Рынок автомобильного программного обеспечения и электроники: текущий анализ и прогноз (2021-2027)

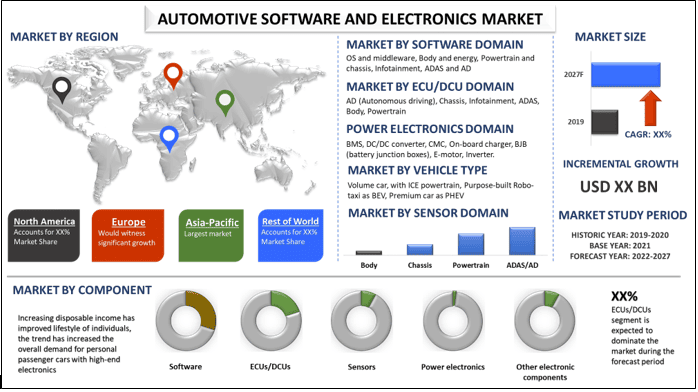

Акцент на компоненты (Программное обеспечение, ЭБУ/БКУ, Датчики, Силовая электроника (без аккумуляторных ячеек), Другие электронные компоненты); Область программного обеспечения (ОС и промежуточное ПО, Кузов и энергоснабжение, Силовая установка и шасси, Инфоразвлечения, ADAS и AD); Область ЭБУ/БКУ (AD (автономное вождение), Шасси, Инфоразвлечения, ADAS, Кузов, Силовая установка); Область датчиков (Кузов, Шасси, Силовая установка, ADAS/AD); Область силовой электроники (BMS (система управления батареями), Преобразователь постоянного тока в постоянный ток, CMC (контроллер управления ячейками), Бортовое зарядное устройство, BJB (распределительные коробки батареи), Электродвигатель, Инвертор); Область других электронных компонентов (Жгуты проводов, прочее); Тип транспортного средства (Массовый автомобиль с ДВС, Специализированное Robo-taxi на BEV, Премиум-автомобиль на PHEV); Регионы/Страны

Ожидается, что рынок автомобильного программного обеспечения и электроники продемонстрирует среднегодовой темп роста около 8% в течение прогнозируемого периода (2021–2027 гг.).Интернет вещей (IoT) достиг зрелости, и теперь сложные решения могут быть реализованы без проблем в рамках систем и процессов городского управления и менеджмента. Автономное вождение (AD), подключенные автомобили, электрификация силовой установки и совместная мобильность (ACES) — основные тенденции, которые взаимно подкрепляют разработки в автомобильной промышленности. Эти тенденции в совокупности не только разрушают цепочку создания стоимости в автомобилестроении и влияют на всех заинтересованных лиц, но и являются основным фактором для рынка автомобильного программного обеспечения и электронных компонентов. Ожидаются существенные отклонения в различных сегментах рынка. Ожидается, что силовая электроника продемонстрирует самый высокий среднегодовой темп роста. Платформы электромобилей (EV) превратятся в новый рынок для высоковольтных (HV) жгутов, в то время как общий спрос на низковольтные (LV) жгуты, как ожидается, сократится, в результате чего сегмент жгутов будет расти самыми медленными темпами. Учитывая имеющиеся возможности, ожидается, что все игроки на рынке получат выгоду от наращивания своих возможностей по доставке программного обеспечения и архитектуры электронных и электрических систем, внедряя новейшие технологические инновации, включая пользовательский интерфейс, UX, аналитику.

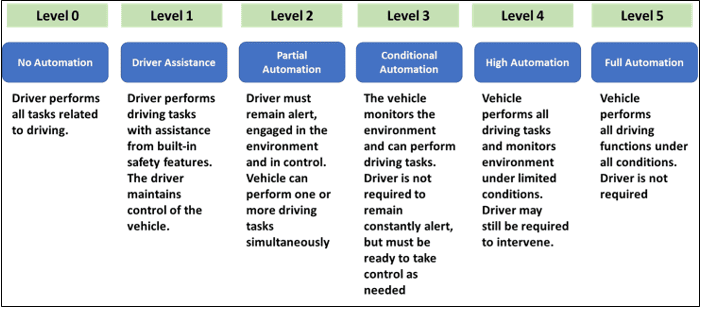

Уровни автоматизации транспортных средств

Представленные в отчете данные

«Среди компонентов сегмент ЭБУ/БКУ лидировал на рынке с долей более 35% в 2020 году»

На основе компонентов рынок автомобильного программного обеспечения и электроники сегментирован на программное обеспечение, ЭБУ/БКУ, датчики, силовую электронику (без аккумуляторных ячеек) и другие электронные компоненты. В 2020 году ЭБУ/БКУ доминировали на рынке, за ними следовали другие электронные компоненты (жгуты проводов, элементы управления, переключатели, дисплеи). Ожидается, что сегмент ЭБУ/БКУ будет доминировать на рынке из-за постоянно растущего рынка транспортных средств в связи с ростом располагаемого дохода.

«Среди области программного обеспечения сегмент ADAS и AD доминировал на рынке»

На основе области программного обеспечения рынок разделен на ОС и промежуточное ПО, Кузов и энергоснабжение, Силовая установка и шасси, Инфоразвлечения, ADAS и AD. По оценкам, программное обеспечение для сегмента ADAS и AD доминировало на рынке, составляя около 40% рынка в 2020 году. Ожидается, что сегмент инфоразвлечений продемонстрирует значительный рост в течение прогнозируемого периода.

«Среди области ЭБУ/БКУ сегмент силовой установки доминировал на рынке»

На основе области ЭБУ/БКУ рынок сегментирован на AD (автономное вождение), Шасси, Инфоразвлечения, ADAS, Кузов, Силовая установка. В 2020 году ЭБУ/БКУ для сегмента силовой установки доминировали на рынке. Ожидается, что конвергенция блоков электронного управления откроет новый рынок для доменных контроллеров. ЭБУ внутри транспортного средства отвечают за управление электрическими подсистемами транспортного средства, в то время как БКУ рассматривается как следующий уровень развития ЭБУ, консолидирующий функциональность нескольких отдельных ЭБУ в единую, более экономичную систему.

«Среди области датчиков продажи датчиков для сегмента ADAS/AD доминировали на рынке»

На основе области датчиков рынок сегментирован на Кузов, Шасси, Силовая установка, ADAS/AD. В настоящее время продажи датчиков для сегмента ADAS/AD доминируют на рынке, за ними следует сегмент силовой установки. Тенденция к автономному вождению является основным фактором, определяющим спрос на датчики в автомобильном секторе. Следовательно, ожидается, что растущее внедрение ADAS и AD поможет сегменту автомобильных датчиков расти умеренными темпами в течение прогнозируемого периода.

«Среди области силовой электроники сегмент инверторов доминировал на рынке»

На основе области силовой электроники рынок сегментирован на BMS (система управления батареями), Преобразователь постоянного тока в постоянный ток, CMC (контроллер управления ячейками), Бортовое зарядное устройство, BJB (распределительные коробки батареи), Электродвигатель, Инвертор. По оценкам, сегмент инверторов доминировал на рынке. Ожидается, что сегмент силовой электроники продемонстрирует самый высокий среднегодовой темп роста, в основном за счет растущего внедрения электромобилей во всем мире, что потребует больше силовой электроники.

«Среди области других электронных компонентов сегмент жгутов проводов доминировал на рынке»

На основе области других электронных компонентов рынок разделен на Жгуты проводов, прочее. В 2020 году сегмент жгутов проводов доминировал на рынке. Сегмент жгутов проводов в основном обусловлен появлением платформ электромобилей, что открыло быстрорастущий рынок высоковольтных жгутов, которые соединяют высоковольтную батарею, зарядное устройство, электродвигатель и другие высоковольтные компоненты внутри электромобиля.

«Среди типов транспортных средств программное обеспечение и электроника в основном используются в специализированных Robo-taxi на BEV»

На основе типа транспортного средства рынок автомобильного программного обеспечения и электроники сегментирован на Массовые автомобили с ДВС, Специализированные Robo-taxi на BEV, Премиум-автомобили на PHEV. В настоящее время программное обеспечение и электроника в основном используются в специализированных Robo-taxi на BEV, за ними следуют премиум-автомобили на PHEV. Ожидается, что затраты на электронику и программное обеспечение для Robo-taxi будут значительно высокими в 2025 году, в основном из-за высоких затрат на датчики, а также небольшой базы транспортных средств.

«Ожидается, что Азиатско-Тихоокеанский регион продемонстрирует самый высокий рост в течение прогнозируемого периода»

Для лучшего понимания спроса на автомобильное программное обеспечение и электронику рынок анализируется для основных регионов, включая Северную Америку (США, Канада, остальная часть Северной Америки); Европа (Германия, Великобритания, Франция, Италия, остальная часть Европы); Азиатско-Тихоокеанский регион (Китай, Япония, Южная Корея, остальная часть Азиатско-Тихоокеанского региона) и остальной мир. В настоящее время Азиатско-Тихоокеанский регион доминирует на рынке. Рынок подключенных автомобилей продемонстрировал значительный рост в Азиатско-Тихоокеанском регионе за последние несколько лет. Рост этого сегмента обусловлен присутствием в регионе таких компаний, как Baidu, Alibaba и других. Некоторые из основных игроков, действующих на рынке, включают Robert Bosch, NXP Semiconductors, Renesas Electronics, BlackBerry Limited, NVIDIA, Continental, Denso Corporation, Magna International, ZF Friedrichshafen AG, Aisin Corporation.

Причины для покупки этого отчета:

- Исследование включает анализ размеров рынка и прогнозирование, подтвержденные проверенными ключевыми экспертами отрасли

- Отчет представляет краткий обзор общей производительности отрасли с первого взгляда

- Отчет содержит углубленный анализ выдающихся представителей отрасли с основным акцентом на ключевые финансовые показатели бизнеса, портфель продуктов, стратегии расширения и недавние разработки

- Детальное изучение движущих сил, ограничений, ключевых тенденций и возможностей, преобладающих в отрасли

- Исследование всесторонне охватывает рынок по различным сегментам

- Углубленный анализ отрасли на региональном уровне

Параметры настройки:

Рынок автомобильного программного обеспечения и электроники может быть дополнительно настроен в соответствии с требованиями или любым другим сегментом рынка. Помимо этого, UMI понимает, что у вас могут быть свои собственные бизнес-потребности, поэтому не стесняйтесь обращаться к нам, чтобы получить отчет, который полностью соответствует вашим требованиям.

Содержание

Анализ исторического рынка, оценка текущего рынка и прогнозирование будущего рынка автомобильного программного обеспечения и электроники — вот три основных этапа, предпринятых для создания и анализа спроса и продаж программного обеспечения и электроники в автомобильном секторе во всем мире. Были проведены исчерпывающие вторичные исследования для сбора исторических рыночных показателей и оценки текущего размера рынка. Во-вторых, для подтверждения этих данных было принято во внимание множество выводов и предположений. Кроме того, были проведены исчерпывающие первичные интервью с экспертами отрасли по всей цепочке создания стоимости отрасли. После предположения и подтверждения рыночных показателей с помощью первичных интервью мы использовали восходящий подход для прогнозирования общего размера рынка. После этого были приняты методы разбивки рынка и триангуляции данных для оценки и анализа размера рынка сегментов и подсегментов, к которым относится отрасль. Подробная методология объяснена ниже.

Анализ исторических размеров рынка

Шаг 1. Углубленное изучение вторичных источников:

Подробное вторичное исследование было проведено для получения исторических размеров рынка автомобильного программного обеспечения и электроники через внутренние источники компании, такие какгодовые отчеты и финансовая отчетность, презентации о деятельности, пресс-релизы и т. д.и внешние источники, включаяжурналы, новости и статьи, правительственные публикации, публикации конкурентов, отраслевые отчеты, сторонние базы данных и другие авторитетные публикации.

Шаг 2. Сегментация рынка:

После получения исторических размеров рынка автомобильного программного обеспечения и электроники мы провели подробный вторичный анализ для сбора исторических рыночных данных и доли различных сегментов и подсегментов для основных регионов. Основные сегменты, включенные в отчет, — это Компонент, Область программного обеспечения, Область ЭБУ/БКУ, Область датчиков, Область силовой электроники, Область других электронных компонентов, Тип транспортного средства. Были проведены дополнительные анализы на региональном уровне для оценки общего спроса на автомобильное программное обеспечение и электронику в глобальном контексте.

Шаг 3. Факторный анализ:

После получения исторических размеров рынка различных сегментов и подсегментов мы провели подробныйфакторный анализдля оценки текущего размера рынка. Кроме того, мы провели факторный анализ, используя зависимые и независимые переменные, такие как растущий спрос на премиальные и электрические транспортные средства и технологические достижения в автомобильном секторе и т. д. Были проанализированы исторические тенденции и их влияние на размер и долю рынка из года в год. Также был тщательно изучен сценарий спроса и предложения.

Оценка и прогноз текущего размера рынка

Определение текущего размера рынка:На основе практических выводов, полученных в результате выполнения указанных выше 3 шагов, мы определили текущий размер рынка, ключевых игроков на рынке, а также доли сегментов и компаний. Все необходимые процентные разбивки и детализация рынка были определены с использованием вышеупомянутого вторичного подхода и подтверждены в ходе первичных интервью.

Оценка и прогнозирование:Для оценки и прогнозирования рынка были назначены веса различным факторам, включая драйверы и тенденции, ограничения и возможности для заинтересованных сторон. После анализа этих факторов были применены соответствующие методы прогнозирования, т.е. восходящий подход, для получения прогноза рынка до 2027 года для различных сегментов и подсегментов в основных регионах мира. Методология исследования, принятая для оценки размера рынка, включает:

- Размер рынка отрасли в стоимостном выражении (долл. США) и спрос на автомобильное программное обеспечение и электронику в основных регионах мира

- Все процентные доли, разбивки и детализация сегментов и подсегментов рынка

- Ключевые игроки на рынке автомобильного программного обеспечения и электроники с точки зрения предлагаемой продукции. Также стратегии роста, принятые этими игроками для конкуренции на быстрорастущем рынке.

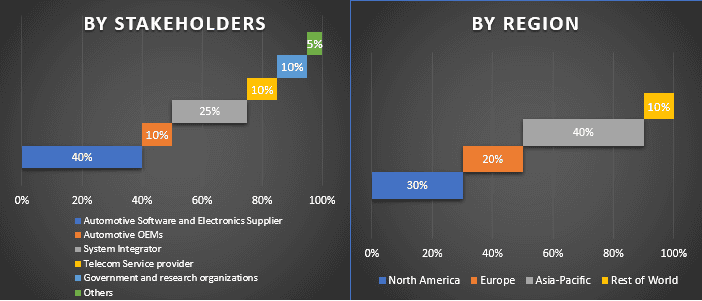

Подтверждение размера и доли рынка

Первичные исследования:Были проведены углубленные интервью с ключевыми лидерами мнений (KOL), включая руководителей высшего звена (CXO/VP, руководители отделов продаж, маркетинга, операционного управления и региональных отделений, руководители стран и т. д.) в основных странах. Результаты первичных исследований были затем обобщены, и был проведен статистический анализ для подтверждения заявленной гипотезы. Данные первичных исследований были консолидированы со вторичными данными, превращая, таким образом, информацию в действенные выводы.

Разбивка участников первичного исследования по различным регионам

Инженерное обеспечение рынка

Для завершения общей оценки рынка и получения точных статистических данных по каждому сегменту и подсегменту рынка автомобильного программного обеспечения и электроники была применена техника триангуляции данных. Данные были разделены на несколько сегментов и подсегментов после изучения различных параметров и тенденций в областях компонентов, программного обеспечения, доменов ECU/DCU, доменов датчиков, силовой электроники и других электронных компонентов, типов транспортных средств и регионов.

Основная цель исследования рынка автомобильного программного обеспечения и электроники

В исследовании определены текущие и будущие рыночные тенденции рынка автомобильного программного обеспечения и электроники. Инвесторы могут получить стратегические выводы для принятия решений об инвестициях на основе качественного и количественного анализа, проведенного в исследовании. Текущие и будущие рыночные тенденции определят общую привлекательность рынка на региональном уровне, обеспечивая платформу для участников отрасли, чтобы использовать неиспользованный рынок и получить преимущество первого игрока. Другие количественные цели исследований включают:

- Проанализировать текущий и прогнозируемый размер рынка автомобильного программного обеспечения и электроники в стоимостном выражении (долл. США). Кроме того, проанализировать текущий и прогнозируемый размер рынка различных сегментов и подсегментов отрасли

- Сегменты в исследовании включают компонент, домен программного обеспечения, домен ECU/DCU, домен датчиков, домен силовой электроники, другие электронные домены, тип транспортного средства и регионы

- Определенный анализ нормативно-правовой базы для индустрии автомобильного программного обеспечения и электроники

- Проанализировать цепочку создания стоимости, связанную с наличием различных посредников, а также проанализировать поведение клиентов и конкурентов, относящееся к отрасли

- Основные регионы, проанализированные в отчете, включают Северную Америку (США, Канада, остальная часть Северной Америки); Европу (Германия, Великобритания, Франция, Италия, остальная часть Европы); Азиатско-Тихоокеанский регион (Китай, Япония, Южная Корея, остальная часть Азиатско-Тихоокеанского региона); и Остальной мир. Определить и проанализировать конкурентную среду сектора автомобильного программного обеспечения и электроники и стратегии роста, принятые игроками рынка для устойчивого развития на быстрорастущем рынке

- Углубленный анализ отрасли на региональном уровне

Связанные Отчеты

Клиенты, купившие этот товар, также купили