q5:哪個國家將主導東南亞二輪車市場?

Q6:東南亞二輪車市場的主要參與者有哪些?

相關 報告

購買此商品的客戶也購買了