인도 자동차 보험 시장: 현재 분석 및 예측 (2024-2032)

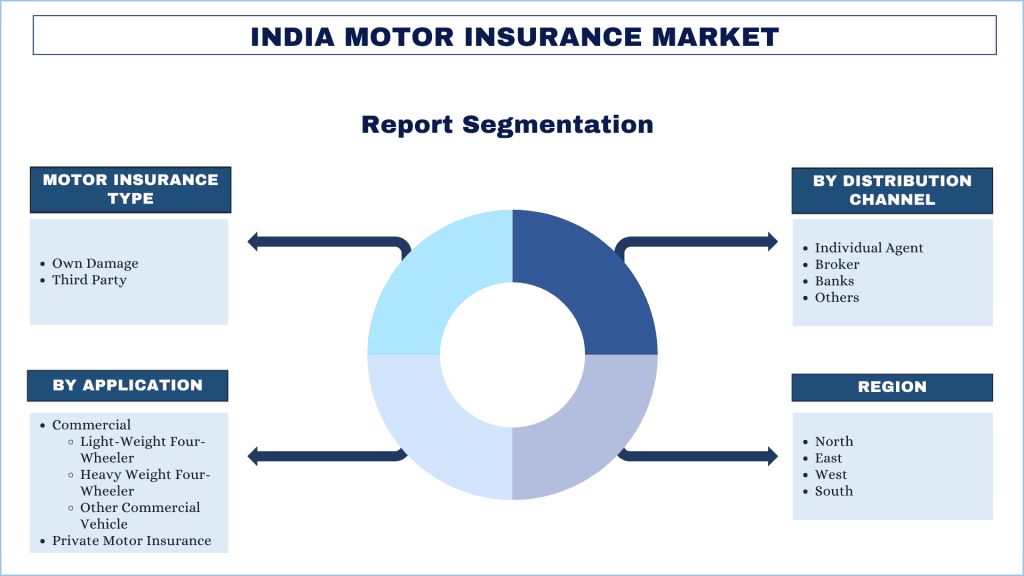

자동차 보험 유형별(자차, 대인); 용도별(상업용(경량 4륜차, 중량 4륜차, 기타 상업용 차량), 개인용 자동차), 유통 채널별(개인 에이전트, 브로커, 은행, 기타); 및 지역별(북부, 동부, 서부, 남부)에 대한 강조

인도 자동차 보험 시장 규모 및 예측

인도 자동차 보험 시장 규모 및 예측

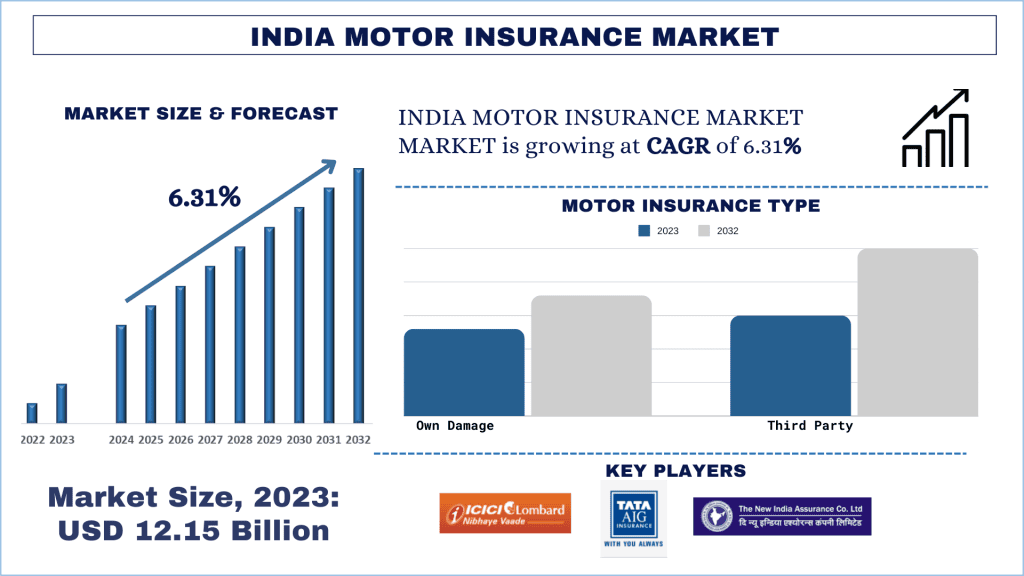

인도 자동차 보험 시장은 2023년에 121억 5천만 달러로 평가되었으며, 예측 기간(2024-2032) 동안 약 6.31%의 강력한 연평균 성장률(CAGR)로 성장할 것으로 예상됩니다. 인도 자동차 부문의 성장 증가에 기인합니다.

인도 자동차 보험 시장 분석

자동차 보험은 수리 및 도난의 경우 다양한 범주의 차량 소유자에게 포괄적인 보호 범위를 제공하는 일반 보험의 일부입니다. 이러한 보험 정책은 인도 보험 규제 개발청(IRDAI)의 규제를 받는 다양한 공공 및 민간 부문 금융 기관 및 은행에서 제공합니다. 보험 정책은 피보험 기간 동안 대부분의 비소모성 품목 및 손상 수리를 보장합니다.

인도 자동차 보험 시장은 2023년에 121억 5천만 달러로 평가되었으며, 예측 기간(2024-2032) 동안 약 6.31%의 강력한 연평균 성장률(CAGR)로 성장할 것으로 예상됩니다.시장 성장에 크게 기여하는 요인 중 하나는 국내 자동차 판매 증가입니다. 중산층 인구의 증가와 국내 가처분 소득의 증가를 고려할 때, 자동차 산업은 최근 몇 년 동안 판매량 증가의 혜택을 받았습니다.

이러한 판매 증가는 모든 자동차 구매에 대한 도로세 납부와 함께 의무화된 자차 및 대인 보험에 대한 수요를 이끌었습니다. 또한, 다양한 정책 변화로 인해 향후 몇 년 동안 자동차 보험에 대한 수요가 더욱 증가할 것입니다.

또한, 자동차 보험은 인도 전체 일반 및 건강 보험 시장에서 상당한 점유율을 차지합니다. IRDAI에 따르면, 인도에서 자동차 보험에 대한 총 보험료는 2021-22년에 704억 3,348만 루피였으며, 2022-23년에는 812억 8,004만 루피로 증가했습니다. 자동차 보험의 대부분의 점유율은 공공 부문이 차지하며, 약 80%의 시장 점유율을 나타냅니다.

인도 자동차 보험 시장 동향

이 섹션에서는 연구 전문가 팀이 파악한 인도 자동차 보험 시장의 다양한 세그먼트에 영향을 미치는 주요 시장 동향을 논의합니다.

전기 자동차의 증가 추세

전기 자동차는 고객의 지속 가능성에 대한 관심이 높아짐에 따라 증가하는 세그먼트입니다. 전기 자동차는 장기적으로 운영 비용 절감, 배기 가스 배출 없음 등과 같은 기존 내연 기관 차량에 비해 다양한 이점을 제공합니다. 이륜차 및 사륜차 범주에서 전기 자동차 판매가 증가함에 따라 향후 몇 년 동안 자동차 보험에 대한 수요가 증가할 것으로 예상됩니다.자동차 판매 데이터에 따르면, 2023년 전기 자동차 총 판매량은 153만 대로, 2022년 대비 50% 증가했습니다.

또한, 많은 주에서 무료 도로세를 제공하는 정부 주도로 인해 자동차, 이륜차 및 e-릭샤 범주에서 전기 자동차 판매가 더욱 촉진되어 인도에서 더 많은 자동차 보험 시장에 기여할 것입니다.

전기 자동차 범주에서 자동차의 증가를 고려할 때, 해당 세그먼트의 자동차 보험에 대한 수요는 향후 몇 년, 즉 2024-2032년에 더욱 증가할 것입니다.

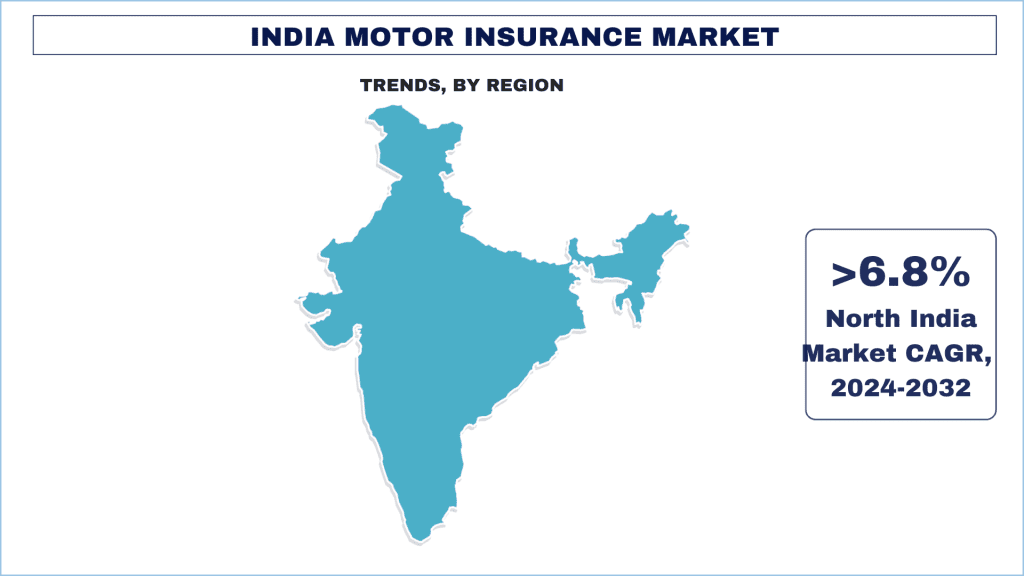

북인도는 예측 기간 동안 주요 시장 점유율을 차지할 것으로 예상됨

북인도는 자동차 보험에서 상당한 시장 점유율을 차지합니다. 북인도 지역의 성장에 기여하는 요인 중 하나는 지난 몇 년 동안 자동차 판매가 높았다는 것입니다. 이 지역은 우타르 프라데시, 뉴델리, 펀자브, 하리아나, 잠무 & 카슈미르 등과 같은 주를 포함하며, 상당한 인구를 보유하고 있으며 최근 몇 년 동안 차량 소유가 끊임없이 증가했습니다.인도 자동차 제조업체 협회(SIAM)에 따르면, 우타르 프라데시, 뉴델리 및 하리아나는 2023년 인도 자동차 판매에서 각각 10.04%, 5.94%, 6.60%의 점유율을 차지했습니다. 이륜차 판매를 관찰하는 동안에도 유사한 추세가 나타났으며, 유사한 기간에 각각 14.35%, 2.5%, 2.89%의 판매량을 기록했습니다.

북인도 지역에서 자동차 판매가 높기 때문에 향후 몇 년, 즉 2024-2032년에 자동차 보험에 대한 수요가 더욱 증가할 것으로 예상됩니다.

인도 자동차 보험 산업 개요

인도 자동차 보험 시장은 경쟁이 치열하고 분열되어 있으며, 여러 지역 및 시장 참여자가 있습니다. 주요 업체들은 파트너십, 계약, 협업, 신제품 출시, 지리적 확장 및 인수 합병과 같은 다양한 성장 전략을 채택하여 시장 입지를 강화하고 있습니다. 시장에서 활동하는 주요 업체 중 일부는 ICICI Lombard General Insurance, Bajaj Allianz General Insurance, Tata AIG General Insurance, HDFC ERGO General Insurance, New India Assurance Co Ltd, United India Insurance Company Ltd, The Oriental Insurance Co. Ltd., Bharti AXA General Insurance, Reliance General Insurance 및 IFFCO Tokio General Insurance입니다.

인도 자동차 보험 시장 뉴스

2022년IRDAI는 일반 보험 회사에서 이륜차 및 자동차를 자동차 보험 정책에 추가 기능으로 동일한 소유주에게 속하는 차량에 대해 Pay As You Drive, Pay How You Drive 및 플로터 정책을 도입하도록 허용했습니다.

2023년ICICI Lombard는 AI 기반 Claim Your Claim 디지털 캠페인을 시작했습니다. 이 캠페인은 인도에서 일반 보험의 미개척 시장을 공략하는 것을 목표로 했습니다.

인도 자동차 보험 시장 보고서 범위

보고서 속성 | 세부 정보 |

기준 연도 | 2023 |

예측 기간 | 2024-2032 |

성장 모멘텀 | 6.31%의 CAGR로 가속화 |

시장 규모 2023 | 121억 5천만 달러 |

지역 분석 | 북부, 동부, 서부, 남부 |

프로파일링된 회사 | ICICI Lombard General Insurance, Bajaj Allianz General Insurance, Tata AIG General Insurance, HDFC ERGO General Insurance, New India Assurance Co Ltd, United India Insurance Company Ltd, The Oriental Insurance Co. Ltd., Bharti AXA General Insurance, Reliance General Insurance 및 IFFCO Tokio General Insurance. |

보고서 범위 | 시장 동향, 동인 및 제약; 수익 추정 및 예측; 세분화 분석; 수요 및 공급 측면 분석; 경쟁 환경; 회사 프로파일링 |

포함된 세그먼트 | 자동차 보험 유형별, 용도별, 유통 채널별, 지역/국가별 |

이 보고서를 구매해야 하는 이유:

- 이 연구에는 인증된 주요 업계 전문가가 검증한 시장 규모 및 예측 분석이 포함되어 있습니다.

- 이 보고서는 전체 산업 성과를 한눈에 빠르게 검토합니다.

- 이 보고서는 주요 비즈니스 재무, 제품 포트폴리오, 확장 전략 및 최근 개발에 중점을 두고 주요 업계 관계자에 대한 심층 분석을 포함합니다.

- 업계에서 지배적인 동인, 제약, 주요 트렌드 및 기회에 대한 자세한 검토.

- 이 연구는 다양한 세그먼트별로 시장을 포괄적으로 다룹니다.

- 업계의 심층 지역 수준 분석.

사용자 정의 옵션:

인도 자동차 보험 시장은 요구 사항 또는 기타 시장 세그먼트에 따라 추가로 맞춤화될 수 있습니다. 또한 UMI는 귀하가 자체 비즈니스 요구 사항을 가지고 있을 수 있음을 이해합니다. 따라서 귀하의 요구 사항에 완벽하게 맞는 보고서를 받으려면 언제든지 저희에게 문의하십시오.

목차

인도 자동차 보험 시장 분석(2024-2032) 연구 방법론

과거 시장 분석, 현재 시장 추정, 인도 주요 지역의 인도 자동차 보험 채택을 생성하고 분석하기 위해 수행된 세 가지 주요 단계는 인도 자동차 보험의 미래 시장 예측이었습니다. 과거 시장 수치를 수집하고 현재 시장 규모를 추정하기 위해 광범위한 2차 조사가 수행되었습니다. 둘째, 이러한 통찰력을 검증하기 위해 수많은 결과와 가정이 고려되었습니다. 또한 인도 자동차 보험 시장의 가치 사슬 전반에 걸쳐 업계 전문가와 광범위한 1차 인터뷰가 진행되었습니다. 1차 인터뷰를 통해 시장 수치를 가정하고 검증한 후, 전체 시장 규모를 예측하기 위해 상향식/하향식 접근 방식을 사용했습니다. 그 후, 시장 분석 및 데이터 삼각 측량 방법을 채택하여 업계의 세그먼트 및 하위 세그먼트의 시장 규모를 추정하고 분석했습니다. 자세한 방법론은 다음과 같습니다.

과거 시장 규모 분석

1단계: 2차 자료 심층 연구:

회사의 내부 소스(예:연례 보고서 및 재무제표, 성과 발표, 보도 자료 등)및 외부 소스 포함저널, 뉴스 및 기사, 정부 간행물, 경쟁사 간행물, 부문 보고서, 타사 데이터베이스 및 기타 신뢰할 수 있는 간행물.

2단계: 시장 세분화:

인도 자동차 보험 시장의 과거 시장 규모를 얻은 후, 주요 지역의 다양한 세그먼트 및 하위 세그먼트에 대한 과거 시장 통찰력 및 점유율을 수집하기 위해 자세한 2차 분석을 수행했습니다. 주요 세그먼트에는 자동차 보험 유형, 적용 분야 및 유통 채널별로 보고서에 포함됩니다. 또한 해당 지역에서 테스트 모델의 전체 채택을 평가하기 위해 지역/국가 수준의 분석이 수행되었습니다.

3단계: 요인 분석:

다양한 세그먼트 및 하위 세그먼트의 과거 시장 규모를 획득한 후, 인도 자동차 보험 시장의 현재 시장 규모를 추정하기 위해 자세한요인 분석을(를) 수행했습니다. 또한 인도 자동차 보험 시장에서 자동차 보험 유형별, 적용 분야별, 유통 채널별 등 종속 변수와 독립 변수를 사용하여 요인 분석을 수행했습니다. 인도 자동차 보험 시장 부문에서 주요 파트너십, 인수 합병, 사업 확장 및 제품 출시를 고려하여 수요 및 공급 측 시나리오에 대한 철저한 분석이 수행되었습니다.

현재 시장 규모 추정 및 예측

현재 시장 규모 측정:위의 3단계에서 얻은 실행 가능한 통찰력을 바탕으로, 현재 시장 규모, 인도 자동차 보험 시장의 주요 업체, 세그먼트의 시장 점유율에 도달했습니다. 필요한 모든 점유율 분할 및 시장 분석은 위에 언급된 2차 접근 방식을 사용하여 결정되었으며 1차 인터뷰를 통해 검증되었습니다.

추정 및 예측:시장 추정 및 예측을 위해 동인 및 트렌드, 제약 및 이해 관계자가 사용할 수 있는 기회를 포함한 다양한 요인에 가중치가 할당되었습니다. 이러한 요인을 분석한 후, 관련 예측 기술, 즉, 상향식/하향식 접근 방식이 인도 주요 시장의 다양한 세그먼트 및 하위 세그먼트에 대한 2032년 시장 예측에 도달하기 위해 적용되었습니다. 시장 규모를 추정하기 위해 채택된 연구 방법론은 다음을 포함합니다:

- 수익(USD) 측면에서 업계의 시장 규모와 국내 주요 시장 전반의 인도 자동차 보험 채택률

- 모든 시장 세그먼트 및 하위 세그먼트의 점유율, 분할 및 분석

- 제공되는 제품 측면에서 인도 자동차 보험 시장의 주요 업체. 또한 빠르게 성장하는 시장에서 경쟁하기 위해 이러한 플레이어가 채택한 성장 전략.

시장 규모 및 점유율 검증

1차 조사:주요 지역의 최고 수준의 임원(CXO/VP, 영업 책임자, 마케팅 책임자, 운영 책임자, 지역 책임자, 국가 책임자 등)을 포함한 주요 여론 주도자(KOL)와 심층 인터뷰를 진행했습니다. 그런 다음 1차 조사 결과를 요약하고, 명시된 가설을 증명하기 위해 통계 분석을 수행했습니다. 1차 조사의 입력은 2차 조사 결과와 통합되어 정보를 실행 가능한 통찰력으로 전환했습니다.

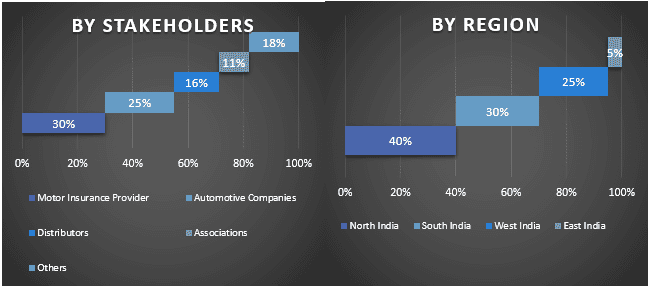

다양한 지역의 1차 참여자 분할

시장 엔지니어링

데이터 삼각 측량 기술을 사용하여 전체 시장 추정을 완료하고 인도 자동차 보험 시장의 각 세그먼트 및 하위 세그먼트에 대한 정확한 통계 숫자에 도달했습니다. 데이터는 인도 자동차 보험 시장에서 자동차 보험 유형별, 적용 분야별, 유통 채널별 등 다양한 매개변수 및 트렌드를 연구한 후 여러 세그먼트 및 하위 세그먼트로 분할되었습니다.

인도 자동차 보험 시장 연구의 주요 목표

연구에서 인도 자동차 보험 시장의 현재 및 미래 시장 트렌드가 정확히 파악되었습니다. 투자자는 연구에서 수행된 질적 및 양적 분석을 기반으로 투자에 대한 재량을 결정하기 위한 전략적 통찰력을 얻을 수 있습니다. 현재 및 미래 시장 트렌드는 지역 수준에서 시장의 전체 매력을 결정하여 산업 참가자가 미개척 시장을 활용하여 선점 이점을 얻을 수 있는 플랫폼을 제공했습니다. 연구의 다른 정량적 목표는 다음과 같습니다:

- 가치(USD) 측면에서 인도 자동차 보험 시장의 현재 및 예측 시장 규모를 분석합니다. 또한 다양한 세그먼트 및 하위 세그먼트의 현재 및 예측 시장 규모를 분석합니다.

- 연구의 세그먼트에는 자동차 보험 유형별, 적용 분야별, 유통 채널별 영역이 포함됩니다.

- 인도 자동차 보험에 대한 규제 프레임워크를 정의하고 분석합니다.

- 다양한 중개인의 존재와 관련된 가치 사슬을 분석하고 업계의 고객 및 경쟁사 행동을 분석합니다.

- 주요 지역에 대한 인도 자동차 보험 시장의 현재 및 예측 시장 규모를 분석합니다.

- 보고서에서 연구된 주요 지역에는 북부, 동부, 서부 및 남부가 포함됩니다.

- 인도 자동차 보험 시장의 회사 프로필과 빠르게 성장하는 시장에서 지속하기 위해 시장 플레이어가 채택한 성장 전략.

- 업계의 심층 지역 수준 분석

자주 묻는 질문 자주 묻는 질문

Q1: 인도 자동차 보험 시장의 현재 시장 규모와 성장 잠재력은 무엇입니까?

Q2: 인도 자동차 보험 시장 성장의 동인은 무엇입니까?

Q3: 보험 유형별로 인도 자동차 보험 시장에서 가장 큰 점유율을 차지하는 부문은 무엇입니까?

Q4: 어떤 지역이 인도 자동차 보험 시장을 지배할 것인가?

관련 보고서

이 상품을 구매한 고객님들도 함께 구매하신 상품