- Home

- About Us

- Industry

- Services

- Reading

- Contact Us

Brazil Biofuel Market: Current Analysis and Forecast (2025-2033)

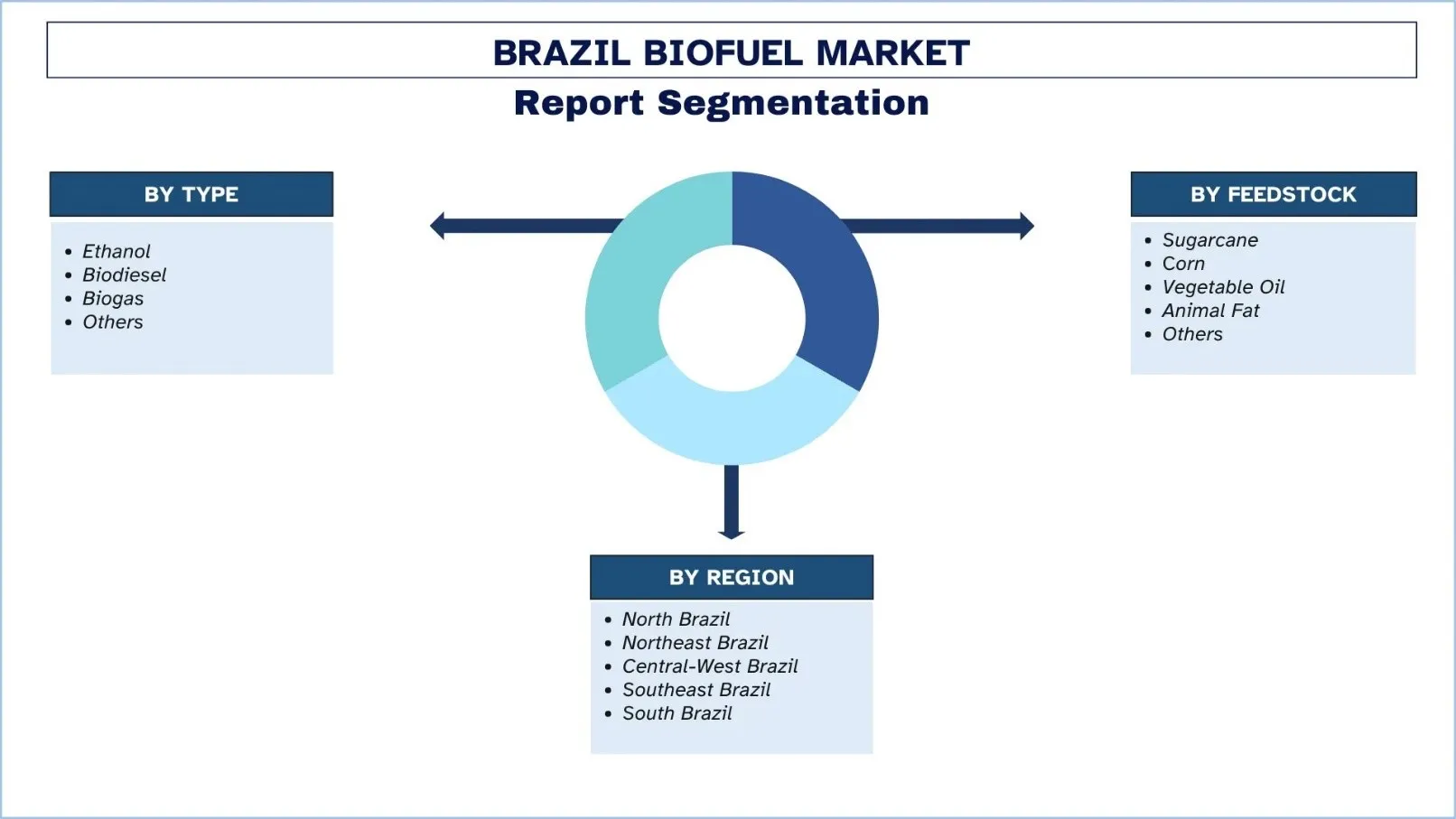

Emphasis By Type (Ethanol, Biodiesel, Biogas, Others), By Feedstock (Sugarcane, Corn, Vegetable Oil, Animal Fat and Others), By Region (North Brazil, Northeast Brazil, Central-West Brazil, Southeast Brazil, and South Brazil)

Brazil Biofuel Market Size & Forecast

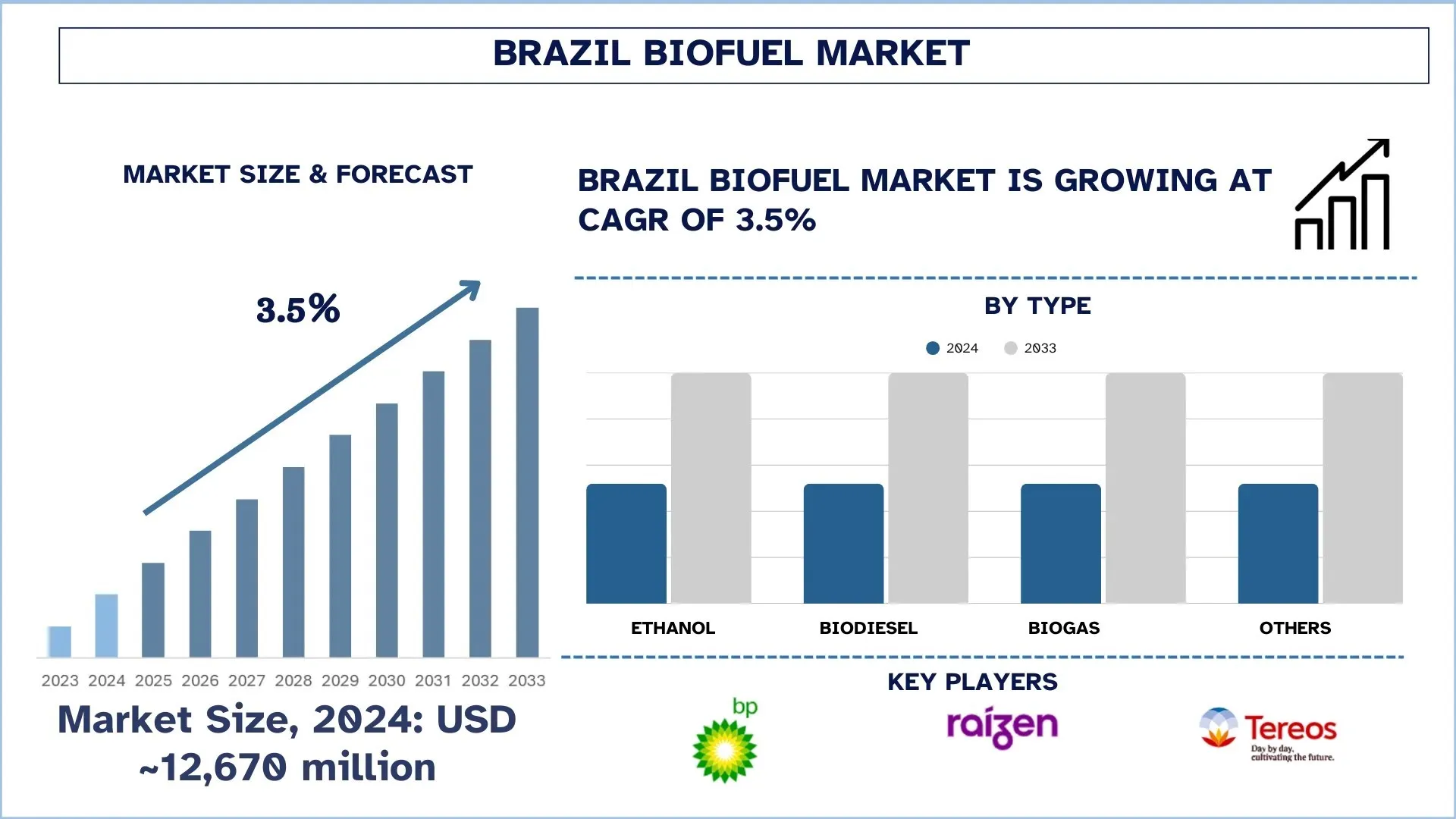

The Brazilian Biofuel Market was valued at USD 12,670 million in 2024 and is expected to grow at a strong CAGR of around 3.5% during the forecast period (2025-2033F), owing to government support and rising expansion of biofuel production.

Brazil Biofuel Market Analysis

The Brazil biofuel sector is growing fast, with the help of positive government policies, increasing energy requirements, and climate decarbonization targets worldwide. Brazil is ranked among the largest producers of ethanol and biodiesel due to sugarcane and corn as the most significant feedstocks. The industry is also enjoying a growth in investments in facilities and technological innovation that are more energy efficient and sustainable. The complexity of the Brazilian economy involves biofuels in ensuring the economy is less dependent on fossil fuels and also enhances energy security. The spiking energy demand for renewable energy both within the country and on the international scene is another competitive advantage of Brazil as a global center of clean energy solutions.

Brazil Biofuel Market Trends

This section discusses the key market trends that are influencing the various segments of the Brazil Biofuel market, as found by our team of research experts.

Expanding investments in biofuel infrastructure:

A surge in investment is redesigning the infrastructure base of Brazil's biofuel market. In August 2025, Cargill declared the construction of a new ethanol plant based on corn in Goi, where it already had sugarcane operations. The growth will represent a shift to dual-feedstock capacity, with additional flexibility to meet demand. In addition to this, the company had acquired full ownership of SJC Bioenergia earlier in February 2025, which had granted the company large corn and sugarcane processing plants in Quirinopolis and Cachoeira Dourada. Collectively, these trends point to the increasing emphasis on scalability, supply chain integration, and competitiveness in the long run in the sector. The growing infrastructure is ensuring that Brazil stays at the top in terms of being a world leader in producing renewable energy.

Brazil Biofuel Industry Segmentation:

This section provides an analysis of the key trends in each segment of the Brazil Biofuel market report, along with forecasts at the country and regional levels for 2025-2033.

Ethanol Category has shown promising growth in the Biofuel Market.

On the basis of type, the market is segregated into ethanol, biodiesel, biogas, and others. These have been occupied mostly by ethanol, which has had a large market share. The growing demand for ethanol as a vehicle fuel has significantly contributed to its market growth. The fuel blending has also played a key part in facilitating, in turn, the increasing demand for ethanol. Additionally, positive government policies, technology in the manufacturing process of ethanol, and the increased pressure on limiting carbon emissions are boosting its uptake in various industries. The increasing awareness of cleaner fuels, combined with positive laws mandating the mixing of ethanol with gasoline, is likely to drive growth to even greater proportions in the near future.

Sugarcane and Corn categories dominate the Brazilian Biofuel Market.

The market is divided on the basis of feedstock, such as sugarcane, corn, vegetable oil, and animal fat, among others. Amongst these, sugarcane and corn have been occupying the largest share of the market. Brazil's biofuels market is very concentrated, and sugarcane and corn are the most common and affordable commodities. Brazil has a great climate and a lot of farmland, which makes sugar cane a good source of ethanol. Corn, on the other hand, has the lowest conversion costs and is grown a lot. The two crops have a well-established production process, government support, and domestic markets, which all help to explain why they have the largest market share.

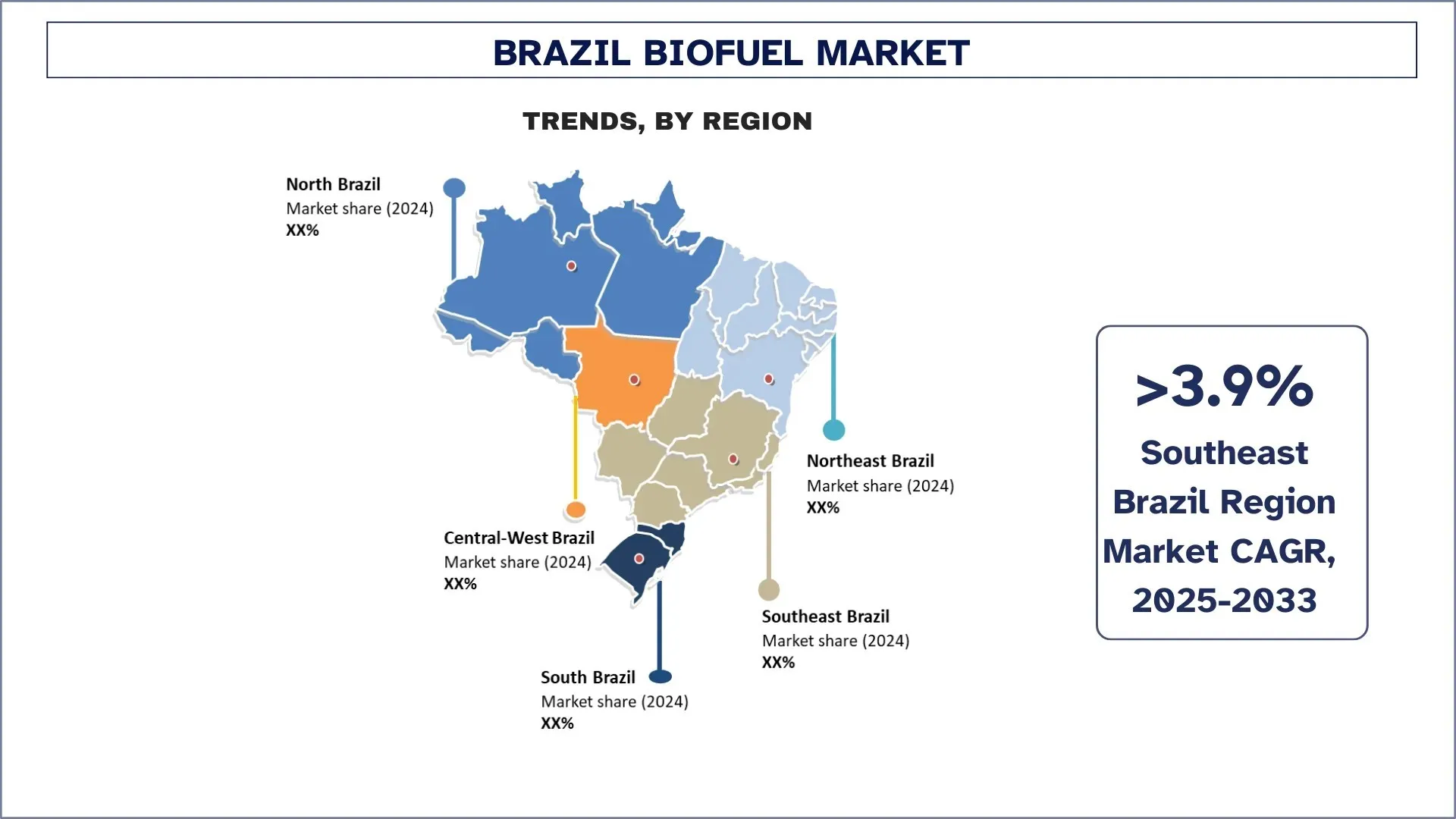

Southeast Brazil is expected to grow at a considerable rate during the forecast period.

Brazil has a robust demand in terms of biofuel production, with Southeast Brazil leading the trend because of the significance of sugarcane production in the region, coupled with its refining complex. Ethanol accounts for the largest share of the sector, driven by favorable climate conditions, efficient logistics, and the long-term development of agricultural technologies. The blending policy of the Government and the growth in domestic demand of the vehicle industry add to the consumption advance, and the investment in second-generation ethanol indicates the innovation potential of the region. Besides ethanol, there is also the increased significance of the presence of biodiesel and biogas, which is supported by the sustainability efforts. And as exports increase and the interest in low-carbon fuels worldwide intensifies, Southeast Brazil continues to play a key role in Brazil's renewable energy future.

Brazil Biofuel Industry Competitive Landscape:

The Brazil Biofuel market is competitive, with several global and international market players. The key players are adopting different growth strategies to enhance their market presence, such as partnerships, agreements, collaborations, new product launches, geographical expansions, and mergers and acquisitions.

Top Brazil Biofuel Companies

Some of the major players in the market are Raízen S.A., Petrobras, GranBio Investimentos S.A., BP p.l.c., Cargill Agrícola S.A., Louis Dreyfus Company Brasil S.A., Copersucar S.A., São Martinho, S.A. Usina Coruripe Açúcar e Álcool, and Tereos Açúcar e Etanol S.A.

Brazil Biofuel Market Report Coverage

Report Attribute | Details |

Base year | 2024 |

Forecast period | 2025-2033 |

Growth momentum | Accelerate at a CAGR of 3.5% |

Market size 2024 | USD 12,670 Million |

Regional analysis | North Brazil, Northeast Brazil, Central-West Brazil, Southeast Brazil, and South Brazil |

Major contributing region | Southeast Brazil is expected to dominate the market during the forecast period. |

Companies profiled | Raízen S.A., Petrobras, GranBio Investimentos S.A., BP p.l.c., Cargill Agrícola S.A., Louis Dreyfus Company Brasil S.A., Copersucar S.A., São Martinho, S.A. Usina Coruripe Açúcar e Álcool, and Tereos Açúcar e Etanol S.A. |

Report Scope | Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Demand and Supply Side Analysis; Competitive Landscape; Company Profiling |

Segments Covered | By Type, By Feedstock, By Region |

Reasons to Buy the Brazil Biofuel Market Report:

The study includes market sizing and forecasting analysis confirmed by authenticated key industry experts.

The report briefly reviews overall industry performance at a glance.

The report covers an in-depth analysis of prominent industry peers, primarily focusing on key business financials, type portfolios, expansion strategies, and recent developments.

Detailed examination of drivers, restraints, key trends, and opportunities prevailing in the industry.

The study comprehensively covers the market across different segments.

Deep dive regional-level analysis of the industry.

Customization Options:

The Brazil Biofuel Market can further be customized as per the requirements or any other market segment. Besides this, UnivDatos understands that you may have your own business needs; hence, feel free to contact us to get a report that completely suits your requirements.

Table of Content

Research Methodology for the Brazil Biofuel Market Analysis (2023-2033)

We analyzed the historical market, estimated the current market, and forecasted the future market of the Brazil Biofuel market to assess its application in major regions. We conducted exhaustive secondary research to gather historical market data and estimate the current market size. To validate these insights, we carefully reviewed numerous findings and assumptions. Additionally, we conducted in-depth primary interviews with industry experts across the Biofuel value chain. After validating market figures through these interviews, we used both top-down and bottom-up approaches to forecast the overall market size. We then employed market breakdown and data triangulation methods to estimate and analyze the market size of industry segments and sub-segments.

Market Engineering

We employed the data triangulation technique to finalize the overall market estimation and derive precise statistical numbers for each segment and sub-segment of the Brazil Biofuel market. We split the data into several segments and sub-segments by analyzing various parameters and trends, By Type, By Feedstock, and by regions within the Brazil Biofuel market.

The Main Objective of the Brazil Biofuel Market Study

The study identifies current and future trends in the Brazil Biofuel market, providing strategic insights for investors. It highlights regional market attractiveness, enabling industry participants to tap into untapped markets and gain a first-mover advantage. Other quantitative goals of the studies include:

Market Size Analysis: Assess the current forecast and market size of the Brazil Biofuel market and its segments in terms of value (USD).

Brazil Biofuel Market Segmentation: Segments in the study include areas By Type, By Feedstock, and by

Regulatory Framework & Value Chain Analysis: Examine the regulatory framework, value chain, customer behavior, and competitive landscape of the Brazil Biofuel industry.

Regional Analysis: Conduct a detailed regional analysis for key areas such as North Brazil, Northeast Brazil, Central-West Brazil, Southeast Brazil, and South Brazil.

Company Profiles & Growth Strategies: Company profiles of the Brazil Biofuel market and the growth strategies adopted by the market players to sustain the fast-growing market.

Frequently Asked Questions FAQs

Q1: What is the Brazil Biofuel market’s current market size and growth potential?

The Brazil Biofuel Market was valued at 12,670 million in 2024 and is expected to grow at a CAGR of 3.5% during the forecast period (2025-2033).

Q2: Which segment has the largest share of the Brazil Biofuel market by Type?

The growing demand for ethanol as a vehicle fuel has significantly contributed to its market growth.

Q3: What are the driving factors for the growth of the Brazil Biofuel market?

• Rising Mandatory Blending Mandates: Increased government mandates for biofuel blending are driving the demand for biofuels, particularly ethanol, across the transportation sector.

• Rapid Growth of Corn-based Ethanol: The expansion of corn-based ethanol production is further contributing to Brazil’s biofuel market, diversifying feedstock and boosting output.

Q4: What are the emerging technologies and trends in the Brazil Biofuel market?

• Advancements in Feedstock and Technology: The adoption of new feedstocks and improvements in biofuel production technologies, such as enzymatic hydrolysis and enhanced fermentation processes, are optimizing yield and sustainability.

• Expanding Investments in Biofuel Infrastructure: Significant investments in infrastructure, such as new production plants and logistical enhancements, are supporting the biofuel industry’s expansion and efficiency.

Q5: What are the key challenges in the Brazil Biofuel market?

• Environmental and Land Use Concerns: The growing demand for biofuels raises concerns about land use change, deforestation, and the environmental impact of large-scale agricultural production.

• Potential Environmental Pollution: The expansion of biofuel production could lead to pollution if not managed properly, particularly in terms of water and soil quality linked to industrial-scale biofuel production.

Q6: Which region dominates the Brazil Biofuel market?

The Southeast Brazil region dominates the Brazilian Biofuel market due to the rising demand from major urban centers.

Q7: Who are the key players in the Brazil Biofuel market?

Some of the top Biofuel companies in Brazil include:

• Raízen S.A.

• Petrobras

• GranBio Investimentos S.A.

• BP p.l.c.

• Cargill Agrícola S.A.

• Louis Dreyfus Company Brasil S.A.

• Copersucar S.A.

• São Martinho, S.A

• Usina Coruripe Açúcar e Álcool

• Tereos Açúcar e Etanol S.A

Q8: What are the opportunities for companies within the Brazil Biofuel market?

• Energy Independence and Domestic Production Growth: The rise of biofuels presents a significant opportunity for Brazil to reduce its dependence on imported fossil fuels, thereby enhancing energy security and fostering greater self-sufficiency in energy production.

• Climate-Conscious Innovation and Sustainable Leadership: Brazil's continued advancements in biofuel technologies provide an opportunity for the country to lead globally in low-carbon energy solutions, aligning with international climate goals and demonstrating environmental leadership.

Q9: How are consumer preferences shaping product development in the Brazil Biofuel market?

Consumer preferences in Brazil are driving product development by increasing demand for cleaner, sustainable fuels. This shift encourages biofuel producers to prioritize advanced technologies, diverse feedstocks, and higher efficiency in production processes.

Related Reports

Customers who bought this item also bought