- Startseite

- Über uns

- Industrie

- Dienstleistungen

- Lesen

- Kontaktieren Sie uns

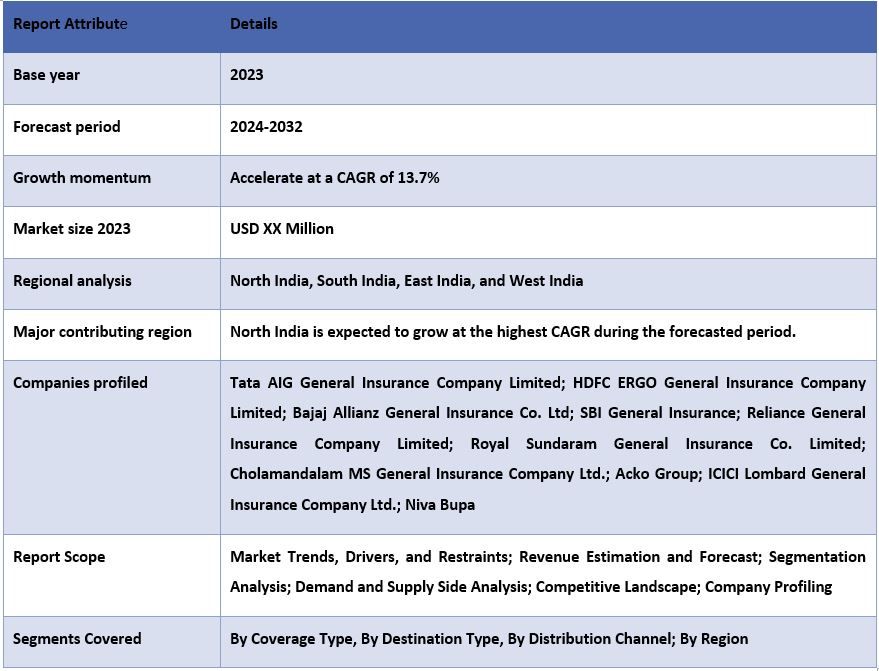

Indien Reiseversicherungsmarkt: Aktuelle Analyse und Prognose (2024-2032)

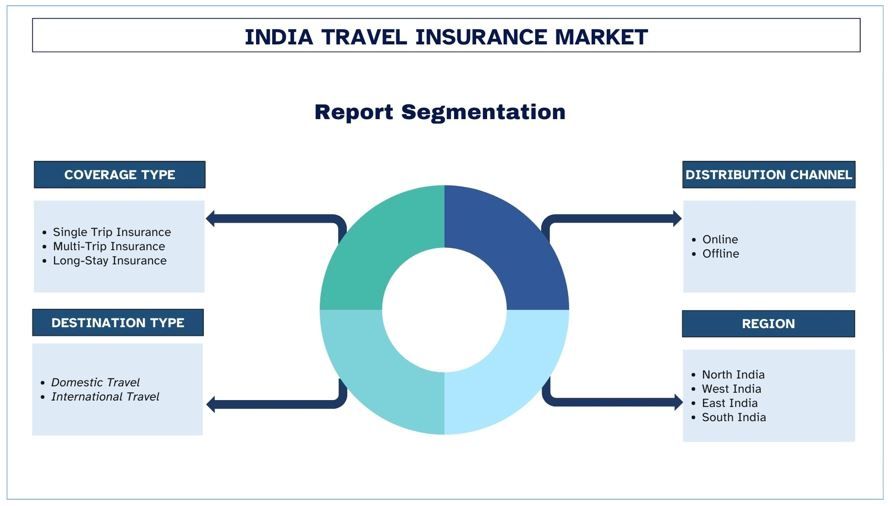

Betonung auf Deckungsart (Einzelreiseversicherung, Mehrfachreiseversicherung und Langzeitversicherung); Reisezieltyp (Inlandsreisen und Auslandsreisen); Vertriebskanal (Online und Offline); Region

Geografie:

Letzte Aktualisierung:

Nov 2024

Indien Reiseversicherungsmarkt Größe & Prognose

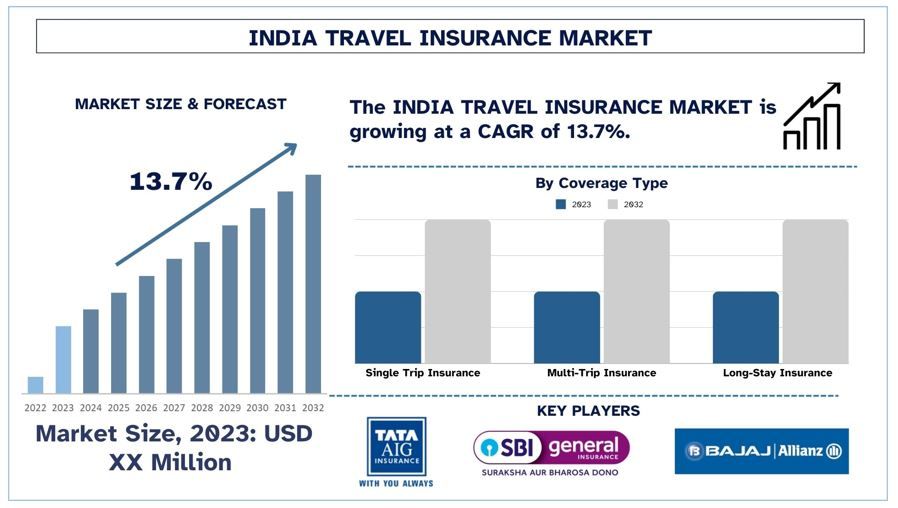

Der indische Reiseversicherungsmarkt wurde 2023 auf USD Millionen geschätzt und wird voraussichtlich mit einer starken CAGR von rund 13,7 % im Prognosezeitraum (2024-2032) wachsen, was auf die zunehmende Reisetätigkeit und das steigende Bewusstsein und die Bildung im Land zurückzuführen ist.

Indien Reiseversicherungsmarkt Analyse

Der Reiseversicherungsmarkt in Indien hat aufgrund der steigenden Zahl sowohl inländischer als auch internationaler Touristen ein großes Wachstumspotenzial in der Nachfrage gezeigt. Das gestiegene Bewusstsein für die Bedeutung des Reisens und das Aufkommen neuer Verbrauchergruppen mit höherem verfügbarem Einkommen bestimmen ebenfalls die große Aufmerksamkeit für Reiseversicherungen. Der Markt umfasst hier ein breites Produktspektrum, um die unterschiedlichen Kundenbedürfnisse wie Einzel-Geschäftsreisende, Familien, Studenten und Unternehmen zu erfüllen.

Jüngste Entwicklungen auf dem Markt

- Auf dem 21. ASEAN-Indien-Gipfel schlug Premierminister Narendra Modi vor, 2025 als „ASEAN-Indien-Tourismusjahr“ zu feiern und damit die Bedeutung der Förderung des Tourismus und des kulturellen Austauschs zwischen den ASEAN-Staaten und Indien hervorzuheben. Um diese Initiative zu unterstützen, hat Indien 5 Millionen USD für gemeinsame Tourismusprojekte und Werbeaktivitäten bereitgestellt.

- Laut einem Bericht von ICICI Lombard mit dem Titel „Recherchen zum Reiseverhalten 2023“ betonte der Lombard-Bericht, dass in einem Land, in dem die Gesamtversicherungsdurchdringung nur etwa 4 % beträgt, 92 % dieser Kohorte wahrscheinlich eine Reiseversicherung für ihren nächsten Urlaub abschließen werden.

Indien Reiseversicherungsmarkt Trends

Dieser Abschnitt erörtert die wichtigsten Markttrends, die die verschiedenen Segmente des Haustier-Parfüm-Marktes beeinflussen, wie von unserem Team von Forschungsexperten identifiziert.

Das internationale Reisesegment wandelt die Branche um

Die internationale Reiseversicherung hat sich aufgrund der Zunahme der Anzahl von Indern, die zu Geschäfts-, Tourismus- und Bildungszwecken in die ganze Welt reisen, als großes Segment des Reiseversicherungsmarktes in Indien herauskristallisiert. Mit der Lockerung der COVID-19-Beschränkungen gibt es einen verstärkten Fokus auf Reiseversicherungen und mehr Reisende, die sich in Situationen wie medizinischer Evakuierung und Reiserücktritt usw. schützen möchten. Weitere damit verbundene Faktoren, die dieses Wachstum angekurbelt haben, sind der Online-Policen-Kaufkanal, auch bekannt als der neue Kaufkanal, und das Aufkommen von Online-Verkaufsplattformen für Versicherungspolicen, die es Reisenden ermöglichen, Versicherungspläne zu vergleichen und auszuwählen, die ihren Bedürfnissen entsprechen, und zwar zu ihrer persönlichen, günstigen Zeit. Darüber hinaus setzen sich verändernde Verbrauchertrends, die zu abenteuerlichen Verlagerungen, Reisen und längeren Aufenthalten führen, auch auf dringende Versicherungslösungen unter Druck. Daher wurde festgestellt, dass das internationale Reisesegment zukünftig hohe Wachstumraten aufweist, wenn man die Gesamtentwicklung der Reisebranche und das zunehmende Interesse der Verbraucher an Risikomanagementverfahren berücksichtigt.

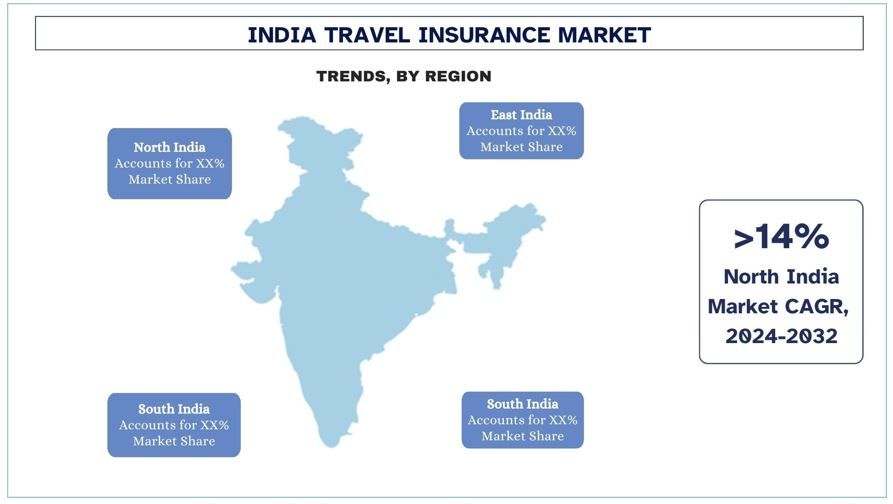

Westindien wird voraussichtlich mit einer signifikanten CAGR im Prognosezeitraum wachsen

Es wird beobachtet, dass der westindische Markt für Reiseversicherungen aufgrund von Faktoren wie Reisefreudigkeit, Tourismusförderungsrahmen und der zunehmenden Erkenntnis von Reiserisiken eine erhebliche Prävalenz aufweist. Große Städte wie Mumbai und Pune haben sich aufgrund der hohen Anzahl von Menschen, die sich hier auf Urlaubs- oder Geschäftsreisen konzentrieren, zu wichtigen Zentren der inländischen und internationalen Konnektivität entwickelt. Die Verfügbarkeit attraktiver Reiseziele in der Region und Abenteuer wie Strände sowie kulturelle und natürliche Touristenattraktionen zwingen mehr Menschen, Policen gegen die Risiken von Ereignissen abzuschließen, die sie verhindern möchten. Auch das Post-COVID-19-Bewusstsein in Bezug auf Reiseversicherungen hat unter Reisenden in Westindien aufgrund der Pandemie erheblich zugenommen. Folglich bringen Versicherer Produkte auf den Markt, die speziell auf die Anforderungen der Reisenden in diesem Bereich zugeschnitten sind, und übertragen Westindien somit eine stärkere Position als Teil des gesamten indischen Reiseversicherungsmarktes. Da das Segment weiterhin das frühere Niveau erreicht, wird angenommen, dass dieses Segment seine Stärke weiter ausbauen wird, basierend auf der zunehmenden Urbanisierung und der Zunahme der Mittelschichtbevölkerung.

Indien Reiseversicherungsbranche Überblick

Der indische Reiseversicherungsmarkt ist wettbewerbsintensiv und fragmentiert, mit der Präsenz mehrerer Marktteilnehmer im Land. Die wichtigsten Akteure verfolgen verschiedene Wachstumsstrategien, um ihre Marktpräsenz zu verbessern, wie z. B. Partnerschaften, Vereinbarungen, Kooperationen, Produkteinführungen, geografische Expansionen sowie Fusionen und Übernahmen. Einige der wichtigsten Akteure, die auf dem Markt tätig sind, sind Tata AIG General Insurance Company Limited; HDFC ERGO General Insurance Company Limited; Bajaj Allianz General Insurance Co. Ltd; SBI General Insurance; Reliance General Insurance Company Limited; Royal Sundaram General Insurance Co. Limited; Cholamandalam MS General Insurance Company Ltd.; Acko Group; ICICI Lombard General Insurance Company Ltd.; Niva Bupa.

Indien Reiseversicherungsmarkt Nachrichten

- Im Oktober 2024 stellte ICICI Lombard, Indiens führender privater Generalversicherer, TripSecure+ vor, eine innovative, KI-gestützte Reiseversicherungslösung, mit der Benutzer ihre Police an ihre individuellen Reisebedürfnisse anpassen können. Sie können ihren Versicherungsschutz einfach anpassen, um einen bestimmten Schutz einzuschließen oder auszuschließen und so sicherzustellen, dass ihre Police für ihre spezifische Reise funktioniert, egal ob es sich um einen entspannten Strandurlaub oder ein robustes Outdoor-Abenteuer handelt.

- Im Juli 2024 gab die Karnataka Bank ihre strategische Partnerschaft mit der ICICI Lombard General Insurance Company bekannt. Durch diese Zusammenarbeit haben die Kunden der Karnataka Bank Zugang zu einer breiten Palette umfassender Versicherungsprodukte und -dienstleistungen von ICICI Lombard. Diese Angebote umfassen Krankenversicherungen, Kfz-Versicherungen, Reiseversicherungen, Hausratversicherungen und mehr, die auf die vielfältigen Versicherungsbedürfnisse von Einzelpersonen und Unternehmen zugeschnitten sind.

- Im Juni 2024 kündigte INSILLION, eine führende Insurtech-SaaS-Plattform, eine bedeutende Partnerschaft an, die die Art und Weise, wie Reiseversicherungen angeboten werden, verändern wird. Royal Sundaram General Insurance (RSGI), ein prominenter Schaden- und Unfallversicherer mit Sitz in Indien, hat sich in das Indian Railway Catering and Tourism Corporation (IRCTC) integriert, um eingebettete Group Personal Accident (GPA)-Policen zusammen mit E-Ticket-Käufen über die API-Plattform von INSILLION anbieten zu können.

Berichtsabdeckung des indischen Reiseversicherungsmarktes

Gründe für den Kauf dieses Berichts:

- Die Studie beinhaltet Marktabschätzungen und Prognoseanalysen, die von authentifizierten wichtigen Branchenexperten validiert wurden.

- Der Bericht bietet einen schnellen Überblick über die Gesamtleistung der Branche auf einen Blick.

- Der Bericht enthält eine eingehende Analyse prominenter Branchenkollegen mit Schwerpunkt auf wichtigen Geschäftsfinanzen, Produktportfolios, Expansionsstrategien und aktuellen Entwicklungen.

- Detaillierte Untersuchung von Treibern, Beschränkungen, wichtigen Trends und Chancen, die in der Branche vorherrschen.

- Die Studie deckt den Markt umfassend über verschiedene Segmente ab.

- Detaillierte regionale Analyse der Branche.

Anpassungsoptionen:

Der indische Reiseversicherungsmarkt kann weiter an die Anforderungen oder jedes andere Marktsegment angepasst werden. Darüber hinaus versteht UMI, dass Sie möglicherweise Ihre eigenen Geschäftsanforderungen haben, daher können Sie sich gerne mit uns in Verbindung setzen, um einen Bericht zu erhalten, der Ihren Anforderungen vollständig entspricht.

Inhaltsverzeichnis

Forschungsmethodik für die Analyse des indischen Reiseversicherungsmarktes (2024-2032)

Die Analyse des historischen Marktes, die Schätzung des aktuellen Marktes und die Prognose des zukünftigen Marktes des indischen Reiseversicherungsmarktes waren die drei wichtigsten Schritte, die unternommen wurden, um die Einführung der indischen Reiseversicherung in den wichtigsten Bundesstaaten zu erstellen und zu analysieren. Es wurde eine umfassende Sekundärforschung durchgeführt, um die historischen Marktzahlen zu sammeln und die aktuelle Marktgröße zu schätzen. Zweitens wurden zur Validierung dieser Erkenntnisse zahlreiche Ergebnisse und Annahmen berücksichtigt. Darüber hinaus wurden ausführliche Primärinterviews mit Branchenexperten über die gesamte Wertschöpfungskette des indischen Reiseversicherungsmarktes geführt. Nach der Annahme und Validierung der Marktzahlen durch Primärinterviews wandten wir einen Top-Down/Bottom-Up-Ansatz an, um die vollständige Marktgröße zu prognostizieren. Danach wurden Marktaufschlüsselungs- und Datentriangulationsmethoden angewendet, um die Marktgröße von Segmenten und Untersegmenten der Branche zu schätzen und zu analysieren. Die detaillierte Methodik wird im Folgenden erläutert:

Analyse der historischen Marktgröße

Schritt 1: Eingehende Untersuchung von Sekundärquellen:

Es wurde eine detaillierte Sekundärstudie durchgeführt, um die historische Marktgröße des indischen Reiseversicherungsmarktes über unternehmensinterne Quellen wie Jahresberichte und Finanzberichte, Präsentationen zur Leistungsfähigkeit, Pressemitteilungen usw. sowie externe Quellen wie Zeitschriften, Nachrichten und Artikel, Regierungsveröffentlichungen, Wettbewerberpublikationen, Branchenberichte, Datenbanken von Drittanbietern und andere glaubwürdige Veröffentlichungen zu erhalten.

Schritt 2: Marktsegmentierung:

Nachdem wir die historische Marktgröße des indischen Reiseversicherungsmarktes erhalten hatten, führten wir eine detaillierte Sekundäranalyse durch, um historische Markteinblicke und Anteile für verschiedene Segmente und Untersegmente für wichtige Regionen zu sammeln. Zu den wichtigsten Segmenten, die in dem Bericht enthalten sind, gehören die Deckungsart, die Art des Reiseziels, der Vertriebskanal und die Regionen. Darüber hinaus wurden Analysen auf Länderebene durchgeführt, um die allgemeine Einführung von Testmodellen in dieser Region zu bewerten.

Schritt 3: Faktorenanalyse:

Nachdem wir die historische Marktgröße verschiedener Segmente und Untersegmente ermittelt hatten, führten wir eine detaillierte Faktorenanalyse durch, um die aktuelle Marktgröße des indischen Reiseversicherungsmarktes zu schätzen. Darüber hinaus führten wir eine Faktorenanalyse unter Verwendung abhängiger und unabhängiger Variablen wie Deckungsart, Art des Reiseziels, Vertriebskanal und Regionen des indischen Reiseversicherungsmarktes durch. Es wurde eine gründliche Analyse der Angebots- und Nachfrageszenarien unter Berücksichtigung der wichtigsten Partnerschaften, Fusionen und Übernahmen, Geschäftsexpansionen und Produkteinführungen im indischen Reiseversicherungsmarktsektor im ganzen Land durchgeführt

Schätzung und Prognose der aktuellen Marktgröße

Aktuelle Marktgrößenbestimmung:Basierend auf umsetzbaren Erkenntnissen aus den obigen 3 Schritten kamen wir zur aktuellen Marktgröße, den wichtigsten Akteuren im indischen Reiseversicherungsmarkt und den Marktanteilen der Segmente. Alle erforderlichen Prozentsatzanteile, Aufteilungen und Marktaufschlüsselungen wurden unter Verwendung des oben genannten Sekundäransatzes ermittelt und durch Primärinterviews verifiziert.

Schätzung und Prognose: Für die Marktschätzung und -prognose wurden verschiedenen Faktoren, darunter Treibern und Trends, Einschränkungen und Chancen für die Stakeholder, Gewichtungen zugewiesen. Nach der Analyse dieser Faktoren wurden relevante Prognosetechniken, d. h. der Top-Down/Bottom-Up-Ansatz, angewendet, um die Marktprognose 2032 für verschiedene Segmente und Untersegmente in den wichtigsten Märkten in Indien zu erstellen. Die Forschungsmethodik zur Schätzung der Marktgröße umfasst:

- Die Marktgröße der Branche in Bezug auf den Umsatz (USD) und die Akzeptanzrate des indischen Reiseversicherungsmarktes in den wichtigsten Märkten im Inland

- Alle prozentualen Anteile, Aufteilungen und Aufschlüsselungen der Marktsegmente und Untersegmente

- Wichtige Akteure im indischen Reiseversicherungsmarkt hinsichtlich der angebotenen Produkte. Außerdem die Wachstumsstrategien, die diese Akteure anwenden, um im schnell wachsenden Markt zu konkurrieren.

Validierung von Marktgröße und -anteil

Primärforschung:Tiefeninterviews wurden mit den Key Opinion Leaders (KOLs) einschließlich Führungskräften (CXO/VPs, Vertriebsleiter, Marketingleiter, Betriebsleiter, Regionalleiter, Länderleiter usw.) in wichtigen Regionen geführt. Die Ergebnisse der Primärforschung wurden dann zusammengefasst und eine statistische Analyse durchgeführt, um die aufgestellte Hypothese zu beweisen. Die Ergebnisse der Primärforschung wurden mit den Sekundärbefunden konsolidiert, wodurch Informationen in umsetzbare Erkenntnisse umgewandelt wurden.

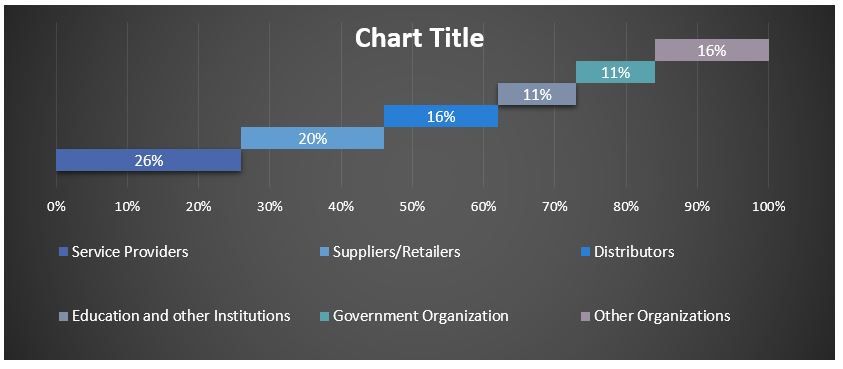

Aufteilung der primären Teilnehmer in verschiedenen Regionen

Markttechnik

Die Datentriangulationstechnik wurde eingesetzt, um die gesamte Marktabschätzung abzuschließen und präzise statistische Zahlen für jedes Segment und Untersegment des indischen Reiseversicherungsmarktes zu erhalten. Die Daten wurden nach der Untersuchung verschiedener Parameter und Trends in den Bereichen der Deckungsart, der Zielart, des Vertriebskanals und der Regionen im indischen Reiseversicherungsmarkt in mehrere Segmente und Untersegmente aufgeteilt.

Das Hauptziel der indischen Reiseversicherungsmarktstudie

Die aktuellen und zukünftigen Markttrends des indischen Reiseversicherungsmarktes wurden in der Studie aufgezeigt. Investoren können strategische Erkenntnisse gewinnen, um ihre Investitionsentscheidungen auf der Grundlage der in der Studie durchgeführten qualitativen und quantitativen Analyse zu treffen. Aktuelle und zukünftige Markttrends bestimmten die allgemeine Attraktivität des Marktes auf staatlicher Ebene und boten den Industrieakteuren eine Plattform, um den unerschlossenen Markt zu nutzen und von einem First-Mover-Vorteil zu profitieren. Weitere quantitative Ziele der Studien umfassen:

- Analyse der aktuellen und prognostizierten Marktgröße des indischen Reiseversicherungsmarktes in Bezug auf den Wert (USD). Außerdem Analyse der aktuellen und prognostizierten Marktgröße verschiedener Segmente und Untersegmente.

- Zu den Segmenten in der Studie gehören Bereiche wie Deckungsart, Zielart, Vertriebskanal und Regionen.

- Definieren und analysieren Sie den regulatorischen Rahmen für die indische Reiseversicherung

- Analysieren Sie die Wertschöpfungskette, die mit der Präsenz verschiedener Intermediäre verbunden ist, sowie das Verhalten von Kunden und Wettbewerbern in der Branche.

- Analysieren Sie die aktuelle und prognostizierte Marktgröße des indischen Reiseversicherungsmarktes für die wichtigsten Regionen.

- Zu den wichtigsten in dem Bericht untersuchten Regionen in Indien gehören Nordindien, Südindien, Ostindien und Westindien.

- Unternehmensprofil des indischen Reiseversicherungsmarktes und die Wachstumsstrategien, die von den Marktteilnehmern angewendet werden, um sich in dem schnell wachsenden Markt zu behaupten.

- Detaillierte Analyse der Branche auf Landesebene

Verwandt Berichte

Kunden, die diesen Artikel gekauft haben, kauften auch