- Home

- About Us

- Industry

- Services

- Reading

- Contact Us

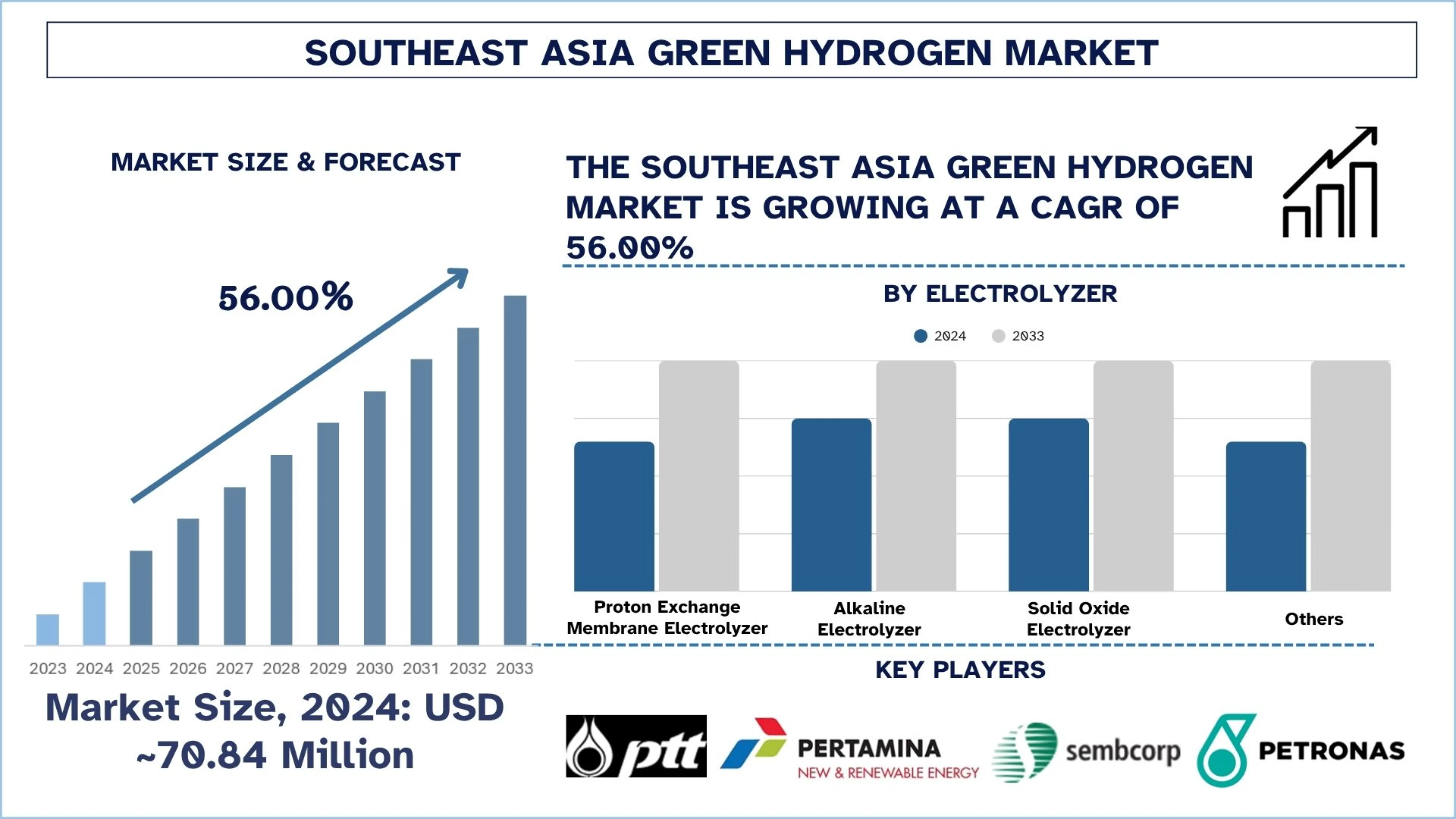

Southeast Asia Green Hydrogen Market: Current Analysis and Forecast (2025-2033)

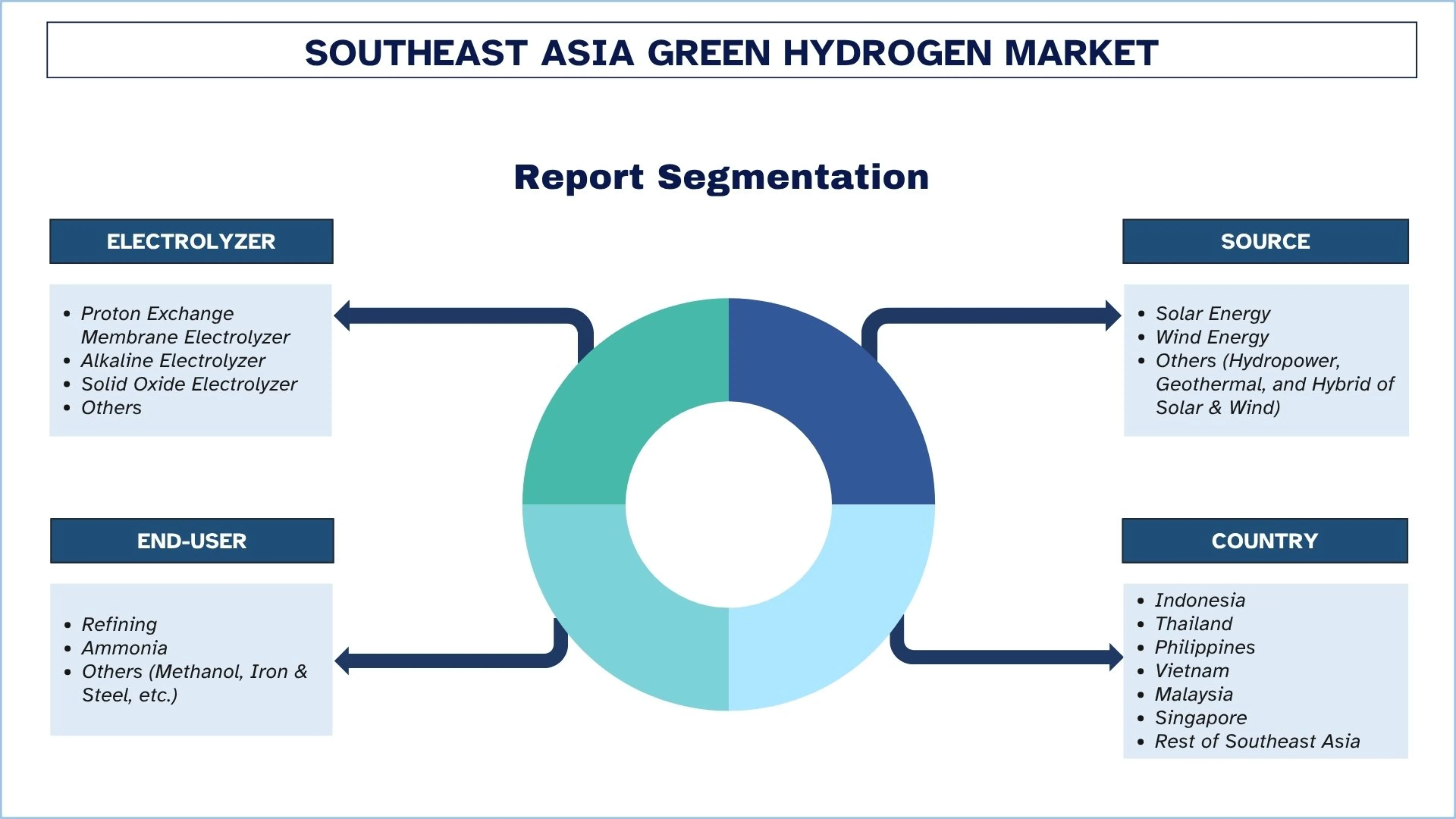

Emphasis on Electrolyzer (Proton Exchange Membrane Electrolyzer, Alkaline Electrolyzer, Solid Oxide Electrolyzer, and Others); Source (Solar Energy, Wind Energy, Others (Hydropower, Geothermal, and Hybrid of Solar & Wind)); End-User (Refining, Ammonia, Others (Methanol, Iron & Steel, etc.)); and Country.

Southeast Asia Green Hydrogen Market Size & Forecast

The Southeast Asia Green Hydrogen market was valued at ~USD 70.84 million in 2024 and is expected to grow at a strong CAGR of approximately 56.00% during the forecast period (2025-2033F), driven by an increasing focus on decarbonization and the transition to renewable energy sources.

Southeast Asia Green Hydrogen Market Analysis

Green hydrogen is hydrogen that was formed through the separation of water into hydrogen and oxygen using electricity produced through renewable sources (solar, wind, or hydropower, etc.). This process releases no carbon emissions, making it a clean and sustainable energy carrier.

To drive market growth, green hydrogen is also being adopted by governments and industries in Southeast Asia as an element of decarbonization. Major renewable plants are being built with pilot projects to determine the feasibility of production, storage, and export. Also, energy ministries are developing a policy framework, and industrial sectors like refining, ammonia, and transport are incorporating the use of hydrogen in their clean energy transition strategies. Moreover, the collaboration with international investors and technology suppliers is empowering the local hydrogen infrastructures and the development of the regional infrastructure.

For instance, on July 22, 2025, Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH, PTT plc and thyssenkrupp Uhde (Thailand) Ltd. joined forces under the International Hydrogen Ramp-Up Programme (H2Uppp) in signing a Cooperation Agreement (CA) for a new public-private partnership (PPP) entitled ‘Opportunity for green hydrogen and sustainable carbon-based products in Southern Thailand’ at PTT Head Office, Bangkok. This new project aims to expand markets and opportunities for green hydrogen and its derivatives in Thailand, focusing on strategic areas in the country’s southern region.

For instance, on October 21, 2024, Sembcorp Industries (Sembcorp), through its wholly-owned subsidiary, Sembcorp Utilities Pte Ltd, and PT PLN Energi Primer Indonesia (PT PLN EPI), a sub-holding company of PT PLN (Persero), entered into a joint development agreement (JDA) for a green hydrogen production facility in Sumatra, Indonesia, capable of producing 100,000 metric tonnes per annum. The project is poised to become Southeast Asia’s largest green hydrogen development initiative, with the goal of creating a regional green hydrogen hub connecting Sumatra, the Riau Islands, and Singapore.

Southeast Asia Green Hydrogen Market Trends

This section discusses the key market trends that are influencing the various segments of the Southeast Asia Green Hydrogen market, as found by our team of research experts.

International Collaboration and Partnerships

The green hydrogen market in Southeast Asia is increasingly influenced by the trend of international collaboration and partnerships. Countries are entering into strategic partnerships with international giants, such as Japan, South Korea, and the European Union, to attract investors, facilitate technology transfer, and establish export institutions. These alliances are facilitating large-scale pilot projects and accelerating the transfer of knowledge in hydrogen production and infrastructure. Moreover, cross-border hydrogen corridors and regional collaboration are also being driven by this trend as part of ASEAN's clean energy roadmap.

Southeast Asia Green Hydrogen Industry Segmentation

This section provides an analysis of the key trends in each segment of the Southeast Asia Green Hydrogen market, along with forecasts at the country level for 2025-2033.

The alkaline electrolyzer market held the dominant share of the green hydrogen market in 2024.

Based on electrolyzer, the market is segmented into proton exchange membrane electrolyzer, alkaline electrolyzer, solid oxide electrolyzer, and others. Among these, the alkaline electrolyzer market held the dominant share of the green hydrogen market in 2024, due to its affordable and developed technology for producing hydrogen at scale. They are reliable and easily scalable, making them suitable for industrial and government-supported projects. This will motivate businesses to invest in hydrogen infrastructure and increase production. On November 15, 2023, Asahi Kasei, Gentari Hydrogen Sdn Bhd, a wholly-owned subsidiary of PETRONAS clean energy arm Gentari Sdn Bhd (Gentari), and JGC Holdings Corporation (JGC) announced the completion of a detailed feasibility study for the production of up to 8,000 tonnes per year of green hydrogen using a 60 megawatt (MW) class alkaline water electrolyser system. The parties also signed a memorandum of understanding (MOU) for a front-end engineering design (FEED) study for the said project. This project is supported by the Green Innovation Fund for Large-scale Alkaline Water Electrolysis System Development and Green Chemical Plant Project by Japan’s New Energy and Industrial Technology Development Organization (NEDO).

The refining segment held the dominant share of the Southeast Asia green hydrogen market in 2024.

Based on end-user, the market is segmented into refining, ammonia, and others (methanol, iron & steel, etc.). Among these, the refining segment held the dominant share of the Southeast Asia green hydrogen market in 2024. The refining industry serves as a major driver of adoption by establishing the direct need for green hydrogen as an alternative to traditional feedstocks, which are cleaner. Southeast Asian companies are using hydrogen to decarbonize their refining processes and to comply with regulations. The industrial project needs to speed up the development of projects and stimulate investments in mass hydrogen planting.

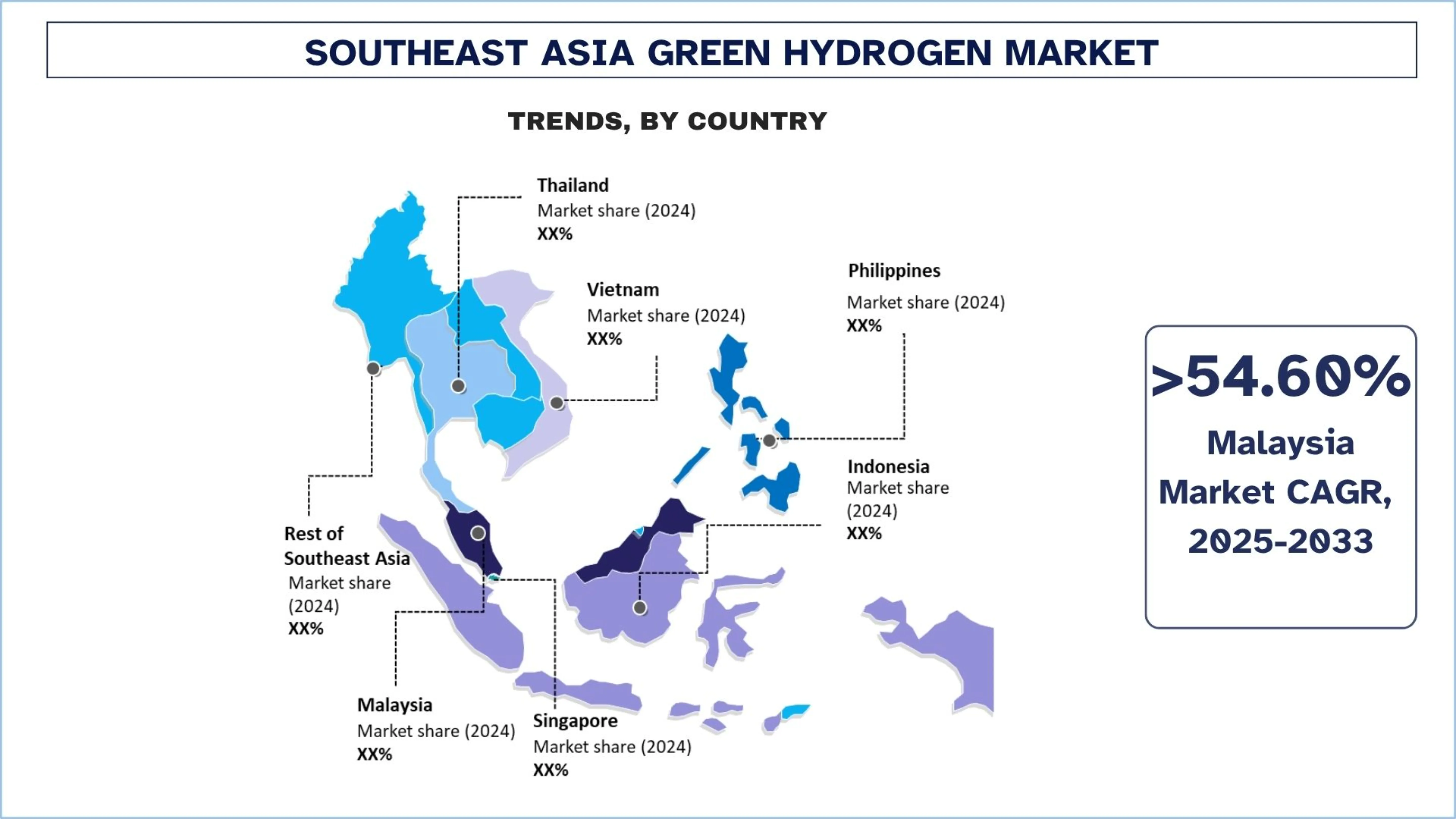

Malaysia held a dominant share of the Southeast Asian Green Hydrogen market in 2024

Malaysia is driving the adoption of green hydrogen, with robust government backing, coherent policy, and its position as an exporter to Japan and South Korea. The nation has a well-developed industrial infrastructure, particularly in the refining and chemical industries, which will provide an immediate source of demand for hydrogen. The presence of investments in renewable energy capacity, as well as collaborations with the world's technology providers, also speeds up the development of the project. The increasing corporate sustainability obligations and the ASEAN regional cooperation also promote universal adoption in the industrial and energy sectors. Malaysia reached a major milestone in its energy transition roadmap with the launch of the Hybrid Hydro Floating Solar (HHFS) and Green Hydrogen Hub in Terengganu on 12 July 2025. These initiatives aim to position Malaysia as a regional leader in the green hydrogen value chain while supporting the National Energy Transition Roadmap (NETR) and the Hydrogen Economy and Technology Roadmap (HETR).

The Green Hydrogen Hub was a strategic collaboration between Petroliam Nasional Berhad (PETRONAS) and Tenaga Nasional Berhad (TNB), with both parties advancing hydrogen production and its derivatives. TNB also enhanced grid infrastructure to support Malaysia’s energy transition and regional clean energy ambitions.

Southeast Asia Green Hydrogen Industry Competitive Landscape

The Southeast Asia Green Hydrogen market is competitive, with several global and international market players. The key players are adopting different growth strategies to enhance their market presence, such as partnerships, agreements, collaborations, new product launches, geographical expansions, and mergers and acquisitions.

Top Southeast Asia Green Hydrogen Companies

Some of the major players in the market are PTT Public Company Limited, Pertamina New & Renewable Energy, Sembcorp Industries, Petroliam Nasional Berhad (PETRONAS), ACWA POWER, SunGreenH2, PLN Nusantara Power (PLN NP), Siemens Energy, Linde PLC, and The Green Solutions Group.

Recent Developments in the Southeast Asia Green Hydrogen Market

On April 16, 2025, PT HDF Energy Indonesia, a subsidiary of HDF Energy, signed a Memorandum of Understanding (MoU) with the Ministry of Transportation (MoT), state-owned electric utility PT PLN (Persero), and ferry operator PT ASDP Indonesia Ferry (Persero). The agreement outlines a joint study to decarbonize Indonesia's maritime sector using locally produced green hydrogen. The study will be conducted in collaboration with, and co-funded by, the International Maritime Organization (IMO).

On February 18, 2025, HYDGEN (Hydrogen Innovation Pte. Ltd), a Singapore-based company, successfully closed a seed funding round raising close to SGD 2 million (~USD 1.54 million), led by Cloudberry Pioneer Investments, with participation from the National University of Singapore (NUS), TK & Partners, and strategic angel investors. This funding will accelerate HYDGEN’s mission to bring cost-effective, on-site green hydrogen production to industries consuming hydrogen as feedstock.

On February 21, 2024, Honeywell announced that it signed a Memorandum of Understanding (MoU) with The Green Solutions Group Corporation (TGS) on the Tra Vinh Green Hydrogen project, Vietnam's first green hydrogen plant in the Mekong Delta.

On May 24, 2022, Hydrogène de France (“HDF Energy” or the “Company”) signed a memorandum of understanding (“MOU”) with PESTECH International Berhad ("PESTECH") to collaborate on green hydrogen production from hydro power plants in Cambodia and Malaysia in order to address multi sectors decarbonation such as, grid services and industrial application projects (“Projects”).

Southeast Asia Green Hydrogen Market Report Coverage

Details | |

Base year | 2024 |

Forecast period | 2025-2033 |

Growth momentum | Accelerate at a CAGR of 56.00% |

Market size 2024 | ~USD 70.84 Million |

Country analysis | Indonesia, Thailand, Philippines, Vietnam, Malaysia, Singapore, Rest of Southeast Asia |

Major contributing Country | Indonesia is expected to grow at the highest CAGR during the forecasted period. |

Companies profiled | PTT Public Company Limited, Pertamina New & Renewable Energy, Sembcorp Industries, Petroliam Nasional Berhad (PETRONAS), ACWA POWER, SunGreenH2, PLN Nusantara Power (PLN NP), Siemens Energy, Linde PLC, The Green Solutions Group |

Report Scope | Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Demand and Supply Side Analysis; Competitive Landscape; Company Profiling |

Segments Covered | By Electrolyzer, By Source, By End-User, By Country |

Reasons to Buy the Southeast Asia Green Hydrogen Market Report:

The study includes market sizing and forecasting analysis confirmed by authenticated key industry experts.

The report briefly reviews overall industry performance at a glance.

The report covers an in-depth analysis of prominent industry peers, primarily focusing on key business financials, product portfolios, expansion strategies, and recent developments.

Detailed examination of drivers, restraints, key trends, and opportunities prevailing in the industry.

The study comprehensively covers the market across different segments.

Customization Options:

The Southeast Asia Green Hydrogen market can further be customized as per requirements or any other market segment. Besides this, UnivDatos understands that you may have your own business needs; hence, feel free to contact us to get a report that completely suits your requirements.

Table of Content

Research Methodology for the Southeast Asia Green Hydrogen Market Analysis (2023-2033)

We analyzed the historical market, estimated the current market, and forecasted the future market of the Southeast Asian Green Hydrogen market to assess its application in major countries. We conducted exhaustive secondary research to gather historical market data and estimate the current market size. To validate these insights, we carefully reviewed numerous findings and assumptions. Additionally, we conducted in-depth primary interviews with industry experts across the Southeast Asian Green Hydrogen value chain. After validating market figures through these interviews, we used both top-down and bottom-up approaches to forecast the overall market size. We then employed market breakdown and data triangulation methods to estimate and analyze the market size of industry segments and sub-segments.

Market Engineering

We employed the data triangulation technique to finalize the overall market estimation and derive precise statistical numbers for each segment and sub-segment of the Southeast Asia Green Hydrogen market. We split the data into several segments and sub-segments by analyzing various parameters and trends, including electrolyzer, source, end-user, and country within the Southeast Asian Green Hydrogen market.

The Main Objective of the Southeast Asia Green Hydrogen Market Study

The study identifies current and future trends in the Southeast Asia Green Hydrogen market, providing strategic insights for investors. It highlights market attractiveness, enabling industry participants to tap into untapped markets and gain a first-mover advantage. Other quantitative goals of the studies include:

Market Size Analysis: Assess the current and forecast market size of the Southeast Asia Green Hydrogen market and its segments in terms of value (USD).

Southeast Asia Green Hydrogen Market Segmentation: Segments in the study include areas of electrolyzer, source, end-user, and country.

Regulatory Framework & Value Chain Analysis: Examine the regulatory framework, value chain, customer behavior, and competitive landscape of the Southeast Asia Green Hydrogen industry.

Country Analysis: Conduct a detailed country analysis for key areas such as Indonesia, Thailand, the Philippines, Vietnam, Malaysia, Singapore, and the Rest of Southeast Asia.

Company Profiles & Growth Strategies: Company profiles of the Southeast Asia Green Hydrogen market and the growth strategies adopted by the market players to sustain in the fast-growing market.

Frequently Asked Questions FAQs

Q1: What is the Southeast Asia Green Hydrogen market’s current market size and growth potential?

The Southeast Asia Green Hydrogen market was valued at ~USD 70.84 Million in 2024 and is projected to expand at a CAGR of 56.00% from 2025 to 2033, driven by rising renewable energy investments, government incentives, and increasing industrial adoption.

Q2: Which segment has the largest share of the Southeast Asia Green Hydrogen market by electrolyzer?

The alkaline electrolyzer segment currently holds the largest market share in Southeast Asia due to its cost-effectiveness, high durability, and established technology adoption across industrial and energy sectors.

Q3: What are the driving factors for the growth of the Southeast Asia Green Hydrogen market?

The market growth is primarily driven by:

• Rising demand for clean and sustainable energy sources

• Government policies and subsidies promoting renewable hydrogen

• Increasing industrial applications, including refining and ammonia production

Q4: What are the emerging technologies and trends in the Southeast Asia Green Hydrogen market?

Key trends shaping the market include:

• Adoption of advanced electrolyzer technologies such as PEM and solid oxide

• Integration of renewable energy sources like solar and wind to produce green hydrogen

• Development of hydrogen storage and distribution infrastructure to support industrial and transportation sectors

Q5: What are the key challenges in the Southeast Asia Green Hydrogen market?

Market challenges include:

• High capital expenditure for green hydrogen projects

• Limited infrastructure for storage and transportation

• Regulatory and policy fragmentation across Southeast Asian countries

Q6: Which country dominates the Southeast Asia Green Hydrogen market?

Malaysia currently leads the Southeast Asia Green Hydrogen market, supported by government-backed initiatives, abundant renewable energy resources, and growing industrial adoption.

Q7: Who are the key players in the Southeast Asia Green Hydrogen market?

Leading companies in the Southeast Asia Green Hydrogen market include:

• PTT Public Company Limited

• Pertamina New & Renewable Energy

• Sembcorp Industries

• Petroliam Nasional Berhad (PETRONAS)

• ACWA POWER

• SunGreenH2

• PLN Nusantara Power (PLN NP)

• Siemens Energy

• Linde PLC

• The Green Solutions Group

Q8: What investment opportunities exist in the Southeast Asia Green Hydrogen market?

Investors can explore opportunities in green hydrogen production facilities, electrolyzer manufacturing, storage and distribution infrastructure, and partnerships with industrial end-users such as refining, ammonia, and chemical industries.

Q9: How is green hydrogen adopted in industrial and energy applications in Southeast Asia?

Green hydrogen is increasingly used for refining, ammonia production, methanol synthesis, and power generation, driven by the region’s push for carbon-neutral and low-emission energy solutions.

Related Reports

Customers who bought this item also bought