- Home

- About Us

- Industry

- Services

- Reading

- Contact Us

Military and Aerospace Communication Systems Market: Current Analysis and Forecast (2025-2033)

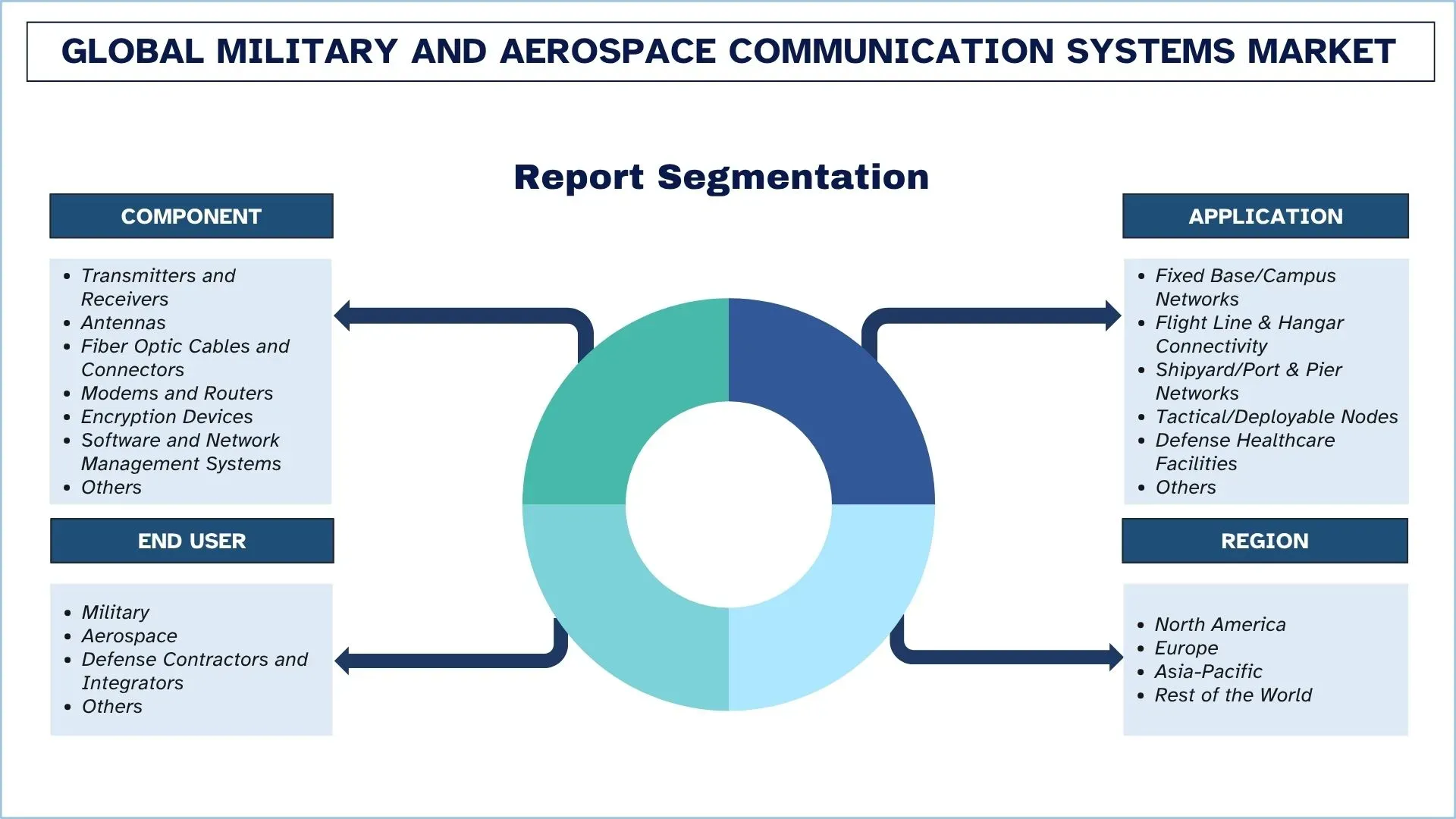

Emphasis on Component (Transmitters and Receivers, Antennas, Fiber Optic Cables and Connectors, Modems and Routers, Encryption Devices, Software and Network Management Systems, Others); Application (Fixed Base/Campus Networks, Flight Line & Hangar Connectivity, Shipyard/Port & Pier Networks, Tactical/Deployable Nodes, Defense Healthcare Facilities, Others); Application (Military, Aerospace, Defense Contractors and Integrators, Others); and Region/Country

Global Military and Aerospace Communication Systems Market Size & Forecast

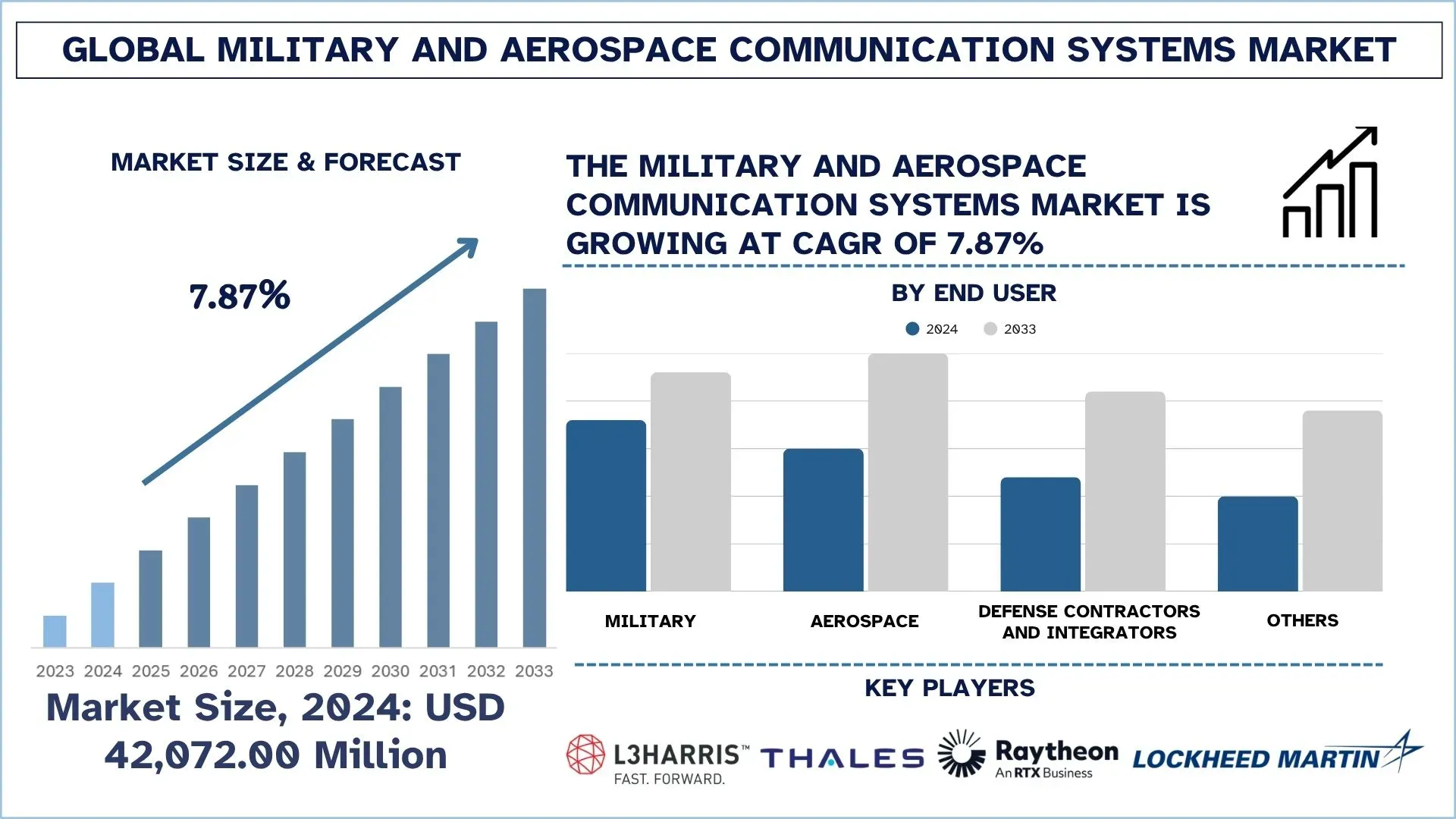

The global Military and Aerospace Communication Systems market was valued at USD 42,072.00 million in 2024 and is expected to grow at a strong CAGR of around 7.87% during the forecast period (2025-2033F), driven by rising defense modernization initiatives and increasing adoption of network-centric warfare strategies.

Military and Aerospace Communication Systems Market Analysis

The industrial forces of defense and aerospace are shifting towards the adoption of AI-enabled, software-defined, and cloud-integrated communication designs to enhance interoperability and responsiveness. The current implementations are aimed at modernization of tactical data connections, installation of satellite-based networks, and the application of IoT and edge computing to coordinate missions in real-time. Moreover, major players are also investing in R&D to come up with resilient, cyber-resistant, and scalable systems capable of working in various domains and surviving threats of electronic warfare.

On September 25, 2025, Mercury Systems, Inc., a global technology company that delivers mission-critical processing to the edge, announced it received a USD 12.3 million development contract from a defense prime contractor to develop an avionics subsystem for a new U.S. military aircraft. Under the three-year agreement signed in July, Mercury will develop a Communication Management Unit (CMU) control head that consolidates and manages multiple cockpit communications systems and is expected to be deployed on a new fleet of aircraft.

Global Military and Aerospace Communication Systems Market Trends

This section discusses the key market trends that are influencing the various segments of the global Military and Aerospace Communication Systems market, as found by our team of research experts.

Rising Use of Cloud and Edge Computing in Defense Communication

The increasing adoption of cloud and edge computing in defense communication is changing the way data is processed, stored, and transmitted over mission-critical networks. These technologies facilitate decentralized and faster decision-making by enabling the analysis of data closer to the source, thereby reducing latency and increasing situational awareness. Adding to this, the cloud infrastructure is used to facilitate scalable and secure communication systems, ensuring an effective level of collaboration between command centers and deployed units. Additionally, edge computing enhances cybersecurity and optimizes bandwidth in remote areas or battlefields. Therefore, companies are stimulating the development and implementation of highly adaptable, innovative, and robust military and aerospace communications systems.

On October 13, 2025, Global aerospace and defense contractor SNC unveiled TRAX Edge™ to link disparate military systems. It will transform how U.S. forces share data across land, air, sea, space, and cyber domains.

The system, called TRAX Edge, is an advanced version of the company’s long-running SNC TRAX software, which has been in use for nearly a decade by more than 100,000 users worldwide. Designed as a SaaS product, TRAX Edge seeks to address one of the Department of Defense’s (DOD) most persistent challenges: enabling different platforms, sensors, and services to communicate seamlessly in real time

Military and Aerospace Communication Systems Industry Segmentation

This section provides an analysis of the key trends in each segment of the global Military and Aerospace Communication Systems market report, along with forecasts at the global, regional, and country levels for 2025-2033.

The tactical/deployable nodes are expected to grow at a significant CAGR during the forecast period (2025-2033).

Based on the application, the market is categorized into fixed base/campus networks, flight line & hangar connectivity, shipyard/port & pier networks, tactical/deployable nodes, defense healthcare facilities, and others. Among these, tactical/deployable nodes are expected to grow at a significant CAGR during the forecast period (2025-2033), driven by enhancing fast and robust communication in isolated or unpredictable mission locations. These mobile systems enhance the deployment of networks, ensure flawless interoperability, and maintain consistent connectivity among surface, air, and naval forces. Moreover, the demand for an adaptable battlefield network and operations that are responsive in nature is growing; companies are investing heavily in these nodes to enhance situational awareness and mission agility. For instance, on September 11, 2025, Nokia and Kongsberg Defence & Aerospace (KONGSBERG) announced the signing of a memorandum of understanding (MoU) to collaborate on enhancing tactical communications solutions for the defence sector. The agreement brings together KONGSBERG’s expertise in military tactical communications and Nokia’s leadership in commercial 4G, 5G, and private wireless technologies to deliver secure, resilient, and high-performance networks for defence organizations and allied nations.

The Military Segment Dominates the Global Military and Aerospace Communication Systems Market.

Based on the end user, the market is segmented into military, aerospace, defense contractors and integrators, and others. Among these, the military segment holds the largest market share in 2024. This is mainly due to its constant updates of communication systems, enabling it to meet the demands of modern warfare, unmanned systems, and multi-domain operations. Their concentration on safe, encrypted, and speedy networks drives their requirement for next-generation communication equipment and programs. With the defense forces focusing on modernization processes, integration of command structures, and the implementation of new communication solutions is rapidly increasing in the land-based, air, and naval platforms. For instance, on June 17, 2025, Airbus Defence & Space selected Thales to supply the safety satcom system of the A400M military transport aircraft programme. The A400M is a military airlifter that combines the ability to fly long distances, carrying loads too heavy or too large for medium airlifters. Extended connectivity is thus critical for ensuring mission success and operational effectiveness.

North America holds the largest market share in the global Military and Aerospace Communication Systems market

North America dominates the military and aerospace communication systems market in 2024, driven by high defense expenditure, a strong technological base, and the adoption of next-generation communication systems. The region's increasing focus on modernizing its military fleets, utilizing satellite-based and secure tactical communications networks, and investing in AI-driven and software-defined communications platforms promotes growth. Moreover, strong government contracts, massive research and development efforts, and cross-defense and aerospace programs also enhance the adoption, and such initiatives overall spur the growth of the market.

On May 15, 2025, Honeywell announced its JetWave™ X satellite communication system had been selected by L3Harris Technologies (L3Harris) to upgrade the U.S. Army’s Airborne Reconnaissance and Electronic Warfare System (ARES) to provide soldiers with improved connectivity around the globe. With JetWave X, the U.S. Army will be able to transmit mission-critical information at higher data rates than currently available while ensuring a constant connection through JetWave X’s resilient, multi-network architecture.

ARES is a U.S. Army demonstrator aircraft owned and operated by L3Harris. The Bombardier Global 6000/6500-class business jet features technologies that represent the future of airborne intelligence, surveillance, and reconnaissance.

The United States held a dominant share of the North American military and aerospace communication systems Market in 2024

The market is led by the United States due to the unmatched defense budget, aggressive modernization cycles, and demand for secure, interoperable, and high-bandwidth communication networks. The nation is redoubling its efforts on next-gen connectivity on the battlefield, AI-powered command systems, resilient networks, and multi-domain connectivity, and this puts pressure on the supply chain to constantly innovate. Moreover, a drastic shift towards hardened space-based communication is underway, with significant government procurements accelerating the modernization of satellites and government-sponsored tactical SATCOM systems. The U.S. is the driving force behind global communication adoption, as companies receive funding and direction, with new contracts being awarded to bolster U.S. Strategic SATCOM capabilities.

For instance, on July 3, 2025, Boeing awarded a USD 2.8 billion contract for the Evolved Strategic Satellite Communications (ESS) program, the space-based component of the U.S. nuclear command, control, and communications (NC3) architecture. This contract is to enhance U.S. strategic SATCOM capabilities. The initial contract is for two satellites, with options for two more in the future.

Military and Aerospace Communication Systems Industry Competitive Landscape

The global Military and Aerospace Communication Systems market is competitive, with several global and international market players. The key players are adopting different growth strategies to enhance their market presence, such as partnerships, agreements, collaborations, geographical expansions, and mergers and acquisitions.

Top Military and Aerospace Communication Systems Market Companies

Some of the major players in the market are L3Harris Technologies, Inc., Thales, RTX Corporation, Lockheed Martin Corporation, General Dynamics Mission Systems, Inc., LIG Nex1, Amphenol Corporation, Timbercon, Inc., Canyon AeroConnect, and COMSYSTEMS.

Recent Developments in the Military and Aerospace Communication Systems Market

On October 20, 2025, L3Harris Technologies received a contract to deliver modified Bombardier Global 6500 airborne early warning and control (AEW&C) aircraft to the Republic of Korea Air Force. L3Harris is partnering with Bombardier, Israel Aerospace Industries’ ELTA Systems, and Korean Air to provide this advanced capability. The program is valued at more than USD 2.26 billion.

On September 25, 2025, Mercury Systems, Inc., a global technology company that delivers mission-critical processing to the edge, announced it received a USD 12.3 million development contract from a defense prime contractor to develop an avionics subsystem for a new U.S. military aircraft. Under the three-year agreement signed in July, Mercury will develop a Communication Management Unit (CMU) control head that consolidates and manages multiple cockpit communications systems and is expected to be deployed on a new fleet of aircraft.

Global Military and Aerospace Communication Systems Market Report Coverage

Report Attribute | Details |

Base year | 2024 |

Forecast period | 2025-2033 |

Growth momentum | Accelerate at a CAGR of 7.87% |

Market size 2024 | USD 42,072.00 million |

Regional analysis | North America, Europe, APAC, Rest of the World |

Major contributing region | The Asia-Pacific region is expected to dominate the market during the forecast period. |

Key countries covered | U.S., Canada, Germany, U.K., Spain, Italy, France, China, Japan, and India. |

Companies profiled | L3Harris Technologies, Inc., Thales, RTX Corporation, Lockheed Martin Corporation, General Dynamics Mission Systems, Inc., LIG Nex1, Amphenol Corporation, Timbercon, Inc., Canyon AeroConnect, and COMSYSTEMS. |

Report Scope | Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Demand and Supply Side Analysis; Competitive Landscape; Company Profiling |

Segments Covered | By Component, By Application, By End User, and By Region/Country |

Reasons to Buy the Military and Aerospace Communication Systems Market Report:

The study includes market sizing and forecasting analysis confirmed by authenticated key industry experts.

The report briefly reviews overall industry performance at a glance.

The report covers an in-depth analysis of prominent industry peers, primarily focusing on key business financials, type portfolios, expansion strategies, and recent developments.

Detailed examination of drivers, restraints, key trends, and opportunities prevailing in the industry.

The study comprehensively covers the market across different segments.

Deep dive regional level analysis of the industry.

Customization Options:

The global Military and Aerospace Communication Systems market can further be customized as per the requirements or any other market segment. Besides this, UnivDatos understands that you may have your own business needs; hence, feel free to contact us to get a report that completely suits your requirements.

Table of Content

Research Methodology for the Global Military and Aerospace Communication Systems Market Analysis (2023-2033)

We analyzed the historical market, estimated the current market, and forecasted the future market of the global Military and Aerospace Communication Systems market to assess its application in major regions worldwide. We conducted exhaustive secondary research to gather historical market data and estimate the current market size. To validate these insights, we carefully reviewed numerous findings and assumptions. Additionally, we conducted in-depth primary interviews with industry experts across the Military and Aerospace Communication Systems value chain. After validating market figures through these interviews, we used both top-down and bottom-up approaches to forecast the overall market size. We then employed market breakdown and data triangulation methods to estimate and analyze the market size of industry segments and sub-segments.

Market Engineering

We employed the data triangulation technique to finalize the overall market estimation and derive precise statistical numbers for each segment and sub-segment of the global Military and Aerospace Communication Systems market. We split the data into several segments and sub-segments by analyzing various parameters and trends, including component, application, end user, and regions within the global Military and Aerospace Communication Systems market.

The Main Objective of the Global Military and Aerospace Communication Systems Market Study

The study identifies current and future trends in the global Military and Aerospace Communication Systems market, providing strategic insights for investors. It highlights regional market attractiveness, enabling industry participants to tap into untapped markets and gain a first-mover advantage. Other quantitative goals of the studies include:

Market Size Analysis: Assess the current and forecast market size of the global Military and Aerospace Communication Systems market and its segments in terms of value (USD).

Military and Aerospace Communication Systems Market Segmentation: Segments in the study include areas of component, application, end user, and region.

Regulatory Framework & Value Chain Analysis: Examine the regulatory framework, value chain, customer behavior, and competitive landscape of the Military and Aerospace Communication Systems industry.

Regional Analysis: Conduct a detailed regional analysis for key areas such as Asia Pacific, Europe, North America, and the Rest of the World.

Company Profiles & Growth Strategies: Company profiles of the Military and Aerospace Communication Systems market and the growth strategies adopted by the market players to sustain the fast-growing market.

Frequently Asked Questions FAQs

Q1: What is the current market size and growth potential of the global military and aerospace communication systems market?

The global Military and Aerospace Communication Systems market is valued at USD 42,072.00 million in 2024, driven by rising defense modernization and secure communication demand. The market is expected to grow steadily due to multi-domain operations, satellite upgrades, and increasing digitalization of defense networks.

Q2: Which segment has the largest share of the global military and aerospace communication systems market by component category?

The fiber optic cables and connectors segment currently leads the market, supported by growing demand for high-bandwidth, low-latency, and EMI-resistant communication infrastructure across airborne, naval, and ground platforms.

Q3: What are the driving factors for the growth of the global military and aerospace communication systems market?

Key growth drivers include the integration of AI and machine learning, rapid expansion of satellite-based communication systems, increasing demand for secure and encrypted networks, and rising investments in multi-domain command and control (MDC2) capabilities.

Q4: What are the emerging technologies and trends in the global Military and Aerospace Communication Systems market?

Major trends include the rising adoption of cloud and edge computing, growing use of digital twin and simulation tools for mission planning, advancements in software-defined radios, and increased focus on cyber-resilient communication architectures.

Q5: What are the key challenges in the global Military and Aerospace Communication Systems market?

Major challenges include high implementation and lifecycle maintenance costs, complex interoperability requirements across allied forces, cybersecurity vulnerabilities, and the difficulty of upgrading legacy defense communication systems.

Q6: Which region dominates the global Military and Aerospace Communication Systems market?

North America dominates the market due to its strong defense spending, extensive satellite communication infrastructure, and continuous modernization programs led by U.S. defense agencies.

Q7: Who are the key competitors in the global Military and Aerospace Communication Systems market?

Top players in the Military and Aerospace Communication Systems industry include:

• L3Harris Technologies, Inc.

• Thales

• RTX Corporation

• Lockheed Martin Corporation

• General Dynamics Mission Systems, Inc.

• LIG Nex1

• Amphenol Corporation

• Timbercon, Inc.

• Canyon AeroConnect

• COMSYSTEMS

Q8: What opportunities are emerging for new entrants and technology providers in this market?

Growing investments in SATCOM upgrades, AI-enabled battlefield communication, cybersecurity solutions, and resilient tactical communication networks are creating strong opportunities for new technology providers, system integrators, and component suppliers.

Q9: How is digital transformation influencing military and aerospace communication systems?

Digital transformation is accelerating the adoption of cloud-enabled mission systems, real-time battlefield data sharing, and automated command-and-control networks, pushing defense agencies to upgrade legacy systems and invest in advanced communication technologies.

Related Reports

Customers who bought this item also bought