- Home

- About Us

- Industry

- Services

- Reading

- Contact Us

India Coffee Retail Chains Market: Current Analysis and Forecast (2025-2033)

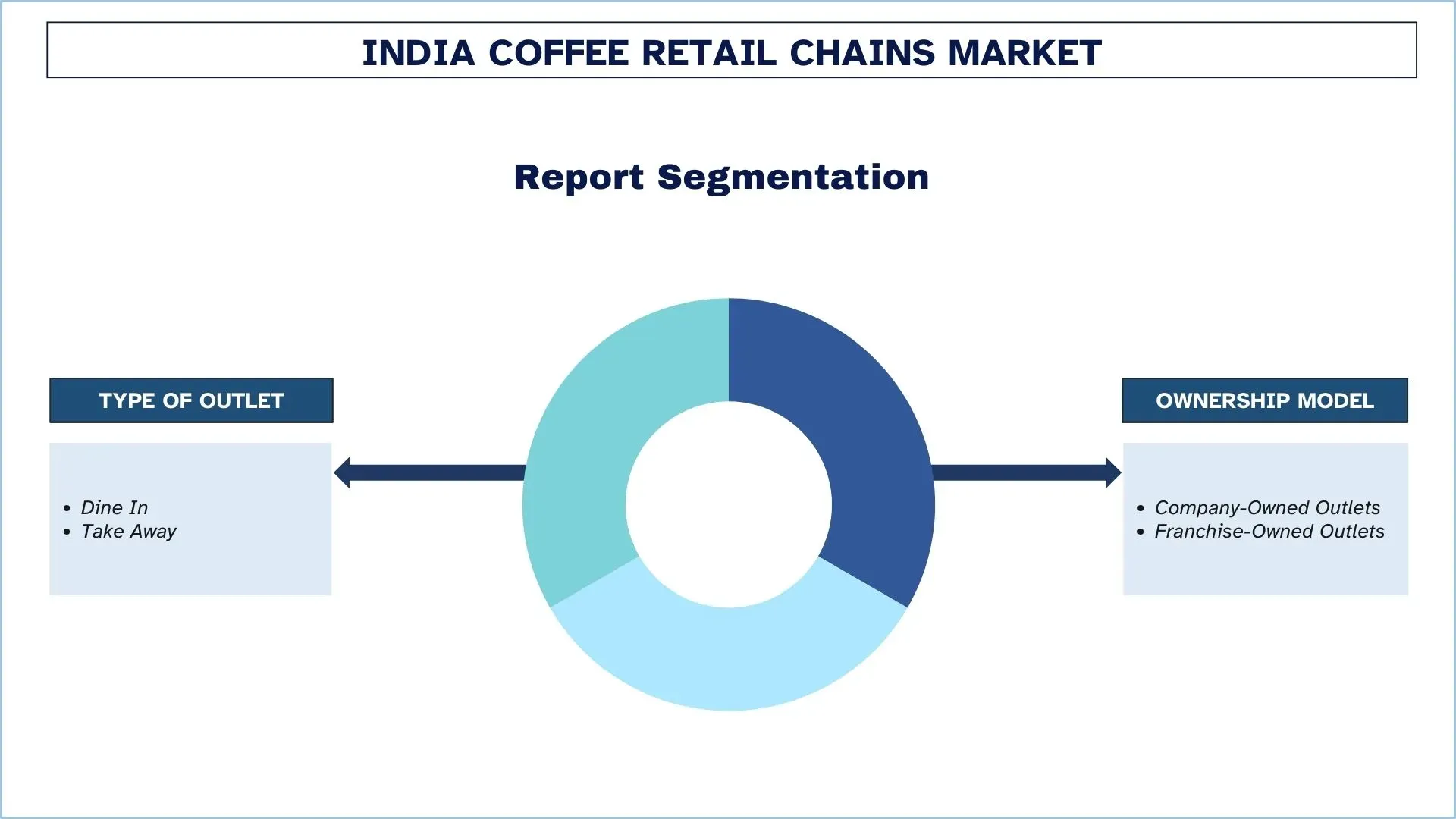

Emphasis on Type of Outlet (Dine In, Take Away); Ownership Model (Company-Owned Outlets, Franchise-Owned Outlets) and Region/States

India Coffee Retail Chains Market Size & Forecast

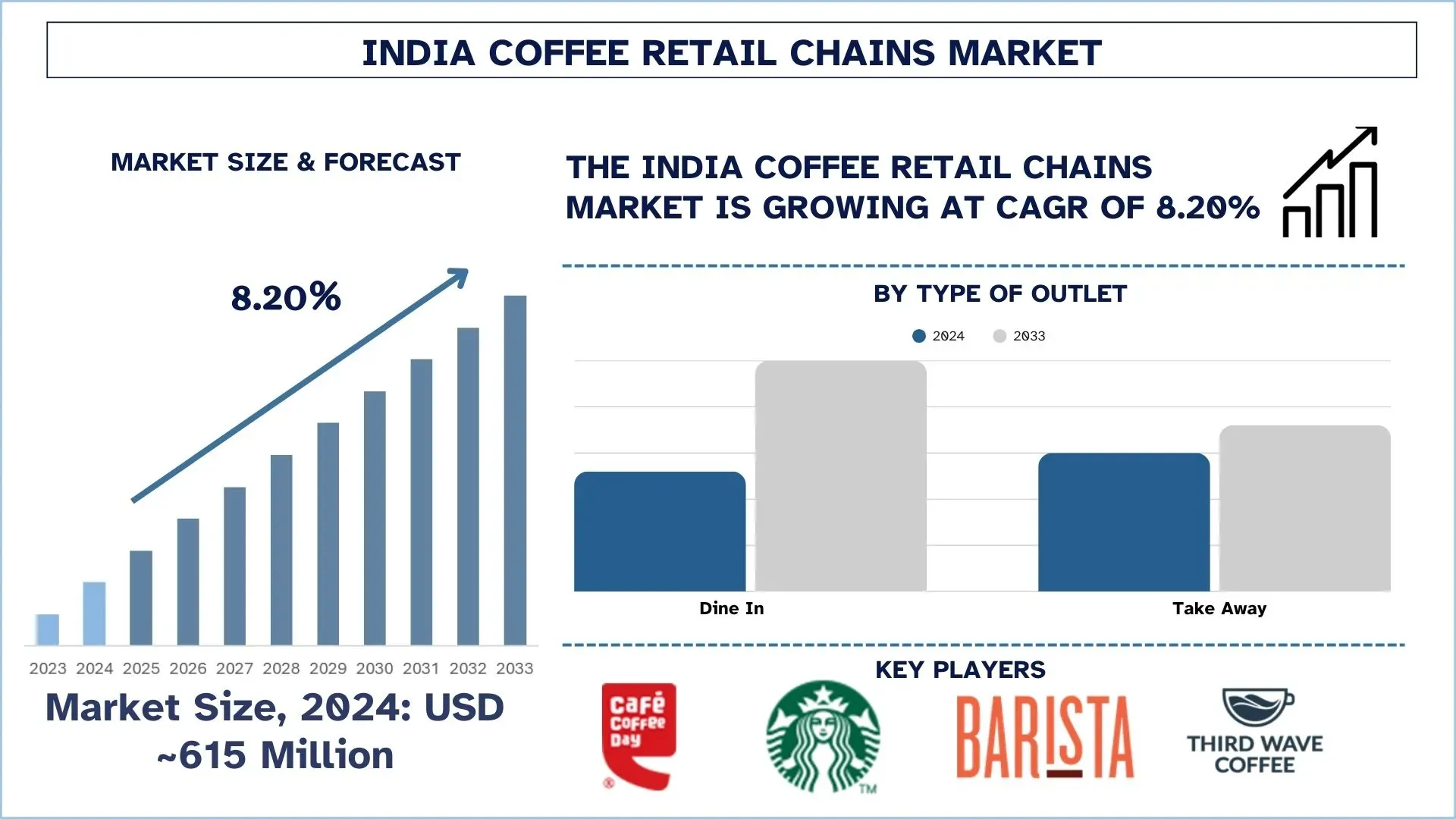

The India Coffee Retail Chains Market was valued at USD ~615 million in 2024 and is expected to grow to a strong CAGR of around 8.20% during the forecast period (2025-2033F), owing to the increasing disposable income and affinity for café culture.

Coffee Retail Chains Market Analysis

Coffee retail chains are business establishments which serve coffee and related products through a chain of outlets under one common brand. These chains focus on the quality consistency, outlet image, and digital interactivity, and most of these are prospects that are established in urban and semi-urban territories. Its importance cannot be denied in the development of coffee culture and changing the consumption pattern of coffee in India.

To achieve growth in the coffee retail chains market, major players in the coffee retail chains market in India are franchising, setting up franchises in Tier II & III cities, and also using technology in the form of loyalty apps and online ordering. Adding to this, companies are innovating in menus with novelties such as cold brew, vegan dishes, cafe layouts for co-working, and packaging and sourcing responsibly for the planet. Moreover, rising achievements through partnership with food delivery platforms or inclusive of express and drive-thru service are also expanding market reach.

For instance, on August 29, 2024, abCoffee announced that it was partnering with Shoppers Stop, India's iconic Premium shopping destination, to make the customer experience more memorable and seamlessly integrate abCoffee's specialty coffee offerings into Shoppers Stop's retail environment.

This collaboration marks a significant milestone in abCoffee's expansion strategy, opening three new state-of-the-art coffee decks across key metropolitan cities.

India Coffee Retail Chains Market Trends

This section discusses the key market trends that are influencing the various segments of the India Coffee Retail Chains market, as found by our team of research experts.

Growth of Cloud Cafés and Delivery-Only Coffee Brands

The emergence of cloud cafés and delivery-only coffee brands is the new trend in the coffee retailing market of India, based on convenience and order. These models again help in cutting down operating costs as the restaurants expand their customer base by offering food delivery apps. Both start-ups and brands are grabbing this opportunity to grow exponentially without the need for any capital cost in brick-and-mortar stores.

For example, on April 10, 2025, Southeast Asia’s fastest-growing grab-and-go coffee chain, Kopi Kenangan, officially launched its first store of Kenangan Coffee in India at Pacific Mall, Tagore Garden, Delhi. The brand aims to craft a uniquely harmonious coffee experience by bringing together India’s premium coffee heritage with its signature milk and Gula Aren (Indonesian Palm Sugar). Plans to open 10+ stores by the end of the year 2025 and 50 stores in the short term.

Coffee Retail Chains Industry Segmentation

This section provides an analysis of the key trends in each segment of the India Coffee Retail Chains market report, along with forecasts at the regional and state levels for 2025-2033.

The dine-in market held the dominant share of the Coffee Retail Chains Market in 2024.

Based on the type of outlet, the market is segmented into dine-in, take-away. Among these, the dine-in café market held the dominant share of the market in 2024. The dine-in segment contributes a lot towards the growth of India’s coffee retail chain market by offering places where one can work, interact with others, and relax. Chained cafés with franchisees and a bright, comfortable atmosphere, wireless Internet access, and selected food and beverages are popular among youngsters and businesspeople who need something beyond beverages. This consumer behaviour increases traffic and repeated use, which helps the kind of growth in urban areas. For instance, on March 27, 2025, UK-based freshly made food and organic coffee chain Pret A Manger launched its first-ever full-service dine-in store globally in India. Located in Pune at Phoenix Mall of the Millennium, the 989 sq. ft. outlet offers guests the brand’s first-ever global sit-down dining experience.

The Franchise-Owned Outlets segment is expected to grow with a significant CAGR during the forecast period (2025-2033) of the Coffee Retail Chains Market.

Based on the ownership model, the market is segmented into company-owned outlets, franchise-owned outlets. Among these, the franchise-owned outlets segment is expected to grow with a significant CAGR during the forecast period (2025-2033) due to the desire to own a café franchise, and the large players expand their reach at a faster pace at the national level. Franchisee-owned models are quite effective in fast expansion because of low capital exposure and better knowledge of the local market. This segment helps in reaching out to the second and third-tier towns with unified and homogenized services and products.

For instance, on February 28, 2025, Vietnam's beloved 24-hour cafe chain, Three O'Clock, made its grand debut in India through a strategic partnership with FranGlobal, the international business arm of Franchise India. As the master franchise partner, FranGlobal will spearhead Three O'Clock's expansion, as it plans to open 100 outlets across India, Nepal, Sri Lanka, and Bangladesh in the coming years.

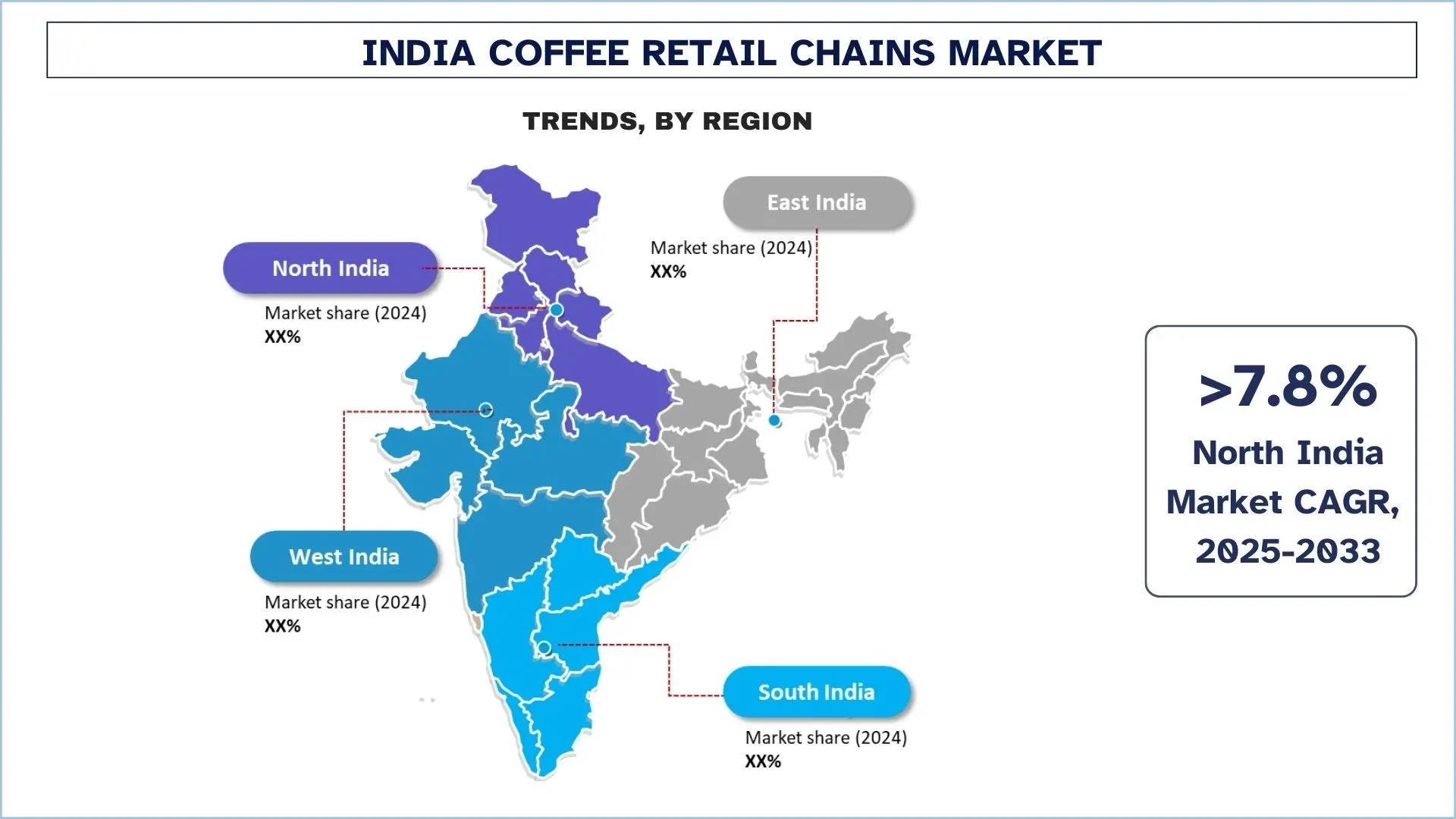

North India leads the Coffee Retail Chains Market in 2024.

North India is considered the most significant region of growth for the coffee retail chain market because of rising urban population, disposable income, and globalization. The major metros and emerging cities of Delhi NCR, Chandigarh, Jaipur, and Lucknow have got branded coffee outlets that the young generation and families tend to embrace. The region’s desire for better lifestyles and luxury products further increases the attractiveness of this market for expansion. Also, the number of malls, business parks, and universities contributes to the regular traffic of people in cafés. Seasonal beverages and local cuisines contribute to the enhancement of customer relations in this part of the world.

For instance, on March 6, 2025, Nespresso, the pioneer in premium portioned coffee, announced the grand opening of its first boutique at Select Citywalk Mall, Ground Floor, Saket, New Delhi. This launch marks a significant milestone in Nespresso's global expansion following its initial entry into India in late 2024.

The new boutique offers coffee enthusiasts an immersive experience, showcasing Nespresso's iconic range of high-quality coffees and state-of-the-art machines. Consumers can explore and savor a variety of coffee blends, receive personalized recommendations from trained coffee specialists, and learn about Nespresso's commitment to sustainability.

Coffee Retail Chains Industry Competitive Landscape

The India Coffee Retail Chains market is competitive, with several global and international market players. The key players are adopting different growth strategies to enhance their market presence, such as partnerships, agreements, collaborations, new product launches, geographical expansions, and mergers and acquisitions.

Top India Coffee Retail Chains Companies

Some of the major players in the market are Cafe Coffee Day (Coffee Day Global Limited), Starbucks Coffee Company (Tata Sons Private Limited), Barista Coffee Company Limited, Third Wave Coffee, Coffee By Di Bella, Blue Tokai (Muhavra Enterprises Private Limited), SLAY Coffee, Costa Coffee (Coca Cola group), HATTI FOOD AND BEVERAGES PRIVATE LIMITED, Brewbay Innovations Private limited (abCoffee).

Recent Developments in the India Coffee Retail Chains Market

On April 04, 2025, Starbucks, the Seattle-headquartered cafe chain, opened its first drive-thru outlet in South India in Bengaluru. The cafe chain’s India operation, TATA Starbucks, a 50:50 joint venture between Starbucks Coffee Company and Tata Consumer Products Limited, opened its maiden drive-thru cafe at Electronics City, also the 50th store in Bengaluru. TATA Starbucks currently has eight drive-thru coffee outlets in the country.

On January 30, 2025, Coffee Island announced its debut in India in partnership with Vita Nova. This strategic entry marks a significant milestone for the brand as it forays into one of the world's most dynamic coffee markets to offer a distinctive European Coffee Culture experience.

India Coffee Retail Chains Market Report Coverage

Report Attribute | Details |

Base year | 2024 |

Forecast period | 2025-2033 |

Growth momentum | Accelerate at a CAGR of 8.20% |

Market size 2024 | USD ~615 million |

Regional analysis | North India, South India, East India, and West India |

Major contributing region | South India is expected to grow at the highest CAGR during the forecasted period. |

Companies profiled | Cafe Coffee Day (Coffee Day Global Limited), Starbucks Coffee Company (Tata Sons Private Limited), Barista Coffee Company Limited, Third Wave Coffee, Coffee By Di Bella, Blue Tokai (Muhavra Enterprises Private Limited), SLAY Coffee, Costa Coffee (Coca Cola group), HATTI FOOD AND BEVERAGES PRIVATE LIMITED, Brewbay Innovations Private limited (abCoffee). |

Report Scope | Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Demand and Supply Side Analysis; Competitive Landscape; Company Profiling |

Segments Covered | By Type of Outlet, By Ownership Model, By Region/Country |

Reasons to Buy the India Coffee Retail Chains Market Report:

The study includes market sizing and forecasting analysis confirmed by authenticated key industry experts.

The report briefly reviews overall industry performance at a glance.

The report covers an in-depth analysis of prominent industry peers, primarily focusing on key business financials, type portfolios, expansion strategies, and recent developments.

Detailed examination of drivers, restraints, key trends, and opportunities prevailing in the industry.

The study comprehensively covers the market across different segments.

Deep dive regional level analysis of the industry.

Customization Options:

The India Coffee Retail Chains market can further be customized as per the requirements or any other market segment. Besides this, UnivDatos understands that you may have your own business needs; hence, feel free to contact us to get a report that completely suits your requirements.

Table of Content

Research Methodology for the India Coffee Retail Chains Market Analysis (2023-2033)

We analyzed the historical market, estimated the current market, and forecasted the future market of the India Coffee Retail Chains market to assess its application in major regions in India. We conducted exhaustive secondary research to gather historical market data and estimate the current market size. To validate these insights, we carefully reviewed numerous findings and assumptions. Additionally, we conducted in-depth primary interviews with industry experts across the Coffee Retail Chains value chain. After validating market figures through these interviews, we used both top-down and bottom-up approaches to forecast the overall market size. We then employed market breakdown and data triangulation methods to estimate and analyze the market size of industry segments and sub-segments.

Market Engineering

We employed the data triangulation technique to finalize the overall market estimation and derive precise statistical numbers for each segment and sub-segment of the India-Coffee Retail Chains market. We split the data into several segments and sub-segments by analyzing various parameters and trends, including type of outlet, ownership model, and regions within the India Coffee Retail Chains market.

The Main Objective of the India Coffee Retail Chains Market Study

The study identifies current and future trends in the India Coffee Retail Chains market, providing strategic insights for investors. It highlights regional market attractiveness, enabling industry participants to tap into untapped markets and gain a first-mover advantage. Other quantitative goals of the studies include:

Market Size Analysis: Assess the current market size and forecast the market size of the India Coffee Retail Chains market and its segments in terms of value (USD).

Coffee Retail Chains Market Segmentation: Segments in the study include areas of type of outlet, ownership model, and regions.

Regulatory Framework & Value Chain Analysis: Examine the regulatory framework, value chain, customer behavior, and competitive landscape of the Coffee Retail Chains industry.

Regional Analysis: Conduct a detailed regional analysis for key areas such as North India, South India, East India, and West India.

Company Profiles & Growth Strategies: Company profiles of the Coffee Retail Chains market and the growth strategies adopted by the market players to sustain in the fast-growing market.

Frequently Asked Questions FAQs

Q1: What is the India Coffee Retail Chains market’s current market size and growth potential?

The India Coffee Retail Chains market was valued at USD ~615 million in 2024 and is expected to grow at a CAGR of 8.20% during the forecast period (2025-2033). This growth is driven by increasing café culture adoption, urban lifestyle changes, and expansion into Tier II and Tier III cities.

Q2: Which segment has the largest share of the India Coffee Retail Chains market by type of outlet?

The dine-in café segment holds the largest market share due to the growing demand for experiential spaces that combine social interaction, co-working environments, and premium beverage consumption.

Q3: What are the driving factors for the growth of the India Coffee Retail Chains market?

Rising urbanization and expanding middle-class population, growing youth demographic with evolving lifestyles, increasing disposable income and affinity for café culture, rising demand for premium and specialty coffee experiences, expanding presence in Tier II and Tier III cities.

Q4: What are the emerging technologies and trends in the India Coffee Retail Chains market?

Key trends include the rise of cloud cafés and delivery-only coffee brands, app-based loyalty programs, AI-driven personalization, and sustainable packaging solutions.

Q5: What are the key challenges in the India Coffee Retail Chains market?

Challenges include high real estate costs in metro areas, supply chain inconsistencies, rising competition from local cafes, fluctuating raw material prices, and the need for consistent quality across multiple outlets.

Q6: Which region dominates the India Coffee Retail Chains market?

North India dominates the Coffee Retail Chains market in terms of market penetration and consumer demand, especially in cities like Delhi NCR and Chandigarh. The region's affinity for premium experiences and lifestyle-oriented consumption patterns makes it an attractive destination for market expansion. Additionally, the growing number of malls, business parks, and educational institutions supports consistent footfall in cafés.

Q7: Who are the key players in the India Coffee Retail Chains market?

Some of the leading companies in the India Coffee Retail Chains Industry include:

• Cafe Coffee Day (Coffee Day Global Limited)

• Starbucks Coffee Company (Tata Sons Private Limited)

• Barista Coffee Company Limited

• Third Wave Coffee

• Coffee By Di Bella

• Blue Tokai (Muhavra Enterprises Private Limited)

• SLAY Coffee

• Costa Coffee (Coca Cola group)

• HATTI FOOD AND BEVERAGES PRIVATE LIMITED

• Brewbay Innovations Private limited (abCoffee)

Q8: What strategies are coffee retail chains using to expand across India?

Companies are adopting franchise models, launching tech-integrated loyalty platforms, diversifying menus with local flavors, and entering smaller cities through cloud café formats to drive faster and cost-effective expansion.

Q9: How is the rise of Tier II and Tier III cities influencing the coffee retail chains market in India?

Growing urbanization, aspirational middle-class consumers, and increased retail infrastructure in Tier II and Tier III cities are creating new opportunities for coffee chains to scale beyond metro markets.

Related Reports

Customers who bought this item also bought