- Home

- About Us

- Industry

- Services

- Reading

- Contact Us

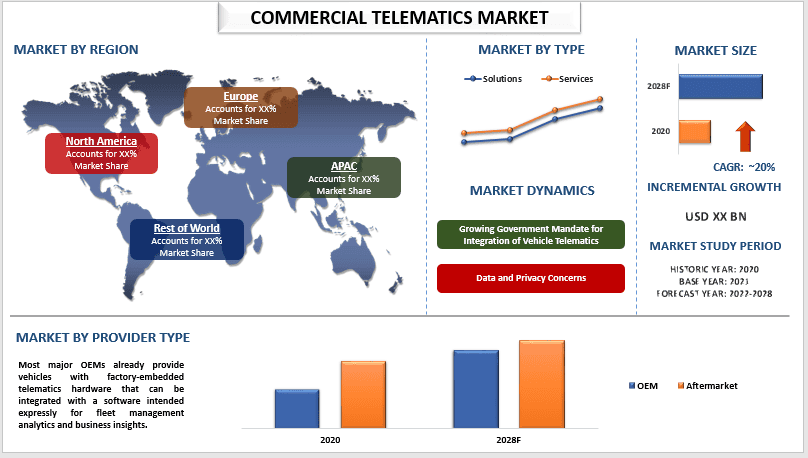

Commercial Telematics Market: Current Analysis and Forecast (2022-2028)

Emphasis on Type (Solution {Fleet tracking and monitoring, Driver management, Insurance Telematics, and Others} and Service); Provider Type (OEM and aftermarket); Region/Country

The global commercial telematics market is expected to witness a significant CAGR of around 20% during the forecast period owing to the rising concerns about fleet safety, mandatory government regulations towards vehicle maintenance & tracking, the need for operational competency in fleet management, and the rapidly increasing number of fleets are also fueling the growth of the market. Vehicle telematics is used to describe vehicle onboard communication services and applications that communicate with one another via GPS receivers and other telematics device.

Telematics solutions such as fleet/asset management systems assist in the smooth operation of a business by recognizing unsafe driver habits, reducing excess fuel usage, and providing a strategy for more efficient routes. Operators can use fleet management systems to find vehicles on demand, gather and preserve engine problem data, and spot unsafe driving tendencies like idling, forceful braking, and speeding. Thus, with rising focus on passenger and driver safety, adoption of telematics solutions to increase during 2022-2028.

Some of the major players operating in the market include Robert Bosch GmbH, Airbiquity Inc., Verizon Communications Inc., Masternaut Limited, Mix Telematics, Omnitracs LLC, Zonar Systems, Harman International, Trimble Inc., and Teletrac Navman.

Insights Presented in the Report

“Amongst type, solutions category accounted for the major share in the global market in 2020”

Based on type, the commercial telematics market is divided into solutions and services. In 2020, solutions category accounted for the major share in the global market. Major market players are creating leading-edge solutions by developing technology that solves real-world problems for fleet leaders around the globe. The companies are now developing and integrating wide array of services and offering advance telematics solutions to its customers. Some of the major solutions offered are vehicle tracking, asset tracking, maintenance, safety tracking, and insurance risk assessment. Thus, growing adoption of telematics in the insurance industry couple with the increasing safety and security regulation are some of the factors that are expected to fuel the market growth in the forecast period.

“Amongst provider type, OEM to witness higher growth during the forecast period”

Based on provider type, the commercial telematics market is divided into OEM and aftermarket. The OEM telematics provider type segment is expected to witness faster growth rate during the forecast period. This is mainly due to the rising government mandates around vehicle safety and telematics solutions thus OEM are offering embedded telematics solutions in new cars due to their extensive foothold in manufacturing embedded modules and strong technological leadership. Furthermore, nearly every commercial sector that uses vehicles for transportation uses vehicle telematics systems, which give fleet managers and analysts vital vehicle telematics data that drives insights, boosts productivity, lowers costs, and enhances driver safety. Thus, most major OEMs already provide vehicles with factory-embedded telematics hardware that can be integrated with a software intended expressly for fleet management analytics and business insights.

“APAC to hold a significant share in the market”

The APAC commercial vehicles telematics market is expected grow at a considerable CAGR during the forecast period. The rising adoption of advanced technologies and growing concern for the security and safety of vehicles are factors driving the growth of the market in the region. The adoption and penetration of vehicle telematics solutions is on the rise – even though the automotive industry has been struggling recently, mainly due to chip shortage and aftermath of COVID-19 resulting in low sales. However, in developing countries like India and China, there is a huge opportunity for key vendors to increase their market share. Furthermore, the increasing focus of fleet managers on operational efficiency and the advent of remote fleet management will bolster the market growth in the coming years. Moreover, growing fleet safety and security concerns are augmenting the need for proper fleet management ultimately surging the growth of the market during the forecast period.

Reasons to buy this report:

- The study includes market sizing and forecasting analysis validated by authenticated key industry experts.

- The report presents a quick review of overall industry performance at one glance.

- The report covers an in-depth analysis of prominent industry peers with a primary focus on key business financials, product portfolio, expansion strategies, and recent developments.

- Detailed examination of drivers, restraints, key trends, and opportunities prevailing in the industry.

- The study comprehensively covers the market across different segments.

- Deep dive regional level analysis of the industry.

Customization Options:

The global Commercial telematics market can further be customized as per the requirement or any other market segment. Besides this, UMI understands that you may have your own business needs, hence feel free to connect with us to get a report that completely suits your requirements.

Table of Content

Research Methodology for the Commercial Telematics Market Analysis (2022-2028)

Analyzing the historical market, estimating the current market, and forecasting the future market of the global commercial telematics market were the three major steps undertaken to create and analyze the adoption of an commercial telematics in major regions globally. Exhaustive secondary research was conducted to collect the historical market numbers and estimate the current market size. Secondly, to validate these insights, numerous findings and assumptions were taken into consideration. Moreover, exhaustive primary interviews were also conducted, with industry experts across the value chain of the global commercial telematics market. Post assumption and validation of market numbers through primary interviews, we employed a top-down/bottom-up approach to forecasting the complete market size. Thereafter, market breakdown and data triangulation methods were adopted to estimate and analyze the market size of segments and sub-segments of the industry pertains to. Detailed methodology is explained below:

Analysis of Historical Market Size

Step 1: In-Depth Study of Secondary Sources:

Detail secondary study was conducted to obtain the historical market size of the commercial telematics market through company internal sources such as annual reports & financial statements, performance presentations, press releases, etc., and external sources including journals, news & articles, government publications, competitor publications, sector reports, third-party database, and other credible publications.

Step 2: Market Segmentation:

After obtaining the historical market size of the commercial telematics market, we conducted a detailed secondary analysis to gather historical market insights and share for different segments & sub-segments for major regions. Major segments are included in the report as type and provider type. Further country-level analyses were conducted to evaluate the overall adoption of testing models in that region.

Step 3: Factor Analysis:

After acquiring the historical market size of different segments and sub-segments, we conducted a detailed factor analysis to estimate the current market size of the Commercial telematics market. Further, we conducted factor analysis using dependent and independent variables such as various type and provider type of commercial telematics. A thorough analysis was conducted for demand and supply-side scenarios considering top partnerships, mergers and acquisitions, business expansion, and product launches in the commercial telematics market sector across the globe.

Current Market Size Estimate & Forecast

Current Market Sizing: Based on actionable insights from the above 3 steps, we arrived at the current market size, key players in the global commercial telematics market, and market shares of the segments. All the required percentage shares split, and market breakdowns were determined using the above-mentioned secondary approach and were verified through primary interviews.

Estimation & Forecasting: For market estimation and forecast, weights were assigned to different factors including drivers & trends, restraints, and opportunities available for the stakeholders. After analyzing these factors, relevant forecasting techniques i.e., the top-down/bottom-up approach were applied to arrive at the market forecast for 2027 for different segments and sub-segments across the major markets globally. The research methodology adopted to estimate the market size encompasses:

- The industry’s market size, in terms of revenue (USD) and the adoption rate of the commercial telematics market across the major markets domestically

- All percentage shares, splits, and breakdowns of market segments and sub-segments

- Key players in the global commercial telematics market in terms of products offered. Also, the growth strategies adopted by these players to compete in the fast-growing market

Market Size and Share Validation

Primary Research: In-depth interviews were conducted with the Key Opinion Leaders (KOLs) including Top Level Executives (CXO/VPs, Sales Head, Marketing Head, Operational Head, Regional Head, Country Head, etc.) across major regions. Primary research findings were then summarized, and statistical analysis was performed to prove the stated hypothesis. Primary research input was consolidated with secondary findings, turning information into actionable insights.

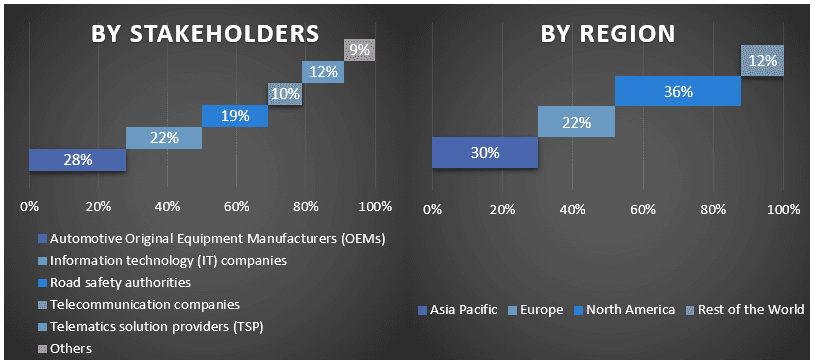

Split of Primary Participants in Different Regions

Market Engineering

The data triangulation technique was employed to complete the overall market estimation and to arrive at precise statistical numbers for each segment and sub-segment of the global commercial telematics market. Data was split into several segments & sub-segments post studying various parameters and trends in the areas of type and provider type in the global commercial telematics market.

The main objective of the Global Commercial telematics Market Study

The current & future market trends of the global commercial telematics market were pinpointed in the study. Investors can gain strategic insights to base their discretion for investments on the qualitative and quantitative analysis performed in the study. Current and future market trends determined the overall attractiveness of the market at a regional level, providing a platform for the industrial participant to exploit the untapped market to benefit from a first-mover advantage. Other quantitative goals of the studies include:

- Analyze the current and forecast market size of the commercial telematics market in terms of value (USD). Also, analyze the current and forecast market size of different segments and sub-segments

- Segments in the study include areas of type and provider type analysis of the regulatory framework for the commercial telematics industry.

- Analyze the value chain involved with the presence of various intermediaries, along with analyzing customer and competitor behaviors of the industry.

- Analyze the current and forecast market size of the commercial telematics market for the major region.

- Major countries of regions studied in the report include Asia Pacific, Europe, North America, and the Rest of the World.

- Company profiles of the commercial telematics market and the growth strategies adopted by the market players to sustain in the fast-growing market

- Deep dive regional level analysis of the industry

Related Reports

Customers who bought this item also bought