- Trang chủ

- Về chúng tôi

- Ngành

- Dịch vụ

- Đọc

- Liên hệ với chúng tôi

Thị trường Ngân hàng số Neo: Phân tích hiện tại và Dự báo (2023-2030)

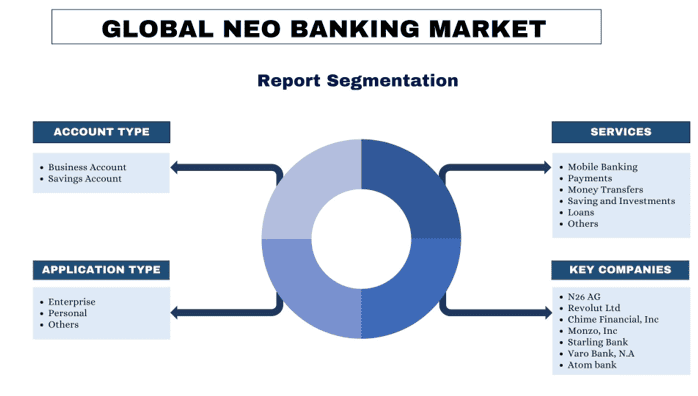

Nhấn mạnh vào Loại Tài khoản (Tài khoản Doanh nghiệp và Tài khoản Tiết kiệm); Dịch vụ (Ngân hàng Di động, Thanh toán, Chuyển tiền, Tiết kiệm và Đầu tư, Cho vay và Các dịch vụ khác); Loại Ứng dụng (Doanh nghiệp, Cá nhân và Loại khác); và Khu vực/Quốc gia

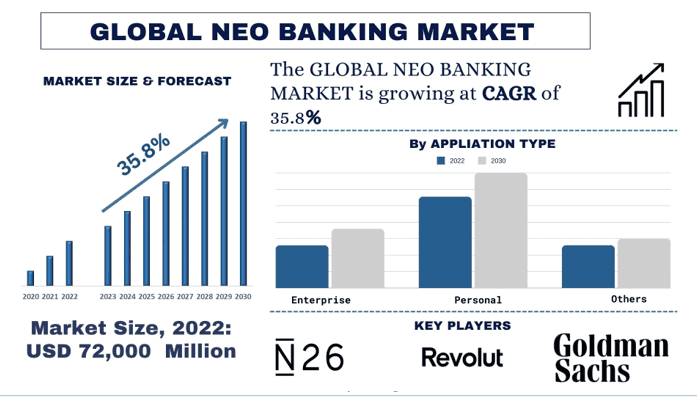

Quy mô & dự báo thị trường Ngân hàng Neo

Thị trường Ngân hàng Neo được định giá 72.000 triệu USD và dự kiến sẽ tăng trưởng với tốc độ CAGR mạnh mẽ khoảng 35,8% trong giai đoạn dự báo (2023-2030) do số hóa tài chính ngày càng tăng.

Phân tích thị trường Ngân hàng Neo

Lý do chính cho sự tăng trưởng nhanh chóng của các ngân hàng neo là sự tiện lợi mà chúng mang lại. Với khả năng truy cập dịch vụ 24/7 thông qua ứng dụng di động, khách hàng có thể quản lý tài chính của mình mọi lúc, mọi nơi. Hơn nữa, các ngân hàng Neo thường có chi phí hoạt động thấp hơn so với các ngân hàng truyền thống do thiếu chi nhánh vật lý.

Hơn nữa, sự tăng trưởng cao này cũng được thúc đẩy bởi sự hỗ trợ thuận lợi của chính phủ đối với ngành này. Chính phủ ở nhiều quốc gia đã nhận ra tiềm năng của đổi mới fintech và đã giới thiệu các sandbox quy định để thúc đẩy sự phát triển của các startup ngân hàng neo. Môi trường pháp lý hỗ trợ này đã khuyến khích các doanh nhân và nhà đầu tư tham gia vào thị trường này.

Hơn nữa, vào năm 2021, Stripe, một nền tảng xử lý thanh toán toàn cầu, đã huy động được 600 triệu USD trong một vòng tài trợ, định giá công ty ở mức 95 tỷ USD, nhấn mạnh sự tin tưởng của nhà đầu tư vào các công ty fintech và các công ty như Chime ở Hoa Kỳ và Revolut ở Châu Âu đã đạt được sức hút bằng cách cung cấp các dịch vụ phù hợp với thế hệ millennials và khách du lịch thường xuyên.

Xu hướng thị trường Ngân hàng Neo

Phần này thảo luận về các xu hướng thị trường chính đang ảnh hưởng đến các phân khúc khác nhau của Thị trường Ngân hàng Neo như được xác định bởi nhóm các chuyên gia nghiên cứu của chúng tôi.

Dịch vụ Ngân hàng Di động đang Chuyển đổi Ngành

Ứng dụng tạo ra doanh thu tối đa cho các ngân hàng neo là ngân hàng di động. Với việc ngày càng có nhiều người sử dụng điện thoại thông minh và tầm quan trọng ngày càng tăng của các giao dịch kỹ thuật số, ngân hàng di động đã trở thành một công cụ không thể thiếu cho những khách hàng tìm kiếm sự tiện lợi và khả năng tiếp cận trong việc quản lý tài chính của họ. Các ngân hàng Neo đã tận dụng xu hướng này bằng cách cung cấp trải nghiệm ngân hàng di động liền mạch và thân thiện với người dùng, đáp ứng nhu cầu tài chính hiện đại. Hơn nữa, một số yếu tố đã góp phần vào khả năng chấp nhận cao của các dịch vụ ngân hàng di động mới giữa người tiêu dùng, chẳng hạn như giao diện thân thiện với người dùng. Ví dụ, các ngân hàng Neo ưu tiên trải nghiệm người dùng, cung cấp các giao diện trực quan giúp khách hàng dễ dàng điều hướng qua các dịch vụ ngân hàng khác nhau. Sự đơn giản và tiện lợi của các ứng dụng ngân hàng di động nâng cao sự hài lòng và lòng trung thành của khách hàng. Hơn nữa, khả năng tiếp cận và các tính năng bảo mật mà ngân hàng neo cung cấp cho người tiêu dùng của họ xây dựng niềm tin giữa người tiêu dùng và mức độ khả năng tiếp cận, cho phép người tiêu dùng truy cập tài khoản của họ mọi lúc và mọi nơi là một động lực chính để giữ chân người tiêu dùng cho các ngân hàng neo. Ví dụ, Brazil đã trở thành một trong những khu vực phát triển nhanh nhất cho ngân hàng neo, được hỗ trợ bởi sự thúc đẩy hướng tới số hóa nền kinh tế Brazil. Tính đến năm 2023, một phần đáng kể dân số Brazil, cụ thể là khoảng 43%, có tài khoản ngân hàng neo. NuBank, ngân hàng neo lớn nhất ở Brazil, đã trải qua sự tăng trưởng vượt bậc với cơ sở người dùng vượt quá 48 triệu, rõ ràng là đảm bảo khoản đầu tư lớn thứ hai khoảng 4,1 tỷ USD theo thời gian kể từ năm 2012.

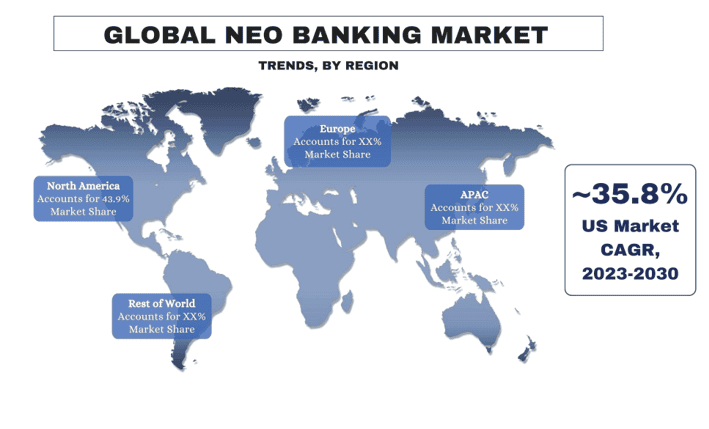

Châu Âu nắm giữ phần lớn đáng kể của Ngân hàng Neo về thị phần

Trong Châu Âu, Đức nắm giữ phần lớn thị phần. Các yếu tố chính thúc đẩy sự tăng trưởng của thị trường trong nước là môi trường pháp lý tài chính thuận lợi giúp ngành công nghiệp phát triển với tốc độ chưa từng có.

Theo Chỉ thị Dịch vụ Thanh toán 2 (PSD2) của Liên minh Châu Âu được ra mắt vào năm 2017 tại Châu Âu, đã đóng một vai trò quan trọng trong việc thúc đẩy sự đổi mới và cạnh tranh trong lĩnh vực tài chính bằng cách tăng cường và điều chỉnh các dịch vụ thanh toán điện tử bằng cách cho phép bên thứ ba truy cập vào dữ liệu ngân hàng thông qua API ngân hàng mở.

Hơn nữa, hệ sinh thái hợp tác ở Châu Âu giữa fintech, các ngân hàng truyền thống và các cơ quan quản lý đã tạo ra một môi trường rất thuận lợi cho ngành ngân hàng neo phát triển trong khu vực. Ví dụ, sự hợp tác giữa các nhà cung cấp dịch vụ ngân hàng neo và các ngân hàng truyền thống đã cho phép các ngân hàng chỉ có kỹ thuật số này mở rộng nhanh chóng và phát triển cơ sở người tiêu dùng của họ với tốc độ nhanh chóng.

Tổng quan về ngành Ngân hàng Neo

Thị trường Ngân hàng Neo có tính cạnh tranh và phân mảnh, với sự hiện diện của một số người chơi thị trường toàn cầu và quốc tế. Những người chơi chính đang áp dụng các chiến lược tăng trưởng khác nhau để tăng cường sự hiện diện trên thị trường của họ, chẳng hạn như quan hệ đối tác, thỏa thuận, hợp tác, ra mắt sản phẩm mới, mở rộng địa lý và sáp nhập và mua lại. Một số người chơi lớn hoạt động trên thị trường là N26 AG; Revolut Ltd; Chime Financial, Inc; Monzo, Inc; Starling Bank; Varo Bank, N.A; Atom bank; Monese Ltd; The Goldman Sachs Group, Inc.; và Tandem Bank.

Tin tức về thị trường Ngân hàng Neo

- Vào năm 2023, một ngân hàng neo có trụ sở tại Đức tên là N26 đã báo cáo số liệu tăng trưởng của mình liên quan đến cơ sở người tiêu dùng, khoảng 7 triệu người tiêu dùng trên khắp Châu Âu nhấn mạnh sự chấp nhận văn hóa của ngân hàng neo trong khu vực.

- Vào tháng 5 năm 2023, Nymbus, một startup cho phép các ngân hàng chuyển đổi từ cơ sở hạ tầng ngân hàng cũ sang ngân hàng neo, với mục tiêu tối đa hóa việc mua lại khách hàng mới, đã đưa ra thông báo về việc đảm bảo khoản đầu tư 70 triệu USD trong vòng Series D.

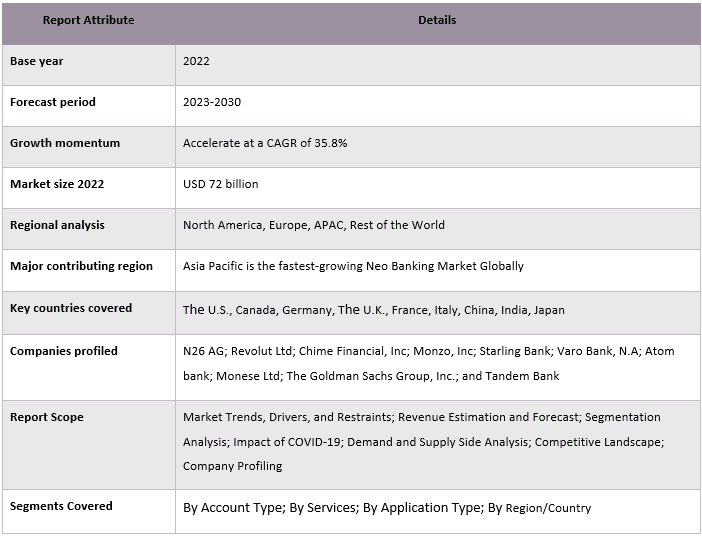

Phạm vi Báo cáo Thị trường Ngân hàng Neo

Lý do để mua báo cáo này:

- Nghiên cứu bao gồm phân tích kích thước thị trường và dự báo được xác thực bởi các chuyên gia ngành công nghiệp chính đã được xác thực.

- Báo cáo trình bày một đánh giá nhanh chóng về hiệu suất tổng thể của ngành trong nháy mắt.

- Báo cáo bao gồm một phân tích chuyên sâu về các đồng nghiệp ngành công nghiệp nổi bật với trọng tâm chính vào tài chính kinh doanh chính, danh mục sản phẩm, chiến lược mở rộng và các phát triển gần đây.

- Kiểm tra chi tiết các động lực, hạn chế, xu hướng chính và cơ hội hiện hành trong ngành.

- Nghiên cứu bao gồm toàn diện thị trường trên các phân khúc khác nhau.

- Phân tích sâu cấp khu vực của ngành.

Tùy chọn tùy chỉnh:

Thị trường Ngân hàng Neo toàn cầu có thể được tùy chỉnh thêm theo yêu cầu hoặc bất kỳ phân khúc thị trường nào khác. Bên cạnh đó, UMI hiểu rằng bạn có thể có nhu cầu kinh doanh riêng, do đó hãy liên hệ với chúng tôi để nhận được báo cáo hoàn toàn phù hợp với yêu cầu của bạn.

Mục lục

Phương Pháp Nghiên Cứu cho Phân Tích Thị Trường Ngân Hàng Số Neobank (2023-2030)

Phân tích thị trường lịch sử, ước tính thị trường hiện tại và dự báo thị trường tương lai của thị trường Ngân hàng Số Neobank toàn cầu là ba bước chính được thực hiện để tạo và phân tích việc áp dụng Ngân hàng Số Neobank ở các khu vực chính trên toàn cầu. Nghiên cứu thứ cấp toàn diện đã được thực hiện để thu thập các số liệu thị trường lịch sử và ước tính quy mô thị trường hiện tại. Thứ hai, để xác thực những hiểu biết sâu sắc này, nhiều phát hiện và giả định đã được xem xét. Hơn nữa, các cuộc phỏng vấn sơ cấp toàn diện cũng được thực hiện với các chuyên gia trong ngành trên toàn bộ chuỗi giá trị của thị trường Ngân hàng Số Neobank toàn cầu. Sau khi giả định và xác thực các số liệu thị trường thông qua các cuộc phỏng vấn sơ cấp, chúng tôi đã sử dụng phương pháp tiếp cận từ trên xuống/từ dưới lên để dự báo quy mô thị trường hoàn chỉnh. Sau đó, các phương pháp phân tích chi tiết thị trường và phương pháp tam giác dữ liệu đã được áp dụng để ước tính và phân tích quy mô thị trường của các phân khúc và phân khúc phụ của ngành liên quan đến. Phương pháp luận chi tiết được giải thích dưới đây:

Phân Tích Quy Mô Thị Trường Lịch Sử

Bước 1: Nghiên Cứu Chuyên Sâu về Các Nguồn Thứ Cấp:

Một nghiên cứu thứ cấp chi tiết đã được thực hiện để thu thập quy mô thị trường lịch sử của thị trường Ngân hàng Số Neobank thông qua các nguồn nội bộ của công ty như báo cáo thường niên & báo cáo tài chính, các bài thuyết trình về hiệu suất, thông cáo báo chí, v.v., và các nguồn bên ngoài bao gồm tạp chí, tin tức & bài viết, ấn phẩm của chính phủ, ấn phẩm của đối thủ cạnh tranh, báo cáo ngành, cơ sở dữ liệu của bên thứ ba và các ấn phẩm đáng tin cậy khác.

Bước 2: Phân Khúc Thị Trường:

Sau khi thu thập được quy mô thị trường lịch sử của thị trường Ngân hàng Số Neobank, chúng tôi đã tiến hành phân tích thứ cấp chi tiết để thu thập thông tin chi tiết về thị trường lịch sử và chia sẻ cho các phân khúc & phân khúc phụ khác nhau cho các khu vực chính. Các phân khúc chính được bao gồm trong báo cáo là loại tài khoản, dịch vụ và loại ứng dụng. Phân tích cấp quốc gia sâu hơn đã được thực hiện để đánh giá việc áp dụng tổng thể các mô hình thử nghiệm trong khu vực đó.

Bước 3: Phân Tích Yếu Tố:

Sau khi có được quy mô thị trường lịch sử của các phân khúc và phân khúc phụ khác nhau, chúng tôi đã tiến hành phân tích yếu tố chi tiết để ước tính quy mô thị trường hiện tại của thị trường Ngân hàng Số Neobank. Hơn nữa, chúng tôi đã tiến hành phân tích yếu tố sử dụng các biến phụ thuộc và độc lập như loại tài khoản, dịch vụ và loại ứng dụng của thị trường Ngân hàng Số Neobank. Một phân tích kỹ lưỡng đã được thực hiện về các kịch bản cung và cầu có xét đến các mối quan hệ đối tác hàng đầu, sáp nhập và mua lại, mở rộng kinh doanh và ra mắt sản phẩm trong lĩnh vực thị trường Ngân hàng Số Neobank trên toàn cầu.

Ước Tính & Dự Báo Quy Mô Thị Trường Hiện Tại

Định cỡ Thị trường Hiện tại: Dựa trên những hiểu biết sâu sắc có thể hành động từ 3 bước trên, chúng tôi đã đưa ra quy mô thị trường hiện tại, những người chơi chính trong thị trường Ngân hàng Số Neobank toàn cầu và thị phần của các phân khúc. Tất cả các tỷ lệ phần trăm chia sẻ và phân tích thị trường cần thiết đã được xác định bằng cách sử dụng phương pháp thứ cấp đã đề cập ở trên và được xác minh thông qua các cuộc phỏng vấn sơ cấp.

Ước tính & Dự báo: Để ước tính và dự báo thị trường, trọng số đã được gán cho các yếu tố khác nhau bao gồm các động lực & xu hướng, hạn chế và cơ hội có sẵn cho các bên liên quan. Sau khi phân tích các yếu tố này, các kỹ thuật dự báo có liên quan, tức là phương pháp tiếp cận từ trên xuống/từ dưới lên đã được áp dụng để đưa ra dự báo thị trường cho năm 2030 cho các phân khúc và phân khúc phụ khác nhau trên các thị trường lớn trên toàn cầu. Phương pháp nghiên cứu được áp dụng để ước tính quy mô thị trường bao gồm:

- Quy mô thị trường của ngành, về doanh thu (USD) và tỷ lệ chấp nhận của thị trường Ngân hàng Số Neobank trên khắp các thị trường lớn trong nước

- Tất cả các tỷ lệ phần trăm chia sẻ, phân chia và phân tích chi tiết của các phân khúc và phân khúc phụ của thị trường

- Những người chơi chính trong thị trường Ngân hàng Số Neobank toàn cầu về các sản phẩm được cung cấp. Ngoài ra, các chiến lược tăng trưởng được áp dụng bởi những người chơi này để cạnh tranh trong thị trường đang phát triển nhanh chóng.

Xác Thực Quy Mô và Thị Phần Thị Trường

Nghiên Cứu Sơ Cấp: Các cuộc phỏng vấn chuyên sâu đã được thực hiện với những Người Có Quan Điểm Chủ Chốt (KOL) bao gồm các Giám Đốc Điều Hành Cấp Cao (CXO/VP, Trưởng Phòng Bán Hàng, Trưởng Phòng Tiếp Thị, Trưởng Phòng Vận Hành, Trưởng Khu Vực, Trưởng Chi Nhánh, v.v.) trên khắp các khu vực chính. Các phát hiện nghiên cứu sơ cấp sau đó đã được tóm tắt và phân tích thống kê đã được thực hiện để chứng minh giả thuyết đã nêu. Thông tin đầu vào từ nghiên cứu sơ cấp đã được hợp nhất với các phát hiện thứ cấp, do đó biến thông tin thành những hiểu biết sâu sắc có thể hành động.

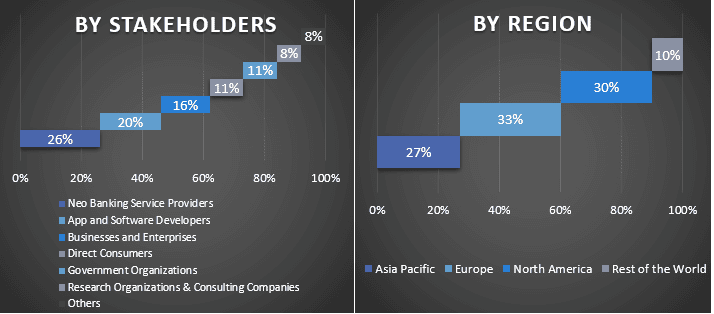

Phân Chia Người Tham Gia Sơ Cấp ở Các Khu Vực Khác Nhau

Kỹ Thuật Thị Trường

Kỹ thuật tam giác dữ liệu đã được sử dụng để hoàn thành việc ước tính thị trường tổng thể và đưa ra các số liệu thống kê chính xác cho từng phân khúc và phân khúc phụ của thị trường Ngân hàng Số Neobank toàn cầu. dữ liệu đã được chia thành nhiều phân khúc & phân khúc phụ sau khi nghiên cứu các thông số và xu hướng khác nhau trong các lĩnh vực độ tinh khiết và ứng dụng trong thị trường Ngân hàng Số Neobank toàn cầu.

Mục tiêu chính của Nghiên cứu Thị trường Ngân hàng Số Neobank Toàn cầu

Các xu hướng thị trường hiện tại & tương lai của thị trường Ngân hàng Số Neobank toàn cầu đã được xác định trong nghiên cứu. Các nhà đầu tư có thể có được những hiểu biết sâu sắc về chiến lược để dựa vào sự tùy ý của họ cho các khoản đầu tư dựa trên phân tích định tính và định lượng được thực hiện trong nghiên cứu. Các xu hướng thị trường hiện tại và tương lai đã xác định sức hấp dẫn tổng thể của thị trường ở cấp khu vực, cung cấp một nền tảng cho người tham gia công nghiệp khai thác thị trường chưa được khai thác để hưởng lợi từ lợi thế của người đi đầu. Các mục tiêu định lượng khác của các nghiên cứu bao gồm:

- Phân tích quy mô thị trường hiện tại và dự báo của thị trường Ngân hàng Số Neobank về giá trị (USD). Ngoài ra, hãy phân tích quy mô thị trường hiện tại và dự báo của các phân khúc và phân khúc phụ khác nhau.

- Các phân khúc trong nghiên cứu bao gồm các lĩnh vực loại tài khoản, dịch vụ và loại ứng dụng.

- Xác định và phân tích khung pháp lý cho Ngân hàng Số Neobank

- Phân tích chuỗi giá trị liên quan đến sự hiện diện của các trung gian khác nhau, cùng với việc phân tích hành vi của khách hàng và đối thủ cạnh tranh của ngành

- Phân tích quy mô thị trường hiện tại và dự báo của thị trường Ngân hàng Số Neobank cho khu vực chính

- Các quốc gia lớn của khu vực được nghiên cứu trong báo cáo bao gồm Châu Á Thái Bình Dương, Châu Âu, Bắc Mỹ và Phần Còn Lại của Thế Giới

- Hồ sơ công ty của thị trường Ngân hàng Số Neobank và các chiến lược tăng trưởng được các công ty tham gia thị trường áp dụng để duy trì trong thị trường đang phát triển nhanh chóng.

- Phân tích sâu cấp khu vực của ngành

Câu hỏi thường gặp Câu hỏi thường gặp

Câu hỏi 1: Quy mô thị trường hiện tại và tiềm năng tăng trưởng của thị trường Neo Banking toàn cầu là gì?

Q2: Đâu là những yếu tố thúc đẩy sự tăng trưởng của Thị trường Neo Banking toàn cầu?

Q3: Phân khúc nào có tốc độ tăng trưởng nhanh nhất trong thị trường Neo Banking toàn cầu theo loại hình dịch vụ?

Q4: Các công nghệ và xu hướng mới nổi trong thị trường Neo Banking toàn cầu là gì?

Câu hỏi 5: Khu vực nào sẽ là thị trường Neo Banking toàn cầu phát triển nhanh nhất?

Q6: Ai là những người chơi chủ chốt trên thị trường Neo Banking toàn cầu?

Liên quan Báo cáo

Khách hàng đã mua mặt hàng này cũng đã mua