- Trang chủ

- Về chúng tôi

- Ngành

- Dịch vụ

- Đọc

- Liên hệ với chúng tôi

Thị trường Công nghệ Bảo hiểm (Insurtech): Phân tích và Dự báo hiện tại (2024-2032)

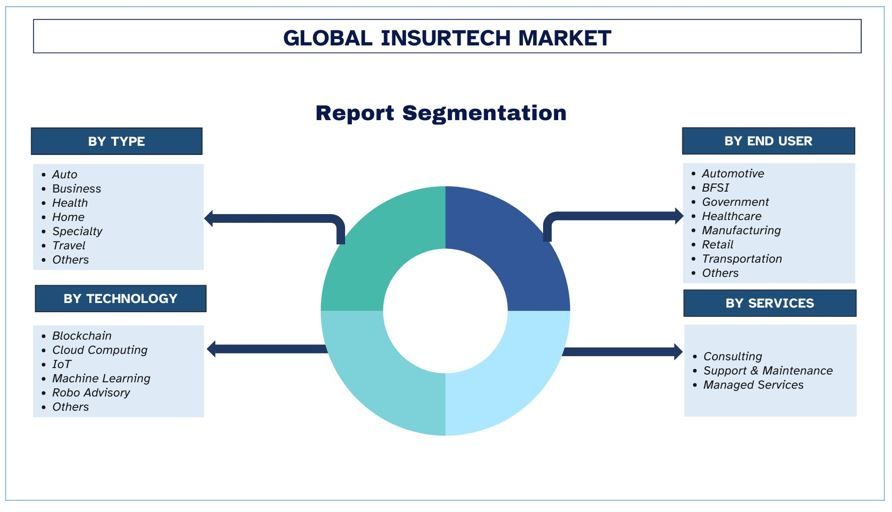

Nhấn mạnh theo Loại (Tự động, Kinh doanh, Sức khỏe, Nhà ở, Đặc biệt, Du lịch, Khác); Theo Công nghệ (Blockchain, Điện toán Đám mây, IoT, Học máy, Robo Advisory, Khác), Theo Dịch vụ (Tư vấn, Hỗ trợ & Bảo trì, Dịch vụ Quản lý); Theo Người dùng cuối (Ô tô, BFSI, Chính phủ, Chăm sóc sức khỏe, Sản xuất, Bán lẻ, Vận tải, Khác) và Khu vực (Bắc Mỹ (Hoa Kỳ, Canada, Phần còn lại của Bắc Mỹ), Châu Âu (Đức, Vương quốc Anh, Pháp, Ý, Tây Ban Nha, Phần còn lại của Châu Âu), Châu Á-Thái Bình Dương (Trung Quốc, Nhật Bản, Ấn Độ, Phần còn lại của Châu Á-Thái Bình Dương), Phần còn lại của Thế giới)

Quy mô & Dự báo Thị trường Công nghệ Bảo hiểm Toàn cầu

Quy mô & Dự báo Thị trường Công nghệ Bảo hiểm Toàn cầu

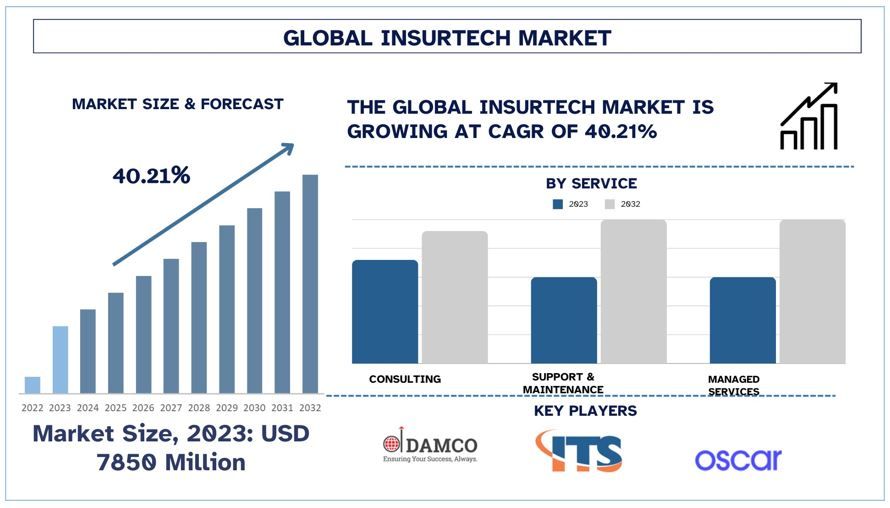

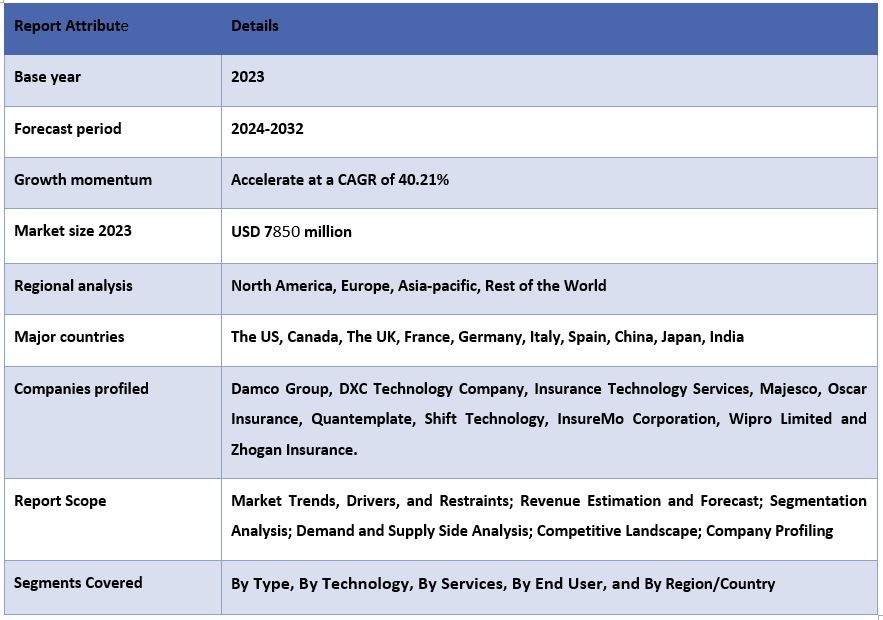

Thị trường Công nghệ Bảo hiểm Toàn cầu được định giá 7850 triệu USD vào năm 2023 và dự kiến sẽ tăng trưởng với tốc độ CAGR mạnh mẽ khoảng 40,21% trong giai đoạn dự báo (2024-2032) do nhu cầu về Công nghệ Bảo hiểm ngày càng tăng trên toàn cầu.

Phân tích Thị trường Công nghệ Bảo hiểm Toàn cầu

Insurtech đề cập đến các dịch vụ Công nghệ Bảo hiểm được thiết kế để cung cấp các dịch vụ kỹ thuật số cho các nhà cung cấp bảo hiểm. Các dịch vụ kỹ thuật số này cung cấp thông tin theo thời gian thực cho các nhà cung cấp bảo hiểm, hỗ trợ tùy chỉnh sản phẩm, thông tin theo thời gian thực, tiền bạc và tiết kiệm, cải thiện khả năng cạnh tranh và làm cho các dịch vụ bảo hiểm bền vững hơn. Vì lượng lớn thông tin được thu thập thông qua nhiều mô hình người dùng khác nhau, một sản phẩm bảo hiểm phù hợp hơn được cung cấp để cải thiện hơn nữa sự mở rộng của các dịch vụ bảo hiểm.

Thị trường Công nghệ Bảo hiểm Toàn cầu được định giá 7850 triệu USD vào năm 2023 và dự kiến sẽ tăng trưởng với tốc độ CAGR mạnh mẽ khoảng 40,21% trong giai đoạn dự báo (2024-2032). Một trong những yếu tố chính đã góp phần vào sự tăng trưởng của thị trường Công nghệ Bảo hiểm là sự hỗ trợ ngày càng tăng của các cơ quan quản lý từ các chính phủ khác nhau trên toàn cầu. Các biện pháp chính sách bảo hiểm này nhằm mục đích cải thiện các nỗ lực số hóa cũng như cho phép các nhà cung cấp dịch vụ bảo hiểm giảm các vấn đề liên quan đến việc xử lý khách hàng và giải ngân yêu cầu bồi thường. Ví dụ, vào năm 2024, Cơ quan Phát triển và Quản lý Bảo hiểm Ấn Độ (IRDAI) đã phê duyệt tám quy định dựa trên nguyên tắc cho các công ty bảo hiểm ở Ấn Độ. Các quy định này tập trung vào việc áp dụng các quy trình tiêu chuẩn và thực hành tốt nhất của các công ty bảo hiểm và các kênh phân phối để giải quyết khiếu nại về quản lý rủi ro. Các quy định này cũng thúc đẩy BIMA Sugam một thị trường trực tuyến để tạo điều kiện cho các hoạt động liên quan đến bảo hiểm.

Trong một trường hợp khác, vào năm 2024, Bộ Kinh doanh, Đổi mới & Việc làm New Zealand thông báo rằng họ sẽ hiện đại hóa và cải thiện luật bảo hiểm để người tiêu dùng và doanh nghiệp có thể tự bảo vệ mình một cách hiệu quả trước rủi ro.

Với sự tập trung cao hơn của các chính phủ trên toàn cầu vào việc số hóa nhanh chóng trong lĩnh vực bảo hiểm để giải quyết các thắc mắc của khách hàng một cách dễ dàng và mở rộng các dịch vụ bảo hiểm trong các lĩnh vực khác nhau, nhu cầu đối với thị trường Công nghệ Bảo hiểm dự kiến sẽ tăng trong giai đoạn 2024-2032.

Xu hướng Thị trường Công nghệ Bảo hiểm Toàn cầu

Phần này thảo luận về các xu hướng thị trường chính đang ảnh hưởng đến các phân khúc khác nhau của Thị trường Công nghệ Bảo hiểm Toàn cầu do nhóm các chuyên gia nghiên cứu của chúng tôi xác định.

Chuyển đổi Kỹ thuật số

Các công ty bảo hiểm ngày càng áp dụng các giải pháp kỹ thuật số để phục vụ một số lượng lớn khách hàng với nhu cầu phù hợp của họ. Các công ty này dựa vào các giải pháp kỹ thuật số để có trải nghiệm thân thiện với người dùng, hợp lý hóa các hoạt động và nâng cao quy trình ra quyết định.

Theo hướng này, nhiều công ty đã đầu tư lớn vào việc tích hợp các giải pháp Công nghệ Bảo hiểm trong những năm gần đây, điều này đã mở đường cho sự tăng trưởng của thị trường.

Ngoài ra, để khai thác các cơ hội tăng trưởng hiện có trên thị trường, nhiều công ty Công nghệ Bảo hiểm đã thông báo sẽ hợp tác với các đối tác khác trong ngành, điều này sẽ giúp mở rộng công nghệ và cung cấp dịch vụ trong dài hạn. Ví dụ, vào năm 2023, một liên minh của nhiều nhà cung cấp công nghệ bảo hiểm có tên Boost, Branch, Clearcover, Lemonade và Root Insurance đã công bố kế hoạch ra mắt liên minh Công nghệ Bảo hiểm. Liên minh này nhằm mục đích hình dung lại việc cung cấp dịch vụ và quản lý các rủi ro liên quan một cách hiệu quả.

Xem xét sự mở rộng tràn lan của các dịch vụ công nghệ bảo hiểm và chuyển đổi kỹ thuật số, thị trường Công nghệ Bảo hiểm Toàn cầu sẽ trải qua sự tăng trưởng trong giai đoạn 2024-2032.

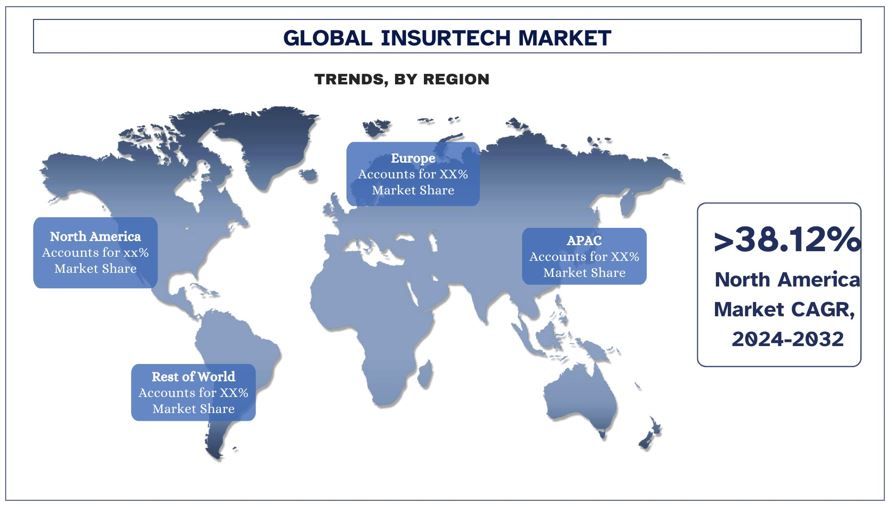

Bắc Mỹ dự kiến sẽ chiếm thị phần lớn nhất trong giai đoạn dự báo

Thị trường Công nghệ Bảo hiểm Bắc Mỹ đã chiếm được một phần thị phần đáng kể trên toàn cầu. Bắc Mỹ đã đạt được sự tăng trưởng đáng kể nhờ cơ sở hạ tầng tiên tiến, hệ sinh thái sáng tạo, nhu cầu của người tiêu dùng về các giải pháp kỹ thuật số, sự hỗ trợ của chính phủ được tăng cường và một thị trường bảo hiểm rộng lớn. Bắc Mỹ có một thị trường bảo hiểm rộng lớn và trưởng thành, trong đó các lĩnh vực chăm sóc sức khỏe, ô tô, kinh doanh, bán lẻ, v.v. là những lĩnh vực nổi bật. Trong số đó, Hoa Kỳ và Canada là một số quốc gia nổi bật đã giữ vị trí chủ chốt cho Công nghệ Bảo hiểm trong khu vực. Ví dụ, theo Tập đoàn Allianz, vào năm 2023, Hoa Kỳ tiếp tục thống trị thị trường bảo hiểm chăm sóc sức khỏe toàn cầu với tổng khoảng hai phần ba tổng phí bảo hiểm toàn cầu. Xem xét sự tập trung cao của khách hàng vào bảo hiểm cho cả bảo hiểm nhân thọ và bảo hiểm chung, khu vực này dự kiến sẽ yêu cầu tăng cường đầu tư vào các dịch vụ Công nghệ Bảo hiểm, từ đó cải thiện hơn nữa sự tăng trưởng của thị trường trong giai đoạn 2024-2032.

Tổng quan về Ngành Công nghệ Bảo hiểm Toàn cầu

Thị trường Công nghệ Bảo hiểm Toàn cầu có tính cạnh tranh và phân mảnh, với sự hiện diện của một số người chơi thị trường toàn cầu và quốc tế. Các đối thủ cạnh tranh chính đang áp dụng các chiến lược tăng trưởng khác nhau để tăng cường sự hiện diện trên thị trường của họ, chẳng hạn như quan hệ đối tác, thỏa thuận, hợp tác, ra mắt sản phẩm mới, mở rộng địa lý và sáp nhập và mua lại. Một số người chơi chính đang hoạt động trên thị trường là Damco Group, DXC Technology Company, Insurance Technology Services, Majesco, Oscar Insurance, Quantemplate, Shift Technology, InsureMo Corporation, Wipro Limited và Zhogan Insurance.

Tin tức Thị trường Công nghệ Bảo hiểm Toàn cầu

- Năm 2024, Allianz Partners đã công bố ra mắt ứng dụng di động Allyz để hỗ trợ và dịch vụ kỹ thuật số cho khách du lịch về các quyền lợi bảo hiểm ở Đức và Pháp.

- Năm 2023, Digital First Insurance đã ra mắt ứng dụng di động của mình để thực hiện các giao dịch bảo hiểm dễ dàng hơn với việc tích hợp AI và chatbot.

- Năm 2024, Roojai Insurance đã mua lại FWD General Insurance Public Company Limited (FWDGI) với mục tiêu trở thành một công ty bảo hiểm kỹ thuật số đầy đủ.

Phạm vi Báo cáo Thị trường Công nghệ Bảo hiểm Toàn cầu

Lý do để mua báo cáo này:

- Nghiên cứu bao gồm phân tích về quy mô và dự báo thị trường được xác nhận bởi các chuyên gia trong ngành chính có thẩm quyền.

- Báo cáo trình bày một đánh giá nhanh về hiệu suất tổng thể của ngành trong nháy mắt.

- Báo cáo bao gồm phân tích chuyên sâu về các đối thủ cạnh tranh trong ngành nổi bật, tập trung chủ yếu vào các số liệu tài chính kinh doanh chính, danh mục sản phẩm, chiến lược mở rộng và sự phát triển gần đây.

- Kiểm tra chi tiết các yếu tố thúc đẩy, hạn chế, xu hướng chính và cơ hội hiện có trong ngành.

- Nghiên cứu bao gồm toàn diện thị trường trên các phân khúc khác nhau.

- Phân tích sâu cấp độ khu vực của ngành.

Tùy chọn tùy chỉnh:

Thị trường Công nghệ Bảo hiểm Toàn cầu có thể được tùy chỉnh hơn nữa theo yêu cầu hoặc bất kỳ phân khúc thị trường nào khác. Bên cạnh đó, UMI hiểu rằng bạn có thể có nhu cầu kinh doanh riêng; do đó, vui lòng kết nối với chúng tôi để nhận được một báo cáo hoàn toàn phù hợp với yêu cầu của bạn.

Mục lục

Phương pháp Nghiên cứu Phân tích Thị trường Công nghệ Bảo hiểm Toàn cầu (2024-2032)

Phân tích thị trường trong quá khứ, ước tính thị trường hiện tại và dự báo thị trường trong tương lai của thị trường Công nghệ Bảo hiểm Toàn cầu là ba bước chính được thực hiện để tạo và phân tích việc áp dụng Công nghệ Bảo hiểm Toàn cầu ở các khu vực chính trên toàn cầu. Nghiên cứu thứ cấp toàn diện đã được tiến hành để thu thập các con số thị trường trong quá khứ và ước tính quy mô thị trường hiện tại. Thứ hai, để xác thực những hiểu biết sâu sắc này, nhiều kết quả và giả định đã được xem xét. Hơn nữa, các cuộc phỏng vấn sơ cấp toàn diện cũng đã được tiến hành với các chuyên gia trong ngành trên toàn bộ chuỗi giá trị của thị trường Công nghệ Bảo hiểm Toàn cầu. Sau khi giả định và xác thực các con số thị trường thông qua các cuộc phỏng vấn sơ cấp, chúng tôi đã sử dụng phương pháp từ trên xuống / từ dưới lên để dự báo quy mô thị trường hoàn chỉnh. Sau đó, các phương pháp phân tích phân tích thị trường và tam giác hóa dữ liệu đã được áp dụng để ước tính và phân tích quy mô thị trường của các phân khúc và phân khúc phụ của ngành. Phương pháp chi tiết được giải thích dưới đây:

Phân tích Quy mô Thị trường Lịch sử

Bước 1: Nghiên cứu chuyên sâu về các Nguồn thứ cấp:

Một nghiên cứu thứ cấp chi tiết đã được tiến hành để có được quy mô thị trường lịch sử của thị trường Công nghệ Bảo hiểm Toàn cầu thông qua các nguồn nội bộ của công ty như báo cáo thường niên & báo cáo tài chính, bài thuyết trình hiệu suất, thông cáo báo chí, v.v. và các nguồn bên ngoài bao gồm tạp chí, tin tức & bài viết, ấn phẩm của chính phủ, ấn phẩm của đối thủ cạnh tranh, báo cáo ngành, cơ sở dữ liệu của bên thứ ba và các ấn phẩm đáng tin cậy khác.

Bước 2: Phân khúc thị trường:

Sau khi có được quy mô thị trường trong quá khứ của thị trường Công nghệ Bảo hiểm Toàn cầu, chúng tôi đã tiến hành phân tích thứ cấp chi tiết để thu thập thông tin chi tiết và chia sẻ thị trường trong quá khứ cho các phân khúc & phân khúc phụ khác nhau cho các khu vực chính. Các phân khúc chính được bao gồm trong báo cáo theo loại, theo công nghệ, theo dịch vụ và theo người dùng cuối. Phân tích cấp độ khu vực / quốc gia hơn nữa đã được tiến hành để đánh giá việc áp dụng tổng thể các mô hình thử nghiệm trong khu vực đó.

Bước 3: Phân tích nhân tố:

Sau khi có được quy mô thị trường trong quá khứ của các phân khúc và phân khúc phụ khác nhau, chúng tôi đã tiến hành phân tích nhân tố chi tiết để ước tính quy mô thị trường hiện tại của thị trường Công nghệ Bảo hiểm Toàn cầu. Hơn nữa, chúng tôi đã tiến hành phân tích nhân tố bằng cách sử dụng các biến phụ thuộc và độc lập như theo loại, theo công nghệ, theo dịch vụ và theo người dùng cuối trong thị trường Công nghệ Bảo hiểm Toàn cầu. Một phân tích chuyên sâu đã được tiến hành đối với các kịch bản cung và cầu, xem xét các quan hệ đối tác hàng đầu, sáp nhập và mua lại, mở rộng kinh doanh và ra mắt sản phẩm trong lĩnh vực thị trường Công nghệ Bảo hiểm Toàn cầu trên toàn cầu.

Ước tính & Dự báo Quy mô Thị trường Hiện tại

Xác định quy mô thị trường hiện tại:Dựa trên những hiểu biết sâu sắc có thể hành động từ 3 bước trên, chúng tôi đã đi đến quy mô thị trường hiện tại, những người chơi chính trên thị trường Công nghệ Bảo hiểm Toàn cầu và thị phần của các phân khúc. Tất cả các tỷ lệ phần trăm chia tách và phân tích thị trường cần thiết đã được xác định bằng cách sử dụng phương pháp thứ cấp đã đề cập ở trên và được xác minh thông qua các cuộc phỏng vấn sơ cấp.

Ước tính & Dự báo:Để ước tính và dự báo thị trường, trọng số đã được gán cho các yếu tố khác nhau, bao gồm các yếu tố thúc đẩy & xu hướng, những hạn chế và cơ hội dành cho các bên liên quan. Sau khi phân tích các yếu tố này, các kỹ thuật dự báo có liên quan, ví dụ: phương pháp từ trên xuống/từ dưới lên, đã được áp dụng để đưa ra dự báo thị trường cho năm 2032 cho các phân khúc và phân đoạn phụ khác nhau trên các thị trường lớn trên toàn cầu. Phương pháp nghiên cứu được áp dụng để ước tính quy mô thị trường bao gồm:

- Quy mô thị trường của ngành, tính theo doanh thu (USD) và tỷ lệ áp dụng của thị trường Insurtech Toàn cầu trên các thị trường lớn trong nước

- Tất cả các tỷ lệ phần trăm, sự phân chia và phân tích chi tiết các phân khúc và phân đoạn phụ của thị trường

- Những người chơi chính trên thị trường Insurtech Toàn cầu về các sản phẩm được cung cấp. Ngoài ra, các chiến lược tăng trưởng được các đối tượng này áp dụng để cạnh tranh trong thị trường đang phát triển nhanh chóng.

Xác thực Quy mô và Thị phần Thị trường

Nghiên cứu chính: Các cuộc phỏng vấn chuyên sâu đã được tiến hành với các Nhà lãnh đạo ý kiến chính (KOL), bao gồm các Giám đốc điều hành cấp cao (CXO/VP, Trưởng phòng Kinh doanh, Trưởng phòng Tiếp thị, Trưởng phòng Vận hành, Trưởng phòng Khu vực, Trưởng phòng Quốc gia, v.v.) trên các khu vực chính. Các phát hiện chính sau đó đã được tóm tắt và phân tích thống kê đã được thực hiện để chứng minh các giả thuyết đã nêu. Đầu vào từ nghiên cứu chính đã được hợp nhất với các phát hiện thứ cấp, do đó biến thông tin thành thông tin chi tiết có thể hành động.

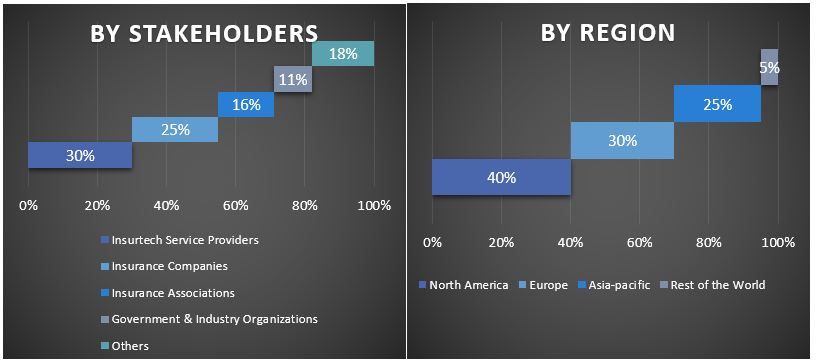

Phân chia Người tham gia chính ở các Khu vực khác nhau

Kỹ thuật Thị trường

Kỹ thuật tam giác dữ liệu đã được sử dụng để hoàn thành việc ước tính thị trường tổng thể và đưa ra các con số thống kê chính xác cho từng phân khúc và phân đoạn phụ của thị trường Insurtech Toàn cầu. Dữ liệu đã được chia thành nhiều phân khúc và phân đoạn phụ sau khi nghiên cứu các thông số và xu hướng khác nhau theo loại, theo công nghệ, theo dịch vụ và theo người dùng cuối trên thị trường Insurtech Toàn cầu.

Mục tiêu chính của Nghiên cứu Thị trường Insurtech Toàn cầu

Các xu hướng thị trường hiện tại & tương lai của thị trường Insurtech Toàn cầu đã được xác định trong nghiên cứu. Các nhà đầu tư có thể thu được những hiểu biết chiến lược để đưa ra quyết định đầu tư dựa trên phân tích định tính và định lượng được thực hiện trong nghiên cứu. Các xu hướng thị trường hiện tại và tương lai đã xác định sức hấp dẫn tổng thể của thị trường ở cấp độ khu vực, cung cấp một nền tảng để người tham gia công nghiệp khai thác thị trường chưa được khai thác để hưởng lợi từ lợi thế đi đầu. Các mục tiêu định lượng khác của các nghiên cứu bao gồm:

- Phân tích quy mô thị trường hiện tại và dự báo của thị trường Insurtech Toàn cầu về giá trị (USD). Ngoài ra, phân tích quy mô thị trường hiện tại và dự báo của các phân khúc và phân đoạn phụ khác nhau.

- Các phân khúc trong nghiên cứu bao gồm các lĩnh vực theo loại, theo công nghệ, theo dịch vụ và theo người dùng cuối.

- Xác định và phân tích khuôn khổ pháp lý cho ngành Insurtech toàn cầu.

- Phân tích chuỗi giá trị liên quan đến sự hiện diện của các trung gian khác nhau, cùng với việc phân tích hành vi của khách hàng và đối thủ cạnh tranh trong ngành.

- Phân tích quy mô thị trường hiện tại và dự báo của thị trường Insurtech Toàn cầu đối với các khu vực chính.

- Các quốc gia chính của các khu vực được nghiên cứu trong báo cáo bao gồm Bắc Mỹ (Hoa Kỳ, Canada và Phần còn lại của Bắc Mỹ), Châu Âu (Vương quốc Anh, Pháp, Đức, Ý, Tây Ban Nha, Phần còn lại của Châu Âu), Châu Á - Thái Bình Dương (Trung Quốc, Nhật Bản, Ấn Độ, Phần còn lại của Châu Á - Thái Bình Dương), Phần còn lại của Thế giới

- Hồ sơ công ty của thị trường Insurtech Toàn cầu và các chiến lược tăng trưởng do những người chơi trên thị trường áp dụng để duy trì trong thị trường đang phát triển nhanh chóng.

- Phân tích chuyên sâu cấp khu vực của ngành

Câu hỏi thường gặp Câu hỏi thường gặp

Q1: Quy mô thị trường và tiềm năng tăng trưởng hiện tại của thị trường Insurtech toàn cầu là gì?

Q2: Yếu tố thúc đẩy tăng trưởng của thị trường Insurtech toàn cầu là gì?

Q3: Phân khúc nào chiếm thị phần lớn nhất của thị trường Insurtech toàn cầu theo loại?

Q4: Khu vực nào sẽ thống trị thị trường Insurtech toàn cầu?

Liên quan Báo cáo

Khách hàng đã mua mặt hàng này cũng đã mua