- Home

- About Us

- Industry

- Services

- Reading

- Contact Us

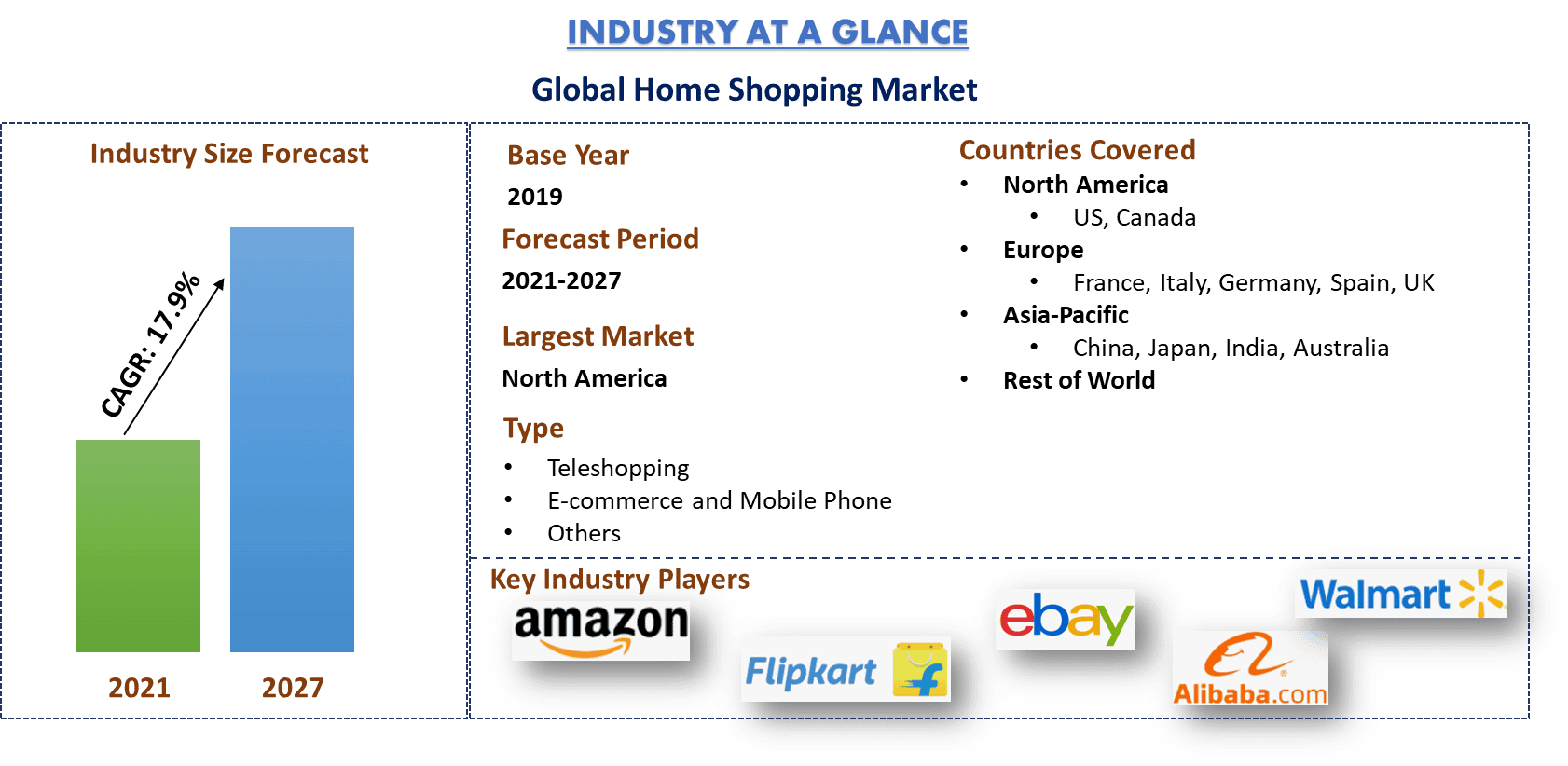

Home Shopping Market: Current Analysis and Forecast (2021-2027)

Emphasis on Product Type (Groceries, Apparels & Accessories, Footwear, Personal & Beauty Care, Furniture & Home Decor, Electronic Goods, Others); Market Type (Teleshopping, E-Commerce & Mobile Shopping, Others); and Region & Country.

Home Shopping channel includes television-based shopping, e-commerce, and telephonic shopping. Improved internet connectivity and increased adoption of smartphones have positively impacted the virtual shopping market. Secured networks, enhanced internet connections, and an increase in the number of internet users are driving retailers to expand their business in the e-commerce market. According to International Telecommunication Union (ITU), in Europe internet penetration reached 82.49% by 2019. Owing to the increase in smartphone users and high internet penetration, the market for home shopping has increased considerably. For instance, the US is among the top e-commerce market. Moreover, the consumers in the U.S. rely more on online shopping, and around 79% of the population, or 258.5 million people had made an online purchase in the year 2018. This is driving the market for home-based shopping. Furthermore, with the rise in disposable income the total per capita spending of the consumers in India has increased in the past few years, owing to this the total spending of consumers on home shopping has been positively impacted. In 2016, Amazon launched Amazon Pantry for customers. Using Amazon Pantry, customers can now shop for over 4,000 everyday essentials such as groceries and household products on the website and mobile. Amazon Pantry comes with guaranteed next-day delivery in India.

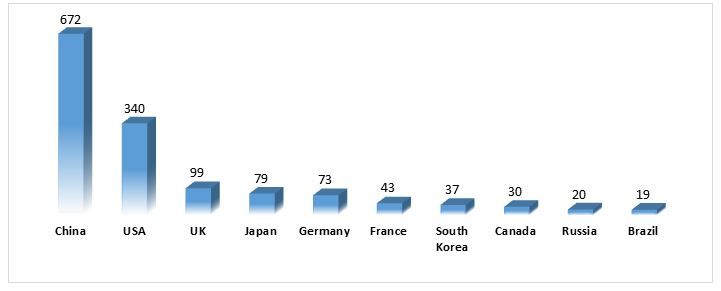

E-commerce Market, 2021 (US$ billion)

According to Oberlo, in 2020 out of 7.8 Bn of the population across the world, 26.28% of the population are potential online shoppers. The number of digital shoppers has significantly increased from 1.32 Bn in 2014 to 2.05 Bn in 2020 and is continuously increasing. Moreover, with the outbreak of COVID-19, consumers have shifted more towards home shopping. For instance, in Denmark online stores sale increased in 2020 after the outbreak of COVID-19 in the region. Additionally, online stores have experienced an overall increase in sales by at least 10.4%. Furthermore, according to Common Thread Collective, the sale of goods by home shopping has increased by 52.2%.

Insights Presented in the Report

“Amongst Product Type, Personal & Beauty Care segment holds a significant share in 2020”

Based on the product type, the global home shopping market is fragmented into groceries, apparel & accessories, footwear, Personal & Beauty care, furniture & home decor, electronic goods, and others. According to oberlo, in 2021, out of the total e-commerce spending of consumers worldwide, consumers’ most spending was on fashion-related which was USD 759.5 Bn. However, the growth rate decreased from 26.5% in 2019 to 20.3% in 2020. This was due to the COVID-19 pandemic. However, significant growth has been seen in the grocery segment and is expected to increase the market growth during the forecast period owing to the dependency of consumers on home shopping due to lockdown in various regions of the world.

“Amongst Market Type, E-commerce and Mobile Shopping segment holds the major share in 2020”

Based on the type, the global home shopping market is fragmented into teleshopping, E-commerce & mobile shopping, and others. According to International Telecommunication Union (ITU), internet users accounted for 3.5 million individuals which rose to 4 million by 2019 and China was at the top with the highest number of internet users as compared to other countries. Owing to the increasing number of internet and smartphone users, the E-commerce and mobile shopping segment dominated the market in 2020.

“North America signifies as one of the largest markets of Home Shopping in 2020”

For a better understanding, detailed analysis has been conducted for major regions including North America (United States, Canada, and the Rest of North America), Europe (Germany, France, Italy, Spain, United Kingdom, and Rest of Europe), Asia-Pacific (China, Japan, India, Australia and Rest of APAC), and Rest of World. Asia-Pacific with the increasing number of smartphone users has the potential to become one of the largest markets for home shopping in near future.

Competitive Landscape

Amazon.com, Inc., Flipkart private limited, eBay Inc., Alibaba Group, Walmart, VGL group of companies, JD.com, Inc., Best Buy, The Home Depot, Apple, Inc., are some of the prominent players operating in the global Home Shopping market. Several M&As along with partnerships have been undertaken by these players to facilitate customers with hi-tech and innovative products.

Reasons to buy this report:

- The study includes market sizing and forecasting analysis validated by authenticated key industry experts

- The report presents a quick review of overall industry performance at one glance

- The report covers an in-depth analysis of prominent industry peers with a primary focus on key business financials, product portfolio, expansion strategies, and recent developments

- Detailed examination of drivers, restraints, key trends, and opportunities prevailing in the industry

- The study comprehensively covers the market across different segments

- Deep dive regional level analysis of the industry

Customization Options:

Home Shopping Market can further be customized as per the requirement or any other market segment. Besides this, UMI understands that you may have your own business needs, hence feel free to connect with us to get a report that completely suits your requirements.

Table of Content

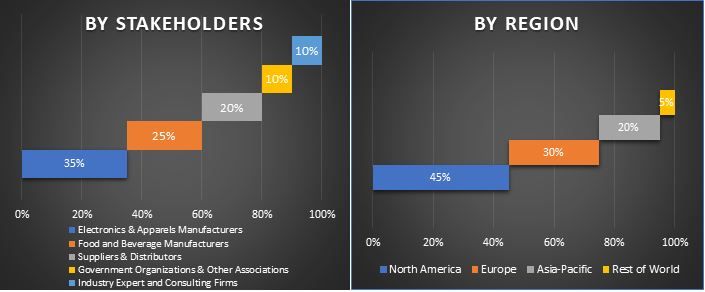

Analyzing the historical market, estimation of the current market, and forecasting the future market of the Global Home Shopping industry were the three major steps undertaken to create and analyze the adoption of Home Shopping for the different product category across major regions globally. Exhaustive secondary research was conducted to collect the historical market size and estimate the current market. Secondly, to validate these insights, numerous findings and assumptions were taken into consideration. Moreover, exhaustive primary interviews were also conducted, with industry experts across the value chain. Post assumption and validation of market numbers through primary interviews, we employed a bottom-up/top-down approach to forecast the complete market size. Thereafter, market breakdown and data triangulation methods were adopted to estimate and analyze the market size of segments and sub-segments the industry pertains to. Detailed methodology is explained below:

Analysis of Historical Market Size

Step 1: In-Depth Study of Secondary Sources:

Detailed secondary study was conducted to obtain the historical market size of the Home Shopping industry through company internal sources such as annual report & financial statements, performance presentations, press releases, etc., and external sources including journals, news & articles, government publications, competitor publications, sector reports, third-party database, and other credible publications.

Step 2: Market Segmentation:

After obtaining the historical market size of the Home Shopping industry, we conducted a detailed secondary analysis to gather historical market insights and share for different segments for major regions. Major segments included in the report are product and market type. Further country-level analyses were conducted to evaluate the overall adoption of Home Shopping in every region.

Step 3: Factor Analysis:

After acquiring the historical market size of different segments and sub-segments, we conducted a detailed factor analysis to estimate the current market size of Home Shopping. Further, we conducted factor analysis using dependent and independent variables such as increasing demand of e-commerce, penetration of home shopping, and advancement in technologies etc. A thorough analysis was conducted for demand and supply-side scenario considering top partnerships, merger and acquisition, business expansion, and product launches in the Home Shopping industry across the globe.

Current Market Size Estimate & Forecast

Current Market Sizing: Based on actionable insights from the above 3 steps, we arrived at the current market size, key players in the Global Home Shopping market, and market shares of the segments. All the required percentage shares split, and market breakdowns were determined using the above-mentioned secondary approach and were verified through primary interviews.

Estimation & Forecasting: For market estimation and forecast, weights were assigned to different factors including drivers & trends, restraints, and opportunities available for the stakeholders. After analyzing these factors, relevant forecasting techniques i.e. top-down/bottom-up approach was applied to arrive at the market forecast by 2027 for different segments and subsegments across the major markets globally. The research methodology adopted to estimate the market size encompasses:

- The industry’s market size, in terms of value (USD) and the adoption rate of home shopping across the major markets domestically

- All percentage shares, splits, and breakdowns of market segments and sub-segments

- Key players in the Home Shopping market in terms of services offered. Also, the growth strategies adopted by these players to compete in the fast-growing market

Market Size and Share Validation

Primary Research: In-depth interviews were conducted with the Key Opinion Leaders (KOLs) including Top Level Executives (CXO/VPs, Sales Head, Marketing Head, Operational Head, and Regional Head, Country Head, etc.) across major regions. Primary research findings were then summarized, and statistical analysis was performed to prove the stated hypothesis. Inputs from primary research were consolidated with secondary findings, hence turning information into actionable insights.

Split of Primary Participants in Different Regions

Market Engineering

Data triangulation technique was employed to complete the overall market estimation and to arrive at precise statistical numbers of each segment and sub-segment of the Global Home Shopping market. Data was split into several segments & sub-segments post studying various parameters and trends in the areas of type and end-users of Home Shopping market.

Main Objective of the Home Shopping Market Study

The current & future market trends of Home Shopping were pinpointed in the study. Investors can gain strategic insights to base their discretion for investments from the qualitative and quantitative analysis performed in the study. Current and future market trends were determined the overall attractiveness of the market at a regional level, providing a platform for the industrial participant to exploit the untapped market to benefit as a first-mover advantage. Other quantitative goals of the studies include:

- Analyze the current and forecast market size of Global Home Shopping market in terms of value (US$). Also, analyze the current and forecast market size of different segments and sub-segments of the sector

- Segments in the study include product type, market type and region/country

- Analyze the value chain involved with the presence of various intermediaries, along with analyzing customer and competitor behaviors pertaining to the industry

- Analyze the current and forecast market size of the Global Home Shopping Market category across major regions including North America (United States, Canada, and Rest of North America), Europe (Germany, United Kingdom, France, Russia, Spain, Italy and Rest of Europe), Asia-Pacific (China, Japan, India, Australia and rest of Asia-Pacific), and Rest of World

- Define and analyze the competitive landscape of the Home Shopping sector and the growth strategies adopted by the market players to sustain in the fast-growing market

Related Reports

Customers who bought this item also bought