- الرئيسية

- معلومات عنا

- صناعة

- الخدمات

- قراءة

- اتصل بنا

سوق تسوية الديون المدعوم بالذكاء الاصطناعي: التحليل الحالي والتوقعات (2025-2033)

التركيز على المكون (البرامج والخدمات)؛ النشر (القائم على السحابة، داخل المقر، والهجين)؛ حسب حجم المؤسسة (الشركات الصغيرة والمتوسطة والمؤسسات الكبيرة)؛ حسب الصناعة (تكنولوجيا المعلومات والاتصالات، والخدمات المصرفية والمالية والتأمين (BFSI)، والتجزئة والتجارة الإلكترونية، والرعاية الصحية، والفضاء والدفاع وغيرها)؛ والمنطقة/الدولة

حجم سوق تسوية الديون العالمي المدعوم بالذكاء الاصطناعي والتوقعات

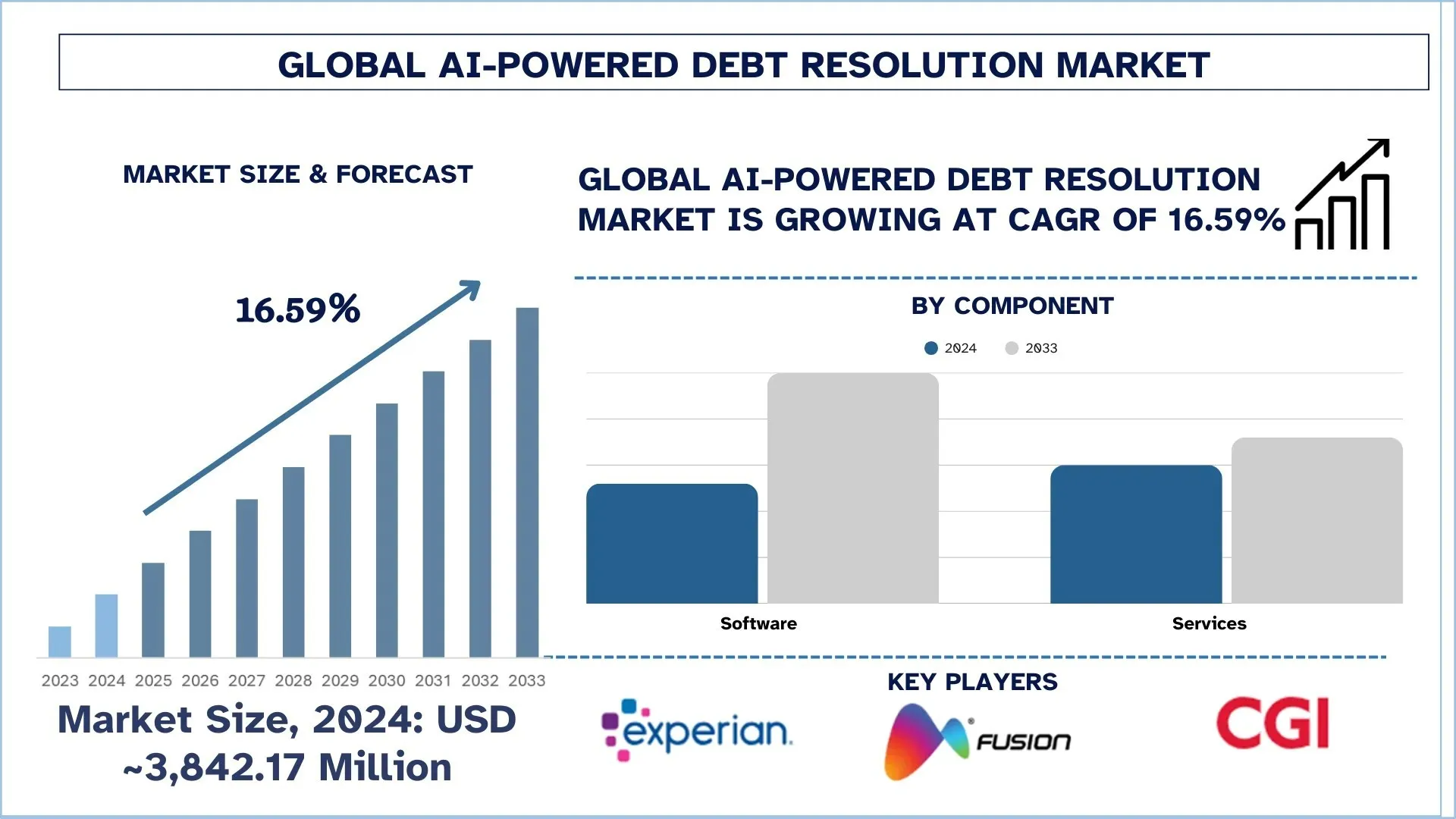

بلغت قيمة سوق تسوية الديون العالمي المدعوم بالذكاء الاصطناعي 3,842.17 مليون دولار أمريكي في عام 2024 ومن المتوقع أن ينمو بمعدل نمو سنوي مركب قوي يبلغ حوالي 16.59٪ خلال الفترة المتوقعة (2025-2033F)، وذلك بسبب ارتفاع الطلب من المؤسسات المالية لخفض الديون من خلال الحلول القائمة على الذكاء الاصطناعي، مما يعزز الطلب على تسوية الديون المدعومة بالذكاء الاصطناعي.

تحليل سوق تسوية الديون المدعوم بالذكاء الاصطناعي

يشهد قطاع تسوية الديون العالمي المدعوم بالذكاء الاصطناعي نموًا سريعًا مع صعود الذكاء الاصطناعي في قطاع الخدمات المالية. تعطل تقنيات الذكاء الاصطناعي عمليات تسوية الديون عن طريق أتمتة المهام التي تشمل تقييم المخاطر الائتمانية، واسترداد الديون، والتواصل مع العملاء. مع ارتفاع مستويات الديون، والحاجة إلى تحصيلات فعالة، والمتطلبات المتزايدة لوسائل أقل إرهاقًا وأكثر تخصيصًا لاسترداد الديون، تُعزى التوسعات في السوق بالتالي. يوفر الذكاء الاصطناعي فرصة للمؤسسات المالية لتحسين اتخاذ القرارات، وتحسين طرق الاسترداد، وتعزيز تجربة العملاء. كما كان البحث والتطوير المتزايد في التعلم الآلي ومعالجة اللغة الطبيعية والتحليلات التنبؤية سببًا آخر لتمكين نمو حلول تسوية الديون الذكية. أيضًا، أدت اللوائح والتحول إلى الخدمات المالية الرقمية إلى تسريع دمج الذكاء الاصطناعي في حلول إدارة الديون.

اتجاهات سوق تسوية الديون العالمي المدعوم بالذكاء الاصطناعي

يناقش هذا القسم اتجاهات السوق الرئيسية التي تؤثر على مختلف قطاعات سوق تسوية الديون العالمي المدعوم بالذكاء الاصطناعي، كما وجدها فريق خبراء الأبحاث لدينا.

التواصل الشخصي:

التواصل الشخصي هو الاتجاه الرئيسي الذي يشكل النمو الدافئ لتحصيل الديون بمساعدة الذكاء الاصطناعي. لقد دفع الطلب المتزايد من الناس على التجارب شركات التحصيل إلى تبني الذكاء الاصطناعي لبناء قنوات تفاعل شخصية مع المدينين. تستخدم الأدوات المدعومة بالذكاء الاصطناعي مثل أنظمة الروبوت والمساعدين الافتراضيين التاريخ لتقديم تذكيرات شخصية للدفع، والشروط المتفاوض عليها، والنزاعات التي تمت معالجتها، وكلها مصممة خصيصًا لحالة المدين وسلوكه المحدد.

تمكن ميزات البرمجة اللغوية العصبية والتعلم الآلي هذه الأنظمة من استخلاص النبرة والسياق بحيث يمكن أن تكون المحادثات على المستوى المناسب من التواصل المتعاطف والفعال في نفس الوقت. يمكن أن يساعد استخدام الذكاء الاصطناعي لتشريح العملاء وتزويدهم أخيرًا برسائل ذات صلة وشخصية وكالات تحصيل الديون في الوصول إلى العملاء، وبالتالي تحسين التحصيل.

لقد ساعد تقديمه العملاء من خلال تخصيص التواصل بشأن الإحباطات التي يعاني منها المدين وساعد المؤسسات المالية في استرداد الديون بشكل أكثر كفاءة. كلما تطور هذا الاتجاه، أصبح الذكاء الاصطناعي الأداة الأكثر أهمية في جعل تحصيل الديون صديقًا للعملاء مع تحسين كل من النتائج والعلاقات.

تقسيم صناعة تسوية الديون المدعومة بالذكاء الاصطناعي

يقدم هذا القسم تحليلاً للاتجاهات الرئيسية في كل قطاع من قطاعات تقرير سوق تسوية الديون العالمي المدعوم بالذكاء الاصطناعي، جنبًا إلى جنب مع التوقعات على المستويات العالمية والإقليمية والقطرية للفترة 2025-2033.

تهيمن فئة البرامج على سوق تسوية الديون المدعومة بالذكاء الاصطناعي.

استنادًا إلى المكونات، ينقسم السوق إلى برامج وخدمات. من بين هذه البرامج استحوذت الشريحة على حصة كبيرة في السوق. تحتل شريحة البرامج في سوق تسوية الديون المدعومة بالذكاء الاصطناعي حصة سوقية ملحوظة نظرًا لفعاليتها في تبسيط وأتمتة عمليات تحصيل الديون المختلفة. مع حلول برامج الذكاء الاصطناعي مثل التحليلات التنبؤية والتواصل الآلي والتعلم الآلي، يمكن لهذه المؤسسات التعامل بكفاءة مع كميات كبيرة من العملاء وتحديد أولويات أولئك المعرضين للخطر والتفاوض على خيارات الدفع بلمسة شخصية. تقلل أدوات البرامج من الجهد اليدوي، وبالتالي تقلل التكاليف التشغيلية وتحسن معدلات الاسترداد. وفي الوقت نفسه، أعطى تحسين معالجة اللغة الطبيعية (NLP) المدمجة مع التعلم الآلي ميزة تنافسية كبيرة لتطبيقات البرامج هذه في توليد تفاعلات متعاطفة وصديقة للعملاء، وبالتالي زيادة تحسين استرداد الديون.

تهيمن الفئة المستندة إلى السحابة على سوق تسوية الديون المدعومة بالذكاء الاصطناعي.

استنادًا إلى النشر، يتم تقسيم السوق إلى فئات قائمة على السحابة ومحلية وهجينة. مع تزايد المطالب بكونها قابلة للتطوير وصديقة للتكلفة، فضلاً عن كونها أقل تعقيدًا نسبيًا في النشر، تمثل الشريحة السحابية من سوق تسوية ديون الذكاء الاصطناعي الحصة الأكبر في السوق. مع مثل هذه الحلول القائمة على السحابة، لا تحتاج المؤسسة المالية إلى إنفاق مبالغ كبيرة على البنية التحتية مقدمًا لتبني أداة تسوية ديون مدفوعة بالذكاء الاصطناعي. توفر المرونة في التحكم في عمليات هذا النوع من الخدمة بحيث يتم الوصول إليها على أساس الحاجة للمؤسسة فرصة لتوسيع نطاق عملياتها حسب الطلب. علاوة على ذلك، فإن ميزات التحديثات في الوقت الفعلي والبيانات الآمنة والمأمونة من الفقدان والدمج السهل مع الأنظمة الحالية تجعلها جذابة للشركات التي تريد طريقة أكثر كفاءة وأمانًا لتحصيل الديون. وذلك أيضًا لأنه، في البنية التحتية السحابية، من المسلم به تقريبًا أن معظم الصناعات والشركات اليوم تستخدم الحوسبة السحابية، مما يجعل توفير السحابة مرنًا وجاهزًا للمستقبل عندما يتعلق الأمر بتسوية الديون.

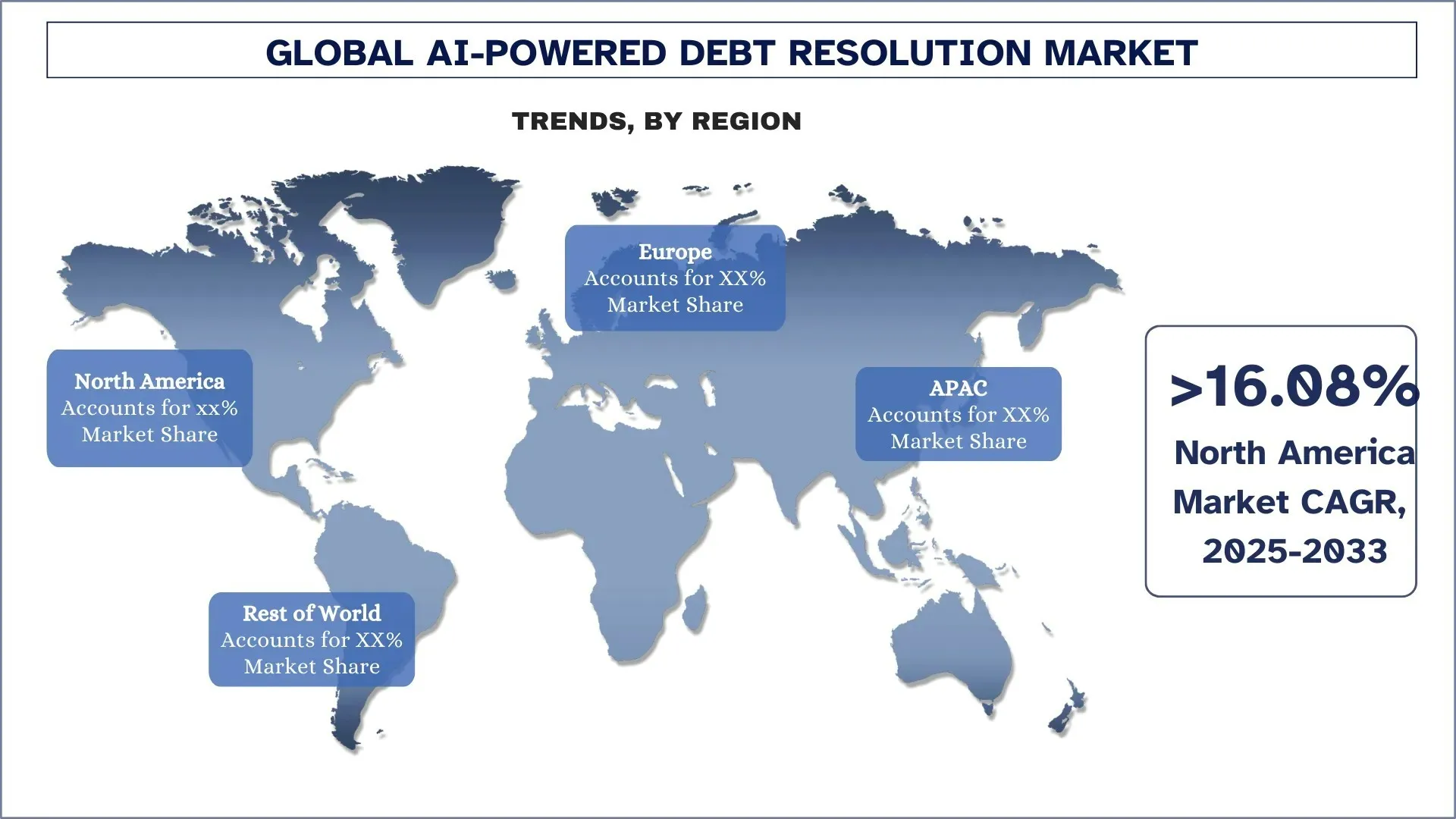

من المتوقع أن تنمو أمريكا الشمالية بمعدل كبير خلال الفترة المتوقعة.

ينمو سوق تسوية الديون المدعومة بالذكاء الاصطناعي في أمريكا الشمالية بشكل كبير بسبب التنفيذ المتزايد للذكاء الاصطناعي في صناعة الخدمات المالية. تثبت أمريكا الشمالية، وخاصة الولايات المتحدة، أنها من أوائل المتبنين لتقنيات الذكاء الاصطناعي في مجالات تحصيل الديون وإدارة الديون. تتم تغذية الحاجة إلى مثل هذه التقنيات المتقدمة لتسوية الديون من خلال البنية التحتية المالية القوية للمنطقة والعدد الكبير من المؤسسات المالية والبنوك ووكالات الائتمان في هذه المنطقة.

تستخدم تطبيقات الذكاء الاصطناعي في استرداد الديون التي يتم قياسها من خلال التحليلات التنبؤية أو أنظمة الاتصالات الآلية أو نماذج التعلم الآلي على نطاق واسع لتسهيل عمليات تحصيل الديون وتحسين استراتيجيات الاسترداد مع تقليل التكاليف التشغيلية. أصبحت حافظة الديون أكثر تعقيدًا، مما يتطلب اتباع نهج أكثر تخصيصًا لحل يركز على العملاء ويضعه في مدار إدخال الذكاء الاصطناعي في تسوية الديون. علاوة على ذلك، مع قوانين حماية المستهلك الصارمة في المنطقة، حفزت الزيادات في الضغوط التنظيمية المؤسسات المالية على دمج تقنيات الذكاء الاصطناعي للامتثال مع كونها فعالة.

تنفق العديد من الشركات العاملة في أمريكا الشمالية على نطاق واسع على البحث والتطوير لمنصات متطورة لتسوية الديون المدعومة بالذكاء الاصطناعي والمخصصة لمختلف الصناعات مثل الرعاية الصحية والاتصالات وتجارة التجزئة. علاوة على ذلك، فإن نمو السوق يكمل تزايد عدد السكان المهتمين بالتكنولوجيا في المنطقة، جنبًا إلى جنب مع الرقمنة المتزايدة للخدمات المالية. ستظل المنطقة المساهم الرئيسي في سوق تسوية الديون العالمي المدعوم بالذكاء الاصطناعي حيث تواصل شركة الذكاء الاصطناعي تبني تقنيات جديدة للتطورات المستقبلية المبتكرة.

استحوذت الولايات المتحدة على حصة مهيمنة في سوق تسوية الديون المدعومة بالذكاء الاصطناعي في أمريكا الشمالية في عام 2024

يشهد سوق تسوية الديون المدعومة بالذكاء الاصطناعي في الولايات المتحدة نموًا كبيرًا، مدفوعًا بالدولة القائمة على البنية التحتية المالية والتكنولوجيا السائدة والمطالب التنظيمية المقبولة. تعد الولايات المتحدة واحدة من أوائل الدول التي نفذت الذكاء الاصطناعي في عدة قطاعات، بما في ذلك الخدمات المالية، مما يجعلها رائدة في تبني تقنيات الذكاء الاصطناعي لحل وتحصيل الديون.

هناك عدد قليل من العوامل المهمة التي غذت الطلب في الولايات المتحدة على تسوية الديون بمساعدة الذكاء الاصطناعي. أهم هذه العوامل هو تعقيد المحفظة: الحقيقة هي أن المؤسسات المالية ووكالات الائتمان يجب أن تتعامل مع البنوك ومصادر أخرى لمجموعة أكبر من الديون؛ لقد تعطلت طرق التحصيل الحديثة، التي تتميز بالاعتماد على العمليات اليدوية والبشر، عندما يتعلق الأمر بإدارة هذه التعقيدات. من خلال التحليلات التنبؤية ونماذج التعلم الآلي وأنظمة الاتصالات الآلية بالكامل، يمكن أن يصبح التحصيل أكثر انسيابية ورخصًا بسبب استخدام حلول الذكاء الاصطناعي المتقدمة.

المشهد التنافسي لتسوية الديون المدعومة بالذكاء الاصطناعي

يتسم سوق تسوية الديون العالمي المدعوم بالذكاء الاصطناعي بالتنافسية، مع وجود العديد من اللاعبين العالميين والدوليين في السوق. يتبنى اللاعبون الرئيسيون استراتيجيات نمو مختلفة لتعزيز وجودهم في السوق، مثل الشراكات والاتفاقيات والتعاون وإطلاق المنتجات الجديدة والتوسعات الجغرافية وعمليات الاندماج والاستحواذ.

أفضل شركات تسوية الديون المدعومة بالذكاء الاصطناعي

بعض اللاعبين الرئيسيين في السوق هم FICO و Experian و Fusion CX و Resolve Debt, LLC و CGI Group Inc. و Simplifi و Receeve (InDebted) و DebtZero Inc. و Observer.AI و C&R Software.

التطورات الأخيرة في سوق تسوية الديون المدعومة بالذكاء الاصطناعي

- في عام 2025، حصلت ClearGrid، إحدى الشركات الناشئة سريعة النمو لبرامج تحصيل الديون، على تمويل قدره 10 ملايين دولار أمريكي. كان هذا التمويل يهدف إلى تحسين برامج تحصيل الديون في منطقة الشرق الأوسط وشمال إفريقيا. تساعد الشركة الناشئة التي تتخذ من دبي مقراً لها البنوك وشركات التكنولوجيا المالية والمقرضين على استرداد المزيد من الديون دون اللجوء إلى مضايقة العملاء.

- في عام 2024، أعلنت شركة Pair France، إحدى الشركات الرائدة في أوروبا في مجال برامج تحصيل الديون الرقمية بالكامل، عن إطلاق برنامج Llama 3 لتحصيل الديون القائم على الذكاء الاصطناعي في خدمات العملاء. تعرف الذكاء الاصطناعي، المخصص بالكامل لتحصيل الديون، وصنف 92٪ من استعلامات المستوى الأول التي تم تلقيها، مثل طلبات الدفع بالتقسيط أو تعليق الدفع أو النزاعات.

تغطية تقرير سوق تسوية الديون العالمي المدعوم بالذكاء الاصطناعي

سمة التقرير | التفاصيل |

السنة الأساسية | 2024 |

الفترة المتوقعة | 2025-2033 |

زخم النمو | التسارع بمعدل نمو سنوي مركب قدره 16.59٪ |

حجم السوق 2024 | 3,842.17 مليون دولار أمريكي |

التحليل الإقليمي | أمريكا الشمالية وأوروبا ومنطقة آسيا والمحيط الهادئ وبقية العالم |

المنطقة المساهمة الرئيسية | من المتوقع أن تهيمن أمريكا الشمالية على السوق خلال الفترة المتوقعة. |

الدول الرئيسية التي تمت تغطيتها | الولايات المتحدة وكندا وألمانيا والمملكة المتحدة وإسبانيا وإيطاليا وفرنسا والصين واليابان والهند |

الشركات التي تم تحديدها | FICO و Experian و Fusion CX و Resolve Debt, LLC و CGI Group Inc. و Simplifi و Receeve (InDebted) و DebtZero Inc. و Observer.AI و C&R Software |

نطاق التقرير | اتجاهات السوق، والدوافع، والقيود؛ تقدير الإيرادات والتوقعات؛ تحليل التجزئة؛ تحليل جانب الطلب والعرض؛ المشهد التنافسي؛ تحديد ملف تعريف الشركة |

القطاعات التي تمت تغطيتها | حسب المكون، وحسب النشر، وحسب حجم المؤسسة، وحسب الصناعة؛ حسب المنطقة/البلد |

أسباب شراء تقرير سوق تسوية الديون المدعومة بالذكاء الاصطناعي:

- تتضمن الدراسة تحليل تقدير حجم السوق والتوقعات الذي أكده خبراء الصناعة الرئيسيون الموثوق بهم.

- يقدم التقرير بإيجاز مراجعة للأداء العام للصناعة في لمحة.

- يغطي التقرير تحليلاً متعمقًا لأقران الصناعة البارزين، مع التركيز بشكل أساسي على البيانات المالية الرئيسية للأعمال، وأنواع المحافظ، واستراتيجيات التوسع، والتطورات الأخيرة.

- فحص تفصيلي للدوافع والقيود والاتجاهات الرئيسية والفرص السائدة في الصناعة.

- تغطي الدراسة السوق بشكل شامل

جدول المحتويات

منهجية البحث لتحليل سوق تسوية الديون المدعومة بالذكاء الاصطناعي العالمي (2023-2033)

قمنا بتحليل السوق التاريخي، وتقدير السوق الحالي، والتنبؤ بالسوق المستقبلي لسوق تسوية الديون المدعومة بالذكاء الاصطناعي العالمي لتقييم تطبيقه في المناطق الرئيسية في جميع أنحاء العالم. أجرينا بحثًا ثانويًا شاملاً لجمع بيانات السوق التاريخية وتقدير حجم السوق الحالي. للتحقق من صحة هذه الرؤى، قمنا بمراجعة دقيقة للعديد من النتائج والافتراضات. بالإضافة إلى ذلك، أجرينا مقابلات أولية متعمقة مع خبراء الصناعة عبر سلسلة قيمة تسوية الديون المدعومة بالذكاء الاصطناعي. بعد التحقق من صحة أرقام السوق من خلال هذه المقابلات، استخدمنا كلا من النهج التصاعدي والتنازلي للتنبؤ بحجم السوق الإجمالي. ثم استخدمنا أساليب تقسيم السوق وتثليث البيانات لتقدير وتحليل حجم سوق القطاعات الصناعية والقطاعات الفرعية.

هندسة السوق

استخدمنا تقنية تثليث البيانات لإنهاء تقدير السوق الإجمالي واشتقاق أرقام إحصائية دقيقة لكل قطاع وقطاع فرعي من سوق تسوية الديون المدعومة بالذكاء الاصطناعي العالمي. قمنا بتقسيم البيانات إلى عدة قطاعات وقطاعات فرعية من خلال تحليل مختلف المعايير والاتجاهات، بما في ذلك حسب المكون، وحسب النشر، وحسب حجم المؤسسة، وحسب الصناعة، والمناطق داخل سوق تسوية الديون المدعومة بالذكاء الاصطناعي العالمي.

الهدف الرئيسي لدراسة سوق تسوية الديون المدعومة بالذكاء الاصطناعي العالمي

تحدد الدراسة الاتجاهات الحالية والمستقبلية في سوق تسوية الديون المدعومة بالذكاء الاصطناعي العالمي، وتقدم رؤى استراتيجية للمستثمرين. وهي تسلط الضوء على جاذبية السوق الإقليمية، مما يمكّن المشاركين في الصناعة من الاستفادة من الأسواق غير المستغلة واكتساب ميزة الريادة. تشمل الأهداف الكمية الأخرى للدراسات ما يلي:

- تحليل حجم السوق: تقييم حجم السوق الحالي والمتوقع لسوق تسوية الديون المدعومة بالذكاء الاصطناعي العالمي وقطاعاته من حيث القيمة (بالدولار الأمريكي).

- تقسيم سوق تسوية الديون المدعومة بالذكاء الاصطناعي: تشمل القطاعات في الدراسة مجالات حسب المكون، وحسب النشر، وحسب حجم المؤسسة، وحسب الصناعة، والمناطق.

- الإطار التنظيمي وتحليل سلسلة القيمة: فحص الإطار التنظيمي وسلسلة القيمة وسلوك العملاء والمشهد التنافسي لصناعة تسوية الديون المدعومة بالذكاء الاصطناعي.

- التحليل الإقليمي: إجراء تحليل إقليمي مفصل للمناطق الرئيسية مثل منطقة آسيا والمحيط الهادئ وأوروبا وأمريكا الشمالية وبقية العالم.

- ملفات تعريف الشركات واستراتيجيات النمو: ملفات تعريف الشركات في سوق تسوية الديون المدعومة بالذكاء الاصطناعي واستراتيجيات النمو التي يتبناها اللاعبون في السوق للاستمرار في السوق سريع النمو.

الأسئلة الشائعة الأسئلة الشائعة

س1: ما هو حجم السوق الحالي وإمكانات النمو لسوق حل الديون العالمي المدعوم بالذكاء الاصطناعي؟

بلغت قيمة سوق تسوية الديون العالمية المدعومة بالذكاء الاصطناعي 3,842.17 مليون دولار أمريكي في عام 2024 ومن المتوقع أن تنمو بمعدل نمو سنوي مركب قدره 16.59٪ خلال الفترة المتوقعة (2025-2033).

س٢: أي شريحة لديها أكبر حصة في السوق العالمي لحلول تسوية الديون المدعومة بالذكاء الاصطناعي حسب المكون؟

قاد قطاع البرمجيات السوق في عام 2024. يحتل قطاع البرمجيات في سوق تسوية الديون المدعوم بالذكاء الاصطناعي حصة سوقية ملحوظة نظرًا لفعاليته في تبسيط وأتمتة عمليات تحصيل الديون المختلفة.

س3: ما هي العوامل الدافعة لنمو السوق العالمي لحلول تسوية الديون المدعومة بالذكاء الاصطناعي؟

الكفاءة المعززة وتقليل التكاليف: يؤدي دمج حلول تسوية الديون المدعومة بالذكاء الاصطناعي إلى تعزيز الكفاءة التشغيلية بشكل كبير عن طريق أتمتة عمليات استرداد الديون وتقليل التدخل اليدوي وتقليل الخطأ البشري. تؤدي هذه الأتمتة إلى تقليل التكاليف وتبسيط سير العمل والسماح للمؤسسات المالية بتخصيص الموارد بشكل أكثر فعالية، مما يحسن الربحية الإجمالية.

صعود قطاع BFSI: إن الطلب المتزايد على الحلول المدفوعة بالذكاء الاصطناعي في قطاع الخدمات المصرفية والمالية والتأمين (BFSI) هو محرك رئيسي لسوق تسوية الديون المدعومة بالذكاء الاصطناعي. نظرًا لأن المؤسسات المالية تسعى إلى تحسين العمليات وتحسين معدلات الاسترداد وتعزيز تجربة العملاء، أصبحت تقنيات الذكاء الاصطناعي ضرورية بشكل متزايد في استراتيجيات إدارة الديون في قطاع BFSI.

صعود قطاع التجارة الإلكترونية والتجزئة: يساهم التوسع في التجارة الإلكترونية وقطاع التجزئة في زيادة الطلب على حلول تسوية الديون المدعومة بالذكاء الاصطناعي. مع تزايد عدد المعاملات عبر الإنترنت وديون المستهلكين، تتبنى شركات البيع بالتجزئة ومنصات التجارة الإلكترونية تقنيات الذكاء الاصطناعي لإدارة واسترداد الديون المستحقة، مما يحسن التدفق النقدي ومشاركة العملاء.

س4: ما هي التقنيات والاتجاهات الناشئة في سوق تسوية الديون العالمي المدعوم بالذكاء الاصطناعي؟

التواصل المخصص: يتمثل أحد الاتجاهات الرئيسية في سوق تسوية الديون المدعوم بالذكاء الاصطناعي في التحول نحو التواصل المخصص. تمكّن حلول الذكاء الاصطناعي المؤسسات المالية من تصميم تواصلها بناءً على الملفات الشخصية للعملاء الفرديين والسلوك المالي والتفضيلات. يعزز هذا النهج تفاعل العملاء ويحسن معدلات الاستجابة ويؤدي إلى استرداد أكثر فعالية للديون.

دمج التحليلات التنبؤية لتحسين استراتيجيات استرداد الديون: إن دمج التحليلات التنبؤية يغير استراتيجيات استرداد الديون من خلال تمكين المؤسسات المالية من التنبؤ بسلوكيات الدفع وتحديد الحسابات عالية المخاطر. يساعد هذا النهج القائم على البيانات على تحسين جهود التحصيل وتحديد أولويات الحسابات وتخصيص خطط السداد، مما يؤدي إلى ارتفاع معدلات الاسترداد واستخدام أكثر كفاءة للموارد.

س5: ما هي التحديات الرئيسية في سوق تسوية الديون العالمي المدعوم بالذكاء الاصطناعي؟

الامتثال والاعتبارات الأخلاقية: في سوق تسوية الديون المدعوم بالذكاء الاصطناعي، يمثل التعامل مع الامتثال والاعتبارات الأخلاقية تحديًا كبيرًا. مع تزايد استخدام الذكاء الاصطناعي في القطاعات المالية، يفرض المنظمون تدقيقًا متزايدًا على الخوارزميات والعمليات التي تستخدمها أنظمة تسوية الديون. إن ضمان امتثال هذه الأنظمة لقوانين حماية البيانات ولوائح مكافحة التمييز والمبادئ التوجيهية للعدالة أمر معقد ومكلف. علاوة على ذلك، يجب معالجة المخاوف الأخلاقية المتعلقة بخصوصية البيانات والتحيزات الخوارزمية والشفافية في اتخاذ القرارات. يمكن أن يؤدي عدم ضمان الامتثال والسلامة الأخلاقية إلى عواقب قانونية والإضرار بالسمعة وفقدان ثقة العملاء.

ارتفاع التكلفة وقضايا القوى العاملة المدربة: يتطلب تطبيق أدوات تسوية الديون المدعومة بالذكاء الاصطناعي استثمارًا أوليًا كبيرًا في التكنولوجيا والبنية التحتية والموارد البشرية الماهرة. غالبًا ما تكون تكلفة تطوير ونشر وصيانة أنظمة الذكاء الاصطناعي عالية، خاصة بالنسبة للشركات الصغيرة والمتوسطة الحجم. بالإضافة إلى ذلك، هناك نقص في المهنيين ذوي الخبرة اللازمة لبناء ومراقبة وضبط خوارزميات الذكاء الاصطناعي لتسوية الديون.

س6: أي منطقة تهيمن على السوق العالمي لحلول تسوية الديون المدعومة بالذكاء الاصطناعي؟

تهيمن أمريكا الشمالية على أكبر حصة سوقية، مدفوعة بالطلب المرتفع من قطاعات الخدمات المالية والمصرفية والتأمين (BFSI)، والتجزئة والتجارة الإلكترونية، والفضاء الجوي والدفاع، والسيارات، وغيرها. ومع ذلك، تشهد منطقة آسيا والمحيط الهادئ نموًا سريعًا بسبب التوسع في خدمات الإقراض الائتماني وتركيز القطاع المصرفي على خفض القروض المتعثرة (NPAs).

س7: من هم اللاعبون الرئيسيون في سوق تسوية الديون المدعومة بالذكاء الاصطناعي العالمي؟

الشركات الرائدة في تسوية الديون المدعومة بالذكاء الاصطناعي

FICO، Experian

Fusion CX

Resolve Debt, LLC

CGI Group Inc.

Simplifi

Receeve (InDebted)

DebtZero Inc.

Observer.AI

C&R Software

س8: كيف تشكل التطورات التكنولوجية مستقبل تسوية الديون المدعومة بالذكاء الاصطناعي؟

تدفع التطورات التكنولوجية، مثل خوارزميات التعلم الآلي المحسنة، ومعالجة اللغة الطبيعية (NLP)، والتحليلات التنبؤية، تطور حلول تسوية الديون المدعومة بالذكاء الاصطناعي. تتيح هذه الابتكارات للمؤسسات المالية إنشاء استراتيجيات أكثر تخصيصًا وكفاءة لتحصيل الديون، مما يحسن تفاعل العملاء ويحسن معدلات التحصيل.

س9: كيف يمكن للمؤسسات المالية الاستفادة من الذكاء الاصطناعي لتحسين تجربة العملاء في تسوية الديون؟

يمكن للمؤسسات المالية الاستفادة من الذكاء الاصطناعي لتحسين تجربة العملاء من خلال تقديم استراتيجيات أكثر تخصيصًا وتعاطفًا لحل مشكلات الديون. تتيح الحلول المدعومة بالذكاء الاصطناعي، مثل روبوتات الدردشة وأنظمة الاتصال الآلية والتحليلات التنبؤية، للمؤسسات تصميم تفاعلاتها مع العملاء بناءً على سلوكهم وتفضيلاتهم المالية. ينتج عن ذلك تواصل أكثر ملاءمة وفي الوقت المناسب، مما يقلل من إحباط العملاء ويحسن الرضا العام.

ذات صلة التقارير

العملاء الذين اشتروا هذا المنتج اشتروا أيضًا