- Home

- About Us

- Industry

- Services

- Reading

- Contact Us

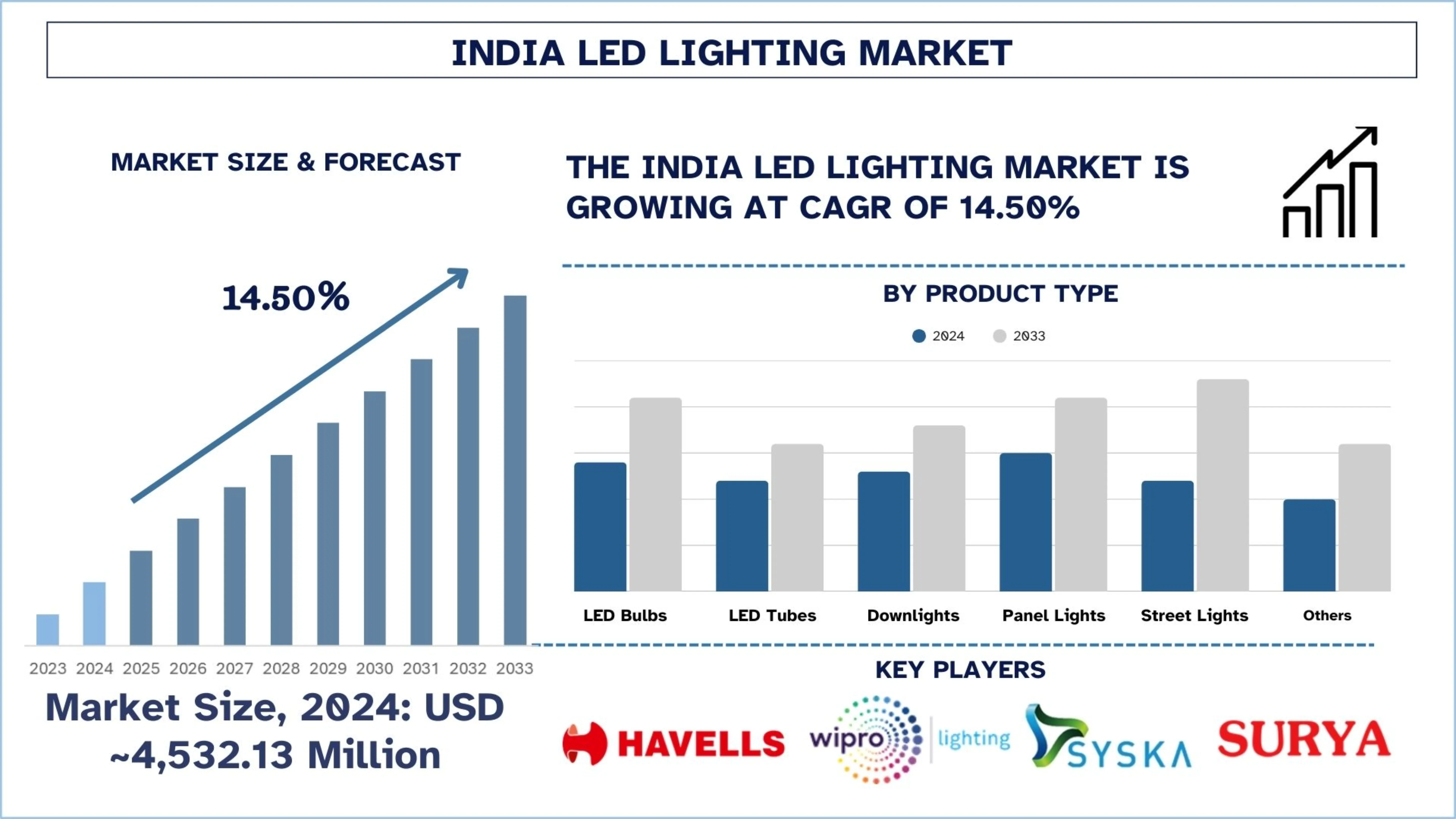

India LED Lighting Market: Current Analysis and Forecast (2025-2033)

Emphasis on Product Type (LED Bulbs, LED Tubes, Downlights, Panel Lights, Street Lights, Others); Application (Residential, Commercial, Industrial, Outdoor/Public Infrastructure); Distribution Channel (Offline, Online); and Region/States

India LED Lighting Market Size & Forecast

The India LED Lighting Market was valued at USD ~4,532.13 million in 2024 and is expected to grow to a strong CAGR of around 14.50% during the forecast period (2025-2033F), owing to the rising smart city projects boosting public infrastructure lighting.

LED Lighting Market Analysis

LED lighting is a type of energy-saving illumination produced by diodes that glow with light when electricity flows through them. The lights are long-lasting, small in design, and are designed to cut down costs on electricity and carbon emissions. They are highly used for different indoor and outdoor projects.

To achieve growth in the LED Lighting Market in India, LED lighting that can be controlled by apps and connected to energy-saving solar power systems is being introduced by many companies in India. Several companies, Havells, Wipro, and Signify, among them, are involved in initiatives such as the Street Lighting National Programme (SLNP) and the Smart Cities Mission organized by the government. In addition, manufacturers are increasing production due to increasing commercial installations, aesthetic appeal, and efficient lighting in offices, malls, and institutions, rolling out environmentally friendly items, and using online sales to provide better services to more people.

For instance, on January 29, 2025, Goldmedal Electricals, one of India's leading Fast Moving Electrical Goods (FMEG) companies, announced the launch of Parkos 01 LED Wall Light, a contemporary up-down wall light designed to elevate both indoor and outdoor aesthetics.

India LED Lighting Market Trends

This section discusses the key market trends that are influencing the various segments of the India LED Lighting Market, as found by our team of research experts.

Growth in Demand for Solar-Powered LED Lighting

The increasing demand for solar LED lighting is emerging as a key market driver of the Indian LED lighting market. Under increased focus on renewable energy and sustainable infrastructure, solar-integrated LED solutions are being installed in rural regions, highways, and smart city projects. Reducing grid dependency, low electricity costs, and long-term savings are the benefits of using these systems. Moreover, the rise in the government’s support to farmers and consumers through subsidies and schemes, i.e., PM-KUSUM, is also encouraging for the adoption of solar-powered LED Lighting by municipalities and private users.

On May 16, 2023, Signify, the world leader in lighting, announced the launch of its first-ever ‘Philips Solar Light Hub’ in India, an exclusive retail store aimed to encourage wider use of solar lighting products. With an endeavor to offer customers an interactive space to explore solar lighting applications and showcase its comprehensive range of products, the store will cater to various user segments, from home and garden to industrial and street lighting applications.

LED Lighting Industry Segmentation

This section provides an analysis of the key trends in each segment of the India LED Lighting Market report, along with forecasts at the regional and state levels for 2025-2033.

The streetlights market is expected to grow with a significant CAGR during the forecast period (2025-2033).

Based on the product type, the market is segmented into LED bulbs, LED tubes, downlights, panel lights, street lights, and others. Among these, the streetlights market is expected to grow with a significant CAGR during the forecast period (2025-2033) due to the fast adoption of government programs like the Street Lighting National Programme (SLNP), and the demand for LED streetlights has sharply increased. Adding to this, the rise of these installations by public organizations saves energy and promotes cost efficiency. As India pursues smart city projects, companies discover plenty of business opportunities to supply LED streetlights. On August 1, 2024, the Street Lighting National Programme (SLNP) is a voluntary programme implemented through Energy Efficiency Services Limited (EESL). Till 30 June 2024, EESL installed 1,31,10,745 LED Street Lights in the country, which has resulted in estimated energy savings of about 8,806 Million Units (MU) per year.

The residential LED lighting market held the dominant share of the market in 2024.

Based on the application, the market is segmented into residential, commercial, industrial, and outdoor/public infrastructure. Among these, the residential LED lighting market held the dominant share of the market in 2024 due to the increasing awareness among consumers about the importance of saving energy is boosting the uptake of LED lighting at home. Adding to this, schemes like UJALA have made it possible to sell LED bulbs at discounts in rural and semi-urban parts of the country. Due to higher demand, manufacturers are now expanding their residential products and improving the way goods are distributed. At the end of January 6, 2025, the UJALA scheme distributed 36.87 crore LED bulbs, making it one of the most widely adopted initiatives in the country. Its implementation across all states has brought about transformative changes, reduced annual household electricity bills, and enabled consumers to save money while improving their quality of life. Transforming the market, so far, the UJALA scheme has generated the sale of 407.92 crore LED bulbs in the Indian market.

North India leads the LED Lighting Market in 2024.

North India held a significant share of the Indian LED Lighting Market due to massive infrastructure development and demand from cities such as Delhi, Haryana, and Punjab. Adding to this, smart city efforts and energy-saving technologies launched in the region are attracting major companies to invest there. Moreover, increasing opportunities for retrofitting and government tenders in towns and cities of North India, along with the rising disposable income and awareness, are helping the real estate sector lead the LED lighting market.

On April 14, 2025, Signify illuminates over 300 forest villages in Bahraich, Uttar Pradesh, under the Har Gaon Roshan CSR project. Har Gaon Roshan CSR project aims to enhance safety in forest regions affected by human-wildlife conflict using the power of light. The project executed in partnership with FINISH Society encompasses the installation of over 5000 high-quality LED and solar streetlights across a vast network of 300 forest villages.

LED Lighting Industry Competitive Landscape

The India LED Lighting Market is competitive, with several global and international market players. The key players are adopting different growth strategies to enhance their market presence, such as partnerships, agreements, collaborations, new product launches, geographical expansions, and mergers and acquisitions.

Top India LED Lighting Companies

Some of the major players in the market are Havells Lighting (Havells India Ltd.), Wipro Lighting (Wipro Enterprises (P) Limited), Syska Led Lights Pvt Ltd, Bajaj Electricals Limited (Bajaj Group), Crompton Greaves Consumer Electricals Limited, Surya Roshni Ltd, Eveready Industries India Ltd., Signify Holding, Orient Electric Ltd. (CKA Birla Group), Goldmedal Electricals Pvt. Ltd.

Recent Developments in the India LED Lighting Market

In August 2024, Karnataka approved an INR 684-crore plan to switch Bengaluru streetlights to LED. The Bruhat Bengaluru Mahanagara Palike is replacing around three lakh streetlights with LED lights.

As per the Ministry of Power, as of 6thJanuary 2025, EESL successfully installed over 1.34 crore LED streetlights across Urban Local Bodies (ULBs) and Gram Panchayats, leading to significant energy savings of over 9,001 million units (MUs) of electricity annually. This achievement has also contributed to a reduction in peak demand by more than 1,500 MW and a decrease in CO₂ emissions by 6.2 million tonnes per year, highlighting the programme’s positive impact on both energy efficiency and environmental sustainability.

On October 11, 2023, Halonix Technologies, one of India's fastest-growing electrical companies, announced the launch of India's first 'UP-DOWN GLOW' LED Bulb, demonstrating its commitment to enriching lives through pioneering technology.

India LED Lighting Market Report Coverage

Report Attribute | Details |

Base year | 2024 |

Forecast period | 2025-2033 |

Growth momentum | Accelerate at a CAGR of 14.50% |

Market size 2024 | USD ~4,532.13 million |

Regional analysis | North India, South India, East India, and West India |

Major contributing region | South India is expected to grow at the highest CAGR during the forecasted period. |

Companies profiled | Havells Lighting (Havells India Ltd.), Wipro Lighting (Wipro Enterprises (P) Limited), Syska Led Lights Pvt Ltd, Bajaj Electricals Limited (Bajaj Group), Crompton Greaves Consumer Electricals Limited, Surya Roshni Ltd, Eveready Industries India Ltd., Signify Holding, Orient Electric Ltd. (CKA Birla Group), Goldmedal Electricals Pvt. Ltd. |

Report Scope | Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Demand and Supply Side Analysis; Competitive Landscape; Company Profiling |

By Product type, By Application, By Distribution Channel, By Region/States |

Reasons to Buy the India LED Lighting Market Report:

The study includes market sizing and forecasting analysis confirmed by authenticated key industry experts.

The report briefly reviews overall industry performance at a glance.

The report covers an in-depth analysis of prominent industry peers, primarily focusing on key business financials, product portfolios, expansion strategies, and recent developments.

Detailed examination of drivers, restraints, key trends, and opportunities prevailing in the industry.

The study comprehensively covers the market across different segments.

Deep dive regional level analysis of the industry.

Customization Options:

The India LED Lighting Market can further be customized as per the requirements or any other market segment. Besides this, UnivDatos understands that you may have your own business needs; hence, feel free to contact us to get a report that completely suits your requirements.

Table of Content

Research Methodology for the India LED Lighting Market Analysis (2023-2033)

We analyzed the historical market, estimated the current market, and forecasted the future market of the India LED Lighting market to assess its application in major regions in India. We conducted exhaustive secondary research to gather historical market data and estimate the current market size. To validate these insights, we carefully reviewed numerous findings and assumptions. Additionally, we conducted in-depth primary interviews with industry experts across the LED Lighting value chain. After validating market figures through these interviews, we used both top-down and bottom-up approaches to forecast the overall market size. We then employed market breakdown and data triangulation methods to estimate and analyze the market size of industry segments and sub-segments.

Market Engineering

We employed the data triangulation technique to finalize the overall market estimation and derive precise statistical numbers for each segment and sub-segment of the India-LED Lighting market. We split the data into several segments and sub-segments by analyzing various parameters and trends, including product type, application, distribution channel, and regions within the India LED Lighting market.

The Main Objective of the India LED Lighting Market Study

The study identifies current and future trends in the India LED Lighting market, providing strategic insights for investors. It highlights regional market attractiveness, enabling industry participants to tap into untapped markets and gain a first-mover advantage. Other quantitative goals of the studies include:

Market Size Analysis: Assess the current market size and forecast the market size of the India LED Lighting market and its segments in terms of value (USD).

LED Lighting Market Segmentation: Segments in the study include areas of product type, application, distribution channel, and regions.

Regulatory Framework & Value Chain Analysis: Examine the regulatory framework, value chain, customer behavior, and competitive landscape of the LED Lighting industry.

Regional Analysis: Conduct a detailed regional analysis for key areas such as North India, South India, East India, and West India.

Company Profiles & Growth Strategies: Company profiles of the LED Lighting market and the growth strategies adopted by the market players to sustain in the fast-growing market.

Frequently Asked Questions FAQs

Q1: What is the India LED Lighting market’s current market size and growth potential?

The India LED Lighting Market was valued at USD ~4,532.13 million in 2024 and is expected to grow at a CAGR of 14.50% during the forecast period (2025-2033). The market’s growth is primarily fueled by rapid urbanization, increasing government initiatives promoting energy efficiency.

Q2: Which segment has the largest share of the India LED Lighting market by product type?

Panel Lights currently account for the largest share in the India LED Lighting market. Their dominance is driven by growing demand in commercial spaces, smart offices, and modern residential settings due to their energy efficiency, sleek design, and superior brightness distribution.

Q3: What are the driving factors for the growth of the India LED Lighting market?

Major growth drivers include government programs like UJALA and SLNP promoting LED adoption, rising consumer awareness of energy savings, lower LED prices, and increasing infrastructure development in Tier II and Tier III cities. Additionally, innovations in smart lighting and IoT integration are expanding the application scope in the country.

Q4: What are the emerging technologies and trends in the India LED Lighting market?

The India LED Lighting industry is witnessing trends such as the adoption of smart and connected lighting systems, integration of IoT and AI for automation, Li-Fi-based LED systems, and growing usage of human-centric lighting solutions in homes and offices to improve wellbeing and energy optimization.

Q5: What are the key challenges in the India LED Lighting market?

Key challenges include high initial investment in smart lighting infrastructure, market fragmentation with the influx of low-quality unorganized players, lack of consumer awareness in rural regions, and supply chain issues impacting raw material availability and product costs.

Q6: Which region dominates the India LED Lighting market?

North India leads the LED Lighting market, primarily due to large-scale urban infrastructure, rapid smart city project execution, and higher awareness and adoption rates in commercial and residential sectors in states like Delhi, Haryana, and Punjab.

Q7: Who are the key players in the India LED Lighting market?

Some of the leading companies in the India LED Lighting Industry include:

• Havells Lighting (Havells India Ltd.)

• Wipro Lighting (Wipro Enterprises (P) Limited)

• Syska Led Lights Pvt Ltd

• Bajaj Electricals Limited (Bajaj Group)

• Crompton Greaves Consumer Electricals Limited

• Surya Roshni Ltd

• Eveready Industries India Ltd.

• Signify Holding

• Orient Electric Ltd. (CKA Birla Group)

• Goldmedal Electricals Pvt. Ltd.

Q8: What investment opportunities exist for businesses and investors in the India LED Lighting industry?

India’s LED Lighting market offers strong investment potential in smart lighting infrastructure, manufacturing units under the ‘Make in India’ initiative, and energy-efficient public lighting projects. With rising demand for domestic production and advanced lighting technologies, investors can explore partnerships in R&D, product innovation, and smart city developments.

Q9: How are government policies and energy-efficiency programs supporting the LED Lighting market in India?

Government initiatives like UJALA (Unnat Jyoti by Affordable LEDs for All), the Street Lighting National Programme (SLNP), and PLI schemes for LED component manufacturing are actively driving LED adoption. These programs offer subsidies, large-scale procurement, and policy-level support to boost domestic production, affordability, and usage across urban and rural areas.

Related Reports

Customers who bought this item also bought