- Home

- About Us

- Industry

- Services

- Reading

- Contact Us

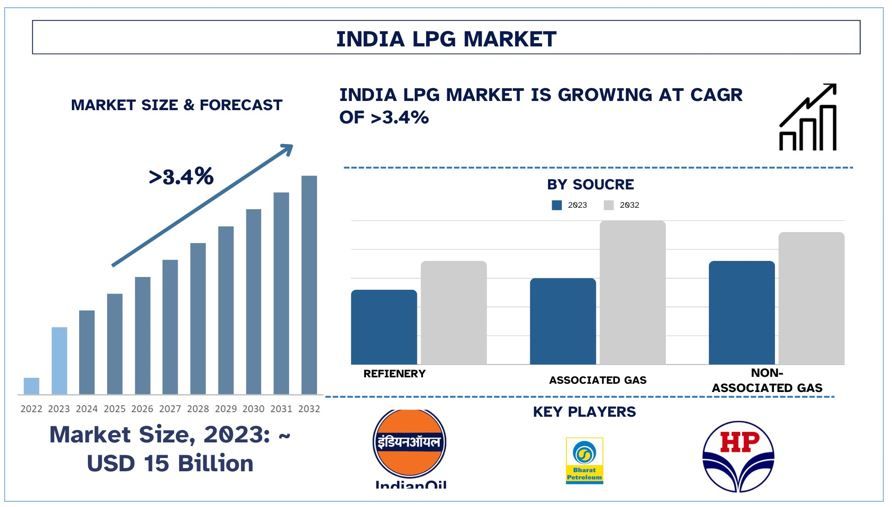

India LPG Market: Current Analysis and Forecast (2024-2032)

Emphasis on Source (Refinery, Associated Gas, Non – Associated Gas); Application (Residential/Commercial, Chemical, Industrial, Auto fuel, Refinery, and Offshore); States

India LPG Market Size & Forecast

India LPG Market Size & Forecast

The India LPG Market was valued at USD 15 Billion in 2023 and is expected to grow at a strong CAGR of around 3.4% during the forecast period (2024-2032). Liquefied Petroleum Gas (LPG) Industry in India has grown and evolved remarkably recently. For ages, Indians have used biomass for cooking; the government has actively marketed LPG as a less pollutive and efficient fuel type. Changing this scenario, the Pradhan Mantri Ujjwala Yojana (PMUY), launched in 2016, targets giving out LPG connections to women from below-poverty-line families. According to the govt. In India, by 2023 the scheme has provided more than 90 million connections which has boosted the use of LPG in rural areas.

India LPG Market Analysis

The government has been putting its efforts into bringing up the LPG facilities particularly the bottling plants and pipeline networks to support consistent supply all over the country’. In the year 2022, the Paradip-Hyderabad pipeline commissioning was successfully done to enhance the distribution network and decrease transportation expenses. The market of India LPG is also experiencing a growing propensity for privatization. Currently, numerous firms such as Reliance and BPCL are venturing to develop their LPG distribution networks which will further accelerate the demand for LPG in India.

India LPG Market Trends

The Shift Towards Cleaner Cooking Solution: One of the most important trends observed in the Indian LPG market is a growing demand for cleaner products and solutions for cooking movements caused by government actions, people’s awareness of improving their health, and technological developments. This trend is largely defined by the increased tendency to use LPG as a cleaner fuel source in comparison with biomass fuels like firewood and kerosene.

Government Initiatives: Several campaigns by the Indian government to encourage the use of LPG have been initiated among them the Pradhan Mantri Ujjwala Yojana (PMUY). PMUY was started in 2016 whose primary focus is to offer LPG connections to BPL families, thus targeting the growth of LPG sales in the rural and otherwise un-served markets. In December 2022, more than eight crore LPG connections were given to the target groups under this scheme changing the energy profile of these areas.

Health Benefits: This has led to a change towards using LPG also because of the growing consciousness on the impacts of the utilization of clean sources of energy in cooking, especially on the health of the people. Conventional bioenergy resources release smoke that is bad for the lungs and other parts of the human body. LPG is cleaner than charcoal and kerosene, which reduces cases of indoor air pollution hence improving on health of women and children.

North India is Expected to Grow with Significant CAGR During Forecast Period

North India holds a significant share of the Indian LPG market due to a combination of demographic, economic, and policy factors. Major states situated in this area include Uttar Pradesh, Punjab, Haryana, and Delhi, all of which have large populations; this makes residential use of LPG high. The overall demand for cooking fuel can also be attributed to many households that are found in Uttar Pradesh, the most populous state in India.

Several Government policies have played a major role in increasing the use of LPG in North India. The major scheme of cash transfer in this regard is the Pradhan Mantri Ujjwala Yojana (PMUY) which is effective in providing LPG connections to the women of below-poverty line BPL) households of this region. Due to focusing the scheme on the rural regions where traditional biomass use technique was common, millions of houses have been switched to LPG. A significant percentage of over 90 million connections under PMUY was in North India by 2023, thereby, increasing the region’s LPG consumption.

India LPG Industry Overview

- The India LPG market is competitive and fragmented, with the presence of several country market players. The key players are adopting different growth strategies to enhance their market presence, such as partnerships, agreements, collaborations, new product launches, geographical expansions, and mergers and acquisitions. Some of the major players operating in the market include Indian Oil Corporation Limited (IOCL), Bharat Petroleum Corporation Limited (BPCL), Hindustan Petroleum Corporation Limited (HPCL), Petro Vietnam Gas, Reliance Industries Limited (RIL), Mangalore Refinery and Petrochemicals Ltd., SUPER GAS, Aegis Logistics Limited, A R Hose Pvt ltd., and MAKEEN Energy.

India LPG Market News

- In 2023, the IOCL inaugurated several new LPG bottling plants and terminals to enhance its distribution network.

- In 2023, the HPCL partnered with research institutions and technology firms to advance the production of bio-LPG from renewable sources.

India LPG Market Report Coverage

Reasons to buy this report:

- The study includes market sizing and forecasting analysis validated by authenticated key industry experts.

- The report presents a quick review of overall industry performance at one glance.

- The report covers an in-depth analysis of prominent industry peers with a primary focus on key business financials, product portfolios, expansion strategies, and recent developments.

- Detailed examination of drivers, restraints, key trends, and opportunities prevailing in the industry.

- The study comprehensively covers the market across different segments.

- Deep dive regional level analysis of the industry.

Customization Options:

The India LPG market can further be customized as per the requirement or any other market segment. Besides this, UMI understands that you may have your own business needs, hence feel free to connect with us to get a report that completely suits your requirements.

Table of Content

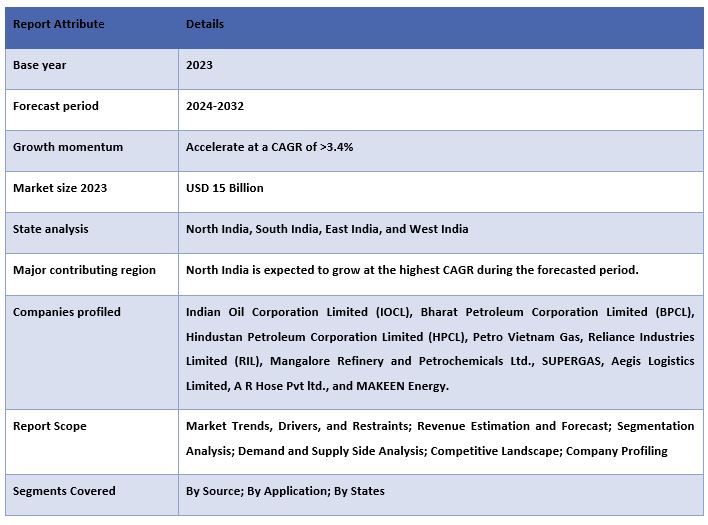

Research Methodology for the India LPG Market Analysis (2024-2032)

Analyzing the historical market, estimating the current market, and forecasting the future market of the India LPG market were the three major steps undertaken to create and analyze the adoption of India LPG in major states. Exhaustive secondary research was conducted to collect the historical market numbers and estimate the current market size. Secondly, to validate these insights, numerous findings and assumptions were taken into consideration. Moreover, exhaustive primary interviews were also conducted, with industry experts across the value chain of the India LPG market. Post assumption and validation of market numbers through primary interviews, we employed a top-down/bottom-up approach to forecasting the complete market size. Thereafter, market breakdown and data triangulation methods were adopted to estimate and analyze the market size of segments and sub-segments of the industry pertains to. Detailed methodology is explained below:

Analysis of Historical Market Size

Step 1: In-Depth Study of Secondary Sources:

A detailed secondary study was conducted to obtain the historical market size of the India LPG market through company internal sources such as annual reports & financial statements, performance presentations, press releases, etc., and external sources including journals, news & articles, government publications, competitor publications, sector reports, third-party database, and other credible publications.

Step 2: Market Segmentation:

After obtaining the historical market size of the India LPG market, we conducted a detailed secondary analysis to gather historical market insights and share for different segments & sub-segments for major regions. Major segments are included in the report as source, application, and region. Further country-level analyses were conducted to evaluate the overall adoption of testing models in that region.

Step 3: Factor Analysis:

After acquiring the historical market size of different segments and sub-segments, we conducted a detailed factor analysis to estimate the current market size of the India LPG market. Further, we conducted factor analysis using dependent and independent variables such as the source, and application of the India LPG market. A thorough analysis was conducted of demand and supply-side scenarios considering top partnerships, mergers and acquisitions, business expansion, and product launches in the India LPG market sector.

Current Market Size Estimate & Forecast

Current Market Sizing: Based on actionable insights from the above 3 steps, we arrived at the current market size, key players in the India LPG market, and market shares of the segments. All the required percentage shares split, and market breakdowns were determined using the above-mentioned secondary approach and were verified through primary interviews.

Estimation & Forecasting: For market estimation and forecast, weights were assigned to varied factors including drivers & trends, restraints, and opportunities available for the stakeholders. After analyzing these factors, relevant forecasting techniques i.e., the top-down/bottom-up approach were applied to arrive at the market forecast 2032 for different segments and sub-segments across the major markets in India. The research methodology adopted to estimate the market size encompasses:

- The industry’s market size, in terms of revenue (USD) and the adoption rate of the India LPG market across the major markets domestically

- All percentage shares, splits, and breakdowns of market segments and sub-segments

- Key players in the India LPG market regarding products offered. Also, the growth strategies adopted by these players to compete in the fast-growing market.

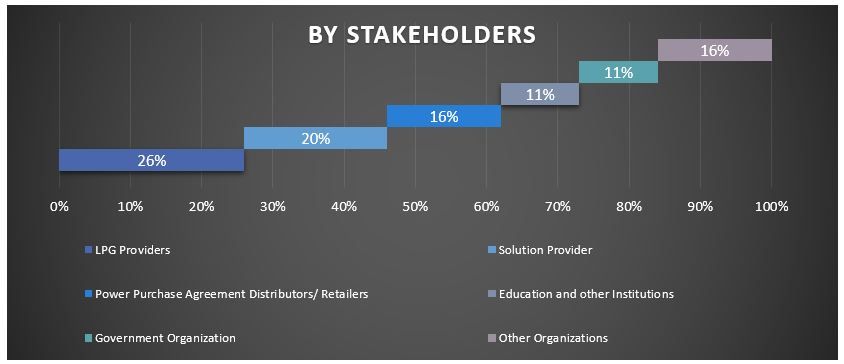

Market Size and Share Validation

Primary Research: In-depth interviews were conducted with the Key Opinion Leaders (KOLs) including Top Level Executives (CXO/VPs, Sales Head, Marketing Head, Operational Head, Regional Head, Country Head, etc.) across major regions. Primary research findings were then summarized, and statistical analysis was performed to prove the stated hypothesis. Inputs from primary research were consolidated with secondary findings, hence turning information into actionable insights.

Split of Primary Participants in Different Regions

Market Engineering

The data triangulation technique was employed to complete the overall market estimation and to arrive at precise statistical numbers for each segment and sub-segment of the India LPG market. Data was split into several segments & sub-segments post studying various parameters and trends in the areas of the source, and application in the India LPG market.

The main objective of the India LPG Market Study

The current & future market trends of the India LPG market were pinpointed in the study. Investors can gain strategic insights to base their discretion for investments on the qualitative and quantitative analysis performed in the study. Current and future market trends determined the overall attractiveness of the market at a state level, providing a platform for the industrial participant to exploit the untapped market to benefit from a first-mover advantage. Other quantitative goals of the studies include:

- Analyze the current and forecast market size of the India LPG market in terms of value (USD). Also, analyze the current and forecast market size of different segments and sub-segments.

- Segments in the study include areas of the source and application.

- Define and analyze the regulatory framework for the India LPG

- Analyze the value chain involved with the presence of various intermediaries, along with analyzing customer and competitor behaviors of the industry.

- Analyze the current and forecast market size of the India LPG market for the major region.

- Major States in India studied in the report include North India, South India, East India, and West India.

- Company profile of the India LPG market and the growth strategies adopted by the market players to sustain in the fast-growing market.

- Deep dive state-level analysis of the industry

Frequently Asked Questions FAQs

Q1: What is the current market size and growth potential of the Indian LPG market?

Q2: What are the driving factors for the growth of the India LPG market?

Q3: Which segment has the largest share of the India LPG market by source?

Q4: What are the emerging technologies and trends in the India LPG market?

Q5: Which state will dominate the India LPG market?

Related Reports

Customers who bought this item also bought