- Home

- About Us

- Industry

- Services

- Reading

- Contact Us

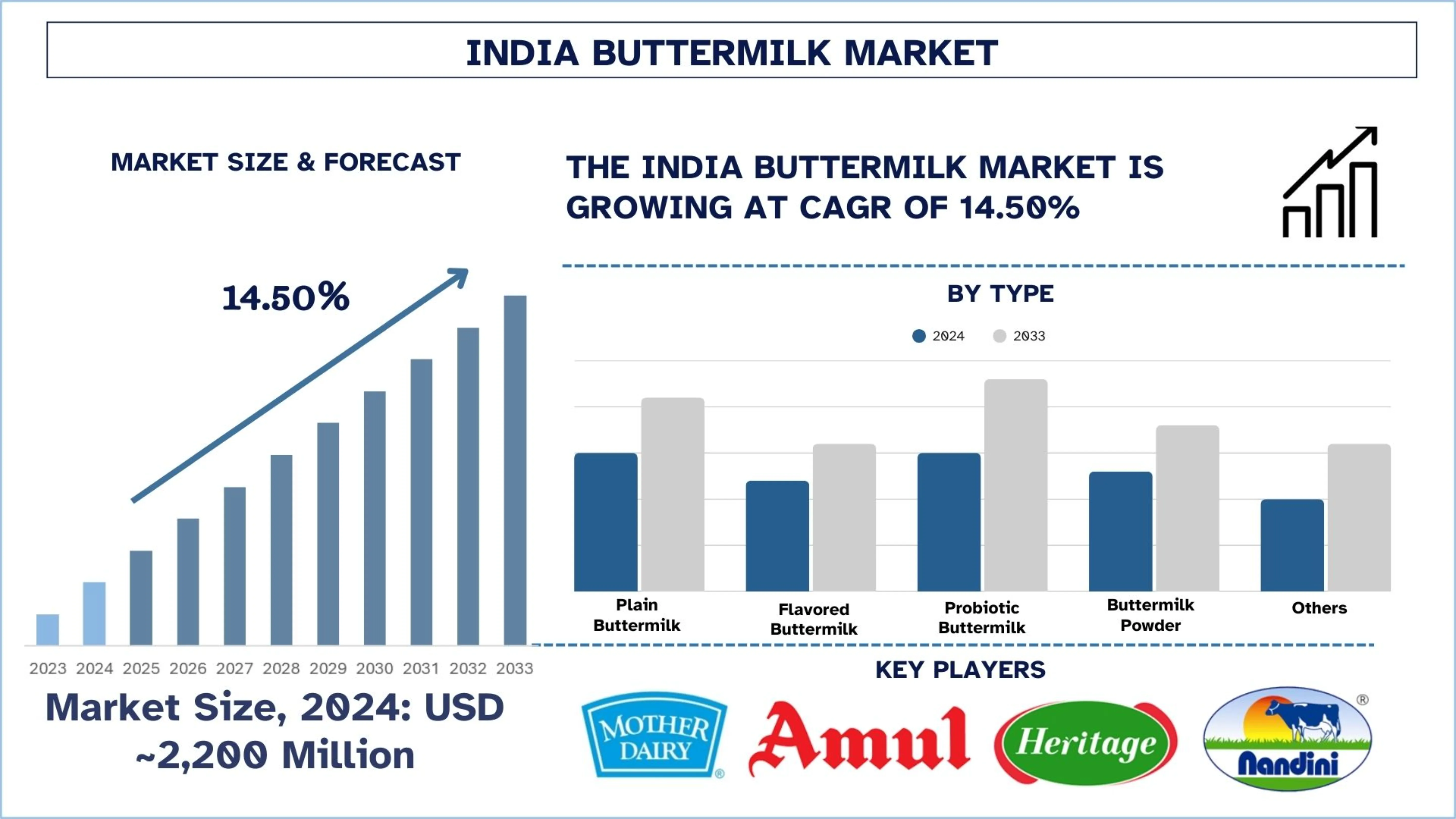

India Buttermilk Market: Current Analysis and Forecast (2025-2033)

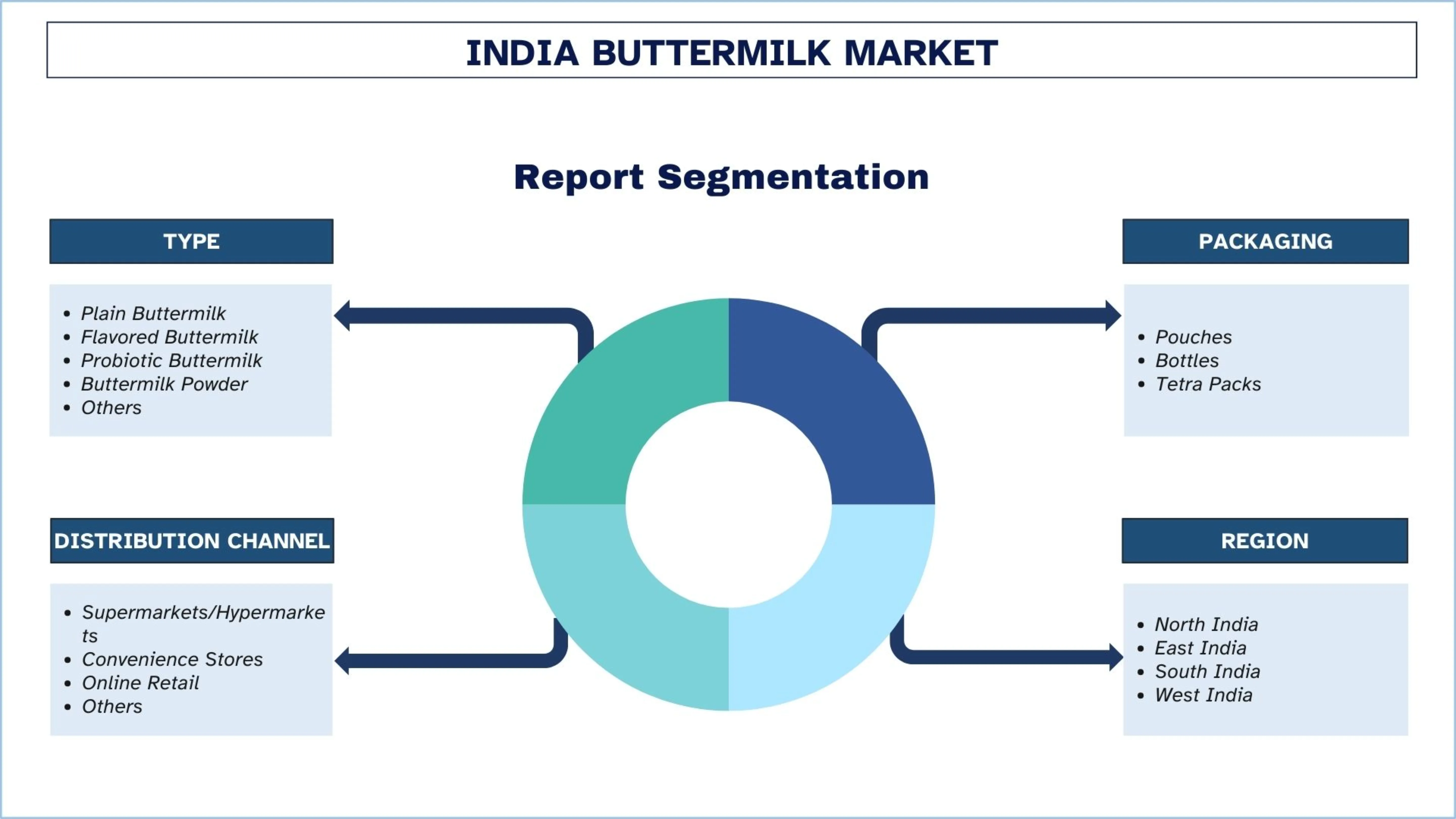

Emphasis on Type (Plain Buttermilk, Flavored Buttermilk, Probiotic Buttermilk, Buttermilk Powder, and Others); Packaging (Pouches, Bottles, and Tetra Packs); Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, and Others); and Region/States

India Buttermilk Market Size & Forecast

The India Buttermilk Market was valued at USD ~2,200 million in 2024 and is expected to grow to a strong CAGR of around 14.50% during the forecast period (2025-2033F), owing to the rising health awareness and demand for natural, functional beverages, which are driving the buttermilk market.

Buttermilk Market Analysis

Buttermilk is what’s remaining once butter is made from cream through churning, and nowadays, it is often cultured with lactic acid bacteria to make the beverage. Also, it is low in fat, contains a lot of useful electrolytes, and is good for digestion. In India, people add spices and herbs, or drink plain and it is a standard part of both rural and urban diets.

To achieve growth in the buttermilk market in India, companies are now including products like flavored and probiotic buttermilk for consumers who pay more attention to health. The industry is introducing cold chain systems and different formats of environment-friendly packaging to increase convenience and shelf life of the buttermilk product. Beverage manufacturers are making the product available through new retail and online outlets, local distribution, and by marketing its cooling and digestive merits with region-specific campaigns. Moreover, rising government initiatives that support the dairy sector drive the buttermilk market in India.

On April 13, 2025, the Union Minister of Cooperation announced that an MoU had been signed between the National Dairy Development Board (NDDB) and the Madhya Pradesh Cooperative Dairy Federation (MPCDF). Currently, five and a half crore liters of milk are produced in Madhya Pradesh, which is nine percent of the total milk production in the country. The aim is to quickly connect every farmer of every village with the cooperative dairy, and also make such arrangements that cheese, curd, buttermilk, etc., are made from milk and sold, and the farmer gets the profit.

India Buttermilk Market Trends

This section discusses the key market trends that are influencing the various segments of the India Buttermilk market, as found by our team of research experts.

Rising Recyclable Food-Grade Disposable Cups

Buttermilk producers in India are moving towards using recyclable disposable cups as an environmentally friendly trend. Adding to this, the rising awareness of environmental issues, brands are developing packaging that is both eco-friendly and convenient for use. Moreover, it is made for busy city dwellers who like beverages that are ready to drink. As a result, the brand gains more value while also supporting initiatives by the government focused on sustainable packaging in this industry.

On April 10, 2023, Sid’s Farm, a premium direct-to-consumer (D2C) dairy brand based in Telangana, announced the launch of its ‘Buttermilk’ in a whole new convenient packaging, as a wholesome and refreshing option for consumers during the upcoming summer season. Packed in 200 ml recyclable food-grade disposable cups, the Buttermilk is priced at INR 20.

Buttermilk Industry Segmentation

This section provides an analysis of the key trends in each segment of the India Buttermilk market report, along with forecasts at the regional and state levels for 2025-2033.

The probiotic buttermilk market is expected to grow with a significant CAGR during the forecast period (2025-2033).

Based on the type, the market is segmented into plain buttermilk, flavored buttermilk, probiotic buttermilk, buttermilk powder, and others. Among these, the probiotic buttermilk market is expected to grow with a significant CAGR during the forecast period (2025-2033). The increasing attention on gut health and healthy drinks is leading to higher demand for probiotic buttermilk. Also, with a better understanding of how gut microbiota and immunity are connected, companies are developing products with plenty of probiotics. Adopting a health-centered approach makes it possible for them to set higher prices and grow in the urban health sector. On November 07, 2024, MilkyMist, a renowned dairy innovator from South India, partnered with SIG and AnaBio Technologies to introduce the world’s first long-life probiotic buttermilk in aseptic carton packs.

The pouches buttermilk market held the dominant share of the market in 2024.

Based on the packaging, the market is segmented into pouches, bottles, and tetra packs. Among these, the pouches buttermilk market held the dominant share of the market in 2024. Pouch packaging expands the number of customers by being cost-effective, practical, and perfect for eating on the go. It allows firms to cut their manufacturing and moving expenses, which in turn helps them offer lower prices to more people. Because of this packaging, buttermilk can be widely distributed to both rural and urban customers. In June 2024, Amul launched Kathiyawadi Chaas — a new variety of buttermilk, especially popular in the Saurashtra and Kutch regions of the state of Gujarat. A 400-millilitre pouch of Kathiyawadi Chaas is priced at INR 10. It has a shelf life of two days.

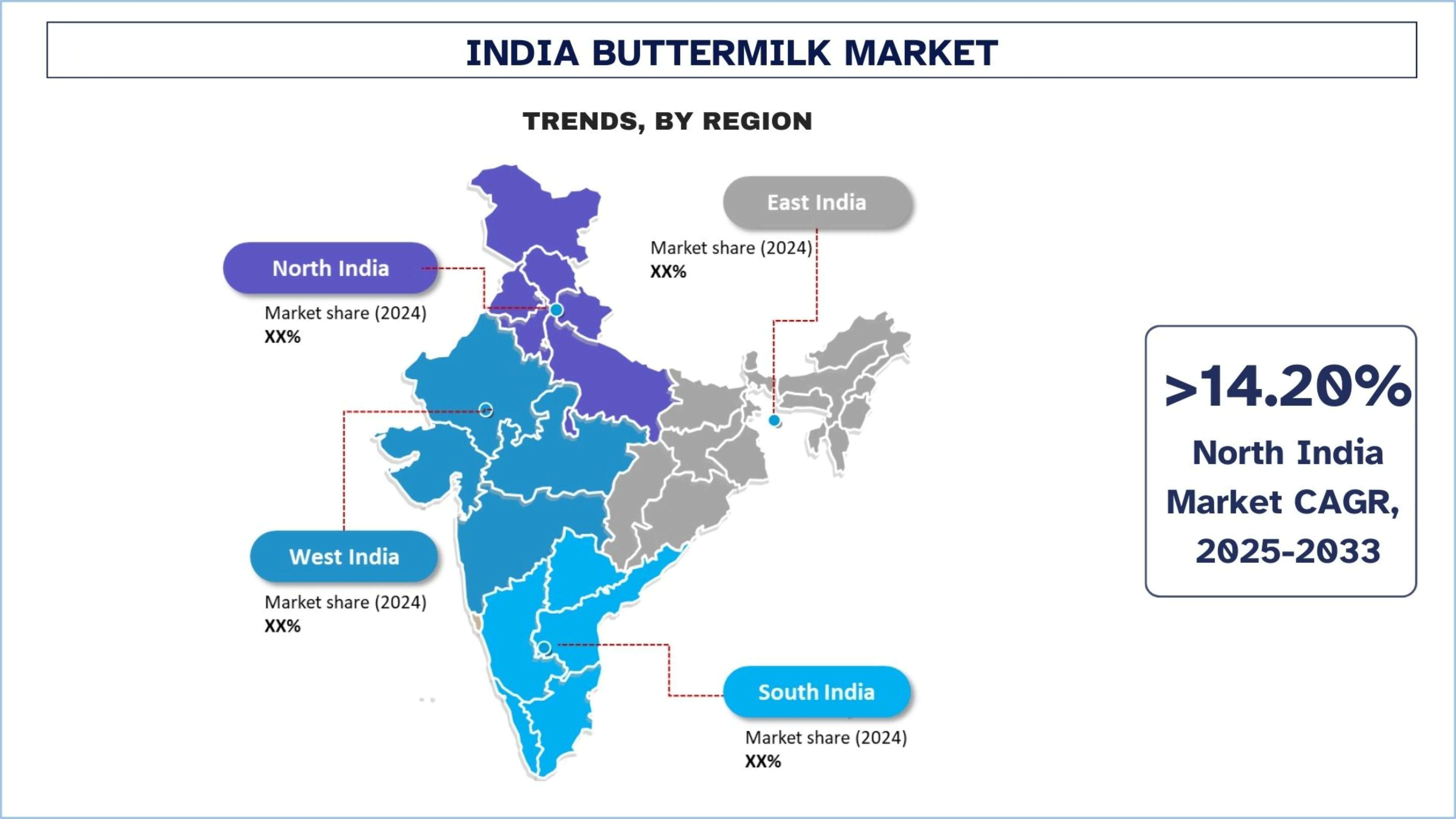

North India leads the Buttermilk Market in 2024.

North India held a significant share of the Indian Buttermilk market, due to its large and broad population. North India experiences higher demand for packaged buttermilk caused by ongoing awareness about health. Also, more people can access products due to the growth of retail and the increase in urban areas. Adding to this, increasing temperatures during the summer lead to more people buying dairy drinks, which drives the buttermilk market in North India. Furthermore, in this region, companies focus on introducing mass-market and branded products with the help of strong networks for distribution.

For instance, on March 17, 2025, the Karnataka Milk Federation (KMF), the second-largest dairy cooperative in India, broadened its footprint with the launch of Nandini milk, curd, and buttermilk in Hathras district of Uttar Pradesh.

Buttermilk Industry Competitive Landscape

The India Buttermilk market is competitive, with several global and international market players. The key players are adopting different growth strategies to enhance their market presence, such as partnerships, agreements, collaborations, new product launches, geographical expansions, and mergers and acquisitions.

Top India Buttermilk Companies

Some of the major players in the market are Mother Dairy Fruit & Vegetable Private Limited (NDDB), Gujarat Cooperative Milk Marketing Federation Ltd (Amul), Heritage Foods Limited, Akshayakalpa Farms & Foods Pvt. Ltd., Ananda Dairy Limited (Gopaljee Dairy Foods Private Limited), Parag Milk Foods (Go), Hatsun Agro Product Ltd, CavinKare Pvt. Ltd. (CKPL), Karnataka Co-operative Milk Producers' Federation Limited (KMF), DAWN LEE BY JAIN ROOTS.

Recent Developments in the India Buttermilk Market

In March 2023, Heritage Foods Ltd. announced the launch of its new range of Buttermilk products under the brand name `A-One' and a new range of milkshakes in easy-to-carry and single-serve carton boxes. Heritage 'A-One' spiced Buttermilk & Milkshakes introduced in Telangana, Andhra Pradesh, Karnataka, Tamil Nadu, Delhi & NCR, and the products are available across the general trade stores.

On February 9, 2022, Tetra Pak, a world-leading packaging and processing solutions provider, introduced its first ever locally manufactured holographic packaging material in India. The innovative packaging, called Tetra Pak® Reflect, has been launched in partnership with Warana, a leading co-operative dairy, for their 1 liter Ghee (clarified butter) packs. In India, the company offers milk, lassi and buttermilk in Tetra Pak cartons.

India Buttermilk Market Report Coverage

Report Attribute | Details |

Base year | 2024 |

Forecast period | 2025-2033 |

Growth momentum | Accelerate at a CAGR of 14.50% |

Market size 2024 | USD ~2,200 million |

Regional analysis | North India, South India, East India, and West India |

Major contributing region | South India is expected to grow at the highest CAGR during the forecasted period. |

Companies profiled | Mother Dairy Fruit & Vegetable Private Limited (NDDB), Gujarat Cooperative Milk Marketing Federation Ltd (Amul), Heritage Foods Limited, Akshayakalpa Farms & Foods Pvt. Ltd., Ananda Dairy Limited (Gopaljee Dairy Foods Private Limited), Parag Milk Foods (Go), Hatsun Agro Product Ltd, CavinKare Pvt. Ltd. (CKPL), Karnataka Co-operative Milk Producers' Federation Limited (KMF), DAWN LEE BY JAIN ROOTS. |

Report Scope | Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Demand and Supply Side Analysis; Competitive Landscape; Company Profiling |

Segments Covered | By Type, By Packaging, By Distribution Channel, By Region/States |

Reasons to Buy the India Buttermilk Market Report:

The study includes market sizing and forecasting analysis confirmed by authenticated key industry experts.

The report briefly reviews overall industry performance at a glance.

The report covers an in-depth analysis of prominent industry peers, primarily focusing on key business financials, type portfolios, expansion strategies, and recent developments.

Detailed examination of drivers, restraints, key trends, and opportunities prevailing in the industry.

The study comprehensively covers the market across different segments.

Deep dive regional level analysis of the industry.

Customization Options:

The India Buttermilk market can further be customized as per the requirements or any other market segment. Besides this, UnivDatos understands that you may have your own business needs; hence, feel free to contact us to get a report that completely suits your requirements.

Table of Content

Research Methodology for the India Buttermilk Market Analysis (2023-2033)

We analyzed the historical market, estimated the current market, and forecasted the future market of the India Buttermilk market to assess its application in major regions in India. We conducted exhaustive secondary research to gather historical market data and estimate the current market size. To validate these insights, we carefully reviewed numerous findings and assumptions. Additionally, we conducted in-depth primary interviews with industry experts across the Buttermilk value chain. After validating market figures through these interviews, we used both top-down and bottom-up approaches to forecast the overall market size. We then employed market breakdown and data triangulation methods to estimate and analyze the market size of industry segments and sub-segments.

Market Engineering

We employed the data triangulation technique to finalize the overall market estimation and derive precise statistical numbers for each segment and sub-segment of the India-Buttermilk market. We split the data into several segments and sub-segments by analyzing various parameters and trends, including type, packaging, distribution channel, and regions within the India Buttermilk market.

The Main Objective of the India Buttermilk Market Study

The study identifies current and future trends in the India Buttermilk market, providing strategic insights for investors. It highlights regional market attractiveness, enabling industry participants to tap into untapped markets and gain a first-mover advantage. Other quantitative goals of the studies include:

Market Size Analysis: Assess the current market size and forecast the market size of the India Buttermilk market and its segments in terms of value (USD).

Buttermilk Market Segmentation: Segments in the study include areas of type, packaging, distribution channel, and regions.

Regulatory Framework & Value Chain Analysis: Examine the regulatory framework, value chain, customer behavior, and competitive landscape of the Buttermilk industry.

Regional Analysis: Conduct a detailed regional analysis for key areas such as North India, South India, East India, and West India.

Company Profiles & Growth Strategies: Company profiles of the Buttermilk market and the growth strategies adopted by the market players to sustain in the fast-growing market.

Frequently Asked Questions FAQs

Q1: What is the India Buttermilk market’s current market size and growth potential?

The India Buttermilk market was valued at USD ~2,200 million in 2024 and is expected to grow at a CAGR of 14.50% during the forecast period (2025-2033). This growth is driven by the proliferation of organized dairy retail across Tier-I and Tier-II cities.

Q2: Which segment has the largest share of the India Buttermilk market by type?

The probiotic buttermilk segment holds the largest market share in the India Buttermilk market in 2024, owing to growing consumer awareness around gut health and immunity. It is especially popular among health-conscious millennials in metro cities and is witnessing increased adoption through both retail and institutional channels.

Q3: What are the driving factors for the growth of the India Buttermilk market?

Key drivers include rising disposable incomes, growing preference for healthy and low-calorie dairy beverages, government support for dairy startups, and the expansion of cold-chain and e-commerce delivery. Additionally, the use of value-added variants like flavored and probiotic buttermilk is catalyzing growth in urban and semi-urban clusters.

Q4: What are the emerging technologies and trends in the India Buttermilk market?

Key trends include aseptic and eco-friendly packaging innovations, AI-powered quality control in dairy processing, the rise of organic and fortified buttermilk, and the launch of instant buttermilk mixes. Additionally, FMCG players are leveraging digital retail and D2C platforms to expand their footprint.

Q5: What are the key challenges in the India Buttermilk market?

Challenges include cold-chain infrastructure gaps in rural regions, fluctuating raw milk prices, limited consumer awareness in certain geographies, and stringent FSSAI compliance costs for smaller producers. Also, intense competition among regional brands impacts pricing strategies and margins.

Q6: Which region dominates the India Buttermilk market?

North India leads the market due to high buttermilk consumption in states like Uttar Pradesh, Punjab, Delhi, Haryana, and Rajasthan. The region benefits from a strong dairy culture, robust cold storage infrastructure, and the presence of major players like Amul, Mother Dairy, and Ananda Dairy.

Q7: Who are the key players in the India Buttermilk market?

Some of the leading companies in the India Buttermilk Industry include:

• Mother Dairy Fruit & Vegetable Private Limited (NDDB)

• Gujarat Cooperative Milk Marketing Federation Ltd (Amul)

• Heritage Foods Limited

• Akshayakalpa Farms & Foods Pvt. Ltd.

• Ananda Dairy Limited (Gopaljee Dairy Foods Private Limited)

• Parag Milk Foods (Go)

• Hatsun Agro Product Ltd

• CavinKare Pvt. Ltd. (CKPL)

• Karnataka Co-operative Milk Producers' Federation Limited (KMF)

• DAWN LEE BY JAIN ROOTS

Q8: What investment opportunities exist in the India Buttermilk market for new entrants or FMCG players?

The India Buttermilk market presents significant investment opportunities for new entrants, dairy processors, and FMCG companies, driven by increasing health consciousness, demand for functional beverages, and government initiatives promoting dairy infrastructure. Investment potential lies in flavored and probiotic buttermilk segments, rural cold-chain logistics, and value-added packaging technologies.

Q9: How are regulatory and FSSAI guidelines influencing product development in the India Buttermilk market?

Regulatory frameworks set by the Food Safety and Standards Authority of India (FSSAI) are shaping product innovation in the buttermilk market. Guidelines on permissible additives, probiotic labeling, and hygiene standards are encouraging manufacturers to ensure compliance while enhancing product safety. FSSAI’s push for clean-label ingredients and fortified dairy is prompting brands to reformulate SKUs with functional health claims, aligning with consumer demand and expanding market credibility.

Related Reports

Customers who bought this item also bought