- Home

- About Us

- Industry

- Services

- Reading

- Contact Us

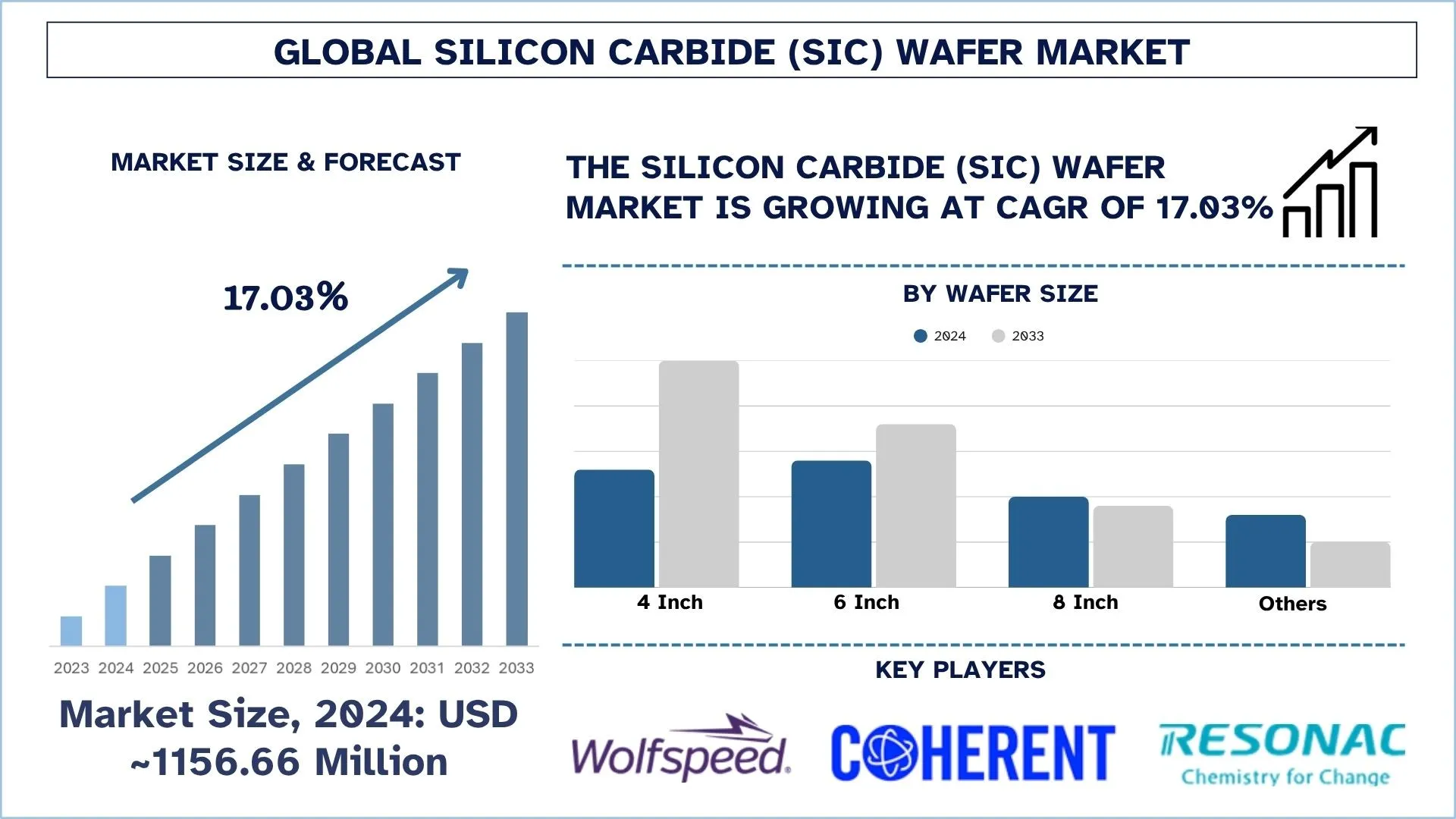

Silicon Carbide (SiC) Wafer Market: Current Analysis and Forecast (2025-2033)

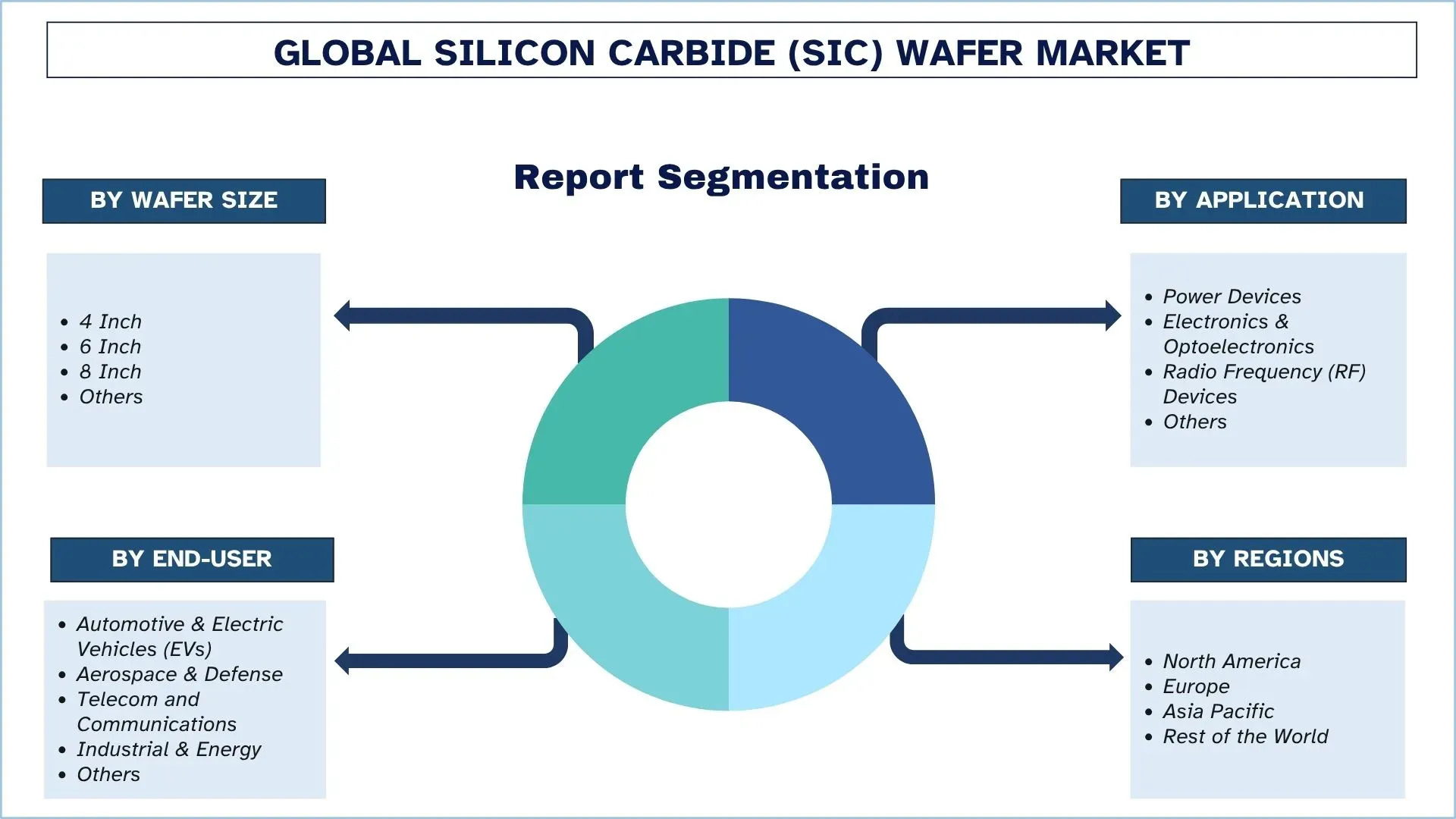

Emphasis on By Wafer Size (4 Inch, 6 Inch, 8 Inch, Others); By Application (Power Devices, Electronics & Optoelectronics, Radio Frequency (RF) Devices, Others); By End-user (Automotive & Electric Vehicles (EVs), Aerospace & Defense, Telecom and Communications, Industrial & Energy, Others); and Region/Country

Silicon Carbide (SiC) Wafer Market Size & Forecast

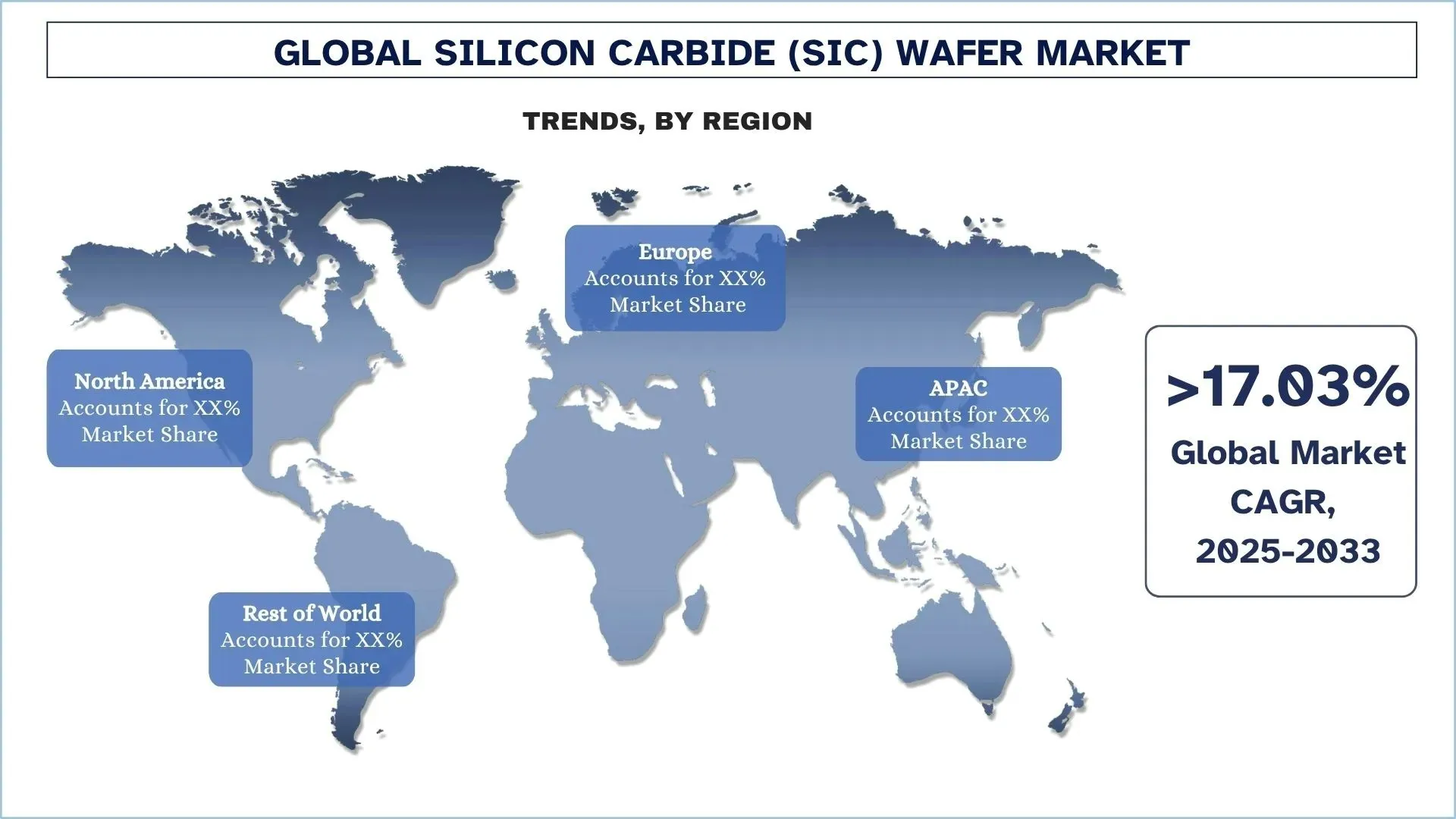

The Silicon Carbide (SiC) Wafer Market was valued at USD 1156.66 million in 2024 and is expected to grow at a strong CAGR of 17.03% for the forecast period (2025- 2033F) due to the rising demand for electric vehicles (EVs), advancements in power electronics, and miniaturization and high-performance needs.

Silicon Carbide (SiC) Wafer Market Analysis

The SiC wafer industry is observing a higher growth rate in the demand driven by factors such as increased adoption of electric vehicles (EVs), higher renewable energy, and 5G infrastructure investments. Due to its outstanding properties, such as high thermal conductivity, high voltage operation, and low switching losses, SiC power devices are ideally suited for EV powertrains, solar inverters, base stations, and other high-frequency RF applications. In addition, one of the largest developments occurring is the industry's transition from 6‐inch to 8‐inch wafer production. This transition is expected to expand dramatically over the forecasted year. Furthermore, it is expected to drive costs lower, yields higher by 5–10 points, and provide expansion in margins. Moreover, acquisitions and upstream partnerships facilitate vertical integration, enabling better control over material quality, supply chain reliability, simplicity of costs, and competitive advantage. Hence, EVs, renewables, telecom, wafer scaling, and vertical integration are some of the driving factors that are creating an energetic and high-growth in the Silicon Carbide wafer market.

Silicon Carbide (SiC) Wafer Market Trends

This section discusses the key market trends influencing the various segments of the Silicon Carbide (SiC) Wafer market as identified by our research experts.

Focus on Automotive Grade SiC Devices

The increasing emphasis on automotive-grade Silicon Carbide (SiC) devices is a major trend in the silicon carbide wafer market, which is effectively ramping up the demand for SiC wafers. Further, the increased adoption of electric vehicles (EVs) in the commercial market has increased the requirements for electric powertrains. SiC devices deliver the higher voltage and lower switching losses of MOSFETs in conjunction with better thermal conduction of Schottky diodes that provide increased utility in silicon. In addition, it translates to longer driving range, shorter charge times, and more compact system design. Moreover, traction inverters, DC-DC converters, and onboard chargers in automotive applications would benefit the most from the SiC wafers. Hence, these requirements have created a new focus for manufacturers toward automotive-grade SiC devices that meet the rigorous automotive industry-quality standards, such as AEC-Q101.

Silicon Carbide (SiC) Wafer Industry Segmentation

This section provides an analysis of the key trends in each segment of the global Silicon Carbide (SiC) Wafer market report, along with forecasts at the global, regional, and country levels for 2025-2033.

The 6-inch product category dominates the Silicon Carbide (SiC) Wafer market.

Based on wafer size, the market is segmented into 4 Inch, 6 Inch, 8 Inch, and others. The 6-inch wafer dominated the market because of its great heat resistance, high thermal capacity, high speed, wideband, and good performance. Power device makers are using these wafers due to their suitable size for high-volume production and cost-effectiveness. Further, their suitable size enables the manufacturers to produce many devices in one go, hence being cost-effective. With a higher production rate, they still maintain their properties of excellent thermal conductivity and low electrical losses. This size works well for electric cars, green energy systems, and big power supplies for factories. Further, the 6-inch wafer also fits well with the already established production lines, thereby reducing the manufacturing costs and making production faster. As demand for robust and energy-efficient components continues to grow, the widespread adoption of 6-inch SiC wafers significantly propels market expansion.

The Power devices category dominates the Silicon Carbide (SiC) Wafer market.

Based on application, the market is segmented into power devices, electronics & optoelectronics, radio frequency (RF) devices, and others. In the silicon carbide (SiC) wafer market, the power devices category dominated because of its characteristic properties of SiC material that make it highly appropriate for high-performance power electronics. With superior breakdown voltages and faster switching speeds, the SiC power devices, such as MOSFET and Schottky diode, outperform their silicon counterparts. Further, cheap energy usage, smaller system dimensions, and lower cooling requirements are requisite features in high-end applications such as electric vehicles (EVs), renewable energy systems, industrial motor drives, and smart grids. With energy efficiency and electrification on the run, SiC-based power devices have paved the way for replacing conventional silicon devices in power conversion and control. The automotive industry is growing by leaps and bounds, providing a strong opportunity to increase SiC devices for improving powertrain efficiency and thus extending the battery range.

North America held a dominant share of the Silicon Carbide (SiC) Wafer market in 2024

The North America region witnessed a spurring growth in the Silicon Carbide (SiC) Wafer market owing to the significant support from member governments. Additionally, grant, tax credit, and loan programs onshore critical semiconductor capacity, reducing the reliance on foreign suppliers in North America. Additionally, manufacturing companies are committing billions of dollars to build and scale new 200 mm silicon carbide wafer fabs in the North America region. Further, the development of new on-shore fab capacity is enhancing production capacity, enabling the traditional manufacturers to vertically integrate wafer fabrication with device assembly, solidifying the local supply chains. Additionally, research centers such as PowerAmerica and onsemi’s Silicon Carbide Crystal Center ensure the ease of facilitation of rapid technology transfer from the lab to the fab. Collectively, this coordinated push from the public and private sectors, spanning policy, investment, new integration, innovation, and end-market demand, is propelling North America as the global leader in the silicon carbide wafer market.

The U.S. held a dominant share of the North American Silicon Carbide (SiC) Wafer market in 2024.

The growth of the silicon carbide (SiC) wafer market in the U.S. is driven by the demand for high-efficiency, high-voltage SiC components, rising EV take-rate, renewable energy roll-out, data center expansion, and 5G infrastructure deployment. Additionally, leading U.S. manufacturers are striving hard to innovate, to become more vertically integrated, and meet automotive-grade quality standards. Further, a storm of federal funding through the CHIPS and Science Act, has directed billions on SiC wafer fabs up to USD 750 million to Wolfspeed, USD 225 million to Bosch, to build and expand SiC wafer fabs in North Carolina, California, and beyond with the aim of increasing U.S. production capacity. Furthermore, Wolfspeed would leverage these funds with private investment to build 200 mm "game-changing" fabs in Upstate New York and Chatham County, and Bosch would completely alter its Roseville site into a major U.S. SiC hub delivering almost 40% of national capacity by 2026. Hence, public and private partnerships are making U.S. industry a global market leader in the silicon carbide wafer production and securing next-generation supply chains.

Silicon Carbide (SiC) Wafer Competitive Landscape

The Silicon Carbide (SiC) Wafer Market is competitive and fragmented, with several global and international market players. The key players are adopting different growth strategies to enhance their market presence, such as partnerships, agreements, collaborations, new product launches, geographical expansions, and mergers and acquisitions.

Top Silicon Carbide (SiC) Wafer Companies

The major players operating in the market are Wolfspeed, Inc., Coherent Corp., Xiamen Powerway Advanced Material Co. Ltd, STMicroelectronics NV, Resonac Holdings Corporation, Atecom Technology Co. Ltd, SK Siltron Co. Ltd., SiCrystal GmbH, TankeBlue Co. Ltd., and Silicon Valley Microelectronics (SVM)

Silicon Carbide (SiC) Wafer Market News

On 7th March 2022, II‐VI Incorporated, one of the leaders in wide-bandgap semiconductors, announced that it would accelerate its investment in 150 mm and 200 mm silicon carbide (SiC) substrate and epitaxial wafer manufacturing with large-scale factory expansions in Easton, Pennsylvania, and Kista, Sweden. This is part of the Company’s previously announced $1 billion investment in SiC over the next 10 years.

On September 24, 2024, Resonac Corporation announced that it has signed an agreement with Soitec, a French manufacturer of advanced semiconductor substrate materials, to jointly develop 200mm (8-inch) silicon carbide (SiC) bonded substrates, which would serve as the material for SiC epitaxial wafers used in power semiconductors.

On April 23, 2024, Infineon Technologies finalized an agreement with global semiconductor manufacturer SK Siltron CSS, which aimed to stipulate the production of 150-mm silicon carbide wafers by SK Siltron for Infineon.

Carbide (SiC) Wafer Market Report Report Coverage

Report Attribute | Details |

Base year | 2024 |

Forecast period | 2025-2033 |

Growth momentum | Accelerate at a CAGR of 17.03% |

Market size 2024 | USD 1156.66 million |

Regional analysis | North America, Europe, APAC, Rest of the World |

Major contributing region | Asia-Pacific is expected to grow at the highest CAGR during the forecasted period. |

Key countries covered | U.S., Canada, Germany, United Kingdom, Spain, Italy, France, China, Japan, and India |

Companies profiled | Wolfspeed, Inc., Coherent Corp., Xiamen Powerway Advanced Material Co. Ltd, STMicroelectronics NV, Resonac Holdings Corporation, Atecom Technology Co. Ltd, SK Siltron Co. Ltd., SiCrystal GmbH, TankeBlue Co. Ltd., and Silicon Valley Microelectronics (SVM) |

Report Scope | Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Demand and Supply Side Analysis; Competitive Landscape; Company Profiling |

Segments Covered | By Wafer Size, By Application, By End-User, By Region/Country |

Reasons to buy the Silicon Carbide (SiC) Wafer Market report:

The study includes market sizing and forecasting analysis validated by authenticated key industry experts.

The report briefly reviews overall industry performance at a glance.

The report covers an in-depth analysis of prominent industry peers, primarily focusing on key business financials, product portfolios, expansion strategies, and recent developments.

Detailed examination of drivers, restraints, key trends, and opportunities prevailing in the industry.

The study comprehensively covers the market across different segments.

Deep dive regional-level analysis of the industry.

Customization Options:

The Global Silicon Carbide (SiC) Wafer Market can be customized by requirement or any other market segment. Besides this, UnivDatos understands that you may have your own business needs; hence, feel free to contact us to get a report that completely suits your requirements.

Table of Content

Research Methodology for the Silicon Carbide (SiC) Wafer Market Analysis (2023-2033)

We analyzed the historical market, estimated the current market, and forecasted the future market of the global Silicon Carbide (SiC) Wafer market to assess its application in major regions worldwide. We conducted exhaustive secondary research to gather historical market data and estimate the current market size. To validate these insights, we carefully reviewed numerous findings and assumptions. Additionally, we conducted in-depth primary interviews with industry experts across the Silicon Carbide (SiC) Wafer value chain. After validating market figures through these interviews, we used top-down and bottom-up approaches to forecast the overall market size. We then employed market breakdown and data triangulation methods to estimate and analyze the market size of industry segments and subsegments:

Market Engineering

We employed the data triangulation technique to finalize the overall market estimation and derive precise statistical numbers for each segment and sub-segment of the global Silicon Carbide (SiC) Wafer market. We split the data into several segments and sub-segments by analyzing various parameters and trends, including wafer size, application, and end-user within the global Silicon Carbide (SiC) Wafer market.

The main objective of the Global Silicon Carbide (SiC) Wafer Market Study

The study identifies current and future trends in the global Silicon Carbide (SiC) Wafer market, providing strategic insights for investors. It highlights regional market attractiveness, enabling industry participants to tap into untapped markets and gain a first-mover advantage. Other quantitative goals of the studies include:

Market Size Analysis: Assess the current forecast and market size of the global Silicon Carbide (SiC) Wafer market and its segments in terms of value (USD).

Silicon Carbide (SiC) Wafer Market Segmentation: Segments in the study include areas of wafer size, application, and end-user.

Regulatory Framework & Value Chain Analysis: Examine the regulatory framework, value chain, customer behavior, and competitive landscape of the Silicon Carbide (SiC) Wafer industry.

Regional Analysis: Conduct a detailed regional analysis for key areas such as Asia Pacific, Europe, North America, and the Rest of the World.

Company Profiles & Growth Strategies: Company profiles of the Silicon Carbide (SiC) Wafer market and the growth strategies adopted by the market players to sustain the fast-growing market.

Frequently Asked Questions FAQs

Q1: What is the Silicon Carbide (SiC) Wafer market's current size and growth potential?

The Silicon Carbide (SiC) Wafer market was valued at USD 1156.66 million in 2024 and is expected to grow at a CAGR of 17.03% during the forecast period (2025-2033).

Q2: Which segment has the largest share of the Silicon Carbide (SiC) Wafer market by wafer size?

The 6-inch wafer dominated the market because of its great heat resistance, high thermal capacity, high speed, wideband, and good performance.

Q3: What are the driving factors for the growth of the Silicon Carbide (SiC) Wafer market?

• Rising Demand for Electric Vehicles (EVs): The increasing adoption of EVs is significantly boosting the need for SiC wafers due to their efficiency in high-voltage power electronics. SiC enables faster charging, reduced power loss, and better thermal management in EV inverters and onboard chargers.

• Advancements in Power Electronics: SiC's superior material properties, like wide bandgap and high breakdown voltage, make it ideal for next-generation power electronic devices. These advancements are accelerating their use in industrial motors, renewable energy systems, and aerospace.

• Miniaturization and High-Performance Needs: The electronics industry demands smaller, lighter, and more efficient components, which SiC can deliver better than traditional semiconductors. This need supports SiC adoption across automotive, industrial, and communication applications.

Q4: What are the emerging technologies and trends in the Silicon Carbide (SiC) Wafer market?

• Shift Toward 200mm Wafer Production: Manufacturers are transitioning from 150mm to 200mm wafers to achieve better economies of scale and yield per wafer. This shift is expected to lower costs and increase supply in the medium term.

• Focus on Automotive Grade SiC Devices: There is growing emphasis on qualifying SiC for automotive standards like AEC-Q101. This trend is critical as EV adoption soars and automakers demand high-reliability components.

Q5: What are the key challenges in the Silicon Carbide (SiC) Wafer market?

• High Cost of SiC Wafers Compared to Silicon: The production cost of SiC wafers remains significantly higher than traditional silicon, limiting widespread adoption. This is due to complex fabrication, lower yields, and expensive raw materials.

• Technological Barriers in Scaling to Larger Wafers: While the shift to 200mm wafers is underway, scaling up while maintaining quality and yield is technically difficult. This affects cost reduction and mass adoption efforts.

Q6: Which region dominates the Silicon Carbide (SiC) Wafer Market?

North America dominates the Silicon Carbide (SiC) wafer market due to its strong presence of key manufacturers, substantial investments in EV and renewable energy infrastructure, and advanced R&D capabilities in power electronics.

Q7: Who are the key players in the Silicon Carbide (SiC) Wafer market?

Some of the Leading companies in Silicon Carbide (SiC) Wafer are:

• Wolfspeed, Inc.

• Coherent Corp.

• Xiamen Powerway Advanced Material Co., Ltd

• STMicroelectronics NV

• Resonac Holdings Corporation

• Atecom Technology Co. Ltd

• SK siltron Co., Ltd.

• SiCrystal GmbH

• TankeBlue Co. Ltd.

• Silicon Valley Microelectronics (SVM)

Q8: What are the key investment opportunities in the global Silicon Carbide (SiC) Wafer industry?

The key investment opportunity in the global SiC wafer industry lies in expanding 8-inch wafer manufacturing facilities and vertically integrating the supply chain, leveraging economies of scale, efficiency improvements, and high-margin control across materials and devices amid rising EV, renewable energy, and 5G demand.

Q9: How are mergers, acquisitions, and brand collaborations shaping the Silicon Carbide (SiC) Wafer landscape?

Mergers, acquisitions, and brand collaborations are rapidly reshaping the SiC wafer landscape by driving vertical integration, enabling key players to secure raw material supply, expand capacity (especially 200 mm fabs), accelerate technology development, and strengthen design-win partnerships across automotive and energy applications.

Related Reports

Customers who bought this item also bought