Отчет по рынку заменителей мяса в Индии: текущий анализ и прогноз (2024-2032)

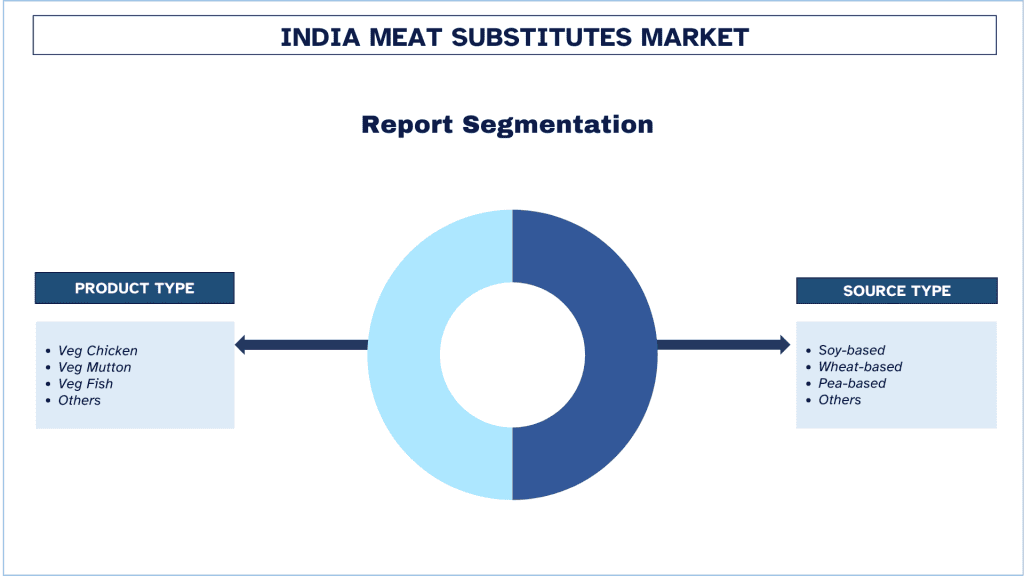

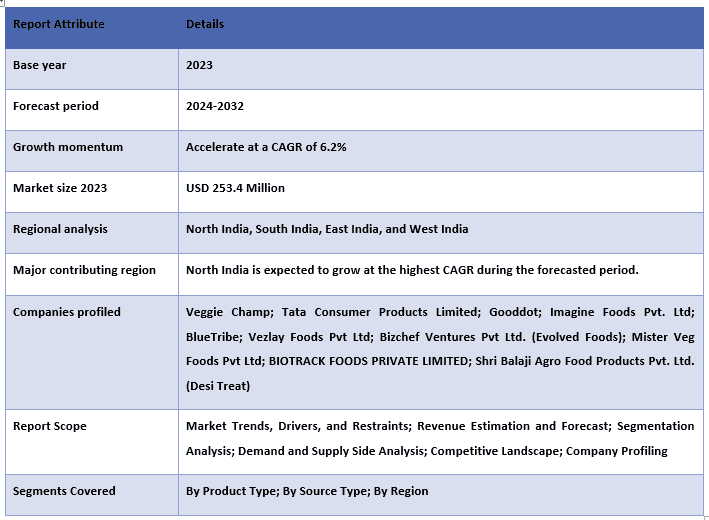

Акцент на типе продукта (вегетарианская курица, вегетарианская баранина, вегетарианская рыба и другие); Тип источника (на основе сои, на основе пшеницы, на основе гороха и другие); Регион

Объем и прогноз рынка заменителей мяса в Индии

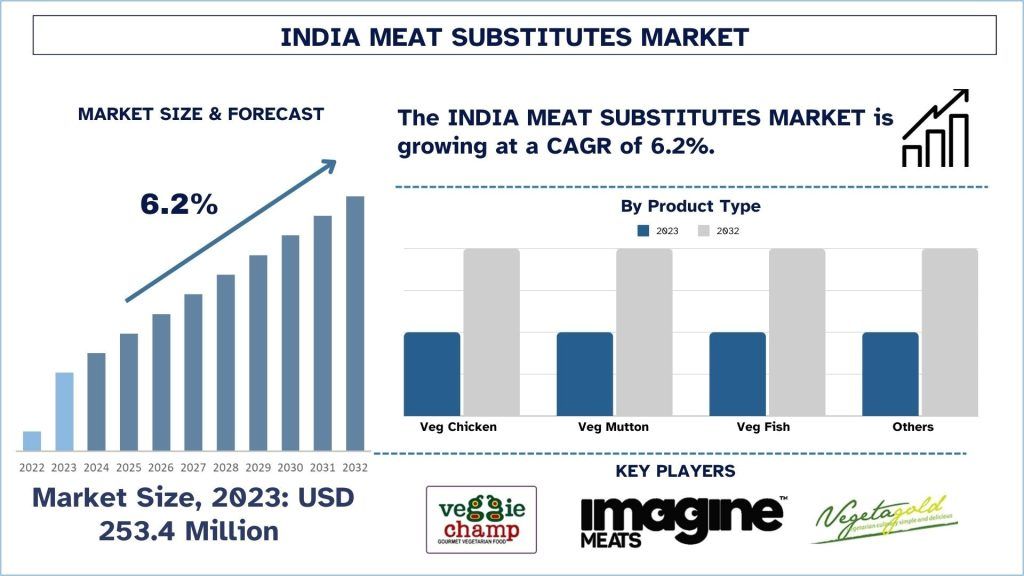

Объем рынка заменителей мяса в Индии в 2023 году оценивался в 253,4 миллиона долларов США, и ожидается, что он будет расти со среднегодовым темпом роста около 6,2% в течение прогнозируемого периода (2024-2032 гг.) благодаря росту сознательности в отношении здоровья и растущей озабоченности экологическими проблемами в стране.

Анализ рынка заменителей мяса в Индии

Рынок заменителей мяса в Индии находится в состоянии трансформации из-за меняющихся факторов, таких как забота о здоровье, осведомленность об окружающей среде и изменение пищевых привычек населения. Поскольку значительная часть населения стала вегетарианцами, наблюдается растущий спрос и интерес к новым растительным заменителям традиционного мяса. Таким образом, рынок диверсифицировался в плане дифференциации продуктов, в настоящее время он содержит широкий спектр сои, бобовых и новых форм умного белка, таких как гороховый протеин. Параллельно с акцентом на здоровье и устойчивость бизнеса, бренды предлагают несколько продуктов с акцентом на пищевую ценность и в то же время вкус.

Недавние события на рынке

В октябре 2022 года компания Licious объявила о выходе в сектор альтернативных белков с запуском Uncrave, первого в Индии бренда растительного мяса D2C. Он стремится стать лидером рынка в первый год своего запуска и создать актуальность для большей группы потребителей, употребляющих мясо.

В июле 2022 года Tata Consumer Products (TCP), подразделение продуктов питания и напитков Tata Group, объявила о выходе на рынок альтернативных продуктов на основе растительного мяса под новым брендом «Tata Simply Better». Компания заявила, что расширяет линейку своей продукции в новую область с этим новым брендом, стремясь привлечь потребителей, которые хотят использовать больше ингредиентов на растительной основе для здоровья, окружающей среды или других факторов.

Тенденции рынка заменителей мяса в Индии

В этом разделе обсуждаются основные рыночные тенденции, влияющие на различные сегменты рынка парфюмерии для домашних животных, как определено нашей командой экспертов-исследователей.

Сегмент вегетарианской рыбы преобразует отрасль

Рынок сегмента вегетарианской рыбы на рынке заменителей мяса в Индии растет устойчивыми темпами, чему способствуют растущая осведомленность потребителей о пищевой ценности, экологической системе и благополучии животных. Поскольку многие люди начинают переходить на вегетарианство или сокращать потребление мяса, на рынке постепенно появляются решения, имитирующие текстуру и вкус рыбы. Бренды используют морские водоросли, бобы и включают их в форму рыбы, которая подходит не только вегетарианцам, но и флекситарианцам и людям, которые заботятся о своем рационе. Кроме того, последствия чрезмерного вылова рыбы, которые снижают количество рыбы в морях, заставляют потребителей искать другую универсальную рыбу для потребления. Этот сегмент дополнительно поддерживается растущими тенденциями и предпочтениями в мировой индустрии продуктов питания и напитков, изменениями в моделях питания флекситарианцев и изменениями в ожиданиях потребителей, которые отражают заботу людей о здоровом выборе и легко транспортируемых диетах флекситарианцев, на которые влияют социальные сети. Поэтому прогнозируется, что сегмент вегетарианской рыбы будет иметь высокий будущий темп роста и сыграет важную роль в росте общего рынка заменителей мяса в Индии.

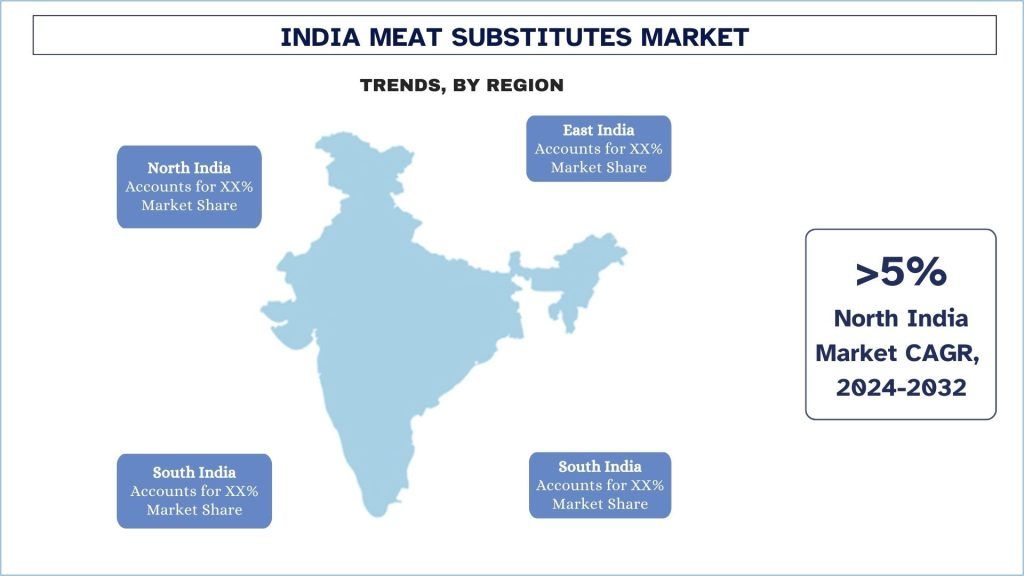

Ожидается, что Западная Индия будет расти со значительным среднегодовым темпом роста в течение прогнозируемого периода

Рынок заменителей мяса в Западной Индии растет быстрыми темпами благодаря здоровому образу жизни, улучшению экологических условий и огромной важности вегетарианских вариантов в климатическом регионе. Наблюдается постепенный переход населения к более здоровым и экологически чистым продуктам, и в двух штатах Махараштра и Гуджарат имеется приличное количество вегетарианцев и флекситарианцев. Такие мегаполисы, как Мумбаи и Пуна, становятся потенциальными торговыми точками для таких продуктов, поскольку потребители здесь готовы перейти на продукты, которые напоминают вкус и/или текстуру мяса. Аналогичным образом, местные растущие предприятия и известные мясные бренды производят уникальные и различные продукты без мяса, такие как продукты на основе сои и чечевицы, чтобы завоевать местный рынок. Доступность этих продуктов через новые розничные точки, супермаркеты и электронную коммерцию также способствует увеличению рыночного спроса. С повышением осведомленности о преимуществах заменителей мяса рынок Западной Индии представляет собой хорошие перспективы в ближайшие несколько лет.

В ноябре 2022 года, основываясь на отраслевых исследованиях и потенциале роста, Continental Coffee (CCL), отечественный кофейный бренд, запустила в Индии свой бренд на растительной основе «Continental Greenbird». Continental Greenbird позволяет своим потребителям делать выбор, который является устойчивым для мира, не теряя при этом вкуса мяса. Бренд Continental Greenbird был впервые запущен в Хайдарабаде в июле 2022 года и теперь доступен в Пуне.

Обзор индустрии заменителей мяса в Индии

Рынок заменителей мяса в Индии является конкурентным и фрагментированным, с присутствием нескольких игроков на рынке страны. Ключевые игроки используют различные стратегии роста для расширения своего присутствия на рынке, такие как партнерства, соглашения, сотрудничество, запуск новых продуктов, географическое расширение, а также слияния и поглощения. Некоторые из основных игроков, работающих на рынке, включают Veggie Champ; Tata Consumer Products Limited; Gooddot; Imagine Foods Pvt. Ltd; BlueTribe; Vezlay Foods Pvt Ltd; Bizchef Ventures Pvt Ltd. (Evolved Foods); Mister Veg Foods Pvt Ltd; BIOTRACK FOODS PRIVATE LIMITED; Shri Balaji Agro Food Products Pvt. Ltd. (Desi Treat).

Новости рынка заменителей мяса в Индии

В сентябре 2024 года индийский бренд альтернатив мясу Blue Tribe расширил свой ассортимент, запустив новый продукт — пельмени из курицы на растительной основе.

В июле 2024 года Plantaway представила два новых дополнения к своему ассортименту альтернатив мясу — пепперони и колбаски — вслед за запуском первой в Индии филе из растительной курицы.

Охват отчета по рынку заменителей мяса в Индии

Причины для покупки этого отчета:

- Исследование включает в себя анализ размеров рынка и прогнозирования, подтвержденный аутентифицированными ключевыми отраслевыми экспертами.

- Отчет представляет краткий обзор общей эффективности отрасли с первого взгляда.

- Отчет содержит углубленный анализ выдающихся отраслевых аналогов с основным акцентом на ключевые бизнес-финансы, продуктовые портфели, стратегии расширения и недавние разработки.

- Детальное изучение движущих сил, ограничений, основных тенденций и возможностей, преобладающих в отрасли.

- Исследование всесторонне охватывает рынок по различным сегментам.

- Углубленный анализ отрасли на региональном уровне.

Варианты настройки:

Рынок заменителей мяса в Индии может быть дополнительно настроен в соответствии с требованиями или любым другим рыночным сегментом. Кроме того, UMI понимает, что у вас могут быть свои собственные бизнес-потребности, поэтому не стесняйтесь обращаться к нам, чтобы получить отчет, который полностью соответствует вашим требованиям.

Содержание

Методология исследования для анализа рынка заменителей мяса в Индии (2024-2032 гг.)

Анализ исторического рынка, оценка текущего рынка и прогнозирование будущего рынка заменителей мяса в Индии были тремя основными шагами, предпринятыми для создания и анализа внедрения заменителей мяса в Индии в основных штатах. Было проведено исчерпывающее вторичное исследование для сбора исторических рыночных показателей и оценки текущего размера рынка. Во-вторых, для проверки этих данных были приняты во внимание многочисленные выводы и допущения. Кроме того, были проведены исчерпывающие первичные интервью с отраслевыми экспертами по всей цепочке создания стоимости рынка заменителей мяса в Индии. После предположения и проверки рыночных показателей посредством первичных интервью мы использовали подход «сверху вниз / снизу вверх» для прогнозирования полного размера рынка. После этого были применены методы разбиения рынка и триангуляции данных для оценки и анализа размера рынка сегментов и подсегментов отрасли, касающихся подробной методологии, объясненной ниже:

Анализ исторического размера рынка

Шаг 1: Углубленное изучение вторичных источников:

Было проведено подробное вторичное исследование для получения исторических размеров рынка заменителей мяса в Индии из внутренних источников компании, таких как годовые отчеты и финансовые отчетности, презентации эффективности, пресс-релизы и т. д., и внешних источников, включая журналы, новости и статьи, правительственные публикации, публикации конкурентов, отраслевые отчеты, сторонние базы данных и другие авторитетные публикации.

Шаг 2: Сегментация рынка:

После получения исторических размеров рынка заменителей мяса в Индии мы провели подробный вторичный анализ для сбора исторических рыночных данных и доли для различных сегментов и подсегментов для основных регионов. Основные сегменты включены в отчет как тип продукта, тип источника и регионы. Далее были проведены анализы на уровне стран для оценки общего внедрения моделей тестирования в этом регионе.

Шаг 3: Факторный анализ:

После получения исторических размеров рынка различных сегментов и подсегментов мы провели подробный факторный анализ для оценки текущего размера рынка заменителей мяса в Индии. Далее мы провели факторный анализ с использованием зависимых и независимых переменных, таких как тип продукта, тип источника и регионы рынка заменителей мяса в Индии. Был проведен тщательный анализ сценариев спроса и предложения с учетом ведущих партнерств, слияний и поглощений, расширения бизнеса и запуска продуктов в секторе рынка заменителей мяса в Индии по всей стране.

Оценка и прогноз текущего размера рынка

Определение текущего размера рынка: Основываясь на практических выводах из вышеуказанных 3 шагов, мы пришли к текущему размеру рынка, ключевым игрокам на рынке заменителей мяса в Индии и рыночным долям сегментов. Все необходимые доли в процентах, разбивки и разделения рынка были определены с использованием вышеупомянутого вторичного подхода и были проверены посредством первичных интервью.

Оценка и прогнозирование: Для оценки и прогнозирования рынка веса были присвоены различным факторам, включая драйверы и тенденции, ограничения и возможности, доступные для заинтересованных сторон. После анализа этих факторов были применены соответствующие методы прогнозирования, т. е. подход «сверху вниз / снизу вверх», чтобы получить прогноз рынка на 2032 год для различных сегментов и подсегментов на основных рынках Индии. Методология исследования, принятая для оценки размера рынка, включает:

Размер рынка отрасли с точки зрения выручки (долл. США) и скорость внедрения рынка заменителей мяса в Индии на основных рынках внутри страны

Все доли в процентах, разбивки и разделения рыночных сегментов и подсегментов

Ключевые игроки на рынке заменителей мяса в Индии, предлагающие продукты. Кроме того, стратегии роста, принятые этими игроками для конкуренции на быстрорастущем рынке.

Проверка размера рынка и доли

Первичные исследования: Были проведены углубленные интервью с ключевыми лидерами мнений (KOL), включая руководителей высшего звена (CXO/VP, руководители по продажам, руководители по маркетингу, руководители операций, региональные руководители, руководители стран и т. д.) во всех основных регионах. Результаты первичных исследований были затем обобщены, и был выполнен статистический анализ для подтверждения заявленной гипотезы. Данные первичных исследований были консолидированы со вторичными данными, превращая, таким образом, информацию в полезные выводы.

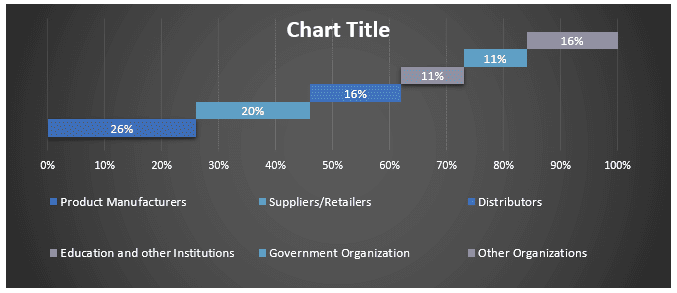

Разбивка первичных участников по различным регионам

Инженерия рынка

Метод триангуляции данных был использован для завершения общей оценки рынка и получения точных статистических данных для каждого сегмента и подсегмента рынка заменителей мяса в Индии. Данные были разделены на несколько сегментов и подсегментов после изучения различных параметров и тенденций в областях типа продукта, типа источника и регионов на рынке заменителей мяса в Индии.

Основная цель исследования рынка заменителей мяса в Индии

В исследовании были определены текущие и будущие тенденции рынка заменителей мяса в Индии. Инвесторы могут получить стратегические выводы для обоснования своих решений об инвестициях на основе качественного и количественного анализа, проведенного в исследовании. Текущие и будущие тенденции рынка определили общую привлекательность рынка на государственном уровне, обеспечивая платформу для участников отрасли для использования неиспользованного рынка, чтобы получить выгоду от преимущества первого участника. Другие количественные цели исследований включают:

- Проанализировать текущий и прогнозируемый размер рынка заменителей мяса в Индии в стоимостном выражении (USD). Также проанализировать текущий и прогнозируемый размер рынка различных сегментов и подсегментов.

- Сегменты исследования включают области типа продукта, типа источника и регионов.

- Определить и проанализировать нормативно-правовую базу для рынка заменителей мяса в Индии

- Проанализировать цепочку создания стоимости с присутствием различных посредников, а также проанализировать поведение клиентов и конкурентов отрасли.

- Проанализировать текущий и прогнозируемый размер рынка заменителей мяса в Индии для основного региона.

- Основные регионы в Индии, изученные в отчете, включают Северную Индию, Южную Индию, Восточную Индию и Западную Индию.

- Профиль компании на рынке заменителей мяса в Индии и стратегии роста, принятые участниками рынка для поддержания позиций на быстрорастущем рынке.

- Углубленный анализ отрасли на уровне штатов

Часто задаваемые вопросы Часто задаваемые вопросы

В1: Каков текущий размер рынка и потенциал роста рынка заменителей мяса в Индии?

В2: Какие факторы способствуют росту рынка заменителей мяса в Индии?

В3: Какой сегмент занимает наибольшую долю рынка заменителей мяса в Индии по типу продукта?

В4: Какие новые технологии и тенденции наблюдаются на рынке заменителей мяса в Индии?

В5: Какой регион будет доминировать на рынке заменителей мяса в Индии?

Связанные Отчеты

Клиенты, купившие этот товар, также купили